Is QMMFX safe?

Pros

Cons

Is QMMFX Safe or a Scam?

Introduction

QMMFX is a forex broker that positions itself within the online trading market, offering a variety of financial instruments including forex pairs, commodities, and cryptocurrencies. However, the legitimacy of QMMFX has come under scrutiny, prompting traders to exercise caution when evaluating this broker. The importance of assessing forex brokers cannot be overstated; unregulated entities can lead to significant financial losses, making it crucial for traders to ensure they are dealing with reputable firms. This article investigates whether QMMFX is safe or a potential scam by examining its regulatory status, company background, trading conditions, client fund security, customer experiences, platform performance, and overall risk profile.

Regulation and Legitimacy

The regulatory status of a forex broker is a critical factor in determining its legitimacy and safety. QMMFX claims to operate globally, but it lacks oversight from any reputable financial authority. This absence of regulation raises significant red flags about the broker's operations and the safety of client funds. Below is a summary of the regulatory information for QMMFX:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The lack of regulation means that QMMFX is not held accountable by any governing body, which is a significant concern for potential traders. Regulated brokers are required to adhere to strict guidelines that protect client funds, including the maintenance of segregated accounts and participation in compensation schemes. In contrast, QMMFX's unregulated status leaves clients vulnerable to potential fraud and mismanagement of funds. Furthermore, the broker's claims of being based in Dubai without valid regulatory backing from the Dubai Financial Services Authority (DFSA) further complicate its legitimacy.

Company Background Investigation

QMMFX is operated by QMMFX Limited, which allegedly has been in operation since 2021. However, information regarding the company's ownership structure and management team is scarce, which raises concerns about transparency. A lack of detailed information about the individuals behind the broker can be indicative of a potential scam.

The company's website does not provide substantial details about its history or professional background, making it difficult for traders to assess the reliability of the firm. Transparency is crucial in the financial sector, and the absence of clear information about the broker's operations and management can be a warning sign. Additionally, the claims of regulatory compliance appear to be misleading, as no verifiable licenses are presented.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is essential for evaluating its overall value. QMMFX presents a range of trading options, but the costs associated with trading can be a concern. The following table summarizes the core trading costs:

| Cost Type | QMMFX | Industry Average |

|---|---|---|

| Spread on Major Pairs | 3.4 pips | 1.0 - 1.5 pips |

| Commission Model | None | Varies (typically low) |

| Overnight Interest Range | Unknown | Varies |

The spreads offered by QMMFX are significantly higher than the industry average, which can eat into traders' profits. Additionally, the lack of transparency regarding commission structures and overnight fees raises further concerns. Traders should be wary of brokers that do not clearly disclose their fee structures, as hidden costs can lead to unexpected financial burdens.

Client Fund Security

The security of client funds is paramount when evaluating a forex broker. QMMFX does not provide adequate information regarding its fund security measures, which is alarming. The broker does not appear to offer segregated accounts, which means that client funds may be mixed with the broker's operational funds, increasing the risk of loss in case of financial difficulties.

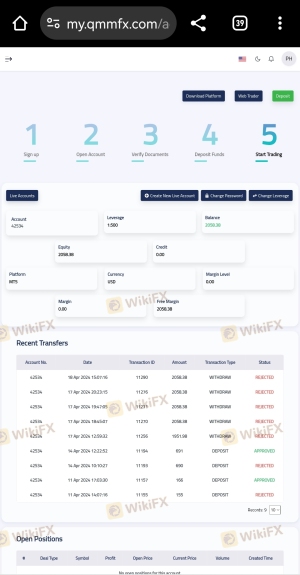

Moreover, the absence of investor protection schemes, such as those provided by regulated brokers, leaves clients without recourse in the event of fraud or insolvency. Historical reports of fund safety issues associated with QMMFX further complicate its reputation, as numerous complaints have emerged regarding difficulties in withdrawing funds.

Client Experience and Complaints

Analyzing customer feedback is essential to gauge the reliability of a broker. QMMFX has received numerous negative reviews, highlighting common issues faced by traders. Below is a summary of the main complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Customer Support | Medium | Poor |

| Misleading Information | High | Minimal |

Many users report being unable to withdraw their funds after making a deposit, which is a significant red flag. Furthermore, the company's customer support is frequently criticized for being unresponsive, leaving traders frustrated and without assistance. These patterns of complaints suggest that QMMFX may not prioritize the welfare of its clients.

Platform and Trade Execution

The trading platform provided by QMMFX is based on the popular MetaTrader 5 (MT5), which is known for its advanced features and user-friendly interface. However, the performance of the platform in terms of order execution and reliability is crucial. Traders have reported issues with slippage and rejected orders, which can severely impact trading outcomes.

While the MT5 platform itself is reputable, the potential for manipulation by an unregulated broker raises concerns about the integrity of trade execution. Traders should be cautious when using platforms that lack oversight, as there may be risks of tampering with order execution.

Risk Assessment

When considering whether QMMFX is safe, it is essential to evaluate the overall risks associated with trading with an unregulated broker. Below is a risk scorecard summarizing key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No oversight or protection for clients. |

| Fund Security Risk | High | Lack of segregated accounts and investor protection. |

| Withdrawal Risk | High | Numerous complaints regarding withdrawal issues. |

| Transparency Risk | Medium | Limited information about company operations. |

To mitigate these risks, traders should conduct thorough research, avoid depositing large sums, and consider using regulated brokers with established reputations.

Conclusion and Recommendations

In conclusion, QMMFX exhibits numerous characteristics that suggest it may not be a safe option for traders. The lack of regulation, poor customer feedback, and high-risk factors indicate that potential clients should exercise extreme caution. While the trading platform may offer various instruments and features, the associated risks outweigh the benefits.

For traders seeking a reliable forex broker, it is advisable to consider alternatives that are regulated and have a proven track record of client satisfaction. Recommendations for trustworthy brokers include those regulated by the Financial Conduct Authority (FCA) or the Australian Securities and Investments Commission (ASIC), which provide safeguards for client funds and ensure transparent operations.

In summary, is QMMFX safe? The evidence suggests that it is not, and traders should be wary of engaging with this broker.

Is QMMFX a scam, or is it legit?

The latest exposure and evaluation content of QMMFX brokers.

QMMFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

QMMFX latest industry rating score is 1.97, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.97 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.