JKE 2025 Review: Everything You Need to Know

Executive Summary

This jke review gives you a complete analysis of JKE International Limited, a forex broker registered in the United Kingdom. JKE shows a mixed profile for traders who might want to use their services. The company works in many areas like construction and online shopping, but it focuses mainly on forex trading through its official platform.

JKE International Limited's UK registration gives it regulatory legitimacy. This serves as one of its main distinguishing features. The broker's diverse business background shows it has experience in various industries, though this multi-sector approach may raise questions about how much it focuses on forex trading services.

JKE targets investors who want to trade forex and prefer working with regulated brokers. However, the limited information about detailed trading conditions and user feedback makes it hard to give a clear recommendation. Available data shows that user reviews have been mostly negative, especially about customer service quality and product offerings.

Current information suggests that JKE specializes in forex trading services. Specific details about account types, trading platforms, and fee structures remain hidden from public view. This lack of transparency may worry potential clients who want detailed information before they make trading decisions.

Important Notice

This evaluation of JKE International Limited uses publicly available information and limited user feedback. The company is registered in the United Kingdom and may operate under different regulatory requirements and business models across various regions where it provides services.

Potential clients should know that regulatory frameworks can vary a lot between different areas. The services that JKE offers may differ depending on where the client lives and what local regulations require. The assessment method used in this review relies on thorough analysis of available public information, industry standards, and comparative benchmarks within the forex brokerage sector.

Since there is limited detailed information about JKE's specific trading conditions, prospective traders should do independent research and contact the broker directly for current terms and conditions before making any trading decisions.

Rating Framework

Broker Overview

JKE International Limited operates as a forex broker with registration in the United Kingdom. This positions it within the regulated financial services sector. The company's establishment details, including founding year and initial money, are not clearly specified in available documentation, but the broker's UK registration shows compliance with British financial regulatory standards and adherence to established operational frameworks.

The company shows a diversified business approach. It maintains operations across multiple sectors including construction services and online shopping activities alongside its primary forex trading services. This multi-industry presence suggests operational experience and business skills, though it may also show divided attention from core forex brokerage activities. JKE's business model appears to focus on providing foreign exchange trading services through its official platform, though specific details about market making versus STP execution remain unclear.

Available information shows that JKE International Limited operates under UK regulatory oversight. This typically involves compliance with Financial Conduct Authority guidelines and consumer protection measures. The broker's platform specializes in foreign exchange trading, offering access to currency markets for retail and potentially institutional clients, but specific information about asset classes beyond forex, such as commodities, indices, or digital currencies, is not detailed in current jke review materials.

The regulatory framework under which JKE operates provides certain protections for client funds and trading activities. Specific details about segregated accounts, compensation schemes, and dispute resolution procedures require further clarification directly from the broker.

Regulatory Jurisdiction: JKE International Limited maintains registration in the United Kingdom, operating under British financial regulations. This registration provides a framework for regulatory compliance and client protection measures, though specific FCA authorization details require verification.

Deposit and Withdrawal Methods: Information about available funding options, processing times, and associated fees is not specified in current documentation. Prospective clients should ask directly about supported payment methods.

Minimum Deposit Requirements: Specific minimum deposit amounts for different account types are not disclosed in available materials. This requires direct communication with the broker for current requirements.

Bonus and Promotional Offers: Details about welcome bonuses, trading incentives, or promotional campaigns are not mentioned in current jke review sources. These would need to be confirmed with the broker.

Tradeable Assets: The primary focus appears to be foreign exchange trading. The complete range of available currency pairs and any additional asset classes require clarification from official sources.

Cost Structure: Specific information about spreads, commissions, overnight fees, and other trading costs is not detailed in available documentation. This represents a significant information gap for potential clients.

Leverage Ratios: Maximum leverage offerings and margin requirements are not specified in current materials. UK regulation typically imposes specific leverage limits for retail clients.

Platform Options: The company operates an official trading platform. Detailed specifications about platform features, compatibility, and third-party integrations are not clearly outlined.

Geographic Restrictions: Service availability in different regions and any geographic limitations are not explicitly stated in available information.

Customer Support Languages: The range of languages supported by customer service teams is not specified in current documentation.

Account Conditions Analysis

The assessment of JKE's account conditions faces big limitations due to insufficient publicly available information. Traditional account evaluation criteria including account types, minimum deposit requirements, and special features cannot be properly analyzed based on current documentation. This lack of transparency represents a notable concern for potential clients seeking to understand their options before committing to the platform.

Account opening procedures, verification requirements, and approval timeframes are not detailed in available materials. The absence of information about different account tiers, such as basic, premium, or VIP offerings, makes it impossible to assess whether JKE provides scalable solutions for traders with varying experience levels and capital requirements.

Special account features that are standard in the industry are not mentioned in current jke review documentation. These include Islamic accounts for Muslim traders, demo accounts for practice trading, or managed account options. This information gap extends to account-related policies including dormancy fees, maintenance charges, and account closure procedures.

