8xTrade 2025 Review: Everything You Need to Know

Summary

This comprehensive 8xtrade review reveals concerning findings about a broker that has been flagged by multiple sources as potentially fraudulent. 8xTrade started in 2018 and presents itself as an online trading platform offering forex, stocks, commodities, and other financial instruments with a remarkably low minimum deposit of just $10. While this low entry barrier may initially attract novice traders seeking to enter the forex market, our investigation uncovers significant red flags that demand serious consideration from anyone thinking about using this platform.

Multiple independent sources say 8xTrade operates without proper regulatory oversight. The platform has been accused of scamming traders, which raises serious concerns about its legitimacy and safety for potential users. The platform offers trading across various asset classes including currency pairs, stocks, gold, and oil, with leverage up to 1:50 for those who want to increase their trading power. Despite supporting multiple devices including Windows, macOS, mobile applications, and web-based platforms, the overall user experience has been marred by numerous negative reviews and fraud allegations that cannot be ignored.

The broker primarily targets newcomers to forex trading. These new traders may be attracted by the minimal capital requirements, which seem appealing when starting out. However, the lack of regulatory protection, combined with widespread scam allegations and poor user feedback, makes this platform unsuitable for serious traders seeking reliable and secure trading environments where their money will be safe.

Important Notice

Regional Entity Differences: 8xTrade is registered in Saint Kitts and Nevis, a jurisdiction known for limited regulatory oversight in the financial services sector. This registration location provides minimal investor protection compared to major regulatory jurisdictions such as the FCA, ASIC, or CySEC, which means traders have fewer rights and protections if something goes wrong.

Review Methodology: This evaluation is based on publicly available information from multiple sources, including user reviews, industry reports, and regulatory databases. Given the nature of unregulated brokers, information accuracy may vary, and readers should exercise extreme caution when considering this platform for their trading needs. The findings presented here reflect the current available data and may not capture the complete operational picture of 8xTrade, so traders should do their own research before making any decisions.

Rating Framework

Broker Overview

8xTrade emerged in the online trading landscape in 2018. The company positioned itself as a comprehensive trading platform for various financial instruments, trying to attract traders with promises of easy access to global markets. The company's registration in Saint Kitts and Nevis immediately raises concerns, as this jurisdiction is frequently chosen by brokers seeking to avoid stringent regulatory requirements that protect traders in major financial centers around the world.

The broker's business model centers around providing online trading services across multiple asset classes. These include foreign exchange, equities, commodities, and precious metals, giving traders access to different types of investments in one place. According to available information, 8xTrade attempts to attract traders with promises of low spreads and access to diverse financial markets, though specific details about their actual trading conditions remain unclear and hard to verify.

The platform's technical infrastructure reportedly supports multiple operating systems and devices. This includes Windows and macOS desktop applications alongside mobile apps and web-based trading interfaces for maximum flexibility. However, the quality and reliability of these platforms have been questioned by users who report various technical issues and execution problems that interfere with their trading. This 8xtrade review reveals that despite the broker's multi-platform approach, the overall trading environment lacks the stability and professional standards expected from legitimate financial service providers in today's competitive market.

The company's asset offerings include major and minor currency pairs, individual stocks, precious metals like gold, and energy commodities such as oil. While this diversity might appear attractive to traders seeking varied investment opportunities across different markets, the lack of detailed information about trading conditions, spreads, and execution quality raises significant concerns about the actual trading experience. Traders need clear information about costs and conditions to make informed decisions about where to invest their money.

Regulatory Status: 8xTrade operates from Saint Kitts and Nevis without authorization from major financial regulatory authorities. This unregulated status means traders have no recourse through established financial ombudsman services or compensation schemes that protect investors in regulated jurisdictions, leaving them vulnerable if problems arise.

Deposit and Withdrawal Methods: Specific information about deposit and withdrawal methods is not clearly disclosed in available materials. This lack of transparency itself represents a significant red flag for potential clients seeking clarity in financial transactions, as legitimate brokers typically provide detailed information about how money moves in and out of accounts.

Minimum Deposit Requirements: The broker advertises a minimum deposit of $10, which while appearing attractive to newcomers, may be a tactic to lure unsuspecting traders into what multiple sources describe as a fraudulent operation. Low minimum deposits are often used by questionable brokers to get people to sign up quickly without thinking through the decision carefully.

Bonus and Promotions: Available documentation does not mention any specific bonus structures or promotional offers. However, unregulated brokers often use misleading incentives to attract deposits, so traders should be wary of any offers that seem too good to be true.

Tradeable Assets: The platform claims to offer currency pairs, stocks, gold, and oil trading. The actual depth and quality of these offerings remain questionable given the broker's disputed legitimacy and lack of clear information about what traders can actually access.

Cost Structure: Critical information about spreads, commissions, and other trading costs is notably absent from available materials. This prevents traders from making informed decisions about the true cost of trading with 8xTrade, which is essential information for anyone considering opening an account.

Leverage Ratios: The maximum leverage is stated as 1:50, which is relatively conservative compared to many unregulated brokers that offer excessive leverage as a marketing tool. While lower leverage can be safer for traders, the lack of regulation still makes this offering risky regardless of the leverage amount.

Platform Options: 8xTrade claims to support Windows, macOS, mobile applications, and web-based trading platforms. User reports suggest significant functionality and reliability issues across all platforms, which can seriously impact a trader's ability to execute trades effectively.

Geographic Restrictions: Specific information about geographic restrictions is not detailed in available sources. The broker's regulatory status likely limits its legitimate operations in many jurisdictions, though this information is not clearly communicated to potential users.

Customer Service Languages: Available materials do not specify the languages supported by customer service. This represents another indication of the broker's lack of transparency regarding operational details that traders need to know before opening accounts.

Detailed Rating Analysis

Account Conditions Analysis (Score: 4/10)

The account conditions offered by 8xTrade present a mixed picture that ultimately favors the broker rather than the trader. While the advertised minimum deposit of $10 appears exceptionally attractive, this low barrier to entry is often a hallmark of fraudulent operations designed to encourage quick deposits from unsuspecting traders who don't research the company thoroughly.

The lack of detailed information about different account types represents a significant deficiency. Legitimate brokers typically offer tiered account structures with varying features, minimum deposits, and benefits that help traders choose the right option for their needs. The absence of such clarity suggests either poor operational structure or deliberate obfuscation of terms and conditions that traders should understand before investing.

According to user feedback compiled from various sources, the account opening process lacks the rigorous verification procedures expected from regulated financial institutions. This streamlined approach, while appearing convenient, actually indicates insufficient Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures that legitimate brokers must implement to protect both themselves and their clients. The lack of proper verification can lead to security issues and regulatory problems down the line.

The 8xtrade review findings indicate that special account features such as Islamic accounts, VIP services, or institutional offerings are not clearly documented or may not exist at all. This limitation significantly restricts the broker's appeal to diverse trading communities and suggests a basic, potentially inadequate service offering that doesn't meet the needs of different types of traders.

8xTrade's trading tools and resources receive a below-average rating due to insufficient information about the quality and comprehensiveness of their offerings. While the broker mentions providing financial news, the depth, accuracy, and timeliness of this information remain unverified by independent sources or user testimonials.

The platform claims to offer various trading tools, but specific details about charting capabilities, technical indicators, or analytical resources are notably absent from available documentation. Professional traders require sophisticated analytical tools, real-time data feeds, and comprehensive market research to make informed decisions about their investments. Without clear information about these essential features, traders cannot properly evaluate whether the platform meets their needs.

Educational resources, which are crucial for the novice traders that 8xTrade appears to target, are not mentioned in available materials. Legitimate brokers typically provide extensive educational content including webinars, tutorials, market analysis, and trading guides to help clients develop their skills and understanding of financial markets. The absence of educational support leaves new traders without the guidance they need to succeed.

The absence of information about automated trading support, API access, or third-party tool integration suggests limited technological capabilities. Modern trading environments require robust infrastructure to support algorithmic trading and advanced order management systems that serious traders depend on for their strategies.

