BluechipFX 2025 Review: Everything You Need to Know

Executive Summary

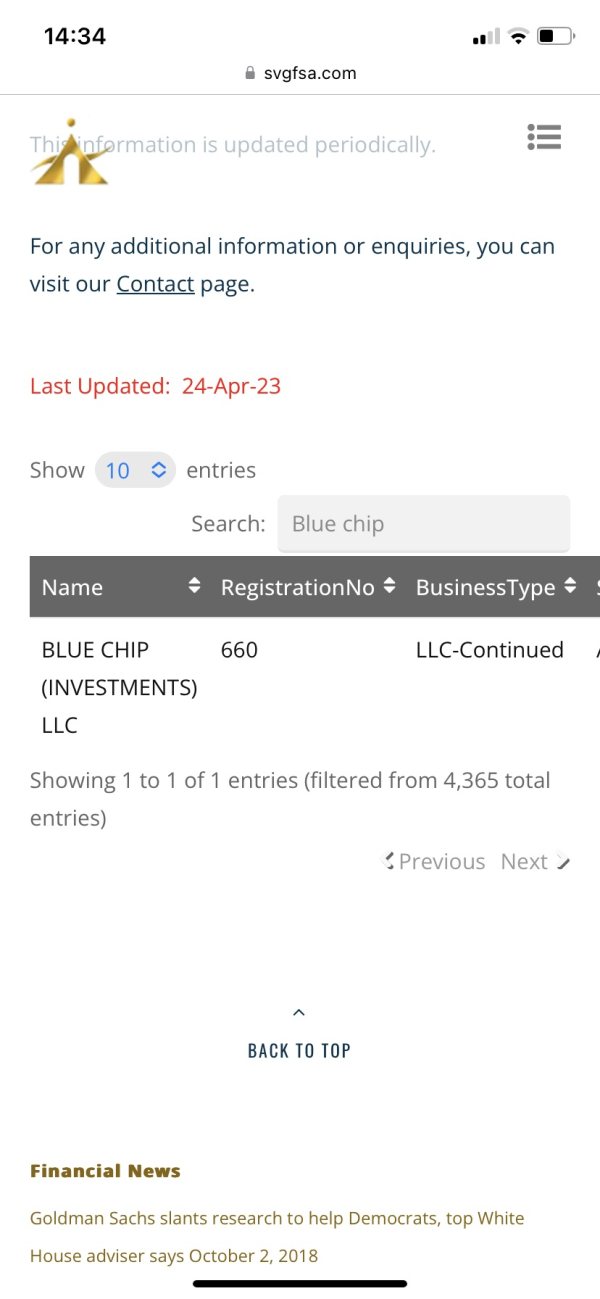

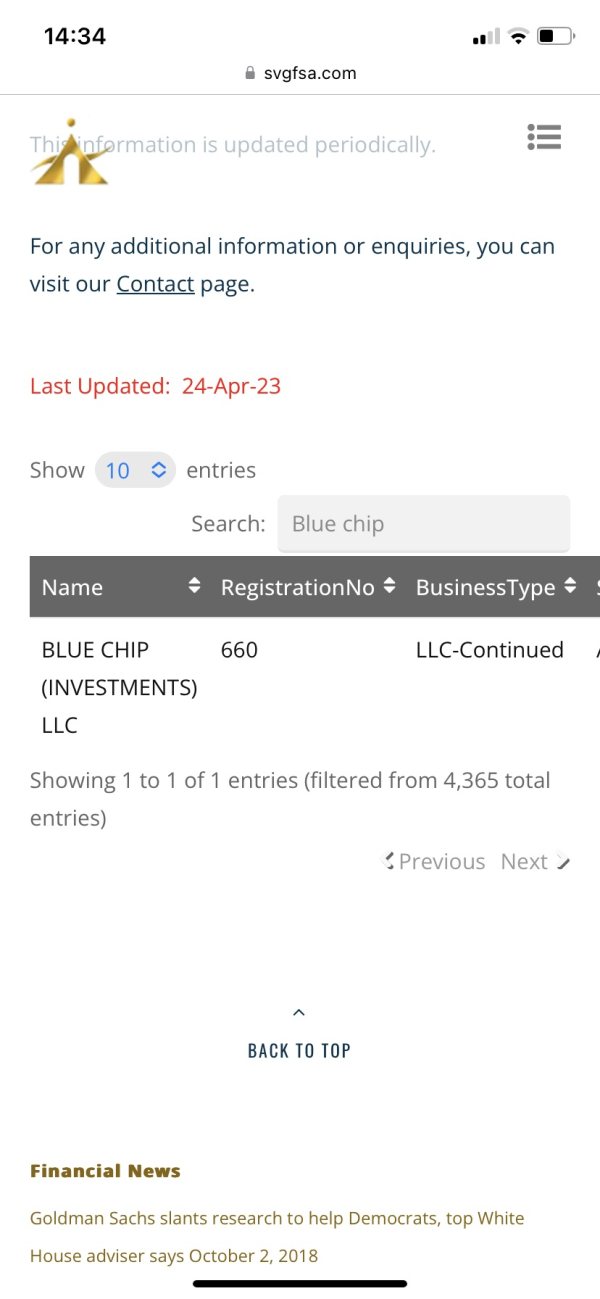

BluechipFX presents itself as a forex and CFD broker. This bluechipfx review reveals significant concerns that potential traders must carefully consider before making any investment decisions. The company was established in 2022 and registered in Saint Vincent and the Grenadines. It operates as an unregulated offshore entity, which immediately raises red flags for trader safety and fund security.

The broker offers high leverage up to 1:400. It also provides access to the MT5 trading platform across desktop, Android, and iOS devices. However, these features are overshadowed by extremely poor user ratings of 1/5 stars and numerous negative reviews highlighting serious operational issues that affect daily trading activities. According to available user feedback, traders report problems with fund accessibility, lack of trading history transparency, and poor customer service quality.

The primary target audience appears to be traders seeking high leverage opportunities. However, the lack of regulatory oversight and consistently negative user experiences make BluechipFX unsuitable for most trading scenarios. The combination of offshore registration, absence of regulatory supervision, and widespread user complaints creates an environment of significant risk for potential clients.

Important Notice

BluechipFX operates as an offshore broker entity registered in Saint Vincent and the Grenadines. Regulatory oversight is notably limited compared to major financial jurisdictions. This regulatory environment may significantly increase operational risks for traders, including potential challenges with fund security and dispute resolution.

This evaluation is based on publicly available information and user feedback collected from various review platforms. Given the limited transparency of offshore brokers and the absence of comprehensive regulatory filings, some operational details remain unclear or unverified.

Rating Framework

Broker Overview

BluechipFX entered the retail trading market in 2022. It operates as an offshore brokerage firm registered in Saint Vincent and the Grenadines. The company positions itself as a provider of forex and CFD trading services, targeting traders who seek high leverage opportunities in global financial markets. However, the broker's offshore registration and lack of meaningful regulatory oversight immediately distinguish it from established, regulated competitors in the industry.

