JP PRO 2025 Review: Everything You Need to Know

Executive Summary

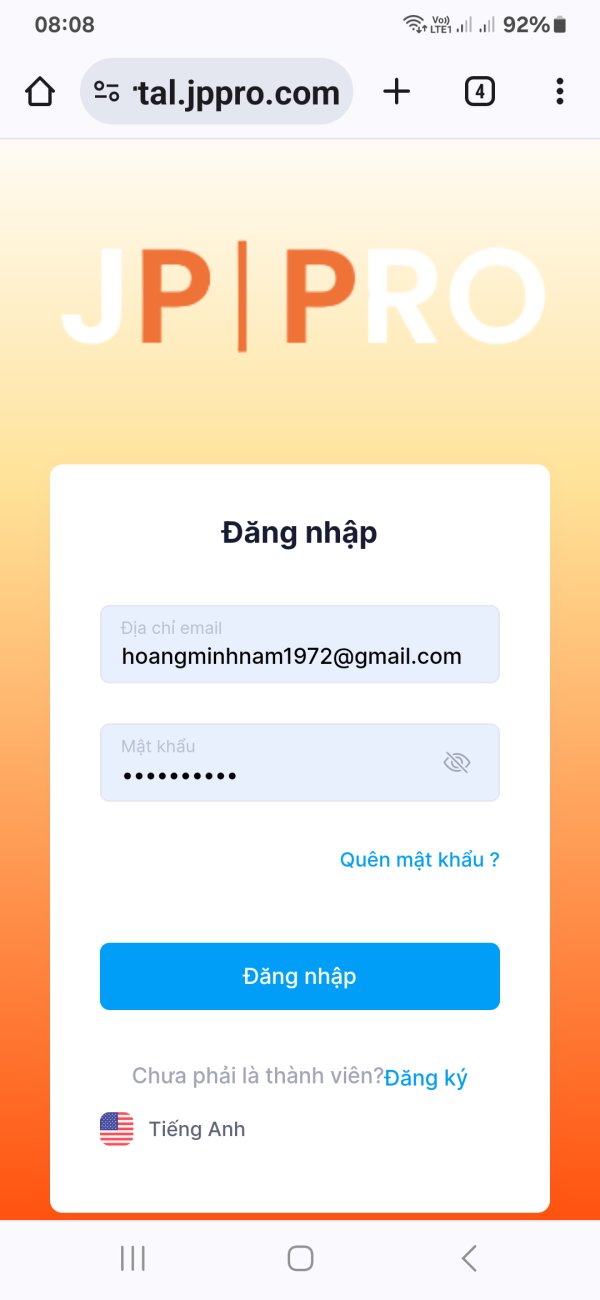

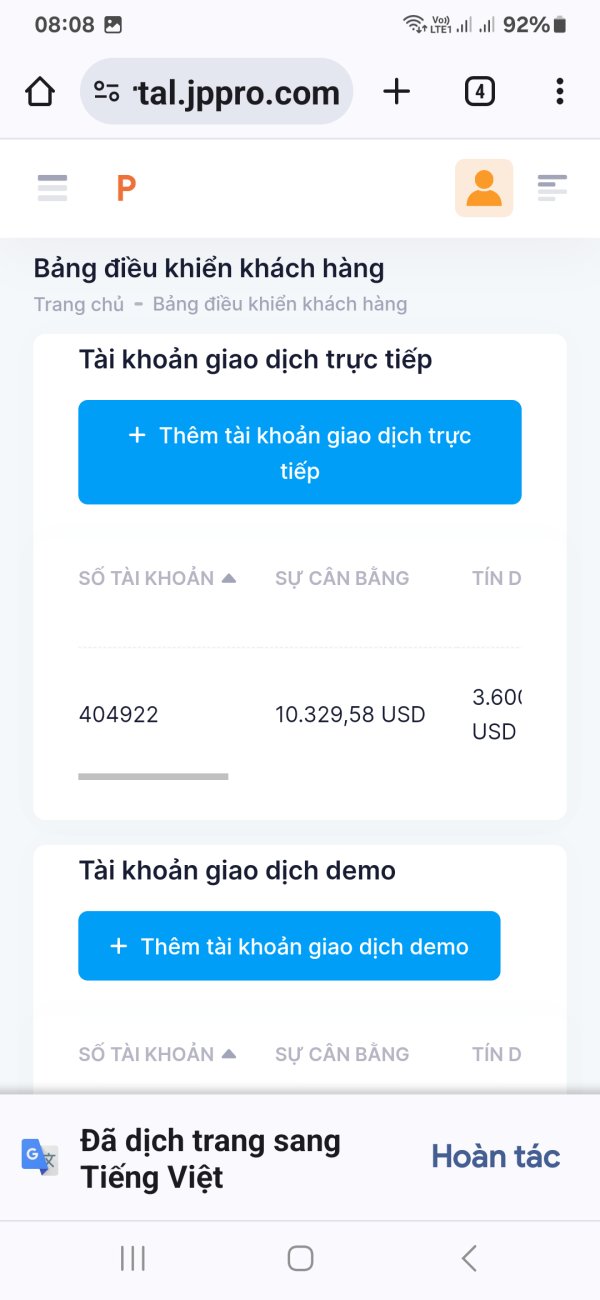

JP PRO is an unregulated forex broker operating from Saint Vincent and the Grenadines. It has attracted significant negative attention from traders and industry observers. This jp pro review reveals a concerning pattern of user complaints and regulatory gaps that potential investors should carefully consider before investing. The broker offers a minimum deposit requirement of 100 USD and leverage up to 1:1000. These features may initially appear attractive to traders seeking high-risk, high-reward opportunities.

However, our analysis indicates that JP PRO lacks proper regulatory oversight. The broker has registration under the SVG FSA - an authority that does not license or supervise forex trading activities. Multiple user reports suggest issues with fund security and customer service responsiveness, which creates serious concerns for potential traders. While the low entry barrier and high leverage ratios might appeal to some traders, the absence of regulatory protection and numerous negative reviews position this broker as suitable primarily for high-risk tolerance investors. These investors must understand the potential for complete loss of capital.

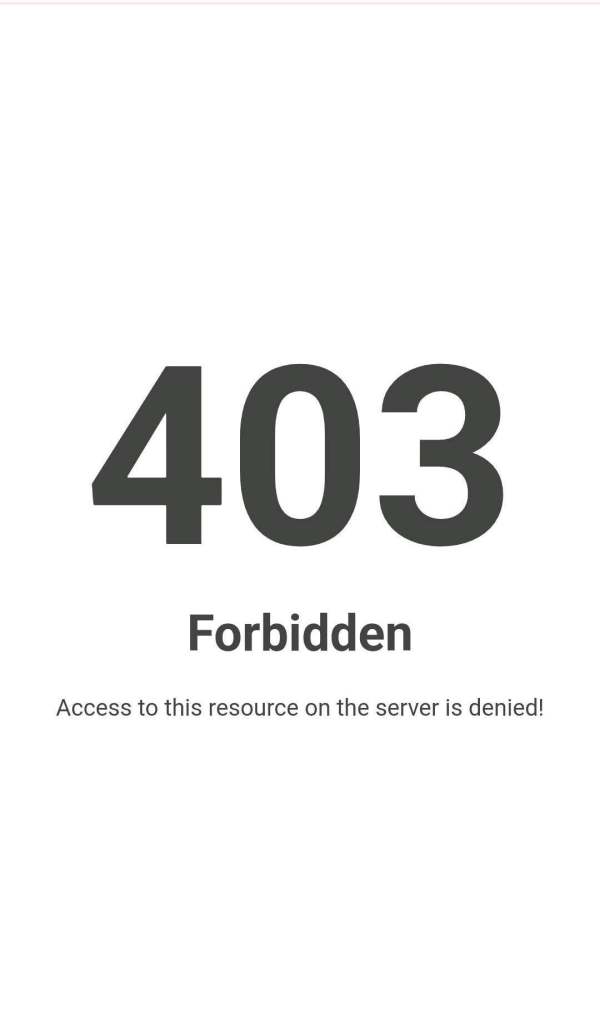

The broker's operational transparency remains questionable. Limited information is available about trading platforms, asset offerings, and fund protection measures. This comprehensive evaluation aims to provide traders with essential information needed to make informed decisions about engaging with JP PRO's services.

