Regarding the legitimacy of FXPesa forex brokers, it provides CMA and WikiBit, .

Is FXPesa safe?

Pros

Cons

Is FXPesa markets regulated?

The regulatory license is the strongest proof.

CMA Forex Execution License (STP)

The Capital Markets Authority

The Capital Markets Authority

Current Status:

RegulatedLicense Type:

Forex Execution License (STP)

Licensed Entity:

EGM Securities Limited

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

https://www.fxpesa.com/Expiration Time:

--Address of Licensed Institution:

P.O. Box 14747 – 00800, Westlands, NairobiPhone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is FXPesa Safe or a Scam?

Introduction

FXPesa is a forex and CFD broker based in Kenya, established in 2019, that aims to provide trading services to both novice and experienced traders in the East African market. As a relatively young broker, FXPesa has quickly positioned itself as a significant player in the region, leveraging its regulatory backing from the Capital Markets Authority (CMA) of Kenya. However, the forex market is notorious for attracting both legitimate brokers and scams, making it imperative for traders to carefully evaluate their options. This article seeks to explore the safety and legitimacy of FXPesa, employing a structured approach that includes regulatory status, company background, trading conditions, customer experiences, and risk assessments.

Regulation and Legitimacy

Understanding the regulatory environment is crucial when assessing the safety of any broker. FXPesa operates under the regulatory framework of the Capital Markets Authority (CMA) in Kenya, which is responsible for overseeing the financial markets in the country. This regulatory oversight is essential as it provides a layer of protection for traders. Below is a summary of the core regulatory information for FXPesa:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Capital Markets Authority (CMA) | 107 | Kenya | Verified |

The CMA has specific regulations to ensure that brokers operate transparently and ethically. FXPesa is required to maintain client funds in segregated accounts, ensuring that these funds are not used for operational purposes. This regulatory framework is similar to tier-1 regulations found in more developed markets, which adds to the broker's credibility. However, the effectiveness of these regulations can vary, and there have been concerns regarding the enforcement of compliance in some regions. Overall, FXPesa's regulatory status suggests it is a legitimate broker, but traders should remain vigilant.

Company Background Investigation

FXPesa is operated by EGM Securities Limited, which has a solid foundation in the Kenyan financial sector. The company was one of the first non-dealing forex brokers to be licensed by the CMA in February 2018. The management team comprises experienced professionals with backgrounds in finance and trading, which adds credibility to the broker. However, the level of transparency regarding the ownership structure and detailed biographies of the management team is somewhat limited.

Despite this, FXPesa claims to prioritize transparency and customer education, offering various resources to help traders navigate the forex market. The company's website provides information about its services and regulatory compliance, although there is room for improvement in terms of detailed disclosures. Overall, while FXPesa appears to be a legitimate operation, the lack of comprehensive information may raise some concerns for potential clients.

Trading Conditions Analysis

FXPesa offers a straightforward trading experience with two primary account types: the Executive account and the Premier account. The fee structure is designed to be competitive, but it is essential to analyze the costs involved. Below is a comparison of key trading costs associated with FXPesa:

| Cost Type | FXPesa | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.4 pips | 1.0 pips |

| Commission Model | $0 (Executive) / $7 (Premier) | $5 (average) |

| Overnight Interest Range | Varies | Varies |

The spreads offered by FXPesa, particularly for the Executive account, are on the higher side compared to industry averages. This could impact profitability, especially for high-frequency traders. Additionally, the commission structure is relatively straightforward, with no commissions on the Executive account and a fixed fee on the Premier account. However, traders should be cautious of any hidden fees that may apply, particularly in relation to overnight positions and withdrawals.

Customer Fund Safety

The safety of customer funds is paramount in forex trading. FXPesa claims to implement several measures to safeguard client funds. The broker maintains segregated accounts, which ensures that client funds are kept separate from company funds. This practice is crucial in protecting traders' capital. However, it is worth noting that FXPesa does not offer negative balance protection, a feature that can help mitigate losses for traders.

