Lunar Capital 2025 Review: Everything You Need to Know

Executive Summary

Lunar Capital works as a forex broker under the Seychelles Financial Services Authority (FSA). It offers flexible trading with a $50 minimum deposit and $3 commissions per lot. The broker provides spreads from 0 pips on their Raw Account and calls itself a legitimate European broker with global investment authority. However, this lunar capital review shows major concerns about customer service quality, with many user complaints about withdrawals and account activation that potential traders should think about carefully.

The broker offers educational resources like courses, webinars, podcasts, and ebooks to help traders get better. Lunar Capital says it provides 100% profit insurance and works as a member of The Financial Commission, offering compensation fund protection up to €20,000. Despite these features, user feedback shows big service quality problems that hurt the overall trading experience.

The platform works best for experienced traders with higher risk tolerance, especially those familiar with forex trading who can handle potential service challenges. While the trading conditions look competitive on paper, the documented customer service issues and withdrawal complaints suggest that traders should be careful and thoroughly check their risk tolerance before using this broker.

Important Disclaimers

Regional Entity Differences: Lunar Capital operates under different rules and legal frameworks across various regions. Users should know about potential legal risks and check the specific regulatory status that applies to their area before opening an account.

Review Methodology: This evaluation uses publicly available information and user feedback collected from various sources. The assessment aims to provide an objective analysis of Lunar Capital's services and business practices, though individual experiences may be very different from the general findings presented here.

Rating Framework

Broker Overview

Lunar Capital presents itself as a popular European broker with claimed authority in the global investment sphere. According to available information, the company operates through Pecunia Ltd, with its registered address at Trust Company Complex, Ajeltake Road, Ajeltake Island, Majuro, Republic of the Marshall Islands. The broker emphasizes having a competent team knowledgeable about financial instruments and trading operations, positioning itself as a legitimate organization in the forex trading sector.

The company's business model focuses on providing forex trading services with multiple account types and educational resources. Lunar Capital operates under the regulatory oversight of the Seychelles Financial Services Authority (FSA), though specific regulatory details and compliance measures remain limited in publicly available documentation. This lunar capital review finds that while the broker claims European popularity, its actual operational base appears to be in the Marshall Islands, which may create jurisdictional complexities for traders.

The broker offers three retail trading accounts with varying features, including Islamic accounts for swap-free trading. Lunar Capital promotes transparency in its operations and claims membership in The Financial Commission, which provides additional trader protection through compensation funds. However, the contrast between promotional claims and actual user experiences suggests potential gaps between marketing promises and service delivery.

Regulatory Status: Lunar Capital operates under regulation from the Seychelles Financial Services Authority (FSA). Traders should understand that Seychelles regulation may offer different levels of protection compared to major financial centers, and users should assess associated legal risks accordingly.

Deposit and Withdrawal Methods: Specific deposit and withdrawal methods are not detailed in available information, though the broker accepts a minimum deposit of $50, making it accessible to beginning traders. The lack of clear information about payment methods creates uncertainty for potential clients.

Minimum Deposit Requirements: The $50 minimum deposit requirement positions Lunar Capital as accessible to new traders, representing one of the lower barriers to entry in the forex broker market.

