Driss IFC 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive driss ifc review looks at a forex broker that has caused major concerns in the trading community. Driss IFC shows itself as a multi-asset trading platform that offers forex, cryptocurrency, and stock trading services. However, our analysis shows big red flags that potential investors should think about carefully.

Scamdoc data shows that Driss IFC has a troubling user trust score of only 25%. This indicates widespread doubt among the trading community. Multiple negative reviews across platforms like WikiFX and TraderKnows create a concerning picture of this broker's operations.

The company started in 2024 and claims its headquarters are in the United States. It lacks clear regulatory information and has received many user complaints about withdrawal issues and poor customer service. The broker mainly targets investors who want multi-asset trading opportunities, especially in forex, cryptocurrencies, and stocks.

However, the lack of clear regulatory oversight and the high number of negative user reviews suggest that traders should be extremely careful when considering this platform. Our investigation shows significant gaps in transparency, customer protection measures, and operational reliability that make Driss IFC unsuitable for serious investors who prioritize safety and regulatory compliance.

Important Notice

Regional Entity Variations: Driss IFC's lack of clear regulatory information creates major uncertainty about legal protections available to users across different areas. The absence of transparent licensing and oversight means that traders in various regions may face different levels of risk and legal options, with potentially limited protection in case of disputes or operational issues.

Review Methodology: This evaluation is based on comprehensive analysis of user feedback from multiple respected forex industry platforms, including WikiFX, TraderKnows, and Scamdoc. Our assessment uses publicly available information, user testimonials, and industry standard evaluation criteria to provide an objective analysis of Driss IFC's services and reliability.

Rating Framework

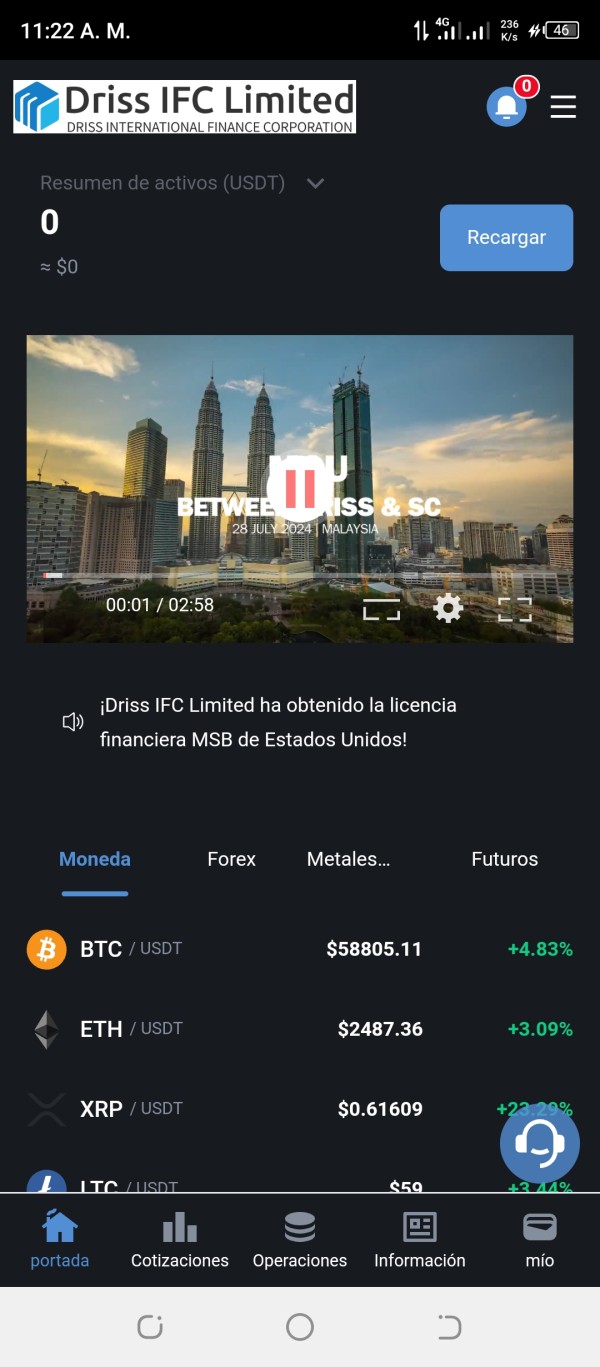

Broker Overview

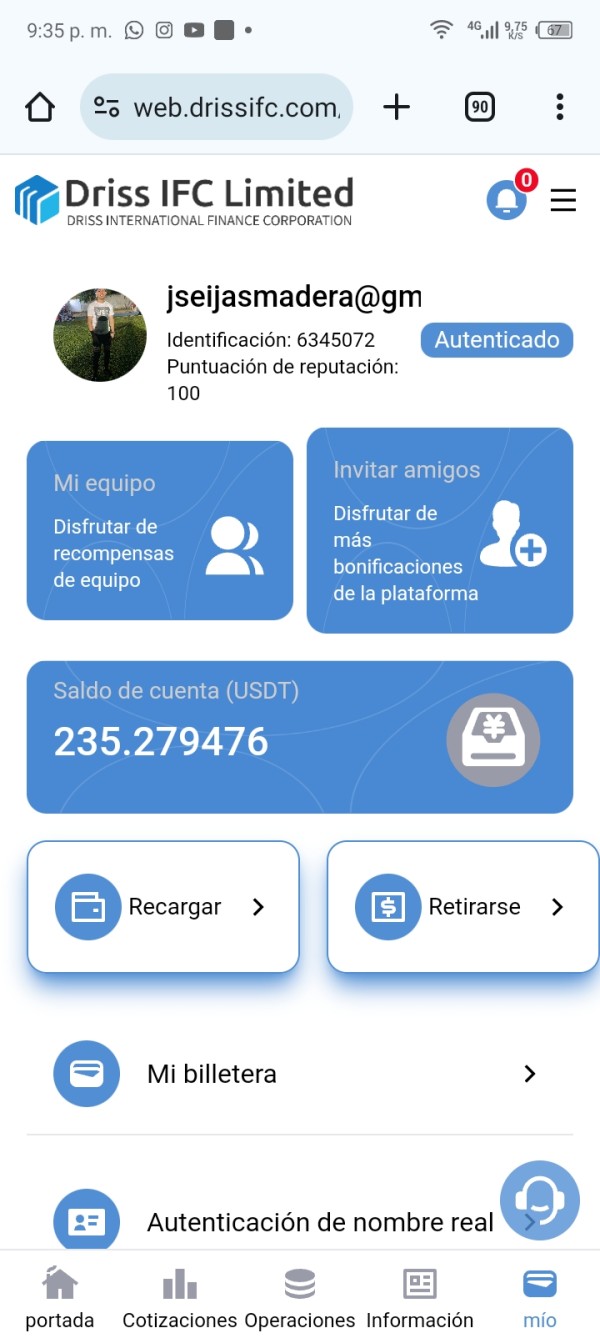

Driss IFC Limited appeared in 2024 as a trading platform based in the United States. The company positions itself as a comprehensive financial services provider. According to available information, Driss IFC markets itself as an emerging investment broker that promises high returns and a wide range of financial services to attract potential clients.

The broker's business model centers around providing multi-asset trading opportunities, including forex pairs, cryptocurrency trading, and stock market access. However, what sets Driss IFC apart from legitimate brokers is the concerning lack of transparent regulatory information and the absence of clear licensing details that would typically provide trader protection and operational oversight.

The platform's operational approach appears to focus on attracting traders with promises of diverse investment opportunities across multiple asset classes. Unfortunately, this driss ifc review reveals that the company's actual service delivery falls significantly short of industry standards, with numerous reports of operational issues, poor customer service, and withdrawal problems that have damaged its reputation among the trading community.

Regulatory Status: Available information indicates that Driss IFC lacks clear regulatory oversight from recognized financial authorities. No specific regulatory licenses or compliance certifications have been identified in our research, raising significant concerns about trader protection and operational legitimacy.

