Deltafx 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive Deltafx review examines a London-based offshore forex and CFD broker that has positioned itself as a provider of high-quality educational resources and trading support. Deltafx stands out in the competitive forex market through its commitment to trader education and mentorship programs. This makes it particularly suitable for both novice traders seeking comprehensive learning resources and experienced traders looking to leverage advanced trading conditions.

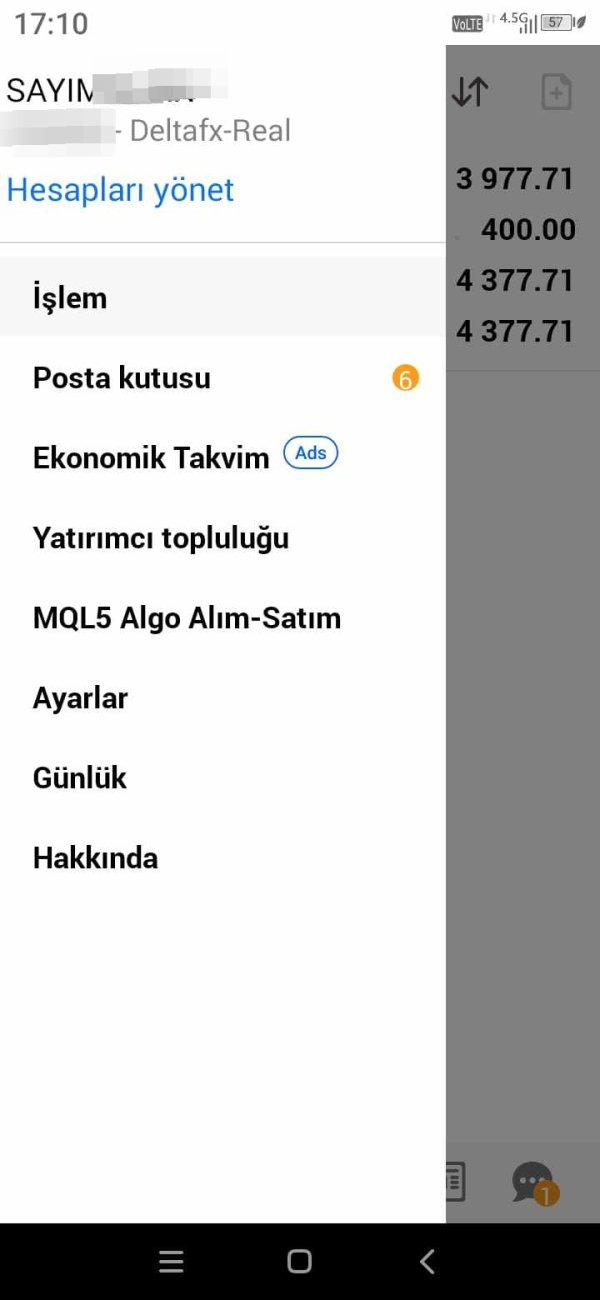

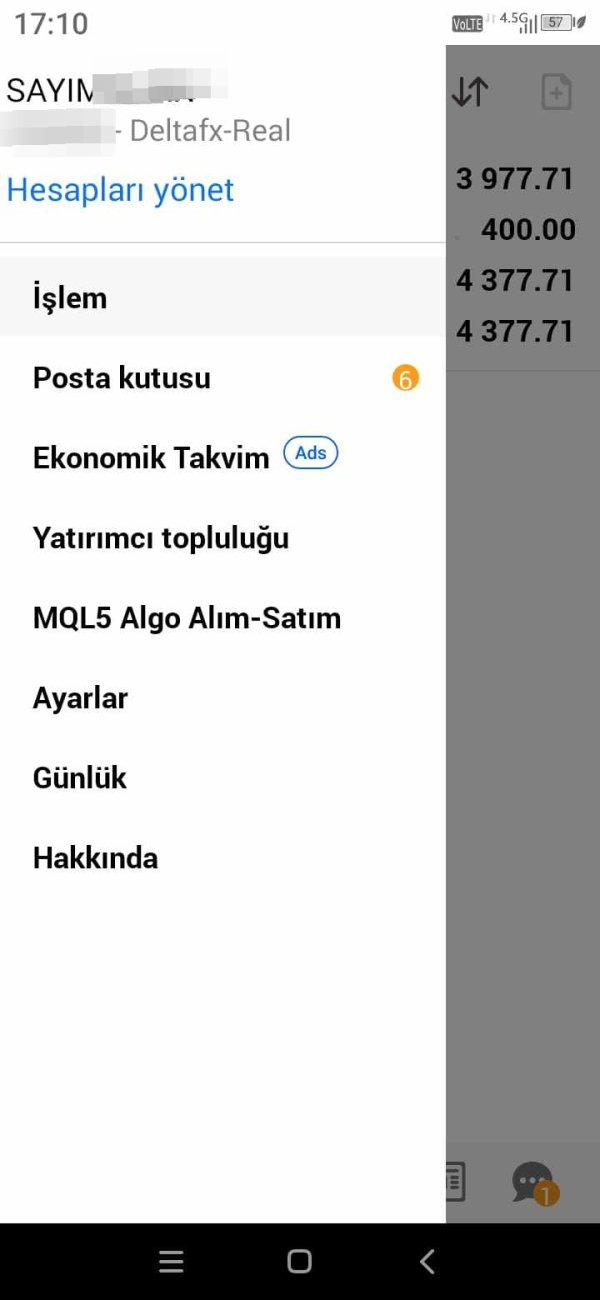

The broker's primary strengths lie in its low spreads and high leverage offerings, which create favorable trading conditions for active traders. According to user feedback, Deltafx has earned recognition for delivering quality educational content. The platform also provides dedicated mentor support throughout the trading journey. The platform supports both MetaTrader 4 and MetaTrader 5, offering access to multiple asset classes including currencies, cryptocurrencies, indices, precious metals, energies, and stocks.

Deltafx targets two distinct user segments: experienced traders who wish to capitalize on high leverage trading opportunities, and newcomers to forex trading who value educational support and mentorship. The broker's "Summit" bonus program further incentivizes trader engagement. This program encourages participation in their trading ecosystem.

Important Notice

As an offshore forex and CFD broker, Deltafx operates across different jurisdictions and may be subject to varying regulatory environments depending on the trader's location. This review is based on available information from multiple sources and user feedback collected from various platforms. Readers should note that specific regulatory details and compliance information were not comprehensively detailed in available materials. Traders should conduct their own due diligence regarding regulatory status in their respective jurisdictions before engaging with any broker.

The evaluation presented here reflects information available at the time of writing. Broker terms and conditions may change over time.

Rating Framework

Broker Overview

Deltafx operates as a London-based offshore forex and CFD broker, positioning itself as a comprehensive trading solution provider in the competitive forex market. According to available information, the company has established its headquarters in London, United Kingdom. The broker maintains a focus on creating a secure and professional trading environment for its clients. The broker's business model centers on providing forex and CFD trading services while emphasizing educational support and trader development.

The company's approach to forex trading distinguishes itself through its commitment to transparency and realistic expectations. As noted in user reviews, Deltafx aims to present "the reality of trading" rather than unrealistic promises commonly found in the industry. This honest approach to trader education appears to resonate with users. Users appreciate straightforward guidance in an industry often characterized by exaggerated claims.

