Regarding the legitimacy of ETB Bullion forex brokers, it provides HKGX and WikiBit, (also has a graphic survey regarding security).

Is ETB Bullion safe?

Software Index

Business

Is ETB Bullion markets regulated?

The regulatory license is the strongest proof.

HKGX Precious Metals Trading (AGN)

Hong Kong Gold Exchange

Hong Kong Gold Exchange

Current Status:

RegulatedLicense Type:

Precious Metals Trading (AGN)

Licensed Entity:

寶富金業有限公司

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

https://www.etb037.comExpiration Time:

--Address of Licensed Institution:

九龍尖沙咀漆咸道南87-105號百利商業中心1318室Phone Number of Licensed Institution:

26823008Licensed Institution Certified Documents:

Is ETB Bullion Safe or Scam?

Introduction

ETB Bullion is a trading platform that operates primarily in the precious metals market, focusing on commodities like gold and silver. Established in Hong Kong, it positions itself as a broker for investors looking to trade these valuable assets. However, as with any financial service, traders must exercise caution and conduct thorough evaluations before committing their funds. The forex market is rife with opportunities, but it is also fraught with risks, especially when it comes to choosing the right broker. This article aims to provide a comprehensive analysis of ETB Bullion, examining its regulatory status, company background, trading conditions, customer experiences, and overall safety. The investigation is based on data from multiple credible sources, including regulatory bodies and user reviews, to ensure an objective assessment of whether ETB Bullion is safe or potentially a scam.

Regulation and Legitimacy

The regulatory environment is a crucial factor in determining the safety of any trading platform. ETB Bullion claims to be regulated by the Chinese Gold and Silver Exchange Society (CGSE) in Hong Kong. However, reports indicate that the legitimacy of this regulation is questionable, with claims of it being a "suspicious clone." The following table summarizes the core regulatory information for ETB Bullion:

| Regulatory Body | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| CGSE | AA License No. 037 | Hong Kong | Suspicious |

While ETB Bullion asserts that it operates under a valid license, multiple reviews suggest that this regulation may not provide adequate investor protection. The lack of a robust regulatory framework raises concerns about the broker's compliance history and operational transparency. Traders should be aware that a broker's regulatory status significantly impacts their safety, as it dictates the level of oversight and protection afforded to clients. Overall, while ETB Bullion claims to be regulated, the questionable nature of its licensing necessitates a cautious approach.

Company Background Investigation

ETB Bullion, also known as Xin Sheng Ju Feng Jin Industry Co., Ltd., has been operational for several years, primarily focusing on precious metals trading. The company is based in Hong Kong, a recognized financial hub. However, there is limited information available regarding its ownership structure and management team. This lack of transparency can be a red flag for potential investors. A broker's management team plays a critical role in its operational integrity, and without clear details about their qualifications and experiences, traders may find it difficult to trust the platform.

Moreover, the company's history is marred by various complaints and reports of malpractices, including allegations of account suspensions and withdrawal difficulties. This raises further concerns regarding the trustworthiness of ETB Bullion and its commitment to ethical trading practices. Overall, the opaque nature of the company's background and its management raises questions about its reliability and operational ethics.

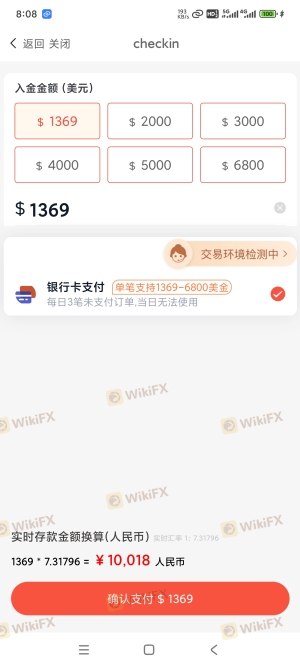

Trading Conditions Analysis

When evaluating whether ETB Bullion is safe, it's essential to analyze its trading conditions, including fees and spreads. The broker offers trading primarily in precious metals, but the cost structure appears to be somewhat opaque. Reports suggest that while the platform advertises low spreads, there are hidden fees that may not be immediately apparent to traders. The following table compares the core trading costs associated with ETB Bullion against industry averages:

| Fee Type | ETB Bullion | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.5% | 0.3% |

| Commission Model | $5 per trade | $3 per trade |

| Overnight Interest Range | Variable | Fixed |

The higher spreads and commissions compared to industry averages may indicate that ETB Bullion is not the most cost-effective option for traders. Additionally, the variability of overnight interest rates can lead to unexpected costs, further complicating the trading experience. Such factors contribute to the overall risk profile of trading with ETB Bullion, making it imperative for potential users to weigh these costs carefully against their trading strategies.

