Bibgold Review 1

Very bad, irresponsible, does not handle problems, and shifts responsibility.

Bibgold Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

Regulation

Risk Control

Very bad, irresponsible, does not handle problems, and shifts responsibility.

This comprehensive bibgold review reveals significant concerns about this forex and precious metals broker. Traders should carefully consider these issues before opening an account. Based on extensive user feedback and available regulatory information, Bibgold presents a mixed picture with notable red flags in customer service and withdrawal processes.

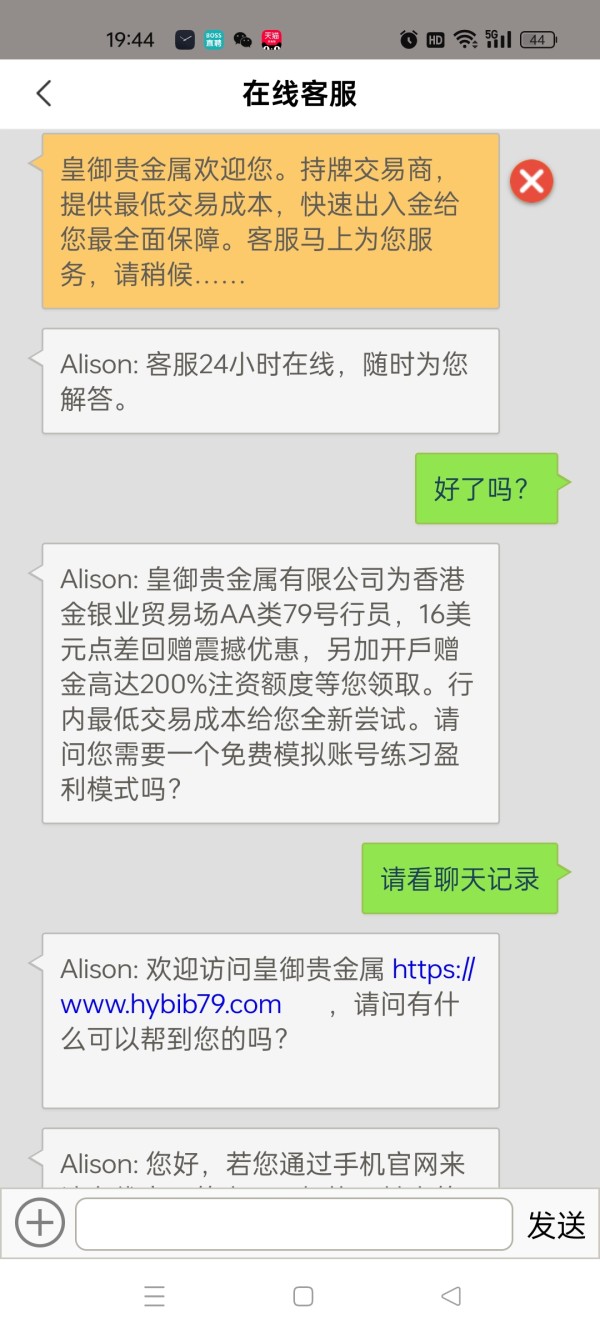