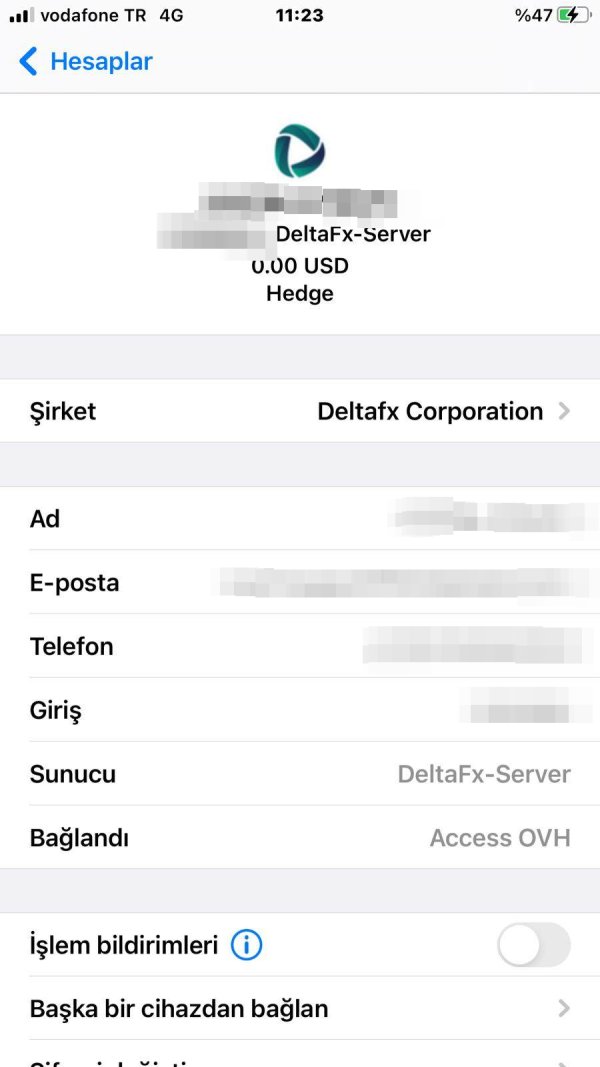

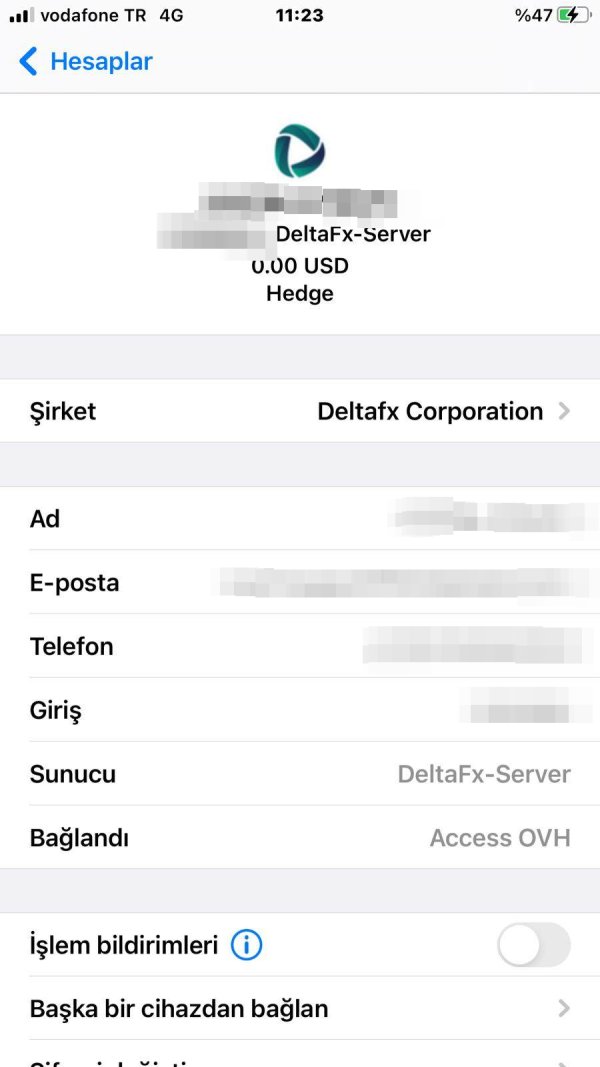

Deltafx supports both MetaTrader 4 and MetaTrader 5 trading platforms, providing traders with industry-standard tools for market analysis and order execution. The broker offers access to multiple asset classes including major and minor currency pairs, popular cryptocurrencies, global indices, precious metals, energy commodities, and individual stocks. While specific regulatory information was not detailed in available sources, the broker operates as an offshore entity serving international clients. This Deltafx review will examine each aspect of the broker's services in detail.

