Is XO safe?

Business

License

Is XO Safe or a Scam?

Introduction

XO is a relatively new player in the forex market, having been established in 2018. As a broker, it primarily operates in the realm of forex and CFD trading, catering to a diverse clientele, including both novice and experienced traders. The rapid growth of online trading has led to an influx of brokers, making it increasingly important for traders to exercise caution and thoroughly evaluate the legitimacy and safety of their chosen platforms. This article aims to provide an in-depth analysis of XO, examining its regulatory status, company background, trading conditions, customer experience, and overall safety. The evaluation is based on a comprehensive review of various online resources, including regulatory information, user feedback, and expert assessments.

Regulation and Legitimacy

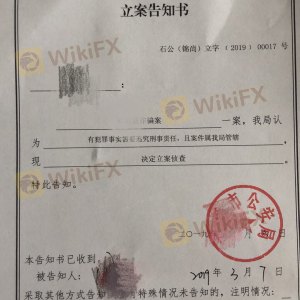

Regulatory oversight is a critical factor in assessing whether a broker is safe or a potential scam. XO's regulatory status is particularly concerning, as it has not been found to be regulated by any major financial authority. This lack of oversight raises significant red flags for prospective traders. A regulated broker is typically required to adhere to strict standards, ensuring the protection of client funds and promoting transparency in operations.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Not Regulated | N/A | N/A | Not Verified |

The absence of regulation means that XO does not offer the same level of investor protection that regulated brokers do. This is particularly alarming because unregulated brokers can operate without the stringent compliance measures that safeguard client interests. In the absence of regulatory oversight, traders are left vulnerable to potential fraud and mismanagement of funds. Moreover, the lack of historical compliance records further diminishes confidence in XO's legitimacy.

Company Background Investigation

XO was founded in 2018, and while it may have started with the intention of providing a reliable trading platform, its rapid rise in the market has been marred by questions regarding its ownership structure and transparency. The broker operates out of Malaysia, but there is scant information available about its ownership and management team. This lack of transparency is a significant concern, as traders may find it challenging to ascertain who is behind the operations and whether they can be held accountable in case of disputes.

The management team‘s background is another critical factor in evaluating the broker's credibility. Unfortunately, there is limited information available regarding the professional experience of the individuals leading XO. A well-qualified and experienced management team is essential for ensuring smooth operations and fostering trust among clients. The absence of such information raises questions about the broker’s commitment to transparency and accountability.

Trading Conditions Analysis

When assessing whether XO is safe, it is essential to analyze the trading conditions it offers. The broker's fee structure is crucial in determining its overall value proposition. XO employs a relatively straightforward pricing model, but there are concerns regarding hidden fees and charges that may not be immediately apparent to traders.

| Fee Type | XO | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1.0 - 1.5 pips |

| Commission Model | None | $5 - $10 per trade |

| Overnight Interest Range | High | Low to Moderate |

The spreads offered by XO are variable and can be higher than industry averages, which may impact traders' profitability. Additionally, the lack of a commission model might seem appealing at first glance; however, traders should be wary of the potential for hidden costs that could arise during trading. This uncertainty in costs can make it difficult for traders to effectively manage their risk and returns.

Customer Funds Safety

The safety of customer funds is paramount when evaluating any broker. In the case of XO, the absence of regulatory oversight raises concerns about the safety measures in place to protect client funds. A reputable broker typically employs segregation of client funds, ensuring that they are kept separate from the broker's operational funds. This practice is crucial for safeguarding traders' investments in the event of the broker facing financial difficulties.

Furthermore, the lack of investor protection schemes, which are often offered by regulated brokers, means that traders using XO may not have recourse in the event of a dispute or if the broker were to become insolvent. The absence of negative balance protection further exacerbates the risks associated with trading with XO, as traders could potentially lose more than their initial deposit.

Customer Experience and Complaints

Customer feedback is a vital component in determining whether XO is a safe trading option. While some users report satisfactory experiences, there are numerous complaints regarding the broker's customer service and responsiveness. Common issues include difficulties in withdrawing funds and a lack of communication from the support team.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow/Unresponsive |

| Customer Service Quality | Medium | Inconsistent |

One notable case involved a trader who reported being unable to withdraw their funds after repeated attempts to contact customer support. This type of complaint is alarming, as it indicates potential underlying issues with the broker‘s operational integrity. The overall sentiment among users suggests a lack of confidence in XO’s ability to provide reliable service and support.

Platform and Trade Execution

The trading platform is another critical aspect of a broker's offering. XO utilizes the MetaTrader 4 (MT4) platform, which is widely regarded for its user-friendly interface and robust features. However, there have been reports of issues related to platform stability and execution quality. Traders have expressed concerns about slippage and order rejections, which can significantly affect trading outcomes.

The execution quality is particularly important for forex trading, where timing can be crucial. If traders experience frequent slippage or rejected orders, it can lead to frustration and financial losses. Such issues may indicate potential manipulation or inefficiencies within the trading environment, further questioning whether XO is indeed a safe broker.

Risk Assessment

Evaluating the overall risk associated with trading with XO is essential for prospective clients. The lack of regulation, combined with the complaints regarding customer service and execution quality, presents a concerning risk profile.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Financial Risk | Medium | Potential for fund mismanagement |

| Operational Risk | High | Issues with platform stability and execution |

To mitigate these risks, traders are advised to conduct thorough research before engaging with XO. Utilizing a demo account to test the platform and assess its performance without financial commitment can be a prudent first step. Additionally, diversifying investments and avoiding overexposure to any single broker can help manage potential losses.

Conclusion and Recommendations

In conclusion, the evidence suggests that traders should approach XO with caution. The lack of regulatory oversight, combined with customer complaints and concerns about trading conditions, raises significant red flags. While some users may have positive experiences, the overall sentiment leans towards skepticism regarding the broker's safety and reliability.

For traders seeking a secure trading environment, it is advisable to consider alternative brokers that are regulated by reputable authorities and offer transparent fee structures. Brokers with strong regulatory frameworks provide a level of protection and recourse that XO currently lacks. In summary, while XO may present opportunities, the associated risks make it a less favorable choice for discerning traders.

Is XO a scam, or is it legit?

The latest exposure and evaluation content of XO brokers.

XO Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

XO latest industry rating score is 1.58, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.58 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.