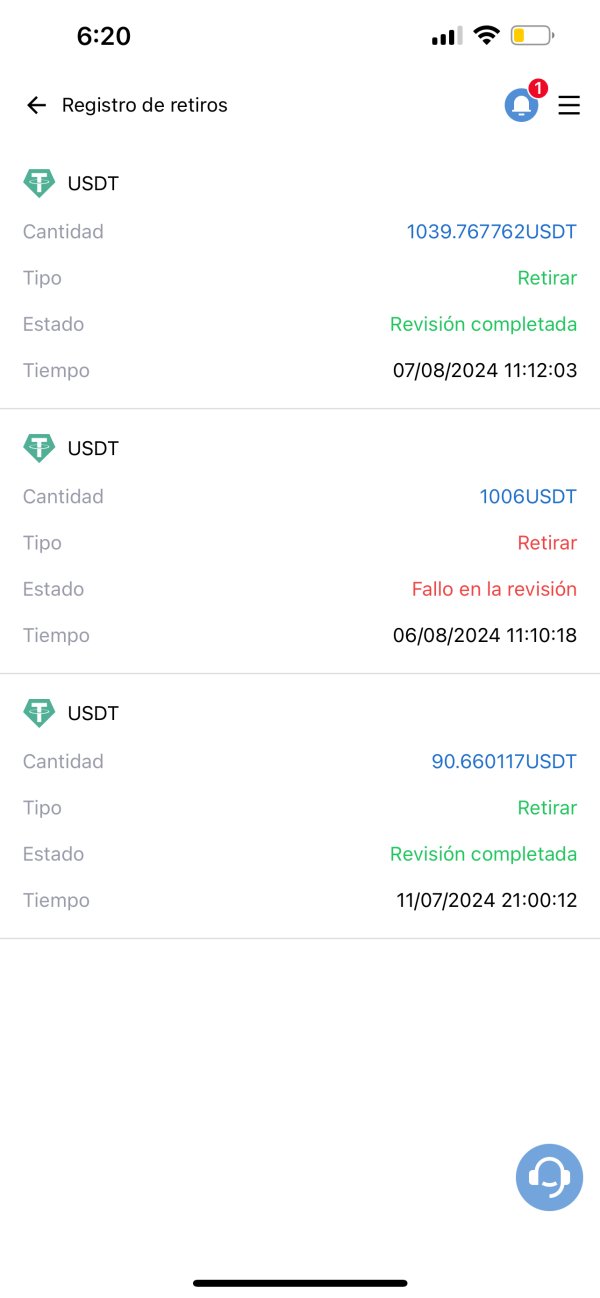

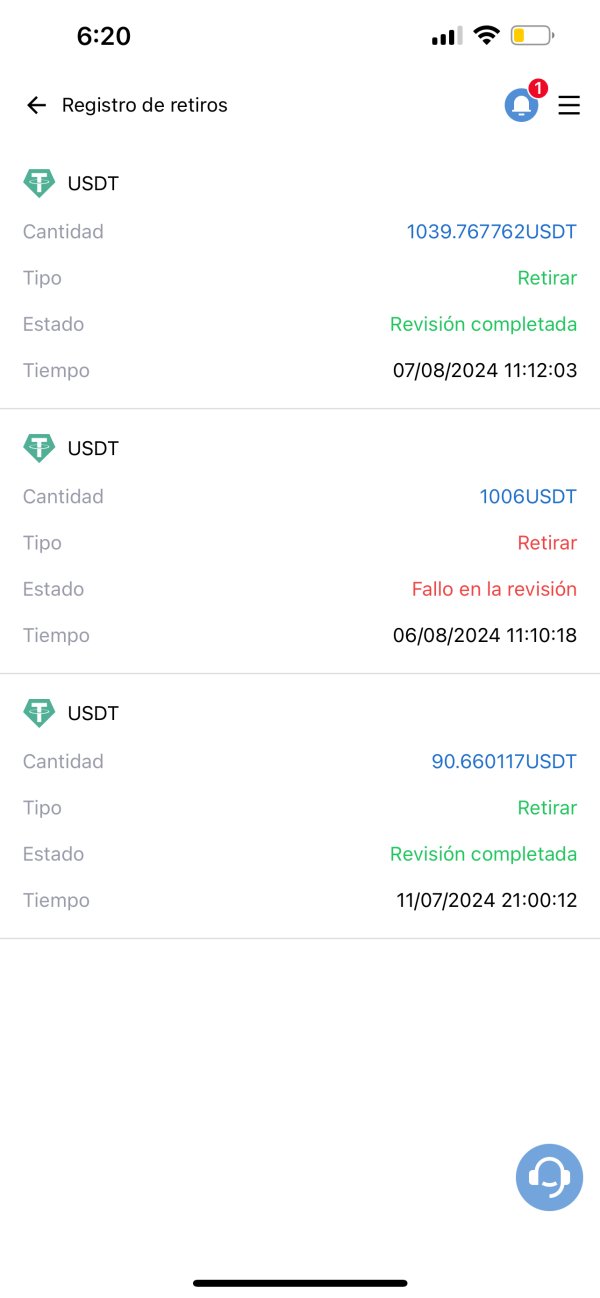

Deposit and Withdrawal Methods: Specific information regarding deposit and withdrawal options is not detailed in available sources. However, user reports suggest significant issues with withdrawal processing, with multiple complaints about funds not reaching client accounts as promised.

Minimum Deposit Requirements: The exact minimum deposit amount required to open an account with Driss IFC is not specified in available documentation. This indicates a lack of transparency in their account opening procedures.

Promotional Offers: No specific bonus programs or promotional activities have been identified in our research. This suggests limited marketing incentives compared to established brokers in the industry.

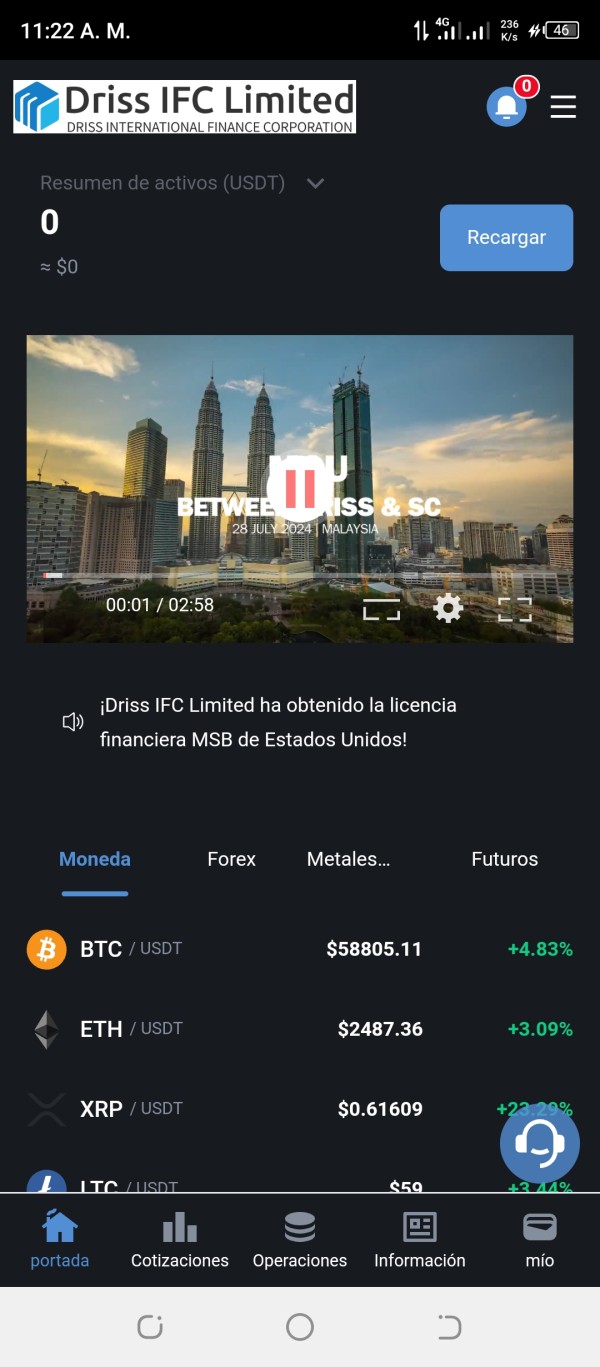

Available Trading Assets: Driss IFC offers trading in forex currencies, cryptocurrencies, and stock markets. The broker promotes access to multiple asset classes as a key selling point, though specific details about available instruments remain limited.

Cost Structure: Detailed information about spreads, commissions, and trading fees is not readily available in public sources. This creates uncertainty about the true cost of trading with this platform and makes it difficult for potential clients to assess competitiveness.

Leverage Options: Specific leverage ratios offered by Driss IFC are not mentioned in available materials. This is concerning given that leverage information is typically prominently displayed by legitimate brokers.

Trading Platforms: The specific trading platform or software used by Driss IFC is not clearly identified in available sources. This raises questions about the technological infrastructure supporting their trading services.

Geographic Restrictions: Information regarding countries or regions where Driss IFC services are restricted is not available in current documentation.

Customer Support Languages: Available customer service languages are not specified in accessible materials. However, this driss ifc review suggests limited multilingual support capabilities.

Detailed Rating Analysis

Account Conditions Analysis (Score: 3/10)

Driss IFC's account conditions present significant transparency issues that concern potential traders. The broker fails to provide comprehensive information about available account types, creating uncertainty for investors trying to understand their options. Unlike established brokers who typically offer detailed account specifications including standard, premium, and VIP tiers, Driss IFC's lack of clear account structure raises immediate red flags.

The minimum deposit requirements remain unspecified in available documentation. This is highly unusual for legitimate forex brokers who typically prominently display this crucial information. This lack of transparency makes it impossible for potential clients to properly budget for account opening or compare Driss IFC's requirements with industry standards.

Account opening procedures and verification processes are not clearly outlined. This suggests potential complications for new clients attempting to establish trading accounts. Legitimate brokers typically provide step-by-step guidance through Know Your Customer (KYC) procedures and document verification requirements.