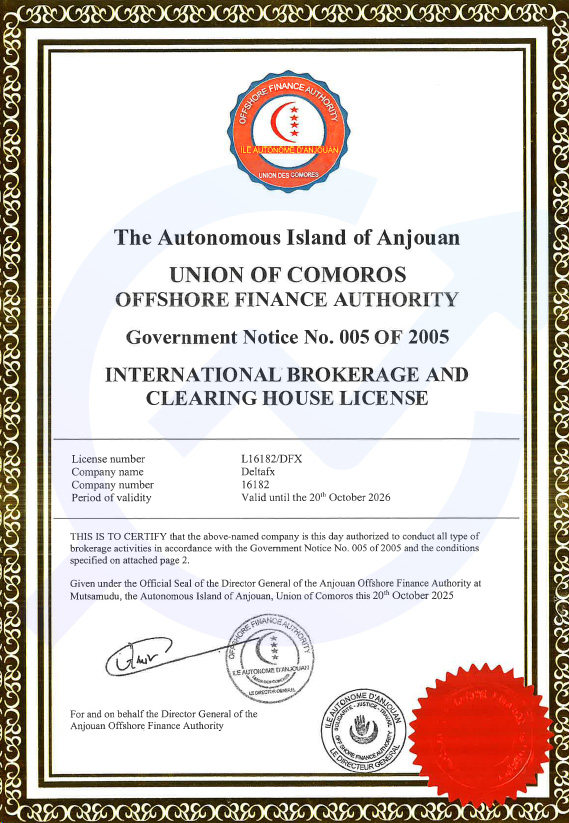

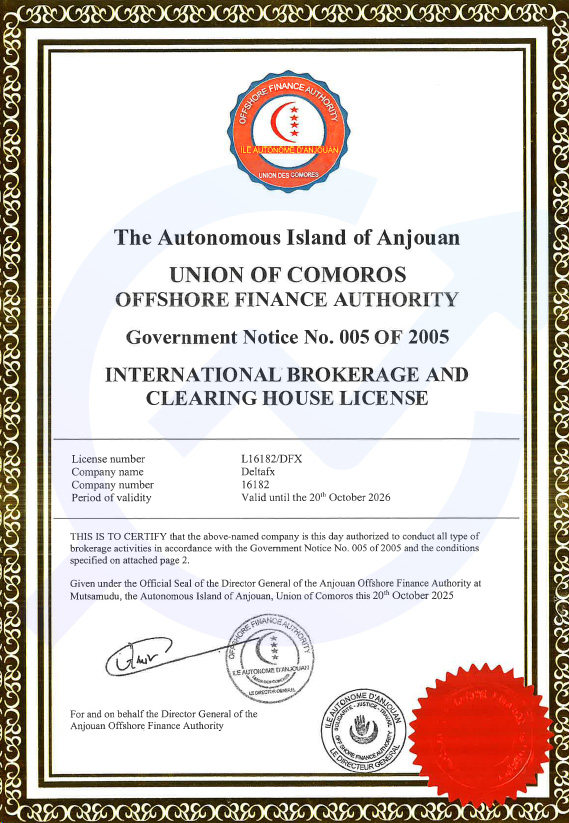

Regulatory Status: Available information does not specify particular regulatory authorities overseeing Deltafx operations. This is common among offshore brokers serving international markets.

Deposit and Withdrawal Methods: Specific funding methods and withdrawal options were not detailed in the available sources. The broker appears to support standard industry payment solutions.

Minimum Deposit Requirements: Exact minimum deposit amounts were not specified in the available information. This suggests potential flexibility in account opening requirements.

Bonus and Promotions: Deltafx offers a "Summit" bonus program designed to reward trading activity. According to promotional materials, this bonus structure encourages traders to progress toward higher levels of success with each trade executed.

Available Trading Instruments: The broker provides access to six major asset categories. These include currencies with major, minor, and exotic pairs, cryptocurrencies covering popular digital assets, indices from global markets, precious metals like gold and silver, energy products including oil and gas, and individual stocks from various markets.

Cost Structure: Deltafx emphasizes low spread offerings as a key competitive advantage. Specific commission structures and fee schedules were not detailed in available sources.

Leverage Options: The broker advertises high leverage availability. Specific maximum leverage ratios were not specified in the reviewed materials.

