FinmaxFX 2025 In-Depth Review: Opportunity or Trap?

Executive Summary

FinmaxFX is an online broker that positions itself as a beginner-friendly trading platform with a low minimum deposit requirement of $250. While it offers a diverse range of trading instruments, including forex and CFDs, potential investors must navigate a landscape marked by mixed reviews regarding its reliability and customer service, particularly in relation to withdrawal processes. The regulatory framework surrounding FinmaxFX is multi-faceted, with licensing from the Vanuatu Financial Services Commission (VFSC) and the International Financial Market Relations Regulation Center (IFMRRC). This review provides a comprehensive analysis, enabling traders to make informed decisions while discussing inherent risks.

⚠️ Important Risk Advisory & Verification Steps

Investors should approach FinmaxFX with caution. Here are some critical steps to verify the brokers legitimacy:

- Research Regulatory Standing:

- Check for updates on the VFSC and IFMRRC websites.

- User Reviews:

- Look for recent trader experiences highlighted on platforms like Trustpilot or broker review sites.

- Test Withdrawal Processes:

- Establish clear expectations regarding withdrawal timelines and fees.

- Assess Security Features:

- Verify data protection measures like SSL encryption on its website.

Broker Overview

Company Background and Positioning

FinmaxFX was founded in 2015 and operates under Max Capital Limited. Headquartered in Vanuatu, the broker is overseeing by the VFSC and the IFMRRC, aiming to instill confidence in clients. Despite these regulatory affiliations, concerns over the broker's overall reliability persist, especially given reports of inconsistent customer service and withdrawal difficulties.

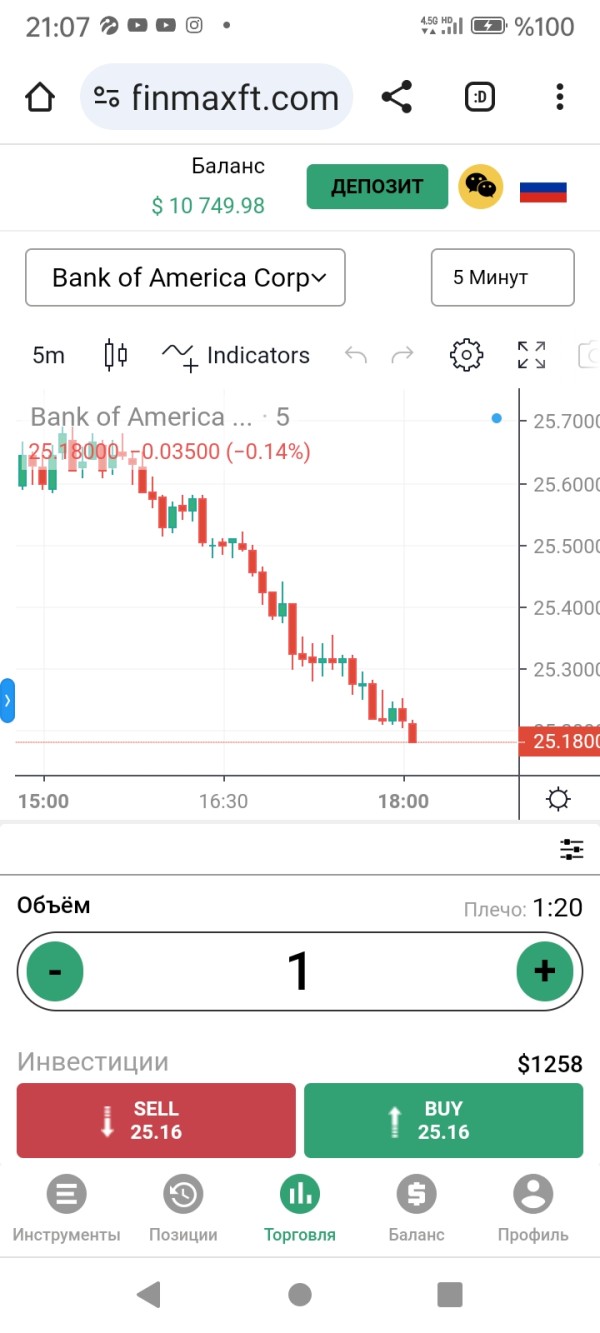

Core Business Overview

FinmaxFX mainly offers trading in forex and CFDs, making available approximately 400 assets across various financial markets including commodities, stocks, and cryptocurrencies. It emphasizes providing user-friendly access through the popular Metatrader 5 platform, catering to traders at different skill levels.

