Titan FX 2025 In-Depth Review: Opportunity or Trap?

Executive Summary

Titan FX presents itself as an offshore-regulated broker that offers competitive trading conditions and a diverse range of instruments, appealing mainly to experienced traders. Established in 2014 and headquartered in Vanuatu, the broker entices clients with its maximum leverage of up to 1:1000 and the promise of low-cost trading across various asset classes. However, potential traders must carefully evaluate the trade-offs between the enticing low-cost trading opportunities and significant risks associated with its regulatory status, particularly concerns over user complaints regarding fund safety and withdrawal difficulties.

While Titan FX may provide advantages for experienced traders familiar with offshore brokers' intricacies, its offerings are not suited for novices lacking understanding of high-risk environments. The broker's multiple regulatory warnings, especially those from the Japanese Financial Services Agency (JFSA), further highlight the need for cautious engagement.

⚠️ Important Risk Advisory & Verification Steps

Risk Statement:

Engaging with Titan FX entails considerable risk due to its offshore regulatory status, which may provide minimal investor protection compared to tier-1 regulated brokers.

Potential Harms:

- Possible issues with fund withdrawal.

- High leverage risks, which could magnify losses.

- Inadequate regulatory oversight could impact fund safety.

How to Self-Verify the Broker's Legitimacy:

- Check Regulatory Compliance: Visit the official websites of the Vanuatu Financial Services Commission (VFSC) and other regulatory bodies to confirm Titan FX's claims.

- Read User Reviews: Look for financial forums or review sites to gather additional insights into other traders' experiences with Titan FX.

- Contact Customer Support: Reach out using the provided email or phone number to assess their responsiveness and reliability.

- Monitor for Regulatory Updates: Regularly check for any news or updates from financial authorities regarding Titan FXs licensing and operational status.

- Conduct Independent Research: Use resources like BrokerChooser and WikiFX to uncover the latest reviews and analysis about Titan FX.

Rating Framework

Broker Overview

Company Background and Positioning

Titan FX, founded in 2014, operates from Vanuatu and holds several offshore licenses from various regulatory bodies, including the Vanuatu Financial Services Commission (VFSC) and the Financial Services Authority (FSA) of Seychelles. The broker was formerly based in New Zealand but relocated to enhance its operational flexibility. Despite its claims of being trusted, Titan FX has raised red flags, particularly for traders from jurisdictions with stricter regulations, such as the EU and the UK.

Core Business Overview

Titan FX focuses on offering a broad array of trading instruments, including forex, commodities, metals, cryptocurrencies, and indices. Traders can engage in speculation across over 60 currency pairs and various other assets using the widely-used MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. The broker markets itself as a no-dealing desk (NDD) solution, facilitating direct market access and devoid of intervention in client trades.

Quick-Look Details Table

In-depth Analysis of Each Dimension

Trustworthiness Analysis

Analysis of Regulatory Information Conflicts

Titan FX is embroiled in trust issues, primarily due to its offshore regulatory status. Despite being licensed under the VFSC and FSA, the lack of stringent compliance compared to tier-1 regulators raises questions about trading safety. The broker has received warnings from multiple regulatory bodies, notably the JFSA, which underscores the severity of operational risks inherent in trading with Titan FX.

User Self-Verification Guide

- Visit the Financial Regulators' Websites: Ensure that Titan FX is listed under the VFSC and FSA to validate its claimed regulatory status.

- Review Historical Performance: Look for any past complaints or actions taken against Titan FX through regulatory bodies.

- Check for User Testimonials: Navigate through forums and review sites for both positive and negative user feedback.

- Examine Website Content: Look for transparency regarding fees, trading conditions, and potential risks involved.

- Seek Independent Reviews: Use platforms like Forex Peace Army to gauge real-world trader experiences with Titan FX.

Industry Reputation and Summary

Community sentiment towards Titan FX varies significantly. While some traders appreciate its competitive spreads and execution speed, negative user experiences regarding fund withdrawal issues undermine its reputation, contributing to an overall sense of distrust among potential investors.

Trading Costs Analysis

Advantages in Commissions

Titan FX promotes a competitive trading environment with low commissions, particularly for the blade account, which can see spreads starting at 0.0 pips. This low-cost entry appeals to many traders looking to maximize their profit margins.

The "Traps" of Non-Trading Fees

Despite low trading costs, users have reported substantial withdrawal fees. Notably, one user stated in their review, “I was charged a 4% fee on my withdrawal after not trading for a period, and the process took longer than expected.” Such fees need to be scrutinized when considering overall trading costs.

Cost Structure Summary

Traders seeking low initial trading costs may find Titan FX attractive. However, it is essential to factor in the potential for hidden fees and withdrawal costs, which can significantly impact net profitability, particularly for more active traders.