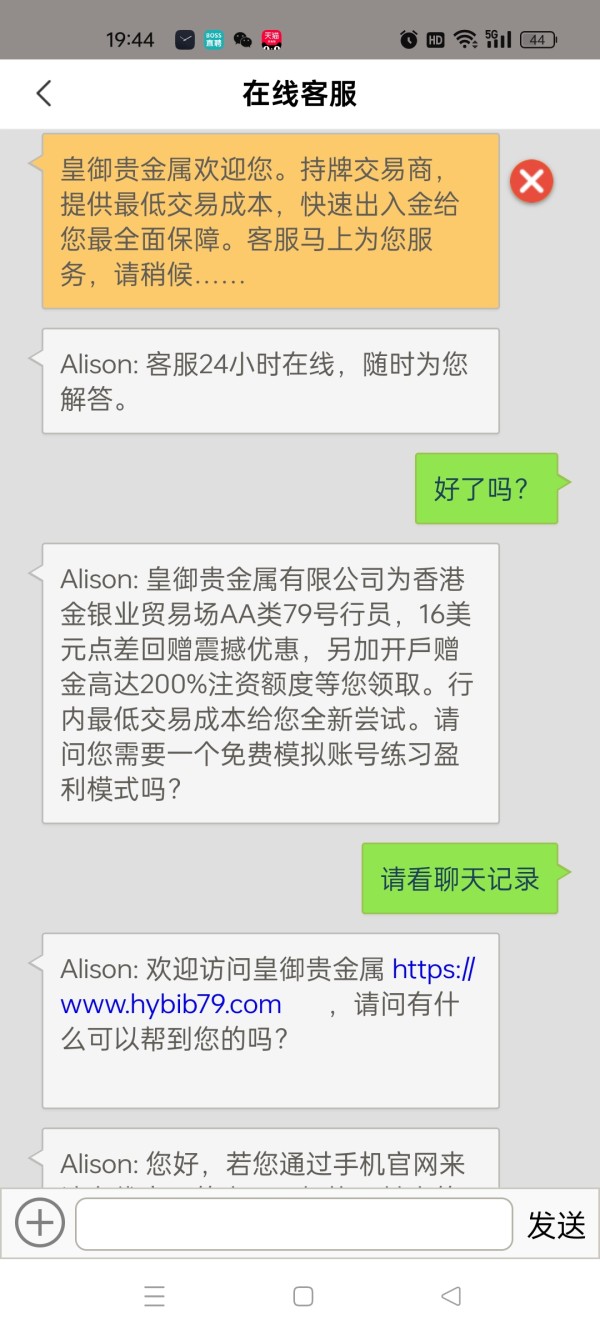

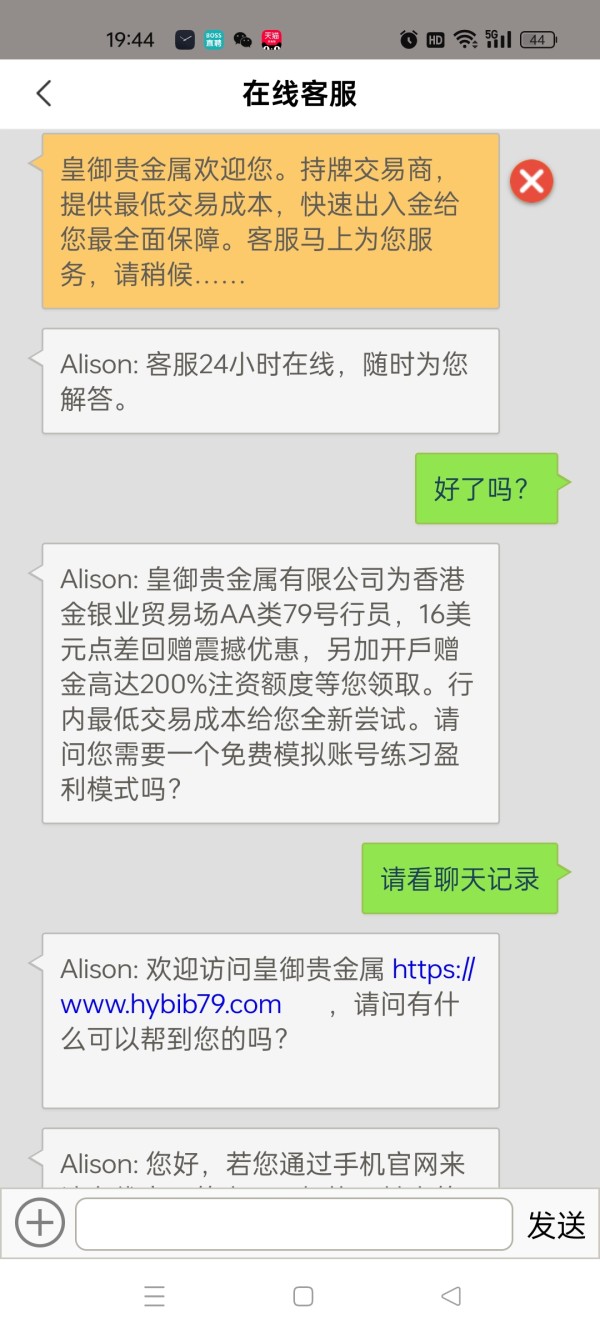

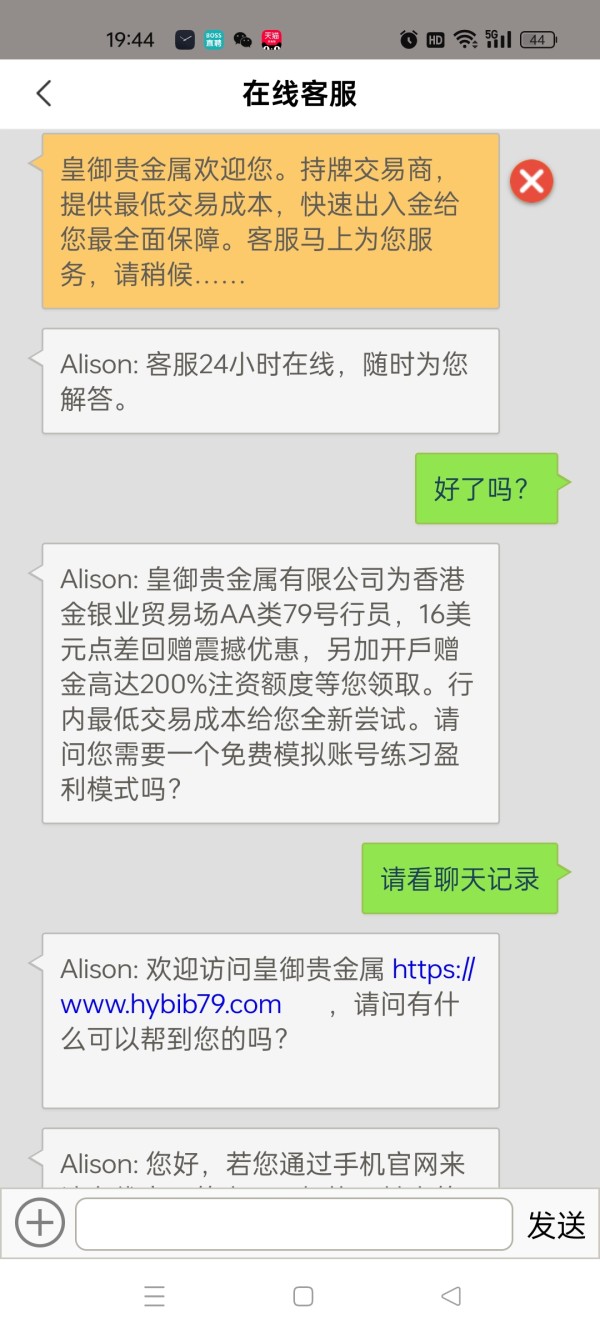

Bibgold operates as a specialized broker focusing primarily on gold and silver trading through MT4 and MT4 Web platforms. While the broker claims regulation under the China Gold & Silver Exchange Society, user experiences paint a troubling picture of operational difficulties and poor customer support responsiveness.

The platform targets investors interested in precious metals trading. It particularly focuses on those seeking exposure to London Gold and London Silver markets. However, multiple user reports indicate serious issues with account management, withdrawal processing, and customer service quality that significantly impact the overall trading experience.

According to WikiFX monitoring data, Bibgold has received predominantly negative user reviews. Particular criticism is directed at the company's handling of customer problems and tendency to shift responsibility rather than provide solutions.

This evaluation is based on publicly available information and user feedback collected from various sources including WikiFX and other industry monitoring platforms. Readers should note that regulatory frameworks and broker operations may vary across different jurisdictions.