Important Disclaimers

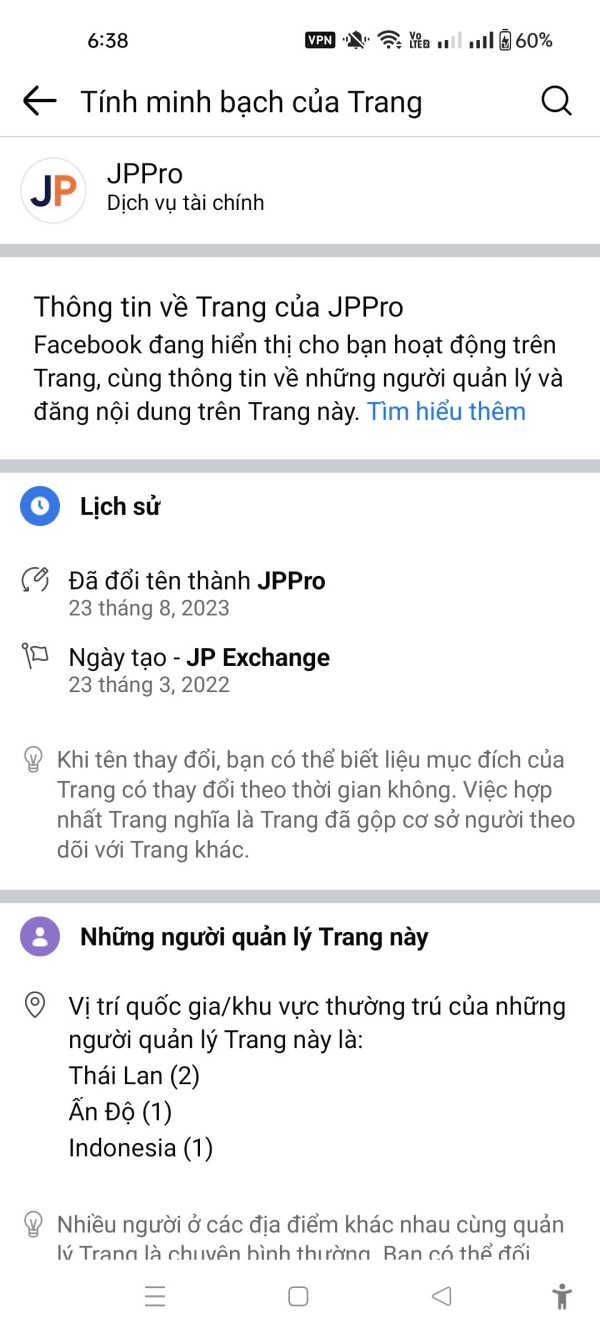

Regional Entity Differences: JP PRO operates as a single entity registered in Saint Vincent and the Grenadines under the SVG FSA framework. However, it's crucial to understand that the SVG FSA does not provide licensing or regulatory oversight for forex brokerage activities. This leaves traders without the protection typically associated with regulated brokers in major financial jurisdictions.

Review Methodology: This evaluation is based on available user feedback, regulatory information, and publicly accessible data about JP PRO's operations. Our assessment has not involved direct testing of the broker's services or platforms, and readers should conduct their own due diligence before making any investment decisions.

Overall Rating Framework

Overall Score: 3.5/10 - High Risk Broker

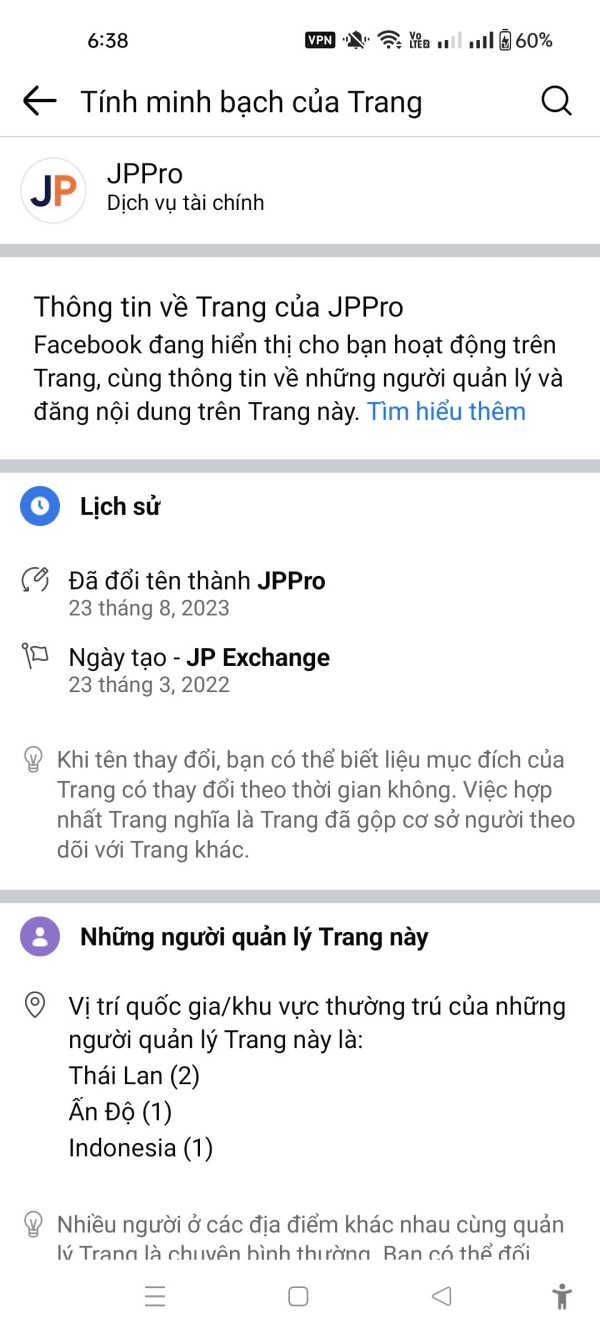

Broker Overview

JP PRO presents itself as a forex trading broker registered in Saint Vincent and the Grenadines. Specific founding dates and comprehensive company background information remain unclear from available sources. The broker operates under the registration of SVG FSA, which, according to WikiStock reports, does not actually license or oversee forex trading brokerage activities. This regulatory gap represents a significant concern for potential traders seeking protected trading environments.

The company's business model appears to focus on attracting traders through low minimum deposit requirements and high leverage offerings. This positions it in the high-risk segment of the forex brokerage market. However, the lack of detailed information about company leadership, financial backing, or operational history raises questions about the broker's credibility and long-term viability.

According to available information, JP PRO operates primarily through online channels. Specific details about trading platforms, asset classes, and service offerings remain limited in public documentation. The broker's registration with SVG FSA provides minimal regulatory protection, as this jurisdiction is known for its lenient oversight of financial services companies. This jp pro review emphasizes the importance of understanding these regulatory limitations before considering any investment with this broker.

Regulatory Jurisdiction: JP PRO is registered in Saint Vincent and the Grenadines under the SVG FSA. This jurisdiction is known for its minimal regulatory requirements for forex brokers and does not provide the investor protections typically found in major financial centers like the UK, US, or EU.