The business model centers around providing access to international financial markets through leveraged trading products. The absence of regulatory supervision creates uncertainty about operational standards and client fund protection measures. Unlike brokers regulated by major authorities such as the FCA, CySEC, or ASIC, BluechipFX operates without the consumer protection frameworks that regulated entities must maintain.

This bluechipfx review reveals that the broker offers MT5 platform access across multiple devices. The platform supports desktop applications as well as Android and iOS mobile trading. The platform provides access to various financial instruments including forex pairs and CFDs, with leverage ratios reaching up to 1:400. However, the technical offerings alone cannot compensate for the fundamental concerns surrounding regulatory status and user satisfaction levels that define the overall trading environment.

Regulatory Status: BluechipFX operates as an unregulated offshore company registered in Saint Vincent and the Grenadines. The broker has not disclosed any specific regulatory licenses or oversight from recognized financial authorities. This creates significant uncertainty about compliance standards and consumer protection measures.

Deposit and Withdrawal Methods: Specific information about available deposit and withdrawal options is not detailed in available materials. This itself raises transparency concerns for potential clients.

Minimum Deposit Requirements: The broker has not clearly disclosed minimum deposit amounts in publicly available information. This makes it difficult for traders to assess account accessibility.

Bonus and Promotions: No specific promotional offers or bonus structures are mentioned in available broker materials.

Tradeable Assets: BluechipFX provides access to forex currency pairs and CFDs across various asset classes. Detailed instrument lists are not comprehensively disclosed.

Cost Structure: The broker operates on a variable spread model without clearly disclosed commission structures. This lack of transparency makes it challenging for traders to accurately calculate trading costs.

