QMMFX 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive qmmfx review reveals significant concerns about QMMFX as a forex broker. Based on available information and user feedback, QMMFX operates as an unregulated broker with substantial red flags that suggest potential scam activities. While the broker claims to offer MT5 and mobile trading platforms, the lack of regulatory oversight and transparent trading conditions raises serious safety concerns for potential traders.

The broker primarily targets individuals seeking to trade in the forex market. It presents itself as a platform dedicated to helping traders of all levels achieve their financial goals. However, multiple sources indicate that QMMFX lacks proper licensing from major financial regulatory authorities, which is a critical factor for trader protection and fund security.

User feedback consistently points to poor service quality and lack of transparency in trading conditions. It also shows concerns about fund safety. The absence of clear information regarding spreads, commissions, minimum deposits, and withdrawal processes further compounds these concerns. Given these factors, this review strongly advises traders to exercise extreme caution. They should consider regulated alternatives for their forex trading activities.

Important Notice

Regional Entity Differences: QMMFX has not been registered with any major financial regulatory authorities across different jurisdictions. Traders should be aware that regulatory requirements vary by region, and the lack of proper licensing means users receive no regulatory protection regardless of their location. This poses significant risks to trader funds and legal recourse options.

Review Methodology: This evaluation is based on available public information and user feedback collected from various trading platforms and review sites. Due to the limited transparency of QMMFX operations, some information may be incomplete or unavailable.

Rating Framework

Broker Overview

QMMFX presents itself as a forex broker committed to helping traders at all levels achieve their financial objectives. However, the company's background information remains largely opaque, with no clear founding date or detailed corporate history available in public sources. The broker operates without proper regulatory oversight, which immediately raises concerns about its legitimacy and operational standards.

The company's business model appears to focus on providing forex trading services through online platforms. However, the lack of transparency regarding its operational structure, management team, and financial backing creates uncertainty about its reliability. Unlike established brokers that provide comprehensive company information, QMMFX's corporate details remain largely undisclosed.

QMMFX offers MT5 and mobile trading platforms to its users. It positions itself in the competitive forex market. However, the broker primarily deals with forex trading, with limited information available about other asset classes such as CFDs, commodities, or indices. Most concerning is the broker's status as an unregulated entity, meaning it operates without oversight from recognized financial authorities such as the FCA, CySEC, or ASIC. This qmmfx review emphasizes that this lack of regulation represents a significant risk factor for potential traders.

Regulatory Status: QMMFX operates as an unregulated broker. This means it has not obtained licensing from any major financial regulatory authorities. This absence of regulatory oversight means traders have no protection mechanisms or recourse options if issues arise with their accounts or funds.

