Fintechfx 2025 Review: Everything You Need to Know

Summary

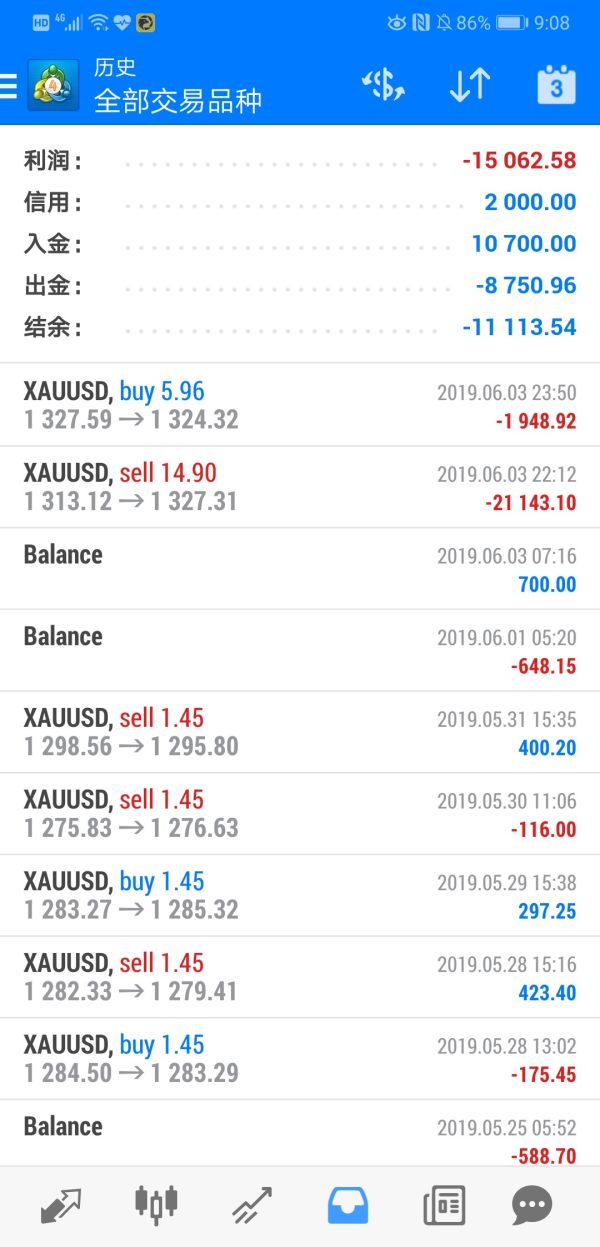

This Fintechfx review shows concerning findings about the broker's operations and regulatory status. Our detailed analysis shows that FintechFX is operated by My Group Fintech Co Pty Ltd and is not authorized to conduct forex brokerage business according to ASIC records. The broker has received only negative user feedback. It has a devastating 1-star rating representing 100% negative reviews from clients.

FintechFX claims to offer trading services across multiple asset classes including over 5 forex currency pairs, gold, silver, indices, and commodities. However, the lack of proper regulatory authorization raises significant concerns about the safety and legitimacy of their operations. The unanimous negative user sentiment suggests serious issues with service delivery, customer support, and overall trading experience.

This broker primarily targets forex traders seeking trading opportunities. Our findings strongly suggest that investors should exercise extreme caution when considering FintechFX for their trading activities. The combination of regulatory concerns and overwhelmingly negative user experiences makes this broker unsuitable for traders seeking a secure and reliable trading environment.

Important Notice

Regulatory Disclaimer: FintechFX operates under My Group Fintech Co Pty Ltd and is not authorized by ASIC to provide forex brokerage services. This creates potential legal and financial risks for clients. The broker lacks proper regulatory oversight and consumer protection measures that authorized brokers must maintain.

Review Methodology: This detailed evaluation is based on available regulatory information from ASIC records and extensive analysis of user feedback and experiences. Our assessment considers multiple factors including regulatory compliance, user satisfaction, service quality, and overall trustworthiness to provide an objective evaluation of the broker's operations.

Rating Framework

Broker Overview

FintechFX operates under the corporate entity My Group Fintech Co Pty Ltd. Specific information about the company's establishment date and founding history is not detailed in available documentation. The broker positions itself as a trading service provider in the financial technology sector. It attempts to offer various trading instruments to retail clients. However, the company's regulatory status presents significant concerns, as ASIC records indicate that FintechFX is not authorized to conduct forex brokerage business. This fundamentally undermines its legitimacy in the Australian financial services sector.

