Numera International 2025 Review: Everything You Need to Know

Executive Summary

This numera international review gives you a complete look at a forex broker that has gotten lots of bad attention since starting in 2022. The company is registered in Saint Vincent and the Grenadines and says it's regulated by the Financial Services Authority (FSA), but many experts and users question this claim. Numera International targets both regular people and big investors who want to trade forex. They offer access to over 50 currency pairs including major, minor, and exotic pairs.

But many users report really bad experiences with this company. Multiple people say the company is fraudulent. Clients lose money from their accounts right after making deposits, can't withdraw their funds, and get poor help from customer service. The broker's legitimacy is very questionable. Users often call it a "scam company" on review websites. The regulatory status that Numera International claims looks fake, which creates serious concerns about fund safety and how open they are about their operations. With all these major red flags, this broker is very risky for people who want reliable forex trading services.

Important Notice

Regional Entity Differences: Numera International operates from Saint Vincent and the Grenadines, a place known for weak regulatory oversight compared to major financial centers. You should know that this regulatory environment may offer limited investor protection compared to brokers licensed in stricter places like the FCA (UK), ASIC (Australia), or CySEC (Cyprus).

Review Methodology: This review uses publicly available information, user feedback from multiple review platforms, and regulatory disclosures. Since the broker itself provides limited transparency, much of this assessment relies on client testimonials and third-party investigations into the company's operations and legitimacy claims.

Scoring Framework

Broker Overview

Numera International started in the forex trading world in 2022. The company says it provides complete trading services for both regular people and big institutions. It registered in Saint Vincent and the Grenadines, a Caribbean place that has become popular among online financial service providers because of its easy regulatory framework. The broker claims to offer advanced trading solutions and market access, targeting investors interested in foreign exchange markets with promises of professional execution and technical support.

The company's business focuses on providing forex brokerage services. They claim to help with trading across more than 50 currency pairs including major pairs like EUR/USD and GBP/USD, minor crosses, and exotic currency combinations. Numera International says it's a technology-driven platform that delivers competitive trading conditions. But specific details about their trading platform technology, infrastructure partnerships, or their own systems are missing from public information, which raises questions about how open they are about their operations - this is central to this numera international review.

Even though they claim FSA regulation, checking this regulatory status has been problematic. Multiple sources question if these regulatory claims are real. The broker seems to focus mainly on regular forex traders who want access to international currency markets, though the company also claims to serve big institutions. The lack of detailed information about minimum account sizes, trading platform details, and fee structures suggests either limited openness or possibly incomplete services compared to established industry players.

Regulatory Region: Numera International claims registration in Saint Vincent and the Grenadines under Financial Services Authority oversight. However, multiple sources have raised big questions about whether this regulatory status is real, with some investigations suggesting these claims may be fake or misleading.

Deposit and Withdrawal Methods: Available information does not specify the payment methods that Numera International supports. This represents a big transparency gap that usually indicates either limited operational infrastructure or deliberate hiding of information about financial transactions.

Minimum Deposit Requirements: Specific minimum deposit amounts are not disclosed in available materials. User testimonials reference initial deposits of $2,000, suggesting this may be a typical entry threshold for new accounts.

Bonus and Promotional Offers: The broker has not publicly disclosed specific promotional campaigns or bonus structures. Some reports suggest they may use aggressive marketing tactics promising unrealistic returns to attract new depositors.

Tradeable Assets: The primary focus appears to be forex trading with access to over 50 currency pairs including major, minor, and exotic combinations. Details about other asset classes such as commodities, indices, or cryptocurrencies remain unspecified.

Cost Structure: Specific information about spreads, commissions, and other trading costs is not readily available. User feedback suggests potentially high costs and unfavorable trading conditions that contribute to rapid account deterioration.

Leverage Ratios: Leverage offerings are not specified in available documentation. This represents another area where the broker lacks transparency compared to industry standards for disclosure.

Platform Options: Details about specific trading platforms, whether their own or third-party solutions like MetaTrader, are not provided in accessible materials. This indicates potential limitations in technological infrastructure.

Geographic Restrictions: Information about restricted jurisdictions or regional limitations is not specified in available sources.

Customer Service Languages: Available customer support languages are not detailed in accessible materials. This numera international review notes big service quality concerns regardless of language options.

Detailed Scoring Analysis

Account Conditions Analysis (Score: 3/10)

The account conditions offered by Numera International present big concerns for potential traders. This is mainly because of the lack of transparency around basic account features. Available information does not clearly outline different account types, their features, or the specific benefits associated with various deposit levels. This lack of openness contrasts sharply with industry standards where reputable brokers provide detailed account specifications including spread types, commission structures, and additional services.

User feedback consistently shows problematic experiences with account management. This is particularly true regarding withdrawal processes and account accessibility. Several testimonials describe situations where accounts quickly moved into loss positions shortly after deposits, suggesting either poor risk management tools or potentially manipulative trading conditions. The absence of clear information about Islamic accounts, professional trading accounts, or other specialized products further indicates limited service diversity.

