Mitrade 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive Mitrade review evaluates one of the most prominent online CFD trading platforms operating under Australian Securities and Investments Commission regulation. Mitrade Global Pty Ltd is an innovative Melbourne-based CFDs online trading broker that has established itself as a notable player in the forex and derivatives trading space, earning recognition as both the "most transparent trading platform" and "most sustainable forex platform" according to various industry assessments.

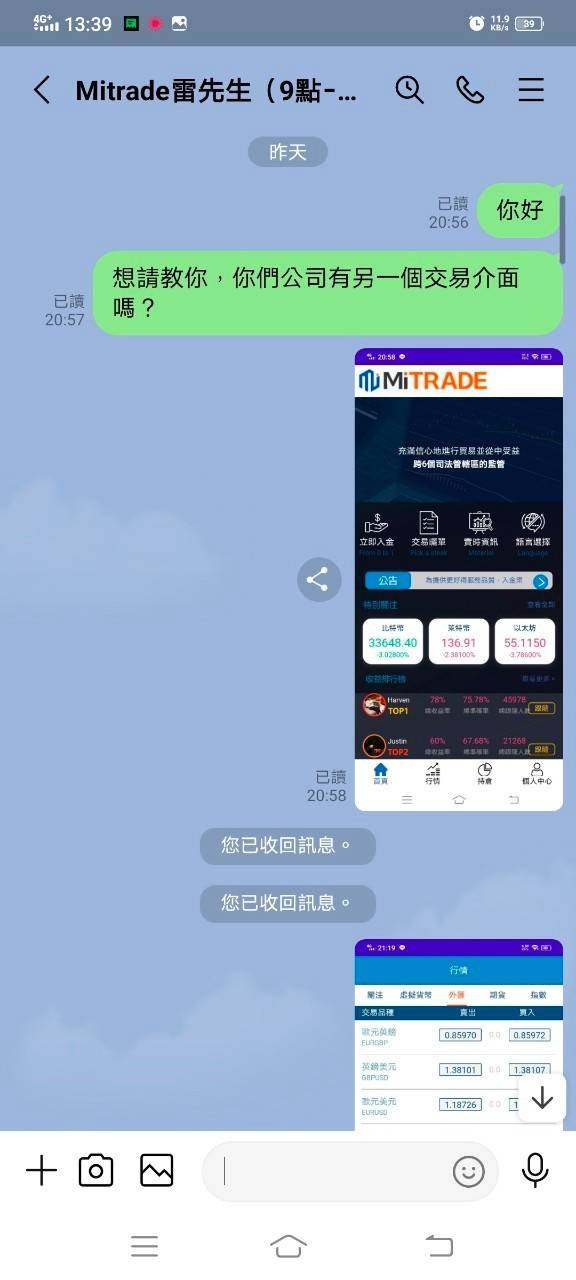

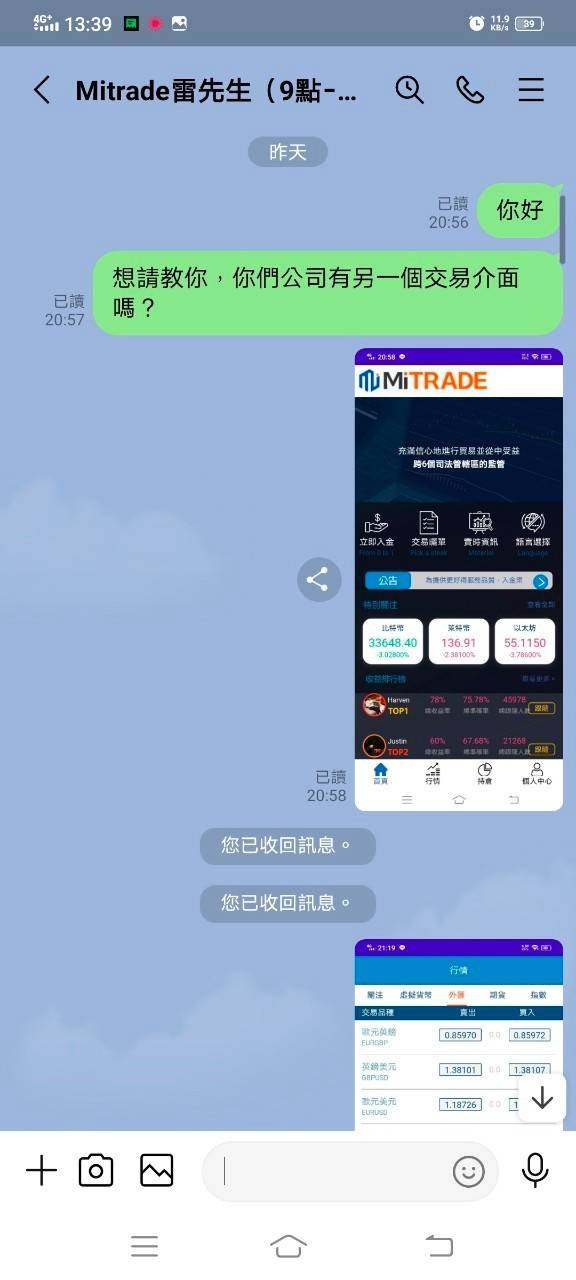

The platform distinguishes itself through its user-friendly trading interface and rapid access to market news. This makes it particularly appealing to both novice and experienced forex traders seeking a streamlined trading experience. According to Trustpilot, Mitrade maintains an active presence with 1,311 customer reviews, demonstrating the company's commitment to transparency by actively responding to client feedback. This level of engagement reflects the broker's dedication to maintaining strong customer relationships and addressing user concerns promptly.

