loyalty liquidity 2025 Review: Everything You Need To Know

1. Summary

Loyalty Liquidity has earned recognition as a trustworthy forex broker. The company focuses on customer loyalty and satisfaction above all else. In this loyalty liquidity review, we highlight the broker for offering flexible leverage and competitive spreads that create new trading opportunities for many different forex traders. The broker uses an operational model designed to provide better trading conditions. This makes it attractive for traders who demand efficiency and strong customer support, which are essential qualities in today's market. With its focus on putting client needs first, Loyalty Liquidity provides a smooth trading environment. This approach has worked well among users who want both speed and reliability in their trading experience. Although certain operational details are not fully shared in the available information, the overall impression stays positive. The firm is especially good for those who value fast execution speeds and customized account conditions. This ensures a high level of satisfaction and keeps clients coming back for more trading opportunities. This review is based only on public information and user feedback. It positions Loyalty Liquidity as a dependable partner for those who appreciate the mix of innovation and customer-focused service.

2. Notice

It is important to note that Loyalty Liquidity operates as an offshore broker and is currently unregulated. This means that its legal and operational frameworks may differ across various regions where it operates. The information available reflects different regional practices and legal restrictions. These could influence your trading experience depending on your jurisdiction and local laws. This review has been put together based on publicly available data and user testimonials. It does not include results from in-person testing or direct broker evaluation. As always, potential clients should conduct their own independent research before engaging in trading activities. The operational risks associated with an unregulated entity should be carefully considered before making any investment decisions. The evaluation methods used here are limited to the accessible information and reported experiences from actual users.

3. Rating Framework

4. Broker Overview

Loyalty Liquidity is headquartered in the United Arab Emirates. The company operates as an offshore broker focused on serving clients around the world. The company is dedicated to offering a range of trading opportunities with an emphasis on flexible leverage and competitive spreads that meet various trader needs. As an unregulated broker, it puts customer loyalty and satisfaction first, which is a central pillar of its business model. Despite the absence of detailed regulatory credentials in the available data, the broker has built a strong reputation for delivering efficient trading conditions while keeping customer service at the core of its operations. This loyalty liquidity review reflects the positive feelings expressed by many users who value the custom trading conditions and a client-first approach.

In addition, Loyalty Liquidity provides access to multiple asset classes. The broker primarily focuses on Forex and Contracts for Difference for its main trading offerings. Although the exact trading platforms have not been detailed in the provided information, the broker appears to offer the necessary technological infrastructure to support a wide array of trading strategies. The firm's business model, being an offshore operation, offers attractive trading conditions but comes with built-in risks due to its limited regulatory oversight. According to various feedback sources included in this loyalty liquidity review, the target client base includes traders who seek highly efficient execution, flexible trading conditions, and strong customer services. The dual emphasis on innovative trading solutions and client satisfaction sets the tone for a favorable if not entirely transparent operational framework.

Drawing on the available public information, this section outlines the essential operational features of Loyalty Liquidity.

Regulatory Regions:

The broker is not under the control of any major regulatory body and operates offshore. Specific jurisdictions or regulatory details are not provided in the information summary.

