Midas Exchange 2025 Review: Everything You Need to Know

The Midas Exchange has garnered attention in the forex trading community, but the overall impression is mixed. While some users appreciate the low minimum deposit and the availability of popular trading platforms like MT4 and MT5, many have raised serious concerns regarding the broker's regulatory status and customer service. Notably, the lack of a robust regulatory framework has led experts to caution potential investors about the risks associated with trading with Midas Exchange.

Note: Its essential to recognize that Midas Exchange operates under different entities across various regions, which can impact the regulatory protections available to traders. This review aims to provide a balanced perspective based on multiple sources to ensure fairness and accuracy.

Ratings Overview

How We Rate Brokers: Our ratings are based on extensive research and analysis of user feedback, expert opinions, and factual data regarding the broker's offerings.

Broker Overview

Founded in 2011, Midas Exchange is an offshore forex broker registered in Saint Vincent and the Grenadines. It claims to provide a user-friendly trading experience through the widely used MetaTrader 4 and 5 platforms. Midas Exchange offers a variety of trading instruments, including forex pairs, commodities, and cryptocurrencies. However, it is important to note that Midas Exchange is not regulated by any major financial authority, which raises concerns about the safety of client funds.

Detailed Insights

Regulatory Geography

Midas Exchange operates without regulation from a major authority, which poses significant risks for traders. The broker is registered in a jurisdiction known for lax regulatory oversight, making it vulnerable to potential fraud and mismanagement.

Deposit/Withdrawal Currencies

Midas Exchange primarily supports cryptocurrency deposits and withdrawals, with no fiat options available. This approach may appeal to crypto-savvy traders but limits accessibility for those preferring traditional banking methods.

Minimum Deposit

The broker has a notably low minimum deposit requirement, set at just $1. While this can be attractive for new traders, the lack of regulatory oversight may outweigh the benefits of such a low entry barrier.

Midas Exchange does not prominently feature bonuses or promotions, which is a common strategy among many brokers to attract new clients. This absence may indicate a focus on straightforward trading conditions rather than incentivizing deposits.

Tradable Asset Classes

The broker offers a range of tradable assets, including over 65 forex currency pairs, commodities, and cryptocurrencies. However, specific details regarding spreads and fees are often vague, leading to uncertainty among potential traders.

Costs (Spreads, Fees, Commissions)

Midas Exchange's cost structure is characterized by low spreads but also includes commissions that can be significant, particularly for smaller accounts. Users have reported mixed experiences regarding the transparency of fees, with some claiming unexpected charges during withdrawals.

Leverage

The broker offers high leverage options, up to 1:1000, which can amplify both profits and losses. While high leverage can be enticing for experienced traders, it poses substantial risks, especially for novices who may not fully understand the implications.