Mitrade primarily targets forex traders and investors who prioritize simplicity and convenience in their trading journey. The platform offers a comprehensive suite of CFD instruments while maintaining regulatory compliance under AFSL 398528. The platform's emphasis on accessibility and transparency makes it suitable for traders seeking a reliable, regulated environment for their trading activities.

Important Notice

Regulatory Variations: Mitrade operates under different regulatory frameworks across various jurisdictions. The primary entity, Mitrade Global Pty Ltd, is regulated by the Australian Securities and Investments Commission under license number AFSL 398528. Traders should verify the specific regulatory status applicable to their region before engaging with the platform.

Review Methodology: This evaluation is based on publicly available information, user feedback from verified sources including Trustpilot reviews, and official company disclosures. The assessment reflects the platform's status as of 2025 and may be subject to changes in services, regulations, or company policies.

Rating Framework

Broker Overview

Mitrade Global Pty Ltd operates as an innovative Melbourne-based online CFD trading broker. The company specializes in providing retail and institutional clients access to global financial markets through contracts for difference. The company has positioned itself as a technology-forward trading platform that emphasizes transparency and user accessibility. While specific founding dates are not detailed in available materials, the broker has established a solid reputation within the Australian financial services sector and expanded its reach to international markets.

The company's business model centers on providing CFD trading services across multiple asset classes. It shows particular strength in forex markets. Mitrade's approach combines regulatory compliance with technological innovation, offering clients a comprehensive trading environment that balances sophisticated trading tools with user-friendly interfaces. The platform has received industry recognition, including awards for transparency and sustainability, indicating its commitment to responsible trading practices.

Mitrade operates primarily as an online trading platform provider. It offers access to contracts for difference across various financial instruments including forex pairs, commodities, indices, and other derivatives. The broker maintains its operations under strict ASIC oversight, ensuring compliance with Australian financial services regulations. According to Trustpilot data, the company actively engages with its user base of over 1,300 reviewers, demonstrating ongoing commitment to customer satisfaction and service improvement. This Mitrade review confirms the broker's focus on maintaining transparent operations while providing accessible trading solutions for diverse investor needs.

Regulatory Status: Mitrade Global Pty Ltd operates under Australian Securities and Investments Commission regulation with license number AFSL 398528. This provides clients with regulatory protection under Australian financial services law.

Deposit and Withdrawal Methods: Specific information regarding deposit and withdrawal options is not detailed in available materials. The platform likely supports standard electronic payment methods common to regulated brokers.

Minimum Deposit Requirements: Exact minimum deposit amounts are not specified in current available materials. Potential clients need to contact the broker directly for account opening requirements.

Promotional Offers: Current bonus or promotional information is not detailed in available public materials. This suggests the broker may focus on transparent pricing rather than promotional incentives.

Trading Instruments: The platform provides access to CFD trading across forex markets and various other financial instruments. Specific asset counts are not detailed in available materials.

Cost Structure: Detailed information regarding spreads, commissions, and other trading costs is not specified in current available materials. Potential clients should request comprehensive pricing information directly from the broker.

Leverage Ratios: Specific leverage ratios available to different client categories are not detailed in current materials. ASIC regulation typically imposes standard leverage limits for retail clients.

Platform Options: Mitrade offers user-friendly trading platforms designed for accessibility. Specific platform names or technical specifications are not detailed in available materials.

Geographic Restrictions: Specific regional limitations are not detailed in available materials. ASIC regulation typically applies to Australian residents and may extend to other jurisdictions.

Customer Support Languages: Available customer service languages are not specified in current materials. The broker's international presence suggests multi-language support capabilities.

Detailed Rating Analysis

Account Conditions Analysis

The available information regarding Mitrade's account conditions presents limited specific details about account types, minimum deposits, or specialized account features. This Mitrade review finds that while the broker operates under ASIC regulation, which typically ensures standard account protection measures, the specific terms and conditions for different account categories are not comprehensively detailed in public materials. The lack of readily available information about account opening requirements, minimum funding amounts, or tiered account structures makes it difficult for potential clients to fully assess whether the broker's account conditions align with their trading needs.

ASIC regulation generally requires brokers to maintain segregated client funds and provide negative balance protection for retail clients. This suggests that Mitrade likely offers these standard protections. However, without detailed information about Islamic accounts, professional trading accounts, or other specialized account types, traders with specific requirements may need to contact the broker directly. The absence of detailed account condition information in public materials may indicate either a simplified account structure or the need for more comprehensive public disclosure of account terms.

