Fortuno Markets 2025 Review: Everything You Need to Know

Executive Summary

Fortuno Markets is a multi-asset, technology-driven forex broker. The company mainly targets beginner traders with its low entry barriers and user-friendly approach that makes trading more accessible to newcomers. This fortuno markets review looks at a broker that offers some attractive features for new traders. The platform includes a remarkably low minimum deposit of just $10 and leverage up to 1:2000, alongside near-zero spreads that could appeal to cost-conscious traders who want to minimize their trading costs.

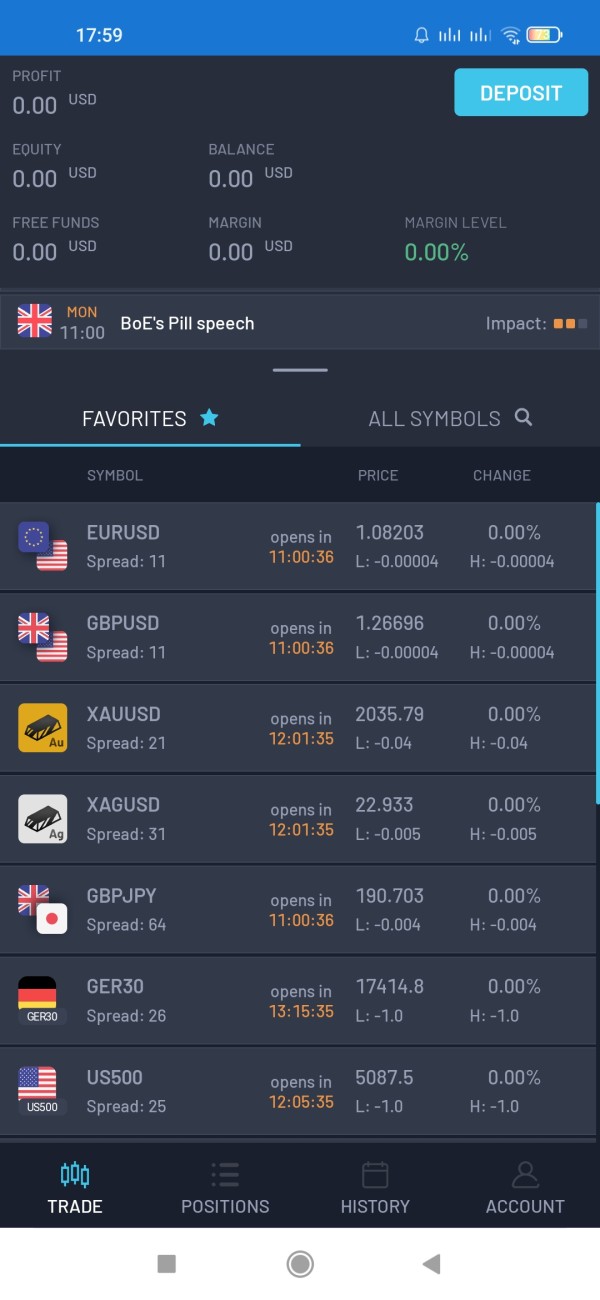

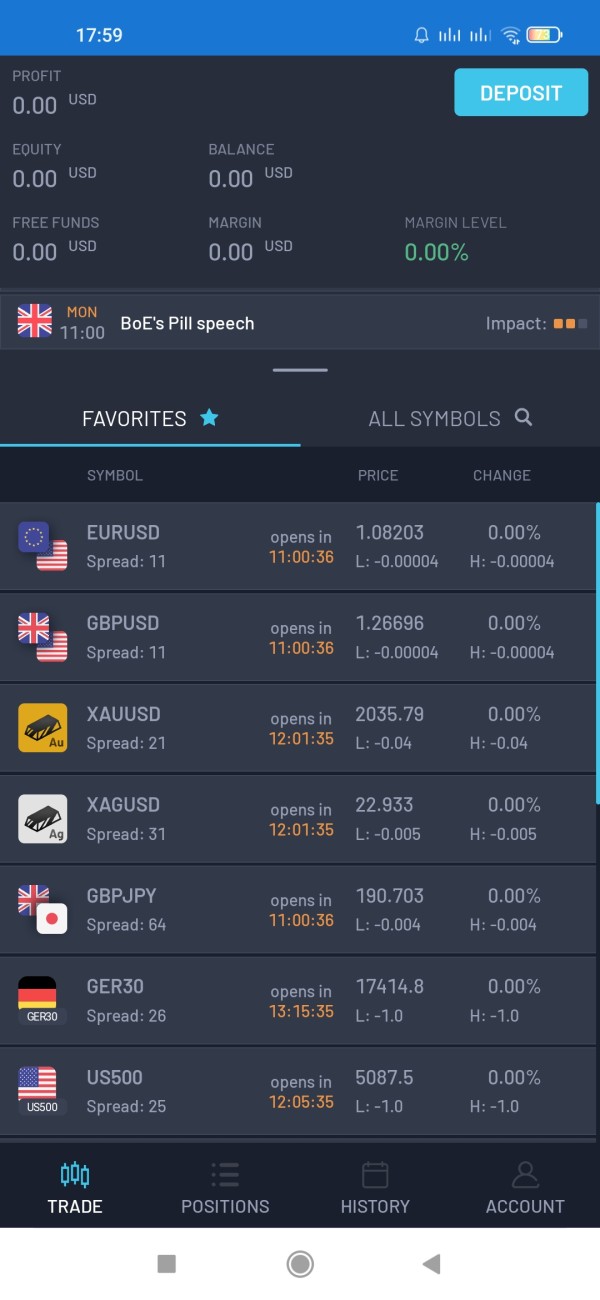

The platform uses a TradingView-powered interface. It also provides access to multiple asset classes including forex, commodities, bonds, precious metals, energy, stocks, and indices that give traders many options for building diverse portfolios. While Fortuno Markets positions itself as beginner-friendly with educational materials and accessible trading conditions, our analysis reveals significant concerns that potential clients should carefully consider before opening accounts.