Platform Selection: Trading is conducted through MetaTrader 4 and MetaTrader 5 platforms. Web-based trading access is also available for enhanced convenience.

Geographic Restrictions: Specific regional limitations were not detailed in available information.

Customer Support Languages: Available sources did not specify the range of languages supported by customer service teams. This Deltafx review notes this as an area requiring direct broker contact for clarification.

Detailed Analysis

Account Conditions Analysis

The specific account structure and conditions offered by Deltafx remain largely undisclosed in available public information. This makes it challenging to provide a comprehensive assessment of account types and their respective features. This lack of detailed account information represents a significant gap for potential traders seeking to understand entry requirements and account-specific benefits.

Without clear information about minimum deposit requirements, traders cannot adequately assess the accessibility of Deltafx services relative to their available capital. Similarly, the absence of detailed account opening procedures makes it difficult to evaluate the efficiency and convenience of the onboarding process.

The lack of information regarding specialized account types, such as Islamic accounts for traders requiring Sharia-compliant trading conditions, further limits the assessment of Deltafx's inclusivity. The broker's accommodation of diverse trader needs remains unclear. Professional or institutional account offerings, if available, were also not detailed in the reviewed sources.

This information gap significantly impacts the ability to provide a meaningful evaluation of account conditions. Direct contact with the broker is necessary for prospective traders seeking specific account details. For the purposes of this Deltafx review, account conditions receive an incomplete assessment pending additional information availability.

