MAR Review 1

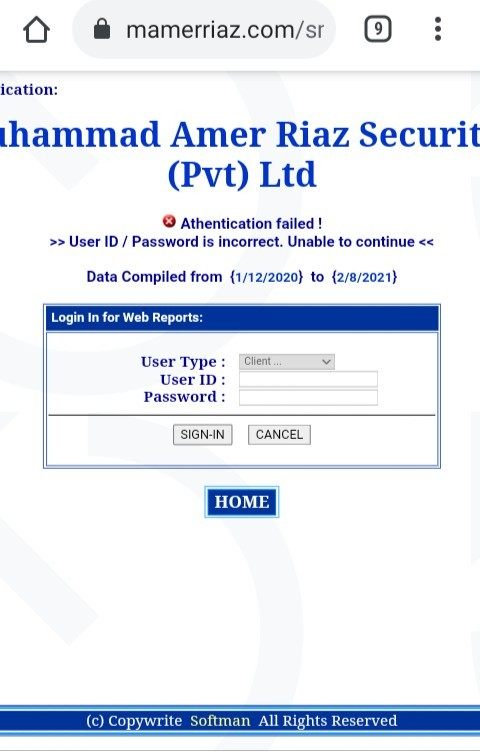

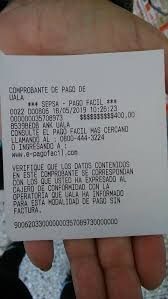

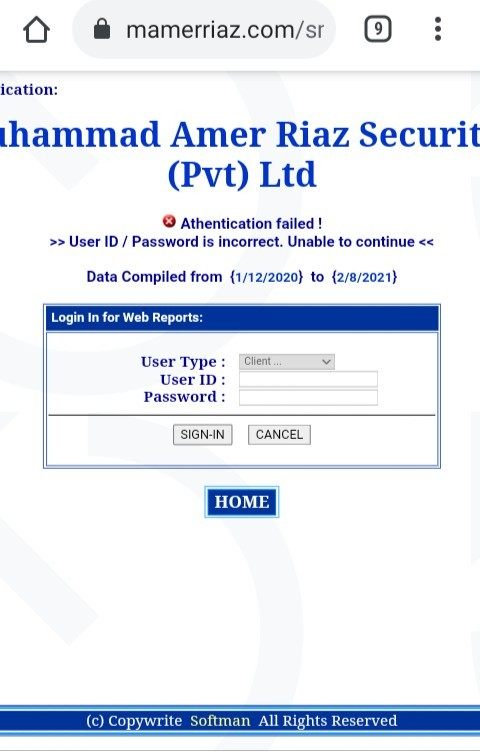

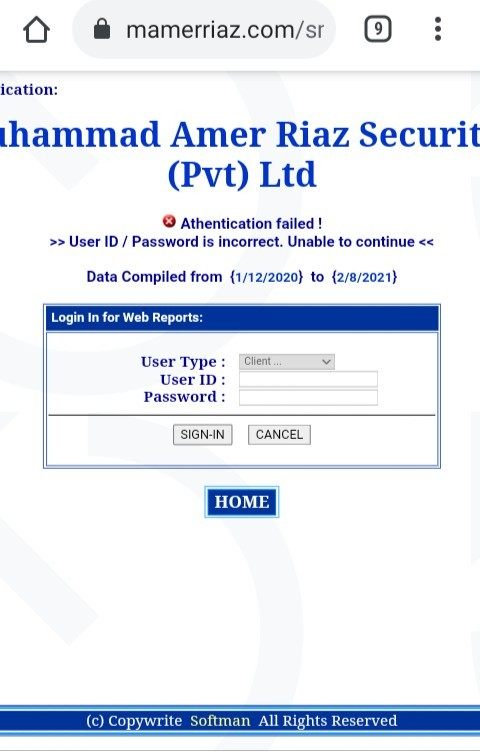

I found the broker on the Internet and deposited $400. But then the broker told me the deposit did not arrive and blocked me from accessing its network.

MAR Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

I found the broker on the Internet and deposited $400. But then the broker told me the deposit did not arrive and blocked me from accessing its network.

This mar review presents a complete evaluation of MAR based on available regulatory information and recent developments. Our assessment reveals a regulatory framework that has undergone significant review by the European Securities and Markets Authority, demonstrating ongoing commitment to market integrity and transparency. The regulation primarily serves institutional investors, compliance officers, and market participants who require robust regulatory oversight in their trading activities.

ESMA's recent publication of MAR review outcomes indicates active monitoring and potential updates to the regulatory framework. However, specific details regarding implementation timelines and practical trading implications remain limited in publicly available documentation. This creates a neutral assessment environment where regulatory credibility is evident, but operational specifics require further clarification.