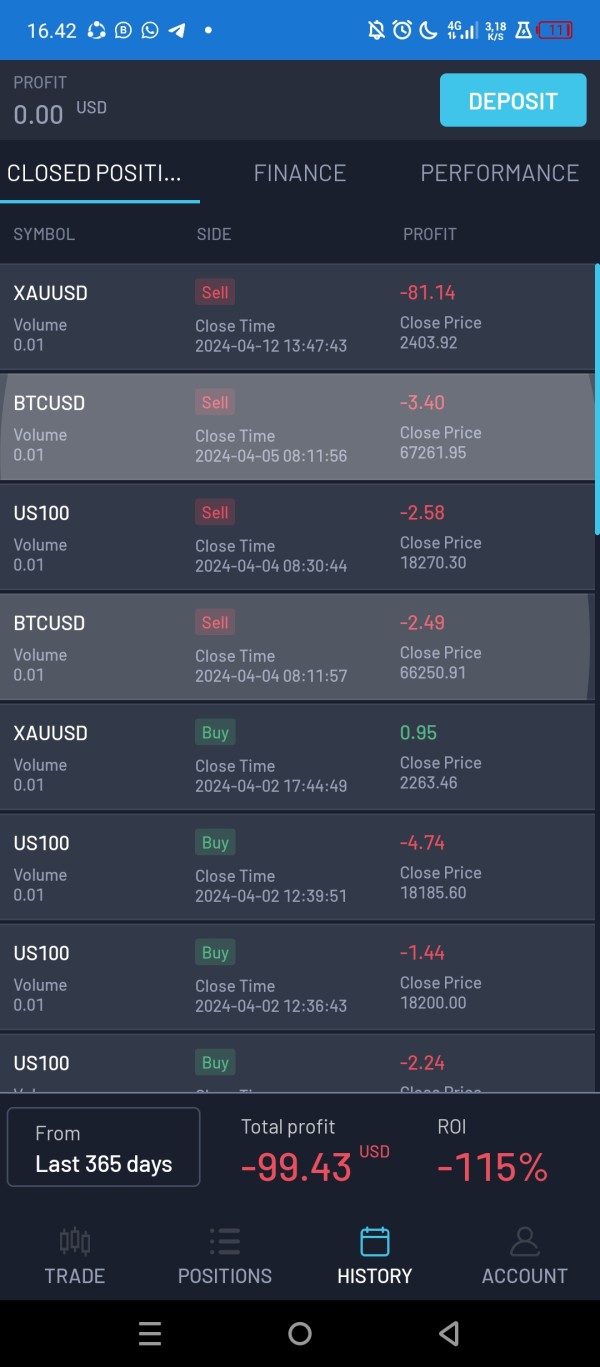

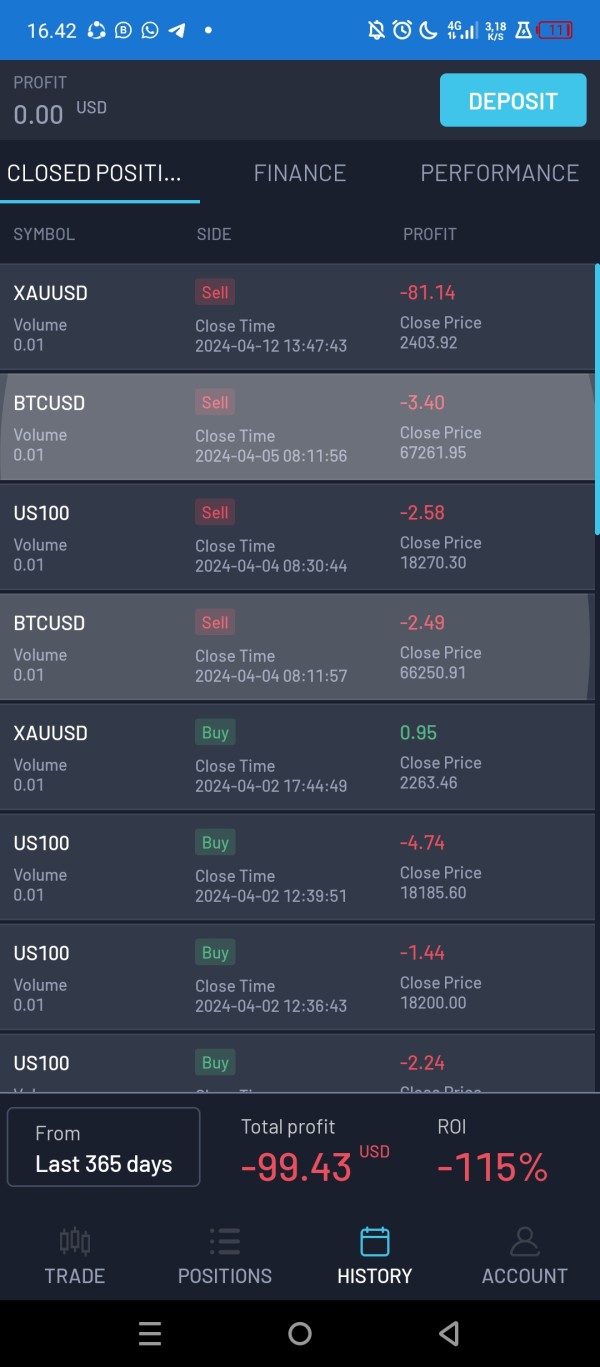

Based on available user feedback and market information, the broker has received mixed reviews. The platform shows a user rating of 3/5 from various sources, which indicates average satisfaction levels among current and former clients. Most notably, there are concerning reports about withdrawal difficulties and service quality issues that have raised red flags among traders who have experienced problems with the platform. Despite its low barrier to entry and technological offerings, these operational challenges significantly impact the overall trading experience and broker reliability in ways that could affect trader success.

The platform's target demographic appears to be new traders and those seeking low-threshold trading opportunities. However, the negative feedback regarding fund withdrawals suggests that even beginners should exercise considerable caution when considering this broker for their trading activities.

Important Disclaimer

Due to the limited availability of comprehensive regulatory information in our research, trading experiences may vary significantly across different regions and user circumstances. This review is based on publicly available user feedback, broker-provided information, and observable market data that we could access during our research process. The information may not encompass all possible user experiences or regulatory scenarios that traders might encounter.

Potential traders should conduct their own due diligence and verify current regulatory status, terms of service, and operational procedures before making any trading decisions. The information presented reflects available data at the time of writing and should not be considered as personalized financial advice that applies to individual circumstances.

Rating Framework

Broker Overview

Fortuno Markets operates as a multi-asset, technology-driven forex and CFD broker. However, specific details about its founding date and corporate headquarters remain undisclosed in available materials, which creates some transparency concerns for potential clients. The company has positioned itself strategically in the competitive online trading space by focusing on accessibility for beginner traders who are just starting their trading journey.

The broker offers what they describe as "unmatched advantages" for entering the forex and CFD markets. According to information from the broker's platform, Fortuno Markets emphasizes its role as "The Best Broker for Trading" and specifically markets itself as the optimal choice for novice traders in 2025, though these claims should be evaluated carefully against actual user experiences. The company's business model centers around providing low-barrier entry points to financial markets, with particular emphasis on user-friendly features and educational support designed to help new traders navigate the complexities of forex trading without overwhelming them.

The broker operates through a TradingView-powered trading interface. This setup provides users with advanced charting capabilities and technical analysis tools that are typically found on more expensive platforms. Their asset offering spans multiple financial instruments including forex pairs, precious metals, energy commodities, stock indices, and individual equities that allow for diverse trading strategies. While the company promotes itself as offering "excellent trading conditions designed especially for novice traders," the lack of detailed regulatory disclosure and corporate transparency information represents a notable gap in the available broker profile that raises questions about oversight and accountability.

This fortuno markets review finds that despite the attractive marketing positioning, the absence of clear regulatory oversight and mixed user feedback creates significant questions about the broker's overall reliability and operational standards. Potential traders should weigh these concerns against the platform's advertised benefits when making their decision.

Regulatory Status

The available information does not specify any regulatory oversight or licensing details for Fortuno Markets. This absence of clear regulatory information represents a significant concern for potential traders who need protection for their funds. Regulatory compliance typically provides important protections for client funds and trading operations that help ensure fair treatment and proper handling of trader assets.

