Is FintechFX safe?

Pros

Cons

Is Fintechfx Safe or Scam?

Introduction

Fintechfx is an online forex broker that has positioned itself in the global trading market, primarily catering to retail traders. As the forex market is often rife with both opportunities and risks, it is crucial for traders to carefully evaluate the brokers they choose to work with. The legitimacy and reliability of a broker can significantly impact traders' experiences and their financial safety. In this article, we will explore the various facets of Fintechfx, assessing its regulatory status, company background, trading conditions, and customer experiences to determine whether Fintechfx is safe or a potential scam. Our investigation relies on data gathered from reputable financial review sites and user testimonials, providing a comprehensive overview of the broker's credibility.

Regulation and Legitimacy

Understanding the regulatory framework within which a broker operates is vital for assessing its safety. Fintechfx claims to be registered with the Australian Securities and Investments Commission (ASIC), which is known for its stringent regulatory standards. However, it is essential to note that while registration with ASIC lends some credibility, it does not equate to full regulation. The company behind Fintechfx, My Group Fintech Pty Ltd, is incorporated in Saint Vincent and the Grenadines, a region notorious for its lax regulatory environment.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | N/A | Australia | Registered |

| SVG | N/A | Saint Vincent | Unregulated |

The lack of comprehensive regulation raises significant concerns regarding the safety of funds and the overall trustworthiness of Fintechfx. ASIC requires brokers to maintain a minimum capital of AUD 1,000,000 and to keep client funds in segregated accounts. However, given that Fintechfx is merely registered and not fully regulated, it does not meet these requirements, which may expose traders to higher risks.

Company Background Investigation

Fintechfx is operated by My Group Fintech Pty Ltd, a company that was established to provide forex trading services. However, the company's operational history and ownership structure raise questions about transparency. The management team behind Fintechfx lacks publicly available information, which makes it difficult to assess their expertise and experience in the financial sector. This lack of transparency can be a red flag for potential investors.

The company's incorporation in an offshore jurisdiction, combined with limited information about its management, further complicates the picture. Traders may find it challenging to hold the company accountable in case of disputes or issues, especially given the absence of a robust regulatory framework to protect their interests.

Trading Conditions Analysis

When evaluating whether Fintechfx is safe, it is crucial to examine its trading conditions and fee structures. Fintechfx offers two types of trading accounts: a standard account with a minimum deposit of $100 and an Ultimate ECN account requiring a $1,000 deposit. The leverage offered is up to 1:500, which is appealing to many traders but also increases risk exposure.

| Fee Type | Fintechfx | Industry Average |

|---|---|---|

| Spread for Major Pairs | N/A | 1.0 - 2.0 pips |

| Commission Model | $10/lot | Varies |

| Overnight Interest Range | N/A | Varies |

A significant concern is the lack of transparency regarding spreads, which are not specified on the brokers website. This absence of clear pricing information can lead to unexpected costs for traders. Additionally, withdrawal fees of $20 and processing times of up to seven business days are not typical in the industry, further questioning the broker's commitment to fair trading practices.

Client Fund Safety

The safety of client funds is paramount when considering whether Fintechfx is safe. Fintechfx claims to implement certain safety measures; however, the lack of regulatory oversight raises questions about the effectiveness of these measures. The companys funds are not kept in segregated accounts, which is a standard practice among reputable brokers to ensure client funds are protected from operational risks.

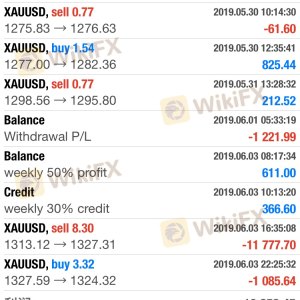

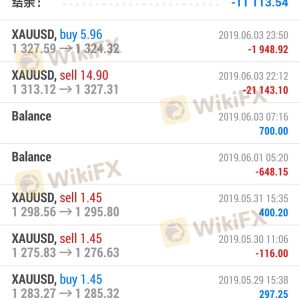

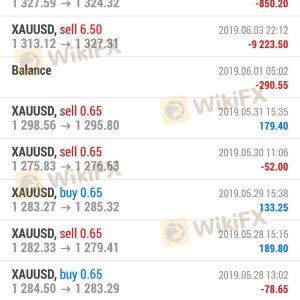

Moreover, there have been reports of withdrawal issues and delays, which can be particularly concerning for traders looking to access their funds quickly. Historical complaints about the broker suggest that there may be a lack of adequate investor protection, further emphasizing the risks associated with trading through Fintechfx.

Customer Experience and Complaints

Customer feedback is an essential aspect of evaluating any broker. Reviews of Fintechfx reveal a mixed bag of experiences, with several users reporting issues related to withdrawals and customer service. Common complaints include delayed withdrawals and a lack of responsive support, which can be frustrating for traders attempting to resolve issues.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Customer Support Issues | Medium | Poor |

For instance, some users have reported that after requesting withdrawals, they faced long processing times and additional fees, leading to dissatisfaction. These patterns of complaints raise concerns about the brokers reliability and whether it is indeed a safe choice for traders.

Platform and Execution

The trading platform offered by Fintechfx is MetaTrader 4 (MT4), a widely used and respected platform in the trading community. MT4 is known for its user-friendly interface and robust features, which can enhance the trading experience. However, the quality of order execution is also crucial for traders.

Issues such as slippage and order rejections have been reported by some users, indicating potential execution problems. Such issues can significantly impact trading outcomes, especially for those employing strategies that rely on precise execution. The presence of any signs of platform manipulation is a serious concern for traders considering whether Fintechfx is safe.

Risk Assessment

Engaging with Fintechfx carries inherent risks that should not be overlooked. The combination of its offshore status, lack of comprehensive regulation, and reported customer service issues creates a challenging environment for potential traders.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated offshore broker |

| Withdrawal Risk | High | Delays and fees on withdrawals |

| Execution Risk | Medium | Potential slippage and rejections |

To mitigate these risks, traders should exercise caution and consider diversifying their investments across multiple brokers, ensuring that they choose those with robust regulatory oversight and a proven track record of customer satisfaction.

Conclusion and Recommendations

In conclusion, while Fintechfx offers some appealing features, such as high leverage and the popular MT4 platform, the overall assessment indicates that it may not be the safest choice for traders. The combination of its offshore incorporation, lack of comprehensive regulation, and numerous customer complaints raises significant red flags.

For traders seeking a safer environment, it is advisable to consider reputable brokers that are fully regulated and have a solid history of customer service and fund protection. Some reliable alternatives include brokers like Plus500, XM, and eToro, which provide a more secure trading experience. Ultimately, if you are contemplating trading with Fintechfx, proceed with caution and ensure that you are fully aware of the risks involved.

Is FintechFX a scam, or is it legit?

The latest exposure and evaluation content of FintechFX brokers.

FintechFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FintechFX latest industry rating score is 1.60, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.60 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.