Seagull 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive seagull review examines a trading entity that has been operating since 2013. The company primarily focuses on providing support and protection for beginner traders. Based in Wales, United Kingdom, Seagull Wealth positions itself as a proprietary trading team that emphasizes diversified trading strategies across multiple platforms. The company's approach centers on avoiding limitations to single trading platforms. Instead, they offer beginners access to various trading choices through their combined expertise and substantial operating capital.

The key highlights of this seagull review include their use of MetaTrader 4 as their primary trading platform and their specialized focus on the Seagull Option Strategy. The company targets novice traders and those seeking flexible trading approaches across different markets. However, our analysis reveals significant gaps in publicly available information regarding regulatory oversight, specific account conditions, and comprehensive trading terms. While registered in New Zealand according to available documentation, detailed regulatory compliance information remains limited in accessible sources.

Important Notice

Due to Seagull's registration in New Zealand and operations based in Wales, UK, users should be aware of potential regulatory differences across various jurisdictions. The company's multi-regional presence may result in different service offerings and regulatory protections depending on the client's location. This review is based on publicly available information and market feedback accessible at the time of writing. Prospective traders should conduct independent verification of all trading conditions, regulatory status, and service terms before engaging with any trading platform. The limited availability of detailed operational information in public sources means some aspects of this evaluation are based on incomplete data sets.

Rating Framework

Broker Overview

Company Background and Establishment

Seagull Wealth was established in 2013 as a proprietary trading team based in Wales, United Kingdom. According to available documentation from TradingBrokers.com, the company has maintained a consistent focus on providing trading support and protection specifically designed for beginning traders. The organization positions itself as more than a traditional broker. It emphasizes its role as a trading team that combines expertise, extensive experience, and substantial operating capital to create opportunities for novice market participants.

The company's business model centers on diversification and flexibility. They deliberately avoid restrictions to single trading platforms. This approach reflects their commitment to providing beginners with broad trading choices across multiple platforms and markets. The emphasis on beginner protection and support has remained a core element of their service proposition since inception. This distinguishes them from brokers that primarily target experienced traders.

Platform and Regulatory Framework

Seagull Wealth operates primarily through the MetaTrader 4 trading platform. This platform provides users with access to standard forex trading functionalities and automated trading capabilities. The platform choice aligns with their beginner-focused approach, as MT4 is widely recognized for its user-friendly interface and comprehensive educational resources. Documentation indicates the company is registered in New Zealand. However, specific regulatory oversight details are not comprehensively detailed in publicly available sources.

The seagull review process reveals that while the company maintains registration status, the extent of regulatory supervision and client protection measures requires further clarification for potential users. This regulatory positioning may influence the types of services available to traders in different jurisdictions and the level of investor protection provided.

Regulatory Jurisdiction and Compliance

Based on available documentation, Seagull operates under New Zealand registration. However, comprehensive regulatory oversight details remain limited in accessible public sources.

Deposit and Withdrawal Methods

Specific information regarding accepted payment methods, processing times, and associated fees for deposits and withdrawals is not detailed in currently available materials.

Minimum Deposit Requirements

The minimum initial deposit amount required to open trading accounts with Seagull is not specified in accessible documentation.

Promotional Offers and Bonuses

Details regarding welcome bonuses, promotional campaigns, or ongoing incentive programs are not available in current public sources.

Available Trading Assets

While the focus appears to be on forex trading through MT4, comprehensive asset class availability including stocks, commodities, and indices is not detailed in accessible materials.

Cost Structure and Fees

Specific information regarding spreads, commission structures, overnight financing rates, and additional trading costs is not provided in available sources. This represents a significant information gap for this seagull review.

Leverage Options

Maximum leverage ratios and margin requirements for different account types and asset classes are not specified in accessible documentation.

Platform Selection

MetaTrader 4 serves as the primary trading platform. It offers standard forex trading functionality and automated trading support for users.

Geographic Restrictions

Specific information regarding restricted countries or regional service limitations is not detailed in available sources.

Customer Support Languages

The range of languages supported by customer service teams is not specified in current documentation.

Detailed Rating Analysis

Account Conditions Analysis (Score: N/A)

The evaluation of Seagull's account conditions faces significant limitations due to the absence of detailed account specification information in publicly accessible sources. Traditional account condition assessment typically examines account tier structures, minimum balance requirements, and associated benefits for different account levels. However, this seagull review cannot provide comprehensive analysis of these elements due to information gaps.

Account opening procedures, verification requirements, and documentation standards are not detailed in available materials. This lack of transparency regarding account conditions represents a significant consideration for potential traders. Account terms directly impact trading costs and available features. The absence of clear account tier information makes it difficult for beginners to understand what services they can access at different investment levels.

Without specific account condition details, traders cannot adequately compare Seagull's offerings with other brokers in the market. The company's focus on beginner traders suggests simplified account structures may be in place. However, confirmation of this approach requires direct inquiry with the company rather than relying on publicly available information.

