LCG 2025 Review: Everything You Need to Know

London Capital Group (LCG), a well-established online brokerage, has garnered mixed reviews from users and experts alike. While it offers a wide array of trading instruments and a robust trading platform, concerns about customer service and specific operational issues have been raised. Users appreciate the competitive spreads and the variety of assets available, but some have reported difficulties with withdrawals and account management. Overall, LCG is positioned as a solid option for beginners and experienced traders, but potential clients should be aware of the varying experiences reported by users.

Note: It is important to recognize that LCG operates through different entities in various jurisdictions, which may affect the services and protections available to traders based on their location.

Ratings Overview

How We Rate Brokers: Our ratings are based on extensive research, user feedback, and expert analysis across various categories.

Broker Overview

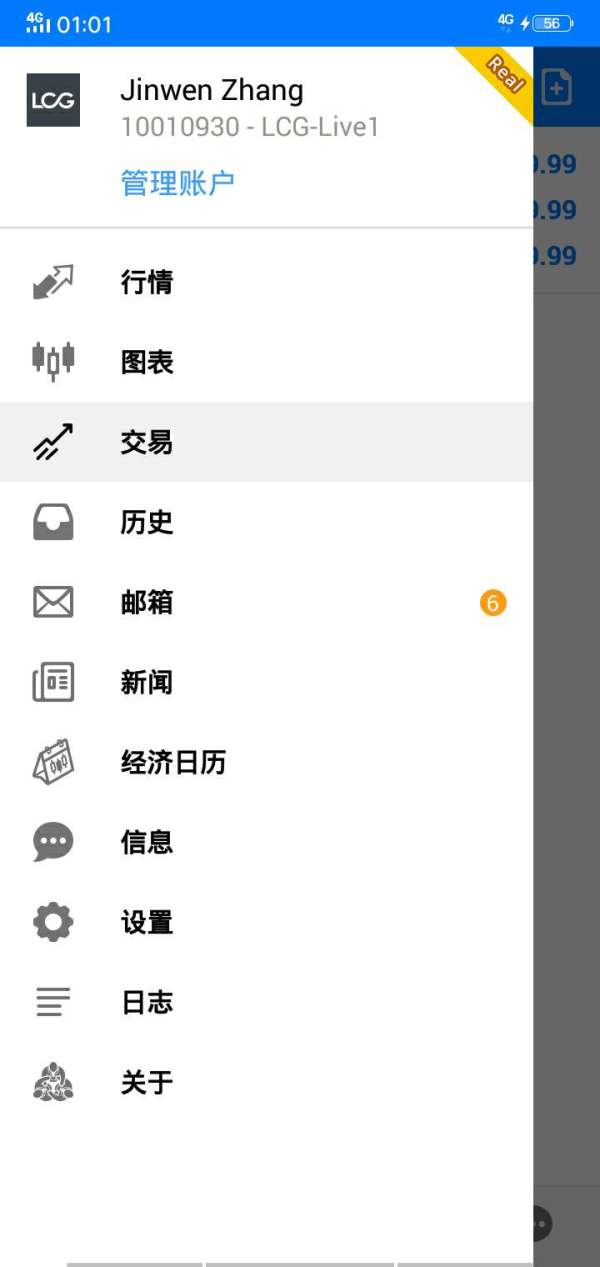

Founded in 1996, London Capital Group (LCG) has established itself as a reputable broker in the online trading space, regulated by the UK's Financial Conduct Authority (FCA) and other authorities like CySEC and SCB. The broker offers access to a diverse range of trading platforms, including the widely used MetaTrader 4 (MT4) and its proprietary LCG Trader platform. Traders can engage with over 7,000 instruments across various asset classes, including forex, indices, commodities, and stocks.