Special account features such as Islamic accounts, demo accounts, or professional trader accounts are not mentioned in available materials. This absence of specialized account options limits the broker's appeal to diverse trading communities and suggests a basic service offering that may not meet sophisticated trader requirements.

The overall account conditions framework appears underdeveloped compared to industry standards. This contributes to the low rating in this driss ifc review category and raises concerns about the broker's commitment to providing comprehensive trading services.

Driss IFC's trading tools and resources offering appears limited based on available information. The broker claims to provide access to multiple asset classes including forex, cryptocurrencies, and stocks, but fails to detail the specific analytical tools and research resources that typically support successful trading decisions.

Market analysis resources, which are considered essential by professional traders, are not prominently featured in Driss IFC's service descriptions. Legitimate brokers typically provide daily market commentary, technical analysis, economic calendars, and research reports to help clients make informed trading decisions. The absence of clear information about these resources suggests a significant gap in service provision.

Educational materials and training resources are not mentioned in available documentation. This is concerning given that reputable brokers invest heavily in client education through webinars, tutorials, trading guides, and market analysis training. This lack of educational support may leave novice traders without crucial learning resources.

Trading tools such as advanced charting packages, technical indicators, automated trading support, and risk management features are not specifically detailed. Professional traders rely on sophisticated analytical tools to develop and implement trading strategies, and the absence of clear tool specifications raises questions about platform capabilities.

The broker's technology infrastructure and trading platform features remain largely undocumented. This makes it difficult to assess whether Driss IFC can provide the technological foundation necessary for effective trading execution and portfolio management.

Customer Service and Support Analysis (Score: 2/10)

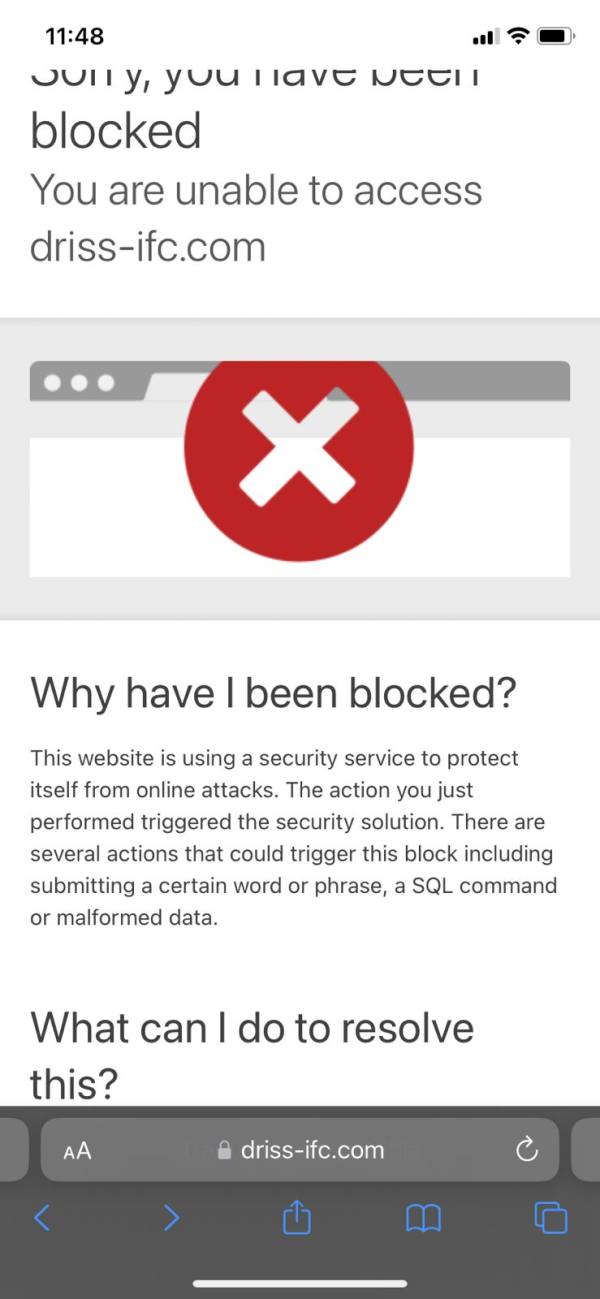

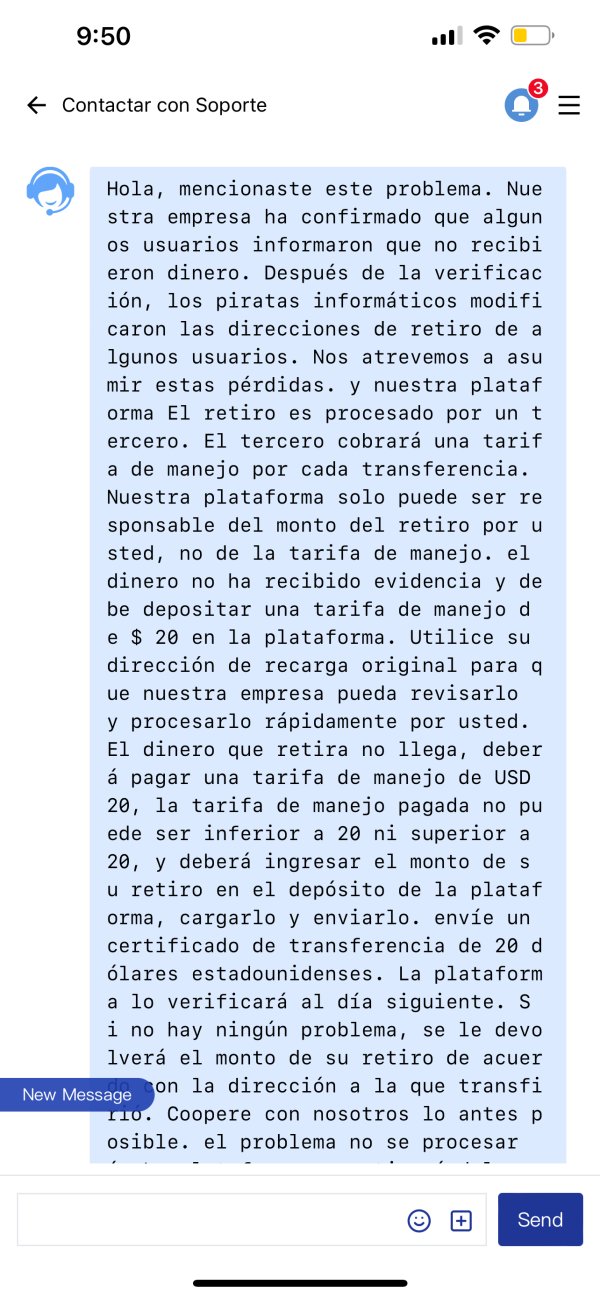

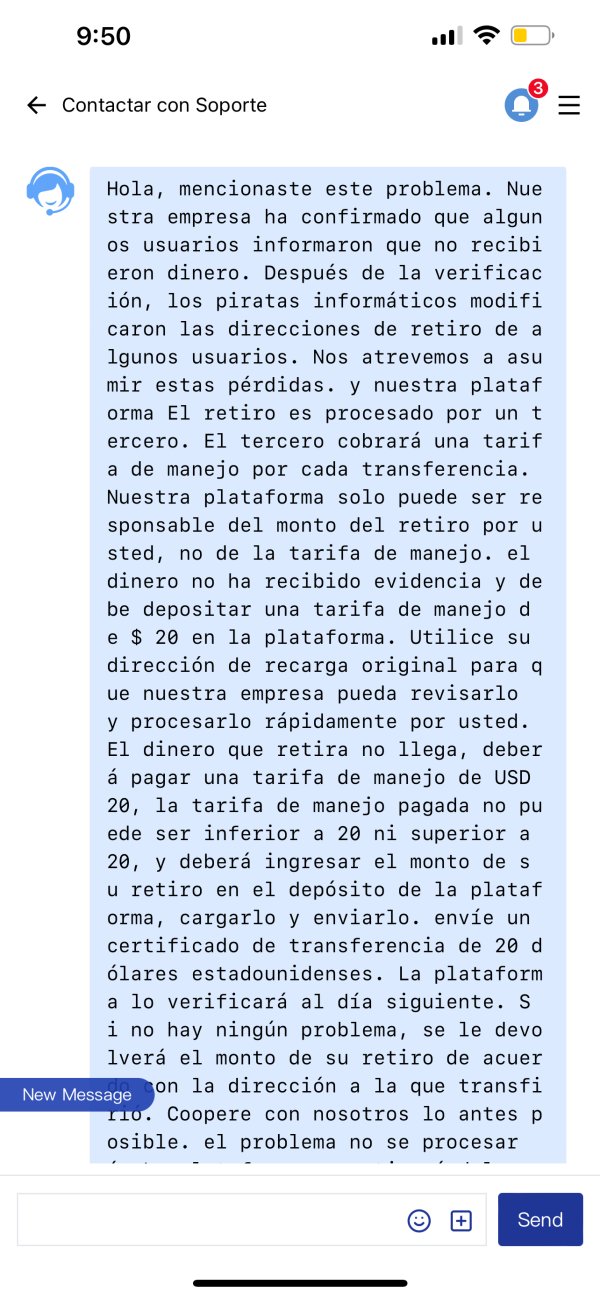

Customer service quality emerges as one of Driss IFC's most significant weaknesses based on user feedback and available reviews. Multiple sources indicate substantial problems with customer support responsiveness, professionalism, and problem resolution capabilities that have frustrated many clients.