Seagull's tools and resources offering centers primarily around the MetaTrader 4 platform and their specialized Seagull Option Strategy. According to TradingBrokers.com, the Seagull Option Strategy represents a specific trading approach that forms part of their service offering. The MT4 platform provides standard forex trading tools including technical analysis indicators, charting capabilities, and automated trading support through Expert Advisors.

However, the scope of additional trading tools and educational resources remains unclear from available documentation. Comprehensive broker evaluations typically assess research resources, market analysis provision, economic calendar integration, and educational content libraries. The limited information available suggests these additional resources may be present but are not prominently featured in public-facing materials.

The company's emphasis on supporting beginners implies educational resources should be a priority. Yet specific details about trading tutorials, webinar programs, or market analysis provision are not detailed in accessible sources. This represents a missed opportunity for transparency, particularly given their target market of novice traders who typically require extensive educational support.

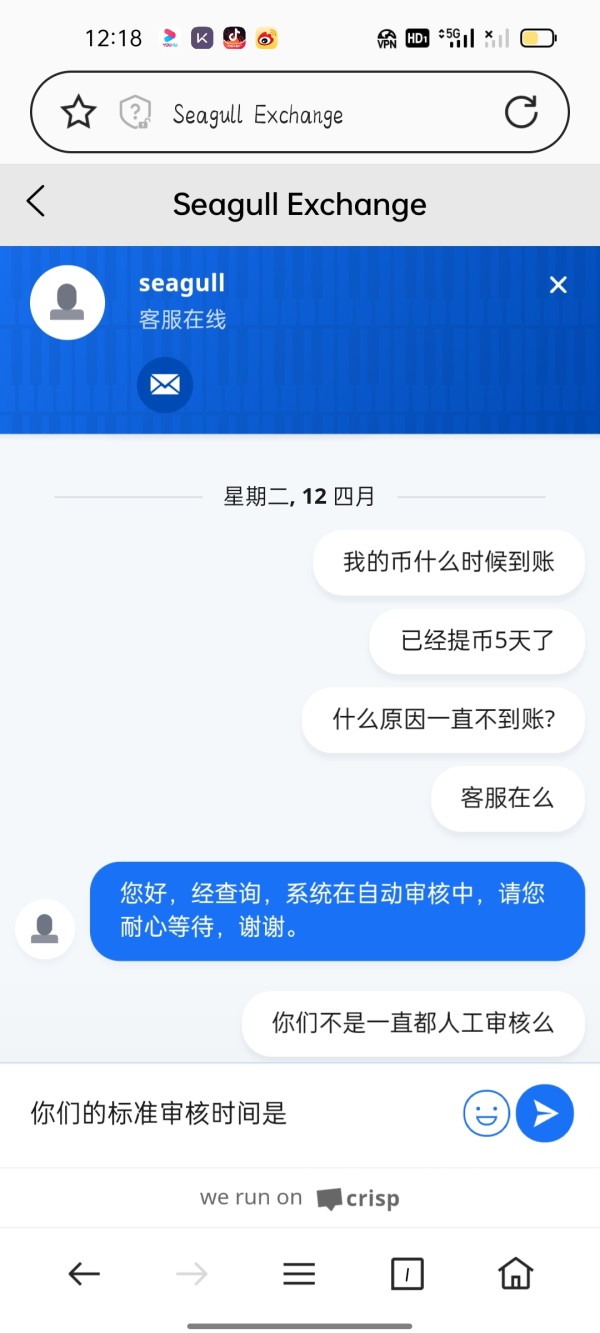

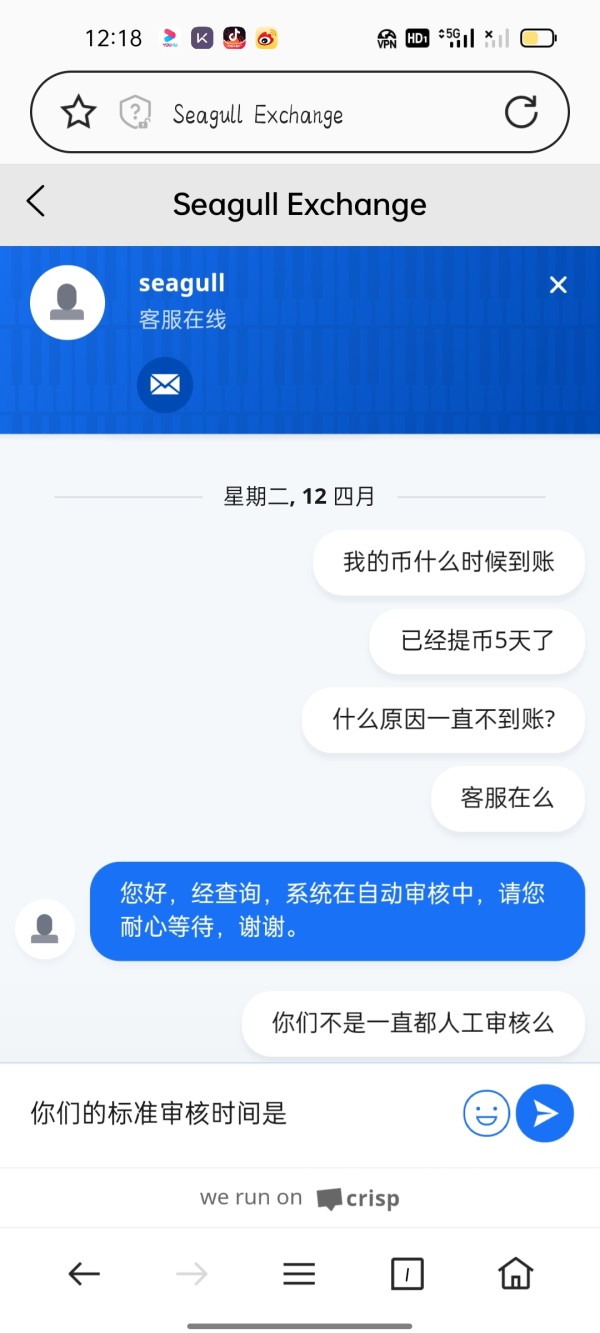

Customer Service and Support Analysis (Score: N/A)

Customer service evaluation for Seagull cannot be comprehensively conducted due to the absence of detailed support information in publicly available sources. Standard customer service assessment examines support channel availability, response time metrics, service quality indicators, and multilingual support capabilities. None of these elements are adequately detailed in accessible documentation.

The company's focus on beginner traders typically necessitates robust customer support infrastructure. Novice traders often require additional guidance and problem resolution assistance. However, without specific information about support hours, contact methods, or service level commitments, potential users cannot assess whether Seagull's support infrastructure aligns with their needs.

Professional broker evaluation standards include analysis of support ticket response times, live chat availability, phone support coverage, and email communication efficiency. The absence of this information in public sources represents a significant transparency gap that affects the overall assessment of the broker's service quality and reliability.

Trading Experience Analysis (Score: 6/10)

The trading experience evaluation for this seagull review is based primarily on the MetaTrader 4 platform implementation and the company's beginner-focused approach. MT4 provides a standardized trading environment with established functionality for order execution, technical analysis, and automated trading. The platform's widespread industry adoption suggests basic trading functionality should meet standard expectations.

However, specific performance metrics such as order execution speeds, slippage rates, and platform stability indicators are not available in accessible sources. Trading experience assessment typically includes analysis of platform uptime, execution quality during market volatility, and mobile trading capabilities. Without user feedback data or performance statistics, this evaluation remains incomplete.

The company's emphasis on supporting beginners suggests the trading environment should be optimized for ease of use and educational value. However, confirmation of user interface customization options, educational integration within the platform, and beginner-friendly features requires additional information not currently available in public sources.

