Regarding the legitimacy of TITAN FX forex brokers, it provides VFSC, FSA, FSC and WikiBit, (also has a graphic survey regarding security).

Is TITAN FX safe?

Pros

Cons

Is TITAN FX markets regulated?

The regulatory license is the strongest proof.

VFSC Forex Trading License (EP)

Vanuatu Financial Services Commission

Vanuatu Financial Services Commission

Current Status:

Offshore RegulatedLicense Type:

Forex Trading License (EP)

Licensed Entity:

Titan FX Limited

Effective Date: Change Record

2022-06-29Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

FSA Derivatives Trading License (EP)

The Seychelles Financial Services Authority

The Seychelles Financial Services Authority

Current Status:

Offshore RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

Goliath Trading Limited

Effective Date:

--Email Address of Licensed Institution:

martin.st-hilaire@goliathtrading.coSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

Office 1, Room B11, First Floor, Providence Complex, Providence, Mahe, SeychellesPhone Number of Licensed Institution:

+248 4374741Licensed Institution Certified Documents:

FSC Securities Trading License (EP)

The Financial Services Commission

The Financial Services Commission

Current Status:

RegulatedLicense Type:

Securities Trading License (EP)

Licensed Entity:

TITAN MARKETS

Effective Date:

2021-03-03Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

C/o Credentia International Management Ltd, Silicon Avenue, 40 Cybercity, Suite 207, 2nd Floor, The Catalyst, 72201 EbenePhone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Titan FX A Scam?

Introduction

Titan FX is a forex and CFD broker that has been operational since 2014, primarily targeting retail and institutional clients. Based in Vanuatu, Titan FX positions itself as an ECN (Electronic Communication Network) broker, offering a variety of trading instruments including forex, commodities, and cryptocurrencies. Given the rapid growth of online trading and the proliferation of brokers, traders must exercise caution in selecting a reliable broker. The potential for scams and unregulated entities has made it crucial for traders to conduct thorough due diligence before investing their funds. This article aims to provide a comprehensive analysis of Titan FX, evaluating its regulatory status, company background, trading conditions, customer experiences, and overall safety. The investigation is based on a combination of user reviews, regulatory information, and expert assessments, ensuring that the findings are well-rounded and factual.

Regulation and Legitimacy

The regulatory landscape for forex brokers is vital for ensuring the safety and security of traders funds. Titan FX operates under multiple licenses, including those from the Vanuatu Financial Services Commission (VFSC), the Financial Services Authority of Seychelles (FSA), and the Financial Services Commission of Mauritius (FSC). However, these regulators are often considered tier-3, meaning they have less stringent oversight compared to top-tier regulators like the UK's FCA or Australia's ASIC.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Vanuatu Financial Services Commission | 40313 | Vanuatu | Verified |

| Seychelles Financial Services Authority | SD 138 | Seychelles | Verified |

| Financial Services Commission of Mauritius | GB20026097 | Mauritius | Verified |

The significance of regulation cannot be overstated; it provides a safety net for traders in case of disputes or financial instability. While Titan FX is indeed regulated, the quality of oversight from these offshore regulators raises concerns. For instance, the VFSC has been criticized for its lenient requirements, making it easier for brokers to obtain licenses. This situation can lead to potential risks for traders, as the regulatory framework may not offer adequate protection in case of broker insolvency or malpractice.

Company Background Investigation

Titan FX Limited was established in 2014 and has since expanded its operations to serve clients globally. The company is headquartered in Port Vila, Vanuatu, and operates under the legal name Titan FX Limited. The ownership structure is not extensively disclosed, which can often be a red flag for potential investors.

The management team of Titan FX consists of experienced professionals from the financial and fintech sectors. Their backgrounds include significant roles in banking and financial services, which adds a layer of credibility to the firm. However, the lack of transparency regarding the company's ownership and the specific identities of its management team may raise concerns about the broker's accountability and trustworthiness.

In terms of information disclosure, Titan FX provides basic details about its services and trading conditions on its website. However, a more comprehensive approach to transparency, including detailed financial reports and regulatory compliance updates, would enhance trust among potential clients.

Trading Conditions Analysis

Titan FX offers a competitive trading environment with various account types and trading conditions. The broker provides two main account types: the Standard account, which features commission-free trading, and the Blade account, which offers raw spreads with a commission structure.

The overall fee structure is as follows:

| Fee Type | Titan FX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.1 pips | 0.9 pips |

| Commission Model | $3.5 per lot (Blade account) | $2.5 per lot |

| Overnight Interest Range | Variable | Variable |

While the spreads on the Blade account can be competitive, the commission of $3.5 per lot is slightly above the industry average. This could deter some traders, particularly those who are cost-sensitive. Additionally, Titan FX does not charge deposit or withdrawal fees, which is a positive aspect for traders looking to minimize costs.

