Regarding the legitimacy of One Financial Markets forex brokers, it provides FSCA, FCA, SFC and WikiBit, (also has a graphic survey regarding security).

Is One Financial Markets safe?

Pros

Cons

Is One Financial Markets markets regulated?

The regulatory license is the strongest proof.

FSCA Derivatives Trading License (EP)

Financial Sector Conduct Authority

Financial Sector Conduct Authority

Current Status:

RevokedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

AXI FINANCIAL SERVICES (UK) LTD

Effective Date:

2015-04-07Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

2024-09-03Address of Licensed Institution:

1 FINSBURY MARKET LONDON UNITED KINGDOMPhone Number of Licensed Institution:

+44 203 544 9646Licensed Institution Certified Documents:

FCA Market Making License (MM)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

UnverifiedLicense Type:

Market Making License (MM)

Licensed Entity:

Axi Financial Services (UK) Limited

Effective Date:

2007-08-16Email Address of Licensed Institution:

compliance.uk@axi.com, katie.leroux@axi.comSharing Status:

No SharingWebsite of Licensed Institution:

www.axi.com/ukExpiration Time:

--Address of Licensed Institution:

Axi Financial Services (UK) Ltd 1 Finsbury Market London EC2A 2BN UNITED KINGDOMPhone Number of Licensed Institution:

+442038572000Licensed Institution Certified Documents:

SFC Market Making License (MM)

Securities and Futures Commission of Hong Kong

Securities and Futures Commission of Hong Kong

Current Status:

UnverifiedLicense Type:

Market Making License (MM)

Licensed Entity:

One Financial Markets Asia Limited

Effective Date:

2016-10-31Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is One Financial Markets A Scam?

Introduction

One Financial Markets is an online broker that has been operational since 2007, primarily focusing on forex and CFDs (Contracts for Difference). With its headquarters in London, the broker aims to provide trading services to both retail and institutional investors across various financial markets. Given the vast number of brokers available today, it is crucial for traders to carefully assess the credibility and reliability of any broker before committing their funds. This article aims to provide a comprehensive evaluation of One Financial Markets, exploring its regulatory status, company background, trading conditions, client fund safety, customer experiences, platform performance, and associated risks. The assessment is based on a thorough review of available data, user feedback, and regulatory information.

Regulation and Legitimacy

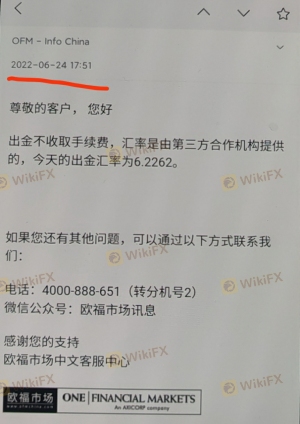

The regulatory framework governing a broker is one of the most significant indicators of its legitimacy. One Financial Markets operates under the supervision of several reputable regulatory authorities, including the Financial Conduct Authority (FCA) in the UK and the Financial Sector Conduct Authority (FSCA) in South Africa. Regulatory oversight ensures that brokers adhere to strict standards, providing a level of protection to traders and enhancing trustworthiness.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | 466201 | UK | Valid |

| FSCA | 45784 | South Africa | Valid |

| DFSA | 2355 | Dubai | Valid |

The FCA is known for its stringent regulatory requirements, which include maintaining client funds in segregated accounts and providing negative balance protection. This means that clients cannot lose more than their deposited amount, a significant safety feature for traders. However, the FSCA's oversight has faced criticism in the past regarding its effectiveness, leading to mixed perceptions about the level of protection it offers. Overall, while One Financial Markets is regulated, the quality of oversight can vary based on the jurisdiction, and traders should remain vigilant.

Company Background Investigation

One Financial Markets was established in London in 2007 and has since expanded its operations globally, with offices in various regions, including the Middle East, Southeast Asia, and Europe. The broker is part of the Axi group, which adds to its credibility. The management team consists of professionals with extensive experience in the financial services industry, contributing to a well-rounded operational framework.

Transparency is vital in the financial sector, and One Financial Markets has made efforts to maintain a clear communication channel with its clients. The broker provides detailed information about its services, regulatory compliance, and trading conditions on its website. However, some concerns have been raised regarding the availability of customer support and responsiveness to client inquiries, which can impact the overall perception of transparency and reliability.