Leverage Ratios: Maximum leverage reaches 1:400. This is notably high and may appeal to traders seeking significant position sizing relative to account balance.

Platform Options: MT5 trading platform is available across desktop, Android, and iOS devices. It provides basic technical analysis and order execution capabilities.

Geographic Restrictions: Specific regional restrictions are not clearly outlined in available materials.

Customer Support Languages: Available support language options are not specified in publicly accessible information.

This bluechipfx review highlights the concerning lack of transparency in basic operational details. Reputable brokers typically disclose these clearly.

Detailed Rating Analysis

Account Conditions Analysis (3/10)

BluechipFX offers three different live account types. The lack of detailed information about account specifications significantly hampers evaluation. The broker's failure to clearly disclose minimum deposit requirements, account features, and specific trading conditions creates immediate transparency concerns that affect the overall account offering quality.

The high leverage ratio of 1:400 may attract traders seeking maximum position sizing capabilities. This feature comes without the regulatory protections typically associated with such offerings from licensed brokers. Variable spreads are mentioned without specific ranges or typical market conditions, making cost assessment difficult for potential clients.

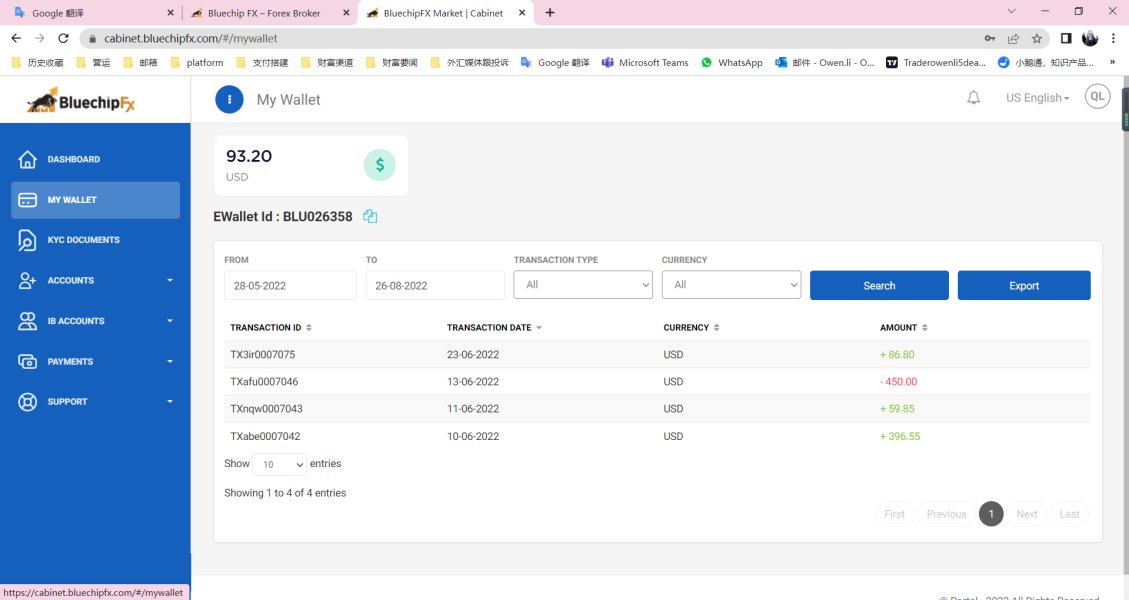

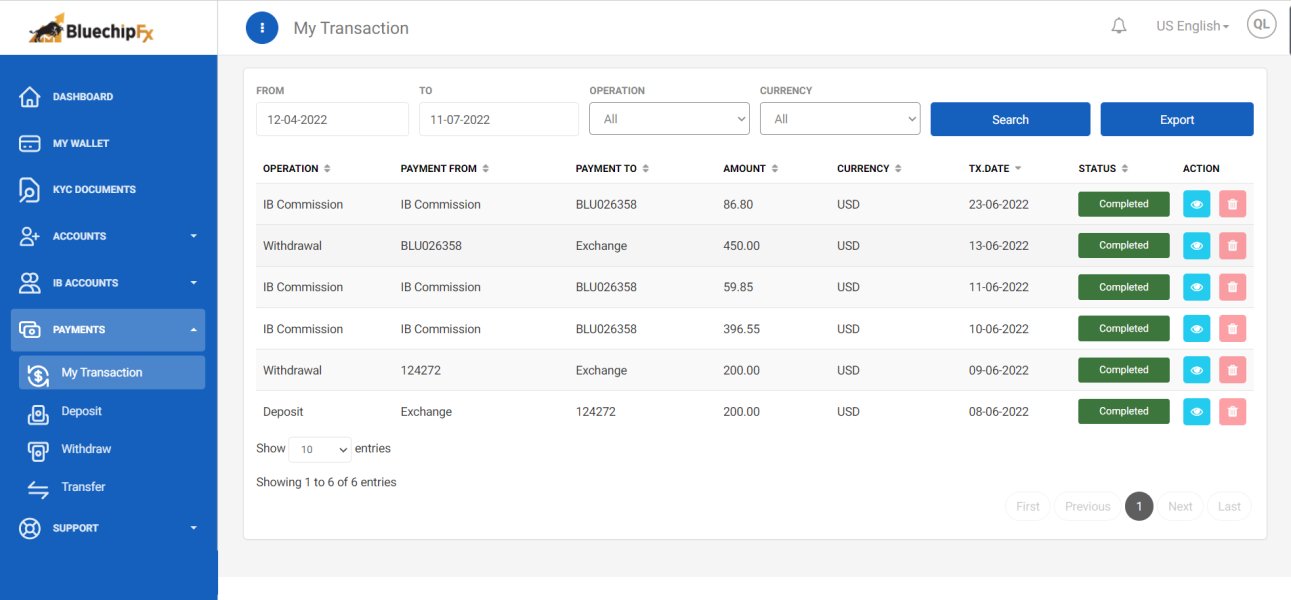

User feedback consistently highlights problems with account functionality. Traders particularly report issues regarding access to trading history and fund visibility. According to available reviews, traders report sudden inability to view account balances and trading records, which represents fundamental operational failures that no reputable broker should exhibit.

The absence of information about Islamic accounts, demo account features, or account upgrade pathways further demonstrates the limited scope of account services. This bluechipfx review finds that while high leverage may seem attractive, the overall account conditions suffer from poor transparency and operational reliability issues. These problems significantly impact the trading environment quality.

The broker provides access to the MT5 trading platform. This platform offers standard technical analysis tools and automated trading capabilities through Expert Advisors. The platform's availability across desktop, Android, and iOS devices ensures basic accessibility for traders who prefer different operating environments.

BluechipFX claims to offer various tradeable financial instruments including forex and CFDs. Detailed instrument specifications, contract sizes, and trading hours are not comprehensively disclosed. This lack of detail makes it difficult for traders to fully understand available opportunities and plan trading strategies effectively.