The broker's business model appears to focus on providing access to multiple asset classes. The specific operational framework and trading conditions remain unclear due to limited transparency. According to available information, FintechFX offers trading opportunities across more than 5 forex currency pairs, precious metals including gold and silver, various market indices, and commodity instruments. However, the lack of detailed information about trading platforms, execution methods, and specific service offerings raises questions about the broker's operational capabilities and commitment to transparency. These are essential factors for any legitimate financial services provider.

Regulatory Jurisdiction: FintechFX operates without proper authorization from ASIC. This creates an uncertain legal framework for its operations and leaves clients without standard regulatory protections.

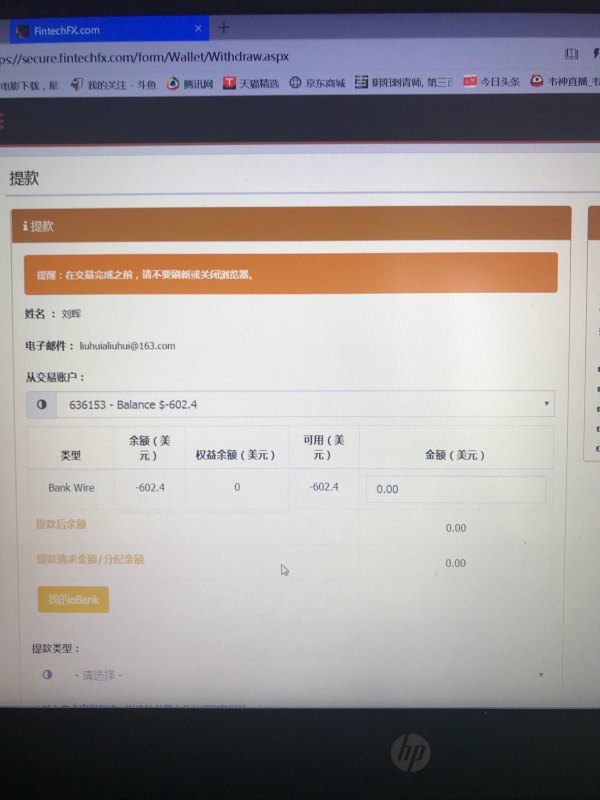

Deposit and Withdrawal Methods: Specific information about funding options and withdrawal procedures is not detailed in available documentation.

Minimum Deposit Requirements: The broker's minimum deposit thresholds and account opening requirements are not specified in available materials.

Bonus and Promotions: No information about promotional offers or bonus programs is available in current documentation.

Trading Assets: The broker claims to offer more than 5 forex currency pairs, gold, silver, market indices, and various commodity instruments for trading.

Cost Structure: Detailed information about spreads, commissions, and other trading fees is not provided in available documentation.

Leverage Options: Specific leverage ratios and margin requirements are not detailed in current materials.

Platform Selection: Information about available trading platforms and technological infrastructure is not specified in available documentation.

Geographic Restrictions: Details about regional limitations and service availability are not provided in current materials.

Customer Support Languages: Specific information about multilingual support options is not available in current documentation.

This Fintechfx review highlights the significant lack of transparency regarding essential trading conditions and operational details.

Detailed Rating Analysis

Account Conditions Analysis (1/10)

The account conditions offered by FintechFX receive the lowest possible rating due to a complete lack of transparency and detailed information about account structures. Available documentation provides no specific details about account types, minimum deposit requirements, account opening procedures, or special account features. These would typically be expected from a legitimate forex broker. This absence of fundamental account information makes it impossible for potential clients to make informed decisions about their trading arrangements.

The 100% negative user rating strongly suggests that whatever account conditions are provided fall far short of industry standards and client expectations. Without clear information about account tiers, deposit thresholds, or account management features, traders cannot adequately assess whether the broker's offerings align with their trading needs and financial capabilities.

The lack of information about specialized account options such as Islamic accounts, professional trader accounts, or managed account services indicates a limited or poorly communicated service structure. This Fintechfx review emphasizes that the absence of clear account condition details, combined with overwhelmingly negative user feedback, makes this broker unsuitable for serious traders seeking transparent and professional account management services.

FintechFX receives a below-average rating for tools and resources. This is primarily based on their claimed offering of more than 5 forex currency pairs, gold, silver, indices, and commodities. While this represents a moderate selection of trading instruments, the broker's overall rating is significantly impacted by the lack of detailed information about research resources, analytical tools, and educational materials. These are essential for successful trading.