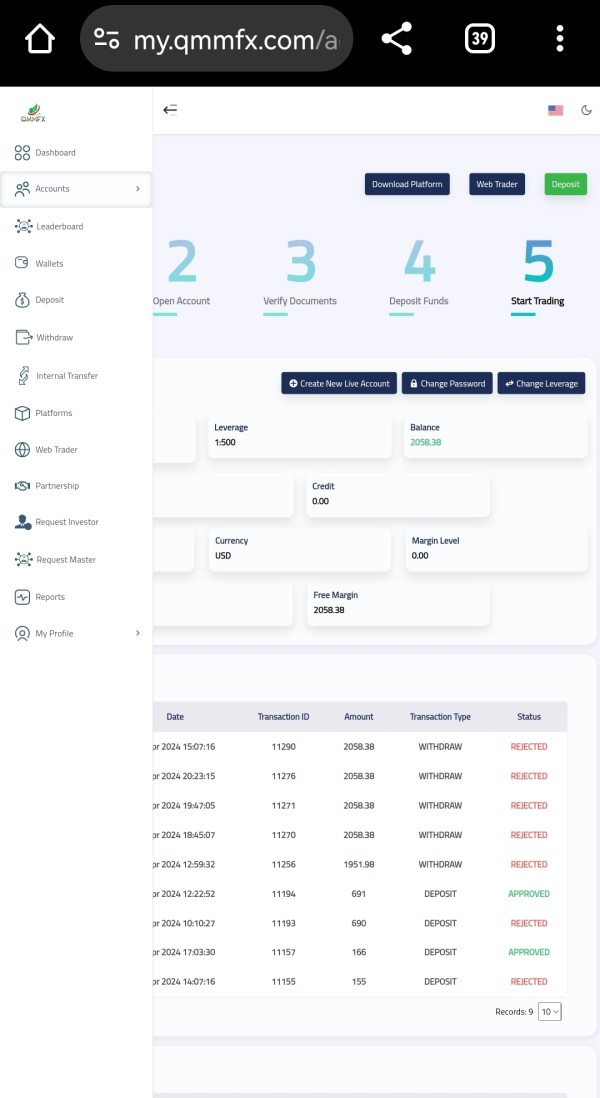

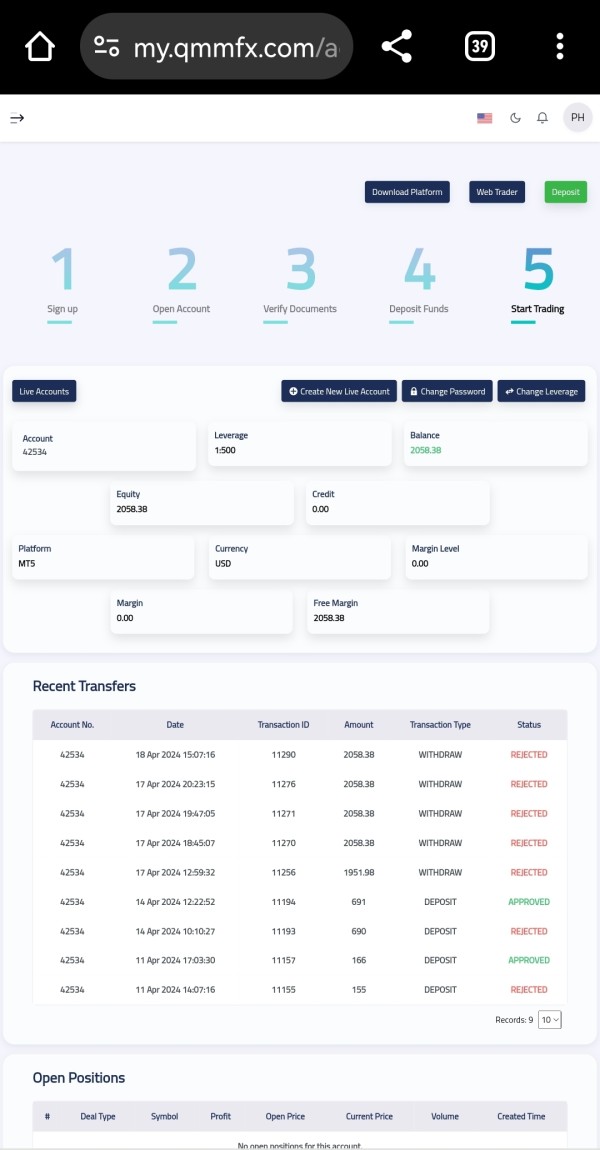

Deposit and Withdrawal Methods: Specific information about available deposit and withdrawal methods is not clearly disclosed in available sources. This lack of transparency regarding payment processing is concerning for potential traders who need to understand how they can fund their accounts and access their profits.

Minimum Deposit Requirements: The minimum deposit amount required to open an account with QMMFX is not specified in available information. This makes it difficult for potential traders to plan their initial investment.

Bonuses and Promotions: Available sources do not mention specific bonus offers or promotional campaigns offered by QMMFX. This suggests either the absence of such programs or lack of transparent marketing practices.

Tradeable Assets: QMMFX primarily focuses on forex trading. However, detailed information about the specific currency pairs available, or other asset classes such as commodities, indices, or cryptocurrencies, is not clearly provided in available sources.

Cost Structure: Critical information about spreads, commissions, overnight fees, and other trading costs remains undisclosed. This makes it impossible for traders to accurately assess the true cost of trading with this broker. This lack of transparency is a significant red flag in the forex industry.

Leverage Options: Specific leverage ratios offered by QMMFX are not mentioned in available sources. This is concerning as leverage is a crucial factor in forex trading decisions.

Platform Options: The broker offers MT5 and mobile trading platforms. However, detailed information about platform features, customization options, or additional trading tools is limited.

Geographic Restrictions: Information about specific countries or regions where QMMFX services are restricted is not clearly outlined in available sources.

Customer Support Languages: The languages supported by QMMFX customer service are not specified in available information. This could be problematic for international traders.