The lack of clear information about account conditions significantly impacts the ability to provide meaningful guidance to prospective clients. Industry best practices typically involve transparent disclosure of all account-related terms and conditions, making this information deficit particularly notable in the competitive forex brokerage landscape.

Evaluation of JKE's trading tools and resources is limited by the lack of available information about the broker's platform capabilities and analytical offerings. Standard industry tools such as economic calendars, market analysis, technical indicators, and charting packages are not specifically detailed in current documentation.

Educational resources, which are crucial for trader development, are not mentioned in available materials. The absence of information about webinars, tutorials, market commentary, or educational articles suggests either limited educational support or insufficient public disclosure of available resources.

Research and analysis capabilities cannot be assessed based on current information. These include fundamental and technical analysis tools, real-time market data, and expert commentary. These resources are typically essential for informed trading decisions and represent standard offerings among competitive forex brokers.

Automated trading support is not addressed in available documentation. This includes Expert Advisor compatibility, algorithmic trading options, and API access for institutional clients. The lack of information about these advanced trading features may limit the platform's appeal to sophisticated traders and institutional clients.

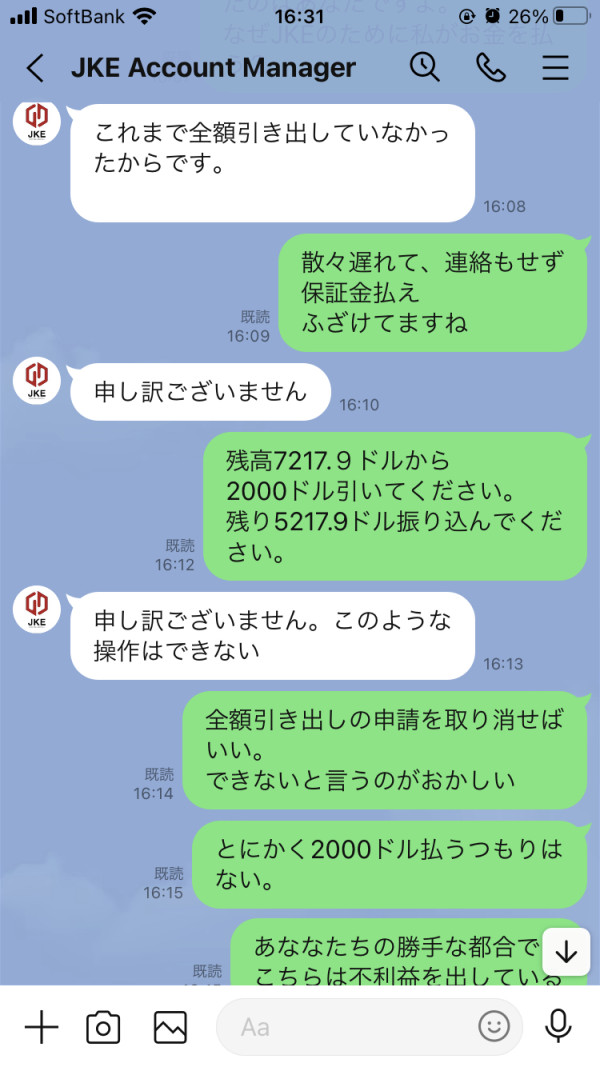

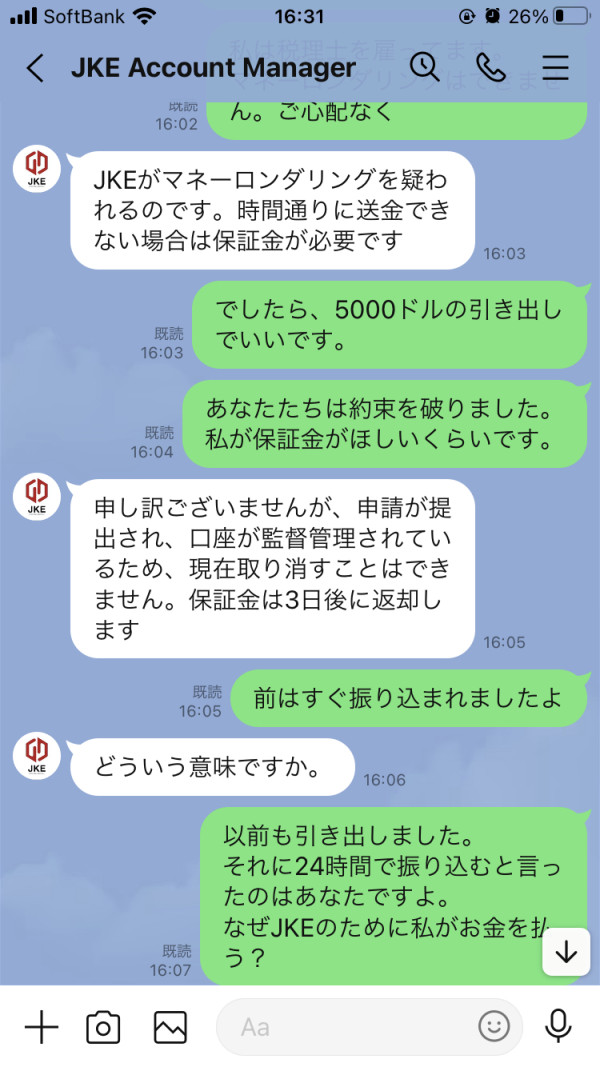

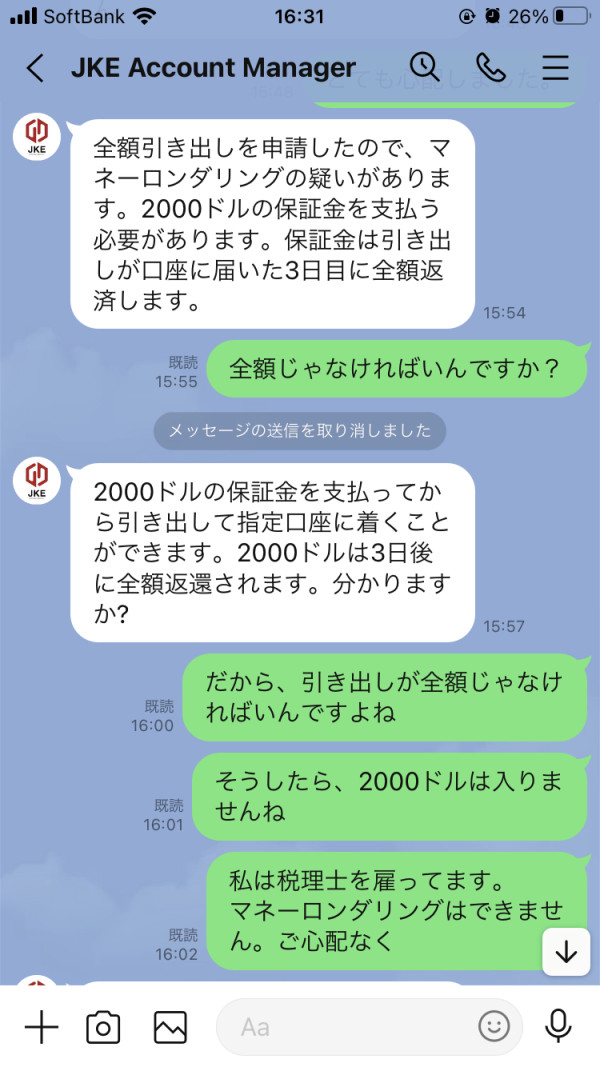

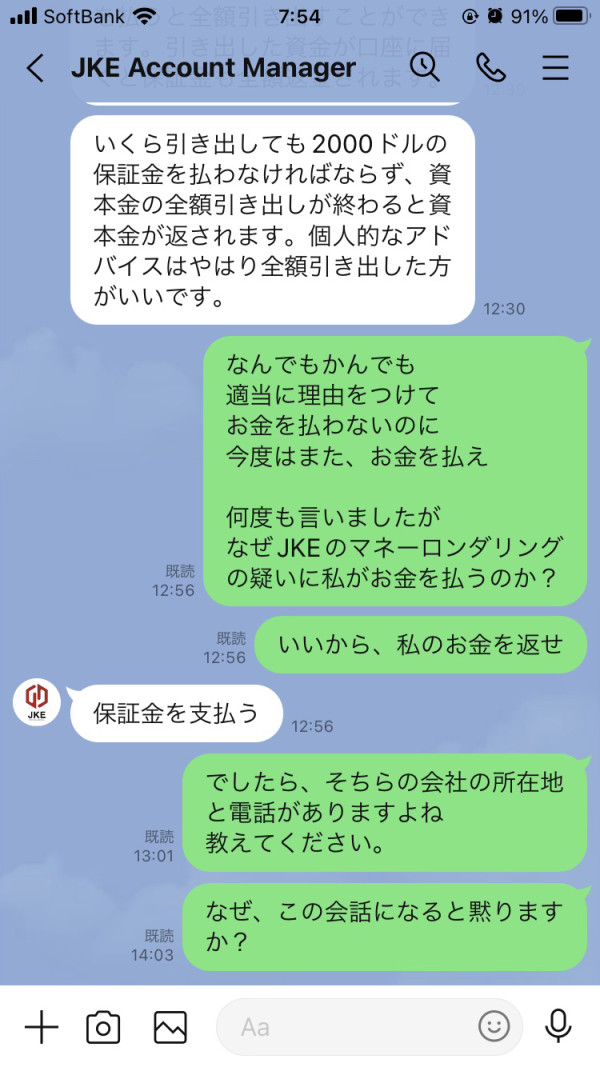

Customer Service and Support Analysis

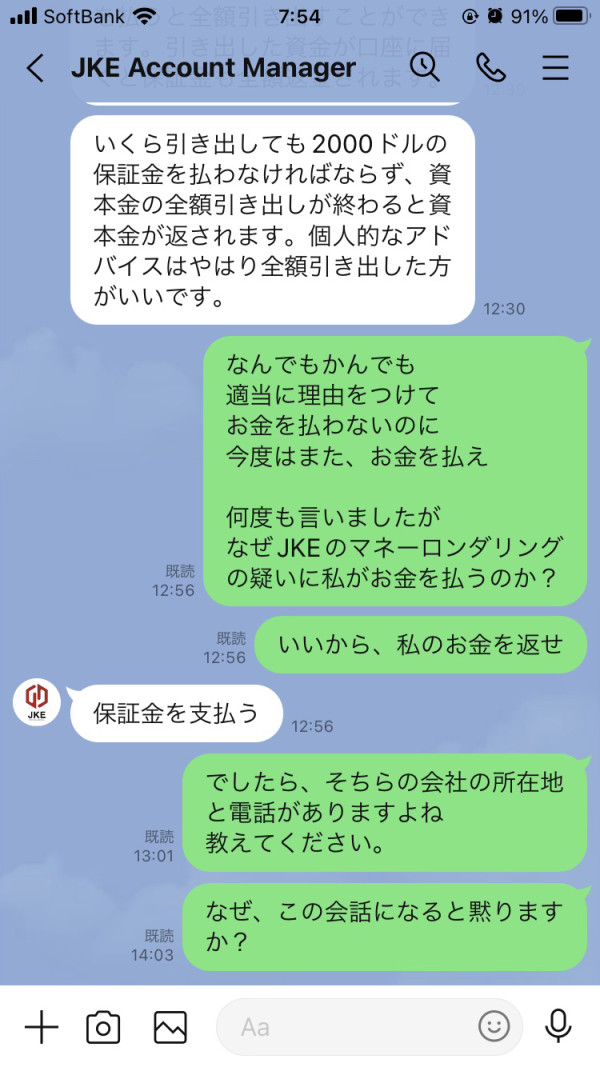

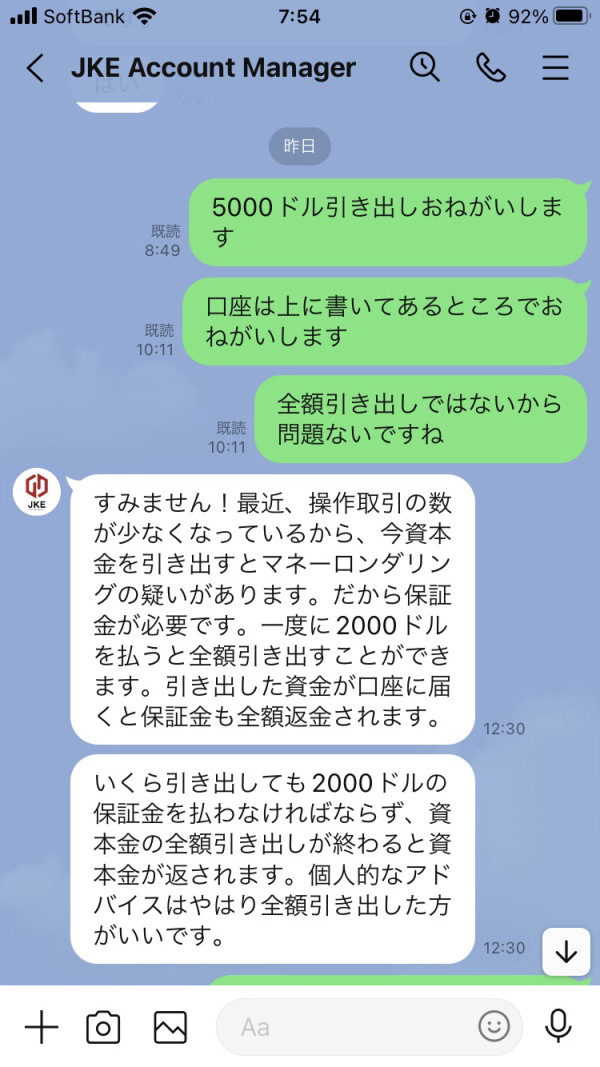

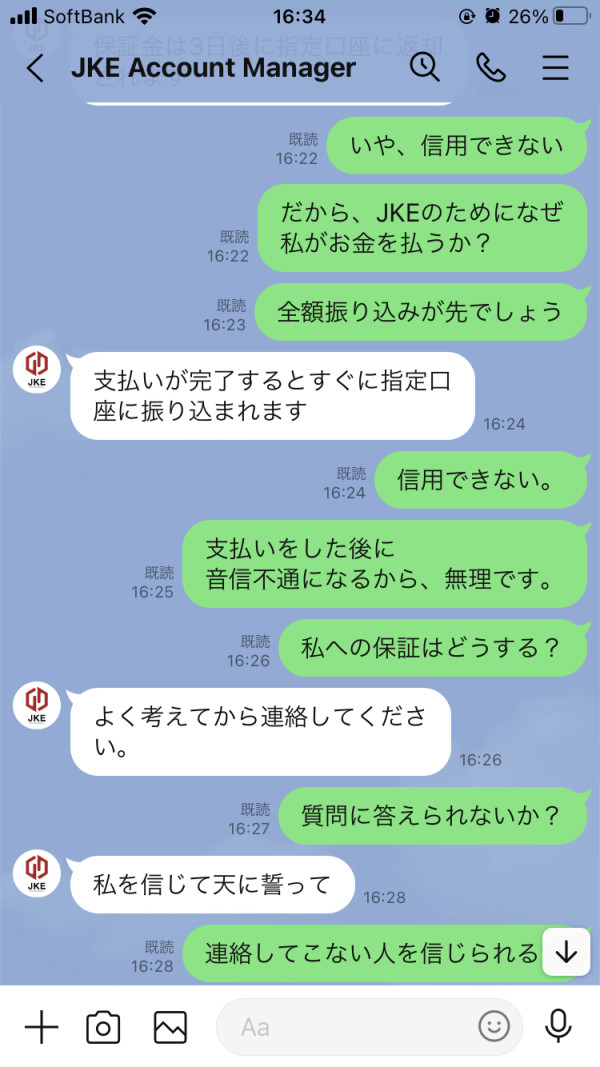

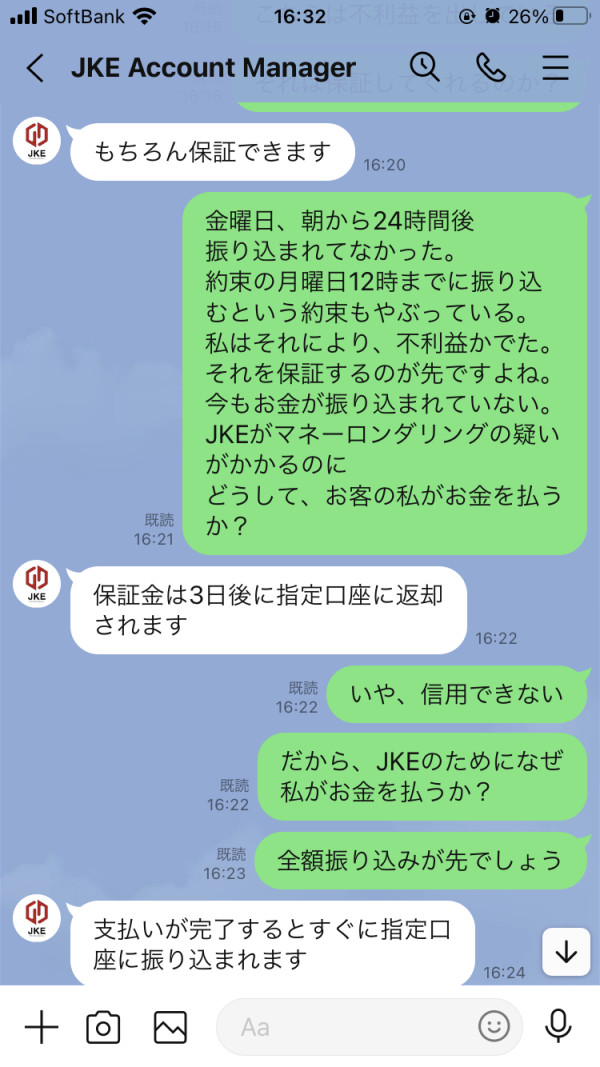

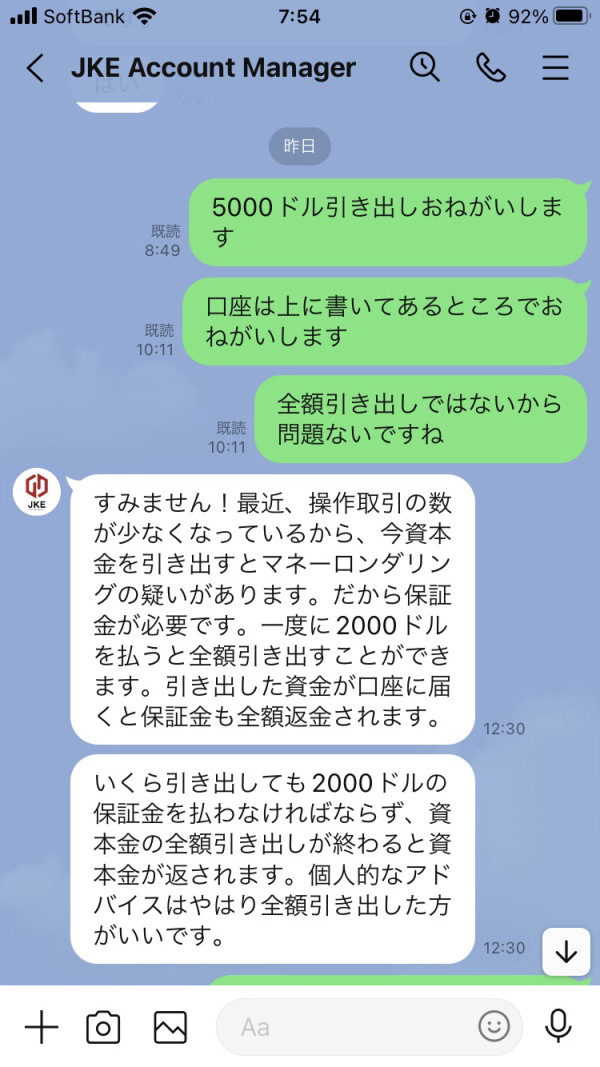

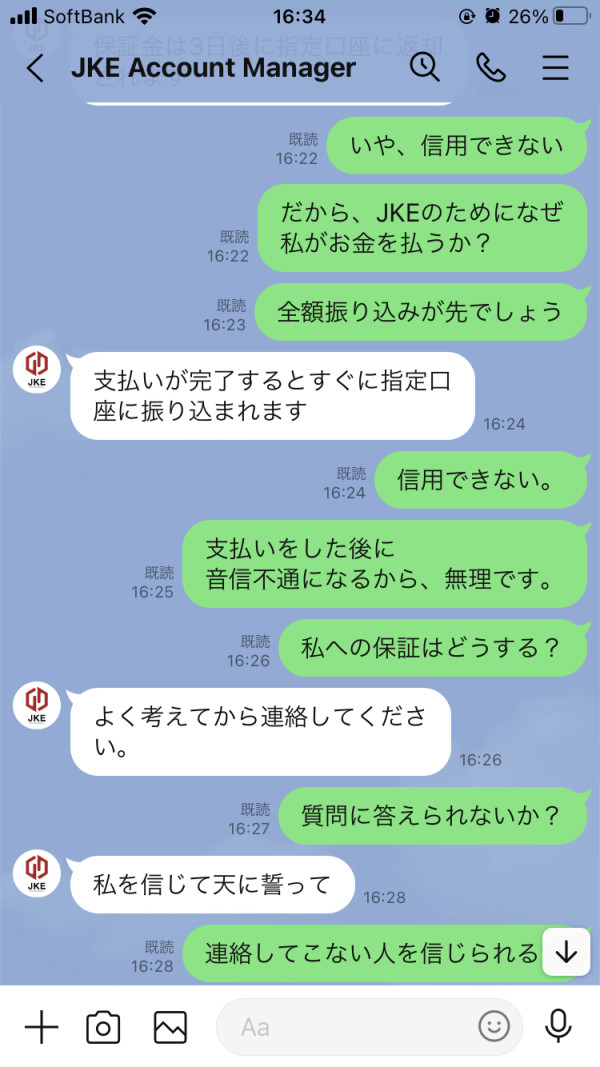

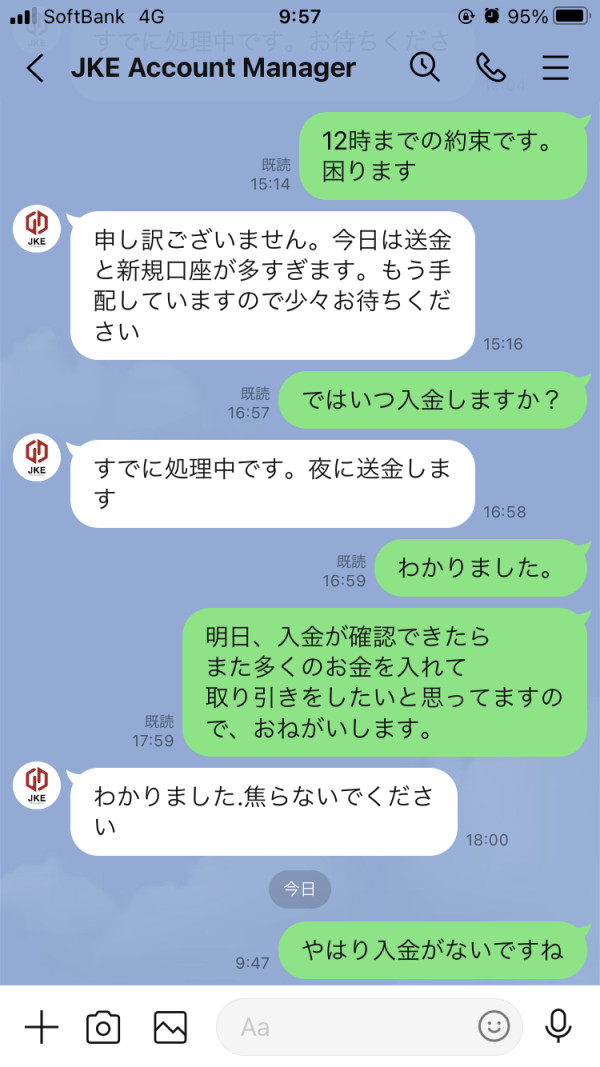

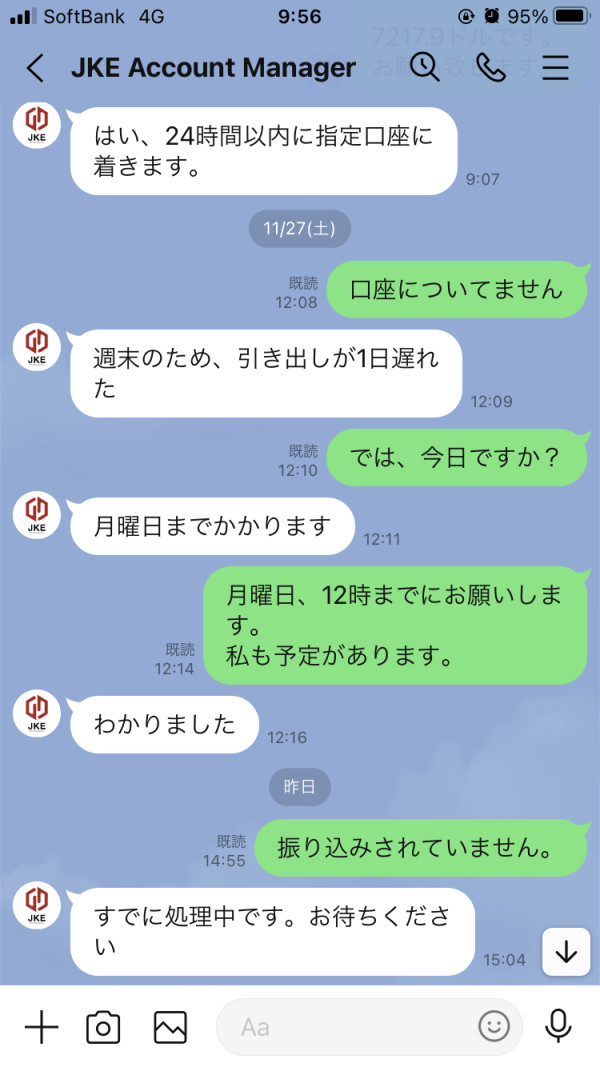

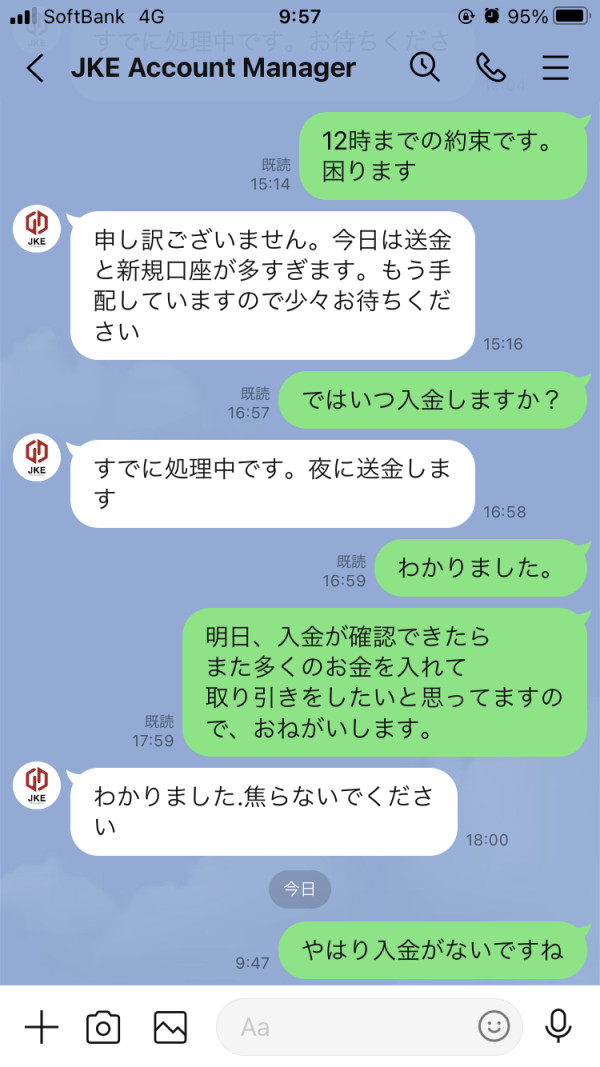

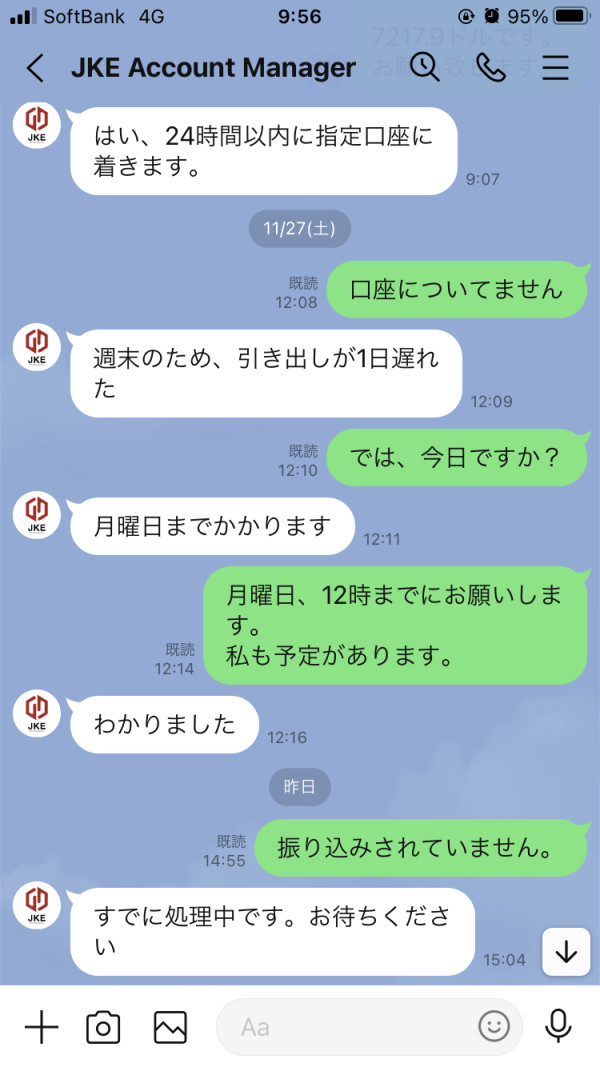