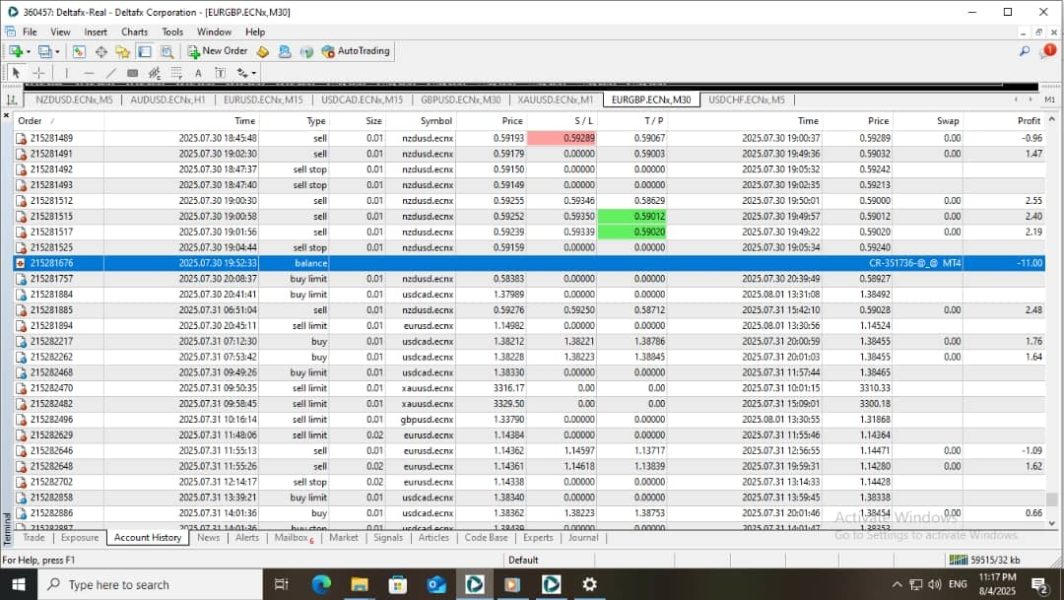

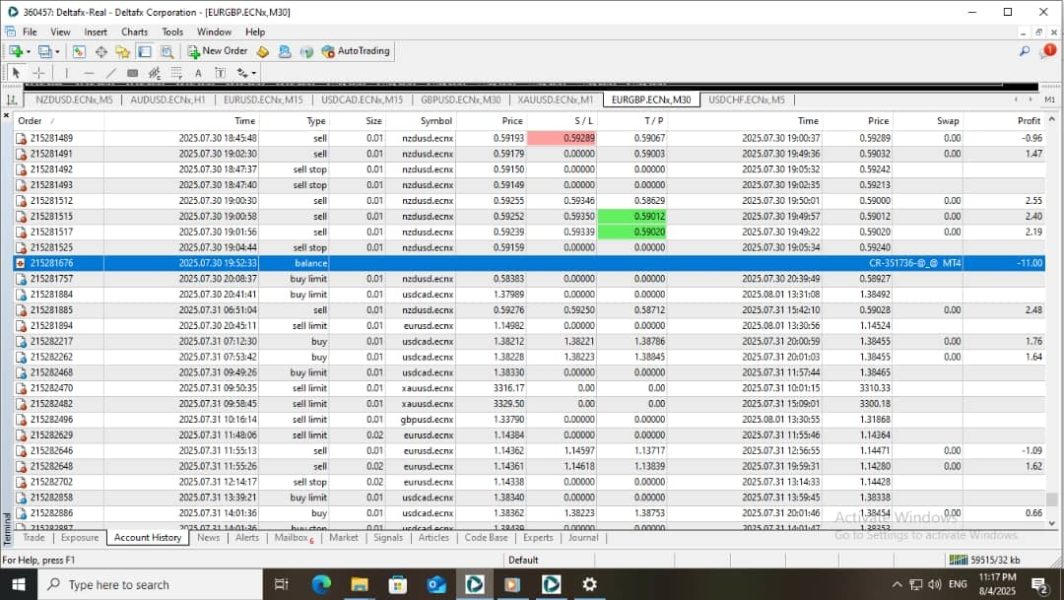

Deltafx demonstrates strength in its platform offerings by supporting both MetaTrader 4 and MetaTrader 5. These platforms provide traders with industry-standard tools that have proven reliability and comprehensive functionality. These platforms offer advanced charting capabilities, technical analysis tools, and automated trading support through Expert Advisors.

The broker's educational resources appear to be a standout feature based on user feedback. According to trader testimonials, Deltafx provides high-quality educational content delivered through dedicated mentorship programs. Users specifically praise the availability of mentors who provide support throughout the learning process. This suggests a hands-on approach to trader development.

One user review highlighted the exceptional nature of the educational course. The user noted that "during the month I spent at deltafx, I received support from mentors whenever I needed it." This indicates a responsive educational support system that goes beyond static learning materials to provide interactive guidance.

The diversity of available trading instruments across six major asset categories provides traders with substantial portfolio diversification opportunities. The inclusion of traditional forex pairs alongside cryptocurrencies, indices, metals, energies, and stocks creates a comprehensive trading environment. This environment suits various trading strategies and market approaches.

However, specific details about research resources, market analysis tools, and automated trading support were not extensively detailed in available sources. This limits the complete assessment of the broker's analytical and research capabilities.

Customer Service and Support Analysis

User feedback regarding Deltafx customer service and support indicates generally positive experiences. This is particularly true in the area of educational support and mentorship. The broker appears to prioritize providing accessible guidance to traders, with users reporting consistent mentor availability during their learning process.

The quality of support services receives praise from users who appreciate the realistic approach to trading education. Rather than promoting unrealistic expectations, Deltafx appears to focus on providing honest guidance about trading realities. Users find this valuable in an industry often characterized by exaggerated promises.

The responsiveness of support services is suggested by user reports of receiving assistance "whenever needed." This indicates that support availability aligns well with trader requirements. This suggests that Deltafx has structured its support operations to be accessible and responsive to user inquiries.

However, specific information about customer service channels, such as phone support, live chat, email response times, or support hours, was not detailed in available sources. The absence of information about multilingual support capabilities also limits the assessment of service accessibility for international traders.

The lack of detailed contact information or specific support procedures represents an area where additional transparency would benefit potential traders. Traders need to understand available support options before committing to the platform.

Trading Experience Analysis

The trading experience with Deltafx appears to be enhanced by favorable market conditions. Low spreads and high leverage options form core components of the broker's value proposition. These conditions can significantly impact trading profitability, especially for active traders who execute multiple positions daily.

User feedback suggests satisfaction with overall trading conditions, indicating that platform stability and execution quality meet trader expectations. The availability of both MetaTrader 4 and MetaTrader 5 ensures that traders can access comprehensive functionality regardless of their platform preference. This accommodates various trading style requirements.