The regulation appears most suitable for traders and institutions prioritizing regulatory transparency and compliance standards. While the regulatory foundation shows strength through ESMA oversight, the lack of detailed operational parameters limits our ability to provide comprehensive trading condition assessments.

This evaluation is based on publicly available regulatory documentation and official ESMA communications regarding MAR review outcomes. Different jurisdictions may have varying implementation requirements and compliance standards that could affect practical application. Regional regulatory differences should be considered when evaluating MAR's relevance to specific trading activities.

Our assessment methodology relies on official regulatory sources and published review findings, rather than direct user trading experiences. This approach ensures regulatory accuracy but may not reflect practical implementation challenges or user satisfaction levels. Readers should consult official regulatory guidance for jurisdiction-specific requirements and compliance obligations.

| Evaluation Criteria | Score | Rationale |

|---|---|---|

| Account Conditions | Not Rated | Specific account requirements not detailed in available documentation |

| Tools and Resources | Not Rated | Regulatory tools and resources not specified in current materials |

| Customer Service | Not Rated | Support mechanisms not outlined in available regulatory information |

| Trading Experience | Not Rated | Trading-specific implementations not detailed in current documentation |

| Trust and Regulation | 8/10 | Strong regulatory oversight through ESMA with published review outcomes |

| User Experience | Not Rated | User interaction elements not specified in available materials |

MAR represents a regulatory framework rather than a traditional brokerage entity, operating under the oversight of the European Securities and Markets Authority. The regulatory structure has recently undergone comprehensive review, with ESMA publishing detailed outcomes that demonstrate ongoing regulatory evolution and adaptation to market conditions. While establishment dates and traditional company background information are not applicable to this regulatory framework, the regulatory history shows consistent development since initial implementation.

The regulatory approach focuses on market abuse prevention and detection, serving as a foundational compliance requirement for European market participants. ESMA's active review process indicates commitment to maintaining relevant and effective regulatory standards. The framework operates through member state implementation rather than direct service provision, creating a distributed regulatory environment.

Trading platform integration occurs through regulated entity compliance rather than direct platform provision. Asset coverage extends across European financial markets through regulatory requirements rather than direct asset offering. This mar review emphasizes the regulatory nature of MAR rather than traditional brokerage services, with ESMA serving as the primary oversight authority ensuring consistent implementation across member jurisdictions.

Regulatory Jurisdiction: MAR operates under European Securities and Markets Authority oversight, providing regulatory framework implementation across European Union member states. The regulation ensures consistent market abuse prevention standards across participating jurisdictions.

Implementation Methods: Specific deposit and withdrawal mechanisms are not applicable to this regulatory framework, as MAR functions through regulated entity compliance rather than direct financial service provision.

Minimum Requirements: Compliance thresholds and minimum implementation standards are not detailed in currently available documentation, requiring consultation with jurisdiction-specific regulatory guidance.

Promotional Framework: Traditional bonus or promotional structures are not applicable to regulatory frameworks, though compliance incentives may exist through regulatory recognition programs.

Covered Assets: The regulation applies to financial instruments traded on European regulated markets, though specific asset categories are not listed in available review documentation.

Cost Structure: Implementation costs and compliance fees are not specified in current materials, likely varying by jurisdiction and entity size. This mar review notes that cost information requires consultation with local regulatory authorities.

Leverage Considerations: Leverage-specific regulatory requirements are not detailed in available MAR review documentation, though market abuse prevention may impact leverage usage.

Platform Integration: Regulatory compliance occurs through existing trading platforms rather than dedicated MAR platforms, with implementation varying by regulated entity.

Geographic Restrictions: Application extends across EU member states with potential variations in local implementation requirements.

Communication Languages: Regulatory documentation availability in multiple European languages, though specific language support details are not provided in current materials.

Account-specific requirements under MAR are not detailed in available regulatory documentation, creating limitations in our assessment of traditional account conditions. The regulatory framework operates through existing brokerage relationships rather than establishing independent account structures. Implementation occurs through regulated entity compliance programs, meaning account conditions depend on individual broker interpretation of MAR requirements.

Minimum deposit considerations are not applicable to the regulatory framework itself, though regulated entities may implement MAR-related account monitoring that could affect deposit requirements. Account opening processes remain with individual brokers, with MAR providing overarching compliance requirements rather than specific account setup procedures.

Special account features, such as Islamic finance compliance, would depend on individual broker implementation of MAR requirements rather than framework-specific accommodations. This mar review emphasizes that account conditions reflect broker implementation of regulatory requirements rather than direct MAR specifications. The regulatory nature of MAR means traditional account condition analysis requires evaluation of individual broker compliance approaches rather than framework-specific account features.

