ETB Bullion 2025 Review: Everything You Need to Know

Executive Summary

This etb bullion review gives you a complete look at ETB Bullion, a Hong Kong-based forex and precious metals broker that has received mixed feedback from traders. ETB Bullion started in 2022 and focuses on London gold and silver trading through the MT4 platform. Our review shows serious concerns that potential clients should think about carefully.

ETB Bullion works under Hong Kong Gold Exchange rules and focuses mainly on precious metals trading along with forex services. The broker gives you MT4 platform access with Chinese language support for investors interested in gold and silver markets. Even with these services, the broker faces major criticism about misleading ads and withdrawal problems that have hurt user trust and happiness.

Our review shows that ETB Bullion does provide access to precious metals trading through a known platform, but many complaints about withdrawal troubles and ad transparency create warning signs. The broker's wide spreads and limited oversight make these concerns worse. Traders thinking about ETB Bullion should be very careful and look at other brokers with stronger rules and better user feedback before investing.

Important Notice

This review looks specifically at ETB Bullion's Hong Kong operations, which are regulated by the Hong Kong Gold Exchange. Traders should know that rules and practices may be very different in other places. Our review method combines public information, user feedback from trading communities, and industry standards.

The information in this review comes from public sources and user reports as of 2025. Since the forex industry changes quickly, traders should check current rules, trading conditions, and company policies directly with ETB Bullion before opening any account.

Rating Framework

Broker Overview

ETB Bullion started in the Hong Kong financial market in 2022 as a specialized broker focusing on precious metals and forex trading services. The company's Hong Kong headquarters puts it in one of Asia's major financial centers, though this location advantage has not led to the strong rules that traders usually expect from established financial centers.

The broker's main business centers on giving access to London gold and silver markets through forex trading methods. This focus on precious metals makes ETB Bullion different from many general forex brokers, which might appeal to investors specifically interested in gold and silver trading opportunities. However, reports from WikiBit and WikiFX show that the broker's practices have raised concerns in the trading community.

ETB Bullion works only through the MetaTrader 4 platform and offers traders access to forex markets with special focus on precious metals trading. The company provides services in Simplified Chinese, showing its target market includes Chinese-speaking investors. The Hong Kong Gold Exchange provides oversight, though the specific license details and compliance measures remain unclear in available documents. The broker's assets are notably limited, focusing mainly on London gold and silver, which may restrict diversification opportunities for traders seeking broader market exposure.

Regulatory Jurisdiction: ETB Bullion operates under the supervision of the Hong Kong Gold Exchange. Hong Kong generally maintains strong financial rules, but the specific framework governing ETB Bullion's operations lacks detailed public disclosure.