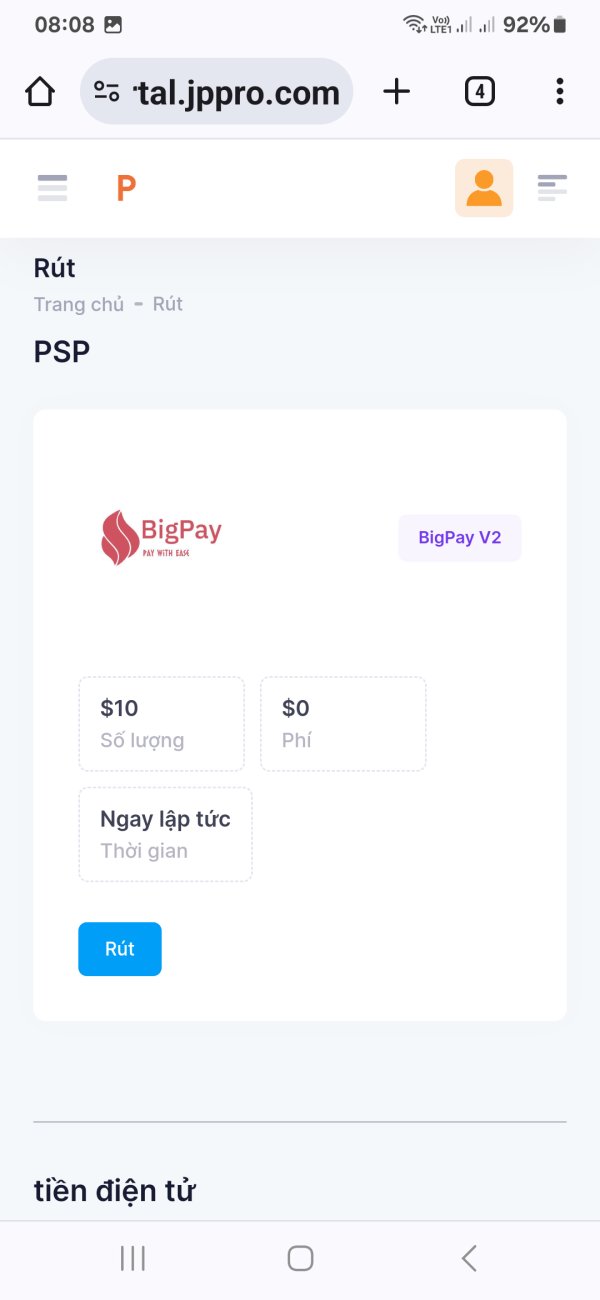

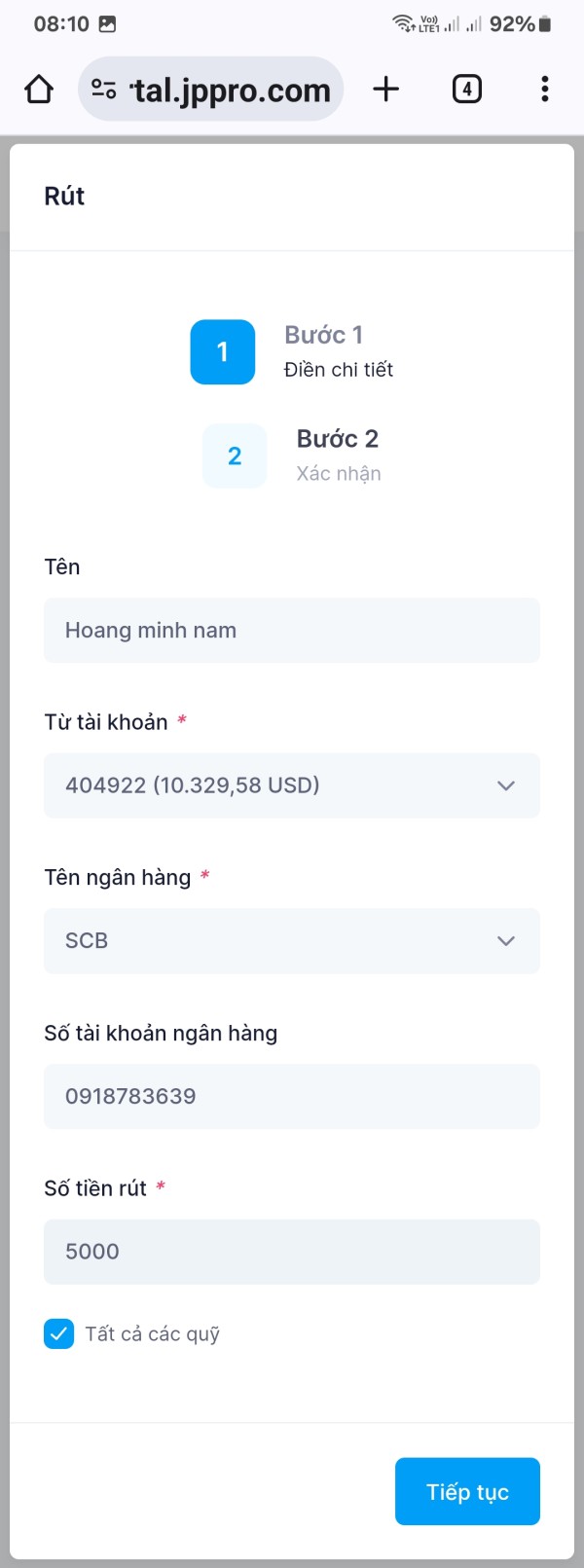

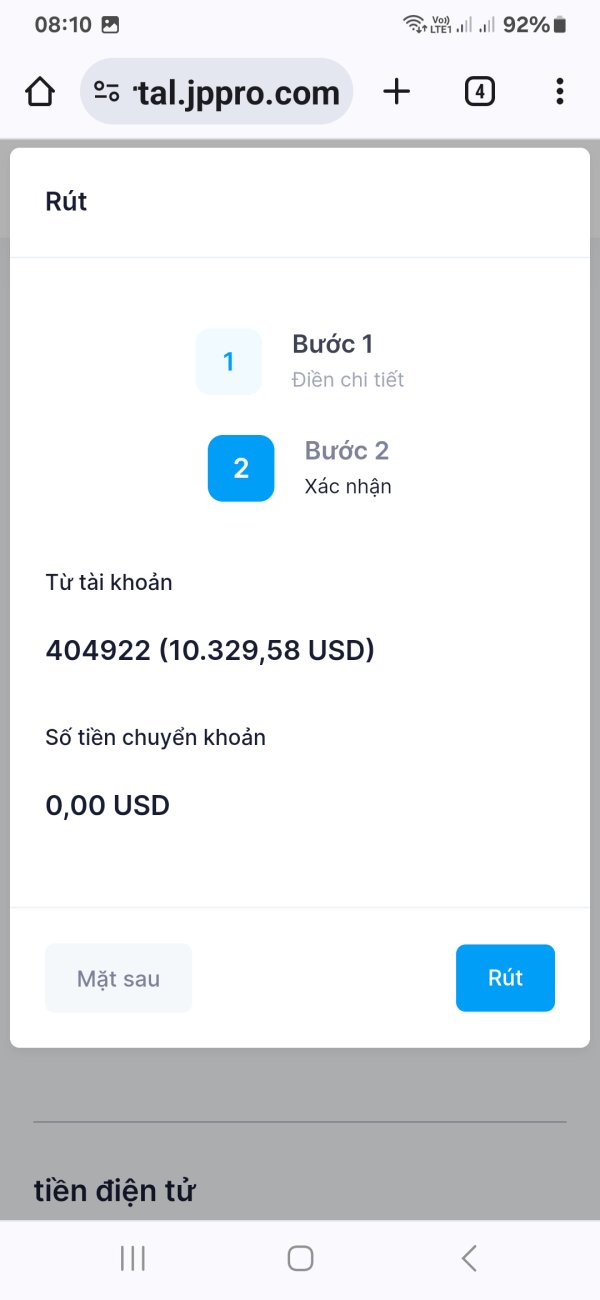

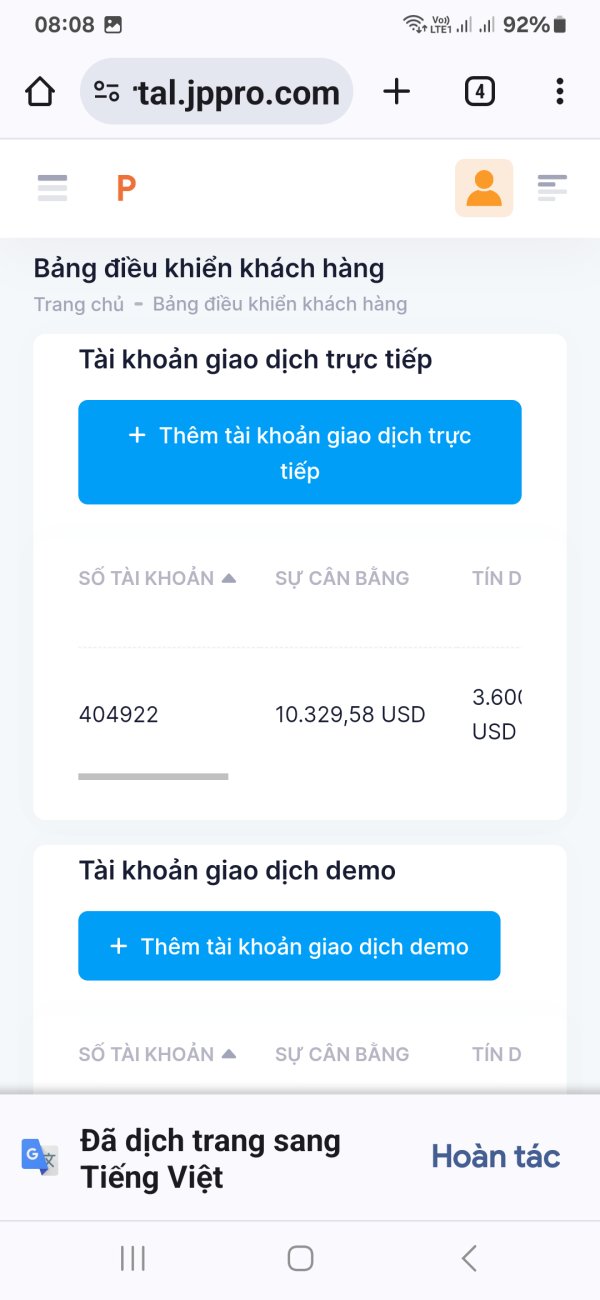

Deposit and Withdrawal Methods: Specific information about deposit and withdrawal methods is not detailed in available sources. This itself represents a transparency concern for potential traders seeking clear information about fund management procedures.