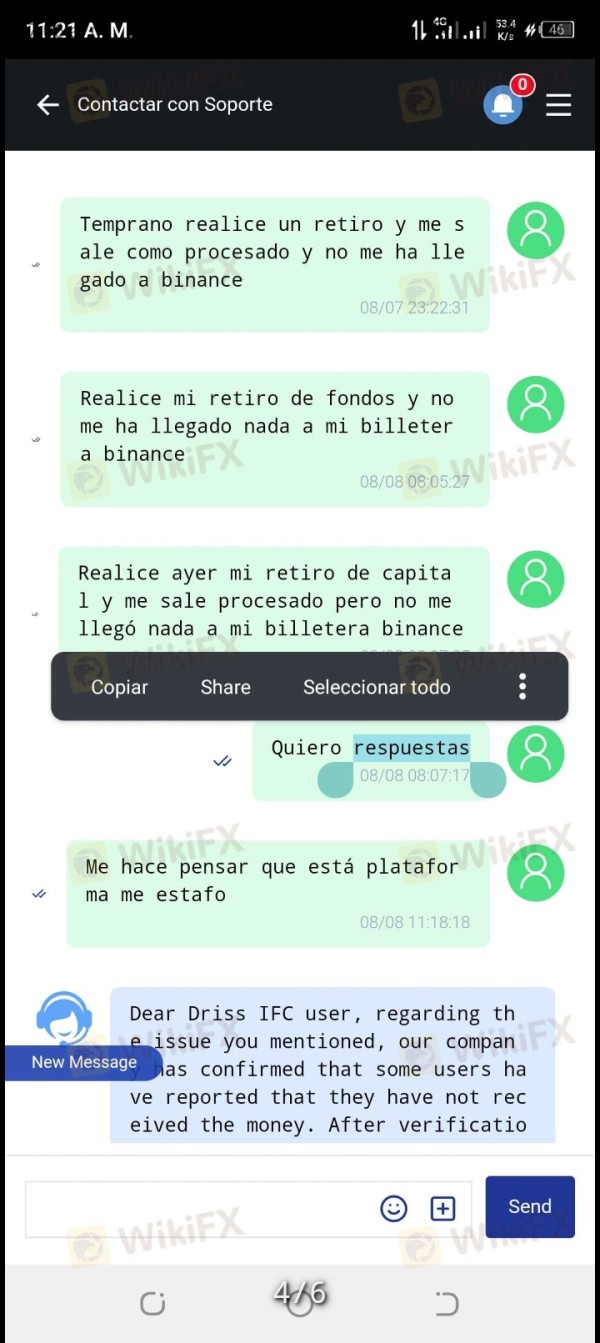

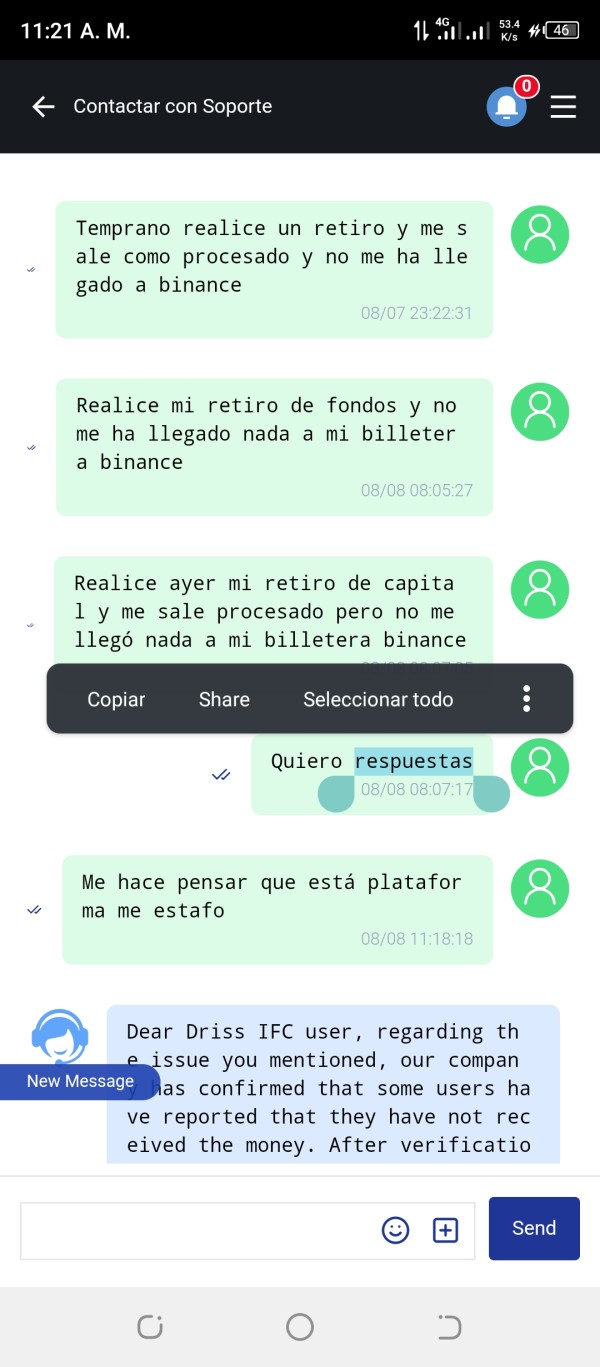

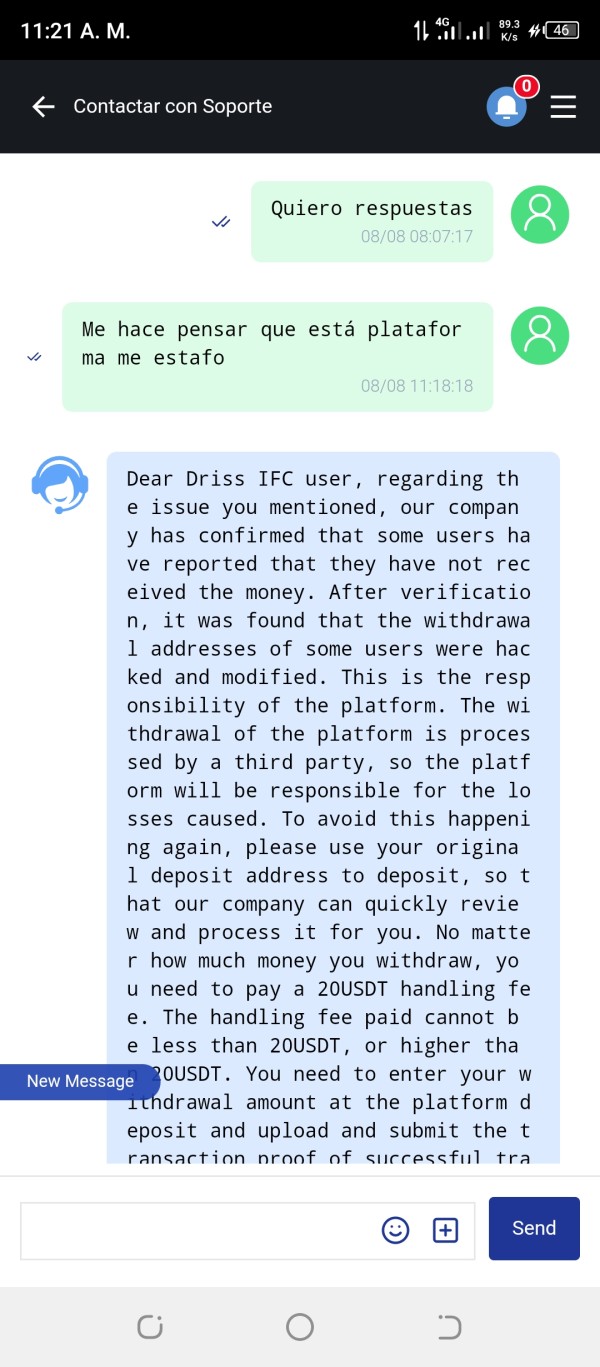

User reports consistently highlight poor communication from support representatives. Many clients experience delayed responses or complete lack of response to urgent inquiries. This communication breakdown becomes particularly problematic when traders face account issues, withdrawal problems, or technical difficulties requiring immediate assistance.

The availability of customer support channels is not clearly documented. This suggests limited options for clients seeking assistance. Professional brokers typically offer multiple contact methods including live chat, phone support, email tickets, and sometimes social media channels to ensure clients can reach support when needed.

Response time performance appears to be a major concern based on user feedback. Reports suggest that client inquiries may go unanswered for extended periods. This level of support inadequacy can be particularly damaging for active traders who require prompt assistance to resolve time-sensitive issues.