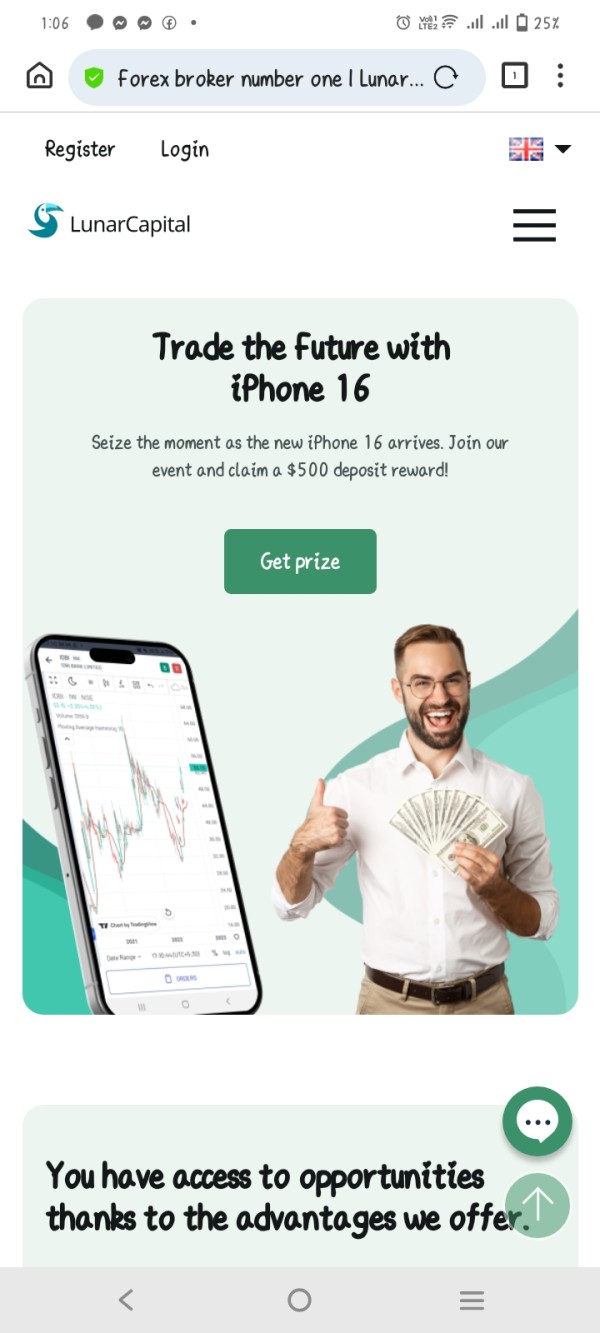

Bonuses and Promotions: Information about specific bonus programs and promotional activities is not detailed in available sources, suggesting either limited promotional offerings or lack of transparency in marketing materials. This absence of promotional information may indicate conservative business practices or inadequate marketing disclosure.

Tradeable Assets: The broker primarily focuses on forex trading services, though specific details about available currency pairs, exotic instruments, or other asset classes remain unspecified in current documentation.

Cost Structure: Lunar Capital offers competitive pricing with spreads starting from 0 pips on Raw Accounts, combined with a $3 per lot commission structure. This transparent fee arrangement allows traders to calculate trading costs more accurately compared to brokers with variable spread-only models.

Leverage Ratios: Specific leverage information is not provided in available sources, requiring potential clients to contact the broker directly for these crucial trading parameters. The absence of leverage information creates significant uncertainty for traders planning their risk management strategies.

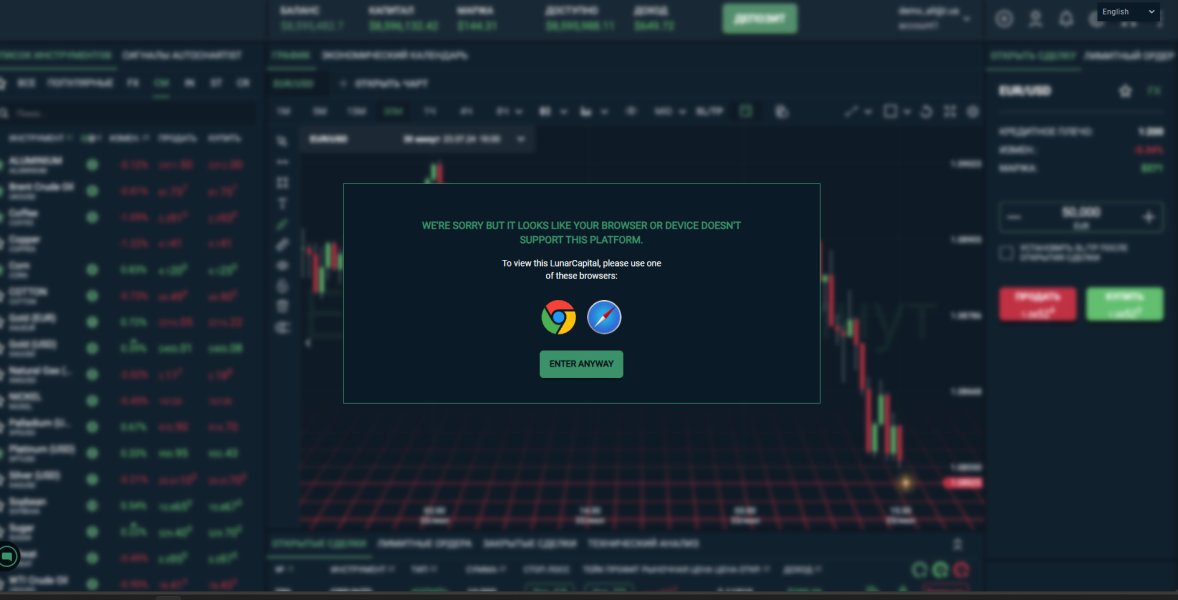

Platform Options: Trading platform details are not specified in current information, leaving questions about whether the broker offers MetaTrader, proprietary platforms, or other trading solutions.