The diversity of available instruments across multiple asset classes provides traders with extensive opportunities for portfolio diversification and various trading strategies. The inclusion of both traditional financial instruments and modern assets like cryptocurrencies reflects the broker's adaptation to evolving market demands.

However, specific information about order execution speeds, slippage rates, or platform uptime statistics was not available in the reviewed sources. Similarly, mobile trading experience details were not provided. This represents an important consideration for traders who require mobile access to their accounts.

The absence of detailed performance metrics limits the ability to provide a comprehensive assessment of trading experience quality. Available user feedback suggests general satisfaction with trading conditions. This Deltafx review notes that prospective traders may need to request specific performance data directly from the broker.

Trust and Reliability Analysis

The assessment of Deltafx's trustworthiness faces significant limitations due to the absence of detailed regulatory information in available sources. Regulatory oversight represents a crucial factor in evaluating broker reliability. It provides assurance regarding operational standards, client fund protection, and dispute resolution mechanisms.

Without specific information about regulatory authorities, license numbers, or compliance frameworks, it becomes challenging to assess the level of protection available to traders. This regulatory transparency gap represents a significant consideration for traders prioritizing regulatory oversight in their broker selection process.

The company's London, United Kingdom location provides some geographical context. Specific regulatory status within UK financial services framework was not clarified in available materials. The offshore nature of the operation suggests potential differences in regulatory coverage compared to fully regulated UK entities.

Client fund protection measures, such as segregated accounts or compensation schemes, were not detailed in available information. Similarly, information about the company's financial stability, insurance coverage, or third-party auditing was not provided.

The absence of information about any regulatory actions, warnings, or industry recognition further limits the ability to assess the broker's standing within the financial services industry. Prospective traders concerned about regulatory protection should seek direct clarification from Deltafx regarding their regulatory status. Client protection measures also require clarification.

User Experience Analysis

Overall user satisfaction with Deltafx appears to be positive based on available feedback. This is particularly true regarding the educational support and mentorship programs that form a core component of the broker's service offering. Users express appreciation for the realistic approach to trading education and the availability of dedicated support throughout their learning journey.

The emphasis on providing honest guidance about trading realities appears to resonate with users who value transparency over promotional promises. This approach to client education suggests a user-centric philosophy that prioritizes long-term trader development. Short-term acquisition takes a back seat to sustainable growth.

User feedback indicates satisfaction with mentor accessibility and support quality. This suggests that Deltafx has successfully implemented systems to provide responsive educational assistance. The hands-on approach to trader development appears to differentiate the broker from competitors who may rely primarily on automated or self-service educational resources.

However, specific information about user interface design, account management tools, or platform navigation was not detailed in available sources. Similarly, information about common user complaints or areas for improvement was not provided. This limits the comprehensive assessment of user experience quality.

The registration and account verification process details were not available. This makes it difficult to assess the convenience and efficiency of the onboarding experience. Fund management experience, including deposit and withdrawal procedures, also lacks detailed user feedback in available sources.

Conclusion

This Deltafx review reveals a broker that prioritizes educational support and realistic trading guidance while offering favorable trading conditions through low spreads and high leverage options. The broker appears well-suited for both experienced traders seeking advantageous trading conditions and newcomers who value comprehensive educational support. Mentorship programs add significant value to the overall offering.

The primary strengths identified include the quality educational resources with dedicated mentor support, competitive trading conditions with low spreads, and access to diverse asset classes through industry-standard MetaTrader platforms. The broker's honest approach to trading education stands out in an industry often characterized by unrealistic promises.

However, significant information gaps regarding regulatory status, specific account conditions, and detailed operational procedures limit the comprehensive assessment of the broker's overall offering. Prospective traders should seek direct clarification on regulatory protection, account requirements, and specific trading terms before making final decisions.

Deltafx appears most suitable for traders who prioritize educational support and are comfortable with offshore broker arrangements. Those requiring extensive regulatory oversight may need to evaluate whether the broker's regulatory framework meets their specific protection requirements.