Trading Conditions Analysis

One Financial Markets offers a range of trading conditions that cater to various types of traders. The broker provides access to multiple financial instruments, including forex, commodities, indices, and cryptocurrencies. The overall fee structure is a crucial aspect for traders to consider, as it directly affects profitability.

The broker has a minimum deposit requirement of $250, which is relatively standard compared to industry averages. However, the spreads offered by One Financial Markets can be higher than some competitors, particularly on certain currency pairs.

| Fee Type | One Financial Markets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.0 - 1.5 pips | 0.6 - 1.0 pips |

| Commission Model | $0 | $0 - $5 |

| Overnight Interest Range | Varies | Varies |

While the absence of commissions on standard accounts is a positive aspect, the spread can significantly affect trading costs, especially for high-frequency traders. Additionally, the broker implements an inactivity fee after a certain period, which may deter some traders from keeping their accounts open.

Client Fund Safety

The safety of client funds is paramount when evaluating a broker. One Financial Markets employs several measures to ensure the protection of client deposits. Funds are held in segregated accounts, which means that client money is kept separate from the broker's operating funds. This practice minimizes the risk of losing client funds in case of the broker's insolvency.

Moreover, clients of One Financial Markets regulated by the FCA are covered by the Financial Services Compensation Scheme (FSCS), which protects deposits up to £85,000. This regulatory framework adds an additional layer of security for clients. However, it is essential to note that this protection is only applicable to clients under the FCA's jurisdiction.

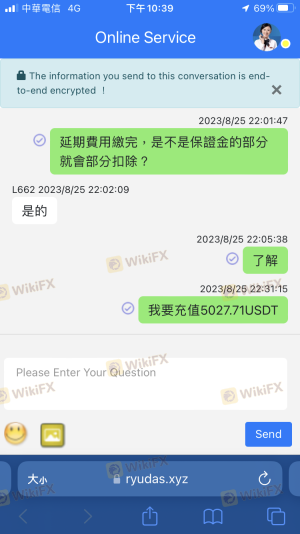

Despite these safety measures, there have been reports of withdrawal issues and complaints regarding the responsiveness of customer support. These concerns can raise red flags for potential clients and warrant careful consideration before opening an account.

Customer Experience and Complaints

The experiences of existing customers can provide valuable insights into a broker's reliability. One Financial Markets has received mixed reviews from clients, with some praising its educational resources and trading platforms, while others have expressed dissatisfaction with withdrawal processes and customer support.

Common complaints include delays in processing withdrawals and difficulties in reaching customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Poor Customer Support | Medium | Mixed response |

| Account Verification Issues | High | Delayed response |

Several users have reported being unable to withdraw funds promptly, leading to frustration and distrust. For instance, one trader mentioned a prolonged withdrawal process that took weeks, which is not ideal for clients needing quick access to their funds. These issues highlight the importance of evaluating a broker's overall customer service and responsiveness.

Platform and Trade Execution

One Financial Markets offers a variety of trading platforms, including the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These platforms are well-regarded for their user-friendly interfaces and robust analytical tools. However, the performance of these platforms can vary based on market conditions.

The broker's order execution quality is generally satisfactory, with most trades being executed promptly. However, some users have reported instances of slippage during volatile market conditions, which can impact trading outcomes.

Risk Assessment

Engaging with One Financial Markets involves several risks that traders should consider before investing.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | Medium | Varies by jurisdiction; FCA provides stronger protection than FSCA. |

| Withdrawal Issues | High | Complaints regarding delays and difficulties with withdrawals. |

| Customer Support Risk | Medium | Mixed reviews on responsiveness and availability of support. |

To mitigate these risks, traders are advised to conduct thorough research, maintain realistic expectations, and utilize risk management strategies. It is also beneficial to start with a demo account to familiarize oneself with the platform and trading conditions before committing real funds.

Conclusion and Recommendations

In conclusion, One Financial Markets is a regulated broker with a long-standing presence in the forex market. While it offers various trading instruments and platforms, potential clients should be cautious due to reports of withdrawal issues and mixed customer feedback. The regulatory oversight from the FCA provides a level of credibility, but traders must remain vigilant about the quality of service and responsiveness.

For traders looking for reliable alternatives, brokers like FXCM, CMC Markets, and Pepperstone may offer competitive trading conditions and better customer service. Overall, it is essential for traders to assess their individual needs and risk tolerance when choosing a broker.

Is One Financial Markets a scam, or is it legit?

The latest exposure and evaluation content of One Financial Markets brokers.

One Financial Markets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

One Financial Markets latest industry rating score is 2.48, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.48 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.