The assessment methodology incorporates user testimonials, regulatory status verification, and platform functionality analysis. Given the limited transparency from the broker regarding specific operational details, some information gaps exist that potential clients should investigate independently before making investment decisions.

| Dimension | Score | Rating |

|---|---|---|

| Account Conditions | 3/10 | Poor |

| Tools and Resources | 7/10 | Good |

| Customer Service and Support | 2/10 | Very Poor |

| Trading Experience | 4/10 | Below Average |

| Trustworthiness | 3/10 | Poor |

| User Experience | 3/10 | Poor |

Bibgold operates as a specialized forex and precious metals broker with a primary focus on gold and silver trading markets. The company positions itself as a provider of MT4-based trading solutions, specifically targeting investors interested in London Gold and London Silver markets. While the exact establishment date remains unclear from available documentation, the broker has developed a presence in the precious metals trading sector.

The company's business model centers around providing access to precious metals markets through established trading platforms. It particularly focuses on the popular MetaTrader 4 ecosystem. This focus on specialized asset classes distinguishes Bibgold from broader multi-asset brokers, though this specialization comes with inherent limitations in portfolio diversification opportunities.

The broker's operational structure appears to concentrate on serving clients interested in precious metals exposure. It offers both standard MT4 desktop applications and web-based trading interfaces. According to available information, Bibgold claims regulatory oversight from the China Gold & Silver Exchange Society, though specific licensing details and regulatory compliance verification remain limited in public documentation.

User feedback suggests that while the broker provides access to precious metals markets, significant operational challenges exist in areas of customer service, account management, and withdrawal processing. This bibgold review indicates that potential clients should carefully evaluate these operational aspects before committing funds to the platform.

Regulatory Status: Bibgold claims regulation under the China Gold & Silver Exchange Society. However, specific license numbers and detailed regulatory compliance information are not readily available in public documentation.

Deposit and Withdrawal Methods: Specific information regarding available deposit and withdrawal methods is not detailed in available sources. This represents a significant transparency gap for potential clients.

Minimum Deposit Requirements: The broker has not clearly disclosed minimum deposit requirements in publicly available information. This creates uncertainty for prospective traders planning their initial investment.

Bonus and Promotions: No specific information about promotional offers or bonus programs is available in current documentation. This suggests either absence of such programs or limited marketing transparency.

Tradeable Assets: The platform primarily focuses on London Gold and London Silver markets. This indicates a specialized approach to precious metals trading rather than a comprehensive multi-asset offering.

Cost Structure: Detailed information about spreads, commissions, and other trading costs is not specified in available sources. This creates uncertainty about the true cost of trading with this bibgold review subject.

Leverage Ratios: Specific leverage offerings are not detailed in current documentation. This is crucial information for risk management and position sizing decisions.

Platform Options: Bibgold provides MT4 and MT4 Web platforms. These offer both desktop and browser-based trading environments for client access to precious metals markets.

Geographic Restrictions: Information about geographic limitations or restricted jurisdictions is not specified in available documentation.

Customer Support Languages: Available customer service languages are not clearly specified in current public information.

The account conditions offered by Bibgold present significant transparency challenges that negatively impact the overall client experience. Based on available information, the broker fails to provide clear details about account types, minimum deposit requirements, or specific account features that would enable potential clients to make informed decisions.

User feedback indicates substantial problems with account management processes. These particularly affect withdrawal procedures and account access issues. Multiple reports suggest that clients have experienced unexpected account restrictions and difficulties in accessing their funds, which raises serious concerns about the broker's account management practices.

The absence of clearly defined account tiers or specialized account features limits clients' ability to select appropriate trading conditions for their investment goals. Without transparent information about account minimums, trading conditions, or special features, potential clients cannot adequately assess whether Bibgold's offerings align with their trading requirements.

Furthermore, user testimonials indicate that account opening processes may lack proper documentation and transparency. This contributes to later complications in account management and fund withdrawal procedures. This bibgold review reveals that the broker's account conditions framework requires significant improvement to meet industry standards for transparency and client protection.

Bibgold's trading tools and resources center around the MetaTrader 4 ecosystem. They provide both desktop and web-based access to precious metals markets. The MT4 platform offers standard charting capabilities, technical indicators, and automated trading support through Expert Advisors, which represents a solid foundation for precious metals trading activities.

The MT4 Web platform extends accessibility by allowing browser-based trading without software downloads. This can benefit clients who prefer web-based solutions or have limited device storage capabilities. These platforms provide essential technical analysis tools including various chart types, timeframes, and a comprehensive selection of technical indicators suitable for precious metals market analysis.