Minimum Deposit Requirements: The broker requires a minimum deposit of 100 USD, which positions it as accessible to retail traders with limited capital. However, this low barrier to entry should not overshadow the significant risks associated with the broker's regulatory status.

Bonus and Promotional Offers: Available sources do not provide specific information about bonus structures or promotional campaigns offered by JP PRO. This limits traders' ability to evaluate potential incentives or their associated terms and conditions.

Tradeable Assets: Detailed information about the range of tradeable instruments, including currency pairs, commodities, or other financial products, is not specified in available documentation. This represents another transparency gap.

Cost Structure: Spread information, commission structures, and other trading costs are not clearly outlined in available sources. This makes it impossible for potential traders to accurately assess the total cost of trading with JP PRO.

Leverage Ratios: The broker offers maximum leverage of 1:1000, which represents extremely high risk exposure. This could result in rapid account depletion for inexperienced traders.

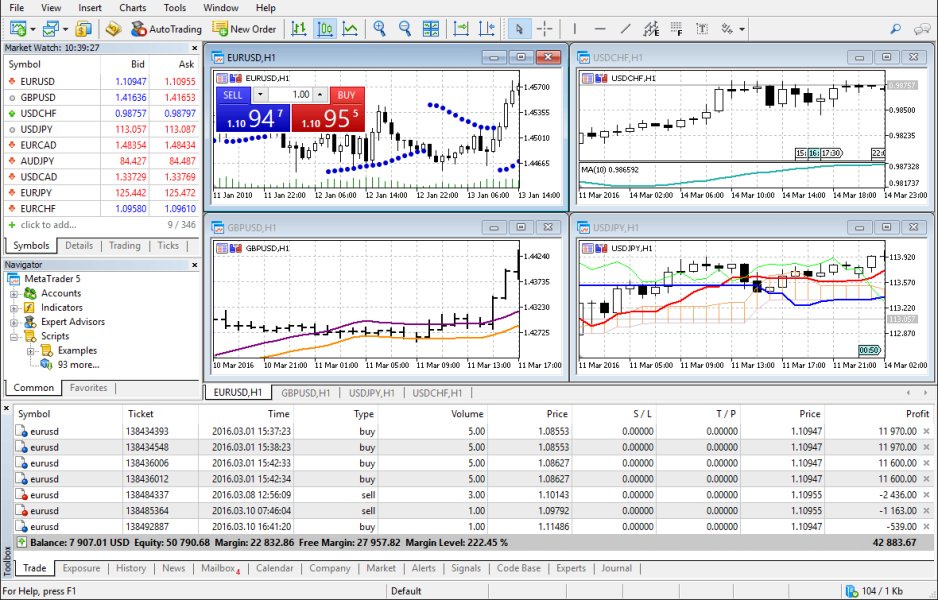

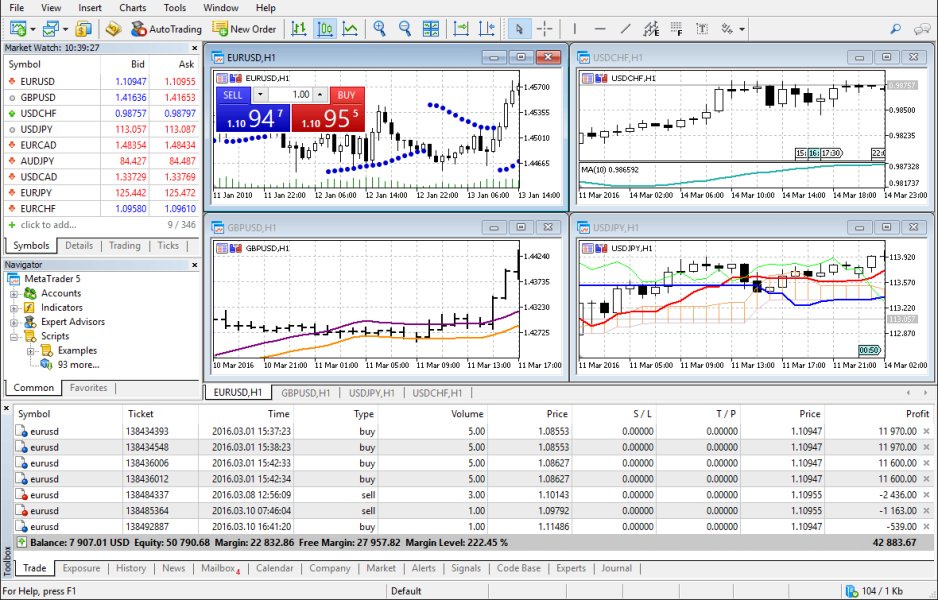

Platform Options: Specific trading platform information is not detailed in available sources. This leaves questions about technology infrastructure and trading capabilities unanswered.

Geographic Restrictions: Information about country-specific restrictions or service limitations is not clearly specified in available documentation.

Customer Support Languages: Available sources do not specify the languages supported by JP PRO's customer service team. This could impact international traders' ability to receive adequate support.

This jp pro review highlights significant information gaps that potential traders should consider as red flags when evaluating broker options.

Detailed Rating Analysis

Account Conditions Analysis (Score: 5/10)

JP PRO's account conditions present a mixed picture that reflects both accessibility and concerning transparency issues. The broker's minimum deposit requirement of 100 USD positions it as accessible to retail traders, particularly those with limited initial capital. This relatively low entry barrier could appeal to new traders or those testing strategies with smaller amounts.

However, the lack of detailed information about account types represents a significant concern. Available sources do not specify whether JP PRO offers different account tiers, such as standard, premium, or VIP accounts with varying features and benefits. This absence of clear account structure information makes it difficult for traders to understand what services they can expect at different investment levels.

The account opening process details are not specified in available documentation. This raises questions about verification requirements, documentation needs, and timeline expectations. Professional brokers typically provide clear, step-by-step guidance for account setup, and this information gap suggests potential operational deficiencies.

Furthermore, specialized account options such as Islamic accounts for traders requiring Sharia-compliant trading conditions are not mentioned in available sources. This omission could limit the broker's appeal to specific trader demographics and suggests a lack of comprehensive service planning.

User feedback regarding account transparency and fund security has been notably negative. Multiple reports suggest concerns about account management practices. When compared to regulated brokers that provide detailed account information, clear fee structures, and transparent terms of service, JP PRO's offering appears significantly limited. This jp pro review emphasizes that while the low minimum deposit might seem attractive, the lack of detailed account information and negative user experiences significantly impact the overall account conditions rating.

