Maybank Kim Eng Review 1

I was very sad that they stole 5,000 pesos from me.

Maybank Kim Eng Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

I was very sad that they stole 5,000 pesos from me.

This detailed maybank kim eng review looks at one of Southeast Asia's top investment banking platforms. Maybank Kim Eng operates as Maybank Securities and serves as the fully-owned investment banking arm of Maybank, which ranks as one of Asia's leading banking groups and Southeast Asia's fourth largest bank by assets. The company started in Singapore in 1972. It became the first stockbroker listed on the Singapore Stock Exchange in 1990.

The platform gives clients multi-market brokerage services with investment chances in popular tools across different asset types. Singapore leads as Maybank's ASEAN hub for brokerage work and drives product innovation by mixing advanced technology with easy-to-use design to give clients complete regional and global network access. The firm handles corporate finance, debt markets, equity capital markets, derivatives, and both retail and institutional investment services.

This review helps investors who want complete financial services in Southeast Asian markets, especially those interested in diverse investment portfolios and institutional-grade trading abilities. Users should know that detailed regulatory information and specific account conditions are hard to find in public materials.

Regional Entity Differences: Users should know about possible regional differences in service offerings and compliance requirements across different areas where Maybank Kim Eng operates because limited specific regulatory information is available in public sources. Potential clients should check specific regulatory status and available services in their regions before moving forward.

Review Methodology: This evaluation uses available public information and market analysis. Real trading experience may change based on individual situations, account types, and regional service differences. Readers should do independent research and think about their specific investment needs before making decisions.

| Dimension | Score | Rating Basis |

|---|---|---|

| Account Conditions | N/A | Specific account terms not detailed in available information |

| Tools and Resources | 7/10 | Multi-market investment platform with popular instruments |

| Customer Service | N/A | Customer support details not specified in available materials |

| Trading Experience | N/A | Platform performance metrics not detailed in public sources |

| Trust and Reliability | 6/10 | Listed company status provides credibility, but limited regulatory transparency |

| User Experience | N/A | User interface and experience details not available in source materials |

Company Background and Heritage

Maybank Kim Eng, now called Maybank Securities, has a rich history that goes back to 1972 when it started in Singapore. The company reached an important milestone by becoming the first stockbroker listed on the Singapore Stock Exchange in 1990, which built its reputation in regional financial markets. As a fully-owned investment banking subsidiary of Maybank, one of Southeast Asia's most important financial institutions, the platform gets substantial backing and regional expertise.

The firm works as Maybank's main ASEAN hub for brokerage operations, with Singapore as the center for product innovation and technology advancement. This smart positioning lets the company use advanced technology while keeping an easy user experience, effectively connecting clients to extensive regional and global networks.

Service Portfolio and Business Model

Maybank Kim Eng gives complete investment services that cover multiple market segments. The platform offers corporate finance solutions, debt market access, equity capital market services, derivatives trading, and both retail and institutional investment opportunities. The firm specializes in multi-market brokerage services and provides investment access to popular financial instruments across various asset classes based on available information.

The business model focuses on delivering institutional-grade services while staying accessible for retail investors. Specific details about trading platforms, minimum deposit requirements, and exact regulatory frameworks are not extensively detailed in publicly available materials, so potential clients need to seek direct consultation for complete service information.

Regulatory Framework: Available information does not specify the exact regulatory bodies that oversee Maybank Kim Eng's operations across different areas. Potential clients should verify specific regulatory compliance in their respective regions given its Singapore base and regional operations.

Deposit and Withdrawal Methods: Specific funding options and withdrawal procedures are not detailed in available public materials. Users who might be interested should contact the firm directly for complete information about supported payment methods and processing timeframes.

Minimum Deposit Requirements: Exact minimum deposit thresholds are not specified in available sources. This suggests potential variation based on account types and regional offerings.

Promotional Offers: Current bonus structures or promotional campaigns are not detailed in accessible information. This indicates the need for direct inquiry about any available incentives.