However, user feedback suggests that the platform's tool selection may be limited compared to more comprehensive multi-asset brokers. The focus on precious metals trading, while specialized, restricts the analytical tools and market data available to clients interested in broader market analysis or portfolio diversification strategies.

Educational resources and research materials are not clearly detailed in available documentation. This represents a significant gap for clients seeking market analysis, trading education, or ongoing market commentary. The absence of comprehensive educational support limits the platform's value proposition, particularly for less experienced traders entering precious metals markets.

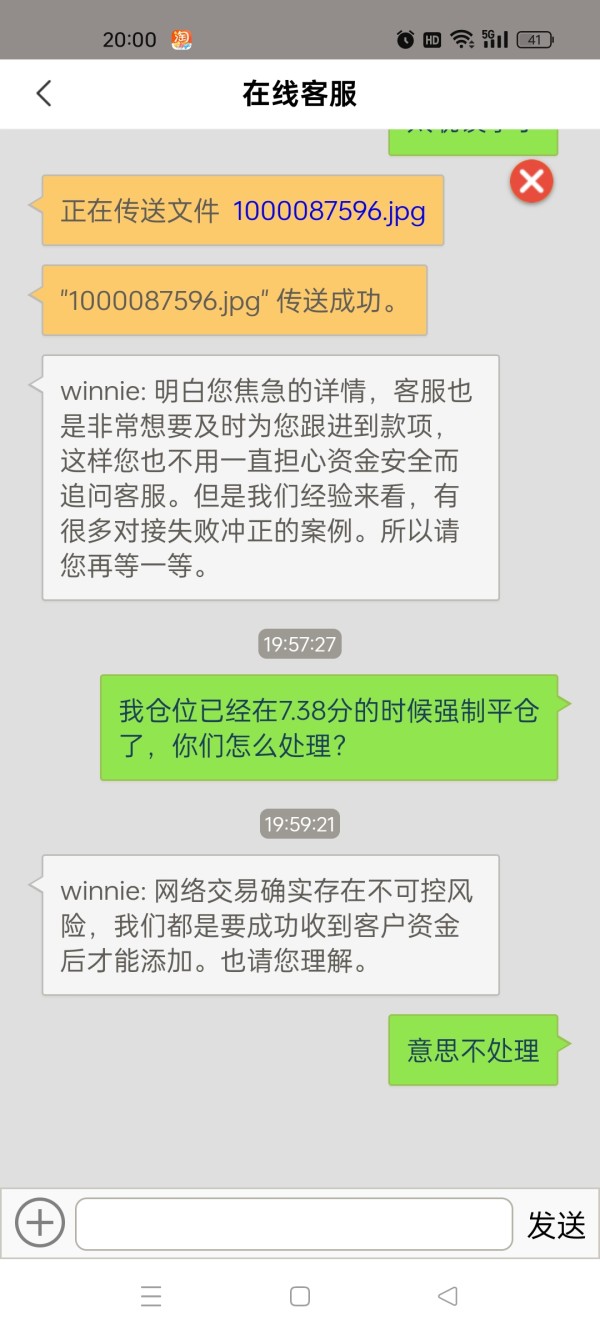

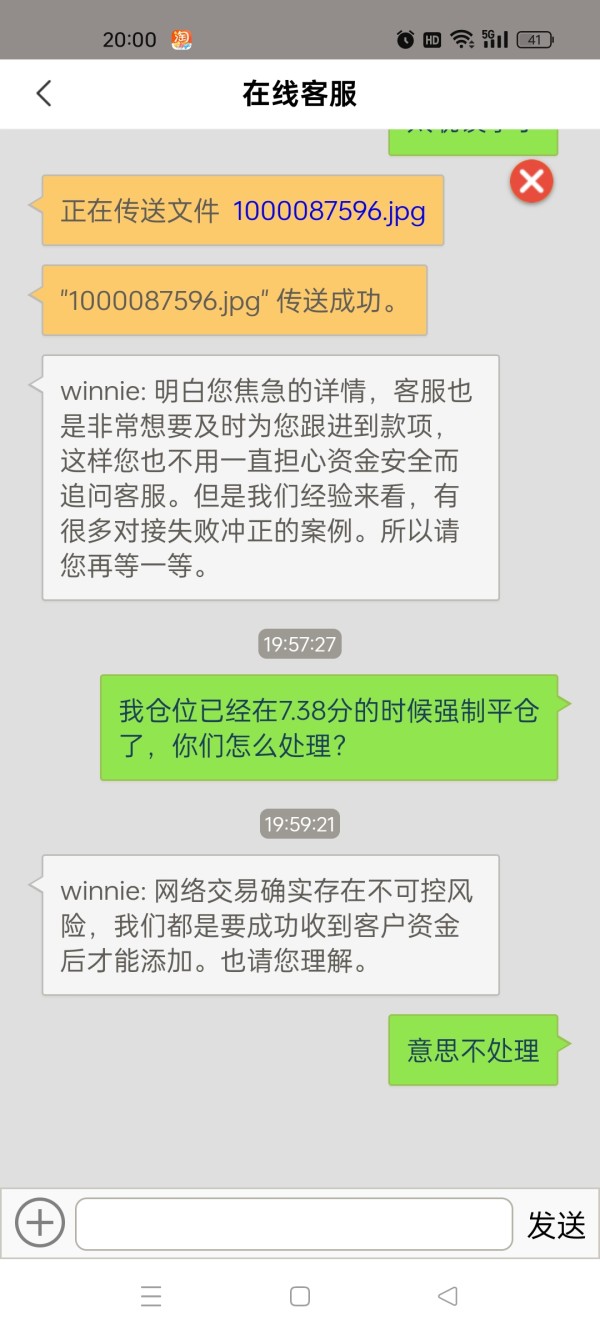

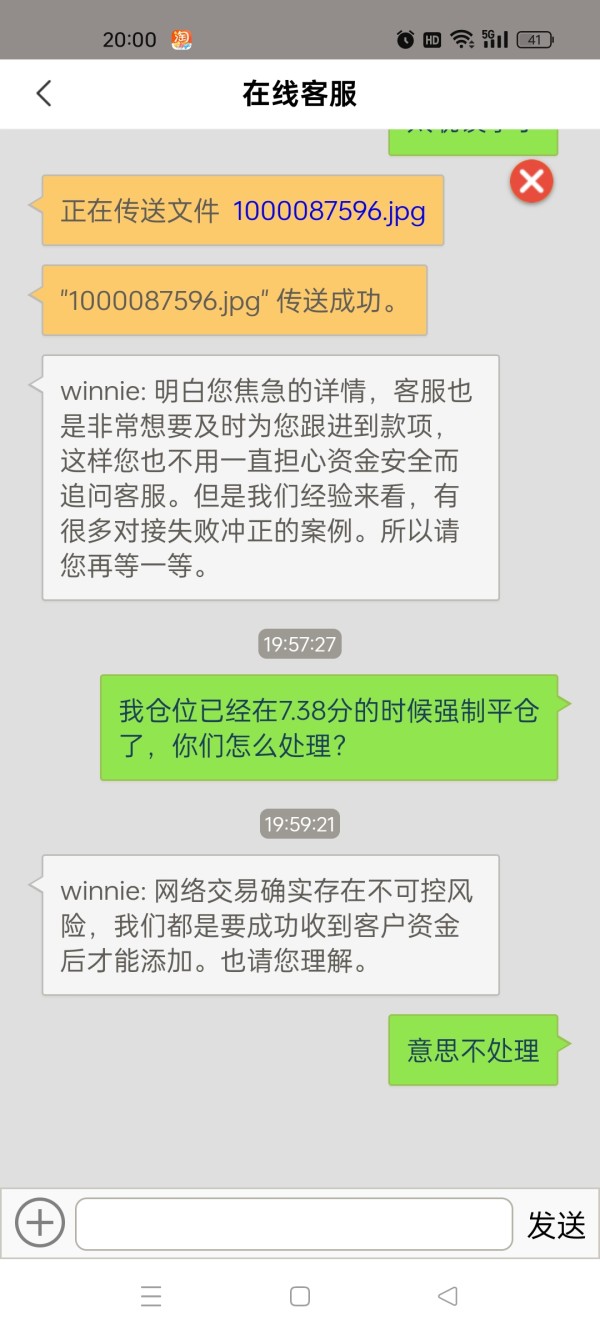

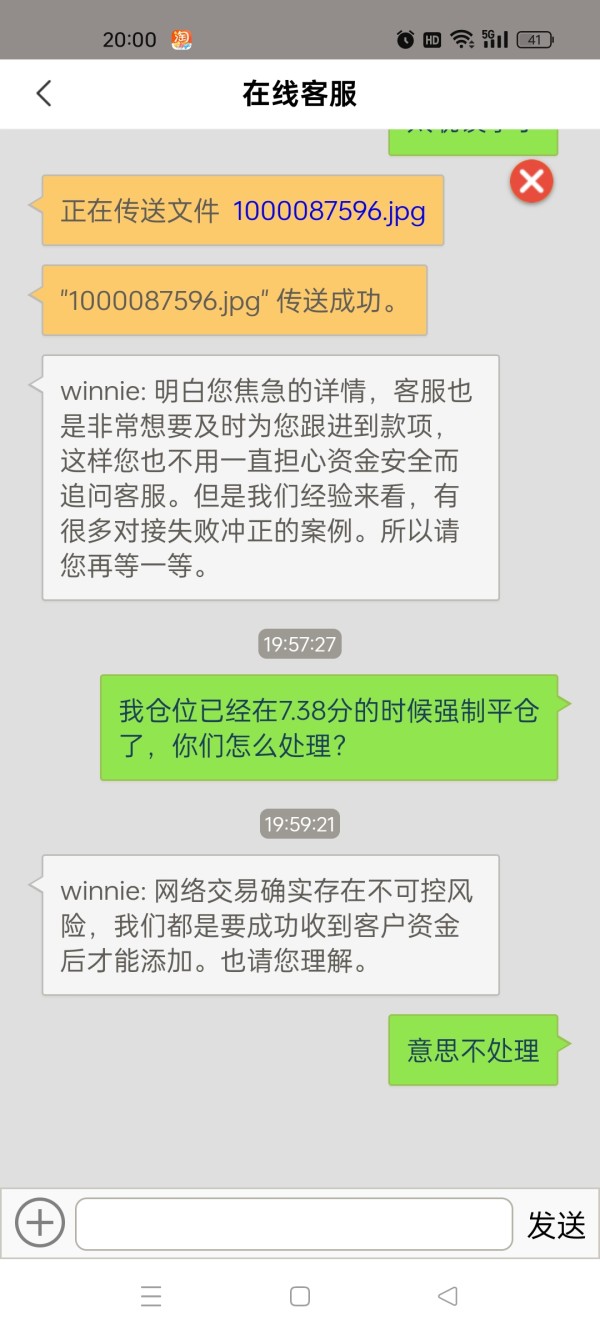

Customer service represents one of the most significant weaknesses identified in this bibgold review. Multiple user reports indicate poor responsiveness, inadequate problem resolution, and unprofessional conduct from support representatives. User feedback consistently highlights the company's tendency to shift responsibility rather than provide constructive solutions to client concerns.

Response times appear to be problematic. Users report extended delays in receiving support for urgent issues including withdrawal requests and account access problems. The quality of support interactions has been criticized for lack of professionalism and insufficient technical knowledge to address complex trading or platform-related issues.

Communication channels and availability hours are not clearly specified in public documentation. This creates additional uncertainty about when and how clients can access support services. The absence of clearly defined escalation procedures or specialized support for different issue types further compounds the customer service challenges.

Multiple user testimonials indicate that support representatives often fail to take ownership of client problems. Instead, they deflect responsibility or provide inadequate explanations for operational issues. This pattern of poor customer service significantly undermines client confidence and creates substantial barriers to effective problem resolution when issues arise.

The trading experience on Bibgold's platforms reflects both the capabilities of the MT4 ecosystem and the operational limitations of the broker's infrastructure. While MT4 provides reliable charting and order execution capabilities, user feedback indicates concerns about platform stability and execution quality during active trading periods.