Detailed Overview

Regulatory Regions

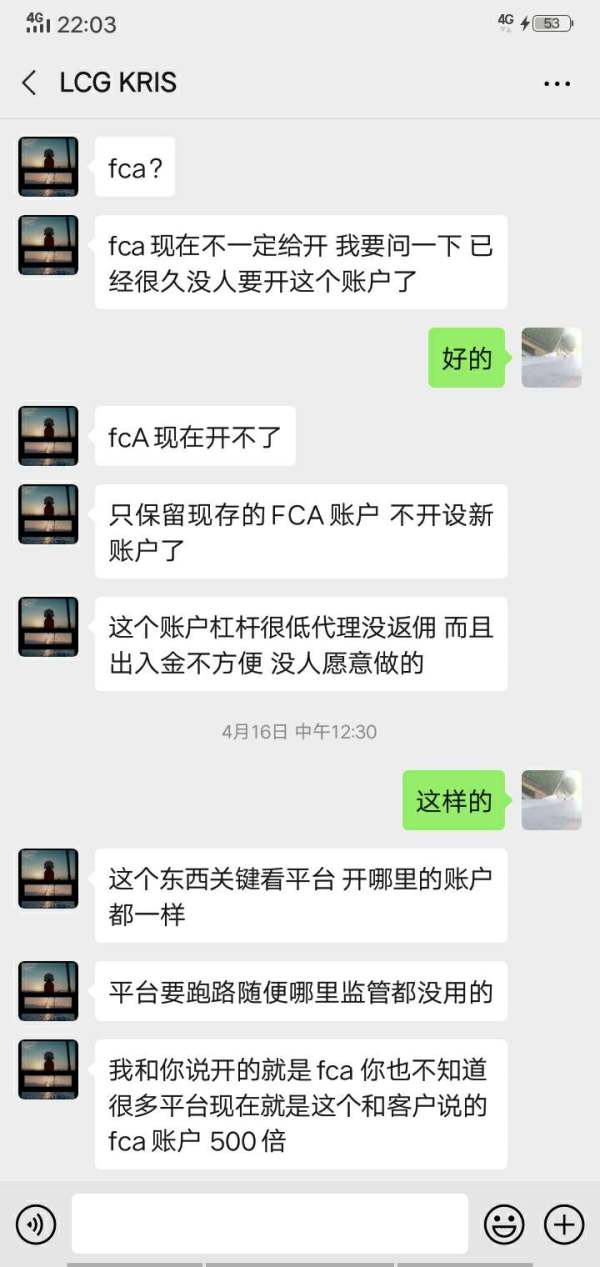

LCG operates under various regulatory frameworks, primarily the FCA in the UK, which ensures a high level of protection for client funds. Additionally, it is regulated by the Cyprus Securities and Exchange Commission (CySEC) and the Securities Commission of the Bahamas (SCB). These regulations mandate that client funds are held in segregated accounts, providing an added layer of security.