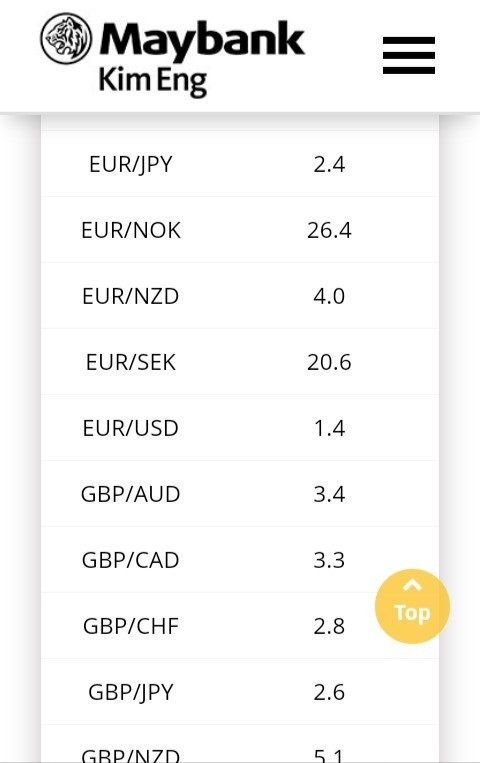

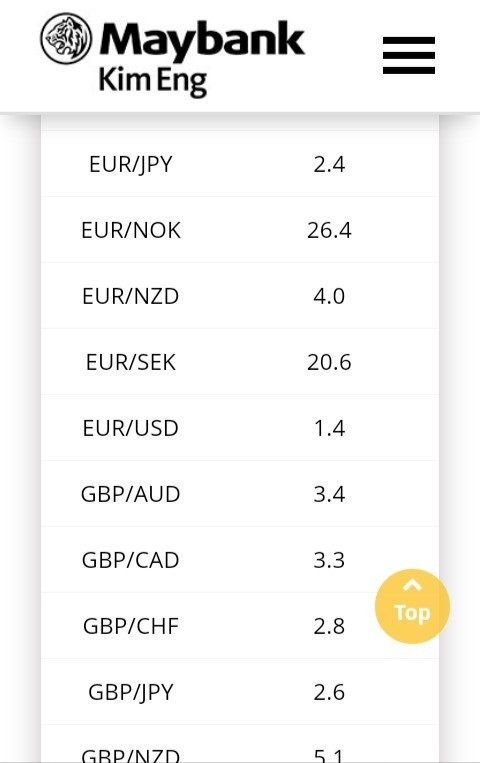

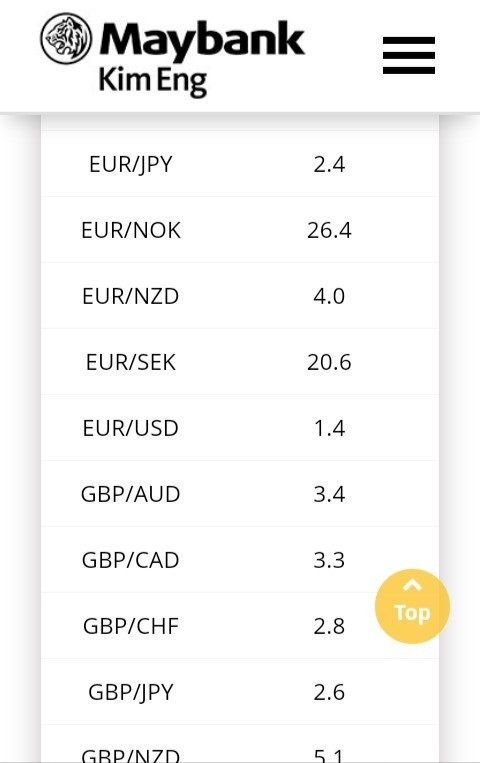

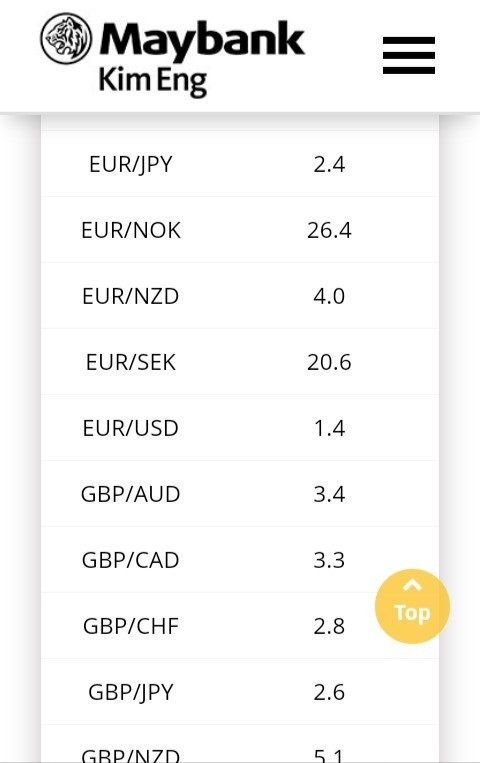

Tradeable Assets: The platform provides multi-market investment opportunities covering popular financial instruments. The firm offers access to various asset classes according to the maybank kim eng review materials, though specific instrument lists require direct verification.

Cost Structure: Detailed information about spreads, commissions, and fee structures is not fully available in public sources. This makes direct consultation necessary for accurate pricing information.

Leverage Options: Specific leverage ratios and margin requirements are not detailed in available materials.

Platform Selection: Information about specific trading platforms and technological infrastructure requires direct inquiry with the firm.

Geographic Restrictions: Regional availability and restrictions are not clearly outlined in accessible sources.

Customer Support Languages: Available customer service languages are not specified in public materials.

The maybank kim eng review shows limited publicly available information about specific account conditions and structures. The firm operates as a subsidiary of one of Southeast Asia's largest banking groups, but detailed account specifications, minimum balance requirements, and tier structures are not fully outlined in accessible materials.

The absence of detailed account information suggests potential customization based on client needs and regional requirements. Account conditions likely vary significantly between different client segments given Maybank Kim Eng's positioning as both a retail and institutional service provider. Users who might be interested should expect institutional-grade account features given the firm's corporate heritage, but specific terms require direct consultation.

The platform's focus on multi-market access suggests sophisticated account structures capable of handling diverse asset classes and regional market access. Potential clients cannot adequately assess suitability without direct engagement with the firm's representatives without detailed public disclosure of account terms.