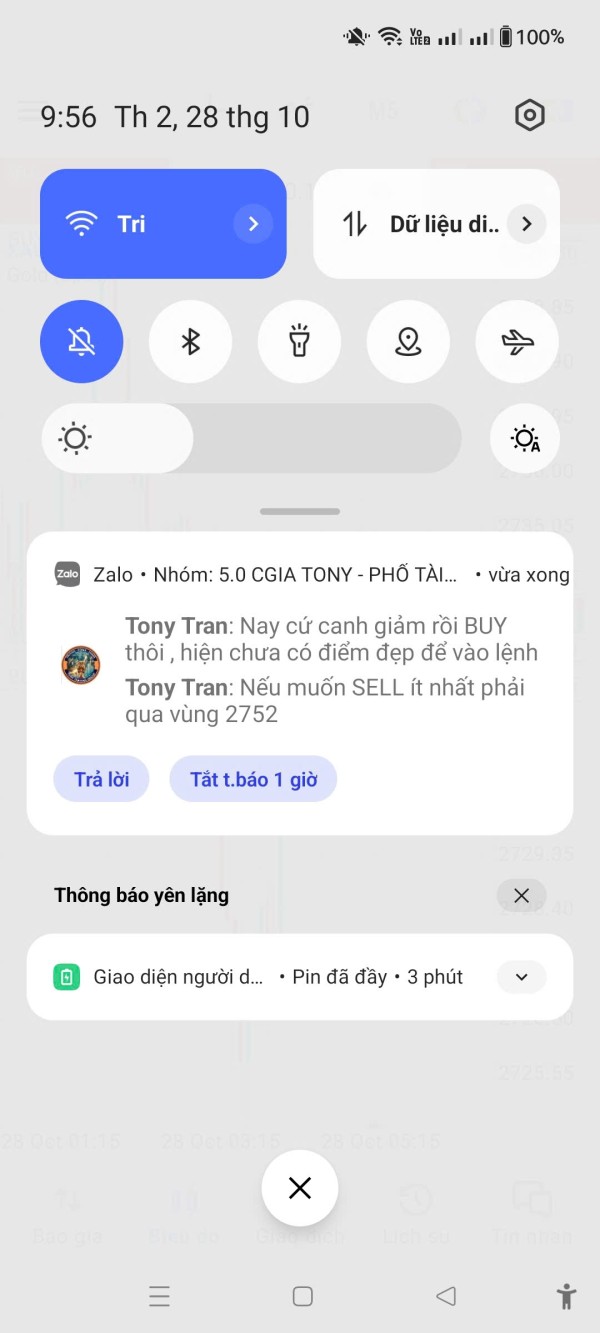

The analysis of JP PRO's trading tools and resources reveals significant deficiencies that could substantially impact trader success and satisfaction. Available sources provide minimal information about the specific trading tools offered by the broker, which itself represents a concerning transparency issue for a modern forex brokerage operation.

Professional forex brokers typically offer comprehensive suites of trading tools including advanced charting packages, technical analysis indicators, economic calendars, and market sentiment tools. The absence of detailed information about JP PRO's tool offerings suggests either limited capabilities or poor communication of available features to potential clients.

Research and analysis resources appear to be particularly lacking. No mention exists of market analysis, daily/weekly market reports, or expert commentary that traders typically rely on for informed decision-making. Quality research resources are essential for forex traders, and their absence significantly limits the value proposition of any brokerage service.

Educational resources, which are crucial for trader development and success, are not detailed in available sources. Reputable brokers typically offer webinars, trading guides, video tutorials, and educational articles to support trader development. The lack of information about educational offerings suggests JP PRO may not prioritize trader education and development.

Automated trading support, including Expert Advisor (EA) capabilities and algorithmic trading tools, is not specifically mentioned in available documentation. Modern traders increasingly rely on automated strategies, and the absence of clear information about automation support represents another significant limitation.

User feedback regarding platform tools has been generally disappointing. Traders express concerns about the comprehensiveness and quality of available resources. The lack of detailed tool information, combined with negative user experiences, positions JP PRO's tools and resources offering as substantially below industry standards for professional forex brokers.

Customer Service and Support Analysis (Score: 3/10)

Customer service and support represent critical areas where JP PRO demonstrates significant deficiencies that directly impact trader satisfaction and problem resolution capabilities. Available information suggests concerning patterns in customer service quality and responsiveness that potential traders should carefully consider.

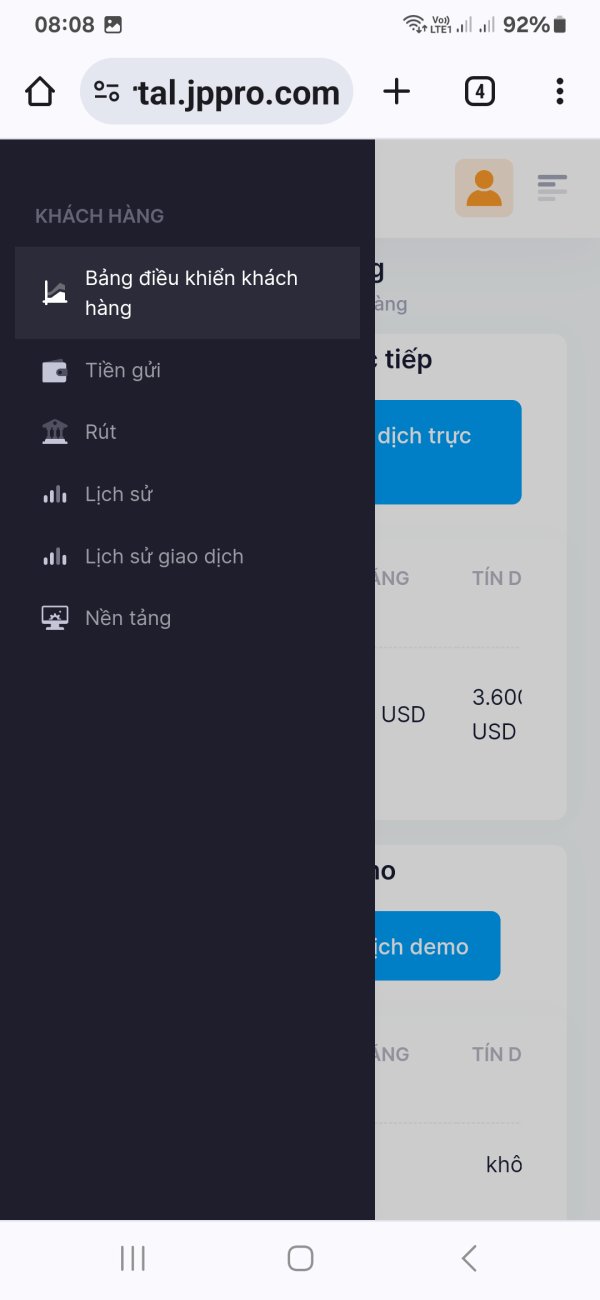

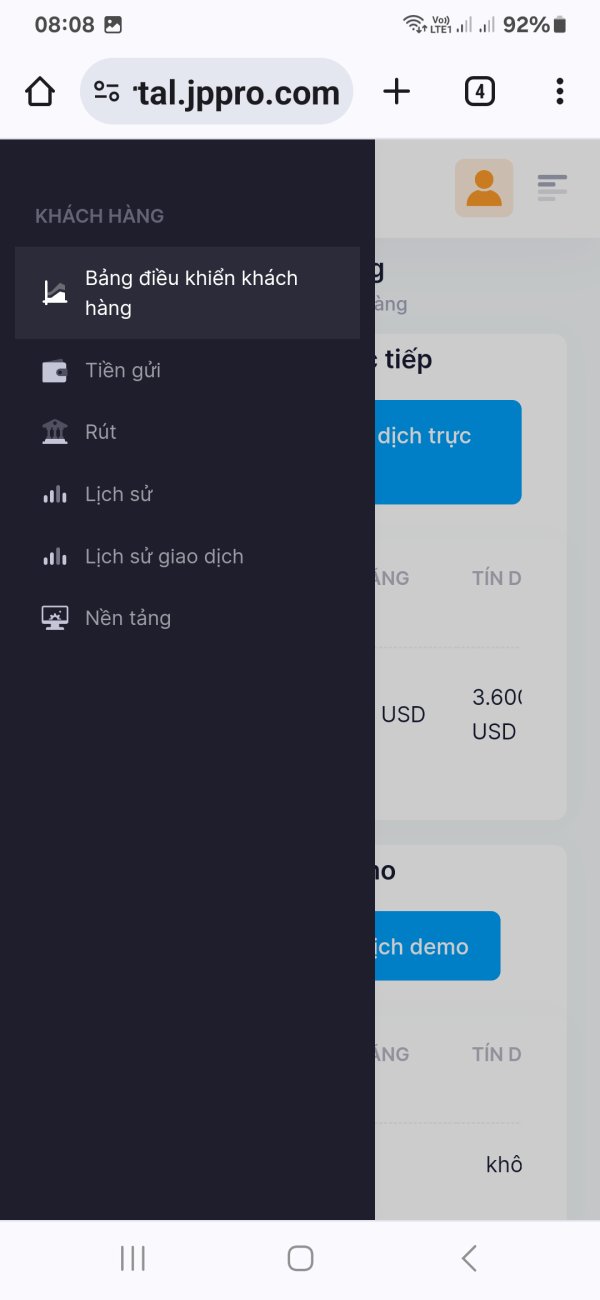

Contact methods and availability information are not clearly specified in available sources. This immediately raises concerns about accessibility when traders need assistance. Professional brokers typically provide multiple contact channels including live chat, email, phone support, and comprehensive FAQ sections. The lack of clear contact information suggests potential communication barriers that could frustrate users seeking help.

Response time performance appears to be problematic based on user feedback. Multiple reports indicate delayed or inadequate responses to trader inquiries. Quick response times are essential in forex trading where market conditions change rapidly and technical issues can result in significant financial losses.