This qmmfx review highlights the concerning lack of transparency across multiple operational aspects that are typically clearly disclosed by legitimate brokers.

Detailed Rating Analysis

Account Conditions Analysis (2/10)

The account conditions offered by QMMFX receive a poor rating due to the significant lack of transparency and detailed information. Available sources do not specify the types of accounts available, whether the broker offers standard, premium, or VIP account tiers that are common in the industry. This absence of clear account structure makes it difficult for traders to understand what services they can expect.

The minimum deposit requirements remain undisclosed. This is highly unusual for legitimate forex brokers who typically provide clear information about initial funding requirements. Without this information, potential traders cannot properly plan their investment or compare QMMFX with other brokers in the market.

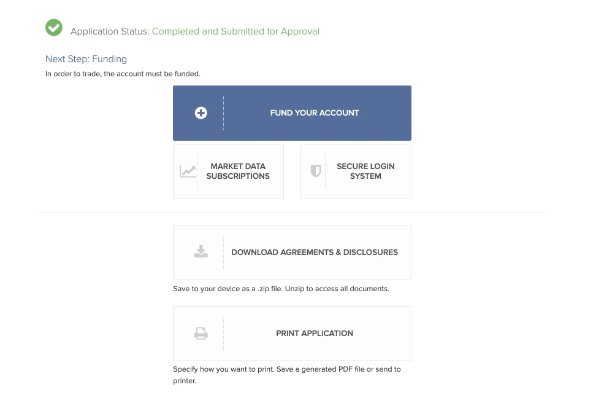

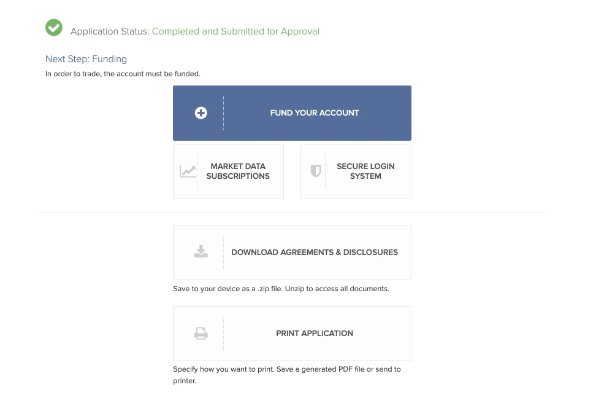

The account opening process is not detailed in available sources. This raises questions about verification procedures, documentation requirements, and the time needed to activate trading accounts. Legitimate brokers typically provide step-by-step guidance for account opening, including KYC requirements and anti-money laundering procedures.

Special account features such as Islamic accounts for Muslim traders, demo accounts for practice trading, or managed accounts for less experienced traders are not mentioned in available information. This qmmfx review finds that the lack of comprehensive account information significantly impacts the broker's credibility and user-friendliness.

QMMFX receives a moderate rating for tools and resources primarily because it offers MT5 trading platform. MetaTrader 5 is recognized as one of the industry's leading trading platforms. MetaTrader 5 provides advanced charting capabilities, technical analysis tools, and automated trading features that are valued by forex traders.

The availability of mobile trading platforms is another positive aspect. Mobile trading has become essential for modern traders who need to monitor and manage their positions on the go. However, detailed information about the mobile platform's features, compatibility, and functionality is not provided in available sources.

Research and analysis resources, which are crucial for informed trading decisions, are not mentioned in available information. Legitimate brokers typically provide market analysis, economic calendars, trading signals, and educational content to support their clients' trading activities.

Educational resources such as webinars, tutorials, trading guides, or market insights appear to be absent or not prominently featured. The lack of educational support is particularly concerning for novice traders who rely on broker-provided resources to develop their trading skills.

Automated trading support through Expert Advisors or signal services is not specifically mentioned. The MT5 platform generally supports such features. The absence of detailed information about additional trading tools and resources limits the overall value proposition for traders.

