Is ICFX safe?

Pros

Cons

Is Icfx Safe or Scam?

Introduction

Icfx is a forex broker that claims to provide a wide range of trading services, including forex, commodities, and cryptocurrencies. Positioned in the competitive landscape of online trading, Icfx aims to attract both novice and experienced traders with its promises of low spreads and high leverage. However, as the forex market continues to grow, so do the risks associated with unregulated brokers. Consequently, traders must exercise caution and conduct thorough due diligence before engaging with any brokerage. This article investigates whether Icfx is a safe trading platform or if it poses potential risks to investors. Our analysis is based on a comprehensive review of the broker's regulatory status, company background, trading conditions, customer experiences, and more.

Regulation and Legitimacy

The regulatory status of a forex broker is crucial to understanding its legitimacy and the level of protection it offers to traders. In the case of Icfx, multiple sources indicate that it operates without proper regulation. This lack of oversight raises significant concerns regarding the safety of traders' funds and the fairness of the broker's practices.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of a valid license from reputable regulatory authorities such as the Financial Conduct Authority (FCA) in the UK or the Australian Securities and Investments Commission (ASIC) suggests that Icfx does not adhere to industry standards for transparency and accountability. Moreover, the broker has been flagged by various financial watchdogs as potentially fraudulent, further solidifying the argument that Icfx is not safe.

The quality of regulation plays a vital role in determining the safety of a trading environment. Well-regulated brokers are required to maintain segregated accounts, ensuring that clients' funds are kept separate from operational funds. This is not the case with Icfx, as it lacks any regulatory oversight, making it difficult for traders to recover their funds in case of disputes.

Company Background Investigation

Icfx claims to be a well-established broker, but a closer look reveals a lack of verifiable information regarding its history and ownership structure. The company presents itself as being registered in the United Kingdom; however, it does not appear in any official registries, raising questions about its legitimacy.

The management team behind Icfx is also shrouded in mystery, with limited information available about their qualifications and experience in the financial sector. Transparency is a critical factor for traders when choosing a broker, and Icfx falls short in this regard. The absence of detailed company information and the lack of a clear ownership structure contribute to the perception that Icfx is a scam.

Moreover, the broker's website does not provide adequate information about its operational history or any affiliations with reputable financial institutions. This lack of transparency can be a red flag for potential investors, indicating that they may be dealing with an untrustworthy entity.

Trading Conditions Analysis

When evaluating a forex broker, understanding the trading conditions is essential. Icfx advertises low spreads and high leverage, which can be appealing to traders. However, the absence of clear information regarding the fee structure raises concerns.

| Fee Type | Icfx | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1-2 pips |

| Commission Model | Not Disclosed | $3-7 per lot |

| Overnight Interest Range | Varies | Varies |

The lack of transparency regarding commission rates and other fees can lead to unexpected costs for traders. Additionally, the broker's claims of offering high leverage can be misleading, especially for inexperienced traders who may not fully understand the risks involved. High leverage can amplify both gains and losses, making it a double-edged sword.

Moreover, there are reports of hidden fees and unfavorable trading conditions, which could significantly impact a trader's profitability. This lack of clarity in trading conditions is a critical factor for assessing whether Icfx is safe or if it poses risks to investors.

Customer Fund Safety

The security of customer funds is a paramount concern for any trader. In the case of Icfx, the absence of regulatory oversight raises serious questions about the safety of deposited funds. Without proper regulation, there are no guarantees that traders' funds are protected or segregated.

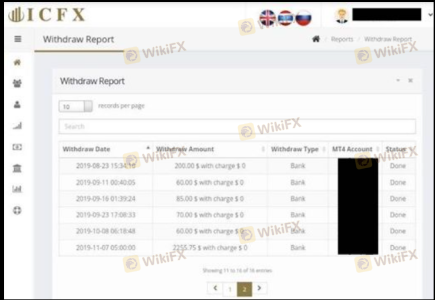

Icfx has not disclosed any information regarding investor protection schemes or negative balance protection policies. This lack of information is troubling, as it leaves traders vulnerable to potential losses without any safety net. Furthermore, there have been reports of difficulties in withdrawing funds from Icfx, which is a common issue with unregulated brokers.

The historical context of the broker's operations also raises concerns. Reports of past disputes and unresolved complaints indicate that Icfx may not prioritize customer satisfaction or fund security. These factors collectively suggest that Icfx is not a safe option for traders looking to secure their investments.

Customer Experience and Complaints

Customer feedback is an essential component of evaluating a forex broker. In the case of Icfx, numerous complaints have surfaced regarding withdrawal issues, lack of customer support, and poor trading conditions.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Unresponsive |

| Poor Customer Support | Moderate | Inconsistent |

| Misleading Information | High | No Clear Response |

Many users report being unable to withdraw their funds, with the company often citing vague reasons or imposing excessive fees. This pattern of behavior is a significant red flag, as it indicates that Icfx may be engaging in practices typical of fraudulent brokers.

Additionally, the quality of customer support has been criticized, with many traders expressing frustration over long wait times and unhelpful responses. These issues contribute to a negative overall experience for customers and further reinforce the notion that Icfx is a scam.

Platform and Trade Execution

The trading platform offered by Icfx is a critical component of the trading experience. While the broker claims to provide a user-friendly interface, there are reports of performance issues, including slow execution times and high slippage rates.

Traders have expressed concerns about the reliability of the platform, with many experiencing difficulties during high-volatility trading periods. Such issues can severely impact a trader's ability to execute trades effectively, leading to potential losses.

Moreover, there are indications that Icfx may manipulate trading conditions, which can further erode trust in the platform. Traders should be wary of any signs of manipulation, as this can severely compromise the integrity of their trading experience. The overall performance and reliability of the platform raise significant concerns about whether Icfx is safe for trading.

Risk Assessment

Engaging with Icfx presents various risks that traders must consider. The absence of regulatory oversight, combined with customer complaints and performance issues, creates a high-risk environment for investors.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Fund Security Risk | High | No segregation of funds |

| Execution Risk | Medium | Potential for slippage and delays |

| Customer Service Risk | High | Poor response to complaints |

Traders should approach Icfx with caution and be aware of the potential for significant financial loss. It is advisable to consider alternative, more reputable brokers that offer better regulatory protections and customer service.

Conclusion and Recommendations

In conclusion, the evidence suggests that Icfx is not a safe trading platform. The lack of regulatory oversight, combined with numerous customer complaints and performance issues, raises significant red flags for potential investors. Traders must be vigilant and conduct thorough research before engaging with any broker, especially one that lacks proper regulation.

For those considering trading with Icfx, it is advisable to seek alternative options that offer better security and transparency. Brokers with strong regulatory frameworks, positive customer feedback, and a commitment to fund safety should be prioritized. By choosing a reputable broker, traders can mitigate risks and enhance their trading experience.

Is ICFX a scam, or is it legit?

The latest exposure and evaluation content of ICFX brokers.

ICFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ICFX latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.