ICFX 2025 In-Depth Review: Opportunity or Trap?

Executive Summary

ICFX, an unregulated forex broker, has presented itself as a potential trading partner for forex traders and others interested in financial instruments. Despite offering a variety of trading options, from forex to commodities and indices, their reputation is mired in significant concerns regarding reliability and trustworthiness. This review targets experienced traders who are cognizant of the risks involved with unregulated brokers and are keen on exploring different trading instruments through demo accounts.

However, the lack of regulatory oversight is a red flag that potential users must carefully consider. Many existing users have reported challenges with fund withdrawals, slow customer support responses, and an overall feeling of distrust towards the platform. In summary, while ICFX may offer attractive trading options, the accompanying risks may outweigh the potential benefits for many traders.

⚠️ Important Risk Advisory & Verification Steps

Risk Statement: Engaging with unregulated brokers like ICFX poses substantial risks to your trading capital and investment security.

Potential Harms:

- Vulnerability to fraud and scams.

- Difficulties in financial recovery in case of fund mishandling.

- Lack of legal recourse due to absence of regulatory framework.

Self-Verification Guide:

- Check Regulatory Status: Visit established financial regulatory authority websites to confirm broker registration, such as the FCA or ASIC.

- Read User Reviews: Look for feedback on multiple independent platforms to assess the reputation of the broker.

- Examine Business Practices: Investigate reports of fund withdrawal issues and understand the fee structures.

- Assess Communication: Test customer support responsiveness before committing capital.

Rating Framework

Broker Overview

Company Background and Positioning

Founded within the past two decades, ICFX operates out of Saint Vincent and the Grenadines, with its registration indicating a focus on international operations. The company claims to offer diverse trading instruments encompassing forex, commodities, and CFDs through the popular MetaTrader 4 platform. However, the absence of regulatory compliance raises substantial concerns regarding investor protection and trust. Many users have expressed skepticism toward ICFX due to its unregulated nature and the mixed reviews it has garnered over time.

Core Business Overview

ICFX provides a range of trading instruments, including forex, commodities, indices, and CFDs, targeting a global audience of traders. The company markets itself as being equipped for various trading needs with different account types available, including demo accounts for practice. Unfortunately, the lack of an official regulatory body overseeing its operations raises alarms about the safety of funds and ethical practices within its business model.

Quick-Look Details Table

In-depth Analysis of Each Dimension

Trustworthiness Analysis

The trustworthiness of ICFX is severely compromised by its unregulated status. Investors are urged to tread carefully when considering trading with a non-licensed broker. Engaging with such brokers can lead to significant uncertainties regarding the safety of trading funds.

Analysis of Regulatory Information Conflicts: The absence of any valid regulatory oversight poses critical risks for traders. As per various reports, ICFX does not adhere to required regulatory frameworks, drastically lowering its reliability in managing trader's funds.

User Self-Verification Guide: To ensure that you are trading with a legitimate broker, follow these steps:

Visit the website of the regulatory body pertinent to your country or region.

Search for the broker's name in their register to check for any valid licenses.

Review feedback and complaints about the broker on independent financial review sites.

Look for consistent information regarding the companys operational history.

Industry Reputation and Summary: User feedback has been primarily negative, often citing issues related to fund withdrawals and compliance failures, raising serious concerns about the integrity of ICFX as a broker.

Trading Costs Analysis

In terms of trading costs, they can exhibit a dual nature, enticing traders with low commissions while simultaneously concealing higher hidden fees.

Advantages in Commissions: ICFX claims to have a competitive commission structure; however, details regarding spreads and leverage are often vague or omitted altogether, leading to challenges in evaluating actual trading costs.

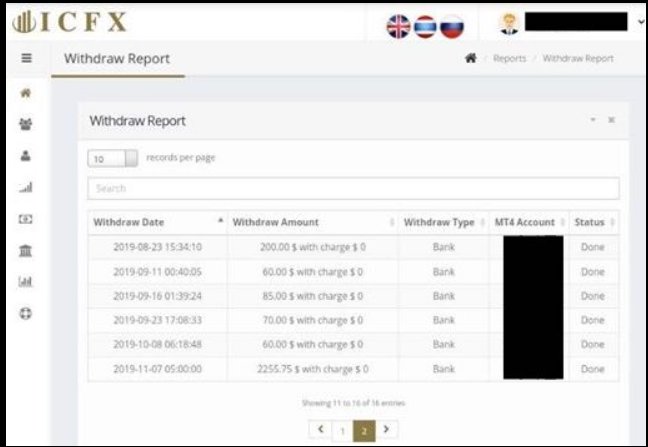

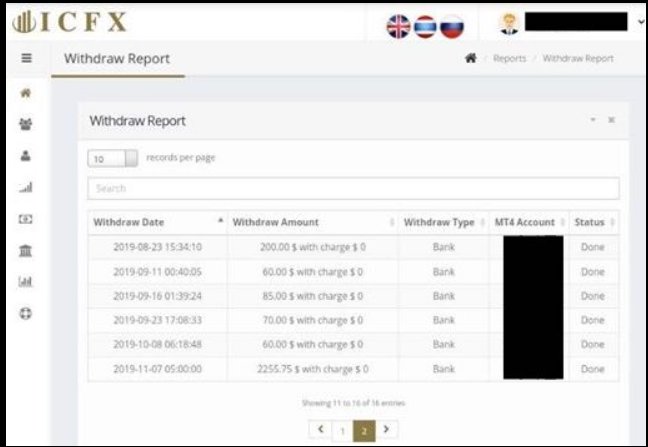

The "Traps" of Non-Trading Fees: High withdrawal fees pose significant drawbacks. Numerous complaints highlight excessive withdrawal charges, such as:

Withdrawal Fees reported by users ranged from $50 to $100, leading many to feel trapped in their investments.