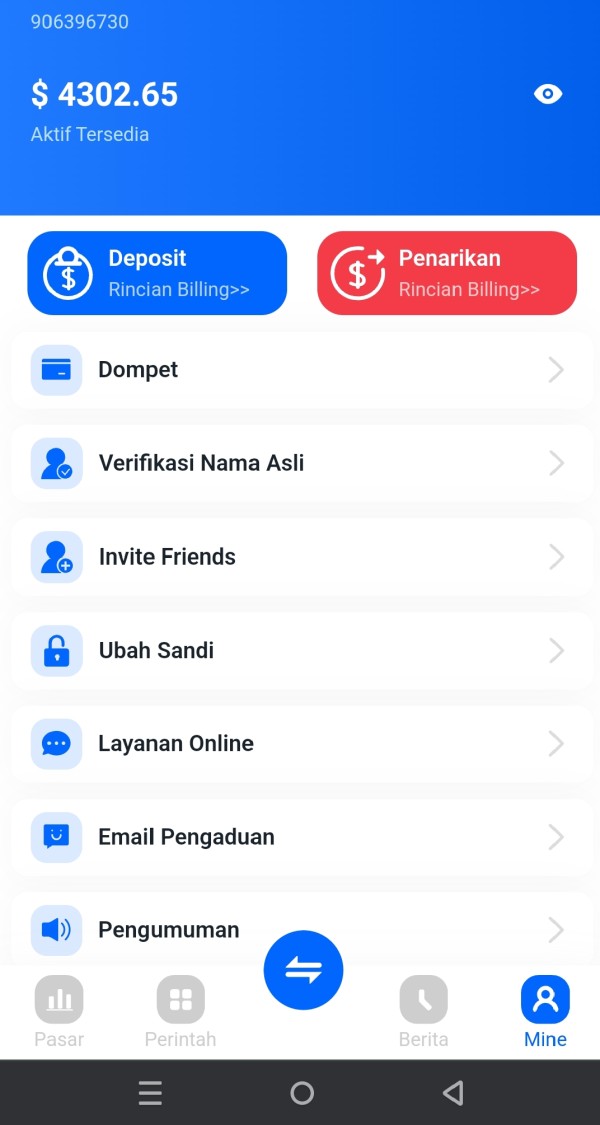

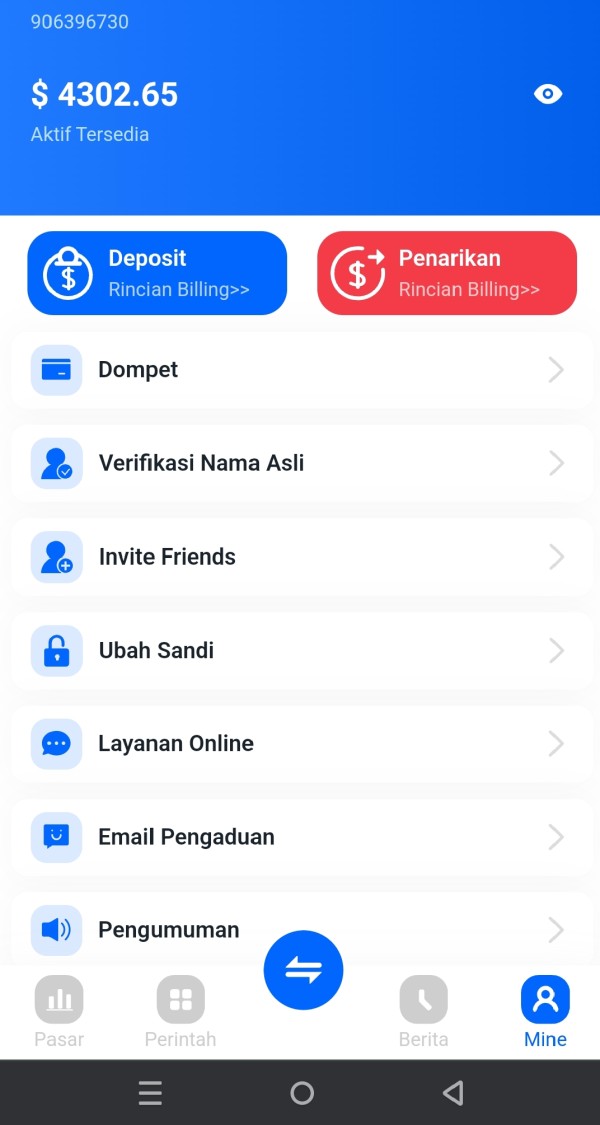

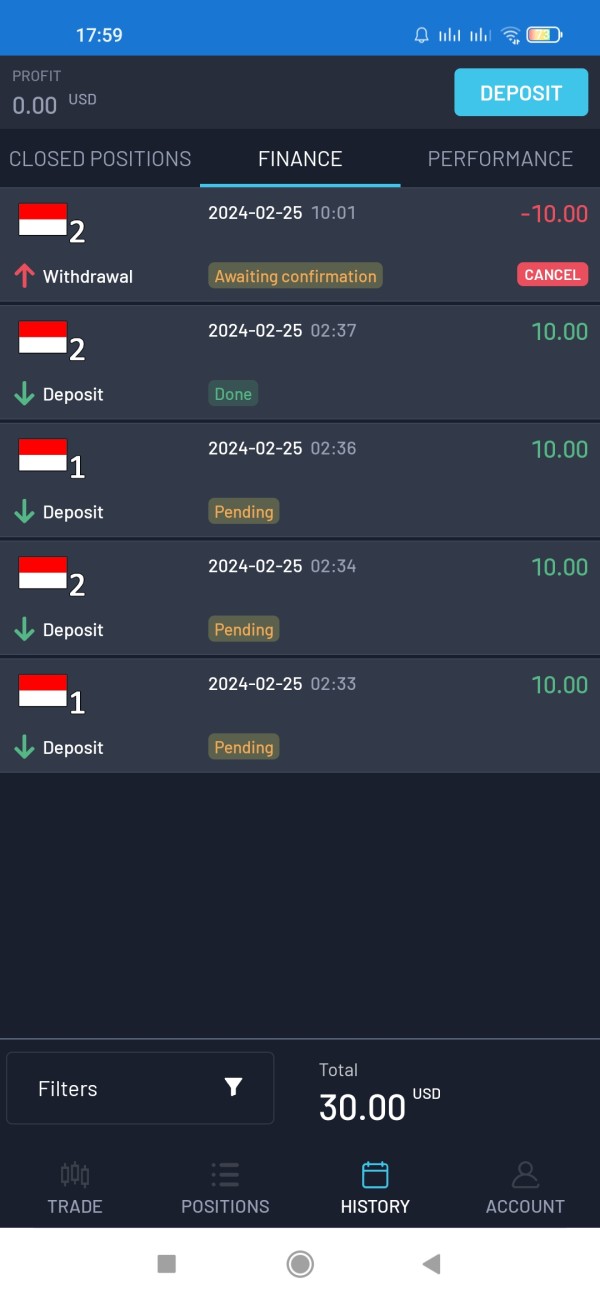

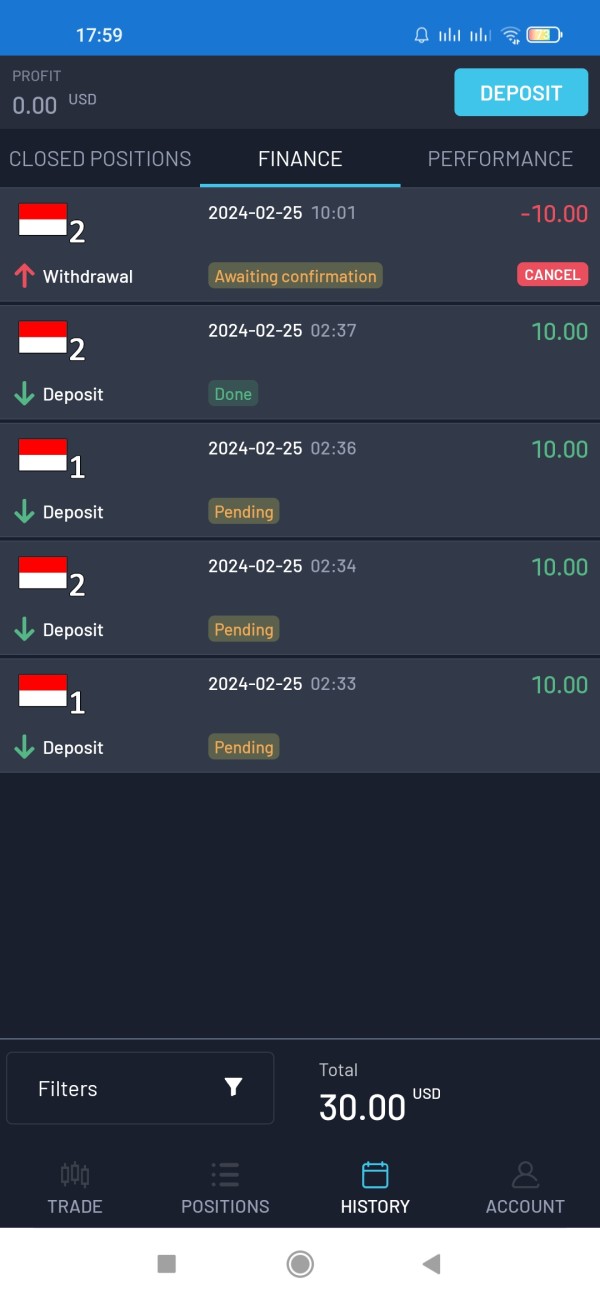

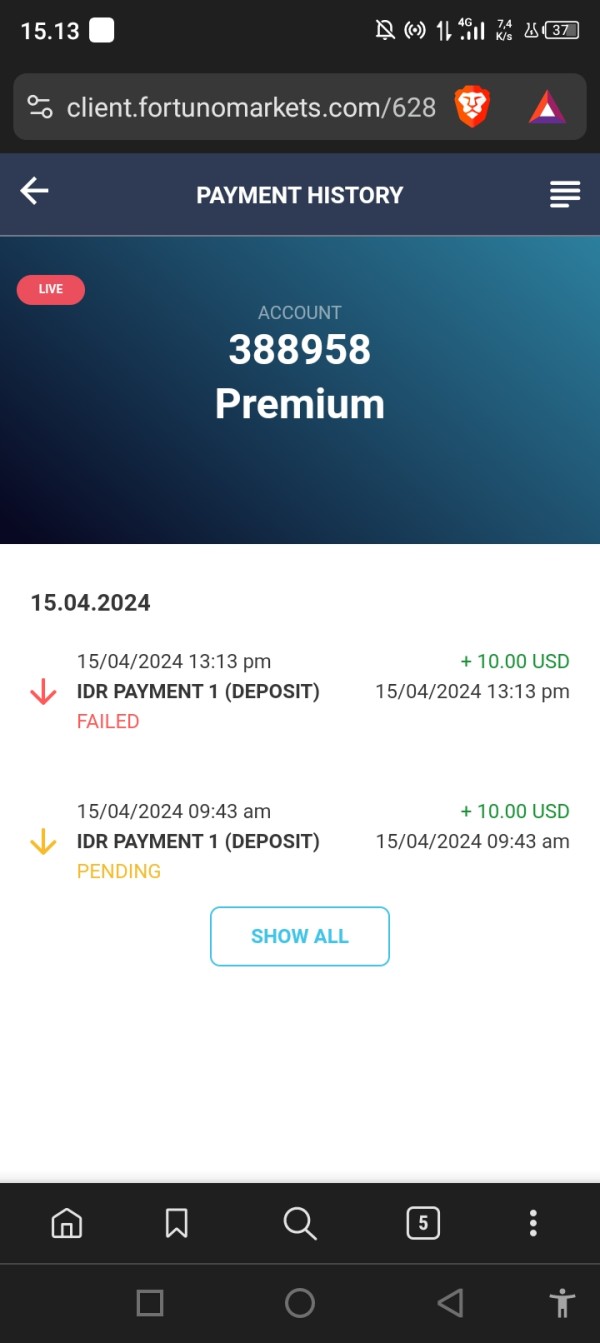

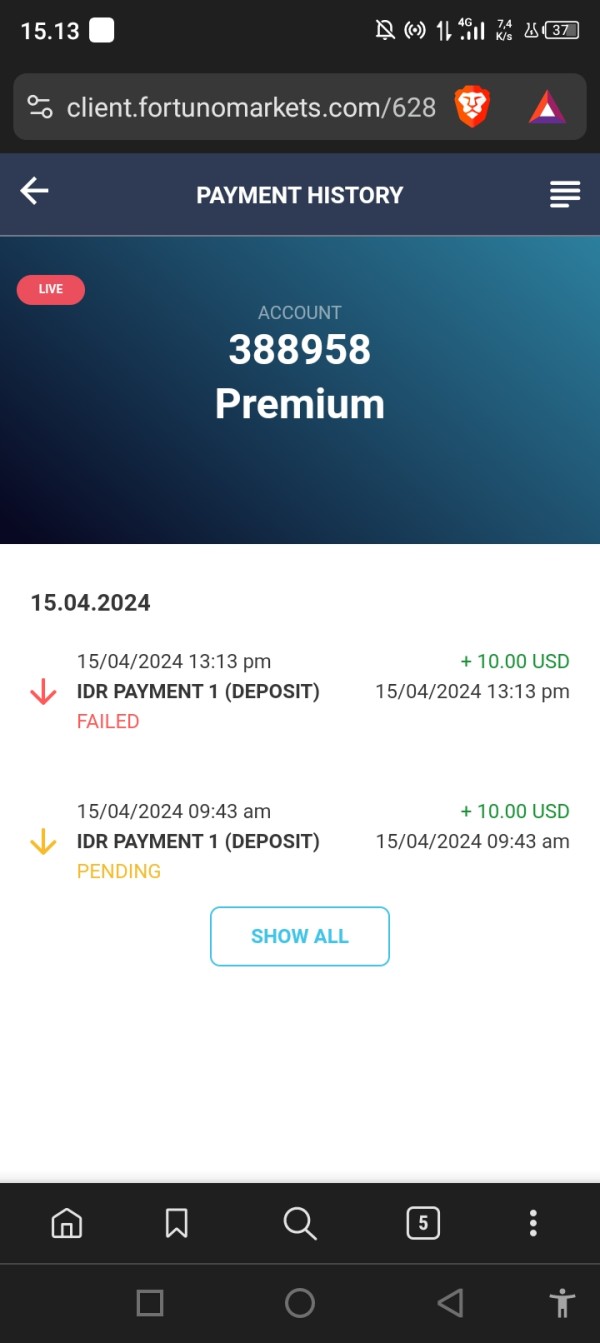

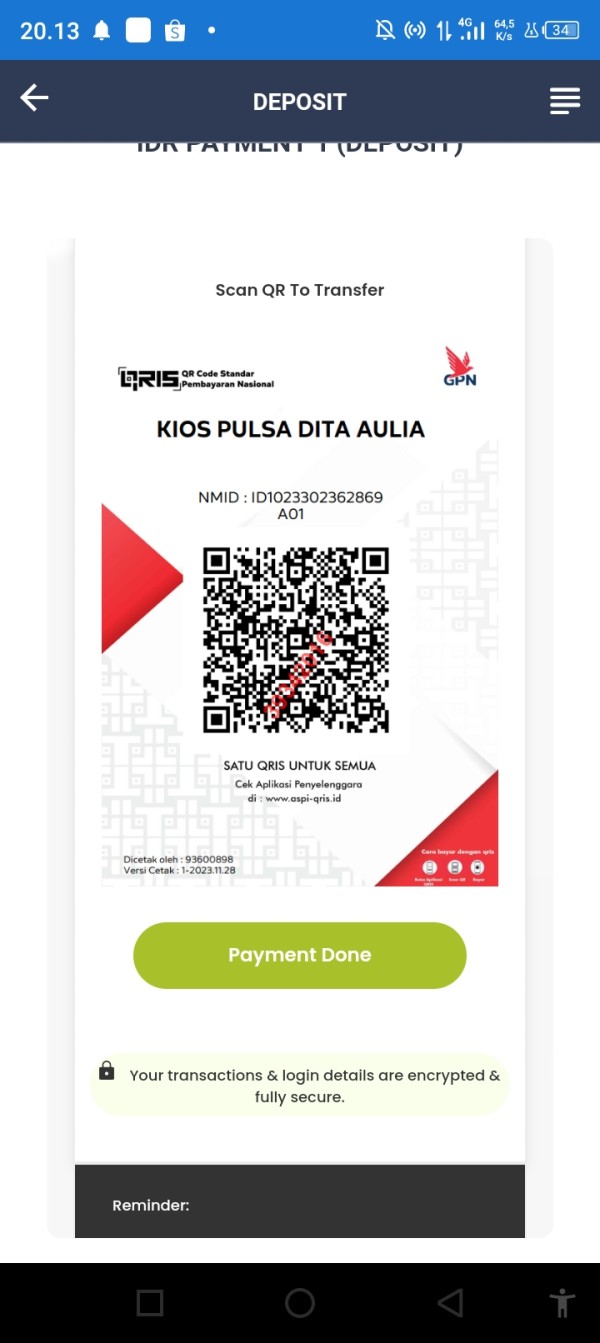

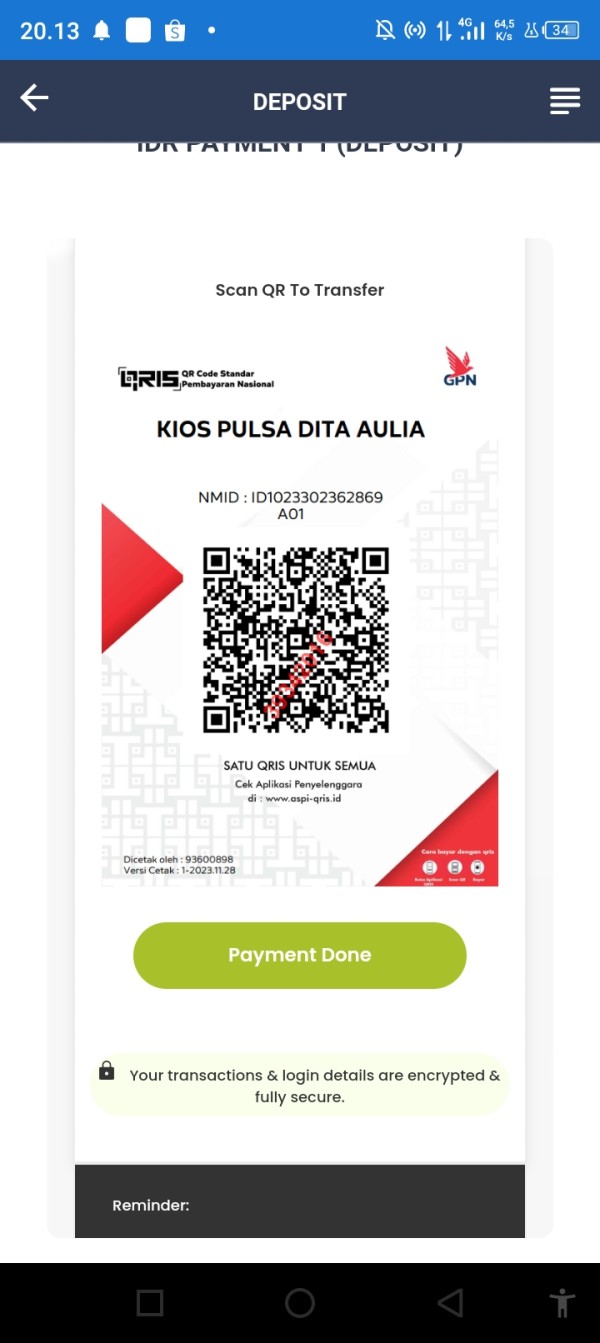

Deposit and Withdrawal Methods

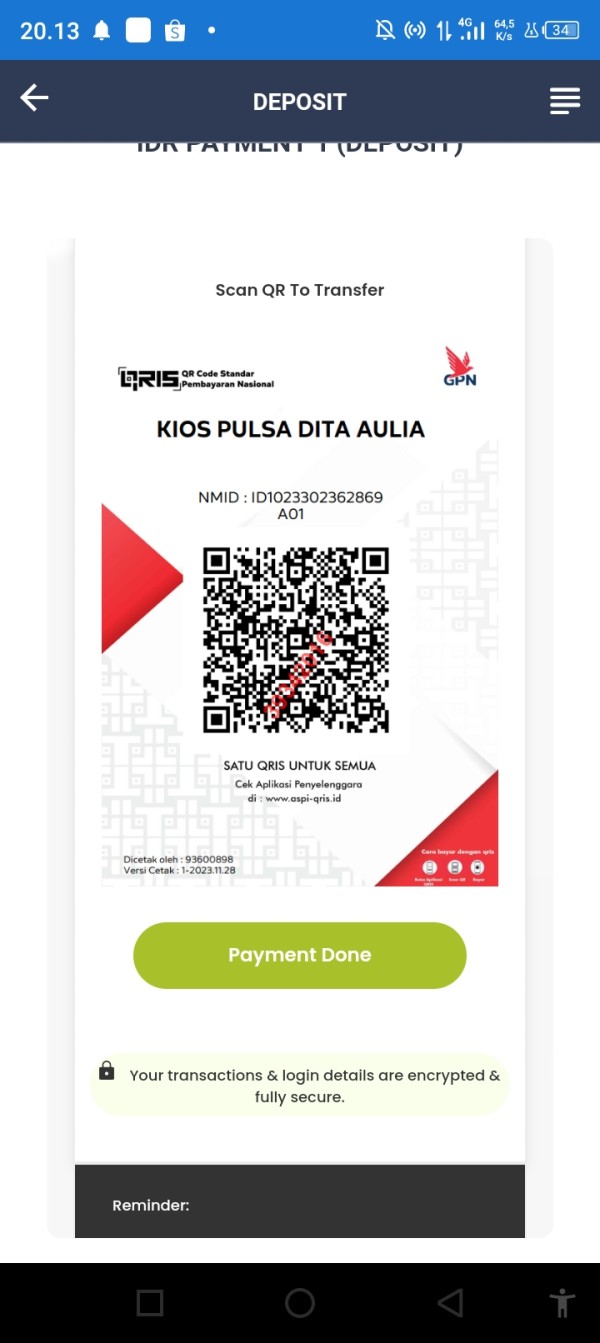

Specific deposit and withdrawal methods are not detailed in the available information. However, the broker does advertise a minimum deposit requirement of $10, which makes it accessible to traders with limited starting capital. The lack of detailed information about payment processing methods, withdrawal timeframes, and associated fees represents an important information gap for potential clients who need to understand how they can access their funds.

Minimum Deposit Requirements

Fortuno Markets offers one of the lowest minimum deposit requirements in the industry at just $10. This low threshold makes it particularly accessible for beginner traders or those looking to test the platform with minimal financial commitment before investing larger amounts.

Current promotional offers and bonus structures are not specifically detailed in the available information. However, the broker's focus on beginner-friendly features suggests they may offer educational incentives or account benefits for new traders who are just starting their trading journey.