Research and analysis resources appear limited based on available information. The broker does not prominently feature market analysis, economic calendars, or educational materials that established brokers typically provide to support trader decision-making. This absence of value-added resources limits the overall trading environment quality.

Educational resources are notably absent from publicly available information. This is concerning for traders who rely on broker-provided learning materials. The lack of webinars, tutorials, or market insights suggests minimal commitment to client development and education, which are standard offerings among reputable brokers in the competitive forex market.

Customer Service and Support Analysis (4/10)

BluechipFX advertises 24/5 customer support availability. User feedback reveals significant quality concerns that undermine the value of extended support hours. The mere availability of support channels becomes meaningless when service quality fails to meet basic professional standards.

User reviews consistently report poor customer service experiences. Complaints include unresponsive support staff and inadequate problem resolution. Traders describe difficulties in obtaining clear answers about account issues, fund accessibility problems, and platform functionality concerns, suggesting systematic customer service deficiencies.

The lack of clearly disclosed contact methods creates additional barriers for clients seeking assistance. This includes specific phone numbers, email addresses, or live chat availability. Professional brokers typically provide multiple, easily accessible contact options with clear response time expectations.

Language support options are not specified. This may limit accessibility for international clients. Given the broker's offshore status and apparent targeting of global markets, the absence of multilingual support information suggests limited international service capabilities that could affect client communication quality.

Trading Experience Analysis (3/10)

User feedback reveals significant concerns about the fundamental trading experience with BluechipFX. Multiple reviews highlight problems with platform reliability, including sudden loss of access to trading history and account balance information. This represents critical operational failures that directly impact trader confidence and decision-making ability.

The MT5 platform itself provides standard functionality. User reports suggest implementation issues that affect performance quality. Traders describe problems with order execution, platform stability, and data accuracy that undermine the technical advantages typically associated with the MT5 platform.