Regulatory tools and resources under MAR are not comprehensively detailed in available documentation, limiting assessment of traditional trading tool availability. The framework provides compliance guidance and regulatory requirements rather than direct trading tools or analytical resources. Implementation tools vary by regulated entity and jurisdiction, creating diverse resource availability depending on broker compliance approaches.

Research and analysis resources related to market abuse detection may be available through regulatory compliance programs, though specific tools are not listed in current documentation. Educational resources regarding MAR compliance exist through ESMA and member state regulatory authorities, though comprehensive educational program details are not provided in available materials.

Automated trading support under MAR depends on individual broker implementation of regulatory requirements rather than framework-specific automation tools. The regulatory focus on market abuse prevention may impact automated trading strategies, though specific guidance is not detailed in current review documentation. Resource availability reflects the regulatory nature of MAR rather than traditional brokerage tool provision.

Customer service and support mechanisms specific to MAR are not outlined in available regulatory documentation, as the framework operates through existing broker relationships rather than direct service provision. Support channels depend on individual regulated entity implementation of MAR compliance programs, creating variable service availability based on broker approaches.

Response times for MAR-related inquiries would depend on individual broker customer service capabilities rather than framework-specific support standards. Service quality assessment requires evaluation of broker compliance support rather than direct MAR service provision, limiting comprehensive service quality analysis.

Multilingual support availability depends on individual broker capabilities and jurisdiction requirements rather than MAR-specific language support programs. Customer service hours reflect broker operations rather than dedicated MAR support schedules, creating variable availability based on regulated entity approaches. The regulatory nature of MAR means support analysis requires evaluation of broker compliance assistance rather than direct framework support services.

Trading experience under MAR reflects regulatory compliance requirements rather than direct trading platform provision, limiting traditional trading experience assessment. Platform stability and speed depend on individual broker implementation of MAR requirements rather than framework-specific trading infrastructure. The regulatory focus on market abuse prevention may impact trading execution through compliance monitoring systems.

Order execution quality under MAR depends on broker implementation of regulatory requirements, with potential impacts from compliance monitoring on execution speeds and processes. Platform functionality integration varies by regulated entity approach to MAR compliance, creating diverse trading experience outcomes based on broker implementation strategies.

Mobile trading experience reflects broker adaptation of MAR requirements to mobile platforms rather than framework-specific mobile solutions. This mar review notes that trading environment assessment requires evaluation of broker compliance implementation rather than direct MAR trading provision. The regulatory nature creates indirect trading experience impacts through compliance requirements rather than direct trading service provision.

Trust and regulatory assessment shows strong foundations through ESMA oversight and published review outcomes, demonstrating active regulatory monitoring and framework evolution. The European Securities and Markets Authority provides credible regulatory oversight with transparent review processes and public outcome communication. Recent publication of MAR review findings indicates ongoing regulatory attention and potential framework improvements.

Fund safety measures operate through existing broker regulatory requirements rather than MAR-specific protection mechanisms, with investor protection depending on broader regulatory compliance rather than framework-specific safeguards. Company transparency reflects ESMA's public communication of review outcomes and regulatory development, showing commitment to stakeholder information sharing.

Industry reputation benefits from established European regulatory framework status and ESMA oversight credibility. Negative event handling would occur through existing regulatory enforcement mechanisms rather than MAR-specific resolution processes. The regulatory framework demonstrates trustworthiness through institutional oversight and transparent review processes, though practical implementation trust depends on individual broker compliance quality.

User experience assessment faces limitations due to the regulatory nature of MAR rather than direct user service provision. Overall user satisfaction depends on broker implementation of MAR requirements rather than framework-specific user interaction. The regulatory compliance focus may impact user experience through additional verification requirements and transaction monitoring.

Interface design and usability reflect broker adaptation of MAR compliance requirements rather than framework-specific interface elements. Registration and verification processes may be enhanced through MAR implementation, though specific process details are not outlined in available documentation.

Fund operation experience depends on broker implementation of MAR monitoring requirements, potentially affecting transaction processing and approval times. Common user concerns would relate to compliance requirement impacts rather than direct framework issues. User experience evaluation requires assessment of broker MAR implementation rather than direct regulatory framework interaction, limiting comprehensive user satisfaction analysis.

Based on available information, this mar review indicates a regulatory framework with strong oversight credentials through ESMA supervision, though limited operational detail availability restricts comprehensive assessment. The regulation demonstrates commitment to market integrity through active review processes and transparent regulatory communication, making it suitable for traders and institutions prioritizing regulatory compliance and transparency.

The framework best serves market participants requiring robust regulatory oversight and compliance standards, particularly those operating within European financial markets. Primary advantages include established ESMA oversight and transparent regulatory review processes, while limitations center on insufficient operational detail availability and dependence on individual broker implementation for practical application. Overall assessment remains neutral pending additional operational information availability.

FX Broker Capital Trading Markets Review