The absence of specific information about trading research, market analysis resources, educational content, or automated trading support suggests either limited offerings or poor communication about available resources. Professional traders typically require comprehensive analytical tools, economic calendars, technical analysis resources, and educational materials to make informed trading decisions.

User feedback indicating 100% negative experiences suggests that whatever tools and resources are provided fail to meet client expectations or industry standards. Without proper regulatory oversight and detailed information about platform capabilities, traders cannot rely on the quality or reliability of any tools that may be offered by this broker.

Customer Service and Support Analysis (1/10)

Customer service and support receive the lowest possible rating based on the devastating 1-star user rating representing 100% negative feedback. This unanimous dissatisfaction indicates severe deficiencies in customer support quality, responsiveness, and problem resolution capabilities. Such overwhelmingly negative sentiment suggests systemic issues with customer service delivery that fundamentally compromise the client experience.

The absence of detailed information about customer support channels, response times, service hours, or multilingual support options further emphasizes the broker's lack of commitment to professional customer service standards. Legitimate brokers typically provide multiple contact methods, clearly defined response timeframes, and comprehensive support documentation to assist clients effectively.

The combination of unanimous negative user feedback and lack of transparent customer service information indicates that FintechFX fails to provide the level of support that traders require for successful trading activities. Professional forex trading demands reliable, responsive, and knowledgeable customer support. This broker appears unable to deliver based on available evidence.

Trading Experience Analysis (1/10)

The trading experience offered by FintechFX receives the lowest possible rating due to 100% negative user feedback and the absence of detailed information about platform performance, execution quality, and trading conditions. Such unanimous negative sentiment indicates fundamental problems with order execution, platform stability, trading environment quality, and overall user experience. These issues make this broker unsuitable for serious trading activities.

Without specific information about platform technology, execution speeds, slippage rates, or mobile trading capabilities, potential clients cannot assess the quality of the trading environment. Professional traders require reliable platforms, fast execution, competitive spreads, and stable technology infrastructure to execute their trading strategies effectively.

The lack of transparency about trading conditions, combined with overwhelmingly negative user experiences, suggests that FintechFX fails to provide the professional trading environment that forex traders require. This Fintechfx review emphasizes that the unanimous negative feedback indicates serious deficiencies in platform performance, execution quality, and overall trading experience delivery.

Trust and Security Analysis (1/10)

Trust and security receive the lowest possible rating due to FintechFX's lack of proper ASIC authorization and the overwhelming negative user feedback. The broker's unauthorized status creates significant concerns about regulatory compliance, client fund protection, and adherence to industry standards. These are essential for maintaining trader trust and security.

ASIC verification confirms that FintechFX is not authorized to conduct forex brokerage business. This fundamentally undermines the broker's credibility and creates potential legal and financial risks for clients. Legitimate forex brokers must maintain proper regulatory authorization to ensure compliance with consumer protection measures, fund segregation requirements, and operational standards.

The 100% negative user feedback further reinforces trust concerns. It suggests that clients have experienced significant problems with the broker's services, reliability, or business practices. Without proper regulatory oversight and with such negative user sentiment, traders cannot have confidence in the broker's ability to provide secure and trustworthy trading services.

User Experience Analysis (1/10)

User experience receives the lowest possible rating based on the 100% negative user feedback. This represents unanimous dissatisfaction among clients who have interacted with FintechFX. This devastating user sentiment indicates comprehensive failures across all aspects of the client experience, from initial registration through ongoing trading activities and customer support interactions.

The absence of detailed information about user interface design, platform usability, registration processes, or account management features suggests either poor implementation or lack of transparency about user experience elements. Professional trading platforms require intuitive design, efficient workflows, and user-friendly interfaces to support effective trading activities.

The unanimous negative feedback indicates that FintechFX consistently fails to meet user expectations across multiple touchpoints. This creates frustration and dissatisfaction that makes this broker unsuitable for any trader seeking a positive and professional user experience. This comprehensive user dissatisfaction, combined with regulatory concerns, creates a compelling case against choosing this broker for forex trading activities.

Conclusion

This comprehensive Fintechfx review reveals significant concerns that make this broker unsuitable for any type of trader or investor. The combination of unauthorized regulatory status, 100% negative user feedback, and lack of transparency about essential trading conditions creates a compelling case against choosing FintechFX for forex trading activities.

The broker cannot be recommended to any user category due to fundamental issues with regulatory compliance, customer satisfaction, and service delivery. Traders seeking legitimate, secure, and professional forex trading services should consider properly regulated alternatives. These alternatives demonstrate transparency, positive user feedback, and comprehensive service offerings that support successful trading activities.