Quick-Look Details Table

In-depth Analysis of Each Dimension

Trustworthiness Analysis

The trustworthiness of FinmaxFX can be assessed through several key points.

The broker is governed by two regulatory bodies, but there are conflicting perceptions regarding the effectiveness of their oversight. The VFSC, although valid, is often criticized for its leniency in regulation, while the IFMRRC, despite its name, does not have rigorous enforcement capabilities, raising doubts about the overall security of deposits.

To ensure your interests are protected, potential clients can follow these steps to verify FinmaxFX's regulatory compliance:

- Visit the official VFSC website to check current licenses.

- Review the IFMRRC website for any updates on compliance.

- Conduct independent research on customer complaints related to funds and withdrawals.

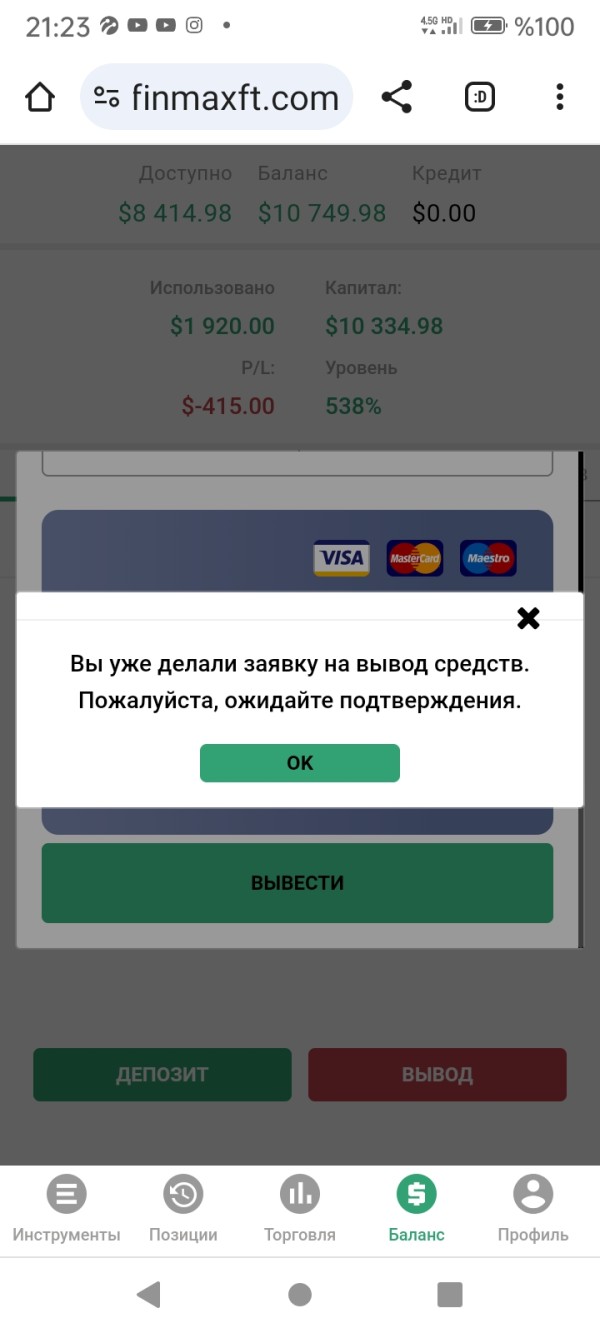