This lunar capital review notes significant information gaps that potential traders should address through direct broker contact before making account opening decisions.

Account Conditions Analysis

Lunar Capital's account structure centers around competitive entry requirements and flexible trading terms. The $50 minimum deposit represents a relatively low barrier to entry, making forex trading accessible to newcomers and those with limited initial capital. This positions the broker favorably compared to many competitors requiring significantly higher initial investments.

The Raw Account offering stands out with spreads starting from 0 pips, combined with a transparent $3 per lot commission structure on both sides of trades. This pricing model benefits active traders who can calculate exact trading costs in advance, rather than dealing with variable spread markups that can fluctuate during market volatility. The commission-based approach typically provides better execution quality and more consistent pricing.

Account activation processes have generated user complaints, with some traders reporting difficulties in getting their accounts properly activated and functional. These issues suggest potential problems in the broker's onboarding procedures that could frustrate new clients expecting smooth account setup experiences.

The availability of Islamic accounts for swap-free trading demonstrates consideration for Muslim traders, expanding the broker's potential client base. However, specific details about account types, their distinct features, and any special functionalities remain limited in available documentation.

User feedback regarding account management reveals mixed experiences, with some traders expressing satisfaction with trading conditions while others report significant frustrations with account-related services. This lunar capital review suggests that while the basic account terms appear competitive, execution of account services may not consistently meet trader expectations.

Lunar Capital demonstrates commitment to trader education through a comprehensive range of learning resources. The broker provides courses, webinars, podcasts, and ebooks designed to help traders improve their skills and market understanding. This educational approach suggests recognition that successful traders benefit the broker through increased trading activity and longevity.

The variety of educational formats accommodates different learning preferences, from visual learners who benefit from webinars to those who prefer reading ebooks or listening to podcasts during commutes. This multi-format approach indicates thoughtful consideration of diverse trader needs and schedules.

However, specific details about the quality, depth, and frequency of these educational offerings remain unclear from available information. The effectiveness of educational resources often depends on factors like instructor expertise, content currency, and practical applicability to real trading situations.

Research and analysis resources beyond basic education are not clearly specified in available documentation. Many traders rely on market analysis, economic calendars, and trading signals to inform their decisions, but the availability and quality of such tools from Lunar Capital remains unconfirmed.

The absence of detailed information about trading tools, analytical software, or automated trading support creates uncertainty about the broker's technological offerings. Modern traders often expect sophisticated charting tools, risk management features, and potentially algorithmic trading capabilities that are not clearly addressed in current broker information.

Customer Service and Support Analysis

Customer service represents a significant weakness in Lunar Capital's operations based on available user feedback. Multiple complaints highlight problems with withdrawal processes and account activation, suggesting systemic issues in customer support responsiveness and problem resolution capabilities.

User reports indicate frustration with unresolved issues, particularly regarding fund withdrawals and account functionality problems. One user specifically mentioned being unable to withdraw funds, while another expressed disappointment about account activation delays. These complaints suggest potential gaps between customer expectations and actual service delivery.

The specific customer service channels, response times, and availability hours are not detailed in available information, making it difficult for potential clients to understand what level of support they can expect. Professional forex brokers typically offer multiple contact methods including phone, email, live chat, and sometimes dedicated account managers.

Language support capabilities remain unspecified, which could be problematic for international traders who require assistance in their native languages. Given the broker's claimed European popularity, multilingual support would be expected but is not confirmed in available documentation.

The pattern of customer complaints combined with limited information about support infrastructure suggests that customer service may not meet industry standards. This creates significant risk for traders who may need assistance with technical issues, account problems, or urgent withdrawal requests.