Customer Service and Support Analysis (Score: 3/10)

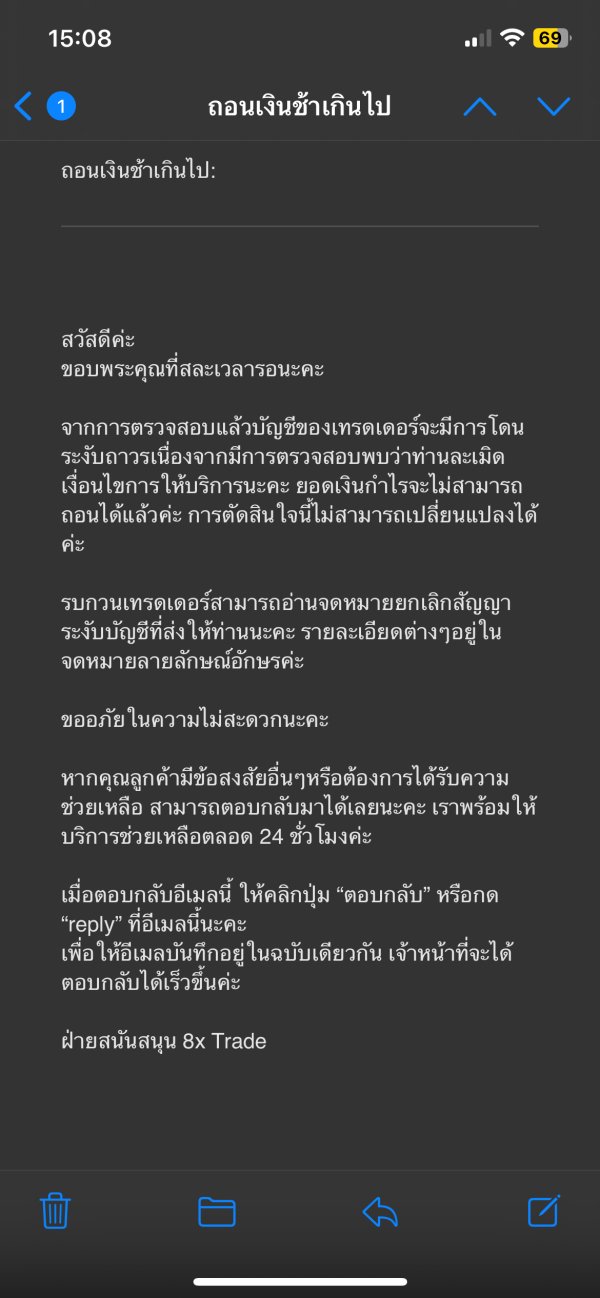

Customer service represents one of 8xTrade's most significant weaknesses, earning a poor rating based on user feedback and lack of transparency about support operations. Multiple user reports indicate slow response times and unsatisfactory resolution of queries and complaints, which can be extremely frustrating when traders need help with urgent issues.

The broker fails to provide clear information about available customer service channels, operating hours, or support languages. This lack of transparency is particularly concerning for an international trading platform that should cater to clients across different time zones and linguistic backgrounds who need assistance at various times. Good customer service requires clear communication about how and when help is available.

User testimonials consistently highlight difficulties in reaching customer support when issues arise, particularly regarding withdrawal requests and account-related problems. These communication failures are especially problematic given the already questionable regulatory status of the broker, as traders have fewer options for resolving disputes. When customer service fails, traders may have no other recourse for getting their problems solved.

The absence of comprehensive FAQ sections, detailed help documentation, or self-service options further compounds the customer service deficiencies. Professional brokers typically provide extensive support resources to help clients resolve common issues independently, reducing wait times and improving overall user satisfaction.

Trading Experience Analysis (Score: 4/10)

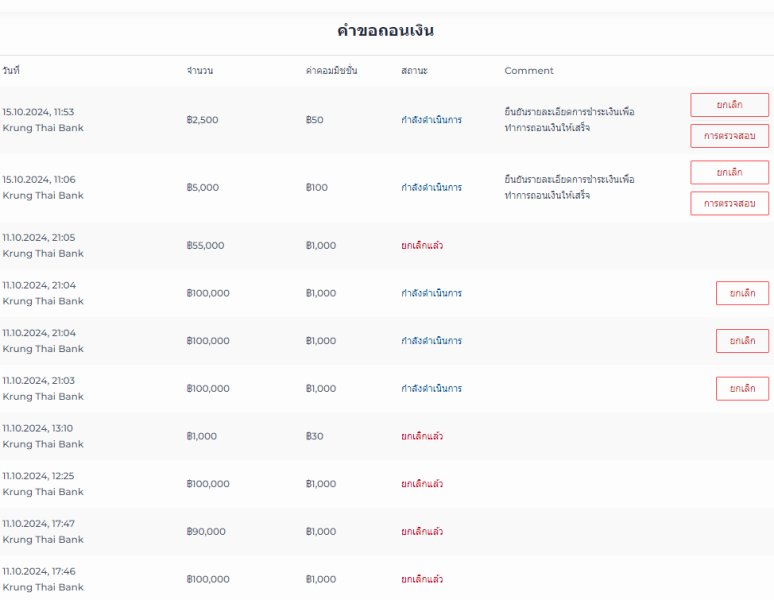

The trading experience with 8xTrade receives a poor rating due to multiple user reports of platform instability, execution issues, and overall unreliability. Users frequently report technical problems that interfere with their ability to execute trades effectively or monitor their positions properly, which can lead to significant financial losses.

Order execution quality appears problematic based on available user feedback, with reports of slippage, requotes, and delays that can significantly impact trading profitability. These execution issues are particularly concerning for active traders who require fast, reliable order processing to implement their strategies successfully. Poor execution can turn profitable trades into losses and make trading strategies ineffective.

The platform's functionality across different devices receives mixed reviews, with users reporting inconsistent performance between desktop, mobile, and web-based versions. This inconsistency can severely impact traders who need reliable access to their accounts from multiple devices throughout the day. Modern traders expect seamless functionality regardless of which device they use to access their accounts.

Specific information about spreads, liquidity providers, and trading environment details remains unavailable, preventing traders from properly assessing the true cost and quality of the trading experience. This 8xtrade review reveals that such opacity is typically associated with brokers that manipulate trading conditions to their advantage rather than providing fair and transparent trading environments.

Trustworthiness Analysis (Score: 2/10)

8xTrade receives the lowest possible rating for trustworthiness due to multiple fraud allegations and complete lack of regulatory oversight. Several independent sources, including Scam Detector and various review platforms, have flagged the broker as potentially fraudulent, which should be a major warning sign for any potential trader.