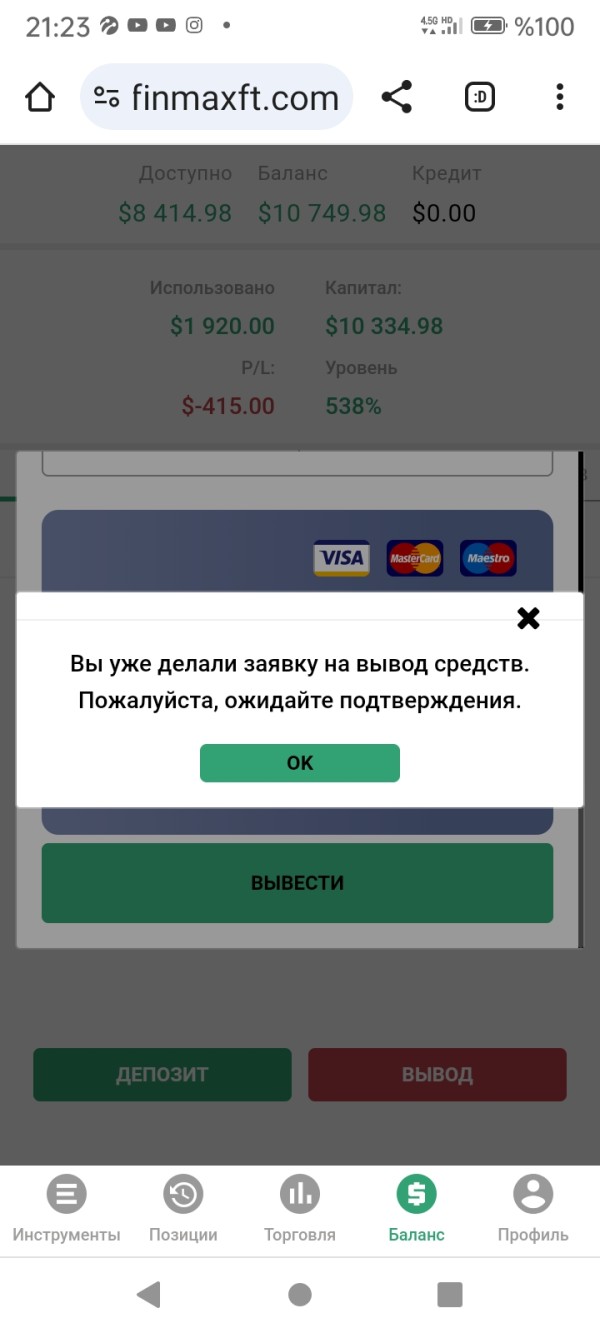

User feedback indicates a growing concern about the safety of funds at FinmaxFX. Recommendations include performing due diligence by reading up-to-date reviews from independent platforms.

Trading Costs Analysis

FinmaxFX presents a dual nature concerning trading costs.

On the positive side, the commission structure provides competitive spreads starting from 3 pips, appealing to newcomer traders. However, users have signaled “traps” through hidden fees:

"I faced $25 charges just to withdraw my funds!"

High withdrawal fees for certain payment methods can complicate profitability for active traders, particularly on lower account tiers.

Analyzing overall costs can paint a clearer picture practically for various user types. While beginner traders may value the low commissions on trades, they could be dissuaded by the potential transaction fees when cashing out.

