Is HFGFX safe?

Business

License

Is HFGFX Safe or Scam?

Introduction

HFGFX, a forex broker operating within the global financial market, claims to provide various trading services, including forex, precious metals, and CFDs. As the forex market continues to grow, the need for traders to carefully evaluate brokers has never been more critical. With numerous reports of fraudulent activities and unregulated brokers, traders must conduct thorough research before committing their capital. This article aims to provide an objective analysis of HFGFX, evaluating its regulatory status, company background, trading conditions, client feedback, and overall safety. The investigation is based on a review of various online resources, including user reviews and regulatory databases, to determine whether HFGFX is safe or if it poses risks to potential investors.

Regulatory and Legality

The regulatory status of a forex broker is one of the most significant indicators of its legitimacy. HFGFX claims to operate under the auspices of various financial authorities; however, there are significant concerns regarding its regulatory compliance. The broker is associated with H Four Glory Pty Ltd, which has faced scrutiny due to its revoked licenses and lack of transparency.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 001281851 | Australia | Revoked |

| FCA | N/A | United Kingdom | No Current License |

The Australian Securities and Investments Commission (ASIC) previously regulated HFGFX but has since revoked its license, raising red flags about the broker's operational legitimacy. The absence of a valid regulatory framework suggests that HFGFX may not adhere to the strict standards typically enforced by reputable authorities. This lack of oversight can expose traders to heightened risks, including potential fraud and mismanagement of funds. Therefore, it is essential for traders to consider these factors before deciding to trade with HFGFX.

Company Background Investigation

HFGFX's corporate history is relatively short, having been established in 2021. The company operates under the name H Four Glory Pty Ltd, which has undergone several changes and faced scrutiny regarding its operational practices. The ownership structure and management team remain opaque, raising concerns about transparency and accountability.

The management teams background is not well-documented, which is a significant drawback for potential clients seeking to understand the broker's credibility. Transparency in a broker's operations is crucial, as it can help build trust among traders. A lack of clear information regarding the company's leadership and operational history may indicate potential issues regarding its reliability.

Furthermore, the companys website has also faced accessibility issues, further complicating the ability of potential clients to gather information. The absence of detailed disclosures about the company's operations can lead to skepticism about its legitimacy. Given these factors, it's crucial for traders to approach HFGFX with caution, as the lack of transparency can be a sign of underlying problems.

Trading Conditions Analysis

HFGFX offers a range of trading conditions that may initially appear attractive to traders. However, a deeper examination reveals potential issues that could affect the overall trading experience. The broker provides various account types, but critical details such as spreads, commissions, and leverage are often not explicitly stated.

| Fee Type | HFGFX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 2.0 pips | 1.0 - 1.5 pips |

| Commission Model | N/A | $5 - $10 per lot |

| Overnight Interest Range | Varies | 0.5% - 2.5% |

The spreads offered by HFGFX are significantly higher than the industry average, which could lead to increased trading costs for clients. Additionally, the lack of clarity regarding commission structures raises concerns about hidden fees that could impact profitability. Traders should be vigilant and inquire about any additional costs that may not be disclosed upfront.

Moreover, the absence of a clear and transparent fee structure can lead to confusion and mistrust among traders. It is advisable for potential clients to thoroughly review the terms and conditions associated with trading on the HFGFX platform before committing any capital.

Client Funds Safety

The safety of client funds is a paramount concern for any trader considering a forex broker. HFGFX claims to implement various measures to protect client funds, including segregated accounts and investor protection policies. However, the effectiveness of these measures is questionable given the broker's regulatory history.

HFGFX's lack of regulation raises significant concerns regarding the safety of client funds. Without oversight from a reputable authority, there is no guarantee that the broker adheres to industry standards for fund protection. The absence of negative balance protection further exacerbates the risks associated with trading with HFGFX. If a trader's account experiences significant losses, they could potentially owe more than their initial investment.