Order execution quality has been questioned by some users. Reports of slippage and requotes may impact trading performance, particularly during volatile market conditions common in precious metals trading. The limited asset selection, while specialized, restricts portfolio diversification opportunities and may not satisfy traders seeking broader market exposure.

Platform functionality appears adequate for basic precious metals trading. It offers standard order types, technical analysis capabilities, and real-time price feeds for London Gold and London Silver markets. However, advanced trading features and sophisticated order management tools may be limited compared to more comprehensive trading platforms.

Mobile trading capabilities are not clearly detailed in available documentation. This represents a significant gap for modern traders who require flexible access to their positions and market monitoring capabilities. The user experience feedback suggests that overall trading conditions may not meet the expectations of more demanding or professional traders seeking institutional-quality execution and platform reliability.

This bibgold review indicates that while basic trading functionality exists, the overall trading experience is hampered by operational issues and limited platform development. These factors affect client satisfaction and trading effectiveness.

Trustworthiness represents a critical concern area for Bibgold. Multiple factors contribute to questions about the broker's reliability and operational integrity. The claimed regulation under the China Gold & Silver Exchange Society lacks detailed verification information, including specific license numbers or regulatory compliance documentation that clients can independently verify.

User reports indicate concerning patterns of account management issues. These include cases where user accounts have been deleted or restricted without adequate explanation or recourse. These incidents raise serious questions about the broker's commitment to client protection and transparent operational practices that are essential for maintaining trust in financial services.

The company's transparency regarding operational procedures, fee structures, and regulatory compliance appears limited. This creates information gaps that prevent clients from making fully informed decisions about their investments. The absence of detailed disclosure about company ownership, financial backing, or regulatory oversight limits clients' ability to assess counterparty risk.

Reputation within the industry appears to be negatively affected by user complaints and operational issues. Monitoring services like WikiFX highlight risk factors associated with the broker's operations. The pattern of user complaints regarding withdrawal difficulties and customer service problems suggests systemic issues that impact the broker's overall trustworthiness and reliability for client fund management.

The overall user experience with Bibgold reflects significant challenges across multiple touchpoints that impact client satisfaction and platform usability. User feedback consistently indicates frustration with withdrawal processes, account management procedures, and general platform administration that creates barriers to effective trading and fund management.

Withdrawal processing appears to be a persistent problem area. Users report extended delays, unexpected restrictions, and inadequate communication about withdrawal status and requirements. These issues create substantial stress for clients and undermine confidence in the broker's operational capabilities and commitment to client service.

Interface design and platform usability are not extensively detailed in user feedback. The reliance on standard MT4 platforms suggests a familiar trading environment for experienced traders. However, the overall user journey appears to be negatively impacted by operational inefficiencies and poor customer support that overshadow any platform advantages.

User satisfaction levels appear to be significantly below industry standards. Negative feedback dominates available reviews and testimonials. The combination of withdrawal difficulties, poor customer service, and limited transparency creates a user experience that fails to meet basic expectations for professional financial services.

Common user complaints center on fund access issues, unresponsive customer support, and lack of transparency in operational procedures. These consistent patterns suggest systemic problems that require substantial operational improvements to achieve acceptable user experience standards for modern forex and precious metals trading services.

This comprehensive bibgold review reveals a broker with significant operational challenges that substantially outweigh any potential advantages from its specialized precious metals focus. While the availability of MT4 platforms provides a familiar trading environment, the persistent issues with customer service, withdrawal processing, and overall transparency create substantial risks for potential clients.

The broker is not recommended for risk-averse investors or those prioritizing reliable customer service and transparent operational procedures. The pattern of user complaints and operational difficulties suggests that clients may face significant challenges in accessing their funds and receiving adequate support when problems arise.

The main advantages include access to MT4 trading platforms and specialization in precious metals markets. However, these benefits are overshadowed by poor customer service quality, withdrawal processing difficulties, and limited operational transparency that create substantial risks for client funds and trading effectiveness.

FX Broker Capital Trading Markets Review