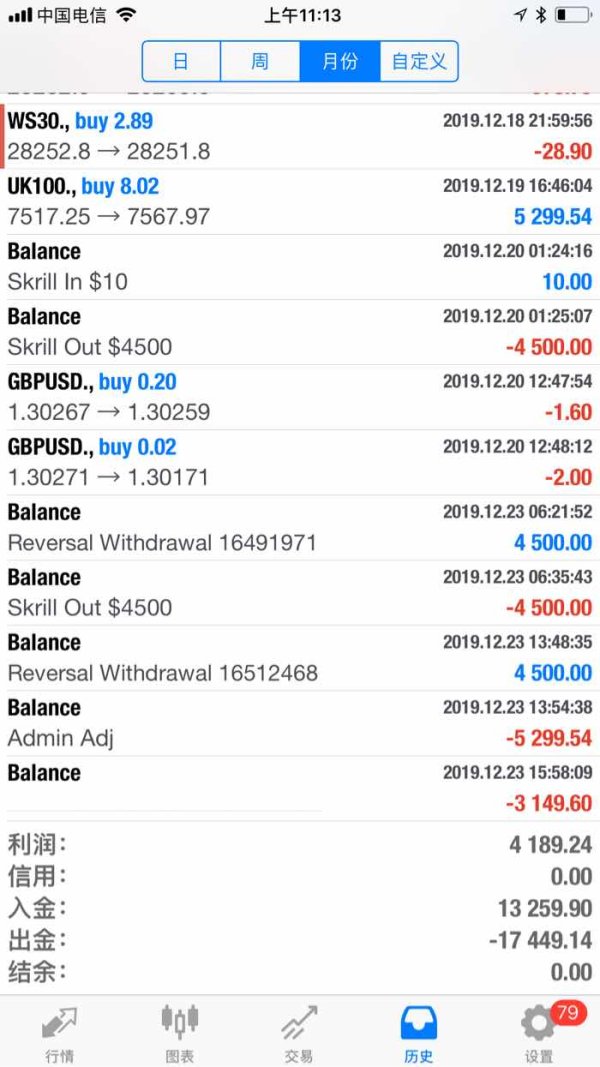

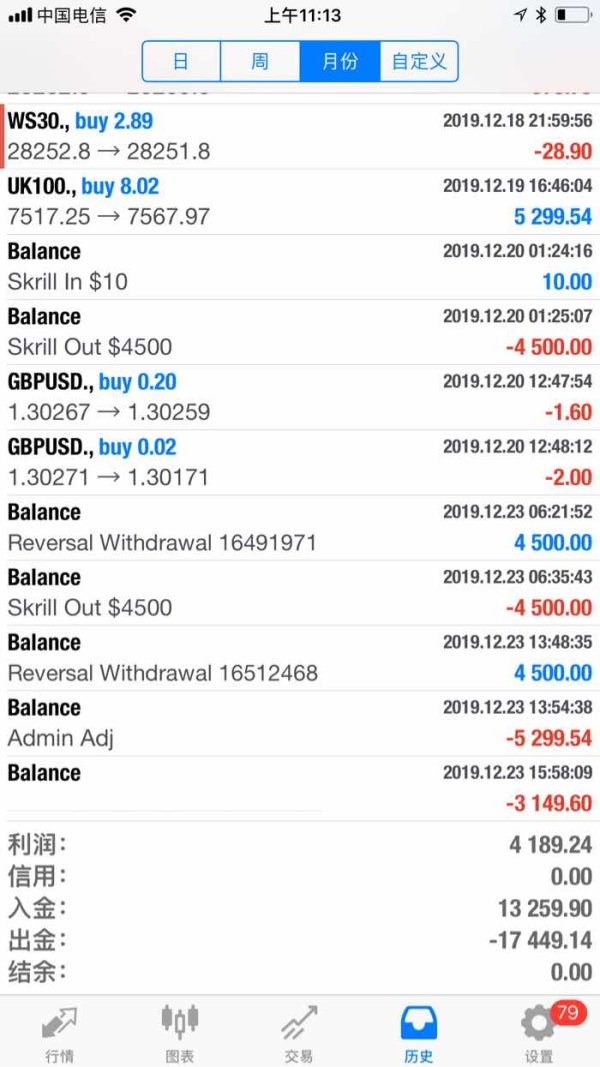

Deposit/Withdrawal Currencies

LCG supports multiple base currencies for trading accounts, including USD, GBP, and EUR. For deposits and withdrawals, clients can use various methods such as bank transfers, credit/debit cards, Skrill, and Neteller. However, credit card deposits incur a 2% fee, while other methods are typically free of charge.

Minimum Deposit

The minimum deposit requirement varies by account type. For a standard account, there is no minimum deposit, making it accessible for beginners. However, the ECN account requires a minimum deposit of $10,000, which may limit access for smaller traders.

Currently, LCG does not offer any bonuses or promotional incentives, which aligns with FCA regulations prohibiting such practices for retail clients. This is a point of contention for some users who prefer brokers that offer promotional benefits.

Tradable Asset Classes

Traders at LCG can access a wide range of financial instruments, including:

- Forex: Over 60 currency pairs, including major, minor, and exotic options.

- Indices: Access to various global indices.

- Commodities: Includes gold, silver, and oil.

- Stocks: More than 4,000 global equities.

- ETFs and Bonds: A selection of exchange-traded funds and bonds.

- Vanilla Options: Available for hedging strategies.

Costs (Spreads, Fees, Commissions)

LCG employs a competitive pricing structure, with spreads starting from 0.0 pips for ECN accounts and averaging around 1.45 pips for major pairs like EUR/USD. The broker charges a commission of $45 per million traded on the LCG Trader platform and $10 per lot on MT4 for ECN accounts. Traders should also be aware of overnight financing fees and a £15 inactivity fee applicable after six months without trading activity.

