Seven Star FX 2025 Review: Everything You Need to Know

Executive Summary

Seven Star FX Limited is a regulated forex broker. The company operates under the supervision of the Mauritius Financial Services Commission and presents itself as a comprehensive trading platform for international investors. This seven star fx review examines a brokerage that has been serving the global trading community since 2004. The company has established itself as a provider of diverse trading instruments across multiple asset classes.

The broker stands out through two key operational strengths: round-the-clock customer support availability and same-day withdrawal processing capabilities. These features position Seven Star FX as a service-oriented platform that prioritizes client accessibility and fund liquidity. According to available data from Trustpilot, the broker maintains a solid reputation with a rating of 4.7 out of 5 stars. This rating reflects generally positive user experiences across its service offerings.

The platform serves traders seeking reliable service delivery combined with access to multiple asset classes including forex pairs, commodities, and cryptocurrency instruments. Seven Star FX operates with a modern trading infrastructure. The system accommodates both retail and institutional trading requirements. The broker's regulatory standing under Mauritius jurisdiction provides a framework for operational oversight. However, traders should be aware that regulatory protections may vary compared to other jurisdictions.

Based on available user feedback and operational data, Seven Star FX appears suitable for traders who prioritize responsive customer service and efficient fund management processes in their broker selection criteria.

Important Disclaimers

Seven Star FX operates across multiple jurisdictions. The company may be subject to different regulatory frameworks depending on the region of operation. While this review focuses on the entity regulated by the Mauritius Financial Services Commission, potential clients should verify the specific regulatory status applicable to their jurisdiction before engaging with the platform.

This comprehensive evaluation draws from publicly available information, user feedback from verified review platforms, and official broker disclosures. The analysis presented herein reflects the broker's status as of 2025. Traders should consider this information alongside current market conditions and individual trading requirements. Traders are advised to conduct independent verification of all broker claims and regulatory standings before making investment decisions.

Rating Framework

Broker Overview

Seven Star FX Limited started operations in 2004. The company established its headquarters in Mauritius while positioning itself as a global online forex and investment brokerage firm. The company has built its business model around providing comprehensive access to international financial markets through a technology-driven trading environment. Over its two-decade operational history, Seven Star FX has developed a client base spanning multiple geographic regions. The company maintains its core focus on foreign exchange trading and multi-asset investment opportunities.

The broker's business model centers on facilitating access to diverse trading instruments. These include major and minor forex pairs, commodity markets, and cryptocurrency assets. Seven Star FX operates as a market maker and provides clients with trading access through its proprietary technology infrastructure. The company's service delivery framework emphasizes client support accessibility and operational efficiency. This focus particularly applies to areas of fund management and customer service responsiveness.

The platform operates under the regulatory oversight of the Mauritius Financial Services Commission. This provides a supervisory framework for the broker's operations. This seven star fx review notes that the regulatory environment in Mauritius offers a balanced approach to financial services oversight while maintaining operational flexibility for international brokerage activities. The broker's modern trading platform infrastructure supports multiple asset classes. The system accommodates various trading strategies and client requirements across different experience levels.

Regulatory Jurisdiction: Seven Star FX operates under the regulatory authority of the Mauritius Financial Services Commission. This provides clients with oversight protection within this jurisdiction's framework. The Mauritius regulatory environment offers structured supervision while maintaining accessibility for international trading operations.

Deposit and Withdrawal Methods: Specific information regarding available payment methods and processing procedures was not detailed in available sources. This requires direct verification with the broker for comprehensive payment option details.

Minimum Deposit Requirements: The broker's minimum deposit thresholds for different account types were not specified in available documentation. This necessitates direct inquiry for accurate account opening requirements.

Promotional Offerings: Current bonus structures and promotional campaigns were not detailed in accessible sources. This suggests potential clients should verify available incentives directly with the broker.

