Regarding the legitimacy of PRCBroker forex brokers, it provides CYSEC, VFSC and WikiBit, (also has a graphic survey regarding security).

Is PRCBroker safe?

Software Index

Risk Control

Is PRCBroker markets regulated?

The regulatory license is the strongest proof.

CYSEC Forex Execution License (STP) 17

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

RegulatedLicense Type:

Forex Execution License (STP)

Licensed Entity:

Performance Ronnaru Company Ltd

Effective Date:

2014-10-30Email Address of Licensed Institution:

prc@cytanet.com.cySharing Status:

No SharingWebsite of Licensed Institution:

www.prcbroker.com, www.prcmarkets.comExpiration Time:

--Address of Licensed Institution:

7B Andrea Papakosta street, Palouriotissa,1037 Nicosia, CyprusPhone Number of Licensed Institution:

+357 22 250 328Licensed Institution Certified Documents:

VFSC Derivatives Trading License (EP)

Vanuatu Financial Services Commission

Vanuatu Financial Services Commission

Current Status:

Offshore RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

Performance Ronnaru Capital Ltd

Effective Date:

2022-12-20Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is PRCBroker A Scam?

Introduction

PRCBroker, established in 2014 and headquartered in Cyprus, is a forex and CFD broker that caters primarily to institutional clients and professional traders. With a focus on providing a robust trading environment, PRCBroker offers various financial instruments, including forex, precious metals, crude oil, and stocks. However, the forex market is rife with potential scams and unreliable brokers, making it crucial for traders to conduct thorough evaluations before committing their funds. This article aims to explore the legitimacy of PRCBroker through a structured assessment framework, covering its regulatory status, company background, trading conditions, customer safety measures, client experiences, platform performance, and overall risk assessment.

Regulation and Legitimacy

Understanding a broker's regulatory status is essential for assessing its legitimacy. PRCBroker operates under the supervision of two primary regulatory bodies: the Cyprus Securities and Exchange Commission (CySEC) and the Vanuatu Financial Services Commission (VFSC). The CySEC is a well-regarded regulatory authority in the European Union, known for enforcing strict compliance standards for financial firms.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| CySEC | 253/14 | Cyprus | Verified |

| VFSC | 14788 | Vanuatu | Verified |

CySEC's regulations require brokers to maintain segregated client accounts and hold a minimum capital of €730,000, which enhances client fund protection. Additionally, as a member of the Investor Compensation Fund (ICF), clients are entitled to compensation of up to €20,000 in case of broker insolvency. However, the VFSC, while providing oversight, is often considered less stringent than CySEC, which raises questions about the robustness of the regulatory framework for international clients.

The historical compliance of PRCBroker with these regulations is crucial. While there are no significant historical compliance issues reported, the dual regulatory structure does present a mixed picture. Traders should weigh the benefits of CySEC's oversight against the more lenient standards of the VFSC when considering the safety of their investments.

Company Background Investigation

Founded in 2014, PRCBroker is operated by Performance Ron Naru Company Ltd, with a focus on providing a range of trading services. The company's ownership structure is straightforward, with no complex layers that could obscure accountability. The management team comprises professionals with extensive backgrounds in finance and trading, which adds a layer of credibility to the operation.

However, the transparency of the company's operations raises some concerns. While PRCBroker provides essential information about its services on its website, there is a notable lack of detailed disclosures regarding its ownership and management team. This lack of transparency can be a red flag for potential investors who seek to understand the people behind the broker.

Trading Conditions Analysis

PRCBroker's trading conditions are pivotal in determining its attractiveness to traders. The broker offers a minimum deposit requirement of $500 for standard accounts and a significantly higher amount of $50,000 for ECN accounts. This high entry barrier may deter many retail traders.

The overall fee structure includes variable spreads, with typical spreads reported at around 2 pips for major currency pairs. However, the absence of a clear commission structure raises questions about the total cost of trading with PRCBroker.

| Fee Type | PRCBroker | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 2 pips | 1.5 pips |

| Commission Model | Not disclosed | Varies |

| Overnight Interest Range | Not disclosed | Varies |

The lack of transparency regarding commissions and overnight fees is a concern. Many brokers clearly outline their fee structures, allowing traders to calculate potential costs accurately. This ambiguity may lead to unexpected costs, particularly for high-frequency traders.