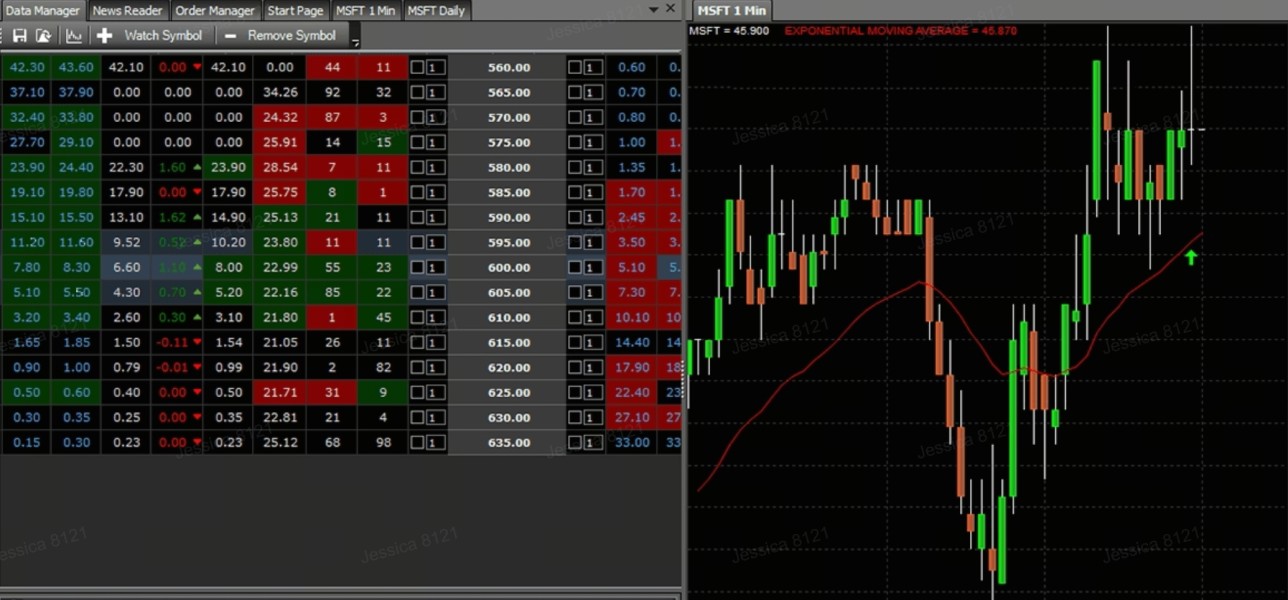

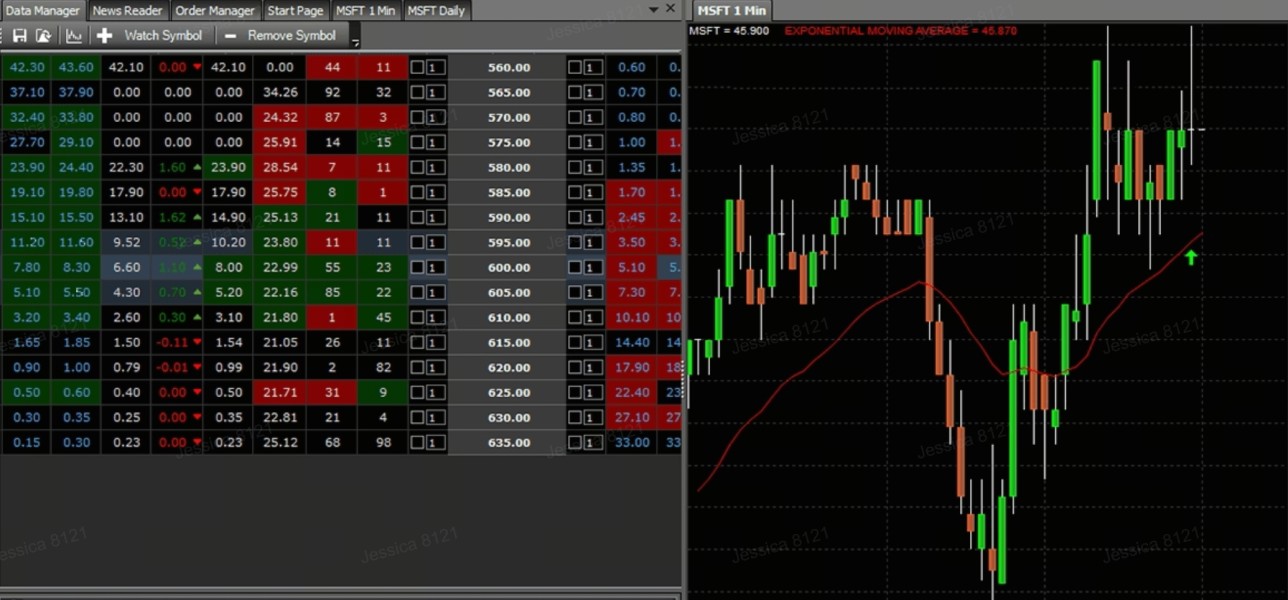

Midas Exchange supports both the MetaTrader 4 and MetaTrader 5 platforms, which are well-regarded in the trading community for their advanced features and user-friendly interfaces. This availability is a positive aspect of the broker's offering.

Restricted Regions

Midas Exchange does not explicitly list restricted regions, but its unregulated status may deter traders from certain jurisdictions. Prospective clients should verify their local regulations before opening an account.

Available Customer Support Languages

Customer support at Midas Exchange is primarily offered in English, with limited options for other languages. Users have reported difficulties in reaching support, particularly regarding withdrawal issues.

Repeated Ratings Overview

Detailed Breakdown

-

Account Conditions (4.0/10): Midas Exchange offers a low minimum deposit, but the lack of regulatory protection raises concerns about account security.

Tools and Resources (5.0/10): The availability of MT4 and MT5 platforms is a plus, but the lack of educational resources may hinder novice traders.

Customer Service and Support (3.0/10): Reports of slow response times and inadequate support during critical issues, such as withdrawals, significantly impact user satisfaction.

Trading Setup (Experience) (4.5/10): While the trading experience is generally smooth, the high leverage options can lead to substantial risks.

Trustworthiness (2.0/10): The absence of regulation and numerous negative reviews regarding fund withdrawals contribute to a low trust rating.

User Experience (3.5/10): Mixed reviews from users indicate that while some appreciate the platform's usability, many express frustration with customer support and withdrawal processes.

In conclusion, the Midas Exchange presents an appealing option for some traders due to its low entry barriers and popular trading platforms. However, the lack of regulation, mixed user reviews, and significant concerns regarding customer support and fund security warrant caution. Potential clients should thoroughly assess their risk tolerance and consider alternative brokers with a more robust regulatory framework.