Customer Service and Support Analysis (3/10)

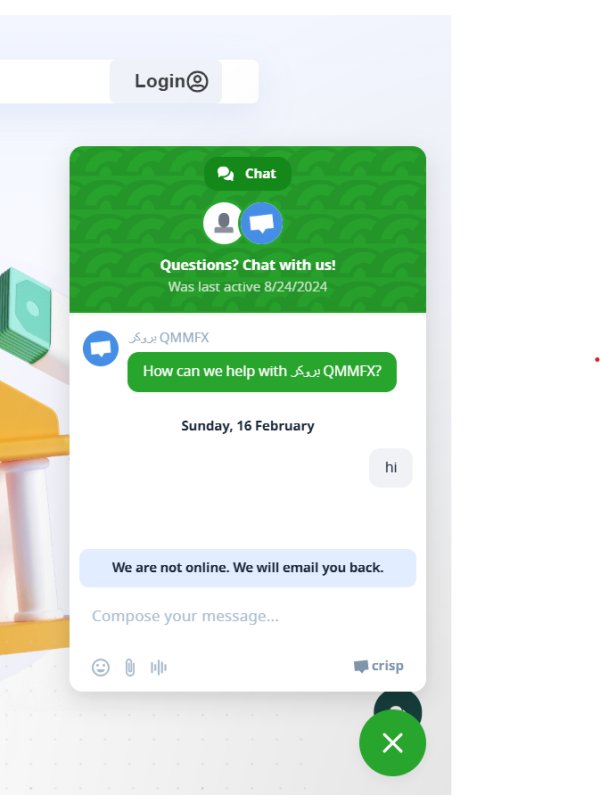

Customer service quality at QMMFX receives a low rating based on predominantly negative user feedback and lack of detailed service information. Available sources do not specify the customer support channels offered, such as live chat, phone support, email assistance, or help desk systems that are standard in the industry.

Response times for customer inquiries appear to be problematic based on user feedback. Many traders report slow or inadequate responses to their questions and concerns. This is particularly concerning in forex trading where timely support can be crucial for resolving trading issues or account problems.

Service quality feedback from users indicates widespread dissatisfaction with the level of support provided. Many users report difficulties in getting their issues resolved effectively, which raises serious concerns about the broker's commitment to customer satisfaction.

Multilingual support capabilities are not clearly specified. This could create communication barriers for international traders who may not be fluent in the primary language used by the support team. Professional brokers typically offer support in multiple languages to serve their diverse client base.

Operating hours for customer support are not mentioned in available sources. This makes it unclear whether traders can access assistance during their preferred trading hours or in case of urgent issues outside standard business hours.

Trading Experience Analysis (4/10)

The trading experience with QMMFX receives a below-average rating due to several concerning factors reported by users and the lack of transparent trading conditions. Platform stability appears to be an issue based on user feedback, with some traders reporting connectivity problems and platform performance issues that can significantly impact trading activities.

Order execution quality is a major concern. User reports indicate problems such as slippage, requotes, and delayed order processing. These issues can severely impact trading profitability and create frustration for traders, especially during volatile market conditions when precise execution timing is crucial.

The completeness of platform functionality is difficult to assess due to limited detailed information about available features, tools, and customization options. While MT5 is generally a comprehensive platform, the specific implementation and additional features provided by QMMFX are not clearly documented.

Mobile trading experience quality is not thoroughly detailed in available sources. Mobile platforms are mentioned as available. The functionality, user interface, and feature parity between desktop and mobile versions remain unclear.

Overall trading environment feedback from users suggests an unsatisfactory experience. Many traders express concerns about the reliability and professionalism of the trading conditions. This qmmfx review notes that poor trading experience significantly impacts trader confidence and long-term satisfaction.

Trust and Safety Analysis (1/10)

Trust and safety represent the most critical weakness in this QMMFX evaluation. They earn the lowest possible rating. The broker operates without regulatory licensing from any recognized financial authority, which means traders have no regulatory protection or recourse mechanisms if problems arise with their accounts or funds.

Fund safety measures are inadequately documented. There is no clear information about client fund segregation, insurance coverage, or other protective measures that legitimate brokers typically implement. The absence of regulatory oversight means there are no mandatory safety standards that the broker must follow.

Company transparency is severely lacking. Minimal information is available about the company's management, financial statements, operational history, or corporate structure. Legitimate brokers typically provide comprehensive company information to build trust with potential clients.

Industry reputation is predominantly negative. QMMFX is widely flagged as a potential scam broker by various review platforms and user communities. This reputation damage is particularly concerning in the forex industry where trust is paramount.

The handling of negative events or customer complaints is not clearly documented. There appears to be no established process for dispute resolution or regulatory intervention when problems occur. The lack of regulatory oversight means traders have limited options if they encounter issues with the broker.

