Regarding the legitimacy of taurex forex brokers, it provides FCA, FSA and WikiBit, (also has a graphic survey regarding security).

Is taurex safe?

Pros

Cons

Is taurex markets regulated?

The regulatory license is the strongest proof.

FCA Market Making License (MM)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

Taurex Limited

Effective Date: Change Record

2019-03-11Email Address of Licensed Institution:

compliance@tradetaurex.comSharing Status:

No SharingWebsite of Licensed Institution:

https://www.tradetaurex.comExpiration Time:

--Address of Licensed Institution:

4th Floor 4 Eastcheap London London EC3M 1AE UNITED KINGDOMPhone Number of Licensed Institution:

+442039838250Licensed Institution Certified Documents:

FSA Derivatives Trading License (EP)

The Seychelles Financial Services Authority

The Seychelles Financial Services Authority

Current Status:

Offshore RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

Taurex Global Limited

Effective Date:

--Email Address of Licensed Institution:

compliance.sc@zenfinex.comSharing Status:

No SharingWebsite of Licensed Institution:

www.tradetaurex.com, global.mytaurex.com, www.taurexprime.comExpiration Time:

--Address of Licensed Institution:

Unit G, F28 Eden Plaza, Eden Island, SeychellesPhone Number of Licensed Institution:

+248 4346163Licensed Institution Certified Documents:

Is Taurex A Scam?

Introduction

Taurex, a relatively new entrant in the forex market, has quickly positioned itself as a multi-asset broker offering a wide range of trading instruments, including forex, commodities, indices, and cryptocurrencies. Established in 2017, the broker operates under multiple regulatory frameworks, which raises questions about its credibility and safety. As the forex trading landscape becomes increasingly crowded, it is essential for traders to exercise caution when evaluating brokers. The risks associated with trading can be significant, and choosing the wrong broker can lead to financial loss. This article aims to provide a comprehensive analysis of Taurex, focusing on its regulatory status, company background, trading conditions, customer experience, and overall safety. The investigation draws on multiple sources, including user reviews, regulatory data, and industry analyses, to offer a balanced view of whether Taurex is a trustworthy broker.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors that determine its legitimacy and safety. A well-regulated broker is generally seen as more reliable, as regulatory bodies enforce strict compliance standards to protect traders. Taurex claims to be regulated by several authorities, including the Financial Conduct Authority (FCA) in the UK and the Financial Services Authority (FSA) in Seychelles. Below is a summary of Taurex's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | 816055 | United Kingdom | Verified |

| FSA | SD 092 | Seychelles | Verified |

| CBLS | Not Available | Sierra Leone | Not Verified |

| SVG FSA | Not Available | St. Vincent | Not Verified |

The FCA is known for its stringent regulations and offers a high level of investor protection, including a compensation scheme that covers up to £85,000. However, the FSA in Seychelles is considered a tier-3 regulator, which means it has less stringent oversight and does not provide the same level of investor protection. This dual regulatory structure raises concerns, as clients trading under the Seychelles entity may not enjoy the same protections as those under the FCA. Furthermore, Taurex's affiliation with entities that are either unregulated or have weaker regulatory oversight can be a red flag for potential investors.

Company Background Investigation

Taurex operates under the ownership of Zen Finex Limited, which has a diverse operational history. The company was established in Seychelles and has expanded its operations to include entities in the UK and Sierra Leone. The management team comprises professionals with backgrounds in finance and trading, which adds credibility to the broker's claims of expertise. However, the company's relatively short history in the financial market raises questions about its long-term stability and reliability.

Transparency is crucial in the financial services industry, and Taurex provides some information about its operations on its website. However, there is limited publicly available financial data, which can make it difficult for potential clients to assess the company's financial health. The lack of detailed disclosures may indicate a lower level of transparency, which is a concern for traders looking to safeguard their investments.