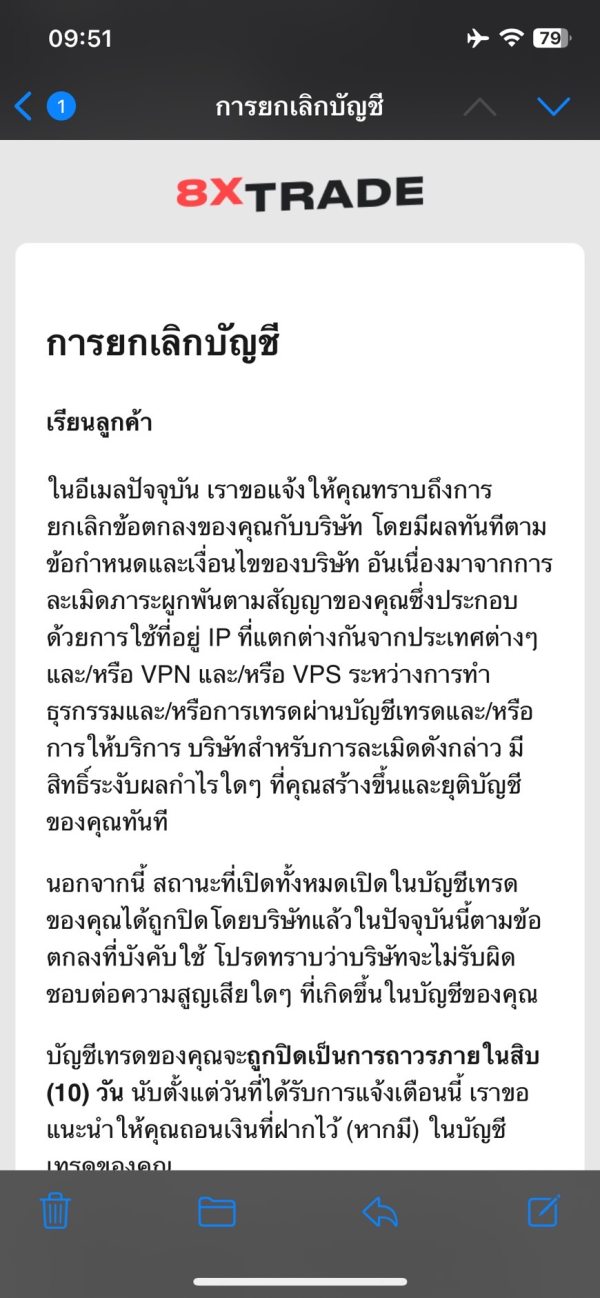

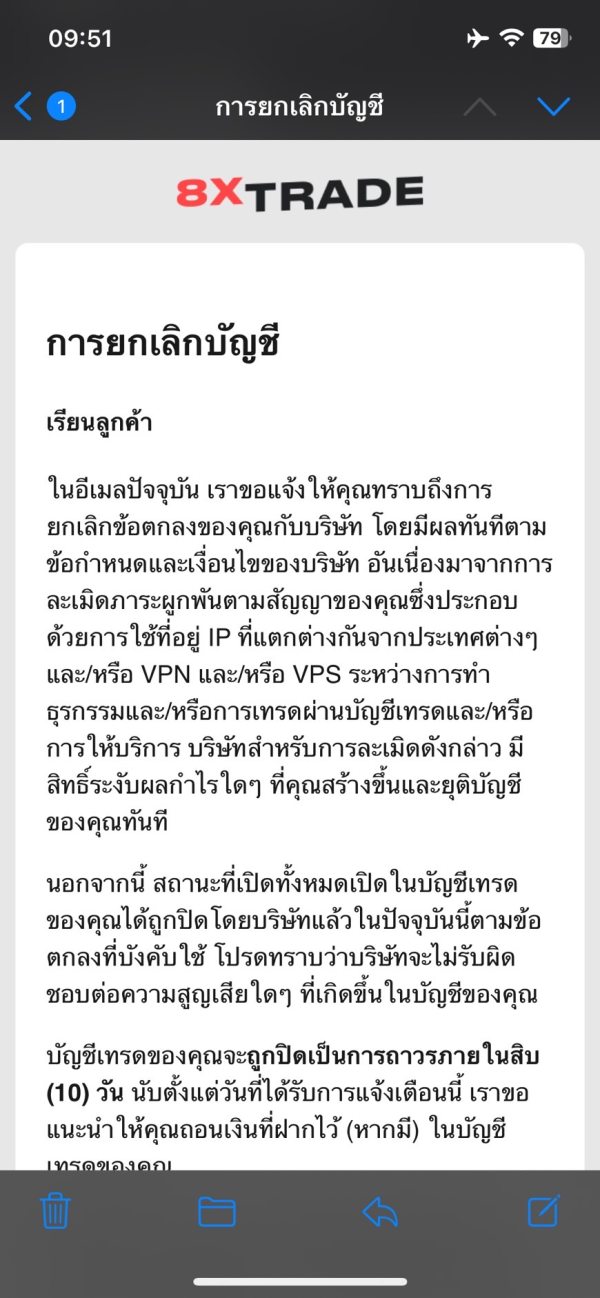

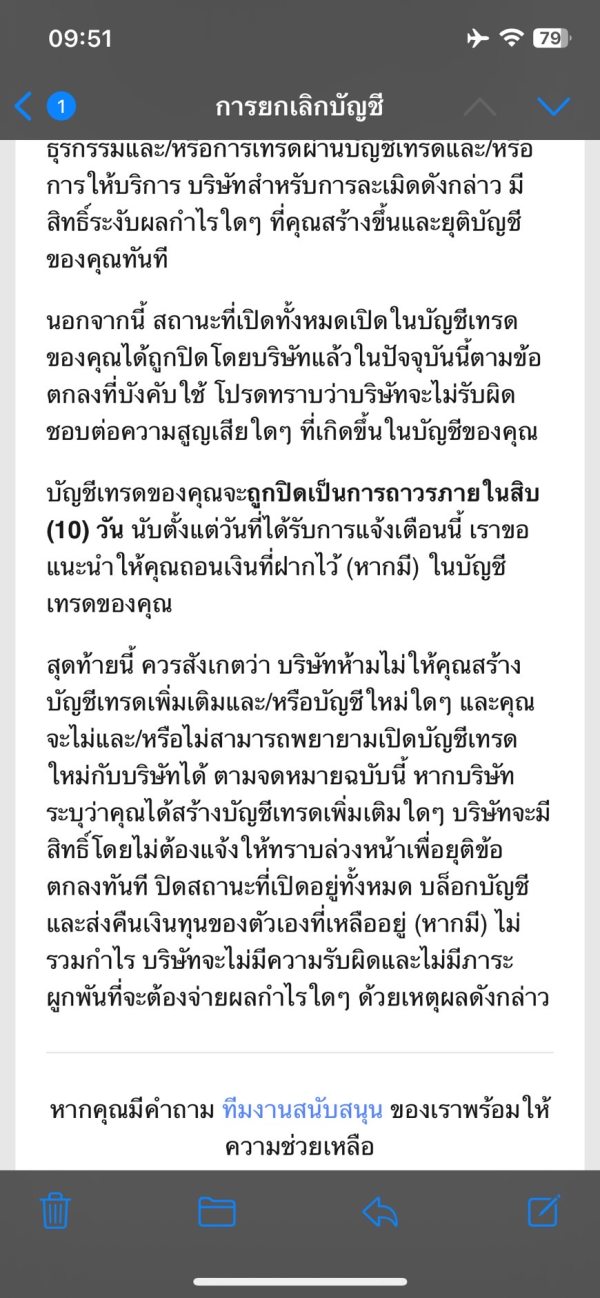

The broker's registration in Saint Kitts and Nevis, combined with the absence of authorization from any major financial regulatory authority, provides no investor protection. Traders have no recourse through established complaint procedures or compensation schemes if issues arise, leaving them completely vulnerable to potential fraud or mismanagement. This lack of protection means that if something goes wrong, traders may lose their money with no way to recover it.