- Cost Structure Summary: While commissions may appear low, the hidden fees associated with withdrawals can eliminate any perceived cost benefits, particularly for active traders who frequently withdraw funds.

ICFX provides access to the widely-used MetaTrader 4 platform, although its toolset is somewhat limited for serious traders.

Platform Diversity: ICFX offers the MT4 platform, popular among trader circles due to its user-friendly interface and charting capabilities, making it suitable for traders at all experience levels.

Quality of Tools and Resources: Educational materials and additional trading resources are lacking, leading to questions about the broker's commitment to supporting traders growth.

Platform Experience Summary: Users have generally reported mixed experiences, with some appreciating MT4's usability while others noted usability issues stemming from poor customer service.

User Experience Analysis

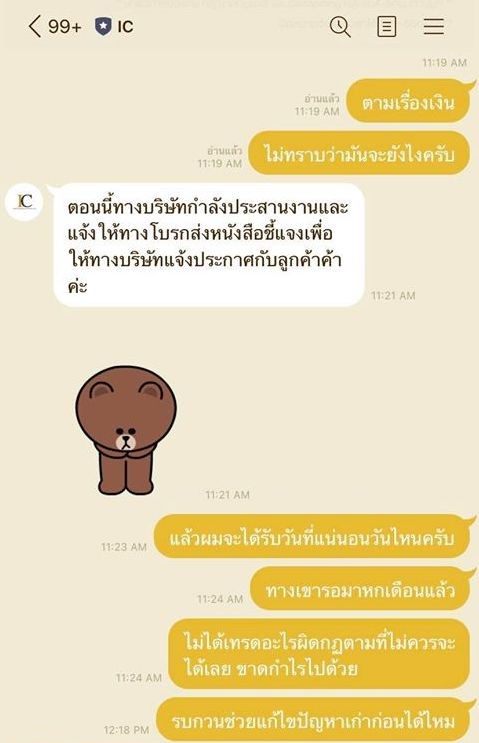

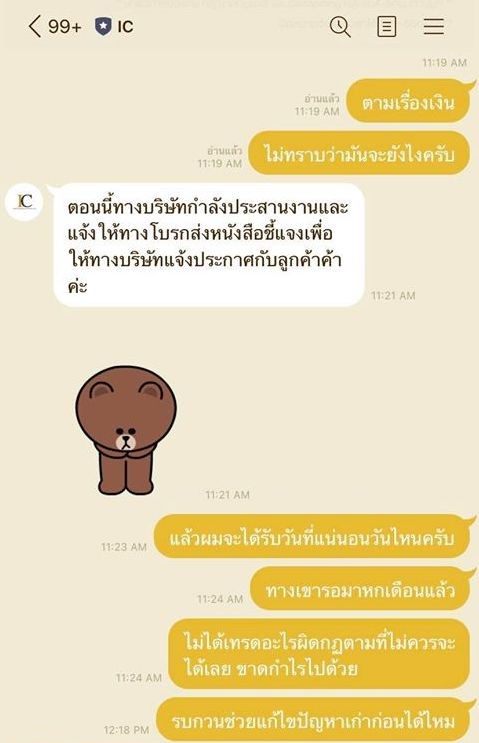

The overall user experience with ICFX is hampered by a variety of factors including technical issues and unsatisfactory customer support.

User Interface and Navigation: While the trading platform operates smoothly, the website is noted for being less intuitive, making it challenging for new users to navigate adequately.

Feedback on Experience: Feedback from users has varied, often oscillating between frustration over a lack of support and appreciation for trading opportunities.

Satisfaction Level Summary: A persistent theme across reviews indicates overall dissatisfaction among users, particularly concerning prompt support for issues encountered in trading activities.

Customer Support Analysis

Customer support is a pivotal consideration for any trading platform. ICFXs support structure has received critical feedback.

Support Channels Available: The broker offers support primarily via email, which has been cited as ineffective due to slow response times and unhelpful replies to user inquiries.

Response Times and Effectiveness: Users report considerable delays in responses, often echoing concerns over the broker's commitment to resolving issues amicably.

Customer Satisfaction Summary: With reports of inadequate support in resolving issues, overall customer satisfaction appears low, significantly detracting from the trading experience.

Account Conditions Analysis

The account conditions at ICFX reveal more concerning elements that potential users should carefully evaluate.

Minimum Deposit Requirements: The minimum deposit is set at $1,000, significantly higher than the industry standard, potentially serving as a barrier for less experienced traders.

Fee Structures Analysis: Accounts often feature high commission structures, raising questions about the overall cost of trading for the average user.

Account Variety and Accessibility: The lack of robust account choices leaves many users feeling disappointed as they do not meet the diverse needs expressed by potential traders.

Conclusion – A Cautious Outlook on ICFX

ICFX displays a vast array of trading instruments which can attract potential users. However, considerable risks emerge from its unregulated status, high withdrawal fees, and a plethora of negative user experiences. Novice traders should exercise extreme caution when considering engagement with this broker, ensuring thorough research into regulatory compliance and user feedback to protect their investments efficiently.

For experienced traders looking for a diverse trading platform, the potential exists, but the critical question remains: is the allure of ICFX worth the significant risks presented? Reviewers overwhelmingly suggest caution and recommend exploring regulated alternatives to safeguard trading capital.