Service quality concerns are evident from user complaints that suggest customer service representatives may lack the expertise or authority needed to resolve complex issues effectively. Professional forex brokers invest heavily in customer service training to ensure representatives can handle technical, account, and trading-related questions competently.

Multi-language support capabilities are not specified in available documentation. This could limit the broker's ability to serve international clients effectively. Global forex brokers typically offer support in multiple languages to accommodate their diverse client base.

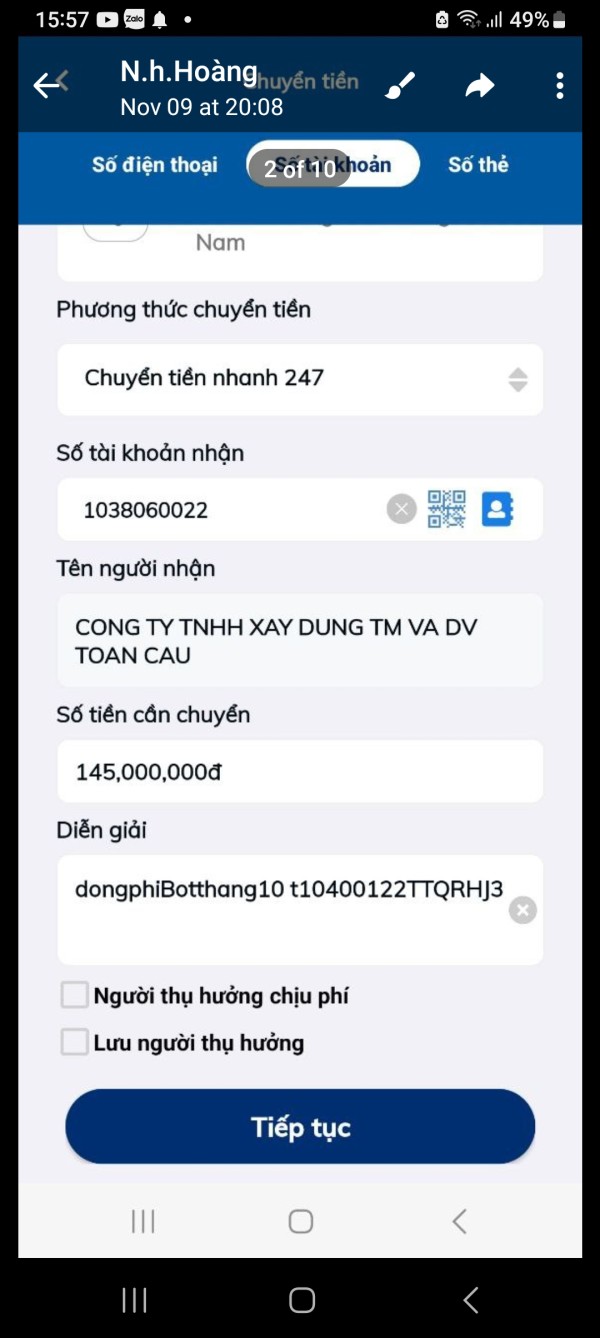

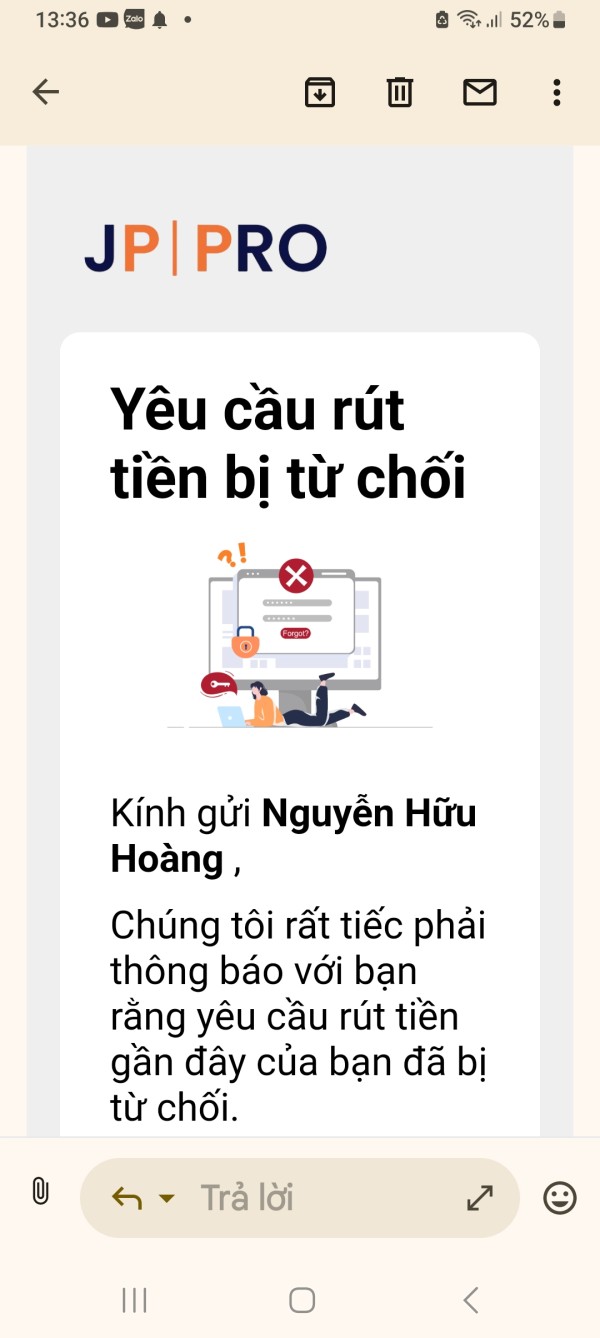

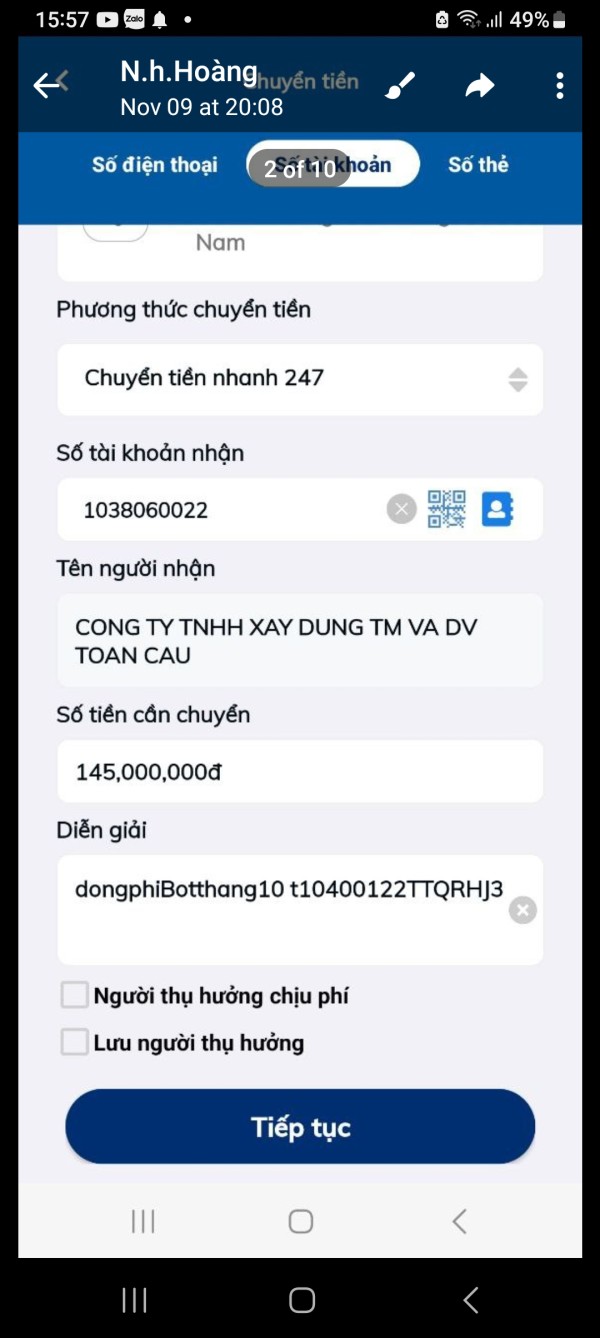

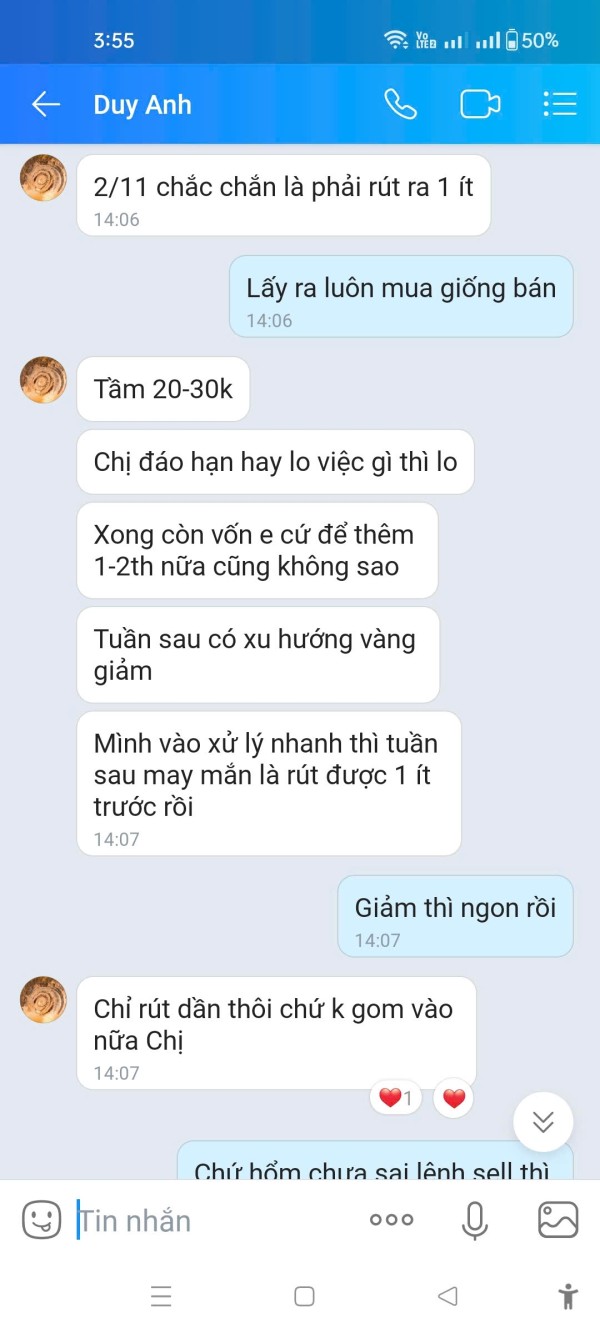

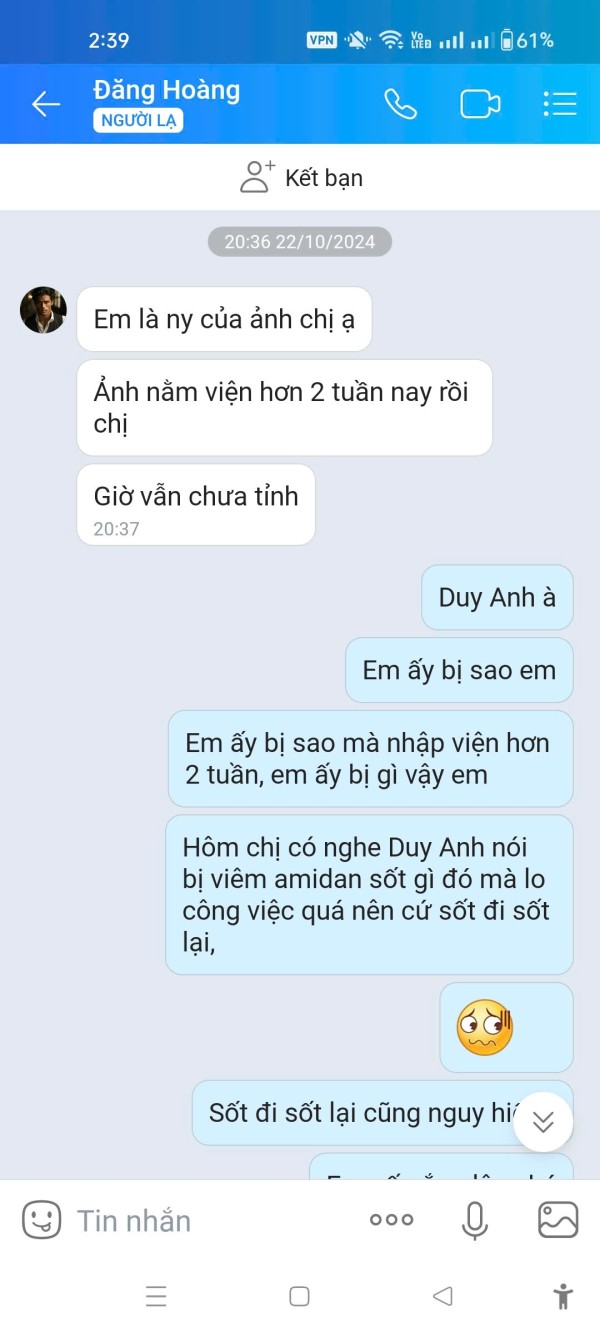

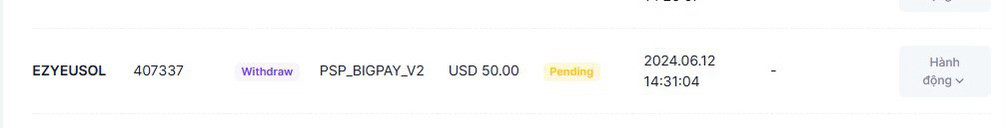