This information gap represents a significant limitation for potential clients seeking transparent comparison with other brokers. Account conditions form a fundamental basis for broker selection decisions.

Maybank Kim Eng demonstrates strength in providing multi-market investment access with coverage of popular financial instruments across various asset classes. The firm's positioning as Maybank's ASEAN hub for brokerage operations suggests access to sophisticated trading tools and complete market research capabilities, though specific tool descriptions are not detailed in available materials.

The company's emphasis on combining advanced technology with intuitive user experience indicates investment in platform development and user interface optimization. The platform likely provides institutional-grade research and analysis resources as a subsidiary of a major banking group, though specific offerings require direct verification.

Traders can expect access to advanced analytical tools and market intelligence given the firm's corporate finance and derivatives capabilities. The absence of detailed tool specifications in public materials limits complete assessment of the platform's competitive position in terms of technical analysis capabilities, automated trading support, and educational resources.

The multi-market focus suggests robust charting capabilities and cross-market analysis tools. These are essential for traders operating across different regional markets and asset classes.

Available information does not provide complete details about Maybank Kim Eng's customer service infrastructure, response times, or support quality metrics. Clients can expect professional-grade customer support given the firm's institutional heritage and regional operations across ASEAN markets, though specific service level agreements are not publicly detailed.

The company's positioning as a full-service investment banking platform suggests multiple communication channels and dedicated relationship management for different client segments. Potential clients cannot adequately assess service quality expectations without specific information about support hours, available languages, or response time commitments.