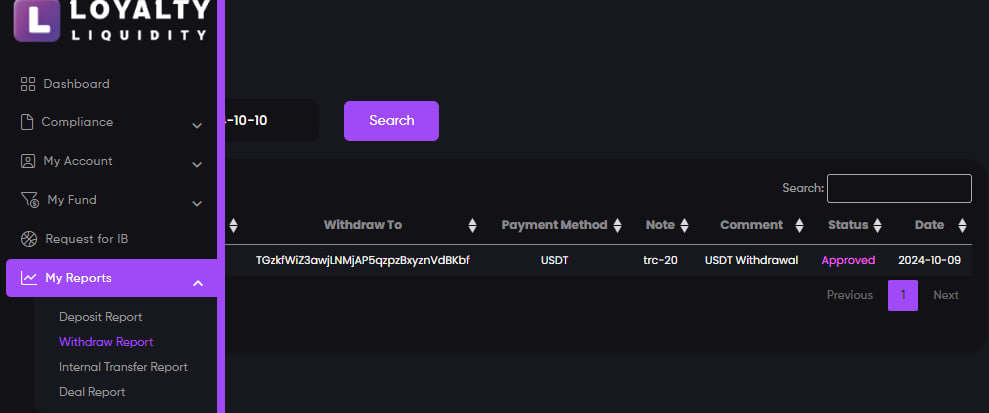

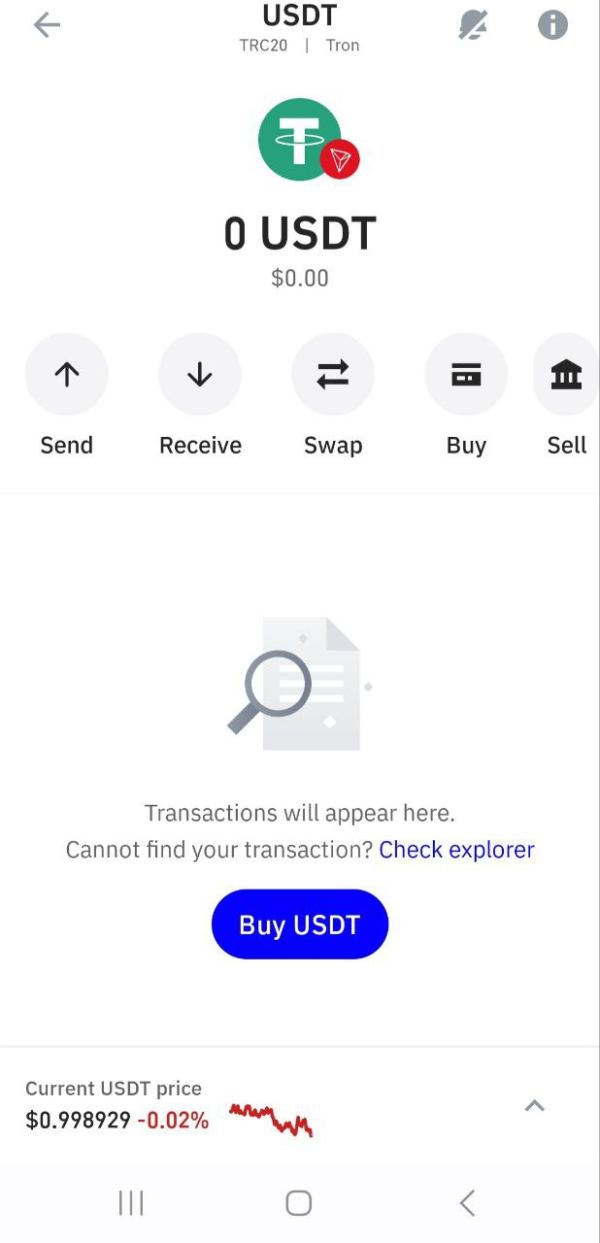

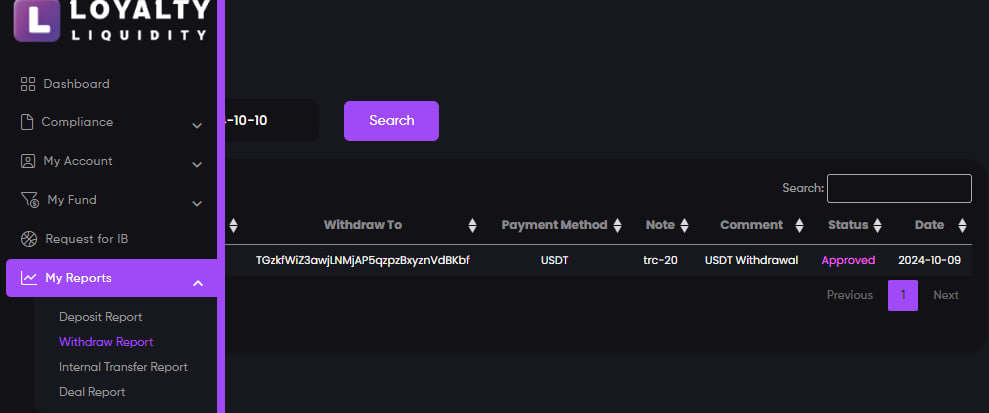

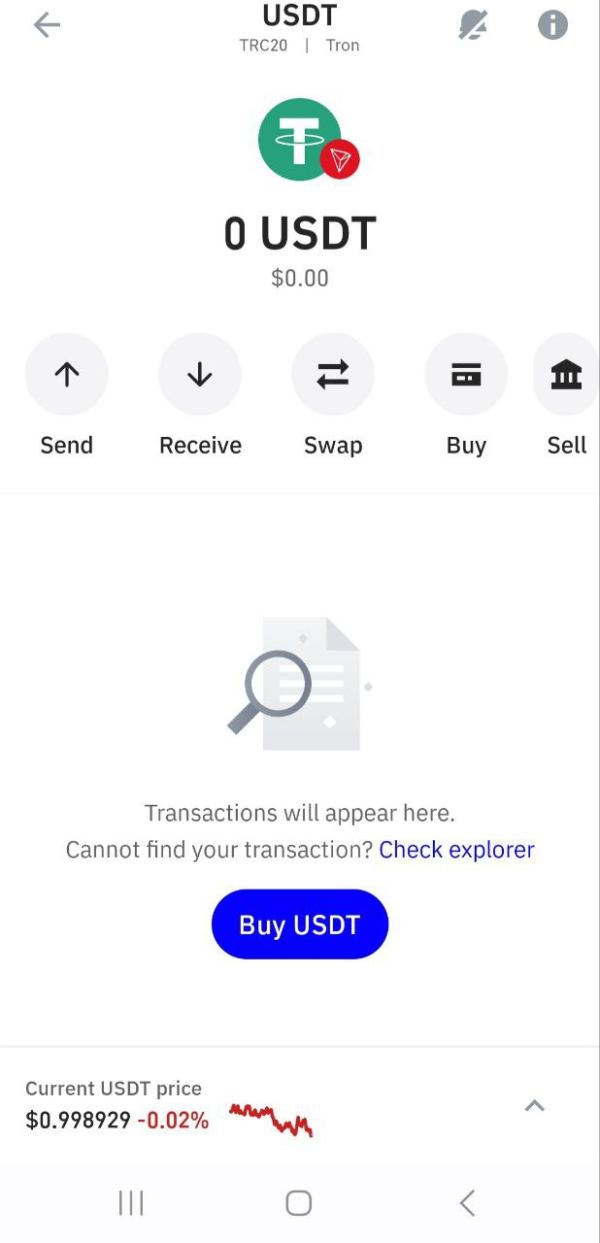

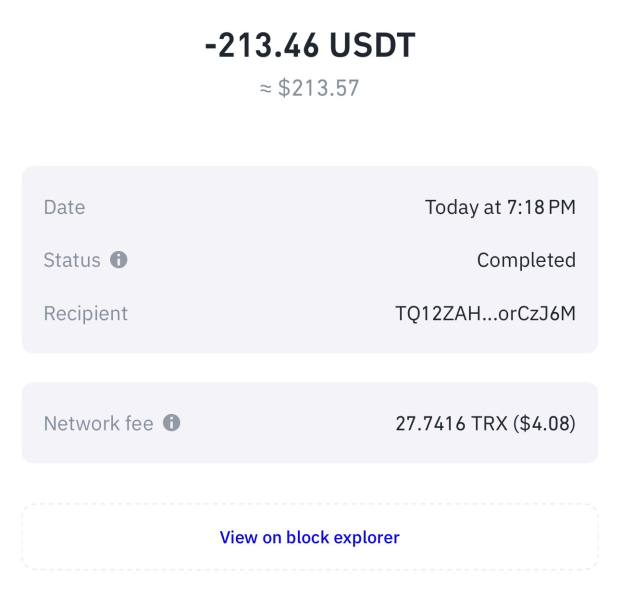

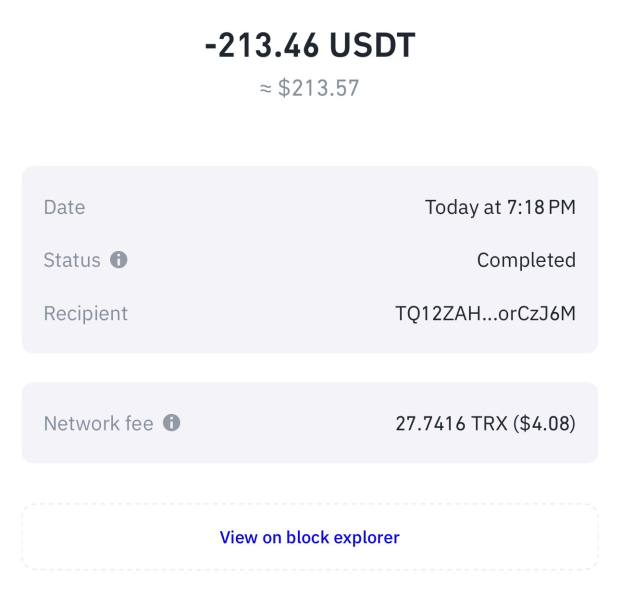

Deposit and Withdrawal Methods:

Payment methods and guidelines for deposits and withdrawals remain unclear in the available details. The information summary did not specify any particular options for fund transfers.

Minimum Deposit Requirement:

The exact minimum deposit requirements have not been detailed in the accessible material.

Bonus and Promotional Offers:

There is no concrete information provided regarding bonus structures or promotional campaigns.