Spread stability and execution quality appear problematic based on available user feedback. Traders report issues with slippage and requoting that suggest poor liquidity management or unfavorable execution practices. These problems can significantly impact trading profitability and strategy effectiveness.

Mobile trading experience receives negative feedback from users who report app performance issues and limited functionality compared to desktop versions. Given the importance of mobile trading in modern forex markets, these technical limitations represent significant disadvantages for traders who require reliable mobile access.

This bluechipfx review finds that despite offering a recognized trading platform, the overall trading experience suffers from fundamental operational and technical issues. These problems prevent effective market participation.

Trustworthiness Analysis (1/10)

The absence of regulatory oversight represents the most significant trustworthiness concern with BluechipFX. Operating without licenses from recognized financial authorities means traders have no regulatory recourse or protection frameworks. Legitimate brokers must maintain these frameworks for client safety.

Fund security measures are not clearly disclosed. This creates uncertainty about client money protection and segregation practices. Regulated brokers typically maintain detailed disclosures about client fund handling, insurance coverage, and segregation procedures that BluechipFX has not provided.

Company transparency is severely limited. There is minimal disclosure about corporate structure, management team, or operational procedures. The lack of detailed company information makes it impossible for traders to assess the organization's stability, experience, or commitment to professional standards.

The extremely low user rating of 1/5 stars reflects widespread client dissatisfaction. It suggests systematic operational problems that extend beyond isolated incidents. Such consistently negative feedback patterns indicate fundamental business practice issues that affect trustworthiness and operational reliability.

User complaints about fund accessibility and account transparency represent the most serious trustworthiness concerns. These issues directly impact client financial security and broker integrity.

User Experience Analysis (2/10)

The overall user satisfaction rating of 1/5 stars represents one of the lowest possible scores in the industry. It reflects widespread client dissatisfaction across multiple operational areas. Such consistently negative feedback suggests systematic failures in service delivery and client relationship management.

User interface design and platform usability receive criticism from traders who report confusing navigation, limited functionality, and poor overall design quality. These interface issues create barriers to effective trading and contribute to overall user frustration with the service experience.

Registration and verification processes are not clearly documented. User feedback suggests complications and delays that create negative first impressions for new clients. Efficient onboarding processes are essential for positive user experiences, and problems in this area affect overall service perception.

