Is FORTUNO MARKETS safe?

Pros

Cons

Is Fortuno Markets A Scam?

Introduction

Fortuno Markets positions itself as a versatile trading platform in the forex market, claiming to provide access to a broad spectrum of financial instruments, including forex, commodities, and cryptocurrencies. However, with the increasing number of unregulated brokers in the industry, traders must exercise caution and thoroughly evaluate any broker before committing their funds. This article aims to investigate the legitimacy of Fortuno Markets through a comprehensive analysis of its regulatory status, company background, trading conditions, customer experiences, and risk factors. Our investigation is based on various online sources and user reviews, ensuring an objective assessment of the broker's credibility.

Regulation and Legitimacy

The regulatory status of a forex broker is crucial for ensuring the safety and security of traders' funds. A well-regulated broker is typically subject to strict oversight, which provides a level of protection for traders. However, Fortuno Markets raises significant concerns in this area.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unregulated |

Fortuno Markets claims to be regulated by the National Futures Association (NFA) and asserts to have offices in Saint Lucia and the United Kingdom. However, a search on the NFA's official website reveals no record of this broker, indicating a blatant misrepresentation of its regulatory status. Additionally, investigations have shown that the claimed offices do not exist, further heightening concerns about the broker's legitimacy. The absence of regulatory oversight means that traders have no recourse in case of disputes or fraudulent activities, making it imperative for potential investors to be cautious.

Company Background Investigation

Fortuno Markets was founded relatively recently, in 2023, and is registered in Cyprus. However, details about its ownership structure and management team remain obscure. The lack of transparency regarding the company's history and management raises red flags about its operational integrity.

Management Team: There is little publicly available information regarding the qualifications and professional backgrounds of the management team at Fortuno Markets. This lack of transparency can be a significant concern for traders looking for a broker with experienced leadership.

Transparency and Information Disclosure: The company does not provide sufficient information about its operational practices, financial statements, or any history of compliance with financial regulations. This opacity can lead to uncertainty among traders regarding the broker's reliability and ethical standards.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is essential for assessing its overall value proposition. Fortuno Markets claims to offer competitive trading conditions, but a closer examination reveals potential issues.

| Fee Type | Fortuno Markets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.5 - 1.2 pips | 1.0 - 2.0 pips |

| Commission Model | No commissions | Varies |

| Overnight Interest Range | High | Moderate |

Fortuno Markets operates on a commission-free model, which may seem appealing. However, the spreads offered can vary significantly, and the potential for high overnight interest rates raises concerns about the overall cost of trading. Traders should be mindful of these costs, as they can impact profitability.

Customer Funds Safety

The safety of customer funds is a paramount concern when trading with any broker. Fortuno Markets claims to implement measures for fund security, but the lack of regulatory oversight raises significant concerns.

- Fund Segregation: It is unclear whether Fortuno Markets segregates client funds from its operating capital, which is a standard practice among regulated brokers to protect clients' money.

- Investor Protection: The absence of regulatory backing means that there are no investor protection schemes in place, leaving traders vulnerable to potential losses.

- Negative Balance Protection: There is no indication that Fortuno Markets offers negative balance protection, which can expose traders to significant financial risk.

These factors combined suggest that traders should exercise extreme caution when dealing with Fortuno Markets, as the safety of their funds is not guaranteed.

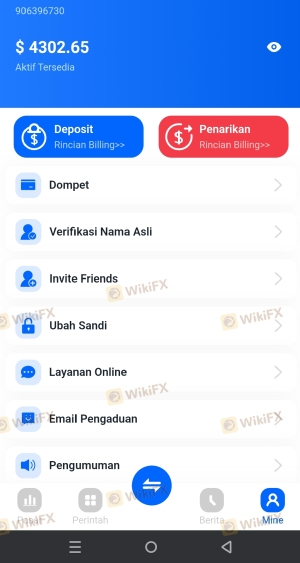

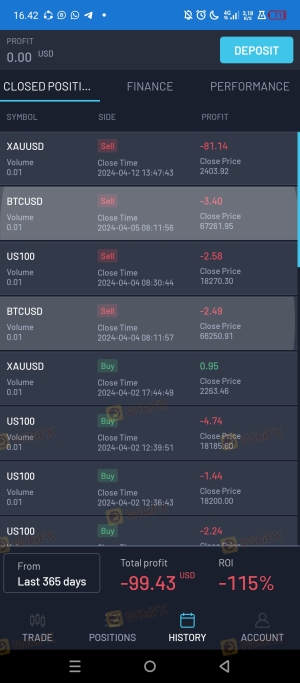

Customer Experience and Complaints

Customer feedback is a vital indicator of a broker's reliability and service quality. Unfortunately, Fortuno Markets has received numerous negative reviews from traders.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Disappearing Funds | Severe | None |

| Unresponsive Support | Medium | Poor |

Common complaints include withdrawal issues, where traders report difficulties in accessing their funds, as well as claims of disappearing funds. Additionally, the company's customer support has been criticized for being unresponsive, further compounding traders' frustrations.

For instance, several users have reported that their withdrawal requests were either delayed or completely ignored, leading to significant financial loss. These patterns of complaints indicate a troubling trend that potential investors should consider seriously.

Platform and Trade Execution

The quality of the trading platform and execution is critical for a successful trading experience. Fortuno Markets claims to offer a user-friendly platform; however, user experiences suggest otherwise.

Traders have reported issues with platform stability, including frequent downtime and slow execution speeds. Additionally, there are concerns regarding slippage and order rejections, which can significantly impact trading performance.

These performance issues raise questions about the broker's ability to provide a reliable trading environment, essential for both novice and experienced traders.

Risk Assessment

Using Fortuno Markets comes with a range of risks that potential traders should be aware of.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated broker with no oversight. |

| Fund Safety Risk | High | Lack of fund segregation and protection. |

| Customer Service Risk | Medium | Poor response to complaints. |

Given these risks, traders should approach Fortuno Markets with caution. It is advisable to consider alternative brokers with established regulatory oversight and a proven track record of customer service.

Conclusion and Recommendations

In conclusion, the investigation into Fortuno Markets reveals numerous red flags that suggest it may not be a trustworthy broker. The absence of regulatory oversight, coupled with significant complaints from users regarding fund safety and customer service, raises serious concerns about the broker's legitimacy.

For potential traders, it is crucial to conduct thorough research and consider safer alternatives. Brokers with strong regulatory frameworks, transparent operations, and positive customer feedback are recommended. Some reliable options include brokers regulated by the FCA or ASIC, which offer better protection and service quality for traders.

In summary, potential investors should exercise extreme caution with Fortuno Markets and consider the associated risks before engaging with this broker.

Is FORTUNO MARKETS a scam, or is it legit?

The latest exposure and evaluation content of FORTUNO MARKETS brokers.

FORTUNO MARKETS Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FORTUNO MARKETS latest industry rating score is 1.37, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.37 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.