Available Trading Assets

The broker provides access to a comprehensive range of trading instruments. These include forex currency pairs, commodities, bonds, precious metals (gold, silver), energy products (oil, gas), individual stocks, and major stock indices that cover most major global markets. This diverse asset selection allows traders to build varied portfolios across multiple market sectors and implement different trading strategies based on their preferences and market outlook.

Cost Structure and Fees

Fortuno Markets advertises near-zero spreads with no commission structure. However, detailed fee schedules for different account types, overnight financing costs, and withdrawal fees are not comprehensively outlined in available materials, which makes it difficult for traders to calculate their total trading costs. This fortuno markets review notes that traders should request complete fee disclosure before opening accounts to avoid unexpected charges.

Leverage Ratios

The broker offers high leverage ratios up to 1:2000. This high leverage can amplify both potential profits and losses significantly, creating opportunities for experienced traders but substantial risks for beginners. While this high leverage may appeal to experienced traders seeking maximum capital efficiency, it represents substantial risk for beginner traders who may not fully understand the implications of leveraged trading.

Fortuno Markets utilizes a TradingView-powered trading platform. This setup provides users with professional-grade charting tools, technical indicators, and market analysis capabilities that are typically associated with more expensive trading platforms. The platform is described as user-friendly with an intuitive interface suitable for beginners who may be intimidated by more complex trading software.

Geographic Restrictions

Specific geographic restrictions and regulatory limitations are not detailed in the available information. This lack of clarity creates uncertainty about service availability in different jurisdictions and whether traders from certain countries can legally access the platform.

Customer Service Languages

The available information does not specify which languages are supported by customer service teams. It also doesn't mention the hours of operation for support services, which could be important for traders in different time zones who need assistance during their local trading hours.

Detailed Rating Analysis

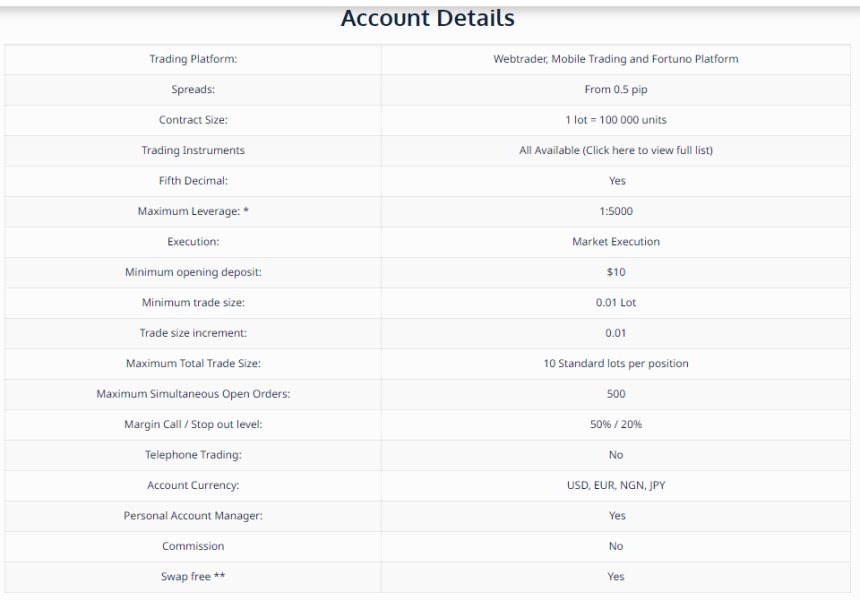

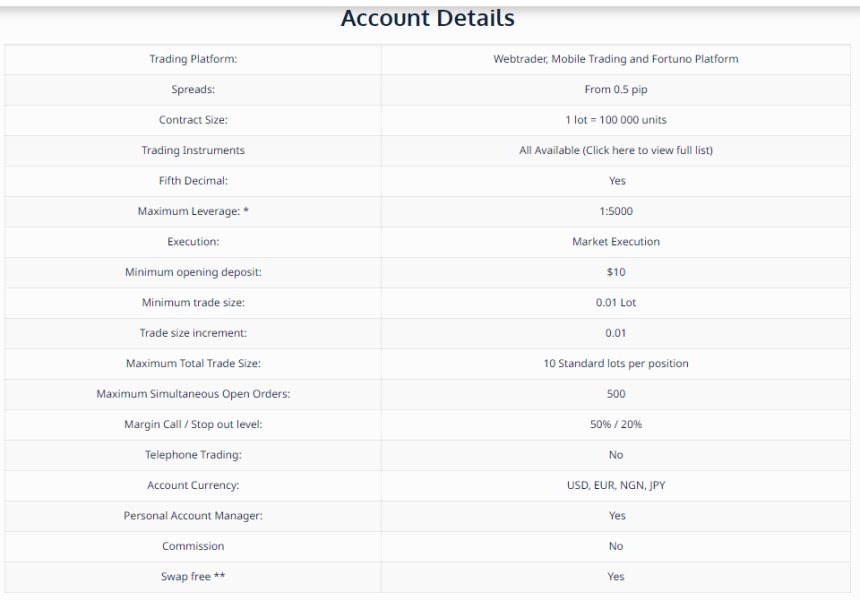

Account Conditions Analysis (7/10)