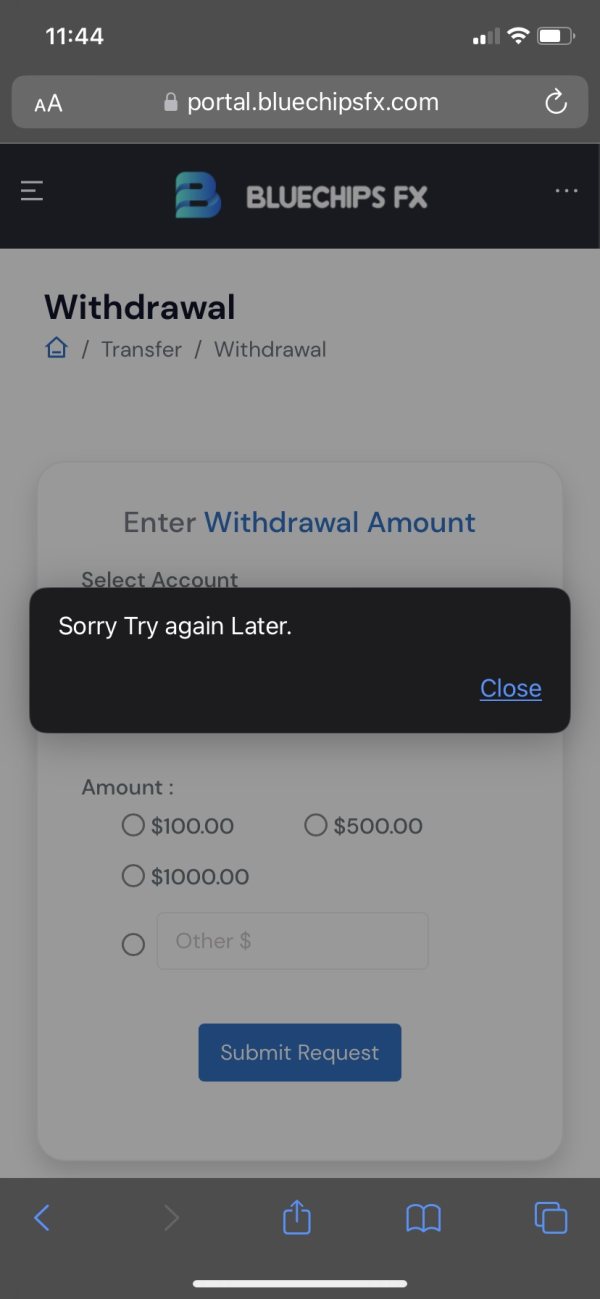

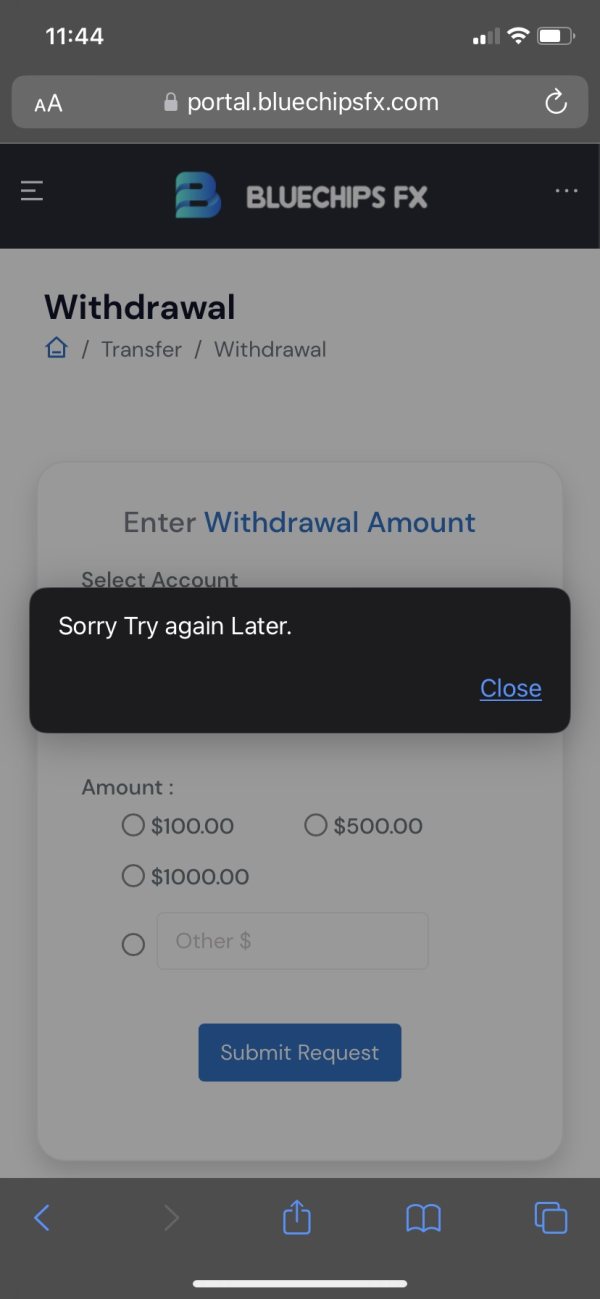

Fund operation experiences represent the most serious user experience concerns. Multiple reports describe difficulties accessing account balances and withdrawal processing problems. These fundamental operational issues create stress and uncertainty that no professional trading environment should impose on clients.

Common user complaints center on transparency issues, fund accessibility problems, and poor customer service quality. The consistency of these complaints across multiple review sources suggests systematic operational deficiencies rather than isolated incidents. This indicates fundamental business practice problems that affect the entire client experience.

Conclusion

This comprehensive bluechipfx review reveals a broker with significant operational and regulatory concerns. These issues make it unsuitable for most trading scenarios. While BluechipFX offers high leverage ratios up to 1:400 and MT5 platform access, these features cannot compensate for the fundamental issues surrounding regulatory oversight, operational transparency, and user satisfaction.

The broker's unregulated offshore status, combined with consistently negative user feedback and lack of transparency in basic operational details, creates an environment of substantial risk for potential clients. The absence of regulatory protection frameworks means traders have limited recourse for dispute resolution or fund recovery in case of problems.

BluechipFX is not recommended for new traders, conservative investors, or anyone prioritizing fund security and regulatory protection. The combination of poor user ratings, operational transparency issues, and unregulated status makes this broker unsuitable for serious trading activities. Traders should consider regulated alternatives in the competitive forex market.