Tradeable Assets: Seven Star FX provides access to multiple asset categories. These include foreign exchange pairs across major, minor, and exotic currencies, commodity markets covering precious metals and energy products, and cryptocurrency instruments reflecting the evolving digital asset landscape.

Cost Structure: Detailed information regarding spreads, commission structures, and additional trading costs was not available in reviewed sources. This prevents comprehensive cost analysis within this seven star fx review. Traders should request complete fee schedules directly from the broker.

Leverage Options: Specific leverage ratios and margin requirements were not detailed in available documentation. This requires direct verification for accurate trading condition information.

Platform Options: The broker utilizes modern trading platform technology. However, specific platform names and technical specifications were not detailed in available sources.

Geographic Restrictions: Information regarding territorial limitations and restricted jurisdictions was not specified in reviewed materials.

Customer Service Languages: Available support languages were not detailed in accessible documentation.

Account Conditions Analysis

The account structure and conditions offered by Seven Star FX require direct verification due to limited specific information available in public sources. This seven star fx review notes that while the broker operates with multiple account options, detailed specifications regarding account types, their distinctive features, and associated benefits were not comprehensively documented in available materials.

Minimum deposit requirements across different account tiers remain unspecified in accessible sources. This prevents accurate assessment of entry barriers for various trader categories. The account opening process appears streamlined based on user feedback. However, specific verification procedures and documentation requirements were not detailed in reviewed materials.

The availability of specialized account features, such as Islamic-compliant trading accounts or institutional-grade services, was not confirmed through available sources. Traders requiring specific account configurations should verify availability directly with the broker's account management team.

Account management services appear to include dedicated support based on user feedback regarding responsive customer service. However, the specific structure of account management tiers and associated benefits requires clarification through direct broker contact. The overall account framework suggests a service-oriented approach. Comprehensive evaluation requires additional detailed information from the broker.

Seven Star FX provides access to modern trading platform technology designed to support multi-asset trading operations. However, specific details regarding proprietary tools and analytical resources were not comprehensively detailed in available sources. The platform infrastructure appears designed to accommodate various trading strategies across the broker's supported asset classes.

The broker's research and analysis resource offerings were not specifically documented in reviewed materials. This prevents detailed assessment of market analysis tools, economic calendars, and research publication availability. Traders seeking comprehensive analytical support should verify available resources directly with the broker.

Educational resource availability, including training materials, webinars, and trading guides, was not detailed in accessible documentation. The broker's approach to trader education and skill development requires direct verification for accurate assessment of available learning opportunities.

Automated trading support capabilities, including Expert Advisor compatibility and algorithmic trading infrastructure, were not specified in available sources. Traders utilizing automated strategies should confirm platform compatibility and technical requirements directly with Seven Star FX support teams.

The overall tools and resources framework suggests modern platform capabilities. However, comprehensive evaluation requires additional detailed information regarding specific features, analytical tools, and educational offerings available to clients.

Customer Service and Support Analysis

Seven Star FX demonstrates strong performance in customer service delivery, with 24-hour online support availability representing a key operational strength. This round-the-clock accessibility addresses the global nature of forex markets and accommodates traders across different time zones. The service reflects the broker's commitment to comprehensive client support.