Leverage

LCG offers dynamic leverage, with maximum levels set at 1:200, varying by asset class. The leverage levels are adjusted based on the client's trading positions, which is a feature that may appeal to risk-conscious traders.

Traders can choose between LCG's proprietary trading platform, LCG Trader, and the popular MetaTrader 4. While LCG Trader is user-friendly and suitable for beginners, MT4 offers advanced features for experienced traders, including automated trading capabilities.

Restricted Regions

LCG does not accept clients from several countries, including the United States, Canada, and Australia, due to regulatory restrictions. This limitation may affect potential clients in those regions looking for a comprehensive trading platform.

Available Customer Service Languages

LCG provides customer support in multiple languages, including English, Spanish, French, German, and more. However, customer service is only available during weekdays, which may be a drawback for traders needing assistance outside these hours.

Ratings Overview (Repeated)

Detailed Breakdown

-

Account Conditions (7): LCG offers both standard and ECN accounts, catering to different trader needs. However, the high minimum deposit for ECN accounts may deter some traders.

Tools and Resources (6): The platform provides basic educational resources, but improvements are needed to meet the demands of more advanced traders.

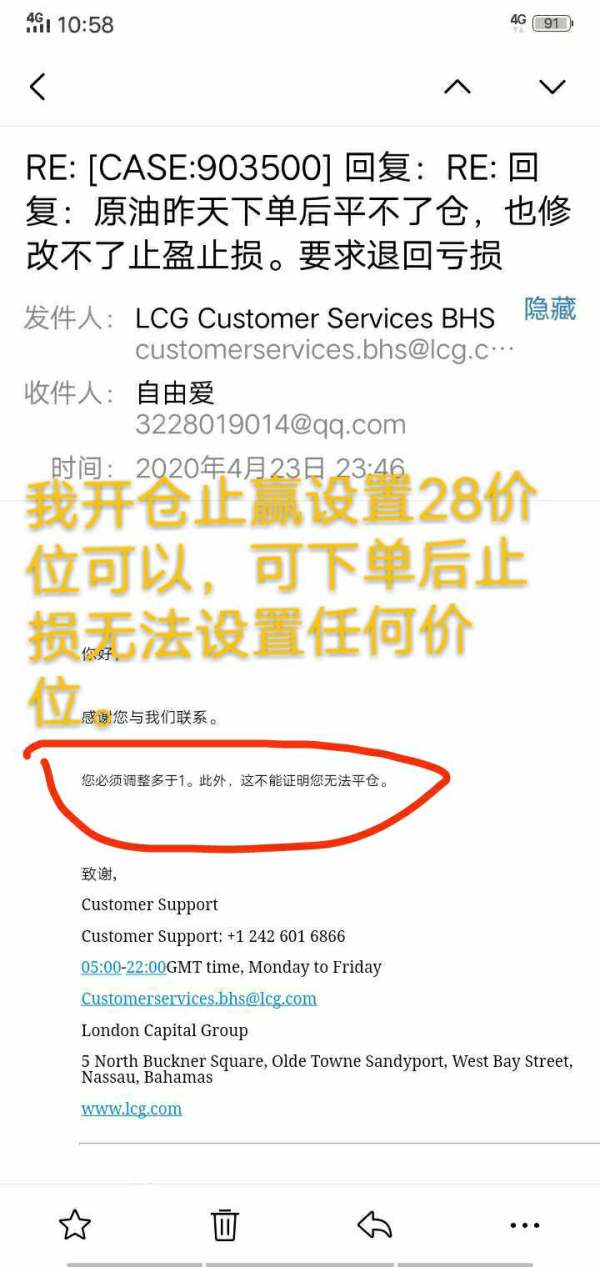

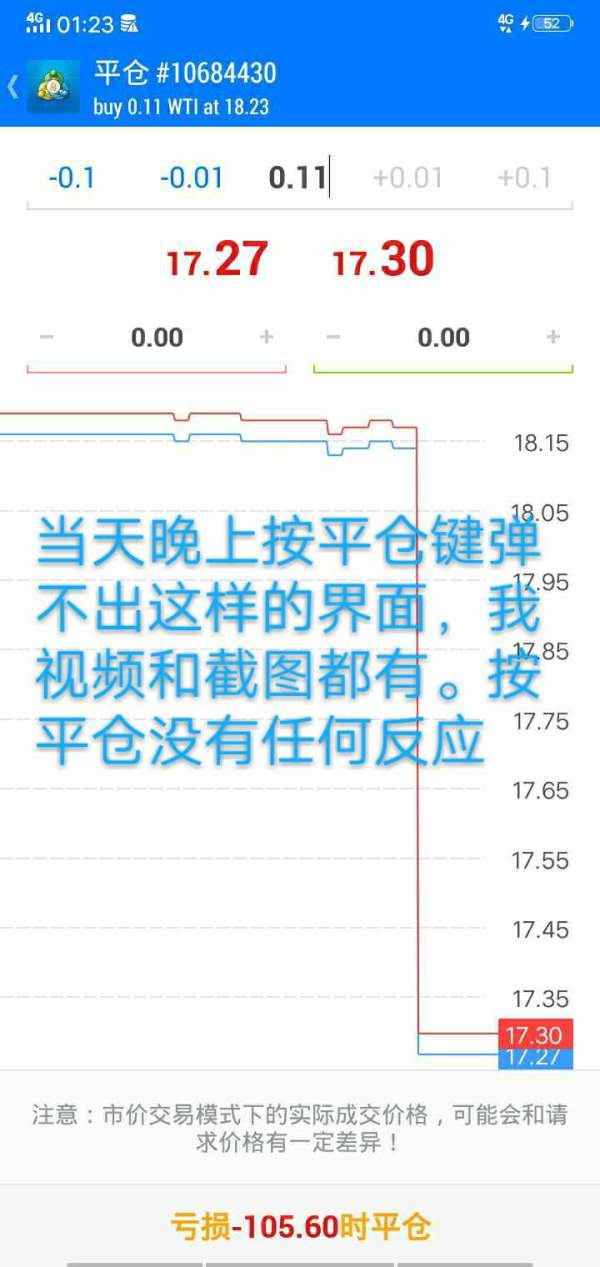

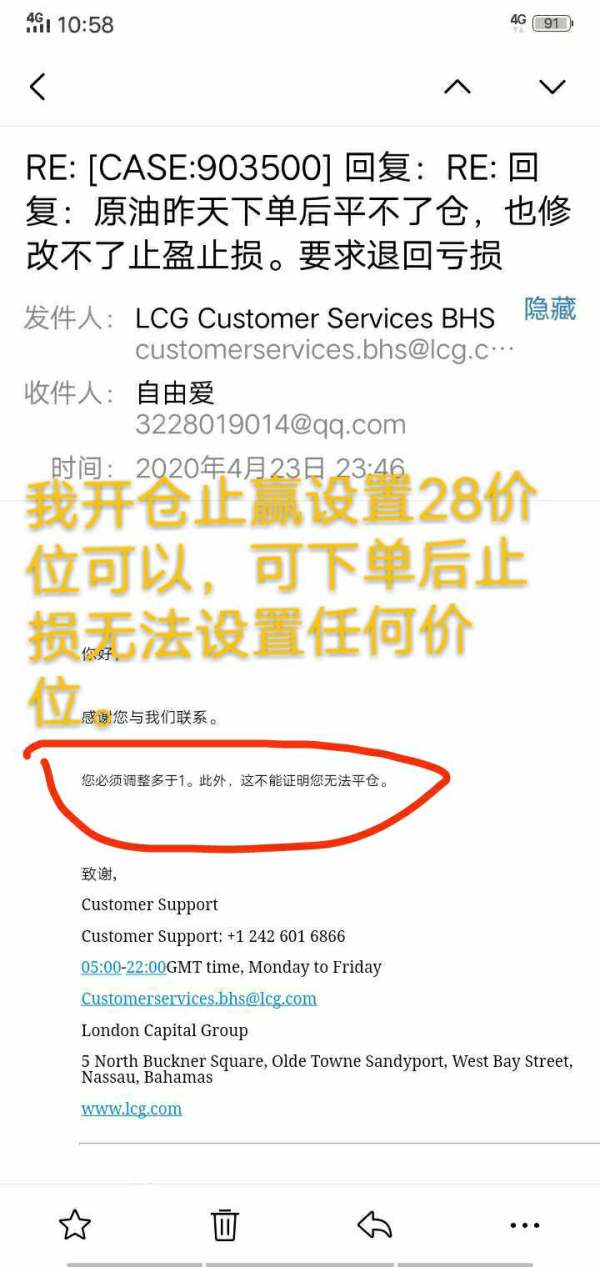

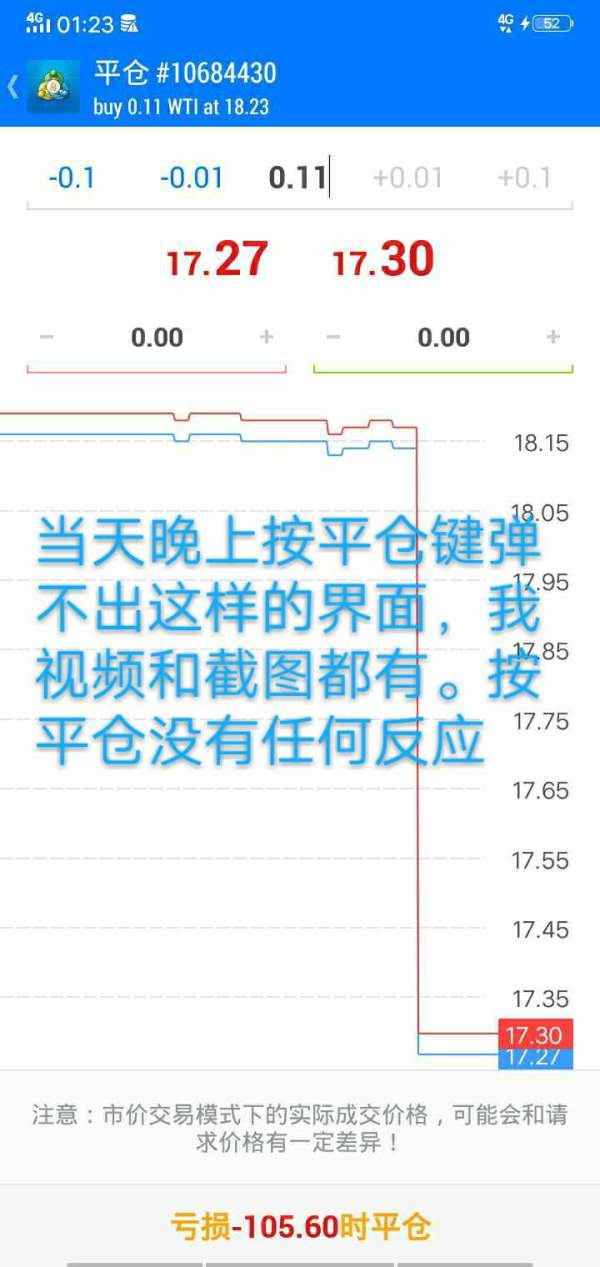

Customer Service and Support (5): While customer service is responsive, issues with live chat availability and slower email responses have been reported.

Trading Experience (7): The trading platforms are functional, but the lack of integration with advanced trading tools may limit experienced traders.

Trustworthiness (8): Regulated by reputable authorities, LCG provides a secure trading environment, but some user complaints about withdrawal issues should be noted.

User Experience (6): The overall user experience is satisfactory, though some users report website performance issues during peak times.

Educational Resources (5): Educational offerings are basic and may not sufficiently support advanced traders seeking in-depth analysis and strategies.

In conclusion, LCG presents itself as a solid choice for traders looking for a regulated broker with a wide range of instruments and competitive pricing. However, potential users should weigh the reported customer service challenges and the varying experiences highlighted in user feedback.