Trading Conditions Analysis

When evaluating a broker, understanding its trading conditions is vital. Taurex offers three types of accounts: Standard Zero, Pro Zero, and Raw, with varying spreads and commission structures. The overall fee structure of Taurex appears competitive, but it is essential to scrutinize any unusual fees that may affect trading costs. Below is a comparison of Taurex's core trading costs against industry averages:

| Fee Type | Taurex | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.6 pips | 1.2 pips |

| Commission Model | $0 for Standard/Pro, $4 for Raw | $6 for ECN |

| Overnight Interest Range | $6.72 (long) | $5.00 (average) |

Taurex's Standard Zero account offers commission-free trading with spreads starting from 1.6 pips, which is slightly above the industry average. The Pro Zero account has similar conditions but requires a higher minimum deposit. The Raw account, which features tighter spreads starting from 0 pips, incurs a commission of $4 per lot, which is competitive for high-volume traders. However, traders should be cautious of the overnight interest rates, which can be higher than average, impacting long-term trading strategies.

Customer Fund Security

The security of client funds is a paramount concern for any trader. Taurex claims to implement several safety measures to protect client investments, including segregated accounts, which ensure that client funds are kept separate from the broker's operational funds. This is a standard practice among reputable brokers and is essential for safeguarding client assets. Additionally, the FCA-regulated entity offers negative balance protection, which prevents traders from losing more than their account balance.

However, clients trading under the Seychelles entity do not benefit from these protections, as the FSA does not mandate negative balance protection or an investor compensation scheme. This discrepancy raises concerns about the overall safety of funds for clients who are not under the FCA's jurisdiction. Furthermore, there have been no significant historical issues reported regarding fund security or disputes, which is a positive indicator.

Customer Experience and Complaints

Customer feedback is crucial for assessing a broker's reliability and service quality. A review of user experiences with Taurex reveals a mixed bag of opinions. While some users praise the broker for its responsive customer support and user-friendly trading platform, others have reported issues related to withdrawal delays and sudden increases in spreads during volatile market conditions. Below is a summary of common complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Spread Manipulation | Medium | Acknowledged |

| Customer Support Issues | Low | Generally responsive |

Two typical case studies highlight these issues. One trader reported a delay in their withdrawal request, which took over a week to process, leading to frustration and concern about the broker's reliability. Another trader experienced a sudden spike in spreads during a major economic announcement, which resulted in unexpected trading losses. In both instances, Taurex's customer support team was responsive but did not fully address the traders' concerns regarding the underlying issues.

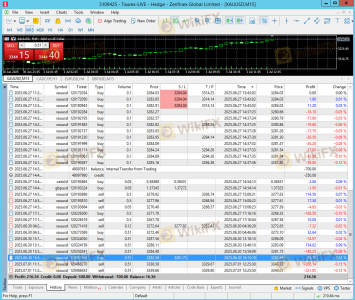

Platform and Trade Execution

The performance of a trading platform is crucial for a seamless trading experience. Taurex offers both MetaTrader 4 and MetaTrader 5, which are popular among traders for their robust features and user-friendly interfaces. However, the execution quality is a critical area of focus. Traders have reported average execution speeds of around 58 milliseconds, which is adequate for most trading strategies but may not be fast enough for scalpers. Additionally, there have been concerns about slippage during high volatility periods, which could impact trading outcomes.

Risk Assessment

Using Taurex comes with its own set of risks, and it is essential to assess these before committing funds. Below is a risk scorecard summarizing key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | Medium | Mixed regulatory oversight |

| Withdrawal Risk | High | Reports of delays and complications |

| Trading Cost Risk | Medium | Spreads and commissions may vary widely |

| Platform Reliability Risk | Medium | Average execution speeds and potential slippage |

To mitigate these risks, traders should conduct thorough research before trading, utilize demo accounts to familiarize themselves with the platform, and maintain a diversified trading portfolio to spread risk.

Conclusion and Recommendations

In conclusion, while Taurex has established itself as a broker with a diverse range of trading instruments and competitive trading conditions, there are several areas of concern that potential traders should consider. The mixed regulatory status, particularly the lack of protections for clients under the Seychelles entity, raises questions about the overall safety of funds. Additionally, the customer experience has shown inconsistencies, particularly regarding withdrawal processes and spread fluctuations.

For traders looking for a reliable broker, it may be prudent to explore alternatives with a stronger regulatory framework and proven track records. Brokers like IG, OANDA, or Forex.com offer robust regulatory oversight and comprehensive client protections. Ultimately, traders must weigh the benefits of Taurex against the potential risks and make informed decisions based on their individual trading needs and risk tolerance.

Is taurex a scam, or is it legit?

The latest exposure and evaluation content of taurex brokers.

taurex Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

taurex latest industry rating score is 8.37, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 8.37 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.