Trading Experience Analysis

The trading experience evaluation is limited by insufficient information about platform specifications, execution quality, and technical performance. Available sources do not provide details about trading platforms, whether MetaTrader or proprietary systems, leaving questions about interface quality and functionality.

Order execution quality remains unassessed due to lack of specific user feedback about slippage, fill rates, or execution speeds. These factors critically impact trading profitability, especially for scalpers and high-frequency traders who depend on precise order execution.

Platform stability and performance data are not available in current sources, though these factors significantly influence trader satisfaction and success. Frequent disconnections, slow order processing, or platform crashes can severely impact trading results and user experience.

Mobile trading capabilities are not addressed in available information, despite mobile trading becoming increasingly important for modern traders who need market access while traveling or away from desktop systems. The absence of mobile platform information suggests either limited mobile offerings or inadequate marketing of existing capabilities.

The Raw Account's 0-pip spreads represent a positive aspect of the trading environment, potentially providing better trading conditions than many competitors. However, the actual consistency of these spreads during different market conditions and news events remains unverified through user feedback.

This lunar capital review finds that while basic trading terms appear competitive, the lack of detailed platform information and mixed user experiences create uncertainty about overall trading experience quality.

Trust and Reliability Analysis

Lunar Capital's trustworthiness presents a mixed picture with both positive regulatory elements and concerning user feedback. The broker operates under Seychelles Financial Services Authority (FSA) regulation, which provides some regulatory oversight, though Seychelles regulation may not offer the same level of protection as major financial centers like the UK or Australia.

The claimed membership in The Financial Commission adds a layer of trader protection through compensation fund coverage up to €20,000. This membership, if verified, demonstrates some commitment to dispute resolution and trader protection beyond basic regulatory requirements.

However, user concerns about the broker's legitimacy create significant trust issues. Some traders have expressed skepticism about whether Lunar Capital operates as a legitimate organization, particularly given unresolved customer service issues and withdrawal problems reported by multiple users.

Company transparency appears limited, with basic corporate information available but lacking detailed disclosure about ownership, financial stability, or operational procedures. The registered address in the Marshall Islands while claiming European broker status may create confusion about actual operational jurisdiction and applicable protections.

The contrast between promotional claims of being a "popular European broker" and actual user experiences reporting service problems suggests potential gaps between marketing representation and operational reality. This disconnect raises questions about overall business practices and commitment to customer satisfaction.

User Experience Analysis

Overall user satisfaction with Lunar Capital appears mixed to negative based on available feedback. While some traders report positive experiences with trading conditions, a significant number express disappointment with service quality and operational issues.

User interface and platform usability information is not available in current sources, making it difficult to assess the ease of navigation, order placement, and account management processes that directly impact daily trading activities. The lack of interface information creates uncertainty about the practical aspects of using the broker's services.

The registration and verification process has generated complaints, with users reporting difficulties in account activation that suggest potential problems in onboarding procedures. Smooth account opening and verification processes are fundamental to positive user experiences with any financial service provider.

Fund management experiences appear problematic, with multiple users reporting withdrawal difficulties and delays. These issues significantly impact user confidence and satisfaction, as traders need reliable access to their funds for effective money management.

Common user complaints center on withdrawal processes and account activation problems, indicating systemic issues rather than isolated incidents. The persistence of these complaints suggests that the broker has not adequately addressed known service problems.

The user demographic appears to include both satisfied customers who appreciate the trading conditions and frustrated clients dealing with service issues. This polarization suggests that while some aspects of the broker's offering may be competitive, operational execution remains inconsistent and problematic for a significant portion of users.

Conclusion

This comprehensive lunar capital review reveals a broker with competitive trading conditions but significant operational challenges that potential traders must carefully consider. While Lunar Capital offers attractive features including low minimum deposits, competitive spreads, and comprehensive educational resources, persistent customer service issues and withdrawal complaints create substantial concerns about overall service quality.

The broker appears most suitable for experienced traders with high risk tolerance who can navigate potential service challenges and have alternative funding sources if withdrawal issues arise. New traders or those requiring reliable customer support may find better options with more established brokers offering stronger operational track records.

The main advantages include accessible entry requirements, competitive Raw Account pricing, and educational resource availability. However, the disadvantages of poor customer service, withdrawal difficulties, and limited transparency about operations significantly impact the overall value proposition and user experience quality.