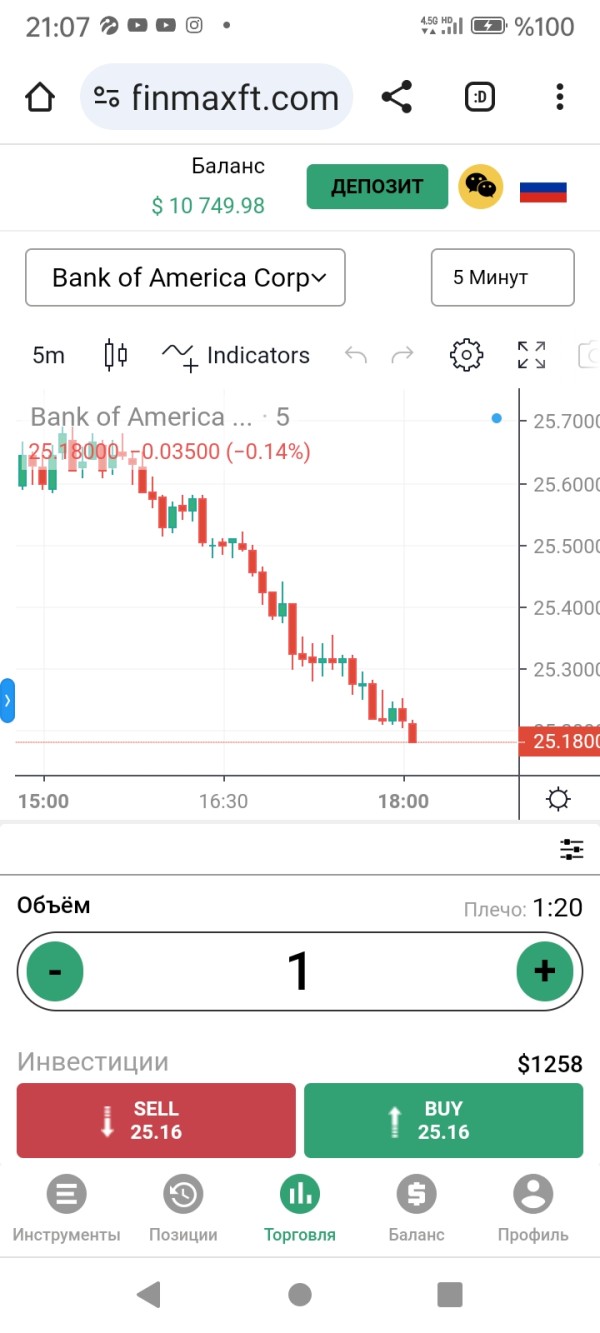

The analysis on platform diversity reveals that FinmaxFX leveraging Metatrader 5 is a pivotal strength.

This robust platform boasts of diverse features catered towards comprehensive market analysis, including real volume data and advanced charting tools, critical for multi-asset trading strategies.

Nonetheless, many users have noted issues with functionality, particularly on the mobile app, distorting what should be the seamless experience expected from such a comprehensive trading environment.

"Their app does not seem to sync orders quickly," was a common user frustration.

In assessing platform experience, user feedback highlights a mixed bag of usability versus technical reliability.

User Experience Analysis

User experiences can often serve as significant indicators of a broker's effectiveness.

FinmaxFX has received a blend of reviews, with many users praising its user-friendly interface in accessing the trading platform. However, dissatisfaction frequently arises from slow response times in customer support and unfulfilled expectations regarding immediate assistance.

The experience a trader receives can considerably affect overall trading success, as relying on prompt resolutions is critical.

Customer Support Analysis

The level of service rendered by the customer support department has been a recurring theme of critique for FinmaxFX.

Users report diminished responsiveness:

"Whenever I reached out for support, it took days to get a reply."

Available through live chat, email, or phone, the multilingual support service offers a glimmer of accessibility but has been overall seen as sluggish, especially in addressing urgent transactions or account inquiries.

Account Conditions Analysis

FinmaxFX offers a diverse range of account types:

- Micro account: Starts with a minimum deposit of $250 and provides access to basic features.

- VIP account: Requires a minimum deposit of $100,000, unlocking significant advantages such as lower spreads and enhanced withdrawal conditions.

While these varied options cater to multiple trading styles, the fees associated with withdrawals—particularly for the lower tier accounts—could deter less experienced traders who may lack substantial capital.

Conclusion

In summary, FinmaxFX presents a tapestry of opportunities that appear well-suited for beginner forex and CFD traders due to the low initial deposit and a wide array of tradable instruments.

However, potential investors must navigate significant risks associated with mixed regulatory endorsements and user reviews that highlight issues related to withdrawal processes and customer support. As with any trading decision, substantial due diligence is advised while weighing the benefits against the inherent risks. Whether FinmaxFX is indeed an opportunity or a trap ultimately hinges on the traders specific requirements and risk appetite.