Client Fund Security

Client fund security is paramount in the trading industry. PRCBroker implements several measures to safeguard client funds, including segregated accounts that ensure client deposits are kept separate from the broker's operating funds. This practice minimizes the risk of loss in the event of the broker's financial difficulties.

Additionally, PRCBroker offers negative balance protection, which prevents clients from losing more than their deposited funds. This feature is particularly beneficial in volatile market conditions, where sudden price swings can lead to significant losses.

Despite these measures, it is essential to note that PRCBroker's offshore operations under the VFSC may not provide the same level of investor protection as its CySEC-regulated entity. Historical incidents of fund security breaches or client complaints should also be scrutinized. Currently, there are no major incidents reported, but potential clients should remain vigilant.

Customer Experience and Complaints

Customer feedback is a critical aspect of evaluating a broker's reliability. Reviews of PRCBroker indicate a mixed experience among users. While some customers commend the broker for its range of trading instruments and responsive customer support, others express dissatisfaction with the high minimum deposit requirements and the lack of transparency regarding trading conditions.

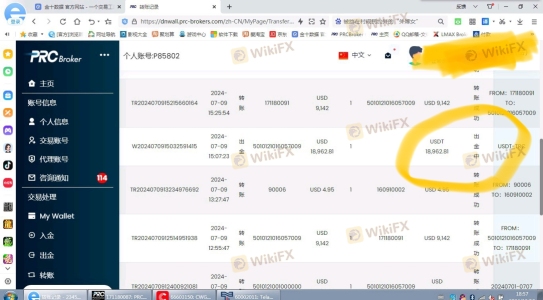

Common complaint patterns include issues related to withdrawal delays and unclear fee structures. The following table summarizes the primary complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Lack of Transparency | Medium | Limited information |

| High Minimum Deposit | Medium | Not addressed |

Typical cases involve clients reporting delays in processing withdrawals, which can significantly impact their trading experience. While PRCBroker has a customer support team available to address issues, the quality and speed of responses vary, leading to frustration among users.

Platform and Trade Execution

The performance of the trading platform is crucial for a seamless trading experience. PRCBroker offers both MetaTrader 4 (MT4) and MetaTrader 5 (MT5), which are widely regarded for their user-friendly interfaces and robust performance. However, user reviews suggest mixed experiences with platform stability and order execution.

Traders have reported instances of slippage and order rejections during high volatility, which can lead to significant trading losses. The following points summarize the platform's performance:

- Execution Quality: Generally good, but instances of slippage reported.

- Stability: Users have experienced occasional downtimes.

- User Experience: MT4 and MT5 platforms are well-received for their features but may lack some advanced functionalities compared to competitors.

Risk Assessment

Using PRCBroker involves several risks that potential traders should consider. These include regulatory risks associated with its offshore licensing, the high minimum deposit requirements, and the potential lack of transparency regarding fees and trading conditions.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | Medium | Offshore license may lack stringent oversight. |

| Financial Risk | High | High minimum deposit could deter retail traders. |

| Transparency Risk | Medium | Unclear fee structure may lead to unexpected costs. |

To mitigate these risks, traders should conduct thorough research, read user reviews, and consider starting with a smaller investment if they choose to proceed with PRCBroker.

Conclusion and Recommendations

In conclusion, PRCBroker presents a mixed picture for potential traders. While it is regulated by CySEC, which provides a level of credibility, the presence of an offshore license from the VFSC raises concerns about the robustness of investor protection. The high minimum deposit requirement and lack of transparency regarding fees further complicate the decision for retail traders.

While PRCBroker is not outright a scam, potential clients should approach with caution. It may be more suitable for experienced traders or institutional clients rather than beginners. For those seeking alternatives, brokers with clearer fee structures and more transparent operations, such as eToro or XM, may provide a more reliable trading environment. Always ensure to invest only what you can afford to lose and seek out brokers with a strong regulatory framework and good customer feedback.

Is PRCBroker a scam, or is it legit?

The latest exposure and evaluation content of PRCBroker brokers.

PRCBroker Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

PRCBroker latest industry rating score is 5.97, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 5.97 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.