Tradable Assets:

The broker primarily offers Forex and CFDs as its asset classes. This provides a wide range of currency pairs and derivative instruments for trading across different markets.

Cost Structure:

Loyalty Liquidity prides itself on competitive spreads that are designed to attract traders. While commission details remain unspecified, the trading costs are largely focused on providing value through tight spreads.

Leverage Offered:

The broker is recognized for offering flexible leverage options. However, specific ratios have not been disclosed in the available documentation.

Platform Choices:

Detailed information about the trading platforms available on Loyalty Liquidity has not been provided. This leaves a gap in understanding the user interface and technological features.

Regional Restrictions:

There is no explicit information on regional restrictions indicated in the provided material.

Customer Service Languages:

Specific language support for customer service inquiries has not been mentioned in the available data.

This loyalty liquidity review serves as a comprehensive outline based on the accessible data. Several areas are noted as "information summary not provided" owing to limited disclosure from the broker.

6. Detailed Rating Analysis

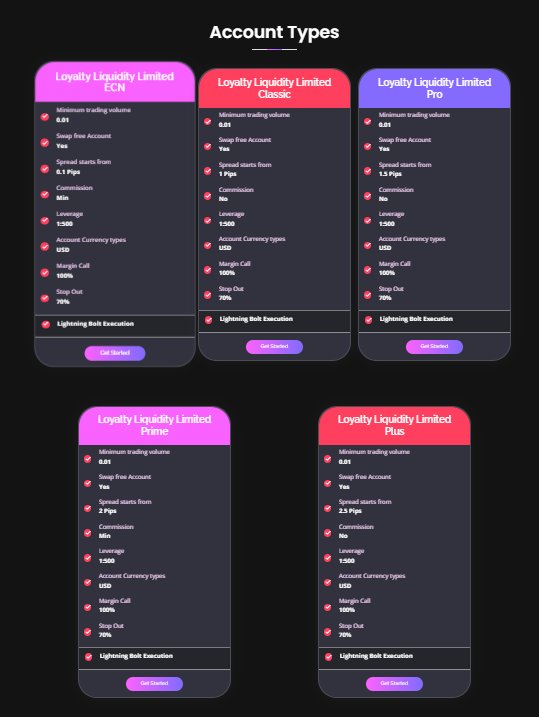

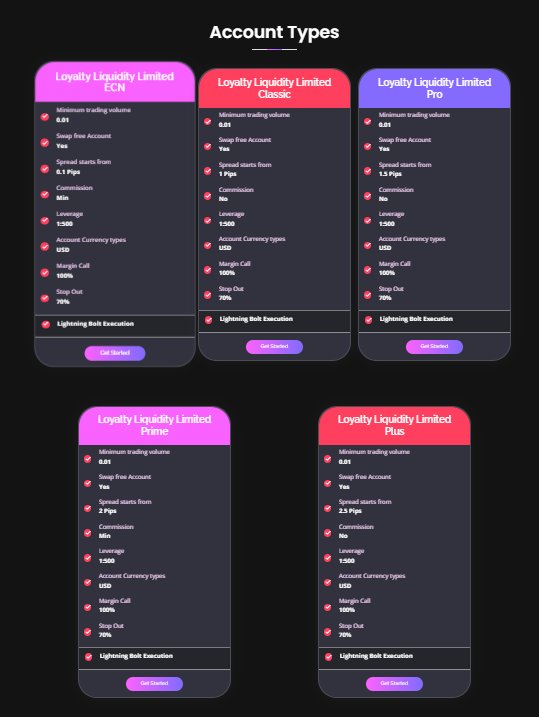

6.1 Account Conditions Analysis

Loyalty Liquidity offers account conditions that benefit from flexible leverage and competitive spreads. This shows a client-focused design that puts trader needs first. Although detailed account types and minimum deposit requirements are not explicitly mentioned in the available information, the emphasis on a tailored trading environment is clear. The account opening process is reported to be streamlined and user-friendly. However, specifics such as documentation requirements and processing times remain undisclosed to potential clients. The absence of specialized account features, such as Islamic accounts, further shows a standard approach rather than a highly different offering. Feedback from various sources supports the idea that while the trading conditions are attractive, certain operational details have not been fully explained to users. This loyalty liquidity review highlights that despite the limited specifics, the overall account conditions are satisfactory for traders seeking flexible trading options. Users appear to appreciate the adaptable leverage parameters. Even so, they call for greater transparency in terms of account segmentation and available options.