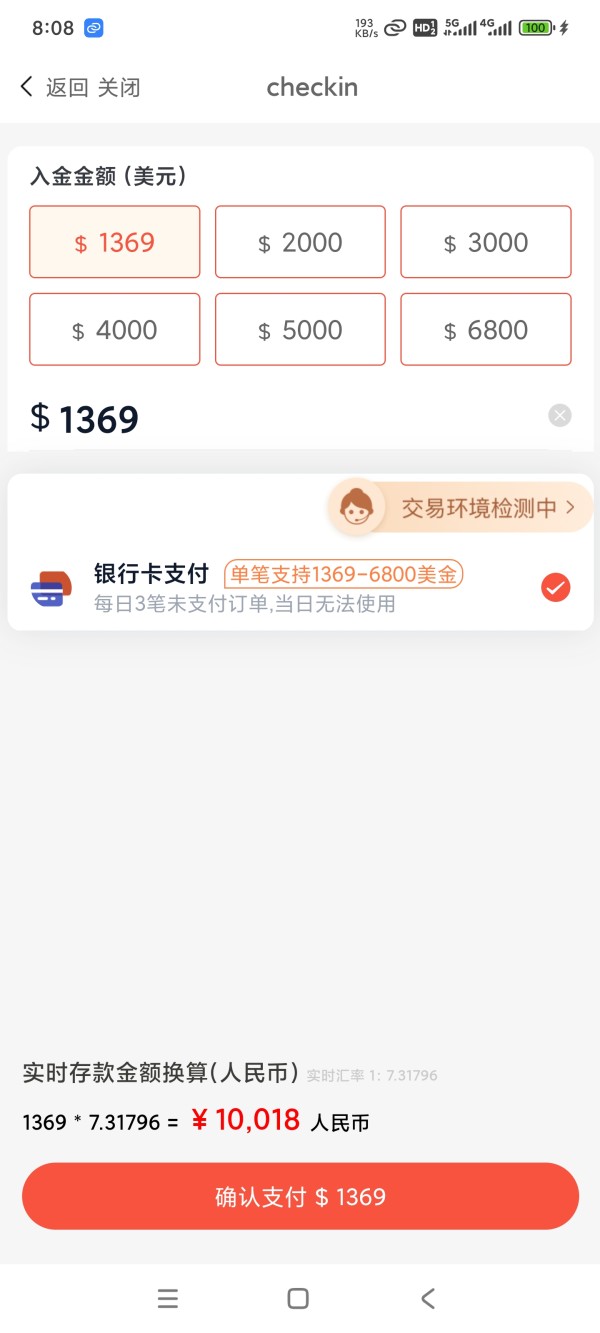

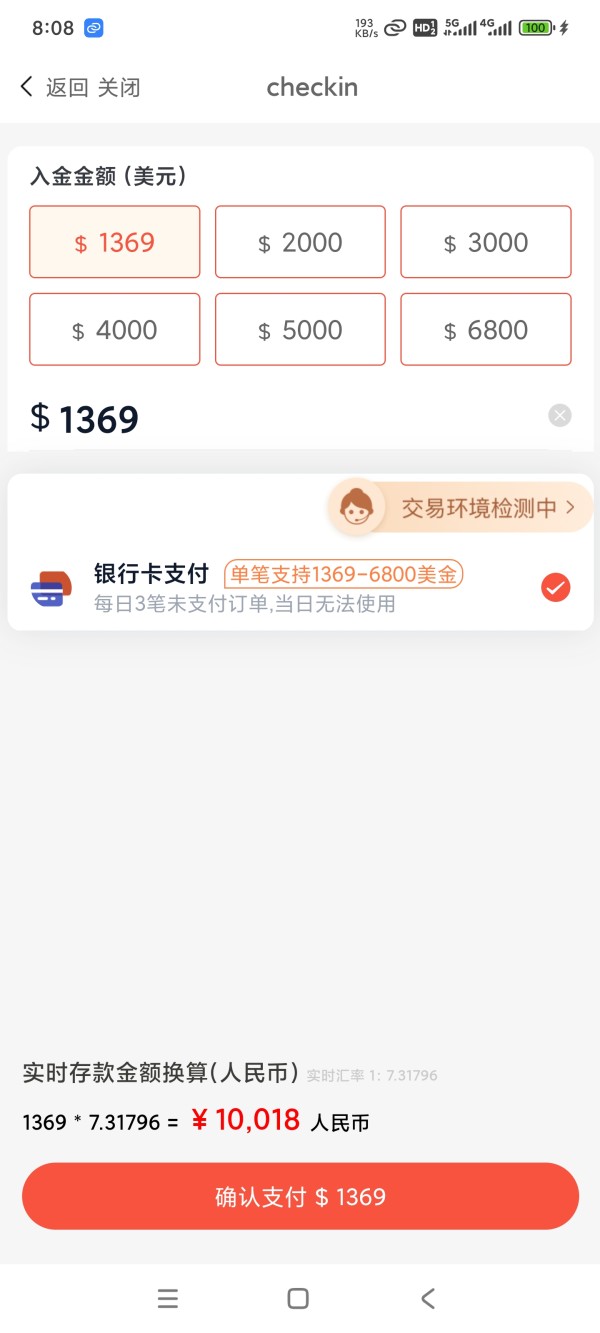

Deposit and Withdrawal Methods: Specific information about deposit and withdrawal options is not detailed in available sources, which raises transparency concerns for potential clients.

Minimum Deposit Requirements: The broker has not publicly shared minimum deposit requirements, making it hard for prospective traders to plan their initial investment.

Bonus and Promotions: Available information does not specify current promotional offerings, though complaints exist about misleading promotional practices in the past.

Tradeable Assets: ETB Bullion specializes mainly in London gold and silver trading, with limited information about other forex pairs or financial instruments.

Cost Structure: User feedback shows the broker uses relatively wide spreads, though specific commission structures and fee schedules are not transparently published.

Leverage Ratios: Leverage information is not specified in available documentation, representing a significant transparency gap.

Platform Options: The broker exclusively offers the MetaTrader 4 platform for all trading activities, which provides standard forex trading functionality.

Geographic Restrictions: Specific regional limitations are not detailed in available sources.