Customer Fund Safety

Customer fund safety is a paramount concern for any trader, and it is essential to evaluate the measures ETB Bullion has in place to protect client funds. Reports suggest that the broker does not provide sufficient information regarding fund segregation, investor protection, or negative balance protection. This lack of clarity can be alarming for potential investors, as it raises questions about the safety of their capital in the event of financial difficulties faced by the broker.

Moreover, historical complaints indicate that users have experienced significant challenges when attempting to withdraw funds, with reports of accounts being suspended without clear justification. Such incidents not only highlight potential operational issues but also underscore the risks associated with trading on platforms like ETB Bullion. Therefore, it is crucial for traders to consider the safety of their funds and the broker's history of handling client capital before proceeding.

Customer Experience and Complaints

Customer feedback often provides valuable insights into a broker's reliability and service quality. In the case of ETB Bullion, user reviews reveal a pattern of dissatisfaction, with many clients reporting difficulties in account management and withdrawal processes. Common complaints include account suspensions, unresponsive customer service, and issues with trade execution. The following table summarizes the primary complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Account Suspension | High | Poor |

| Withdrawal Issues | High | Poor |

| Trade Execution Problems | Medium | Average |

These complaints indicate a troubling trend regarding customer service and operational efficiency at ETB Bullion. While the company may have mechanisms for addressing issues, the overall response quality appears to be lacking. Such experiences can significantly impact traders' trust and confidence in the platform, making it essential for potential users to consider these factors before engaging with ETB Bullion.

Platform and Trade Execution

The trading platform's performance is another critical aspect when assessing whether ETB Bullion is safe. Users have reported mixed experiences, with some indicating that the platform is prone to technical issues, including slippage and delayed order executions. These problems can hinder traders' ability to execute their strategies effectively, leading to potential financial losses. Additionally, concerns about order manipulation have been raised, further complicating the platform's reputation.

A reliable trading platform should provide a seamless user experience and robust execution capabilities. However, the issues reported by ETB Bullion users suggest that the platform may not meet these expectations. Traders should be cautious about committing to a platform that exhibits signs of instability or potential manipulation, as it can significantly affect trading outcomes.

Risk Assessment

In summary, the overall risk associated with trading through ETB Bullion appears to be elevated due to various factors. The following risk assessment summarizes key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Questionable regulatory legitimacy |

| Financial Risk | Medium | Hidden fees and withdrawal difficulties |

| Operational Risk | High | Technical issues and account management problems |

| Customer Service Risk | High | Poor response to client complaints |

Given these risk factors, traders are advised to approach ETB Bullion with caution. Implementing risk mitigation strategies, such as starting with a demo account or limiting initial investments, can help manage exposure to potential pitfalls.

Conclusion and Recommendations

After a thorough analysis of ETB Bullion, it is evident that there are significant concerns regarding its safety and reliability. While the broker claims to be regulated, the legitimacy of this regulation is questionable, and the company has a history of customer complaints related to account management and withdrawal issues. Therefore, potential traders should exercise extreme caution when considering ETB Bullion as a trading platform.

For those seeking safer alternatives, it is advisable to explore brokers with established regulatory frameworks, transparent fee structures, and positive user experiences. Platforms that are regulated by top-tier authorities, such as the FCA or ASIC, are generally more reliable and offer better protection for client funds. In conclusion, while ETB Bullion may provide some trading opportunities, its overall risk profile suggests that it may not be the safest choice for traders.

Is ETB Bullion a scam, or is it legit?

The latest exposure and evaluation content of ETB Bullion brokers.

ETB Bullion Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ETB Bullion latest industry rating score is 7.66, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 7.66 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.