Multilingual support capabilities are not specified. This potentially limits assistance for international clients who may not be comfortable communicating in English. The overall customer service experience appears to fall well below industry standards, contributing significantly to the negative perception of Driss IFC among users.

Trading Experience Analysis (Score: 3/10)

The trading experience offered by Driss IFC appears to be significantly compromised by various operational and technical issues reported by users. Platform stability and execution quality are fundamental requirements for any serious trading operation, and available feedback suggests that Driss IFC struggles to meet these basic standards.

Order execution quality has been questioned by users who report difficulties with trade processing and concerns about execution speeds. Reliable order execution is crucial for traders, particularly in volatile market conditions where delays can result in significant financial losses or missed opportunities.

Platform functionality and user interface design information is limited in available sources. This makes it difficult to assess the actual trading environment that clients experience. Professional trading platforms typically offer advanced charting capabilities, real-time market data, multiple order types, and sophisticated risk management tools.

Mobile trading capabilities are not clearly documented. This is concerning given that mobile trading has become essential for modern traders who need to monitor and manage positions while away from desktop computers. The absence of clear mobile platform information suggests potential limitations in trading accessibility.

Market access and instrument availability, while claimed to include forex, cryptocurrencies, and stocks, lack detailed specifications about specific markets, trading hours, or instrument diversity. This lack of transparency makes it difficult for traders to assess whether Driss IFC can meet their specific trading requirements and market access needs.

Trust and Safety Analysis (Score: 2/10)

Trust and safety represent perhaps the most concerning aspects of Driss IFC's operations. Multiple indicators suggest significant risks for potential clients. The broker's 25% trust score from Scamdoc immediately raises red flags about operational reliability and client protection measures.

Regulatory compliance appears to be a major weakness. No clear information is available about licensing from recognized financial authorities. Legitimate forex brokers typically hold licenses from respected regulators such as the FCA, ASIC, CySEC, or other recognized bodies that provide client protection and operational oversight.

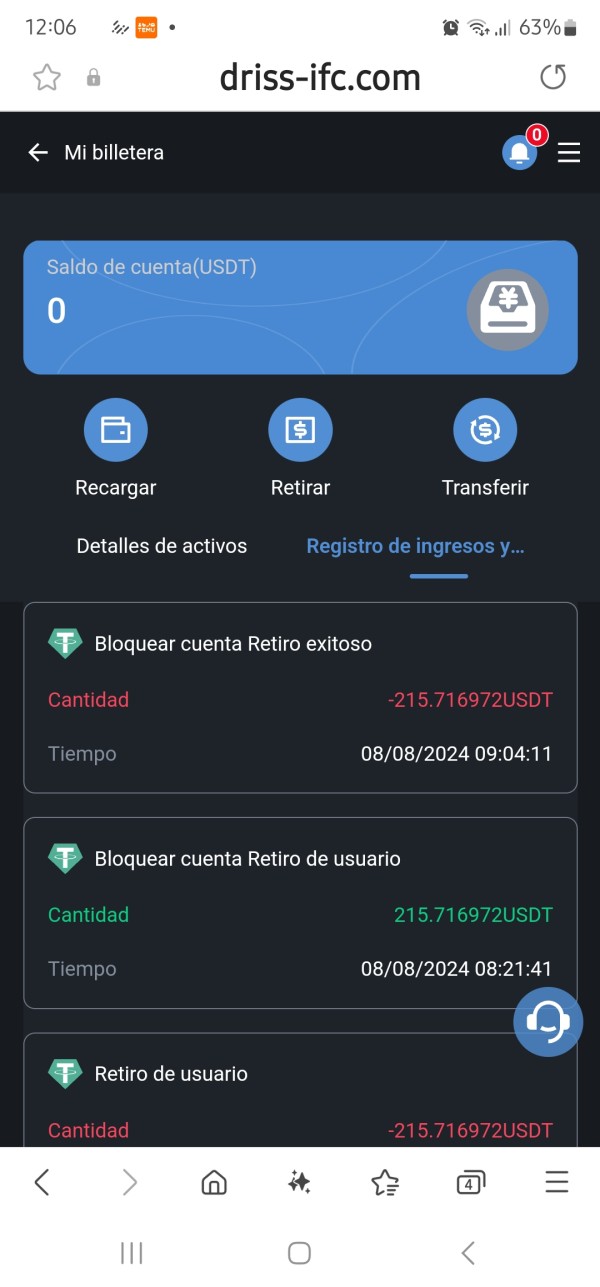

Fund security measures are not transparently documented. This creates uncertainty about how client deposits are protected. Reputable brokers typically maintain segregated client accounts, provide deposit insurance, and implement robust security protocols to protect client funds from operational risks and potential company insolvency.

Company transparency is significantly lacking. Limited information is available about company leadership, financial backing, operational history, or corporate governance structures. This opacity contrasts sharply with legitimate brokers who typically provide comprehensive company information and maintain transparent business operations.

