Pride Capital Review 2

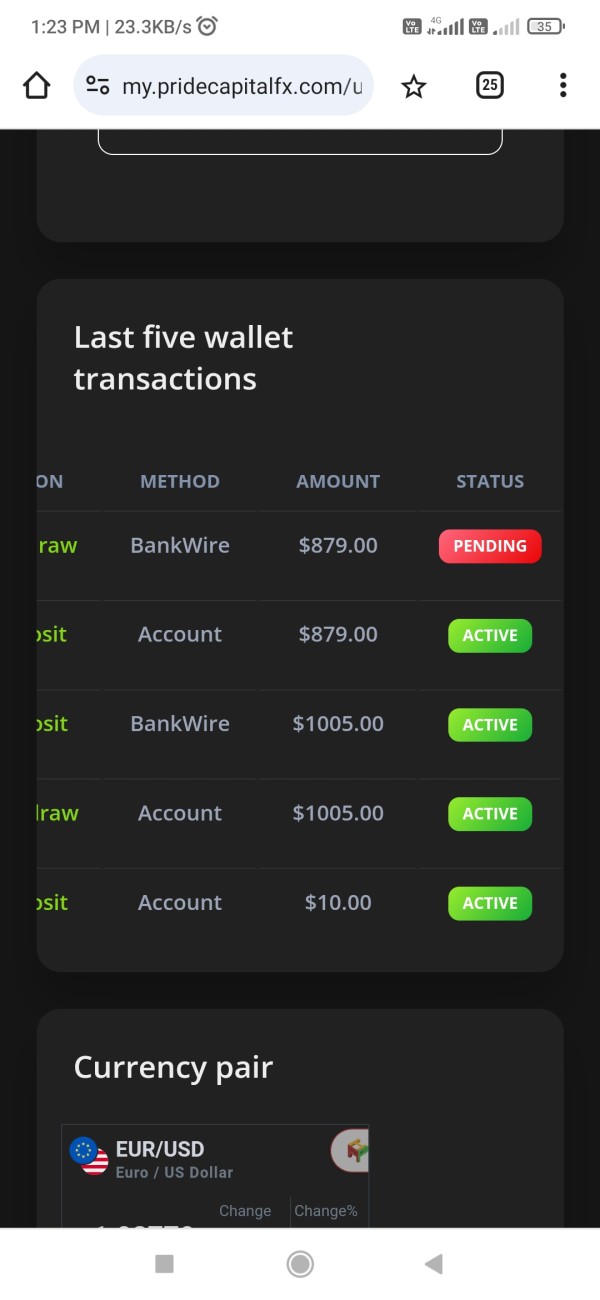

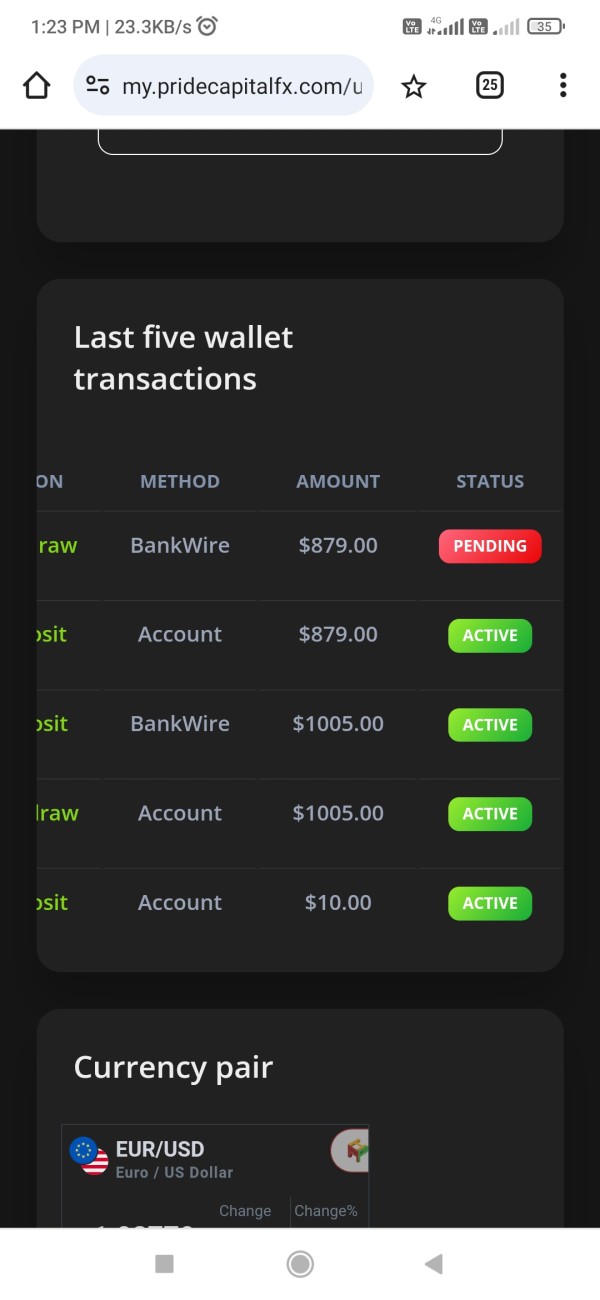

This pridecapitalfx not given my withdrawal principal amount

Hii pridecapitalfx team please give me my withdrawal money

Pride Capital Forex Broker provides real users with * positive reviews, * neutral reviews and 2 exposure review!

This pridecapitalfx not given my withdrawal principal amount

Hii pridecapitalfx team please give me my withdrawal money

This pride capital review reveals concerning findings about a broker that claims significant market presence but faces serious credibility issues. Pride Capital presents itself as a Financial Conduct Authority authorized CFDs broker. The company offers diverse investment products including Forex, Commodities, Stocks, Indices, Bonds, and Digital Currencies across global markets. The platform reportedly serves 820,000 clients, suggesting substantial market reach.

However, critical red flags emerge from multiple sources marking Pride Capital as a SCAM operation. Despite claims of FCA authorization and an extensive product portfolio spanning major asset classes, the broker has received overwhelmingly negative user feedback and regulatory warnings. The platform targets traders seeking diversified investment opportunities across traditional and digital assets. Potential clients must exercise extreme caution given the documented concerns about legitimacy and operational practices. According to available reports, Pride Capital operates through pridecapitalfx.com but faces serious questions about regulatory compliance and client fund safety.