Fortuno Markets receives a good rating for account conditions primarily due to its exceptionally low minimum deposit requirement of $10. This low threshold removes significant barriers for new traders entering the forex market who may not have large amounts of capital to start with. This accessibility factor represents a genuine advantage over many competitors who require hundreds or thousands of dollars for account opening, making trading more democratic and accessible.

However, the rating is limited by the lack of detailed information about different account types, tier structures, or special account features. The platform doesn't provide clear information about Islamic accounts for Muslim traders or other specialized account options that many brokers offer. The available materials do not provide comprehensive details about account benefits, upgrade requirements, or specific features that differentiate various account levels, which makes it difficult for traders to understand what they're getting.

User feedback regarding account setup and management processes is mixed. Some traders appreciate the low entry threshold while others report complications with account verification and maintenance procedures that can delay their ability to start trading. The absence of detailed account documentation and terms of service transparency further impacts the overall assessment and creates uncertainty about account conditions.

While the low minimum deposit is attractive, this fortuno markets review notes that the lack of comprehensive account structure information and mixed user experiences prevent a higher rating in this category. Potential traders should request detailed account information before committing to the platform to ensure they understand all terms and conditions.

The broker's tools and resources receive a fair rating based on their TradingView-powered platform integration. This setup provides access to professional-grade charting tools, technical indicators, and market analysis capabilities that are typically found on more expensive platforms. TradingView's reputation for quality technical analysis tools represents a significant strength in the broker's offering and gives traders access to institutional-level analysis capabilities.

Fortuno Markets promotes educational materials designed specifically for beginner traders. These resources align with their target market positioning and could help new traders learn the basics of forex trading. However, the depth, quality, and comprehensiveness of these educational resources are not detailed in available information, making it difficult to assess their true value for trader development and whether they actually help beginners become successful traders.

The platform appears to offer standard trading tools including various order types, risk management features, and market analysis capabilities. However, specific details about automated trading support, expert advisors, or advanced trading algorithms are not mentioned in available materials, which limits our ability to assess the full range of tools available. The absence of detailed information about research resources, market commentary, economic calendars, or third-party analysis tools limits the overall assessment and makes it difficult to compare with other brokers.

While the TradingView integration is positive, the lack of comprehensive tool documentation and user feedback about resource quality prevents a higher rating. Traders who rely heavily on research and analysis tools may find the available information insufficient for making an informed decision about the platform's capabilities.

Customer Service and Support Analysis (4/10)