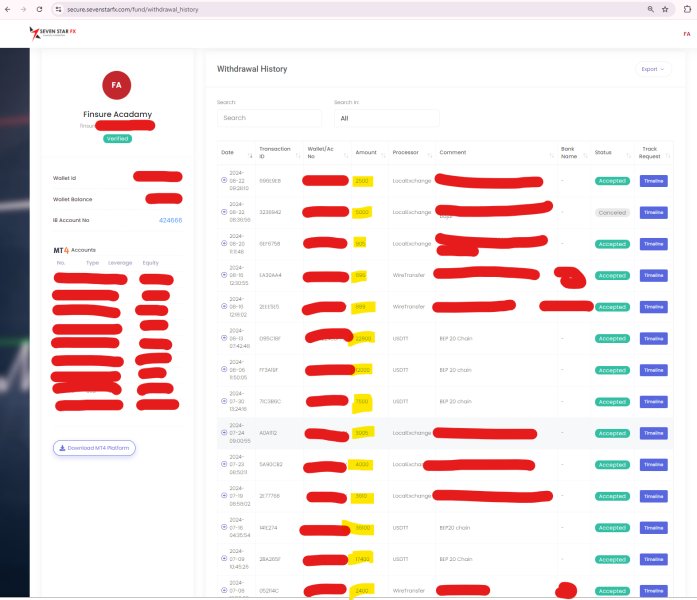

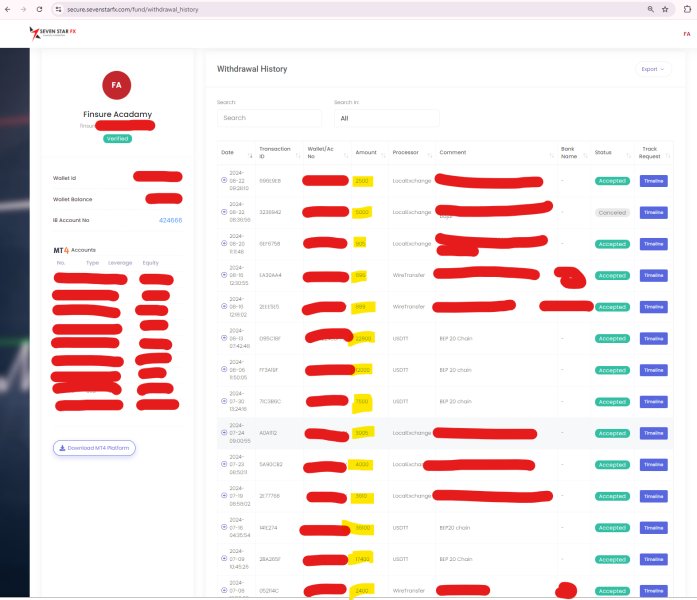

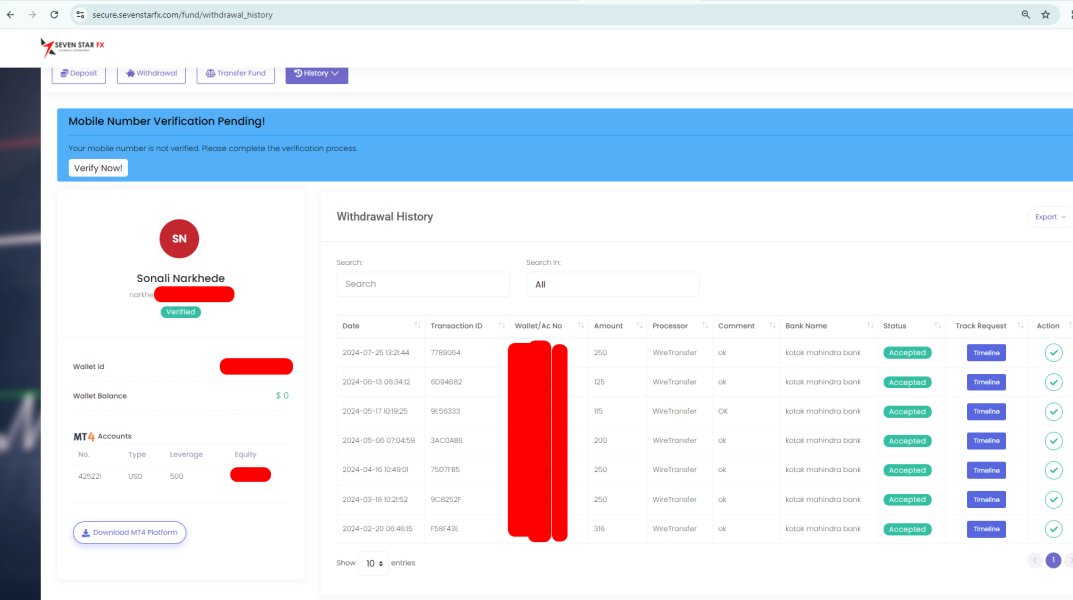

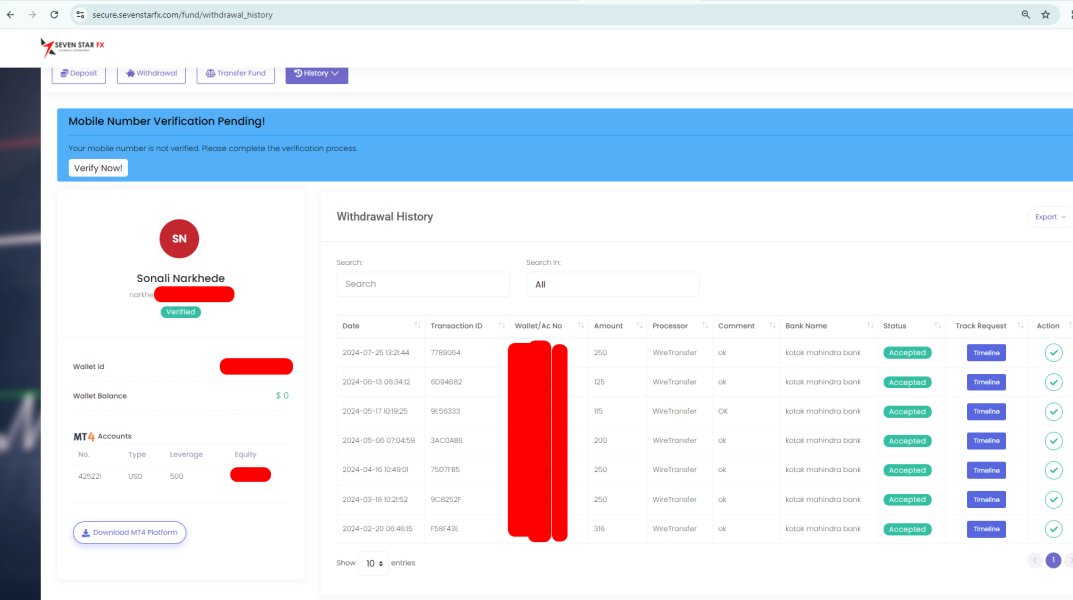

Response time efficiency appears notably strong based on user feedback highlighting same-day withdrawal processing capabilities. This rapid fund processing suggests well-developed operational procedures and efficient back-office management systems. The broker's ability to process withdrawal requests within the same day indicates robust liquidity management and streamlined administrative processes.

Service quality assessment based on available user feedback indicates professional handling of client inquiries and effective problem resolution. The Trustpilot rating of 4.7 out of 5 stars suggests consistent service delivery meeting client expectations across various support interactions. User comments reference "good experience" with the broker's services. This indicates satisfactory support quality.

While specific information regarding multilingual support capabilities was not detailed in available sources, the broker's international operational scope suggests accommodation for multiple languages. The customer service framework appears designed to support the broker's global client base. However, specific language availability requires direct verification.

The overall customer service infrastructure demonstrates strong commitment to client accessibility and efficient service delivery. This positions this aspect as a notable strength in the broker's operational framework.

Trading Experience Analysis

The trading experience evaluation for Seven Star FX faces limitations due to insufficient specific information regarding platform performance metrics and execution quality in available sources. User feedback regarding platform stability, execution speed, and overall trading environment reliability was not comprehensively documented in reviewed materials.

Order execution quality assessment requires additional data regarding fill rates, slippage statistics, and execution speed benchmarks. These technical performance indicators are crucial for evaluating the broker's trading environment effectiveness. However, they were not detailed in accessible sources.

Platform functionality completeness, including charting capabilities, technical analysis tools, and order management features, was not specifically documented in available materials. The broker's modern platform infrastructure suggests comprehensive functionality. However, detailed feature assessment requires direct platform evaluation.