This evaluation encompasses potential regional variations in Pride Capital's operations. Different jurisdictions may implement varying regulatory standards affecting user experiences across geographical boundaries. Regulatory policies in different countries could significantly impact trading conditions, fund protection measures, and dispute resolution processes for international clients.

This pride capital review represents an independent assessment based on publicly available information, user testimonials, and regulatory data sourced from official financial authorities including the FCA. Our analysis methodology incorporates multiple verification sources to provide comprehensive insights. We acknowledge the dynamic nature of broker operations and regulatory status changes.

| Dimension | Score | Rating |

|---|---|---|

| Account Conditions | 4/10 | Below Average |

| Tools and Resources | 5/10 | Average |

| Customer Service and Support | 3/10 | Poor |

| Trading Experience | 5/10 | Average |

| Trust and Reliability | 2/10 | Very Poor |

| User Experience | 4/10 | Below Average |

Pride Capital operates as an online CFDs broker claiming authorization from the Financial Conduct Authority in the United Kingdom. The company positions itself as a comprehensive trading platform serving global markets through diverse investment products. Based on available information, Pride Capital targets retail traders seeking exposure to multiple asset classes through a single platform interface.

The broker's business model centers on providing CFDs trading across traditional financial instruments and emerging digital assets. Pride Capital claims to serve over 820,000 clients worldwide. This suggests significant operational scale. However, the substantial client base contrasts sharply with negative reputation indicators and scam allegations documented across multiple review platforms.