User Experience Analysis (2/10)

Overall user satisfaction with QMMFX is notably low based on available feedback and reviews. The majority of user testimonials and reviews express dissatisfaction with various aspects of the broker's services, from account management to customer support and trading conditions.

Interface design and usability information is limited in available sources. This makes it difficult to assess the quality of the user interface beyond the basic platform offerings. Professional brokers typically invest in user-friendly interfaces and provide detailed information about their platform features.

Registration and verification processes are not clearly documented. This can create uncertainty for potential traders about what to expect when opening an account. Transparent onboarding processes are typically a hallmark of professional broker operations.

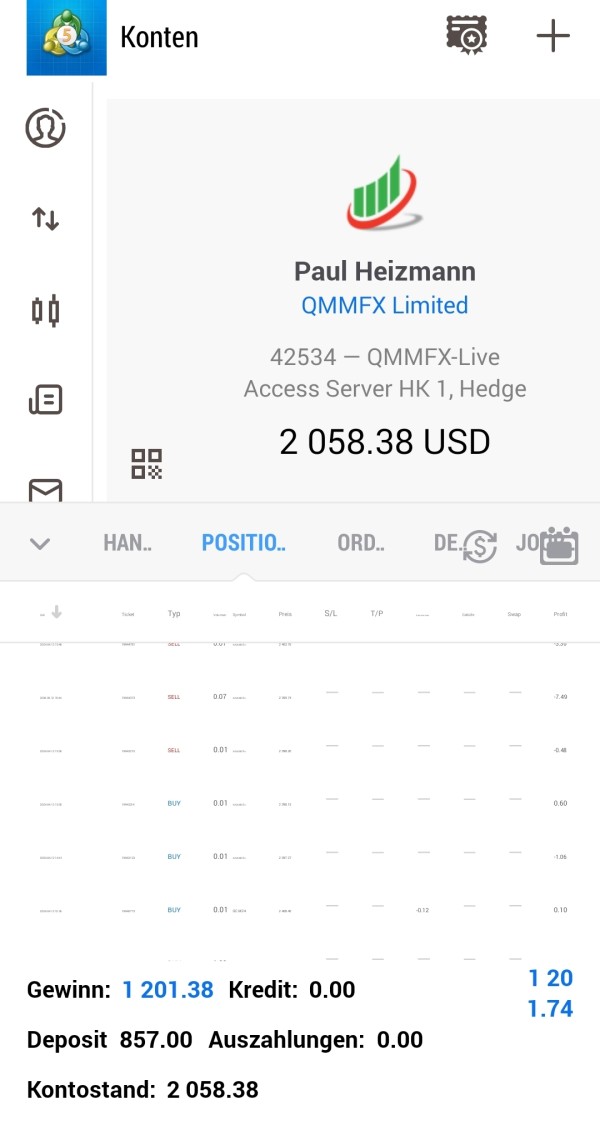

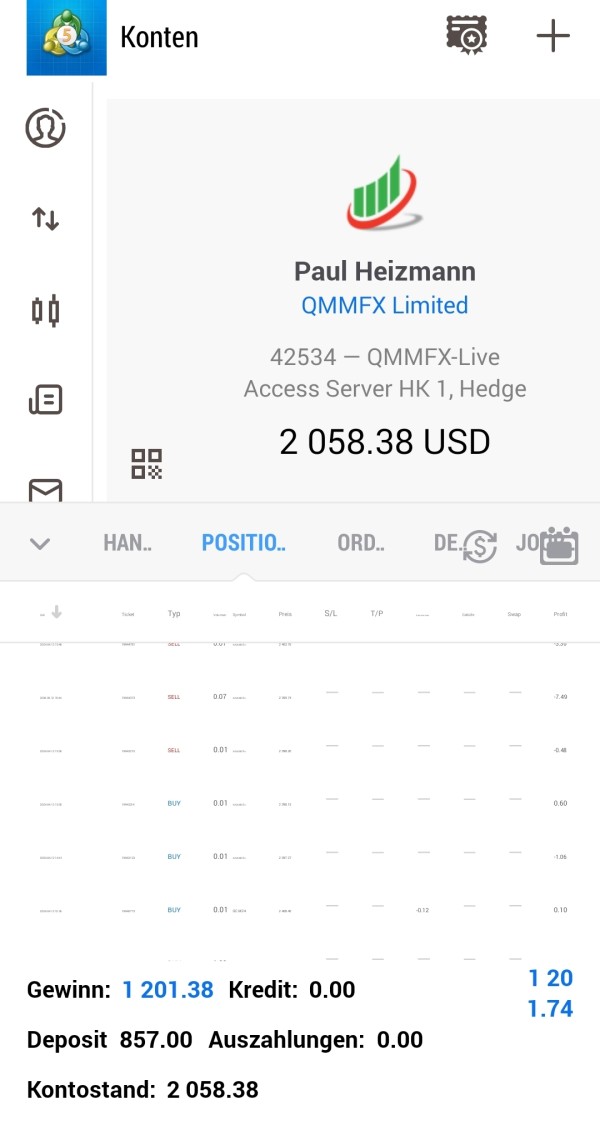

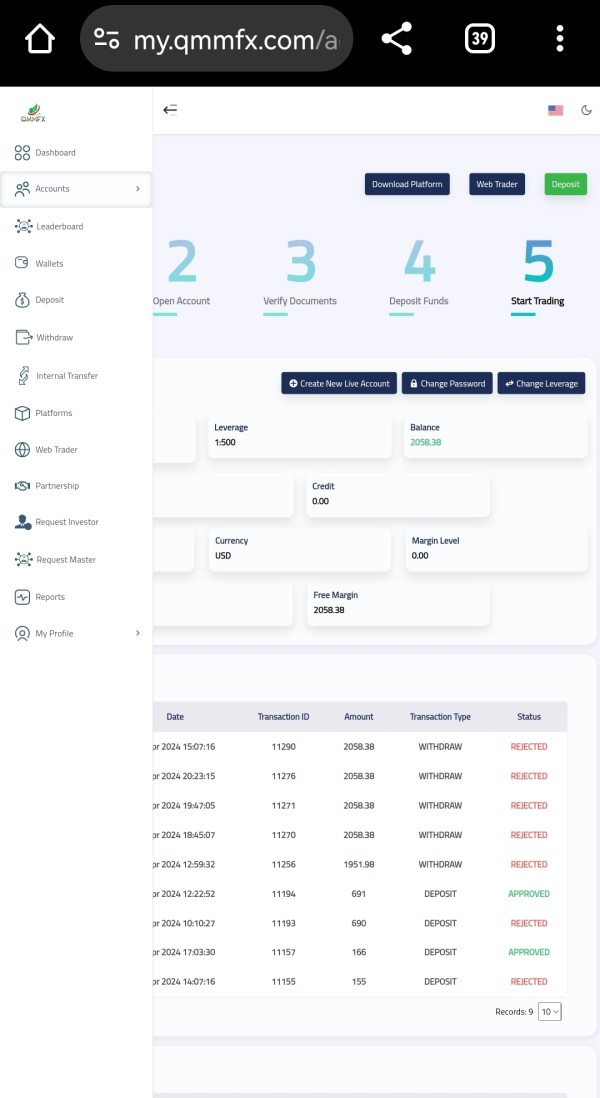

Fund operation experience, including deposit and withdrawal processes, is not well-documented in available sources. User feedback suggests potential issues with fund access, though specific details about processing times, fees, and procedures are not clearly provided.

Common user complaints center around concerns about fund safety, service quality, and overall broker reliability. The concentration of negative feedback across multiple aspects of the service suggests systemic issues with the broker's operations rather than isolated problems.

The target user profile for QMMFX appears to be traders seeking forex market access. However, the high-risk nature of dealing with an unregulated broker makes it unsuitable for risk-averse traders or those prioritizing fund safety and regulatory protection.

Conclusion

This comprehensive qmmfx review concludes that QMMFX presents significant risks for forex traders due to its unregulated status and numerous red flags identified throughout this evaluation. The broker's lack of regulatory oversight, combined with predominantly negative user feedback and limited transparency in operational details, makes it unsuitable for traders prioritizing safety and reliability.

The broker is not recommended for risk-averse traders or anyone concerned about fund safety and regulatory protection. While QMMFX offers MT5 trading platform, which is a positive feature, this single advantage is heavily outweighed by the substantial risks associated with dealing with an unregulated entity.

The main advantages include access to the MT5 platform and mobile trading capabilities. However, the disadvantages are significant and include lack of regulatory protection, poor transparency in trading conditions, negative user feedback, and absence of comprehensive customer support. Traders are strongly advised to consider regulated alternatives that offer better protection and more transparent operating conditions.