The account opening process, based on user reports, appears to focus on rapid deposit collection over proper client onboarding and education. This approach raises concerns about client suitability assessments and risk disclosure procedures. Multiple users report feeling pressured to make additional deposits when accounts moved into negative territory, suggesting account management practices that focus on revenue generation over client protection. This numera international review finds these practices inconsistent with reputable broker operations and representative of concerning industry practices.

Numera International's offerings in terms of trading tools and analytical resources appear limited based on available information. While the broker claims to provide access to multiple currency pairs, specific details about chart analysis tools, technical indicators, or market research capabilities are notably absent from public materials. This lack of transparency regarding analytical resources suggests either limited platform capabilities or insufficient investment in trader education and support tools.

The absence of detailed information about research and analysis resources represents a big shortcoming for traders who rely on market insights for decision-making. Reputable brokers typically provide economic calendars, market analysis, expert commentary, and educational webinars to support client trading activities. The lack of such offerings suggests Numera International may not focus on trader education or long-term client success, focusing instead on deposit acquisition.

Educational resources, which are crucial for new traders entering the forex market, appear to be minimal or non-existent based on available information. This absence is particularly concerning given the broker's apparent targeting of retail investors who may lack extensive trading experience. The lack of automated trading support, copy trading features, or advanced order types further suggests limited technological infrastructure compared to established industry players.

Customer Service and Support Analysis (Score: 2/10)

Customer service quality represents one of the most significant weaknesses identified in user feedback about Numera International. Multiple testimonials describe poor responsiveness, inadequate problem resolution, and unprofessional handling of client concerns. Users report difficulty reaching support representatives and receiving meaningful assistance when facing account issues or withdrawal problems.

The lack of specified customer service channels in available materials suggests limited support infrastructure. This is concerning for traders who require timely assistance during market hours. Response times appear to be problematic based on user feedback, with many clients reporting delays in receiving replies to critical inquiries about their accounts or trading conditions.

Service quality issues extend beyond simple responsiveness to include fundamental problems with issue resolution capabilities. Users describe situations where customer service representatives were unable or unwilling to address legitimate concerns about account performance, withdrawal requests, or trading conditions. The absence of multilingual support information further suggests limited global service capabilities, which is problematic for an international broker claiming to serve diverse markets.

Trading Experience Analysis (Score: 3/10)

The trading experience provided by Numera International appears to be severely compromised based on extensive user feedback and reported performance issues. Multiple clients report rapid account deterioration following deposits, with some describing complete loss of invested funds within days of account opening. These patterns suggest either extremely poor execution quality, unfavorable trading conditions, or potentially manipulative practices designed to generate losses.

Platform stability and execution speed appear to be problematic areas. Specific technical performance data is not available in public sources. User reports suggest issues with slippage, requotes, and other execution problems that can significantly impact trading outcomes. The absence of detailed platform specifications makes it difficult to assess technological capabilities, but user experiences suggest substandard performance compared to industry norms.

Trading environment quality, including factors like spreads, liquidity, and market access, appears to be poor based on client testimonials. Users report unfavorable conditions that contribute to rapid account deterioration, suggesting either poor liquidity provider relationships or intentionally disadvantageous pricing structures. The lack of mobile trading experience information further indicates potential limitations in platform accessibility and functionality. This numera international review finds these trading experience issues to be substantial red flags for potential clients.

Trust and Reliability Analysis (Score: 2/10)

Trust and reliability concerns represent perhaps the most serious issues surrounding Numera International. Multiple sources question the fundamental legitimacy of the operation. The broker's claimed regulatory status with the Financial Services Authority in Saint Vincent and the Grenadines faces significant scrutiny, with several investigations suggesting these regulatory claims may be fabricated or misleading.

Fund safety measures are not clearly outlined in available materials. This is concerning given the importance of client fund segregation and protection in legitimate brokerage operations. The lack of transparency regarding client fund handling, insurance coverage, or segregation practices raises serious questions about financial security for deposited funds.

Company transparency is notably poor, with limited disclosure of key operational details, management information, or business practices. This lack of openness contrasts sharply with legitimate brokers who typically provide comprehensive information about their operations, regulatory compliance, and corporate structure. Industry reputation is severely damaged by numerous user testimonials describing the company as fraudulent, with multiple clients explicitly labeling it a "scam company" based on their experiences.

User Experience Analysis (Score: 3/10)

Overall user satisfaction with Numera International appears to be extremely low based on available feedback from multiple review platforms and testimonial sources. The main theme in user reviews centers on negative experiences, financial losses, and difficulties with basic account operations like withdrawals. This pattern of negative feedback suggests systemic issues with service delivery and client treatment.