Customer Service Languages: ETB Bullion provides customer support in Simplified Chinese, catering to Chinese-speaking clients.

This etb bullion review highlights the concerning lack of transparency in many basic aspects of the broker's operations, which should be carefully considered by potential clients.

Account Conditions Analysis

ETB Bullion's account conditions present several areas of concern for potential traders. The broker fails to clearly communicate basic account information such as minimum deposit requirements, account types, and specific trading conditions, creating an immediate transparency problem that experienced traders typically view as a red flag.

User feedback suggests that the account opening process lacks the clarity and straightforward communication that characterizes reputable brokers. The absence of detailed information about different account tiers, if they exist, makes it impossible for traders to make informed decisions about which account type might best suit their trading style and capital allocation.

The broker's cost structure, particularly regarding spreads, has received criticism from users who report wider spreads compared to industry standards. This directly impacts trading profitability, especially for active traders who rely on tight spreads to maintain competitive trading costs. The lack of transparent fee schedules further complicates cost assessment for potential clients.

Special account features such as Islamic accounts, demo accounts, or professional trader classifications are not mentioned in available documentation. This suggests either limited account variety or poor communication of available options. Additionally, the account verification and onboarding process details remain unclear, potentially leading to unexpected delays or requirements during account setup.

According to this etb bullion review, the overall account conditions framework appears underdeveloped compared to established brokers, with significant information gaps that may indicate operational immaturity or deliberate opacity in business practices.

ETB Bullion's trading infrastructure centers exclusively around the MetaTrader 4 platform, which, while industry-standard, represents a limited technological offering in today's competitive forex landscape. The MT4 platform provides basic charting capabilities, technical indicators, and automated trading support, but lacks the advanced features and modern interface that many contemporary traders expect.

The broker's research and analysis resources appear significantly underdeveloped based on available information. Market analysis, economic calendars, trading signals, and educational content are not prominently featured or detailed in the broker's public materials. This absence of comprehensive market research tools places traders at a disadvantage, particularly those who rely on broker-provided analysis for trading decisions.

Educational resources, which are crucial for trader development and retention, seem notably absent from ETB Bullion's offerings. The lack of webinars, trading guides, video tutorials, or market commentary suggests that the broker may not prioritize client education and development, which is concerning for both novice and experienced traders seeking to enhance their skills.

Automated trading support through Expert Advisors is available via the MT4 platform, though specific limitations or enhanced features are not detailed. The broker does not appear to offer proprietary trading tools, advanced analytics platforms, or third-party integrations that might distinguish its service offering from competitors.

The limited scope of tools and resources reflects a basic service model that may satisfy simple trading needs but falls short of the comprehensive support systems that characterize leading forex brokers in the current market environment.

Customer Service and Support Analysis

ETB Bullion's customer service capabilities present a mixed picture with notable areas of concern based on user feedback and available information. The broker provides customer support in Simplified Chinese, which serves its target demographic but may limit accessibility for international traders seeking multilingual support options.

User complaints, particularly those highlighted in Reddit discussions and broker review platforms, indicate significant issues with service quality and responsiveness. The most concerning feedback relates to withdrawal processing problems, where users report difficulties in accessing their funds and inadequate support responses to these critical issues.

The availability and responsiveness of customer service channels remain unclear, as specific information about operating hours, response time commitments, or escalation procedures is not readily available. This lack of transparency in service standards makes it difficult for traders to set appropriate expectations for support quality.

Communication effectiveness appears problematic based on user reports, with complaints suggesting that customer service representatives may not adequately address complex issues or provide satisfactory resolutions to trading and account-related problems. The handling of withdrawal complaints, in particular, seems to be a recurring issue that affects user confidence in the broker's service capabilities.

The absence of detailed information about support channels, such as live chat availability, phone support hours, or email response guarantees, further indicates that customer service may not be a prioritized aspect of ETB Bullion's business model. This service gap could significantly impact user experience, especially during critical trading situations or account emergencies.

Trading Experience Analysis

The trading experience with ETB Bullion reveals several concerning aspects that potential clients should carefully evaluate. User feedback indicates inconsistent trading conditions, with particular emphasis on issues that directly affect trade execution and overall platform performance.

Platform stability and execution speed appear to be areas of concern based on user reports. While the MT4 platform itself is generally reliable, the broker's implementation and server infrastructure may not meet the standards that active traders require for consistent performance. The lack of specific data about execution speeds, slippage rates, or server uptime makes it difficult to assess the technical reliability of the trading environment.