Trustworthiness Analysis (Score: 5/10)

Trustworthiness evaluation for Seagull reveals mixed indicators that require careful consideration. The company's establishment in 2013 demonstrates operational longevity, which typically correlates with business stability and client satisfaction. Registration in New Zealand provides some regulatory framework. However, the specific oversight mechanisms and client protection measures are not detailed in accessible sources.

The absence of comprehensive regulatory information represents a significant concern for trustworthiness assessment. Professional broker evaluation standards require clear identification of regulatory authorities, license numbers, and client fund protection measures. The limited availability of this information in public sources affects the overall trustworthiness rating.

Additionally, the lack of detailed user feedback, industry recognition, or third-party verification in accessible sources limits the ability to assess market reputation and client satisfaction levels. Trustworthiness evaluation typically incorporates user testimonials, industry awards, and regulatory compliance history. None of these are adequately available for comprehensive analysis.

User Experience Analysis (Score: N/A)

User experience assessment for Seagull cannot be comprehensively conducted due to limited availability of user feedback and detailed service experience information in accessible sources. Standard user experience evaluation examines registration process efficiency, account verification procedures, fund management convenience, and overall service satisfaction indicators.

The company's positioning as beginner-focused suggests user experience should prioritize simplicity and educational support. However, specific information about onboarding procedures, user interface design, and customer journey optimization is not detailed in available materials. This information gap prevents thorough analysis of how effectively Seagull serves its target market of novice traders.

User experience evaluation typically incorporates analysis of common user complaints, satisfaction surveys, and service improvement initiatives. The absence of this feedback data in public sources represents a significant limitation for potential users seeking to understand the practical aspects of trading with Seagull.

Conclusion

This comprehensive seagull review reveals a broker that has maintained operations since 2013 with a clear focus on supporting beginner traders through diversified trading strategies and MetaTrader 4 platform access. While the company's longevity and specialized approach to novice trader support represent positive indicators, significant information gaps limit the ability to provide a complete evaluation.

Seagull appears most suitable for beginning traders seeking a simplified approach to forex trading with access to established platform technology. The company's emphasis on avoiding single-platform limitations suggests flexibility in trading approach. This may appeal to traders wanting to explore different strategies. However, the limited transparency regarding regulatory oversight, account conditions, and comprehensive service terms requires potential users to conduct additional due diligence before committing to the platform.

The main advantages include established MT4 platform access and beginner-focused service positioning. The primary concerns center on limited regulatory transparency and insufficient publicly available information about trading conditions and costs.