The most concerning aspect of JP PRO's customer service is the pattern of user complaints regarding fund security and withdrawal issues. Multiple reports suggest that customer service has been unable or unwilling to effectively resolve serious financial concerns, including allegations of fund misappropriation. These types of unresolved complaints represent the most serious possible customer service failures and significantly impact the broker's credibility and trustworthiness.

Trading Experience Analysis (Score: 4/10)

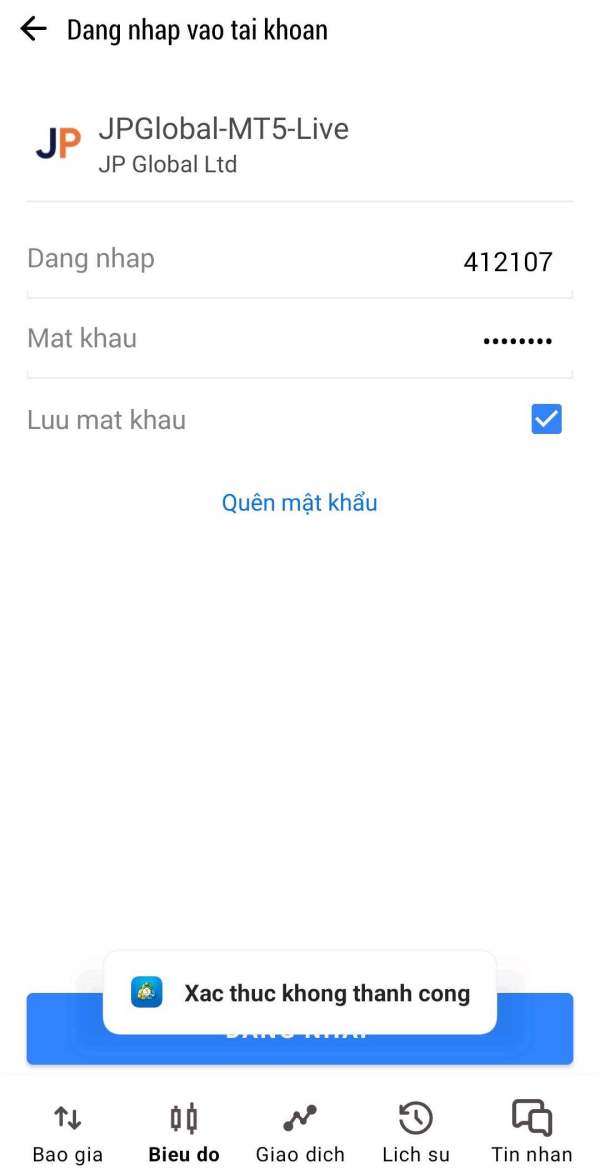

The trading experience offered by JP PRO presents several concerns that could significantly impact trader satisfaction and success. Platform stability and performance information is notably absent from available sources, which prevents potential traders from understanding the technical reliability they can expect during market hours.