The broker's spread structure has received criticism for being wider than industry averages, which directly impacts trading costs and profitability. For traders who rely on scalping strategies or high-frequency trading, these wider spreads can significantly erode potential profits and make certain trading strategies unviable.

Order execution quality remains a question mark, as detailed information about fill rates, slippage statistics, or requote frequencies is not publicly available. This lack of transparency in execution metrics makes it challenging for traders to assess whether the broker can meet their execution requirements, particularly during volatile market conditions.

Mobile trading capabilities through MT4 mobile apps are presumably available, though specific features or limitations of the mobile trading experience are not detailed. The overall trading environment appears to focus on basic functionality rather than enhanced features that might improve the trading experience.

This etb bullion review indicates that the trading experience may be adequate for basic trading needs but lacks the sophistication and reliability that experienced traders typically demand from their broker relationships.

Trust and Safety Analysis

Trust and safety represent the most concerning aspects of ETB Bullion's operations, with multiple red flags that potential clients must carefully consider. The broker's regulatory status under the Hong Kong Gold Exchange, while providing some oversight, lacks the comprehensive protection frameworks offered by top-tier financial regulators such as the FCA, ASIC, or CySEC.

The specific license number and detailed regulatory compliance measures are not clearly disclosed in available public information, which raises transparency concerns about the broker's actual regulatory standing. This lack of clear regulatory documentation makes it difficult for traders to verify the broker's legitimate operational status and protection measures.

User complaints regarding misleading promotional practices represent a significant trust issue. Reports on Reddit and other platforms show traders have raised concerns about the broker's marketing claims and promotional accuracy, suggesting potential misrepresentation of services or trading conditions.

Withdrawal difficulties constitute perhaps the most serious trust concern, with multiple user reports indicating problems accessing funds. These withdrawal issues not only affect individual traders but also suggest potential liquidity problems or operational mismanagement that could impact the broker's long-term viability.

Client fund protection measures, segregation policies, and insurance coverage details are not clearly communicated, leaving traders uncertain about the safety of their deposits. The absence of transparent information about fund handling and protection protocols represents a significant risk factor that distinguishes ETB Bullion from more established and transparent brokers.

The combination of regulatory opacity, user complaints, and withdrawal issues creates a risk profile that experienced traders would typically consider unacceptable for serious trading activities.

User Experience Analysis

The overall user experience with ETB Bullion reflects the various operational and service issues that characterize the broker's current market position. User satisfaction appears to be significantly impacted by fundamental problems that affect both new and existing clients.

Interface design and platform usability are limited to the standard MT4 experience, which, while familiar to many traders, lacks modern enhancements or customizations that might improve the user journey. The absence of proprietary platform developments or interface improvements suggests limited investment in user experience optimization.

The registration and account verification process details are not clearly documented, which may lead to unexpected complications or delays for new users. This lack of clarity in onboarding procedures can create frustration and uncertainty for traders attempting to begin their relationship with the broker.

Fund management experience represents a critical pain point based on user feedback, particularly regarding withdrawal processes. The reported difficulties in accessing funds create significant stress and uncertainty for users, fundamentally undermining confidence in the broker's operational reliability.

Common user complaints center around two primary areas: withdrawal processing problems and service quality issues. These complaints suggest systematic problems rather than isolated incidents, indicating deeper operational challenges that affect the overall user experience.

User demographic analysis suggests that ETB Bullion may be more suitable for traders specifically interested in precious metals trading who can tolerate higher operational risks. However, the significant user experience issues make it difficult to recommend the broker even for this specialized use case without substantial improvements in service delivery and operational transparency.

Conclusion

This comprehensive etb bullion review reveals a broker with significant operational and trust-related challenges that potential clients should carefully consider. While ETB Bullion offers access to precious metals trading through the MT4 platform with Chinese language support, the numerous concerns about withdrawal difficulties, misleading promotional practices, and limited transparency create substantial risk factors.

The broker may appeal to traders specifically interested in gold and silver markets who are willing to accept higher operational risks. However, the combination of wide spreads, limited regulatory transparency, and user complaints about fund access makes ETB Bullion a questionable choice for serious trading activities.

The main advantages include specialized precious metals focus and MT4 platform access, while significant disadvantages encompass withdrawal issues, misleading promotional practices, limited transparency, and concerning user feedback. Traders are strongly advised to consider established brokers with stronger regulatory frameworks and better user satisfaction records before engaging with ETB Bullion.