Customer service evaluation for JKE reveals concerning patterns based on available user feedback. Reports show generally unfavorable experiences with customer support, particularly regarding service quality and responsiveness. These negative assessments represent a significant concern for potential clients who may require assistance with account management, technical issues, or trading-related inquiries.

The specific channels available for customer support are not clearly outlined in current documentation. These include phone, email, live chat, or ticket systems. Response time expectations, support availability hours, and escalation procedures remain unclear based on available information.

Multilingual support capabilities, which are essential for serving international clients, are not specified in current materials. The absence of clear information about language support may limit accessibility for non-English speaking traders seeking to use JKE's services.

Problem resolution effectiveness and customer satisfaction metrics are not available for analysis. User feedback suggests challenges in these areas. The lack of transparent customer service policies and procedures represents an area requiring attention for potential service improvements.

Trading Experience Analysis

Assessment of the trading experience at JKE is limited by the absence of detailed user feedback and platform specifications. Critical factors such as order execution speed, platform stability, and trading environment quality cannot be properly evaluated based on current jke review materials.

Platform functionality requires further investigation through direct platform testing or detailed broker disclosure. This includes order types, risk management tools, and trading interface design. The absence of information about slippage rates, execution statistics, and platform uptime represents significant gaps in trading experience evaluation.

Mobile trading capabilities, which are essential in today's trading environment, are not specifically addressed in available documentation. The quality of mobile applications, feature parity with desktop platforms, and mobile-specific functionality remain unclear.

Trading conditions are not detailed in current materials. These include minimum trade sizes, maximum position limits, and scalping policies. These factors significantly impact the practical trading experience and require clarification for meaningful assessment.