Historically, there have been concerns regarding fund safety with various brokers, but FXPesa has not reported any significant incidents that would raise red flags. Nevertheless, traders should remain cautious and conduct due diligence before investing. Overall, while FXPesa appears to have robust safety measures in place, the absence of negative balance protection could pose risks for inexperienced traders.

Customer Experience and Complaints

Customer feedback is an essential aspect of assessing a broker's reliability. Many traders report positive experiences with FXPesa, highlighting the ease of account setup and the quality of customer support. However, like any broker, FXPesa has its share of complaints. Common issues include withdrawal delays and difficulties in accessing customer support during peak times. Below is a summary of the primary complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Mixed |

| Customer Support Availability | Medium | Generally responsive |

| High Spreads | Medium | Noted but not addressed |

One notable case involved a trader who experienced significant delays in withdrawing funds, leading to frustration and concerns about the broker's reliability. While FXPesa responded to the complaint, the resolution took longer than expected, which may deter potential clients. Overall, while customer experiences vary, it is essential for traders to consider both positive and negative feedback when evaluating FXPesa.

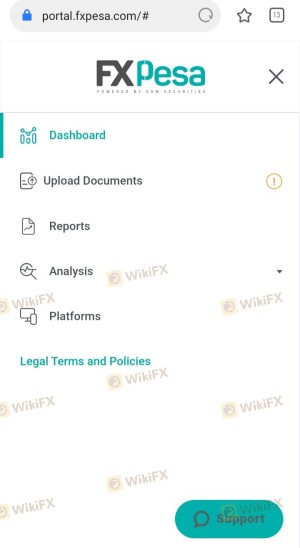

Platform and Trade Execution

FXPesa offers a range of trading platforms, including MetaTrader 4 (MT4) and its proprietary trading platform. The performance and stability of these platforms are crucial for a seamless trading experience. Users generally report that the platforms are user-friendly, although there have been occasional issues with execution speed and slippage.

The quality of order execution is critical, as delays can significantly impact trading outcomes. While FXPesa claims to provide fast execution, some users have reported instances of slippage during volatile market conditions. There have been no widespread reports of platform manipulation, but traders should remain vigilant and monitor their trades closely.

Risk Assessment

Using FXPesa involves certain risks that traders must consider. Below is a summary of the key risk areas associated with trading through this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | Medium | While regulated, the enforcement of regulations can vary. |

| Fund Safety | Medium | Segregated accounts are used, but negative balance protection is absent. |

| Customer Support | Medium | Mixed reviews on responsiveness and availability. |

| Trading Costs | Medium | Higher spreads may impact profitability. |

To mitigate these risks, traders should adopt sound risk management practices, such as setting stop-loss orders and not risking more than they can afford to lose. Additionally, it is advisable to start with a demo account to familiarize oneself with the platform and trading conditions before committing real capital.

Conclusion and Recommendations

In conclusion, FXPesa presents itself as a legitimate broker with regulatory backing from the CMA in Kenya. However, potential traders should be aware of the higher spreads and the absence of negative balance protection. While there are no significant indicators of fraud, the mixed customer feedback and some complaints regarding fund withdrawals warrant caution.

For traders considering FXPesa, it is essential to weigh the benefits against the potential risks. Those new to forex trading may find the low minimum deposit and user-friendly platforms appealing, while more experienced traders may want to explore alternatives with tighter spreads and better customer service.

If you are looking for reliable alternatives, consider brokers like HotForex or XM, which offer competitive trading conditions and a strong reputation in the industry. Always conduct thorough research and ensure that you understand the risks involved before trading with any broker, including FXPesa.

Is FXPesa a scam, or is it legit?

The latest exposure and evaluation content of FXPesa brokers.

FXPesa Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FXPesa latest industry rating score is 4.13, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 4.13 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.