According to reports, Pride Capital offers trading in Forex, CFDs, Commodities, Stocks, Indices, Bonds, and Digital Currencies. The platform operates under FCA regulatory oversight, though specific license verification details require careful examination. This pride capital review emphasizes the importance of verifying regulatory claims given documented concerns about the broker's legitimacy and operational practices.

Regulatory Jurisdiction: Pride Capital claims Financial Conduct Authority authorization in the United Kingdom. Verification of active regulatory status requires independent confirmation through official FCA registers.

Deposit and Withdrawal Methods: Specific information about supported payment methods, processing timeframes, and associated fees was not detailed in available documentation. This represents a significant transparency gap.

Minimum Deposit Requirements: The exact minimum deposit amounts for different account types were not specified in reviewed materials. This limits potential clients' ability to assess accessibility.

Bonus and Promotions: Available sources did not provide details about promotional offers, welcome bonuses, or ongoing incentive programs offered to new or existing clients.

Tradeable Assets: The platform offers comprehensive asset coverage including Forex pairs, CFDs on stocks, Commodities trading, Stock indices, Government and corporate bonds, and Digital currencies across major global markets.

Cost Structure: According to available information, spreads begin from 0 pips. Specific commission structures, overnight financing rates, and additional trading costs were not detailed in reviewed sources.

Leverage Ratios: Maximum leverage limits and margin requirements for different asset classes were not specified in available documentation. This limits assessment of risk management parameters.

Platform Options: Specific trading platform types, software providers, and technological infrastructure details were not documented in reviewed materials. This represents another transparency concern.

Geographic Restrictions: Information about restricted countries, regional limitations, or jurisdiction-specific trading conditions was not available in reviewed sources.

Customer Support Languages: Available language support options and regional customer service capabilities were not specified in documented materials. This pride capital review highlights significant information gaps affecting potential client decision-making.

Pride Capital's account structure lacks essential transparency regarding specific account types, tier benefits, and qualification requirements. The absence of detailed minimum deposit information prevents potential clients from understanding accessibility thresholds across different account categories. Without clear documentation of account opening procedures, verification requirements, or processing timeframes, prospective traders cannot adequately assess the onboarding experience.

The platform's failure to specify special account features such as Islamic accounts, professional trader classifications, or institutional services represents a significant informational deficiency. User feedback indicates concerning experiences with account management processes. Multiple reports suggest difficulties in account access and fund withdrawal procedures.

Compared to established brokers providing comprehensive account documentation, Pride Capital's opacity regarding account conditions raises serious questions about operational transparency. The lack of clear fee structures, maintenance requirements, and account closure procedures further compounds these concerns. This pride capital review emphasizes that legitimate brokers typically provide detailed account information to facilitate informed decision-making. Pride Capital's information gaps are particularly concerning for potential clients.

While Pride Capital claims to offer diverse investment products across major asset classes, the platform lacks detailed information about specific trading tools, analytical resources, and educational materials. The broker's product range spanning Forex, commodities, stocks, indices, bonds, and digital currencies suggests comprehensive market coverage. Without platform specifications, tool quality assessment remains impossible.

Available documentation does not detail research capabilities, market analysis resources, or third-party tool integrations that modern traders expect from legitimate brokers. The absence of information about automated trading support, API access, or advanced order types limits assessment of the platform's technological sophistication.

Educational resource availability, including webinars, tutorials, market commentary, or trading guides, was not documented in reviewed materials. This represents a significant gap for traders seeking broker-supported learning opportunities. The lack of detailed tool specifications, combined with negative user feedback about overall platform reliability, suggests that Pride Capital's resource offering may not meet contemporary trading standards. This occurs despite claims of comprehensive market access.