Mitrade demonstrates strong performance in providing trading tools and resources, earning an 8/10 rating based on its emphasis on rapid market news access and diverse trading instruments. The platform's commitment to delivering timely market information represents a significant advantage for traders who rely on current market analysis for their trading decisions. The broker's recognition as the "most transparent trading platform" suggests that its tools are designed with clarity and user accessibility in mind.

The platform's focus on user-friendly tool design indicates that both novice and experienced traders can effectively utilize the available resources. However, specific details about advanced charting capabilities, technical analysis tools, automated trading support, or comprehensive educational resources are not detailed in available materials. The rapid market news access feature appears to be a standout offering, potentially giving traders an edge in fast-moving market conditions. While the overall tool offering appears robust based on user feedback and industry recognition, the lack of detailed specifications about research capabilities, economic calendars, or trading signals limits the complete assessment of this category.

Customer Service and Support Analysis

Mitrade's customer service receives a 7/10 rating based primarily on the company's demonstrated commitment to actively responding to customer feedback on Trustpilot. The platform maintains over 1,300 reviews there. This active engagement with user concerns suggests a company culture that prioritizes customer satisfaction and continuous service improvement. The broker's willingness to publicly address customer feedback indicates transparency in handling both positive and negative client experiences.

However, specific information about customer service channels, response times, availability hours, or multi-language support capabilities is not detailed in available materials. The quality of customer service often depends on factors such as 24/7 availability, multiple contact methods including live chat, phone, and email support, as well as the expertise of support staff in handling technical trading issues. While the active Trustpilot engagement is positive, comprehensive assessment requires more detailed information about service level agreements, average response times, and the range of issues that customer support can effectively resolve.

Trading Experience Analysis

The trading experience evaluation yields a 7/10 rating based on Mitrade's emphasis on user-friendly platform design and accessibility. The broker's recognition for transparency suggests that the trading environment is designed to provide clear, straightforward access to market information and trading execution. The platform's focus on user-friendliness indicates that traders can navigate the interface efficiently and execute trades without unnecessary complexity.

However, this Mitrade review notes that specific information about platform stability, execution speeds, order types available, or mobile trading capabilities is not detailed in current materials. Critical trading experience factors such as slippage rates, requote frequency, platform uptime statistics, and the quality of mobile applications require additional investigation. The lack of detailed technical performance data or user testimonials about execution quality makes it challenging to provide a comprehensive assessment of the actual trading experience under various market conditions.

Trust and Security Analysis

Mitrade achieves a strong 9/10 rating for trust and security, primarily based on its ASIC regulation under license AFSL 398528 and industry recognition for transparency. ASIC regulation provides substantial client protection through segregated fund requirements, negative balance protection for retail clients, and oversight of business practices. The broker's recognition as both the "most transparent trading platform" and "most sustainable forex platform" indicates industry acknowledgment of its commitment to ethical business practices.

The Australian regulatory framework is considered among the most robust globally. It provides clients with access to the Financial Ombudsman Service for dispute resolution and compensation schemes in case of broker insolvency. Mitrade's active engagement with customer feedback on public platforms like Trustpilot further demonstrates transparency in operations. However, specific information about additional security measures such as two-factor authentication, encryption protocols, or cyber security certifications is not detailed in available materials. The strong regulatory foundation and industry recognition provide solid grounds for trust, though additional technical security details would enhance the complete security assessment.

User Experience Analysis

The user experience category receives an 8/10 rating based on Mitrade's clear focus on providing user-friendly trading platforms and accessible market information. The broker's design philosophy appears to prioritize simplicity and convenience, making it particularly suitable for traders seeking straightforward access to financial markets without unnecessary complexity. The platform's recognition for transparency suggests that users can easily understand costs, terms, and trading conditions.

The target market of forex traders and investors seeking convenient trading experiences indicates that the platform is designed with practical usability in mind. However, specific details about registration processes, account verification timelines, deposit and withdrawal experiences, or common user pain points are not comprehensively covered in available materials. User experience encompasses multiple touchpoints including website navigation, account opening efficiency, funding processes, trading platform responsiveness, and overall service delivery. While the emphasis on user-friendliness is positive, a complete user experience assessment would benefit from detailed user journey analysis and specific feedback about platform performance across different devices and trading scenarios.

Conclusion

This comprehensive Mitrade review reveals a regulated, transparent broker that prioritizes user-friendly trading experiences under robust ASIC oversight. Mitrade Global Pty Ltd demonstrates strong credentials through its Australian regulation and industry recognition for transparency and sustainability. The platform appears well-suited for forex traders and investors who value regulatory protection, transparent operations, and accessible trading tools.

The broker's strengths include its strong regulatory framework, active customer engagement, rapid market news access, and user-friendly platform design. However, potential areas for improvement include providing more detailed public information about account conditions, trading costs, and specific platform capabilities. Overall, Mitrade presents a solid option for traders seeking a regulated, transparent trading environment, particularly those who prioritize simplicity and regulatory protection over complex advanced features.