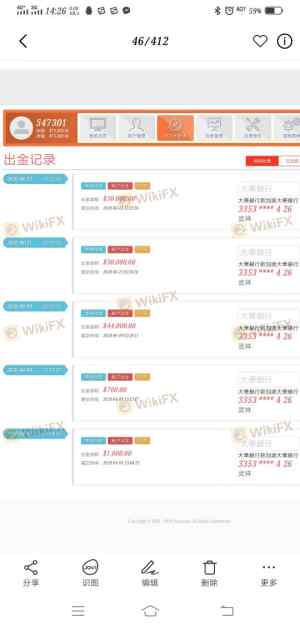

Historically, HFGFX has faced allegations related to fund mismanagement and withdrawal issues, which further complicates the assessment of its safety. Traders should be cautious and consider the potential risks associated with entrusting their capital to a broker that lacks robust regulatory oversight and a proven track record of fund safety.

Customer Experience and Complaints

Customer feedback is an essential component of assessing a broker's reliability and service quality. HFGFX has received numerous complaints from users regarding withdrawal issues, lack of responsive customer service, and transparency concerns. Common complaint patterns include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Unresponsive Support | Medium | Poor |

| Misleading Information | High | Poor |

Many traders have reported difficulties in withdrawing funds, with some claiming that their requests were ignored or denied without explanation. This lack of responsiveness can be a significant red flag, indicating potential fraud or mismanagement.

Additionally, users have expressed frustration regarding the clarity of information provided by HFGFX, further complicating the trading experience. A few individual cases highlight severe issues, such as clients being unable to access their funds after significant profits were made, leading to accusations of fraud.

Given these complaints, it is crucial for potential clients to approach HFGFX with caution, as the negative experiences reported by others may indicate systemic issues within the broker's operations.

Platform and Execution

The trading platform offered by HFGFX is the widely used MetaTrader 4 (MT4), known for its robust features and user-friendly interface. However, the performance and reliability of the platform are critical for successful trading. Users have reported issues related to order execution, including slippage and rejected orders, which can significantly impact trading outcomes.

The overall execution quality on HFGFX has been called into question, with reports of slippage reaching up to 1000 pips in some instances. Such extreme slippage can lead to forced liquidation of positions, raising concerns about the broker's ability to provide a fair trading environment.

Additionally, any indications of platform manipulation or technical issues can further erode trust in the broker. Traders should be vigilant and consider these factors when evaluating whether to trade with HFGFX, as execution quality is a crucial aspect of the trading experience.

Risk Assessment

Overall, the risks associated with trading with HFGFX are significant, primarily due to its lack of regulation, transparency issues, and negative customer feedback. A risk assessment reveals the following key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | High | No valid regulatory oversight |

| Fund Safety | High | Lack of protection measures |

| Execution Quality | Medium | Reports of slippage and rejections |

| Customer Support | High | Poor response to complaints |

To mitigate these risks, traders should conduct thorough due diligence before engaging with HFGFX. This includes researching alternative brokers with better regulatory standing, more transparent fee structures, and positive customer feedback. Additionally, traders should consider starting with a demo account to test the platform before committing real funds.

Conclusion and Recommendations

In conclusion, the evidence suggests that HFGFX may pose significant risks to potential traders. The lack of regulatory oversight, combined with troubling customer feedback and transparency issues, raises serious concerns about the broker's legitimacy. While HFGFX offers various trading services, the potential for fraud and mismanagement cannot be overlooked.

Traders are advised to exercise caution and consider alternative brokers that are well-regulated and have a proven track record of reliability. Some reputable alternatives include brokers regulated by tier-1 authorities such as the FCA or ASIC, which provide higher levels of safety and transparency. By prioritizing safety and due diligence, traders can better protect their investments and enhance their trading experience.

Ultimately, the question "Is HFGFX safe?" leans toward a negative response, as the broker's operational practices and regulatory history suggest that caution is warranted.

Is HFGFX a scam, or is it legit?

The latest exposure and evaluation content of HFGFX brokers.

HFGFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

HFGFX latest industry rating score is 1.60, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.60 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.