In terms of available tools and resources, Loyalty Liquidity is noted for using advanced technology and strong infrastructure. This supports its trading environment effectively for users. Even though the detailed list of trading tools has not been provided, the broker is praised for maintaining a high-performance technological base. The level of research and analysis resources available to traders, including market commentary and economic calendars, remains unspecified. This leaves a gap in complete evaluation of the broker's offerings. Similarly, there is no mention of educational modules or automated trading support. These factors could otherwise enhance the platform's appeal to different types of traders. User reviews suggest that while the present technological setup is competent, there exists an untapped potential for further expansion in terms of integrated research tools and automated functionalities. The broker's technological offerings, though adequate, indicate room for improvement. This is especially true when compared with highly regulated counterparts who often provide more extensive resource packages.

6.3 Customer Service and Support Analysis

Customer service and support have consistently been highlighted as strong points for Loyalty Liquidity. The broker emphasizes client loyalty and satisfaction in all its operations. Although detailed information regarding specific contact channels, such as live chat or dedicated phone support, is not provided, user feedback consistently points to a positive experience with the support team. The information summary notes a commitment to high-quality service. However, specifics regarding response times and language support remain unspecified for potential clients. This leaves open questions regarding the full range of customer service options available to traders. Nonetheless, the general feeling among clients is positive. Many note that their issues are resolved quickly and effectively. The overall approach appears to align with a customer-first philosophy. This is a notable strength in an environment where operational transparency is limited. The provision of a supportive trading environment adds significant value to the overall experience. This remains true despite uncertainties in detailed service structure and specific support protocols.

6.4 Trading Experience Analysis

The trading experience at Loyalty Liquidity is reported to be generally satisfying. It is characterized by efficient execution and favorable trading conditions for most users. Although specifics about platform stability, order execution speed, or mobile trading capabilities are not provided, the overall trading environment is seen as competent. Users have referenced the competitive spreads and flexible leverage as contributing factors to the effective trading experience they receive. Additionally, while detailed technical performance data and functionality of the trading interface remain unreported, the common feedback emphasizes the smooth operational flow in executing trades. This loyalty liquidity review underlines that despite the lack of detailed data concerning the technological parameters, the trading experience is largely positive for most users. The general acceptance of the trading conditions, combined with favorable user reviews, provides traders with confidence. Even so, more specific performance metrics would be beneficial for a comprehensive evaluation.

6.5 Trust Analysis

Trust remains a critical evaluation dimension for any broker. Here Loyalty Liquidity exhibits mixed reviews from the trading community. The absence of regulatory oversight is a significant concern. No major regulatory bodies have endorsed the broker's operations. This lack of regulation increases the perceived risk, particularly regarding fund security and transparency for client investments. While the company is based in a reputable location such as the UAE, the offshore status leaves several questions unanswered about operational compliance and risk management. There is limited insight into the broker's internal safeguards or third-party endorsements. Reports of fund safety measures are noticeably absent from available information. The information available does not shed light on any awards or industry recognitions. These typically enhance market credibility and trust among potential clients. This inherently reduces the trust score despite the broker's commitment to customer satisfaction. Users are advised to exercise caution due to these factors. The overall reliability of the platform is primarily driven by its customer-focused approach rather than strong regulatory credentials.

6.6 User Experience Analysis

User experience with Loyalty Liquidity appears to be generally positive. Overall satisfaction is centered on the ease of trading and effective customer support provided. Although detailed descriptions of interface design, registration procedures, and fund operation methods are not provided, most user feedback has been favorable. Clients appreciate the broker's straightforward approach to trading. This caters to both novice and experienced traders seeking a hassle-free experience. Efforts to simplify the registration and verification processes are suggested by the positive client testimonials. This remains true despite the absence of explicit details in the provided information. In addition, the operational environment seems tuned towards timely execution of trades. This enhances the overall user experience significantly. The platform's simplicity, coupled with an emphasis on client loyalty, has worked well with its user base. Even with certain specifics remaining undisclosed, the common opinion is that the trading environment maintains an adequate balance between functionality and user convenience.

7. Conclusion

Loyalty Liquidity stands out for its commitment to client satisfaction. This is evidenced by flexible trading conditions, competitive spreads, and responsive customer service. However, the lack of detailed regulatory oversight poses a challenge in terms of trust and transparency for potential clients. This review clearly indicates that while the broker is well-suited for traders who prioritize efficient execution and supportive service, those requiring strict regulatory safeguards may need to exercise additional caution. Overall, Loyalty Liquidity offers attractive trading opportunities for investors looking for competitive cost structures and adaptable leverage options. As such, this loyalty liquidity review recommends the platform for traders focused on active market engagement. We advise a careful evaluation of the inherent risks associated with an unregulated operational model.