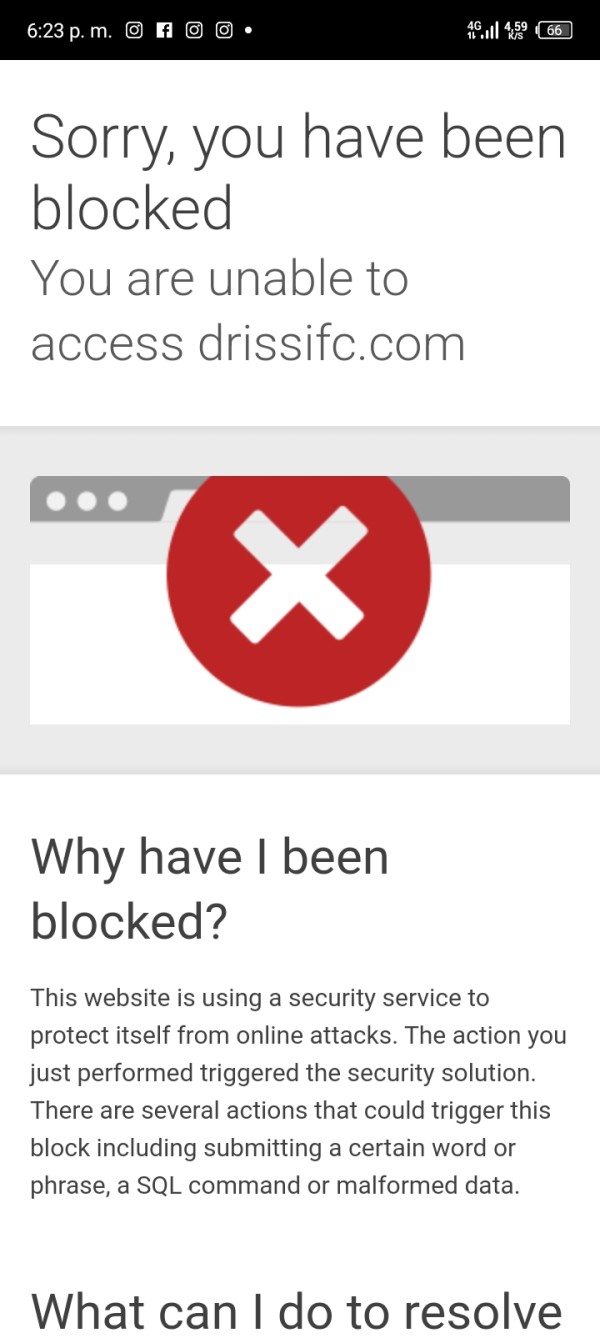

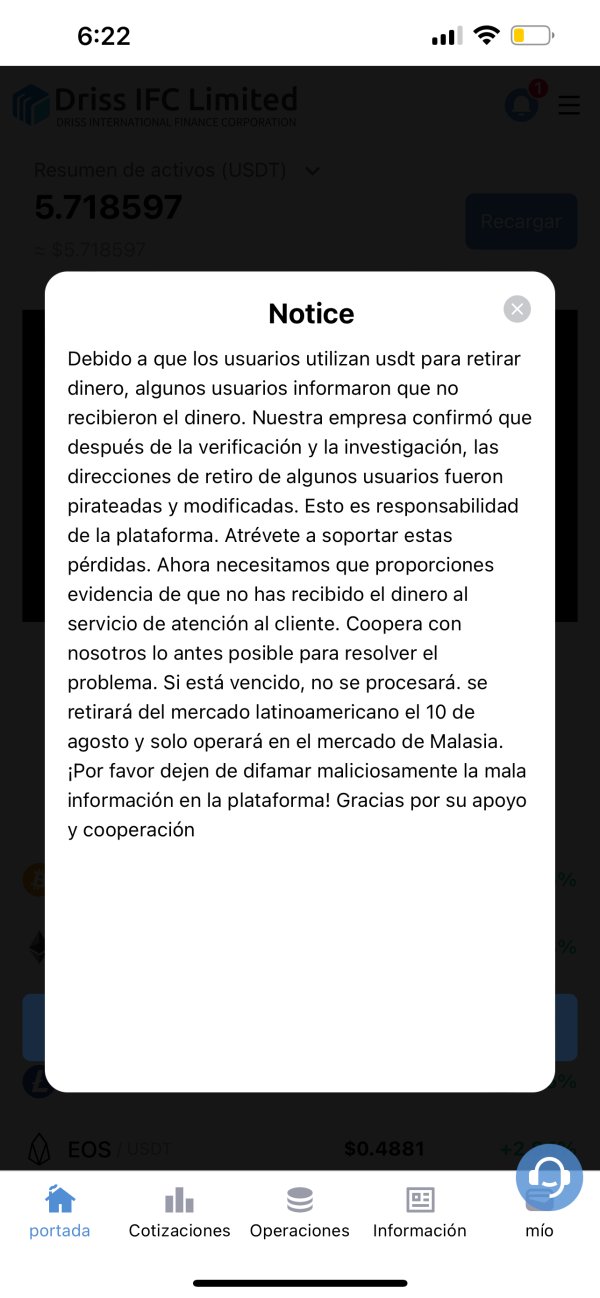

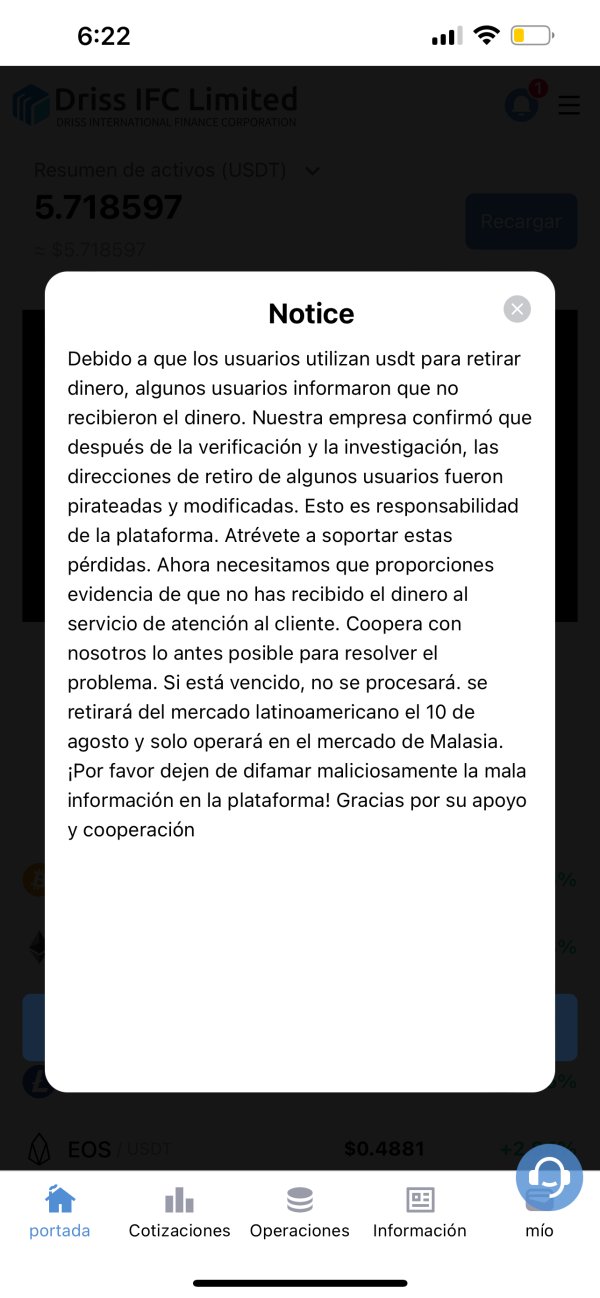

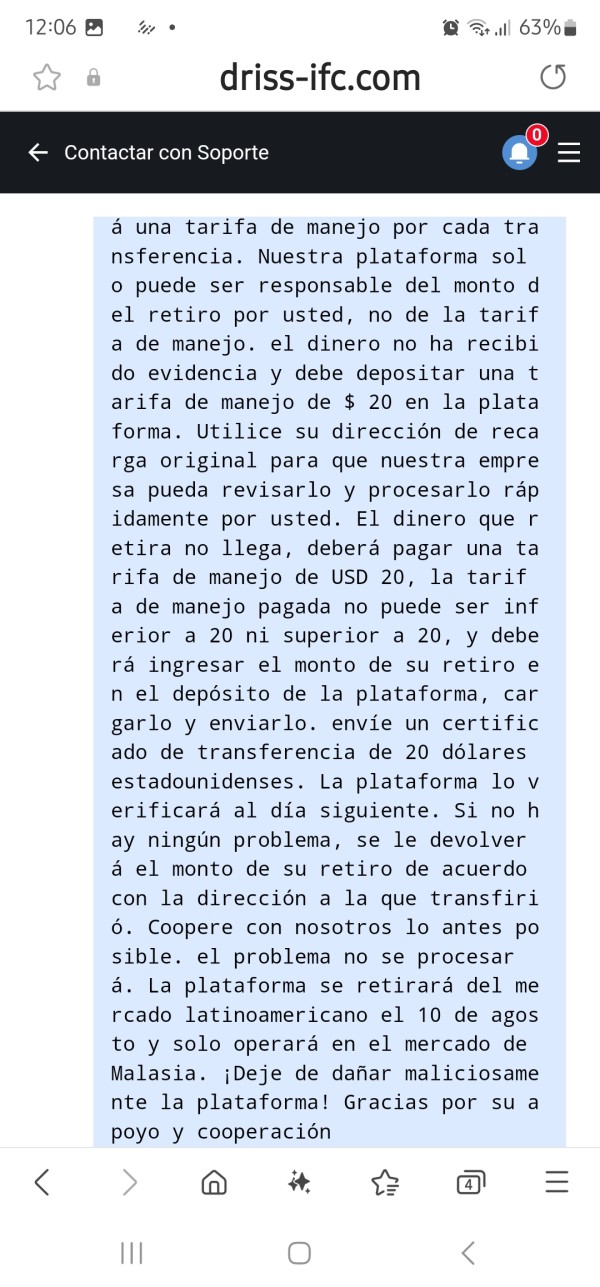

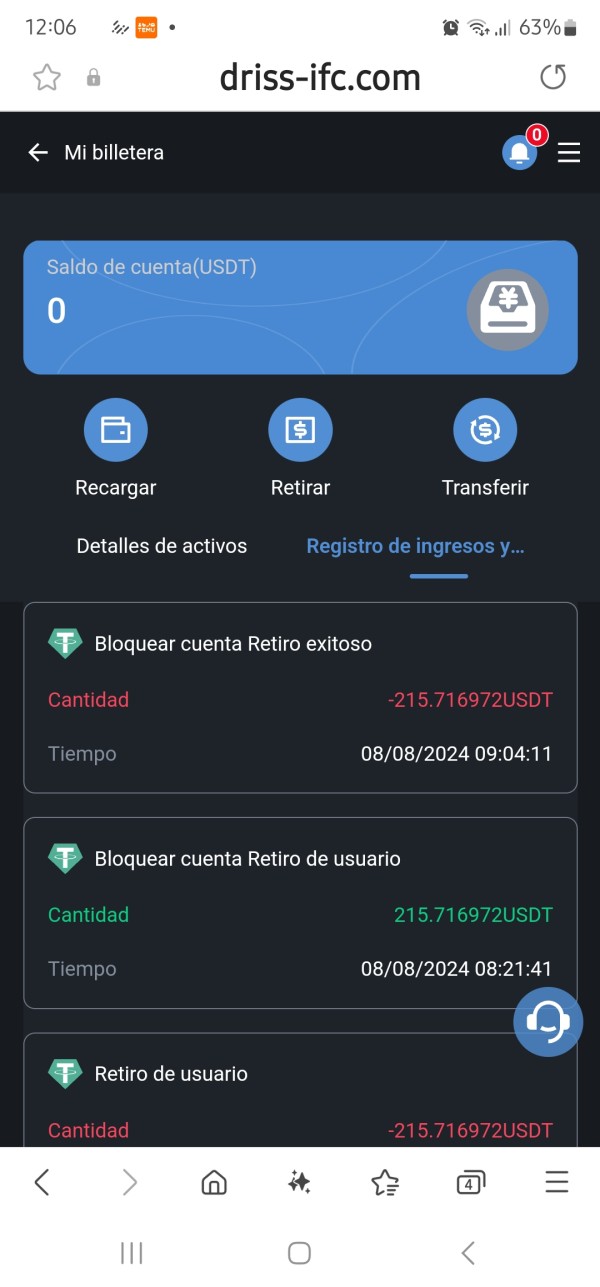

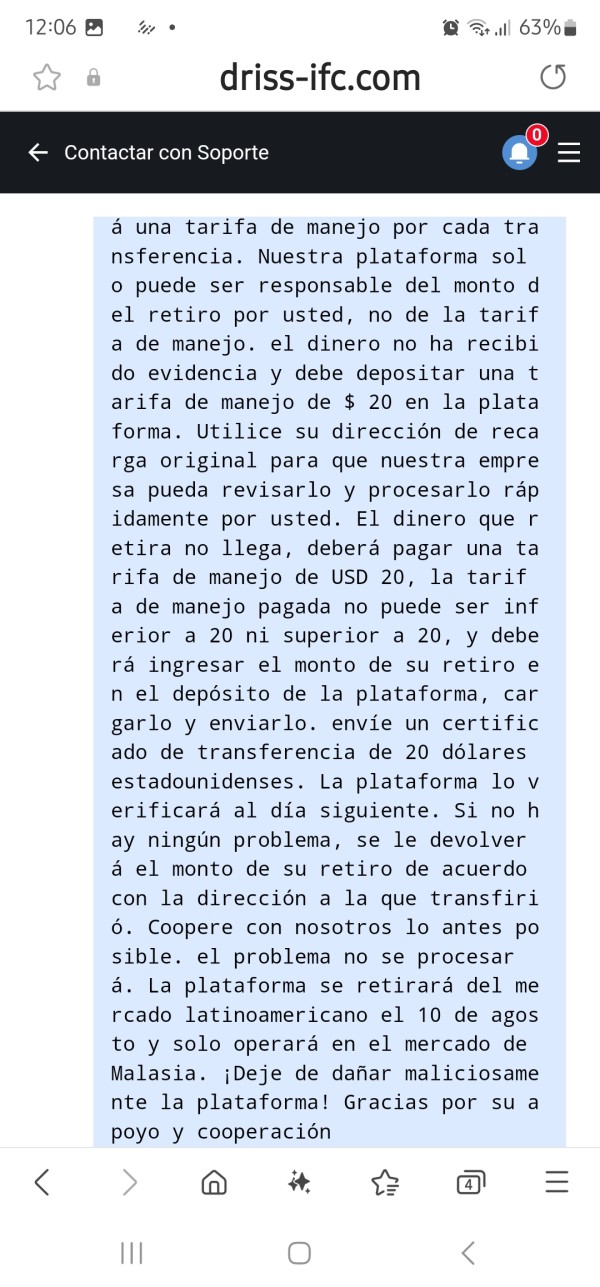

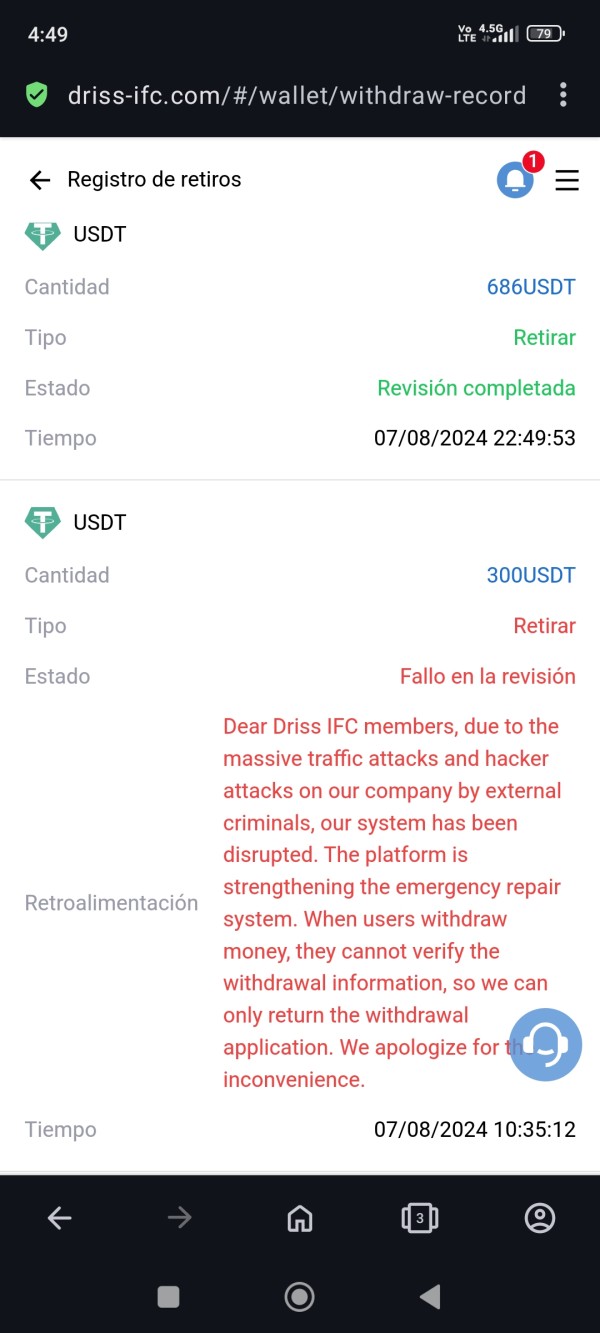

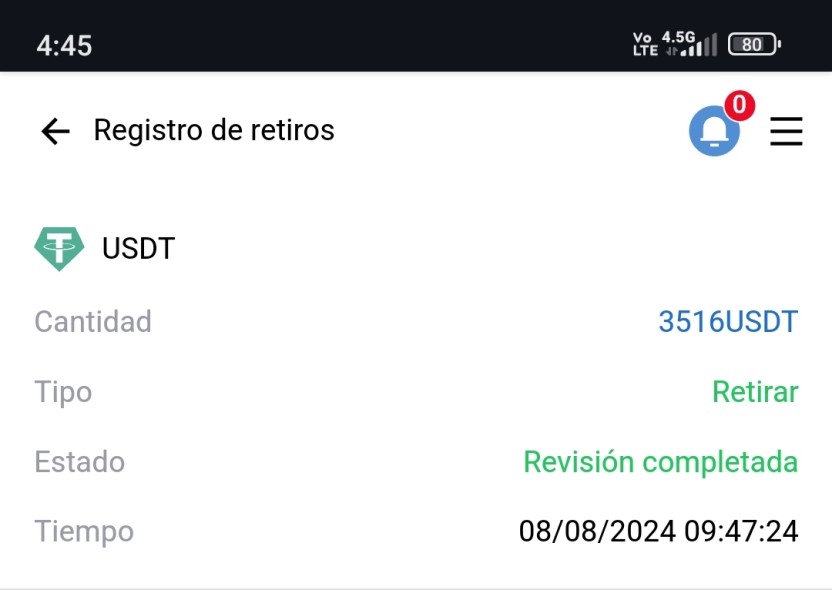

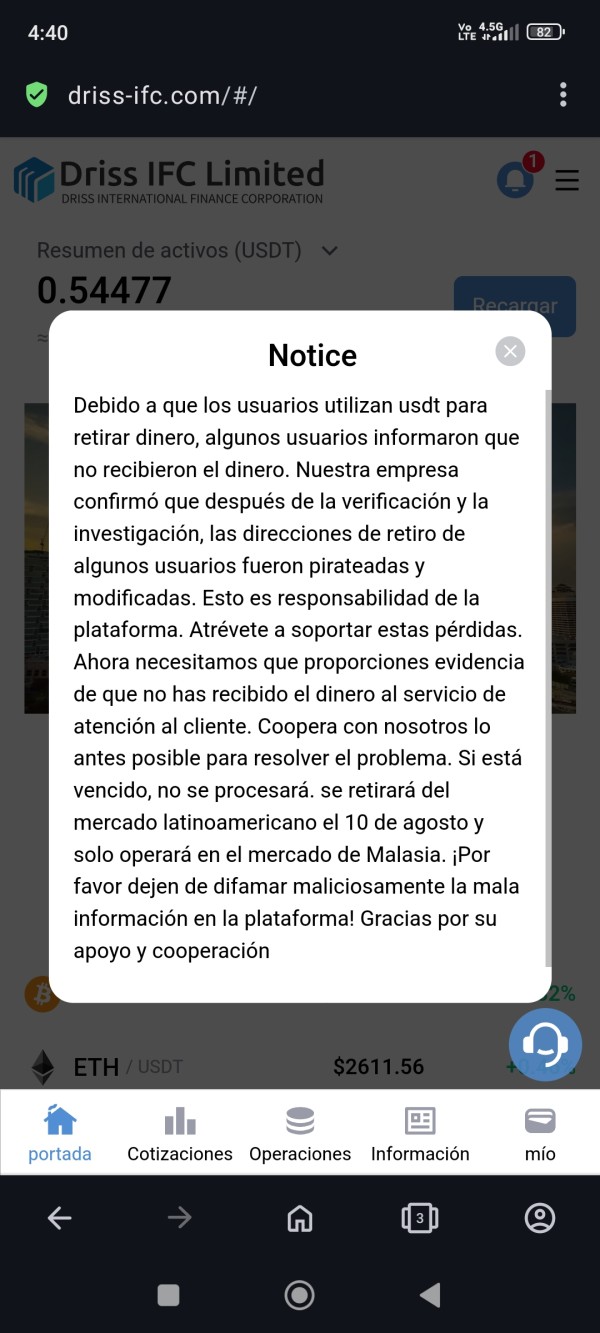

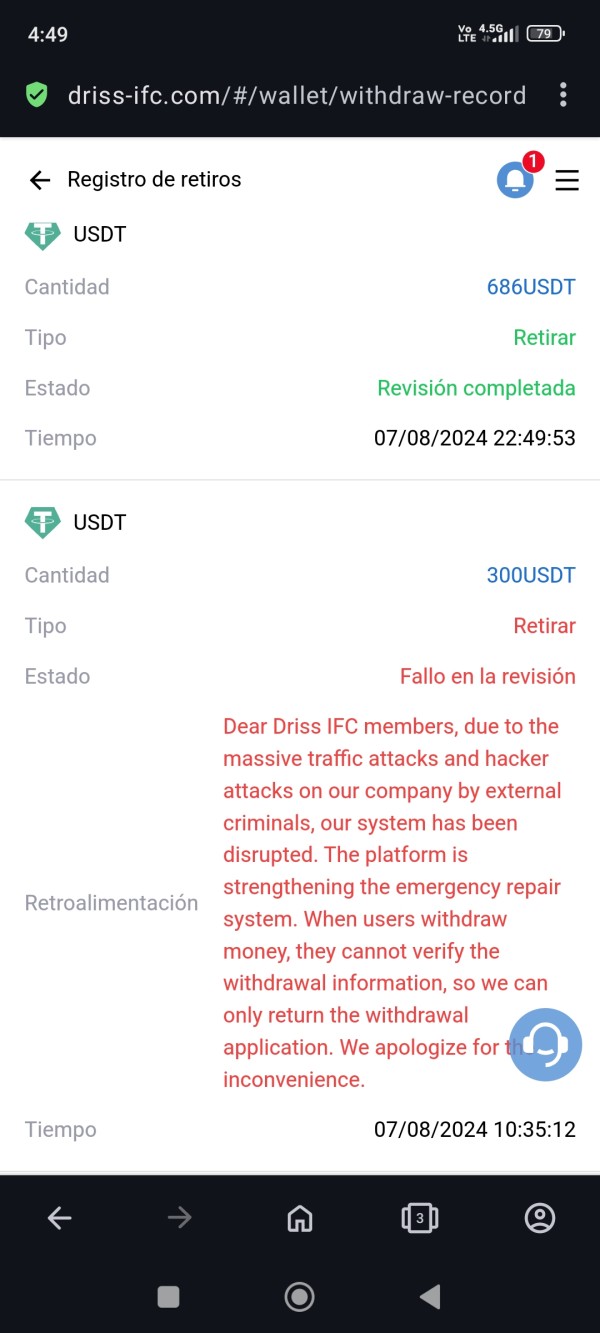

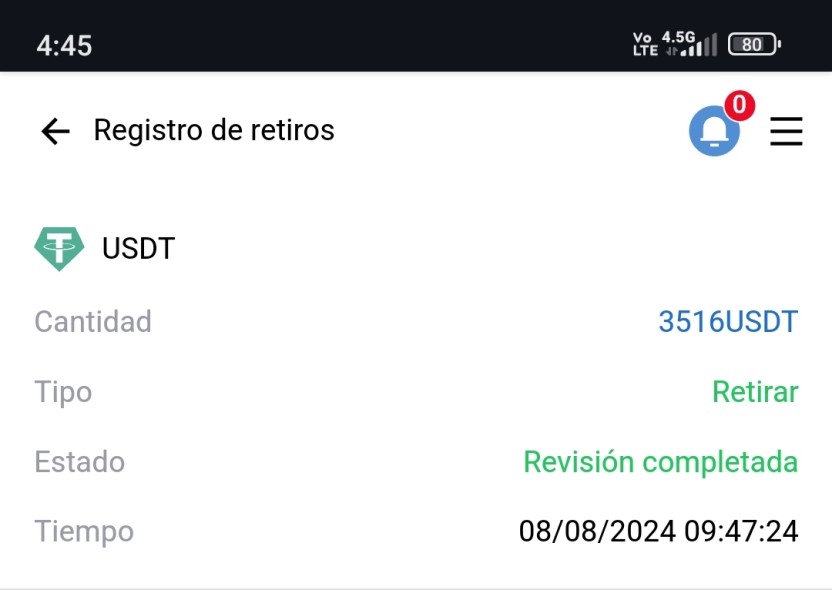

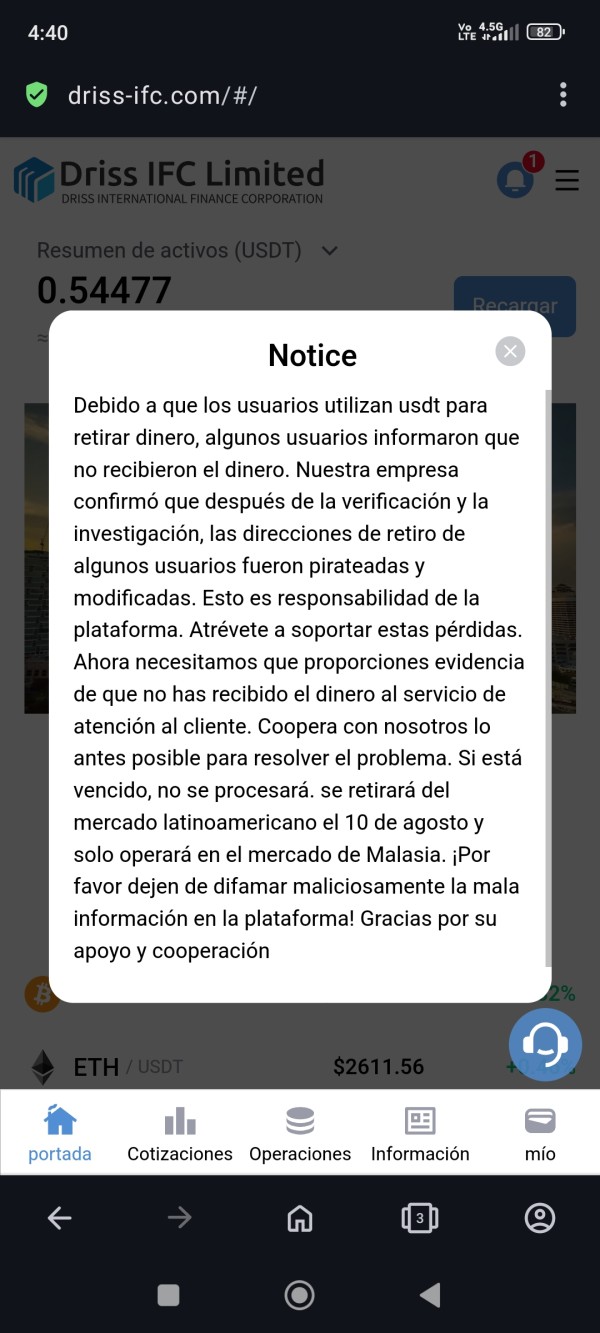

Negative incident handling appears problematic based on user reports, particularly regarding withdrawal issues where clients report funds not reaching their accounts as promised. The broker's response to these serious allegations appears inadequate, further damaging confidence in their operational integrity and client protection capabilities.

User Experience Analysis (Score: 3/10)

Overall user satisfaction with Driss IFC appears to be significantly below industry standards based on available feedback and review data. The accumulation of negative reviews across multiple platforms suggests systemic issues with service delivery and client satisfaction.