Mobile trading experience evaluation was not possible due to lack of specific information regarding mobile platform availability, features, and performance characteristics. Given the importance of mobile trading accessibility in current market conditions, this represents a significant information gap requiring direct verification.

The overall trading environment assessment suggests modern infrastructure capabilities. However, comprehensive evaluation of execution quality, platform performance, and user experience requires additional detailed information and direct platform testing.

Trust and Security Analysis

Seven Star FX operates under regulatory oversight from the Mauritius Financial Services Commission. This provides a supervisory framework for the broker's operations. The Mauritius regulatory environment offers structured oversight while maintaining operational flexibility for international brokerage services. This regulatory standing provides clients with recourse mechanisms and operational transparency requirements within the jurisdiction's framework.

The broker's industry reputation benefits from a strong Trustpilot rating of 4.7 out of 5 stars. This indicates positive user experiences and satisfaction levels. This third-party validation suggests consistent service delivery and client satisfaction across the broker's operational activities. The rating reflects user experiences across various service aspects including customer support, fund management, and overall service quality.

Fund security measures and client asset protection protocols were not specifically detailed in available sources. This prevents comprehensive assessment of segregated account policies, insurance coverage, and other protective measures. These security aspects represent crucial considerations for trader fund safety and require direct verification with the broker.

Company transparency regarding operational procedures, fee structures, and business practices shows room for improvement based on limited detailed information availability. Enhanced transparency in operational disclosures would strengthen client confidence and facilitate more informed decision-making.

The overall trust framework suggests a legitimate operation with regulatory oversight and positive user feedback. However, enhanced transparency and detailed security information disclosure would strengthen the trust profile.

User Experience Analysis

User satisfaction levels appear generally positive based on available feedback, with users reporting "good experience" with Seven Star FX services. The overall user sentiment suggests satisfactory service delivery across key operational areas including customer support responsiveness and fund management efficiency.

Interface design and platform usability assessment was not possible due to limited specific information regarding user interface characteristics and navigation efficiency. The modern platform infrastructure suggests attention to user experience design. However, detailed usability evaluation requires direct platform interaction.

Registration and account verification processes appear streamlined based on positive user feedback. However, specific procedures and timeline requirements were not detailed in available sources. The account opening experience seems designed for efficiency while maintaining necessary compliance procedures.

Fund management experience receives positive user feedback, particularly regarding same-day withdrawal processing capabilities. This efficient fund handling suggests well-developed operational procedures and commitment to client liquidity needs. The rapid withdrawal processing represents a significant user experience advantage in the brokerage industry.

The target user profile suggests suitability for traders seeking reliable service delivery combined with efficient fund management. The broker appears well-positioned to serve clients who prioritize responsive customer support and streamlined operational procedures in their broker selection criteria.

Conclusion

Seven Star FX Limited presents itself as a credible forex brokerage option with notable strengths in customer service delivery and operational efficiency. The broker's 20-year operational history combined with regulatory oversight from the Mauritius Financial Services Commission provides a foundation of legitimacy and operational continuity. The strong Trustpilot rating of 4.7 out of 5 stars reflects positive user experiences and suggests consistent service quality delivery.

The broker demonstrates particular strength in customer support accessibility through 24-hour online service availability and efficient fund management with same-day withdrawal processing capabilities. These operational advantages position Seven Star FX favorably for traders who prioritize responsive service and liquidity access in their broker selection criteria.

However, this evaluation reveals significant information transparency limitations regarding specific trading conditions, fee structures, and detailed service specifications. Enhanced disclosure of account conditions, cost structures, and platform capabilities would strengthen the broker's market positioning and facilitate more informed client decision-making. Potential clients should conduct direct verification of key trading conditions and service specifications before account opening.

Seven Star FX appears most suitable for traders seeking reliable customer service combined with multi-asset trading access, particularly those who value efficient fund management and responsive support over detailed cost optimization or advanced trading tools.