Is JKE safe?

Pros

Cons

Is JKE Safe or Scam?

Introduction

JKE International Limited is an online forex broker that has garnered attention in the trading community, particularly among new investors. Operating primarily in the forex market, JKE offers various financial instruments including currency pairs, indices, and precious metals. However, the increasing number of scams in the forex industry necessitates that traders exercise caution when selecting a broker. This article aims to provide a comprehensive assessment of JKE's legitimacy, focusing on its regulatory status, company background, trading conditions, customer experiences, and overall safety. The analysis is based on data gathered from multiple credible sources, including user reviews and industry reports.

Regulation and Legitimacy

Regulation plays a crucial role in determining the safety and reliability of a forex broker. A regulated broker is held to specific standards that protect traders, such as maintaining client funds in segregated accounts and adhering to fair trading practices. Unfortunately, JKE is not a regulated broker, as confirmed by various investigations, including those from WikiFX. Below is a summary of JKE's regulatory status:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| NFA | 0542020 | United States | Unauthorized |

The lack of valid regulation raises significant concerns regarding JKE's legitimacy. Despite claiming to be regulated by the National Futures Association (NFA), it has been listed as unauthorized, indicating that it does not comply with the necessary legal requirements. This absence of regulation poses a high risk for potential investors, as it leaves them vulnerable to potential fraud and malpractice.

Company Background Investigation

JKE International Limited was established with the intention of providing a diverse range of trading options for investors. However, the specifics regarding its history and ownership structure remain vague. The company claims to be registered in the United Kingdom, but there is a lack of transparency regarding its operational history and the qualifications of its management team.

The absence of detailed information about the company's background raises questions about its credibility. A reliable broker should provide clear information about its founders, management team, and operational milestones. Unfortunately, JKE does not meet this standard, leading to concerns about its commitment to transparency and ethical business practices.

Trading Conditions Analysis

When evaluating the trading conditions offered by a broker, it is essential to consider the overall fee structure and any unusual policies that may affect profitability. JKE has a minimum deposit requirement of $500 and offers leverage up to 1:200. However, the specifics regarding spreads and commissions are not clearly defined, which can be problematic for traders seeking transparency.

The following table summarizes JKE's core trading costs:

| Fee Type | JKE | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Not specified | 1-2 pips |

| Commission Model | None for forex trades | Varies |

| Overnight Interest Range | Not disclosed | Varies |

The lack of clarity surrounding spreads and overnight interest rates is concerning. Traders may encounter unexpected costs that could significantly impact their trading performance. Furthermore, the absence of a commission model for forex transactions raises questions about how JKE generates revenue, which is often a red flag in the industry.

Customer Fund Safety

The safety of customer funds is paramount when considering a forex broker. JKE claims to implement measures to protect client funds, but the lack of regulatory oversight diminishes the effectiveness of these measures. The absence of segregated accounts and investor protection schemes means that traders are at risk of losing their funds in case of insolvency or mismanagement.

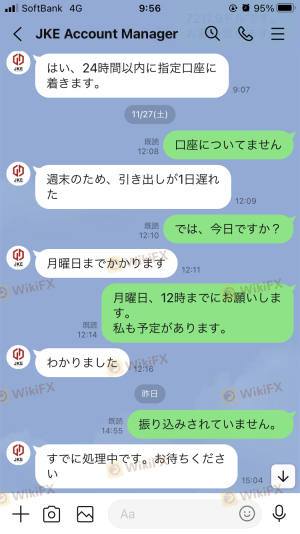

Historically, there have been complaints from users regarding difficulties in withdrawing funds, which exacerbates concerns about JKE's reliability. Reports indicate that some traders have faced significant challenges when attempting to access their capital, raising alarms about the broker's commitment to safeguarding client assets.

Customer Experience and Complaints

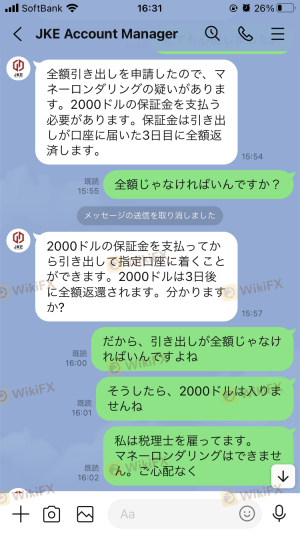

Customer feedback is a vital aspect of evaluating a broker's reputation. Many users have reported negative experiences with JKE, particularly concerning withdrawal issues. Common complaints include delays in processing withdrawals and requests for additional payments to release funds. Below is a summary of the primary complaint types:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal difficulties | High | Poor |

| Delayed fund processing | High | Poor |

One notable case involved a trader who was unable to withdraw $7,000 without being asked to pay an additional $2,000. This situation illustrates the potential risks associated with trading with JKE and raises questions about the broker's integrity and customer service.

Platform and Trade Execution

The trading platform offered by JKE is the widely used MetaTrader 4 (MT4), known for its user-friendly interface and advanced analytical tools. However, the performance and stability of the platform are crucial for ensuring a positive trading experience. Users have reported issues with order execution, including slippage and rejections, which can significantly impact trading outcomes.

Moreover, there are concerns about potential platform manipulation, which can further erode trust in the broker. A reliable broker should provide a transparent and efficient trading environment, but the reported issues with JKE raise doubts about its operational integrity.

Risk Assessment

Using JKE as a forex broker presents several risks that traders should be aware of. The lack of regulation, combined with numerous negative customer experiences, creates a high-risk environment for potential investors. The following risk assessment summarizes the key risk areas associated with JKE:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | High | No valid regulation |

| Fund Security | High | Reports of withdrawal issues |

| Customer Service Reliability | High | Poor response to complaints |

To mitigate these risks, potential traders should consider conducting thorough research before engaging with JKE. It may also be prudent to explore alternative brokers with established regulatory frameworks and positive customer feedback.

Conclusion and Recommendations

In conclusion, the evidence suggests that JKE International Limited poses significant risks for potential investors. The lack of regulation, coupled with numerous complaints regarding fund withdrawals and customer service, raises serious concerns about its legitimacy. Is JKE safe? Based on the information available, it is advisable for traders to approach this broker with caution.

For those seeking a more reliable trading experience, it may be beneficial to consider alternative brokers that are well-regulated and have a positive reputation in the trading community. Options such as brokers with established regulatory oversight and positive customer feedback can provide a safer trading environment. Ultimately, traders should prioritize their safety and do thorough due diligence before making any investment decisions.

Is JKE a scam, or is it legit?

The latest exposure and evaluation content of JKE brokers.

JKE Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

JKE latest industry rating score is 1.49, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.49 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.