However, potential issues arise with the overnight interest rates and the lack of clarity regarding how these fees are calculated. Traders should be aware of these costs, as they can significantly impact profitability, especially for those engaging in longer-term trades.

Customer Funds Security

The safety of customer funds is a paramount concern for any trader. Titan FX claims to implement several measures to protect client funds, including keeping them in segregated accounts with reputable banks. This practice ensures that client funds are not co-mingled with the broker's operational funds, providing an additional layer of security.

Moreover, Titan FX offers negative balance protection, which is crucial for preventing traders from losing more than their initial investment. Despite these measures, the broker's offshore regulatory status raises questions about the overall safety of funds, especially in the event of financial disputes or insolvency.

Historically, there have been no significant reports of fund mismanagement or withdrawal issues associated with Titan FX. However, the lack of a robust regulatory framework means that traders must remain vigilant and conduct their own risk assessments when choosing to trade with this broker.

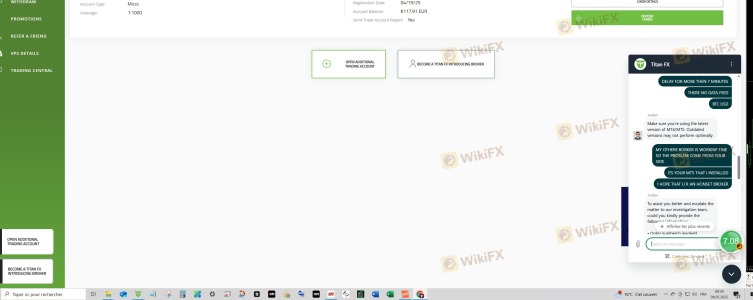

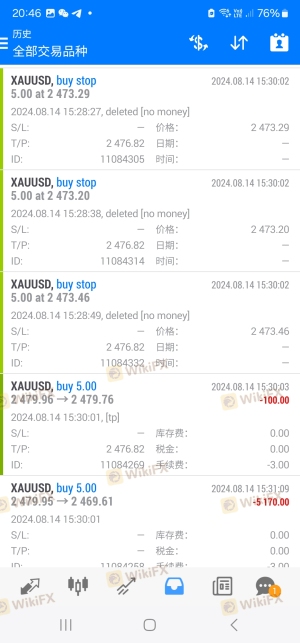

Customer Experience and Complaints

Customer feedback is a valuable indicator of a broker's reliability and service quality. Reviews of Titan FX are mixed, with some users praising the broker for its competitive spreads and efficient trading platform. However, common complaints include issues with customer service response times and difficulties in fund withdrawals.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Mixed responses |

| Customer Support | Medium | Generally responsive |

| Platform Stability | Low | Generally stable |

One notable case involved a trader who experienced delays in fund withdrawals, which took longer than the promised timeframe. While Titan FX eventually resolved the issue, the initial lack of communication left the trader feeling frustrated and uncertain about the broker's reliability. Such experiences highlight the importance of responsive customer service and clear communication in maintaining client trust.

Platform and Trade Execution

The trading platform offered by Titan FX is based on the widely-used MetaTrader 4 and 5, known for their reliability and user-friendly interfaces. Traders generally report a stable trading experience with minimal downtime. The broker's ECN model allows for direct market access, which is advantageous for traders seeking competitive pricing and execution speeds.

However, there have been occasional reports of slippage and order rejections, particularly during periods of high volatility. While these issues are not uncommon in the forex market, they can be frustrating for traders who rely on precise execution for their strategies.

Risk Assessment

Using Titan FX comes with its own set of risks, primarily due to its offshore regulatory status and the associated lack of stringent oversight.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Operates under tier-3 regulation |

| Financial Risk | Medium | Potential for fund mismanagement |

| Customer Service Risk | Medium | Mixed reviews on support responsiveness |

To mitigate these risks, traders should conduct thorough research, start with smaller investments, and utilize risk management strategies such as setting stop-loss orders. Additionally, opting for a demo account can help familiarize oneself with the trading platform before committing real funds.

Conclusion and Recommendations

In conclusion, while Titan FX is a legitimate broker that offers competitive trading conditions and a range of instruments, it operates under a regulatory framework that may not provide the same level of protection as top-tier brokers. The mixed customer feedback and occasional service issues suggest that traders should exercise caution.

For those considering trading with Titan FX, it is advisable to start with a demo account and remain vigilant about the risks involved. If you are looking for more regulated alternatives, brokers such as OANDA, Pepperstone, or IC Markets may offer a more secure trading environment with better regulatory oversight. Ultimately, the decision to trade with Titan FX should be based on your individual risk tolerance and trading preferences.

Is TITAN FX a scam, or is it legit?

The latest exposure and evaluation content of TITAN FX brokers.

TITAN FX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

TITAN FX latest industry rating score is 7.18, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 7.18 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.