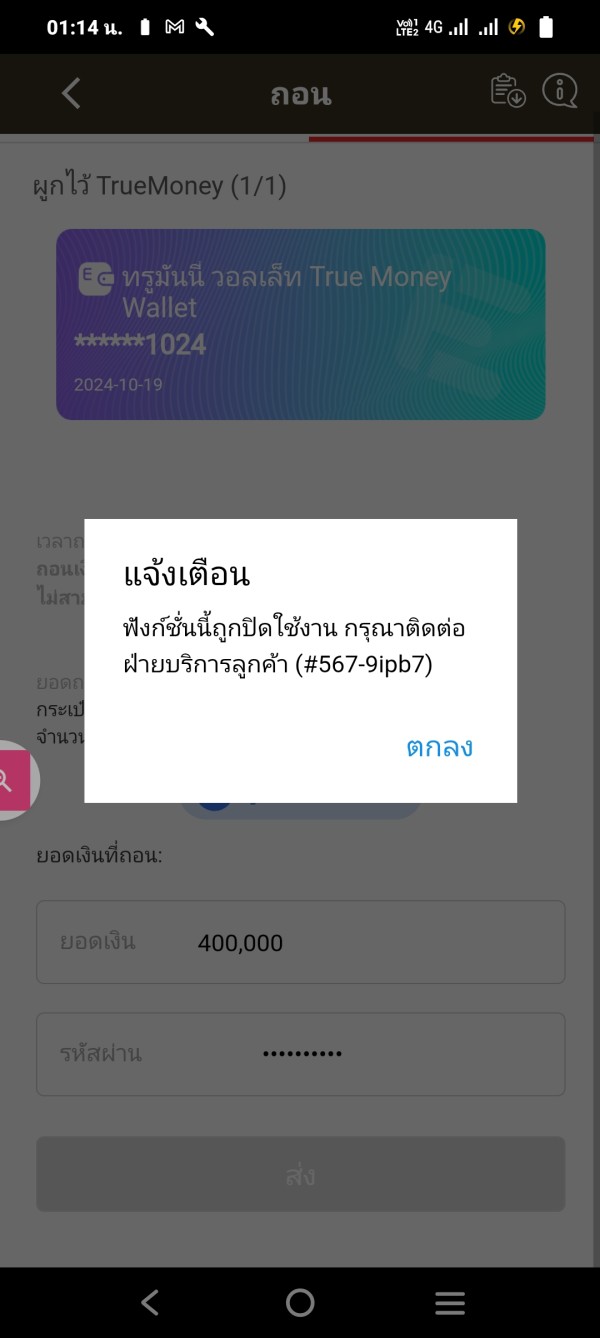

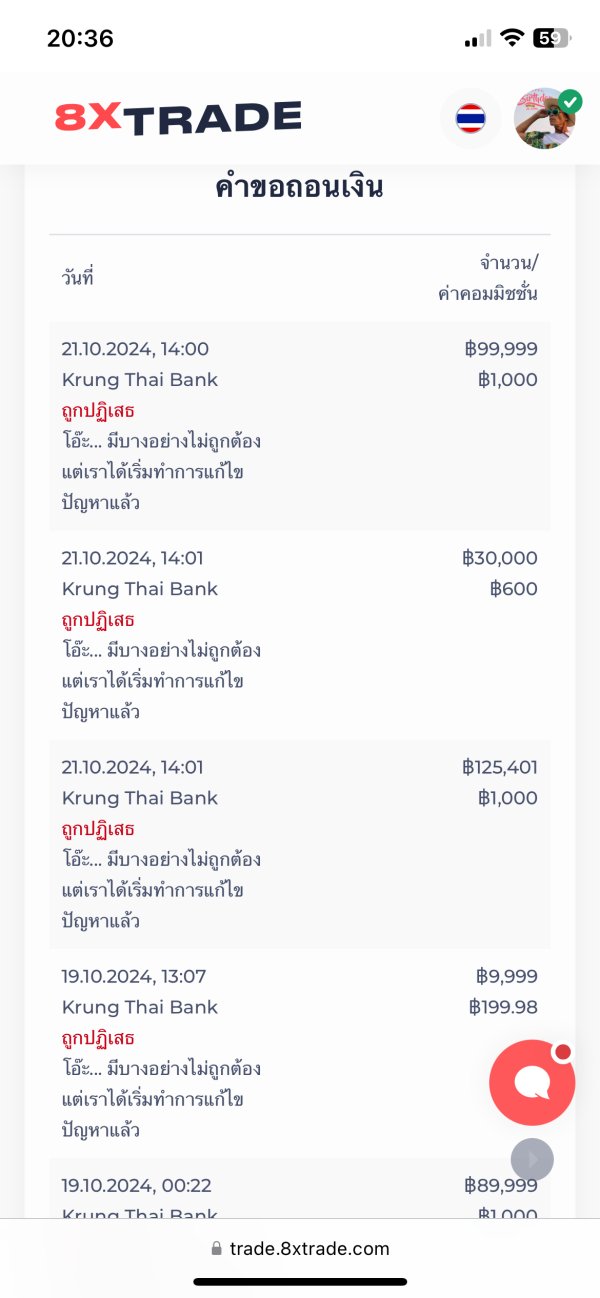

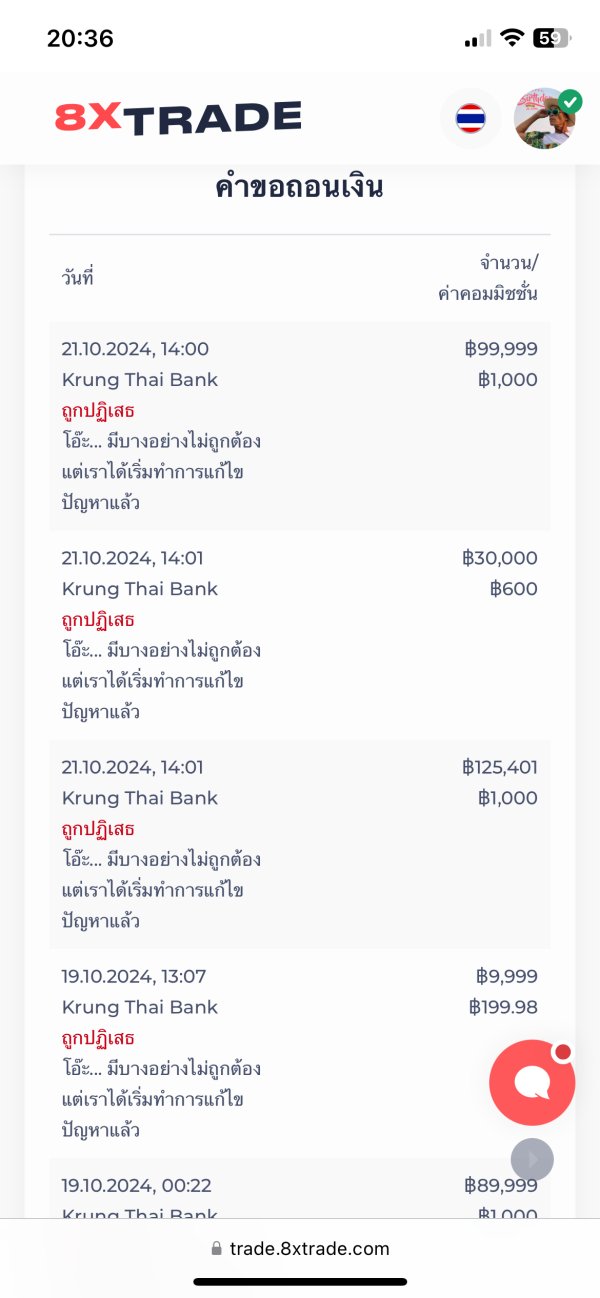

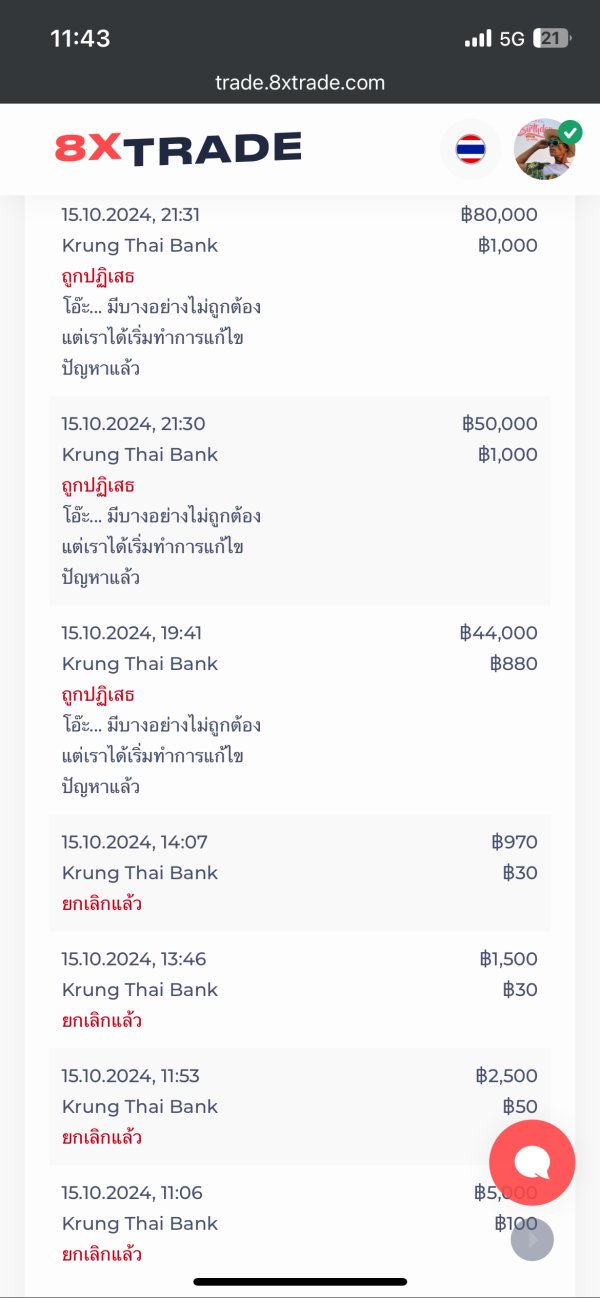

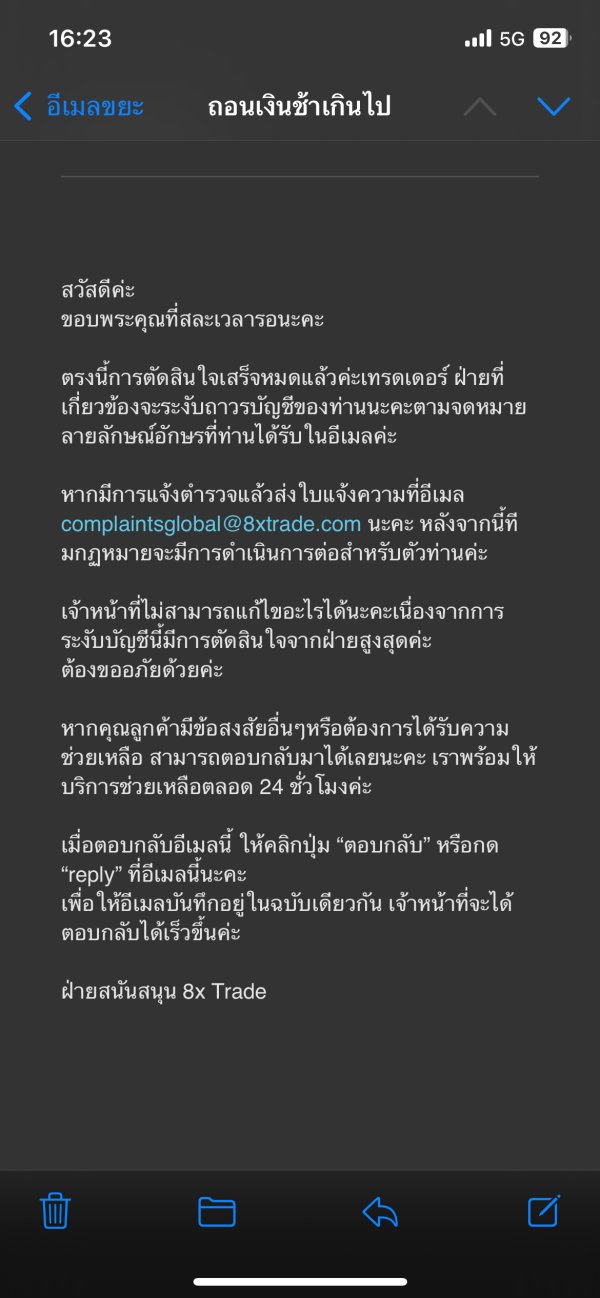

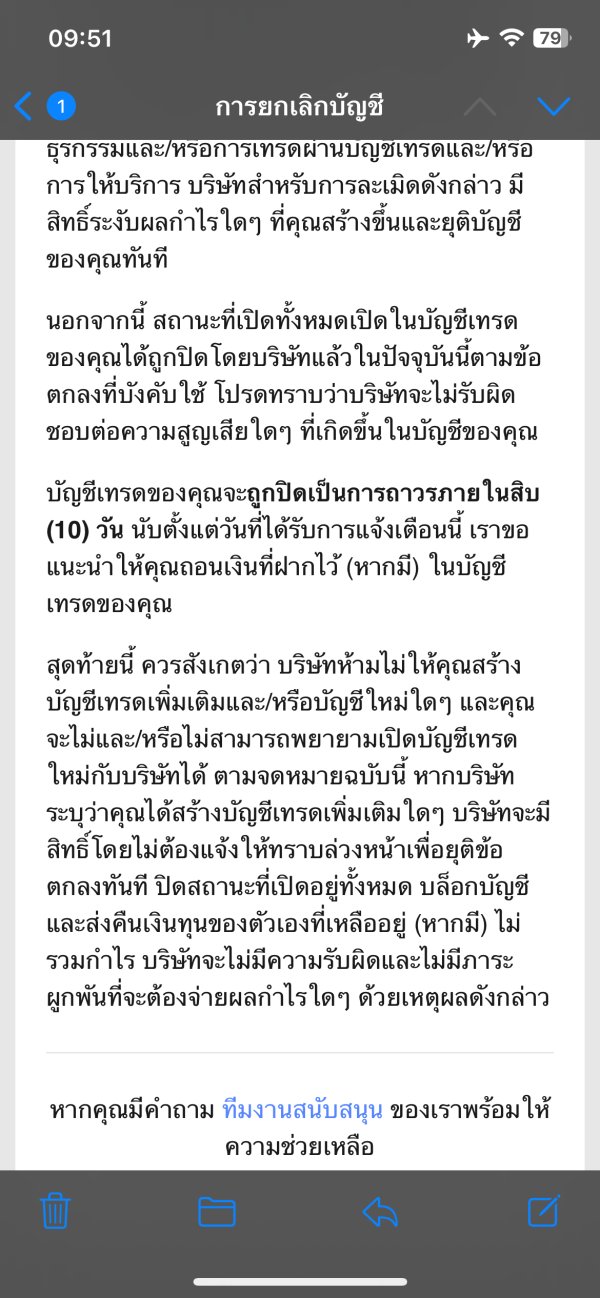

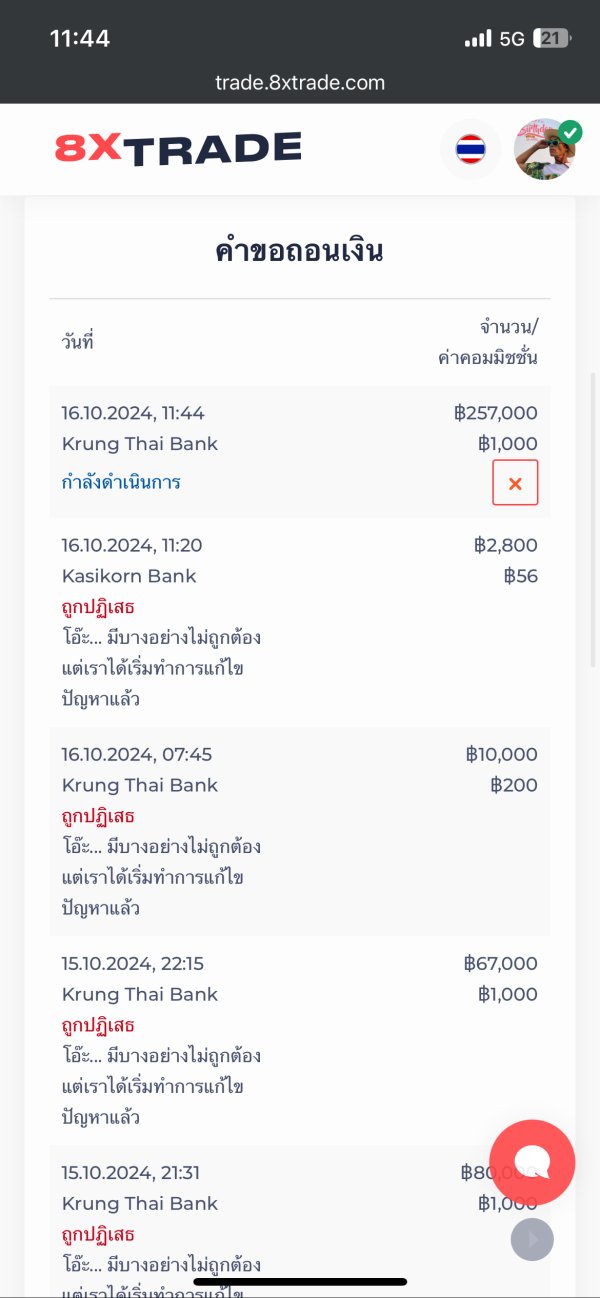

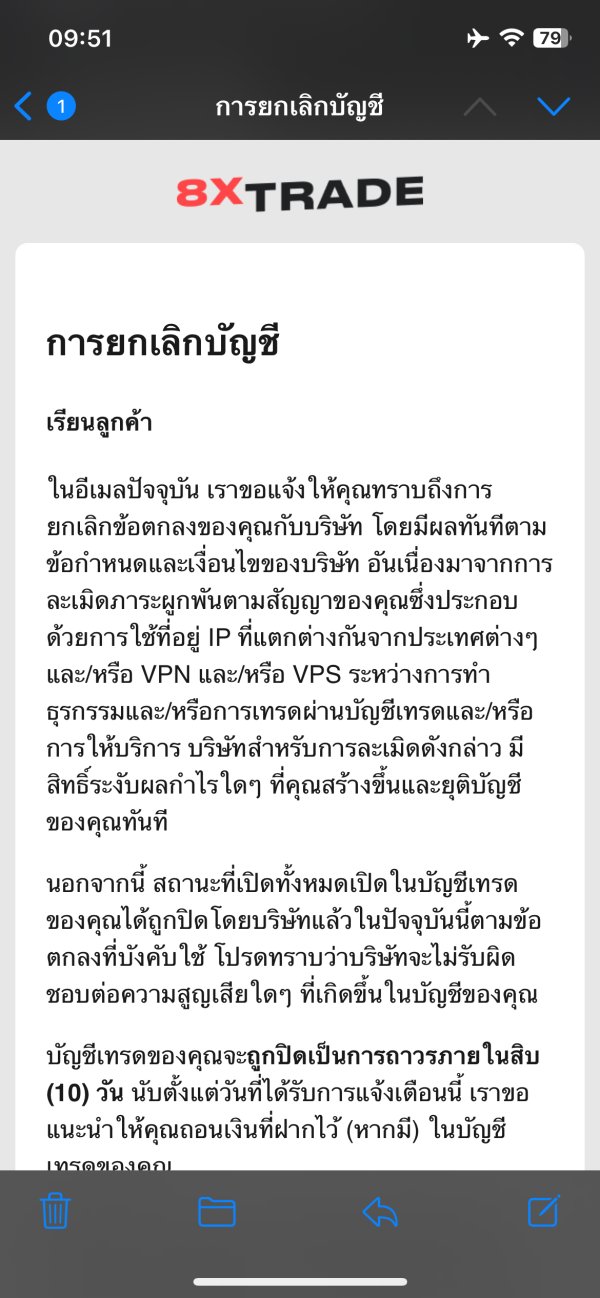

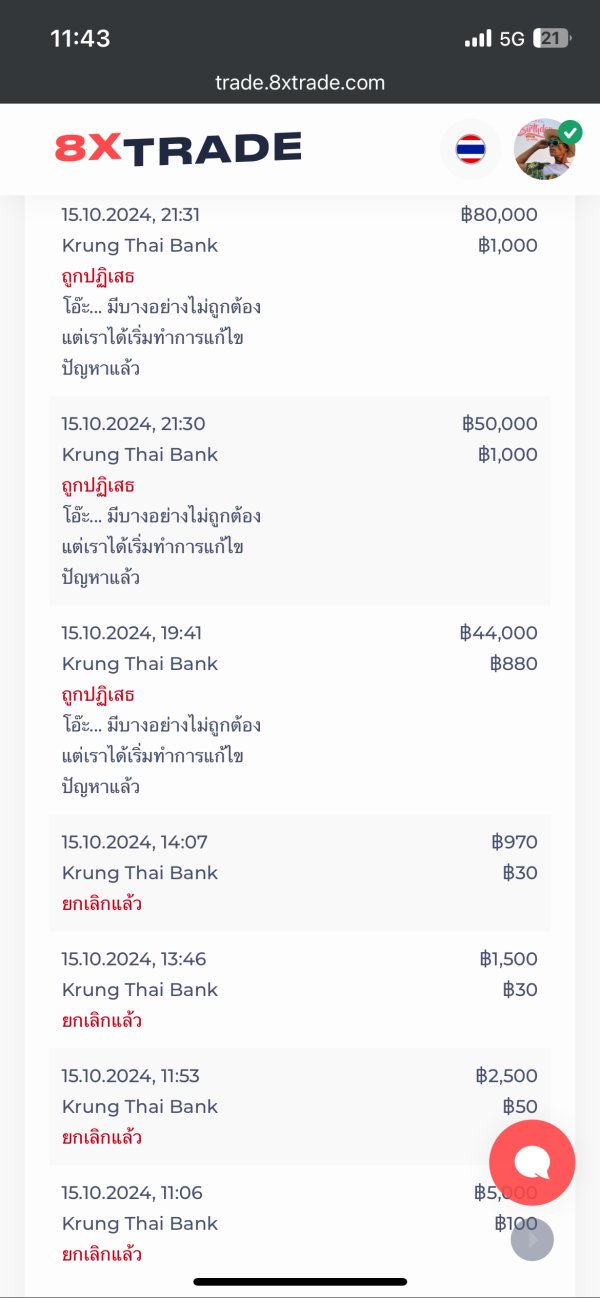

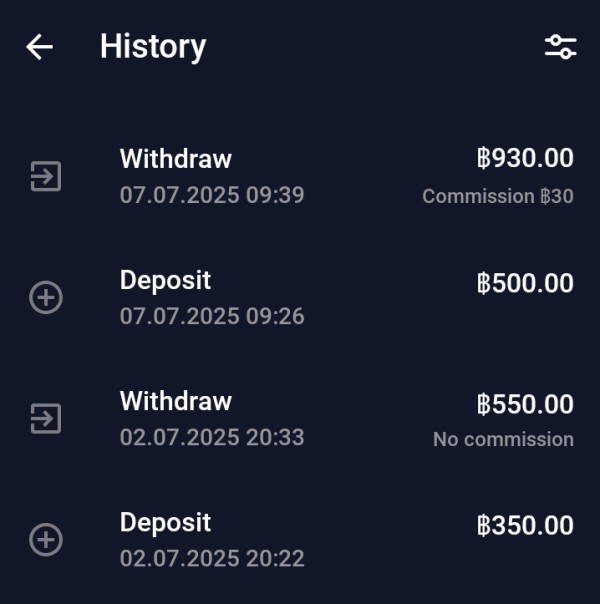

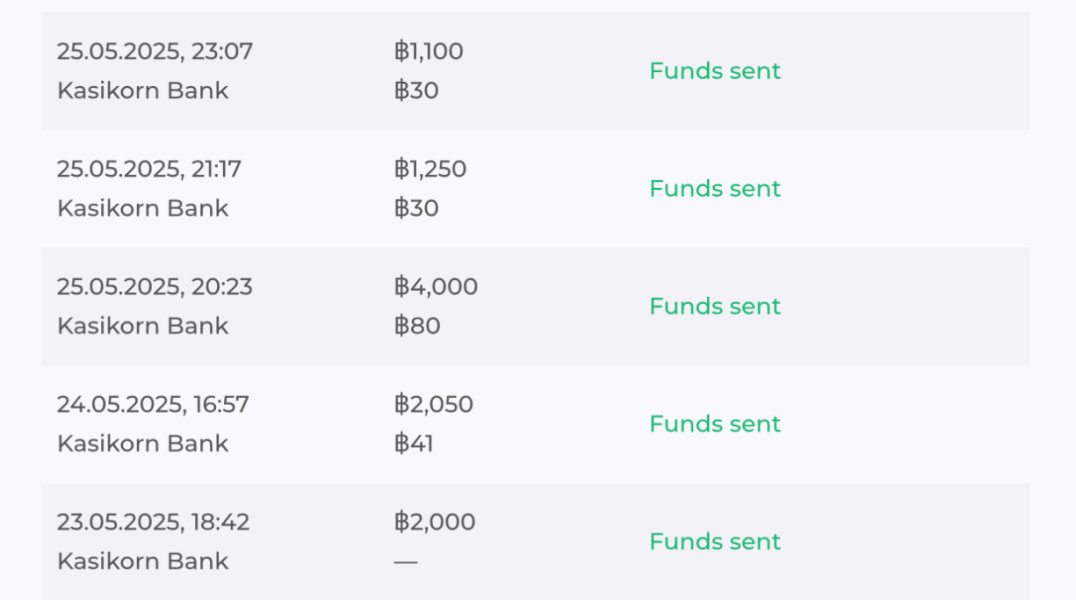

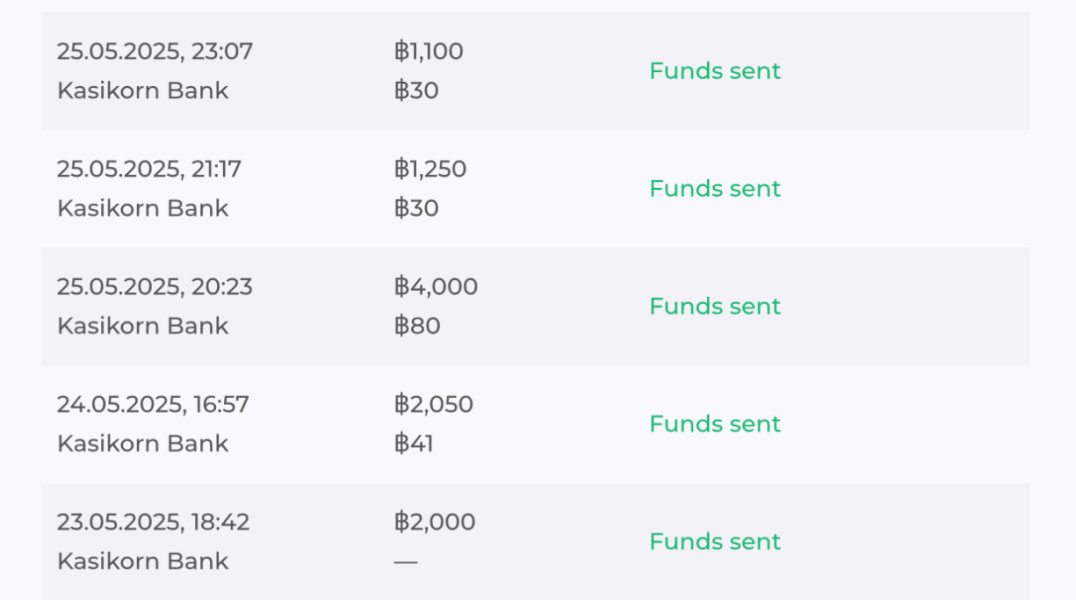

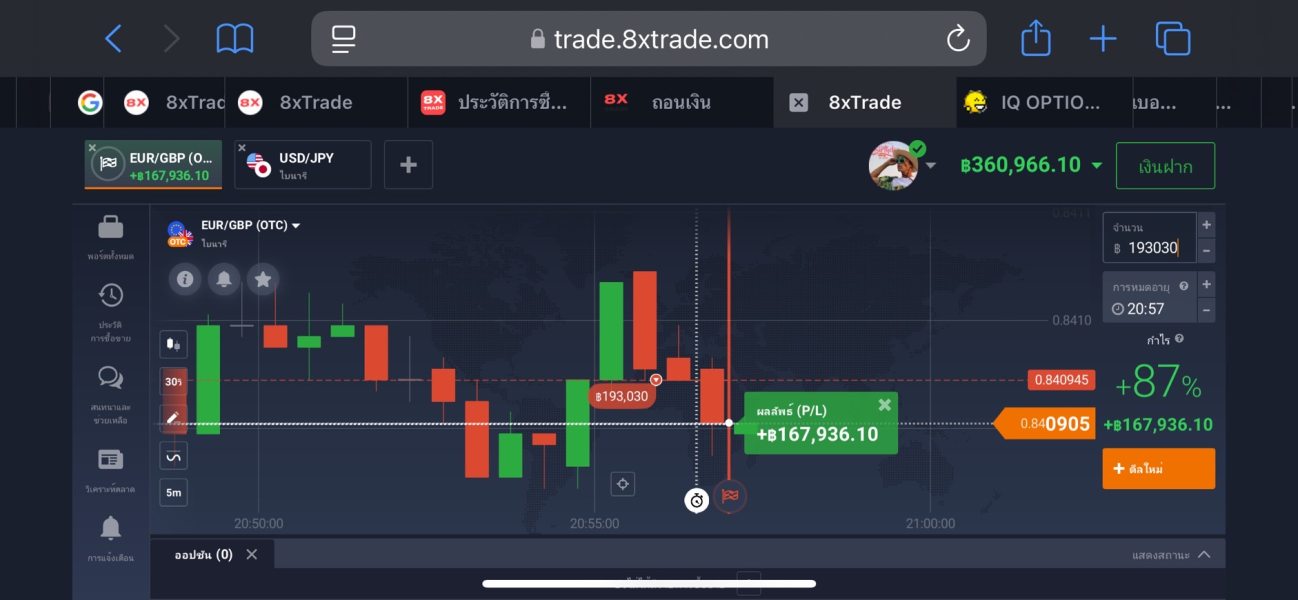

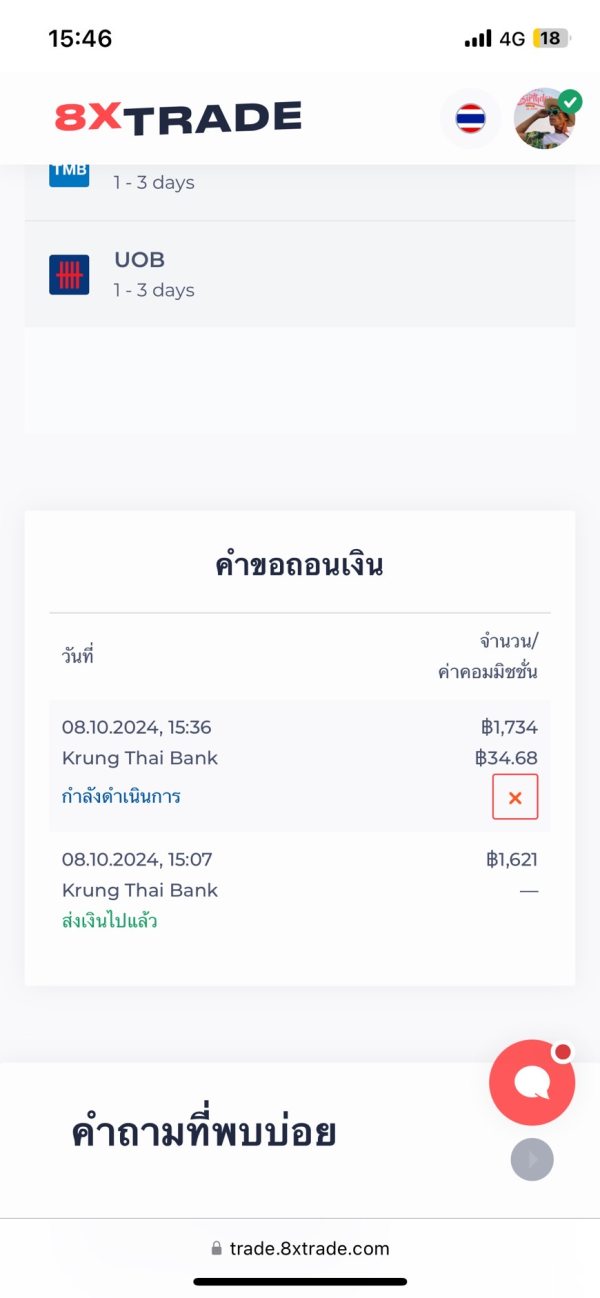

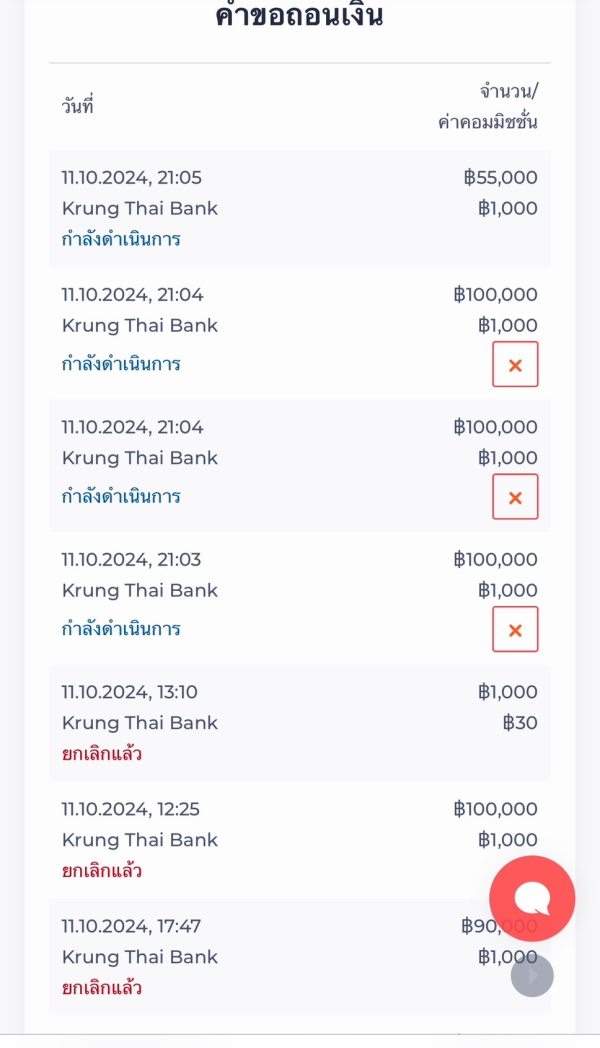

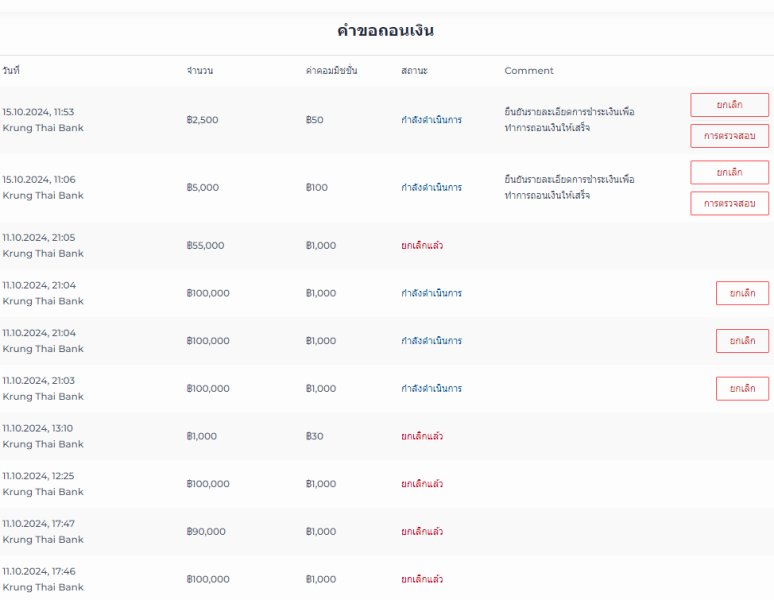

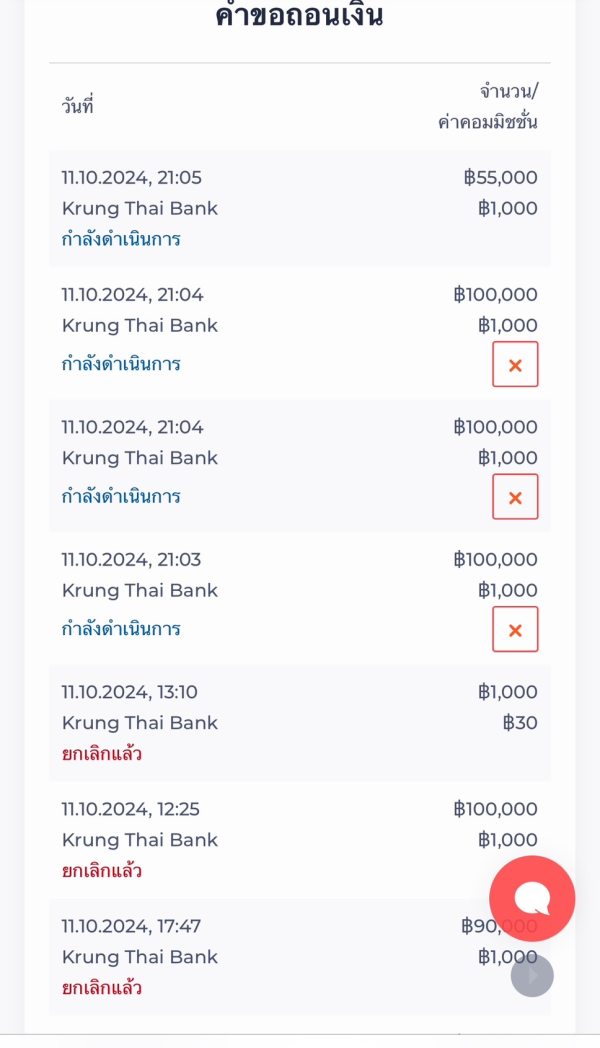

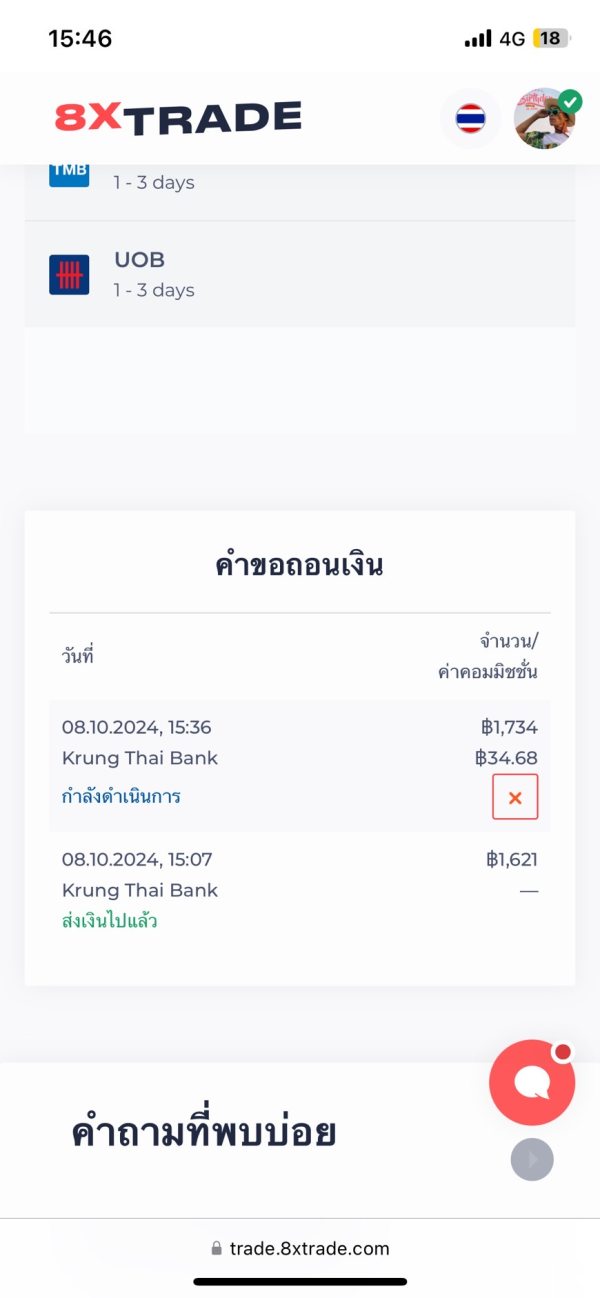

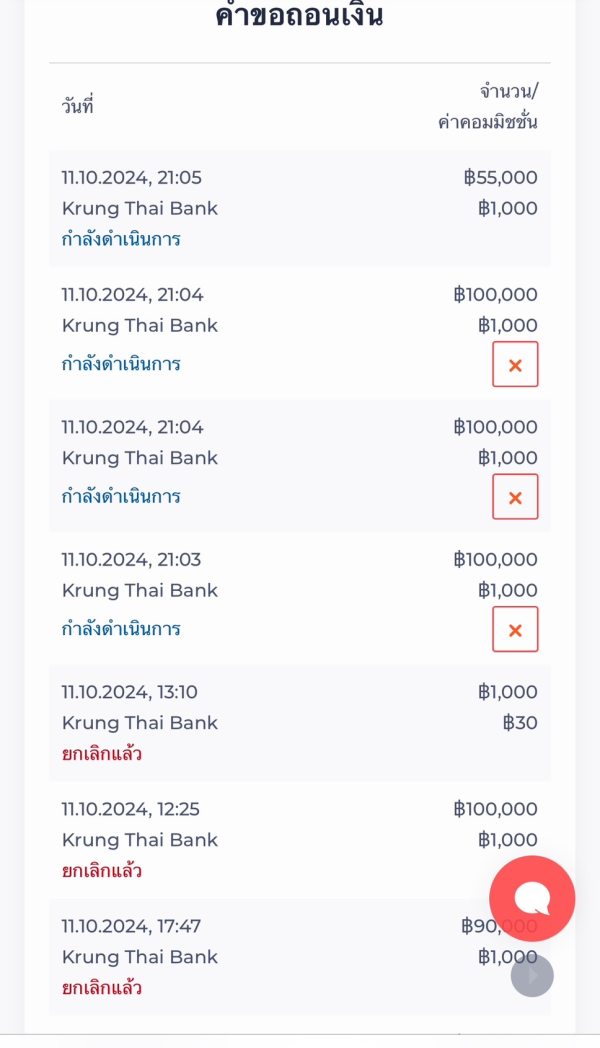

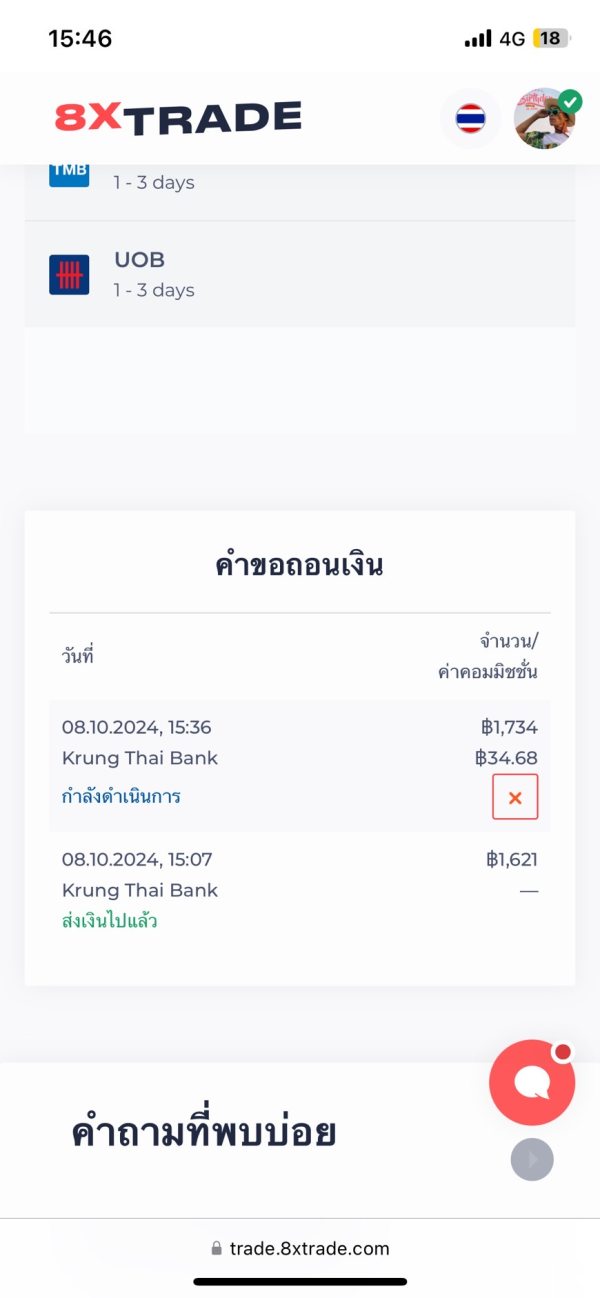