User interface design and platform usability information is limited. However, available feedback suggests that clients encounter difficulties navigating the platform and accessing necessary trading functions. Intuitive platform design is crucial for trader productivity and satisfaction.

Account registration and verification processes are not clearly documented. This potentially creates confusion and delays for new clients attempting to establish trading accounts. Streamlined onboarding processes are typically prioritized by legitimate brokers to ensure positive initial client experiences.

Fund management operations appear to be a significant source of user dissatisfaction. Multiple reports exist of withdrawal problems and funds not reaching client accounts. These issues represent serious operational failures that undermine client confidence and suggest inadequate financial processing capabilities.

Common user complaints center around withdrawal processing failures, poor customer service quality, and lack of transparency in operations. The pattern of similar complaints across multiple sources suggests systematic problems rather than isolated incidents, indicating fundamental operational deficiencies.

The user demographic that might find Driss IFC suitable appears very limited. The broker is unsuitable for traders prioritizing safety, transparency, and reliable service. The accumulation of negative feedback suggests that most serious traders would be better served by established, regulated alternatives.

Conclusion

This comprehensive driss ifc review reveals a broker that falls significantly short of industry standards and poses considerable risks to potential clients. With a trust score of only 25% and numerous negative reviews across multiple platforms, Driss IFC demonstrates fundamental deficiencies in transparency, customer service, and operational reliability.

The broker is not recommended for investors seeking safety, regulatory protection, and transparent operations. The lack of clear regulatory oversight, combined with widespread user complaints about withdrawal issues and poor customer service, creates an unacceptable risk profile for serious traders.

While Driss IFC offers access to multiple asset classes including forex, cryptocurrencies, and stocks, these potential advantages are overshadowed by significant operational shortcomings and credibility concerns. Traders are strongly advised to consider well-established, properly regulated alternatives that provide adequate client protection and transparent business operations.