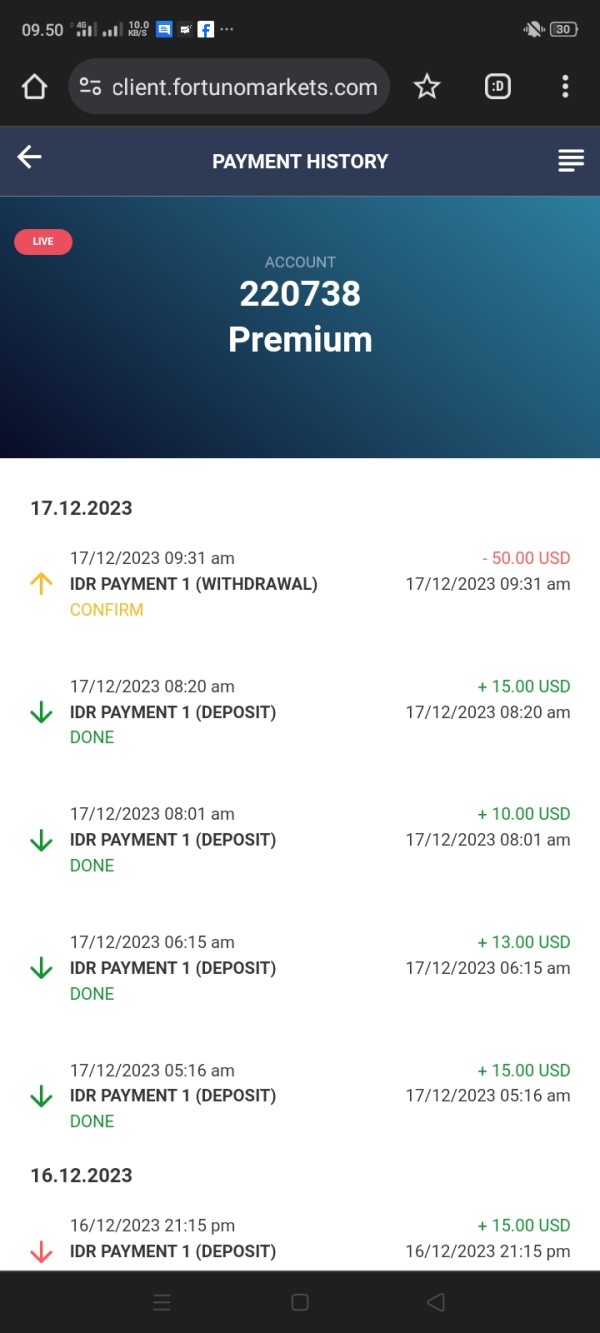

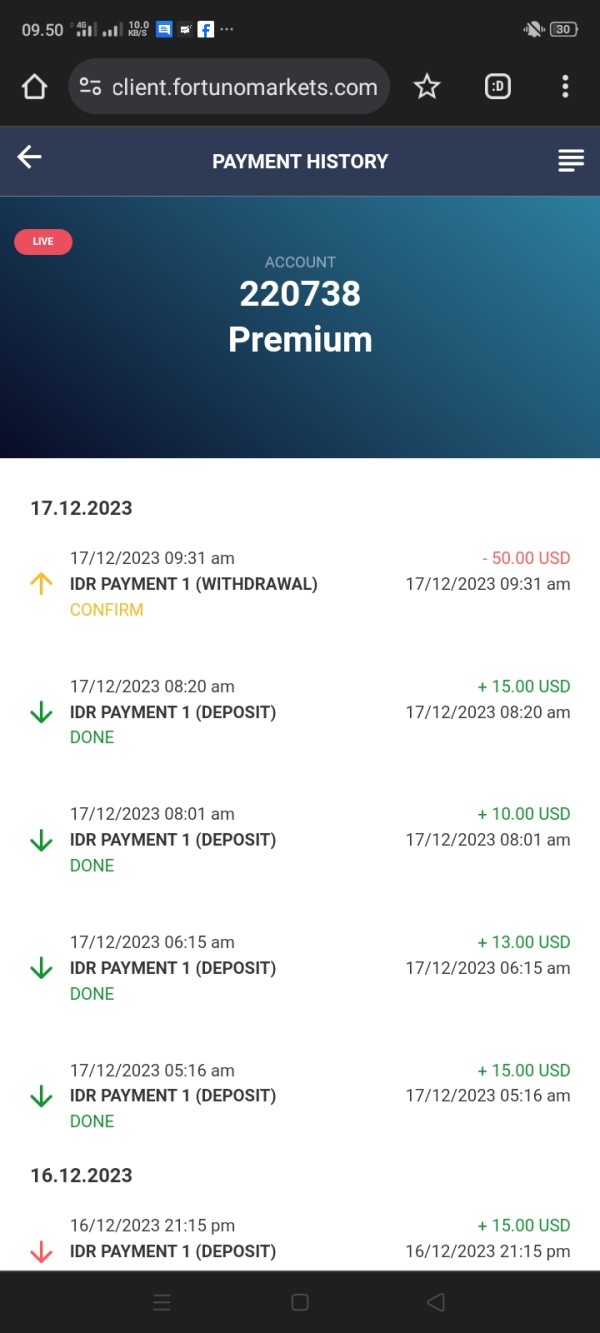

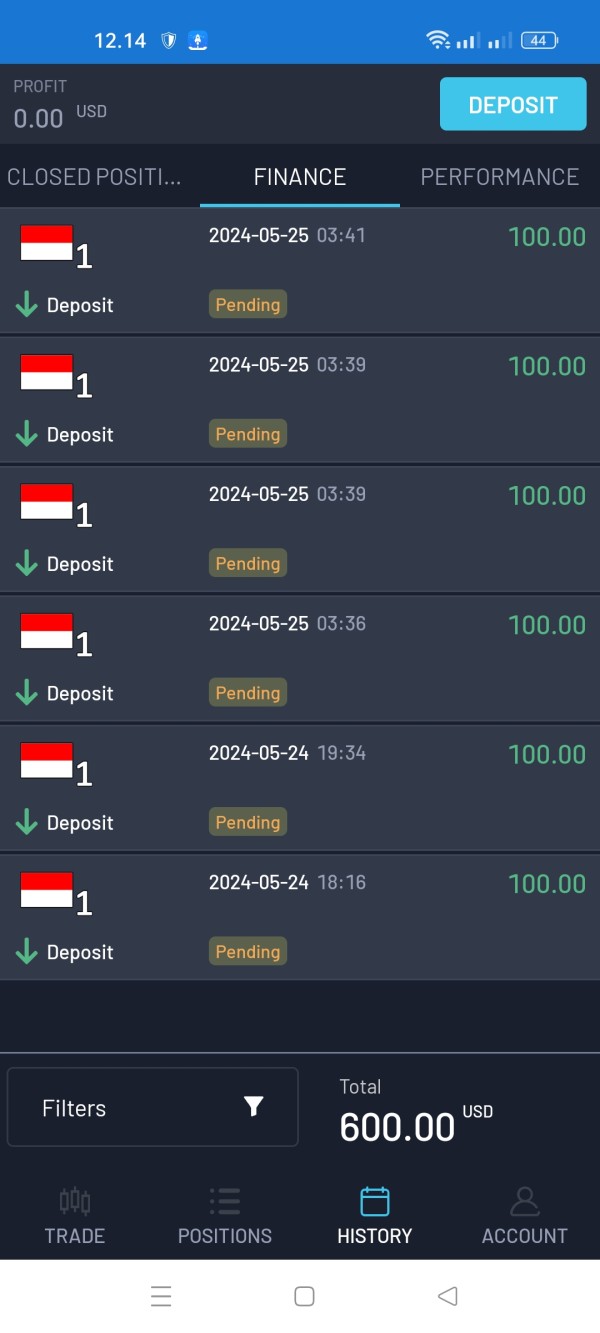

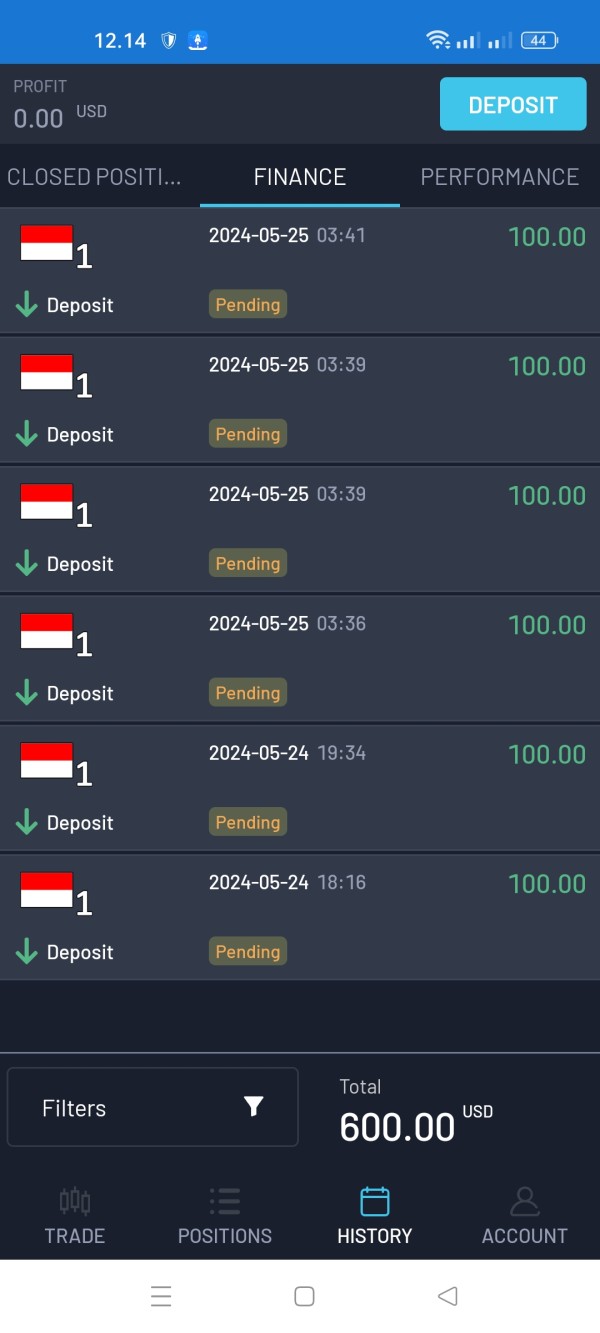

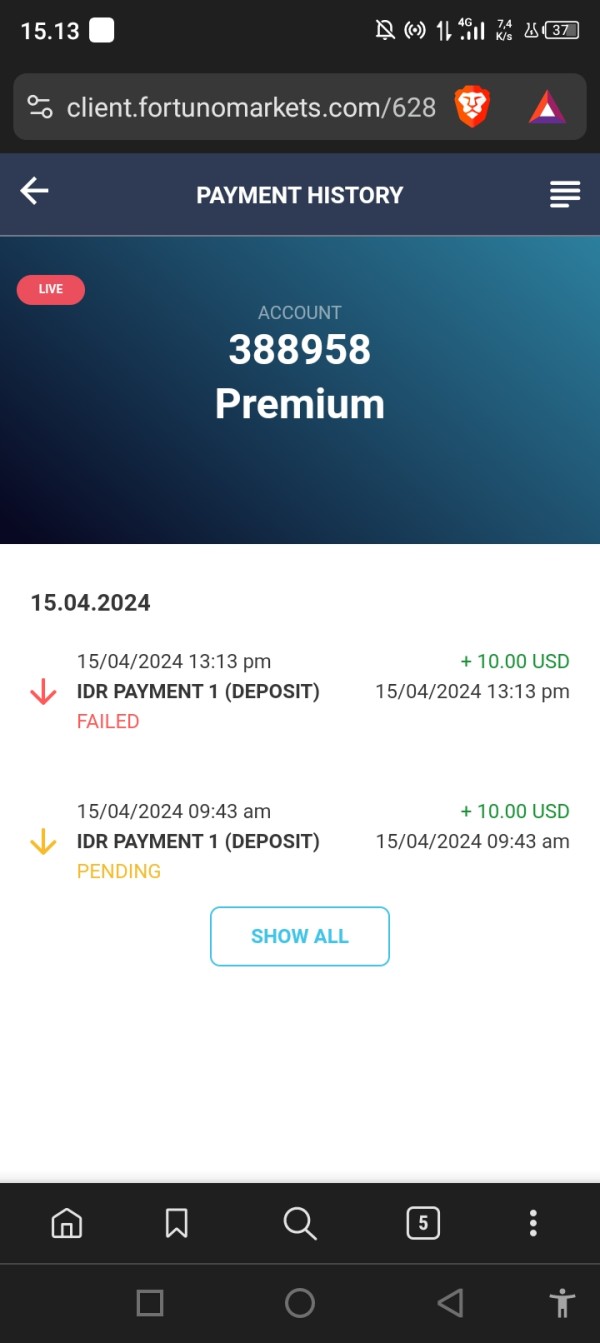

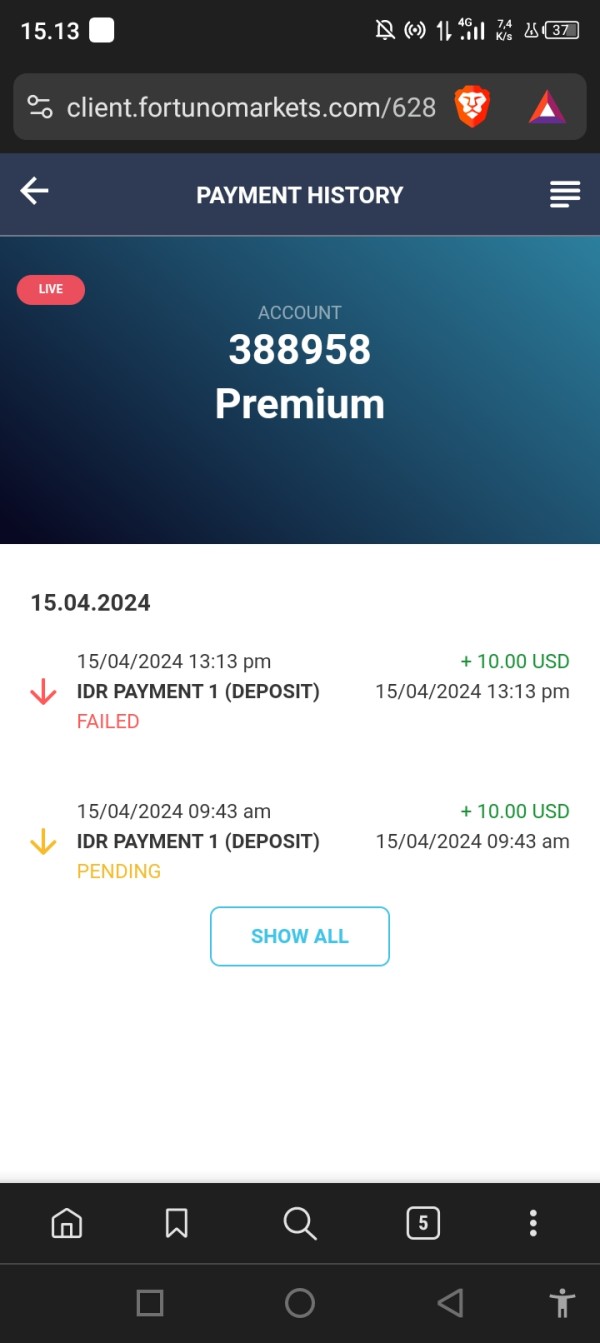

Customer service receives a poor rating based on concerning user feedback about service quality and responsiveness. Multiple sources indicate that traders have experienced difficulties with customer support, particularly regarding withdrawal processing and account-related inquiries that are critical to the trading experience. These issues suggest systematic problems with the support infrastructure that could affect trader satisfaction and success.

The available information does not specify customer service channels, operating hours, or response time commitments. This lack of transparency represents a significant gap since professional forex brokers typically provide multiple contact methods including phone, email, live chat, and comprehensive FAQ sections that help traders get quick answers to their questions. Without clear service standards, traders cannot set appropriate expectations for support quality.

User reports consistently mention challenges with withdrawal processing and inadequate support responses. These complaints suggest systemic issues with customer service operations that go beyond isolated incidents and indicate broader problems with the broker's commitment to client service. These complaints are particularly concerning given that reliable customer support is crucial for resolving trading-related issues and maintaining client confidence in the platform.

The lack of multilingual support information and unclear escalation procedures for complex issues further impact the service assessment. Without clear customer service standards and given the negative user feedback patterns, potential traders should have serious concerns about support quality and whether they'll be able to get help when they need it most.

Trading Experience Analysis (5/10)

The trading experience receives an average rating based on mixed user feedback and limited technical performance data. While the TradingView-powered platform provides professional charting capabilities, user experiences with actual trading execution appear varied, with some traders reporting satisfactory performance while others encounter problems. The inconsistency in user experiences suggests that trading conditions may not be reliable across all market conditions.

The advertised near-zero spreads could provide cost advantages for active traders who execute many trades. However, specific execution quality metrics such as slippage rates, requote frequencies, and order fill speeds are not documented in available materials, making it difficult to verify actual trading conditions. These technical performance factors are crucial for assessing real trading conditions and determining whether the platform can deliver on its promises during volatile market periods.

Platform stability and reliability information is not comprehensively available. The use of TradingView technology suggests access to robust charting and analysis tools that are generally well-regarded in the industry. However, user feedback indicates mixed experiences with overall platform performance and trade execution quality, suggesting that the underlying trading infrastructure may not match the quality of the charting interface.

Mobile trading experience details are not specified in available information. This gap is increasingly important for modern traders who require flexible access to markets and the ability to manage their positions from anywhere. The absence of detailed performance metrics and mixed user feedback prevents a higher rating for trading experience in this fortuno markets review.

Trust and Reliability Analysis (3/10)

Trust and reliability receive a poor rating due to several significant concerns that potential traders should carefully consider. The absence of clear regulatory oversight represents a major transparency issue since reputable brokers typically provide detailed regulatory information and licensing details that demonstrate their commitment to following industry standards. This lack of regulatory clarity creates uncertainty about whether the broker operates under any meaningful oversight.