Interface design and usability information is not available in public sources. The focus of user complaints on fundamental operational issues suggests that platform aesthetics are secondary to more serious concerns about functionality and reliability. The registration and verification process appears to be designed for rapid onboarding, potentially at the expense of proper client screening and education.

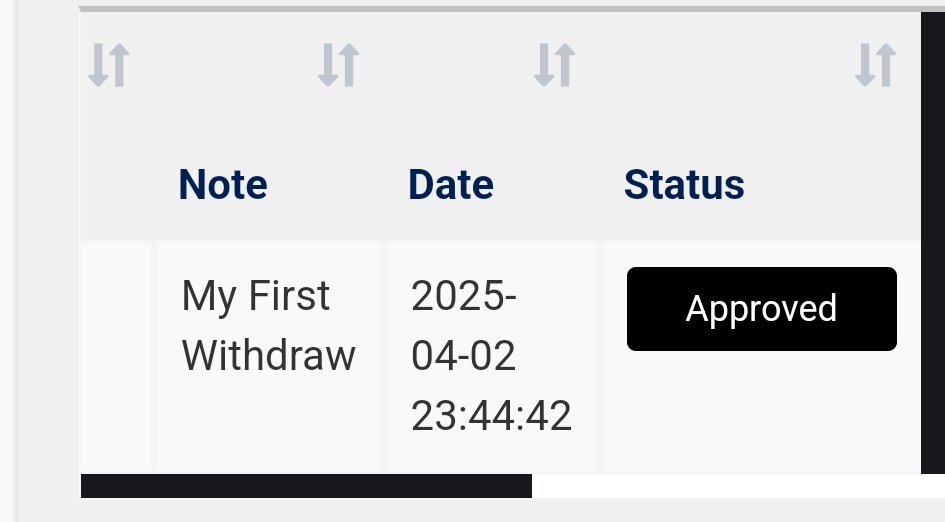

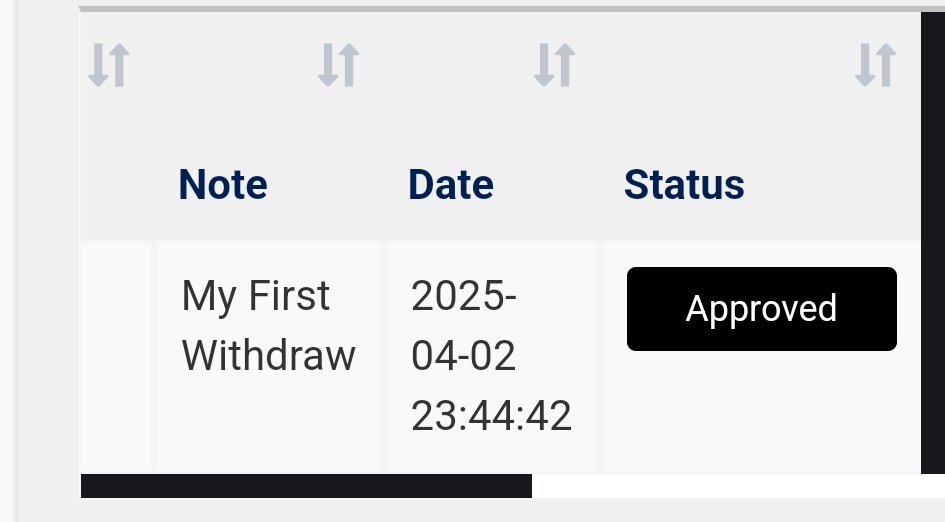

Fund operation experiences represent a major source of user dissatisfaction. Multiple reports describe withdrawal difficulties and delays. These issues suggest either inadequate financial infrastructure or intentional obstacles to fund access. Common user complaints center on rapid account losses, poor customer service, withdrawal problems, and lack of transparency regarding trading conditions. The user demographic appears to consist primarily of retail forex traders seeking accessible trading opportunities, though the experiences reported suggest these needs are not being met effectively.

Conclusion

This comprehensive numera international review reveals a forex broker with substantial operational and regulatory concerns that present significant risks for potential clients. The evidence suggests Numera International fails to meet basic industry standards for transparency, regulatory compliance, and client protection. Multiple red flags including questionable regulatory claims, poor user experiences, and widespread fraud allegations indicate this broker should be approached with extreme caution.

The analysis shows Numera International is not suitable for retail investors seeking reliable forex trading services. The combination of poor customer service, questionable trading conditions, and regulatory uncertainty creates an environment where client funds and trading success are at substantial risk. While the broker claims to offer access to multiple currency pairs, the operational problems and trust issues far outweigh any potential benefits.

Key disadvantages include unverified regulatory status, consistently negative user feedback, poor customer service quality, withdrawal difficulties, and lack of operational transparency. The absence of clear advantages, combined with serious legitimacy concerns, suggests potential clients should consider well-established, properly regulated alternatives for their forex trading needs.