Is Pride Capital safe?

Pros

Cons

Is Pride Capital Safe or a Scam?

Introduction

Pride Capital is a forex broker that has recently gained attention in the trading community. Positioned as a platform that offers a wide array of investment options, including forex, commodities, and cryptocurrencies, it aims to attract both novice and experienced traders. However, as with any financial investment, traders must exercise caution when evaluating brokers, especially in an unregulated market. This article aims to provide a comprehensive analysis of Pride Capital, examining its regulatory status, company background, trading conditions, customer safety, user experiences, and potential risks. The evaluation is based on a thorough review of various sources and user feedback to determine whether Pride Capital is safe or if it exhibits signs of being a scam.

Regulation and Legitimacy

The regulatory status of a broker is crucial for ensuring the safety and security of traders' funds. Pride Capital operates without any valid regulatory oversight from recognized financial authorities. This lack of regulation raises significant concerns regarding the protection of client funds and the overall legitimacy of the broker.

| Regulatory Body | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of a regulatory license means that Pride Capital is not bound by any legal obligations to maintain transparency or adhere to ethical trading practices. Engaging with an unregulated broker like Pride Capital carries substantial risks, as there is no safety net for traders in case of disputes or financial mismanagement. Furthermore, the broker's claims of being regulated in multiple jurisdictions have been found to be misleading, as no records exist on official regulatory websites. This lack of oversight is a strong indicator that Pride Capital is not safe for traders seeking a reliable investment platform.

Company Background Investigation

Pride Capital's company history and ownership structure provide further insight into its legitimacy. The broker has been in operation for approximately 1-2 years, with its headquarters located at 131 Princess St, Manchester, England. However, limited information is available regarding its ownership and management team, which raises concerns about transparency.

The management teams background and professional experience are critical factors in assessing the credibility of a broker. Unfortunately, there is little publicly available information about the key individuals behind Pride Capital, which makes it difficult to evaluate their qualifications or track record in the financial industry. The lack of transparency regarding company operations and ownership can be a red flag for potential investors. This opacity contributes to the notion that Pride Capital may not be safe, as it does not provide sufficient information for traders to make informed decisions.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions is essential. Pride Capital offers various account types with different fee structures, but the overall cost of trading appears to be higher than industry averages. The broker claims to provide competitive spreads and leverage options, but user reports suggest discrepancies between advertised and actual trading conditions.

| Fee Type | Pride Capital | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 2.0 pips | From 1.0 pips |

| Commission Model | Varies by account type | Typically lower |

| Overnight Interest Range | Not disclosed | Typically disclosed |

The spread for standard accounts starts at 2.0 pips, which is significantly higher than the industry average. Additionally, the commission structure is not clearly outlined on the website, leading to confusion among traders. The lack of transparency regarding fees, coupled with higher-than-average costs, raises concerns about the overall trading conditions at Pride Capital. These factors contribute to the perception that Pride Capital is not safe for traders looking for cost-effective trading solutions.

Client Fund Safety

The safety of client funds is paramount when choosing a broker. Unfortunately, Pride Capital does not provide clear information regarding its fund safety measures. There is no indication that client funds are kept in segregated accounts, which is a standard practice among regulated brokers to protect investors in case of bankruptcy or financial mismanagement.

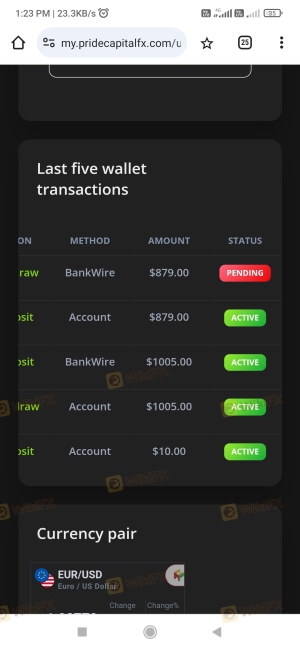

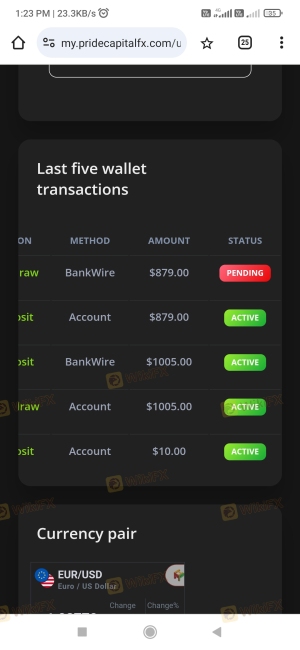

Additionally, the absence of investor protection schemes means that if Pride Capital were to encounter financial difficulties, traders could potentially lose their entire investment. Historical complaints suggest that users have faced challenges when attempting to withdraw their funds, further highlighting the lack of safeguards in place. This raises serious concerns about whether Pride Capital is safe for investors, as the potential for loss is significantly heightened in an unregulated environment.

Customer Experience and Complaints

User feedback is an essential aspect of evaluating a broker's reliability. A significant number of reviews for Pride Capital highlight issues such as withdrawal difficulties, unresponsive customer service, and misleading promotional offers. Many users report that once they deposit funds, accessing their money becomes increasingly challenging, with complaints about unexpected fees and delays in processing withdrawals.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Issues | Medium | Poor |

| Misleading Promotions | High | Inconsistent |

Several users have shared their experiences, indicating that they felt trapped after depositing funds, with minimal support from the company. For instance, one trader reported that after investing a significant amount, they were unable to withdraw their money despite multiple requests. Such patterns of complaints raise serious questions about the integrity of Pride Capital and suggest that Pride Capital may not be safe for potential investors.

Platform and Trade Execution

The trading platform provided by Pride Capital is another critical factor to consider. The broker claims to offer a user-friendly interface with access to a range of trading instruments. However, user experiences indicate that the platform suffers from stability issues, including frequent downtime and slow execution speeds. Traders have reported instances of slippage and rejected orders, which can significantly impact trading performance.

The quality of order execution is a vital aspect of trading, as delays or failures can lead to substantial financial losses. Reports of poor execution quality and technical issues further contribute to the perception that Pride Capital is not safe for traders who rely on timely and efficient trade execution.

Risk Assessment

Engaging with Pride Capital involves several risks that potential investors should be aware of. The absence of regulation, combined with high trading fees, withdrawal difficulties, and poor customer service, creates an environment fraught with potential pitfalls.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No oversight from financial authorities |

| Financial Risk | High | Potential for loss due to unregulated practices |

| Operational Risk | Medium | Issues with platform stability and execution |

To mitigate these risks, it is advisable for traders to conduct thorough research before committing any funds. Seeking out regulated brokers with transparent practices and robust customer support can help ensure a safer trading experience.

Conclusion and Recommendations

In conclusion, the evidence suggests that Pride Capital is not safe for investors. The lack of regulation, combined with numerous complaints regarding customer service and withdrawal issues, raises significant red flags. Traders are strongly advised to exercise caution and consider alternative options that offer regulatory oversight and a proven track record of reliability.

For those seeking safer trading environments, consider exploring well-regulated brokers such as IG, OANDA, or Forex.com, which have established reputations and provide adequate protections for client funds. Overall, it is crucial for traders to prioritize their safety and security by choosing brokers that adhere to strict regulatory standards and offer transparent trading conditions.

Is Pride Capital a scam, or is it legit?

The latest exposure and evaluation content of Pride Capital brokers.

Pride Capital Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Pride Capital latest industry rating score is 1.32, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.32 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.