User feedback includes concerning reports about withdrawal difficulties and service quality issues. Some sources question the broker's legitimacy and operational practices, creating serious doubts about the broker's reliability and commitment to client service. These negative reports create serious doubts about the broker's reliability and commitment to client service, particularly regarding the fundamental ability to access funds when needed.

The lack of comprehensive corporate information is another red flag. The absence of founding details, management team disclosure, and regulatory compliance documentation further undermines trust assessment since established brokers typically provide extensive transparency about their operations and regulatory standing. This opacity makes it difficult for traders to verify the broker's credentials and track record.

Fund safety measures, segregation of client funds, and investor protection policies are not detailed in available materials. This creates uncertainty about asset security and whether trader funds are properly protected in case of operational problems. Without clear regulatory oversight and given the negative user feedback patterns, the trust rating reflects significant concerns about broker reliability that could put trader funds at risk.

User Experience Analysis (5/10)

Overall user experience receives an average rating based on the 3/5 user rating from various sources and mixed feedback about platform usability and service quality. While the TradingView interface is generally regarded as user-friendly and the low minimum deposit appeals to beginners, operational issues significantly impact the overall experience and prevent higher satisfaction levels. The combination of attractive features and operational problems creates an inconsistent user experience.

The registration and account verification processes are not detailed in available information. However, user feedback suggests potential complications with account setup and maintenance procedures that can frustrate new users. Streamlined onboarding is crucial for user satisfaction, particularly for beginner traders who may already feel overwhelmed by the complexity of forex trading.

Fund management experience appears problematic based on user reports of withdrawal difficulties. This represents a critical user experience failure since reliable deposit and withdrawal processing is fundamental to user satisfaction and platform credibility. When traders cannot easily access their funds, it undermines confidence in the entire platform regardless of other positive features.

Common user complaints center on customer service responsiveness and withdrawal processing delays. These issues indicate systematic problems that impact overall user satisfaction and suggest that the broker has not invested adequately in customer support infrastructure. While the platform may offer attractive trading conditions, these operational challenges significantly undermine the user experience quality and create frustration for traders who expect professional service standards.

Conclusion

This fortuno markets review reveals a broker with mixed characteristics that require careful consideration by potential traders. While Fortuno Markets offers attractive features for beginners, including a low $10 minimum deposit, high leverage up to 1:2000, and access to TradingView's professional trading platform, significant operational concerns overshadow these advantages and create substantial risks for traders.

The broker best suits traders seeking low-threshold market entry and those interested in testing forex trading with minimal initial investment. However, the concerning reports about withdrawal difficulties, poor customer service, and lack of clear regulatory oversight create substantial risks that even beginner traders should carefully evaluate before committing their funds. These operational issues could potentially result in significant problems for traders who need reliable access to their money and professional support services.

The main advantages include accessible entry requirements and diverse asset offerings that make it easy for new traders to start. The primary disadvantages center on reliability concerns and service quality issues that could affect the fundamental aspects of the trading experience, particularly fund security and customer support. Potential traders should exercise considerable caution and thoroughly research current operational status before considering this platform for their trading activities, especially given the mixed user feedback and transparency concerns identified in this review.