Trust and Regulation Analysis

JKE International Limited's registration in the United Kingdom provides a foundation for regulatory credibility and operational legitimacy. UK registration typically involves compliance with established financial regulations and consumer protection measures, contributing positively to the broker's trust profile.

However, specific details about regulatory authorization levels, license numbers, and compliance history are not clearly documented in available materials. Verification of current regulatory status with relevant authorities would be smart for prospective clients seeking assurance about the broker's legal standing.

Fund security measures are not detailed in current documentation. These include client money segregation, compensation scheme participation, and audit procedures. These factors are crucial for client confidence and represent standard disclosures among reputable brokers.

The company's transparency about ownership structure, financial backing, and corporate governance is limited in available materials. Enhanced disclosure in these areas would strengthen the trust profile and provide greater confidence for potential clients considering JKE's services.

User Experience Analysis

Comprehensive user experience evaluation is limited by the lack of feedback from actual platform users. The overall satisfaction levels, interface usability, and platform navigation efficiency cannot be thoroughly assessed based on current information availability.

Registration and account verification processes are not detailed in available documentation. These significantly impact initial user experience. Streamlined onboarding procedures are essential for positive first impressions and user retention in the competitive forex brokerage market.

Fund management experience requires clarification through direct broker communication. This includes deposit and withdrawal procedures, processing efficiency, and fee transparency. These operational aspects significantly influence overall user satisfaction and platform usability.

Common user concerns and frequently reported issues are not well-documented in available materials. This limits the ability to identify potential problem areas or service improvement opportunities. Enhanced user feedback collection and public disclosure would benefit both the broker and prospective clients.

Conclusion

This jke review reveals a forex broker with basic regulatory legitimacy through its UK registration, but significant information gaps that limit comprehensive evaluation. JKE International Limited appears to offer forex trading services within a regulated framework, which provides basic credibility for potential clients seeking regulated brokerage options.

The broker appears most suitable for traders who prioritize regulatory compliance and are willing to do extensive research to obtain detailed trading conditions and service specifications. However, the limited transparency about trading terms, costs, and platform features may discourage traders seeking comprehensive information before making commitments.

Primary advantages include the regulatory foundation provided by UK registration and multi-sector business experience. Key disadvantages include limited transparency about trading conditions, insufficient user feedback for service quality assessment, and reported customer service challenges. Prospective clients should prioritize direct communication with the broker to obtain current terms and conditions before making trading decisions.