Customer service quality emerges as a major concern area for Pride Capital. Multiple user reports indicate poor responsiveness and inadequate support resolution. The absence of detailed information about available support channels, operating hours, or response time commitments suggests limited customer service infrastructure or transparency about support capabilities.

Documentation does not specify whether Pride Capital offers live chat, phone support, email assistance, or help desk ticketing systems. Without clear escalation procedures, multilingual support options, or regional service availability, potential clients cannot assess support accessibility for their specific needs.

User feedback consistently highlights negative experiences with customer service interactions. Reports include unresponsive support teams and inadequate assistance with account issues. The combination of limited support transparency and documented user complaints about service quality indicates systemic customer service deficiencies. These significantly impact the overall client experience and broker reliability assessment.

Pride Capital's trading experience assessment faces significant limitations due to insufficient technical specifications and platform performance data. While the broker claims spreads starting from 0 pips, the absence of execution speed metrics, slippage data, or platform stability information prevents comprehensive trading environment evaluation.

Available documentation does not detail order execution quality, market depth access, or pricing transparency measures. Without specific information about trading platform types, mobile application capabilities, or user interface design, potential clients cannot assess the practical trading experience quality.

User feedback suggests concerning experiences with platform functionality and trade execution. Specific technical performance issues were not detailed in available reports. The lack of independent platform testing results, uptime statistics, or execution quality benchmarks makes it difficult to verify Pride Capital's trading environment claims. This pride capital review notes that legitimate brokers typically provide detailed platform specifications and performance metrics. Pride Capital's information gaps are particularly concerning for serious traders.

Trust and reliability represent Pride Capital's most significant weakness. The broker receives SCAM designation from multiple review sources and faces serious questions about operational legitimacy. While Pride Capital claims FCA authorization, independent verification of active regulatory status and compliance standing requires careful examination through official regulatory databases.

The absence of detailed fund protection measures, segregated account information, or client money handling procedures raises serious concerns about financial security. Without clear documentation of insurance coverage, compensation schemes, or regulatory oversight mechanisms, potential clients face substantial uncertainty about fund safety.

Multiple sources have flagged Pride Capital with scam warnings. User feedback consistently reports negative experiences including difficulties with fund withdrawals and account access. The combination of regulatory questions, scam allegations, and documented user complaints creates a severely compromised trust profile. This makes Pride Capital unsuitable for serious trading consideration.

Overall user satisfaction with Pride Capital appears significantly compromised based on available feedback and operational transparency concerns. The platform's failure to provide comprehensive information about registration procedures, verification requirements, or user onboarding processes creates uncertainty about the initial client experience.

Interface design quality, platform navigation, and user-friendly features cannot be assessed due to insufficient documentation about platform specifications and user interface capabilities. Without detailed information about mobile accessibility, account management tools, or user dashboard functionality, potential clients cannot evaluate practical usability.

Common user complaints focus on account access difficulties, withdrawal problems, and poor customer service experiences. The pattern of negative feedback, combined with scam allegations and regulatory concerns, suggests systematic user experience issues that extend beyond individual service problems. Potential clients should exercise extreme caution given the documented pattern of user dissatisfaction and operational concerns. These issues affect Pride Capital's overall user experience quality.

This comprehensive pride capital review reveals significant concerns that make Pride Capital unsuitable for serious trading consideration. Despite claims of FCA authorization and serving 820,000 clients across diverse investment products, the broker faces critical credibility issues including scam designations and overwhelmingly negative user feedback.

Pride Capital may appeal to traders seeking diversified asset exposure across Forex, commodities, stocks, indices, bonds, and digital currencies. However, the substantial risks far outweigh potential benefits. The platform's main advantage lies in claimed product diversity, while major disadvantages include poor reputation, lack of transparency, inadequate customer service, and serious questions about regulatory compliance and fund safety.

Potential clients should exercise extreme caution and consider established, well-regulated alternatives. These provide comprehensive transparency, verified regulatory status, and positive user experiences for secure trading environments.

FX Broker Capital Trading Markets Review