Order execution quality represents a critical factor in forex trading success. Yet specific information about JP PRO's execution speeds, slippage rates, and order fill capabilities is not detailed in available documentation. Professional brokers typically provide transparent execution statistics and performance metrics to demonstrate their technical capabilities.

Platform functionality completeness cannot be adequately assessed due to limited information about the specific trading platforms offered by JP PRO. Modern forex traders expect comprehensive platform features including advanced charting, multiple order types, risk management tools, and real-time market data. The absence of detailed platform information suggests potential limitations in trading capabilities.

Mobile trading experience details are not specified in available sources. This represents a significant gap given the importance of mobile trading in today's forex market. Professional traders increasingly rely on mobile platforms for monitoring positions and executing trades while away from desktop computers.

The overall trading environment stability has been questioned by user feedback. Reports suggest concerns about platform reliability and trade execution consistency. These types of technical issues can directly impact trading profitability and trader confidence in the broker's services.

User feedback regarding trading experience has been generally negative. Traders express frustration about various aspects of the trading process. The combination of limited platform information, technical concerns, and negative user experiences suggests that JP PRO's trading environment may not meet the standards expected by serious forex traders.

Trust and Reliability Analysis (Score: 2/10)

Trust and reliability represent the most concerning aspects of JP PRO's operations. Multiple factors contribute to significant credibility issues that potential traders must carefully consider. The broker's regulatory status presents the primary concern, as registration with SVG FSA provides minimal investor protection compared to regulation by major financial authorities.

Regulatory oversight gaps are particularly problematic because SVG FSA does not license or supervise forex trading activities. This leaves traders without the protections typically associated with regulated brokers. Major regulatory bodies like the FCA, CySEC, or ASIC provide compensation schemes, segregated fund requirements, and dispute resolution mechanisms that are absent in JP PRO's regulatory framework.

Fund safety measures are not clearly detailed in available sources. This represents a critical transparency issue for any financial services provider. Professional brokers typically maintain segregated client accounts, provide clear information about fund protection measures, and offer insurance coverage for client deposits.

Company transparency is significantly lacking. Limited information is available about company leadership, financial backing, ownership structure, or operational history. This opacity makes it impossible for potential clients to assess the broker's stability and long-term viability.

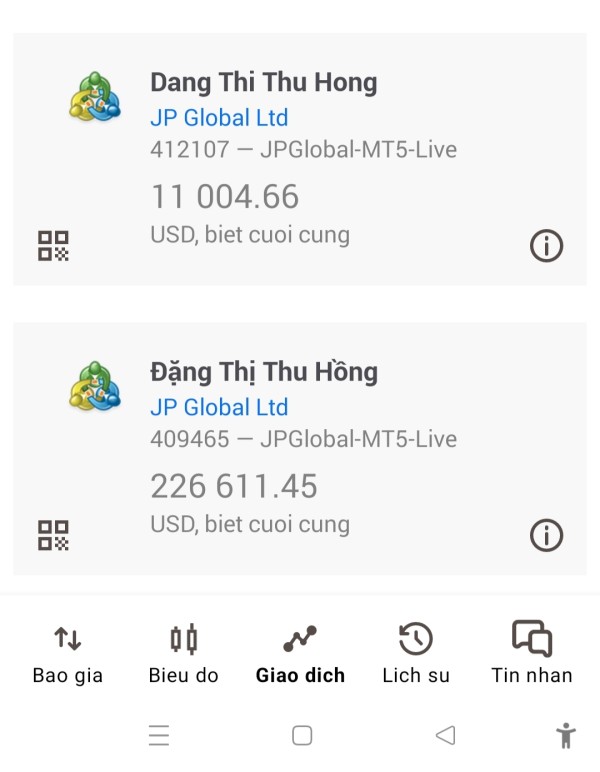

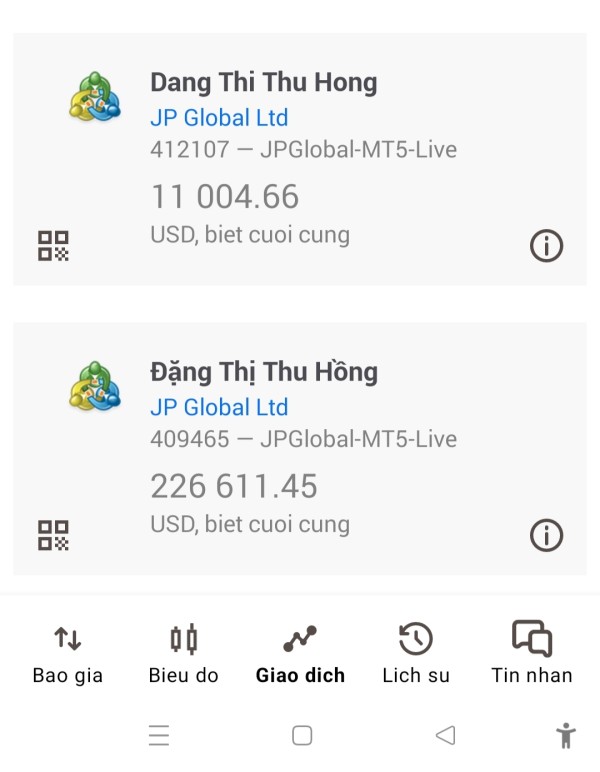

Industry reputation has been severely damaged by multiple negative reports and user complaints suggesting serious operational issues. Several sources indicate allegations of fund misappropriation and withdrawal difficulties, which represent the most serious possible concerns about broker reliability.

Negative incident handling appears to be inadequate based on user reports suggesting that serious complaints have not been effectively resolved. Professional brokers typically have established procedures for investigating and resolving client disputes, and the apparent lack of effective complaint resolution mechanisms further undermines confidence in JP PRO's operations. The combination of regulatory gaps, transparency issues, and negative user experiences positions JP PRO as a high-risk broker choice that traders should approach with extreme caution.

User Experience Analysis (Score: 3/10)

Overall user satisfaction with JP PRO appears to be significantly below industry standards based on available feedback and user reports. The pattern of negative reviews and complaints suggests systemic issues that impact multiple aspects of the user experience, from initial account setup through ongoing trading activities.

Interface design and usability information is not detailed in available sources. This prevents assessment of how user-friendly the broker's platforms and websites are. Modern traders expect intuitive, well-designed interfaces that facilitate efficient trading and account management, and the lack of information about design quality represents another transparency gap.

Registration and verification processes are not clearly outlined in available documentation. This could lead to confusion and frustration for new users. Professional brokers typically provide clear, step-by-step guidance for account opening, including documentation requirements and timeline expectations.

Fund operation experiences represent a particularly concerning aspect of user feedback. Multiple reports suggest difficulties with deposits and withdrawals. These types of financial transaction issues directly impact trader confidence and represent serious operational deficiencies that could affect fund security.

Common user complaints focus primarily on fund security concerns and customer service responsiveness issues. The frequency and severity of these complaints suggest systemic problems that go beyond isolated incidents and indicate potential structural issues with the broker's operations.

User demographic analysis suggests that while high-risk tolerance traders might be initially attracted to JP PRO's high leverage and low minimum deposit offerings, the negative experiences reported by actual users indicate that even risk-tolerant traders become dissatisfied with the service quality. The pattern of negative feedback spans multiple aspects of the user experience, from technical issues to customer service problems and fund security concerns. Based on available user feedback, most traders would likely find better experiences with regulated brokers that provide greater transparency, better customer service, and stronger fund protection measures.

Conclusion

This comprehensive jp pro review reveals a forex broker that presents significant risks and concerns that outweigh any potential benefits for most traders. JP PRO operates without meaningful regulatory oversight, lacks transparency in its operations, and has accumulated a troubling pattern of negative user feedback regarding fund security and service quality.

While the broker's low minimum deposit of 100 USD and high leverage of 1:1000 might initially appeal to traders seeking accessible entry points and high-risk opportunities, these features cannot compensate for the fundamental issues surrounding regulatory protection and operational reliability. The absence of proper oversight from SVG FSA, combined with limited information about trading platforms, tools, and fund protection measures, creates an environment where traders face substantial risks beyond normal market exposure.

The broker may only be suitable for experienced traders with extremely high risk tolerance who fully understand the potential for complete loss of capital and are comfortable operating without regulatory protections. However, even risk-tolerant traders would likely benefit from choosing regulated alternatives that provide similar leverage and deposit requirements while offering greater transparency and fund security. For the vast majority of forex traders, JP PRO's risk profile and operational concerns make it an unsuitable choice compared to properly regulated brokers operating under major financial authorities.