Multiple user reports describe difficulties withdrawing funds, a classic indicator of fraudulent broker operations. These withdrawal problems, combined with poor customer service, suggest that 8xTrade may be operating as a scam designed to collect deposits without providing legitimate trading services to its clients. When brokers make it difficult to withdraw money, it's often because they never intended to allow withdrawals in the first place.

The company's lack of transparency regarding ownership, operational details, and regulatory compliance further undermines its credibility. Legitimate brokers provide comprehensive information about their corporate structure, regulatory status, and operational procedures so that clients can verify their legitimacy and understand who they're dealing with.

User Experience Analysis (Score: 4/10)

Overall user satisfaction with 8xTrade is significantly below industry standards, with predominantly negative feedback across multiple review platforms. Users consistently report frustration with various aspects of the platform, from technical issues to customer service problems that make trading difficult and stressful.

Interface design and usability information is limited in available sources, though user complaints suggest that the platform may suffer from poor design choices and confusing navigation. Effective trading platforms should provide intuitive interfaces that facilitate rather than hinder trading activities, making it easy for traders to execute their strategies efficiently. Poor design can lead to costly mistakes and missed opportunities.

The registration and account verification process appears streamlined, but this simplicity may actually indicate insufficient security measures rather than user-friendly design. Legitimate brokers implement thorough verification procedures to protect both the firm and its clients from fraud and regulatory issues, even if this makes the signup process slightly more complex.

Common user complaints center around withdrawal difficulties, platform instability, and poor customer support responsiveness. The pattern of negative feedback suggests systemic problems rather than isolated incidents, indicating fundamental operational deficiencies that are unlikely to be resolved without significant changes to the broker's business model and approach to customer service.

Conclusion

This comprehensive 8xtrade review reveals a broker that poses significant risks to traders and should be avoided. Despite the attractive low minimum deposit requirement of $10, the overwhelming evidence suggests that 8xTrade operates as an unregulated entity with numerous fraud allegations and consistently poor user experiences that make it unsuitable for serious trading.

The broker may initially appear suitable for novice traders with limited capital. However, the lack of regulatory protection, withdrawal difficulties, and poor customer service make it inappropriate for any serious trader who wants to protect their investment and have a positive trading experience.

The primary advantage of 8xTrade—its low entry barrier—is far outweighed by significant disadvantages including lack of regulation, fraud allegations, poor customer service, unreliable trading platforms, and withdrawal difficulties. Traders seeking legitimate forex and CFD trading opportunities should consider regulated brokers that offer proper investor protection and transparent operating conditions that prioritize client safety and satisfaction over quick profits.