The absence of publicly available customer service metrics or user testimonials limits the ability to evaluate support effectiveness. Support structures likely prioritize relationship-based service delivery over high-volume retail support models given the firm's corporate client focus.

Potential clients should inquire directly about specific support arrangements. This is particularly important for technical assistance, account management, and problem resolution procedures across different service regions.

The maybank kim eng review materials provide limited insight into specific trading experience metrics, including platform stability, execution speed, or order processing capabilities. The firm emphasizes advanced technology and intuitive user experience, but specific performance benchmarks are not publicly available.

The trading infrastructure likely supports sophisticated order types and advanced execution capabilities given Maybank Kim Eng's institutional focus and multi-market operations. The platform's regional hub status suggests robust connectivity to major Asian markets and potentially global market access, though specific execution statistics require direct verification.

The absence of detailed platform specifications, mobile trading capabilities, or user interface descriptions limits complete assessment of the trading experience. Potential users cannot adequately compare performance expectations with alternative platforms without specific information about platform uptime, execution speeds, or slippage metrics.

The firm's corporate heritage suggests institutional-grade execution capabilities. Retail traders should verify platform suitability for their specific trading styles and frequency requirements through direct consultation or demonstration accounts.

Maybank Kim Eng benefits from significant institutional credibility through its association with Maybank, one of Southeast Asia's largest and most established banking groups. The firm's history as the first stockbroker listed on the Singapore Stock Exchange in 1990 provides additional credibility markers, though specific regulatory oversight details are not fully available in public materials.

The company's longevity since 1972 and its role as a major regional financial institution's investment banking arm suggest stable operational foundations and substantial financial backing. The limited availability of specific regulatory information, capital adequacy details, or client fund protection mechanisms in public sources creates transparency gaps for potential clients.

The institutional heritage provides confidence in operational stability and financial strength, but the absence of detailed regulatory compliance information or third-party security certifications limits complete trust assessment. Potential clients should verify specific regulatory status and client protection measures in their respective jurisdictions.

The firm's focus on institutional clients and corporate finance suggests robust compliance frameworks. Specific consumer protection measures require direct verification for retail traders.

Available materials do not provide complete information about user interface design, platform navigation, or overall user satisfaction metrics for Maybank Kim Eng's services. The company emphasizes intuitive user experience as a key differentiator, but specific usability features or user feedback are not detailed in accessible sources.

The firm's focus on combining advanced technology with user-friendly interfaces suggests investment in user experience optimization. Actual experience quality remains unclear without specific platform demonstrations or user testimonials. The multi-market focus implies complex functionality requirements that must be balanced with ease of use.

User experience design likely prioritizes professional traders and sophisticated investors over novice users given the platform's institutional heritage. Potential retail clients cannot adequately assess platform suitability without detailed information about onboarding processes, educational support, or user interface complexity.

The absence of publicly available user reviews or satisfaction surveys limits insight into common user experiences, pain points, or particularly valued features. This could inform potential client decisions.

This maybank kim eng review reveals a well-established investment platform with significant institutional backing and regional market expertise. Maybank Kim Eng offers multi-market investment opportunities through a sophisticated platform backed by one of Southeast Asia's largest banking groups. The firm's heritage since 1972 and status as the first listed stockbroker in Singapore provides credibility. Its role as Maybank's ASEAN brokerage hub suggests access to advanced technology and complete market coverage.

The limited availability of specific information about account conditions, regulatory details, and user experience metrics creates transparency challenges for potential clients. The platform appears most suitable for investors seeking complete financial services within Southeast Asian markets, particularly those requiring institutional-grade capabilities and multi-market access.

Strengths include strong institutional backing, extensive market experience, and multi-market investment capabilities. Limitations include limited public disclosure of specific terms, regulatory transparency gaps, and insufficient user experience documentation for complete evaluation.

FX Broker Capital Trading Markets Review