Platform Diversity

Titan FX supports both MT4 and MT5, both of which are well-regarded trading platforms in the industry for their comprehensive tools and user-friendly interfaces. The platforms allow traders to utilize expert advisors and automated trading, catering to a variety of trading strategies.

Quality of Tools and Resources

While Titan FX offers a robust platform environment, traders have expressed concerns over the lack of advanced charting tools compared to some competitors. However, the access to a wide range of market instruments coupled with reliable execution speeds compensates somewhat for this shortcoming.

Platform Experience Summary

User experiences on the Titan FX platform are mixed, with positive feedback on reliability and execution speed, while concerns persist over user support for complex issues. This dichotomy can affect user retention and satisfaction in the long run.

User Experience Analysis

User Experience Overview

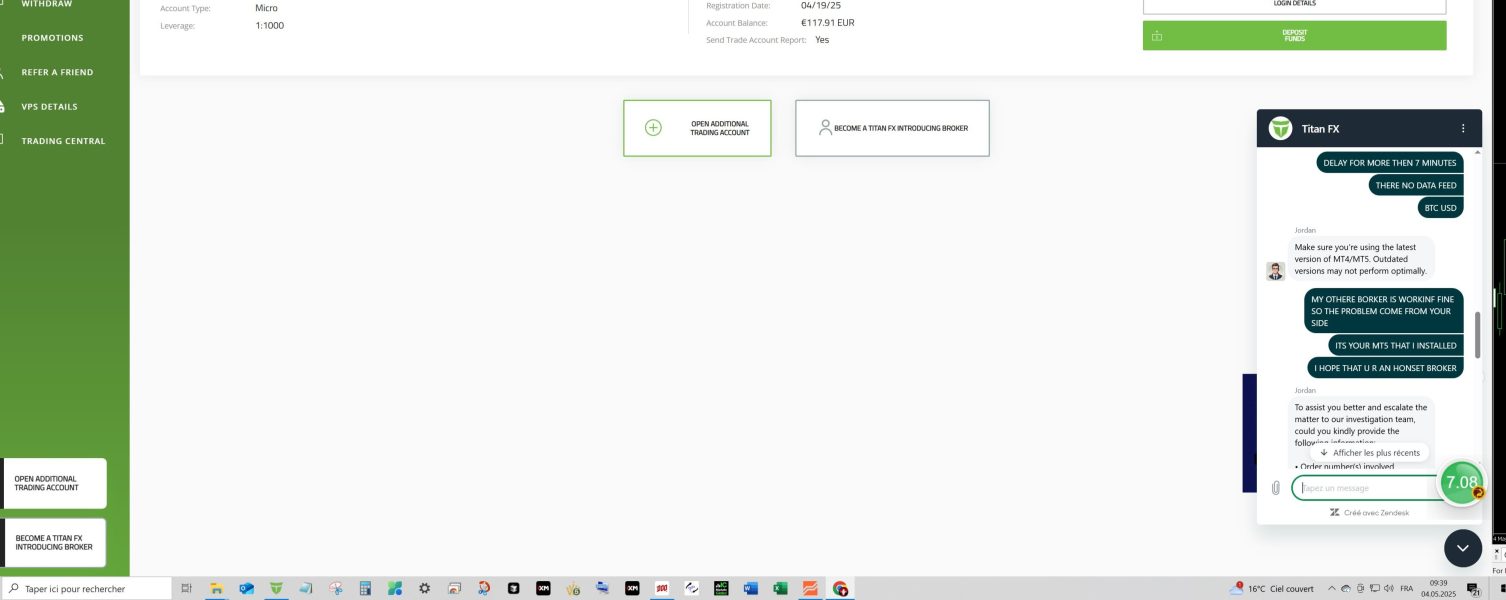

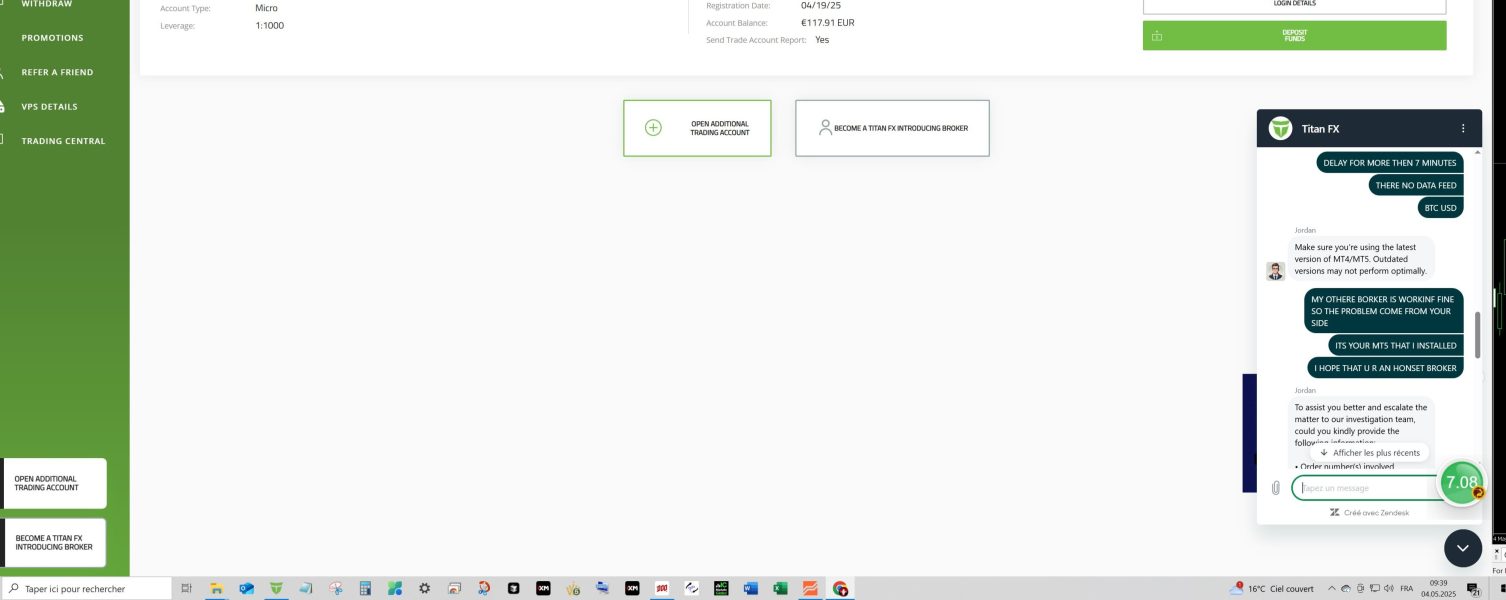

The user experience is often a pivotal factor in a trader's choice of broker. Titan FXs interface is seen as intuitive but can confuse newer traders due to its variety of features and tools. Some users have reported sluggish customer support responses when issues arise, noting that “My query took too long to receive a confirmation, hindering my trading decisions.”

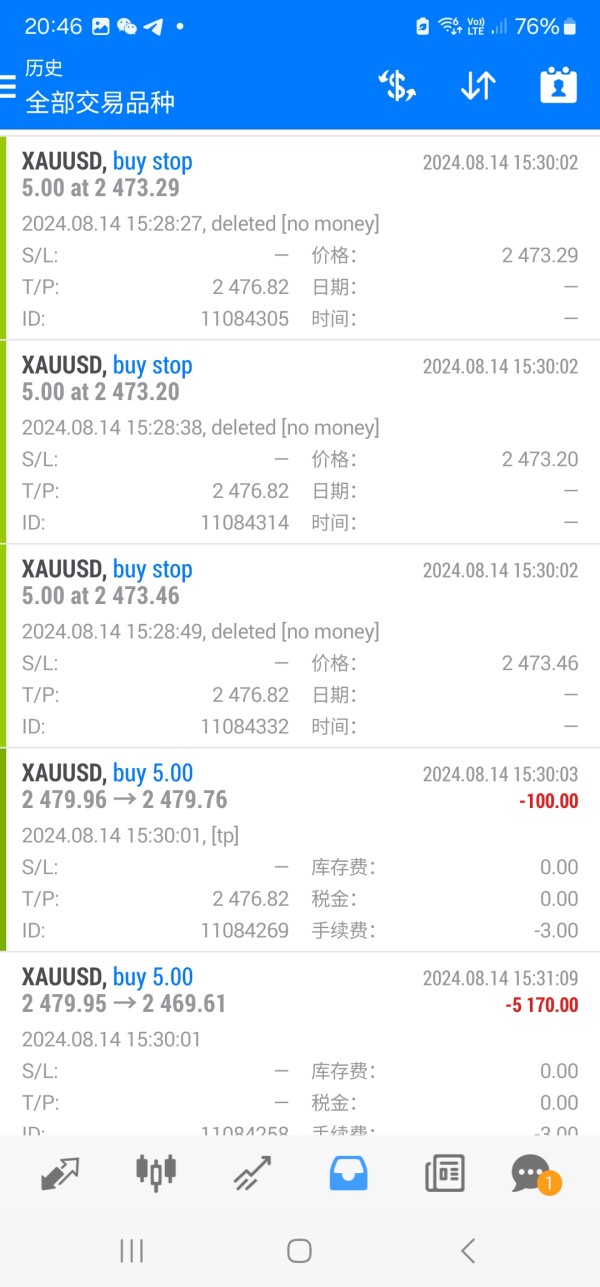

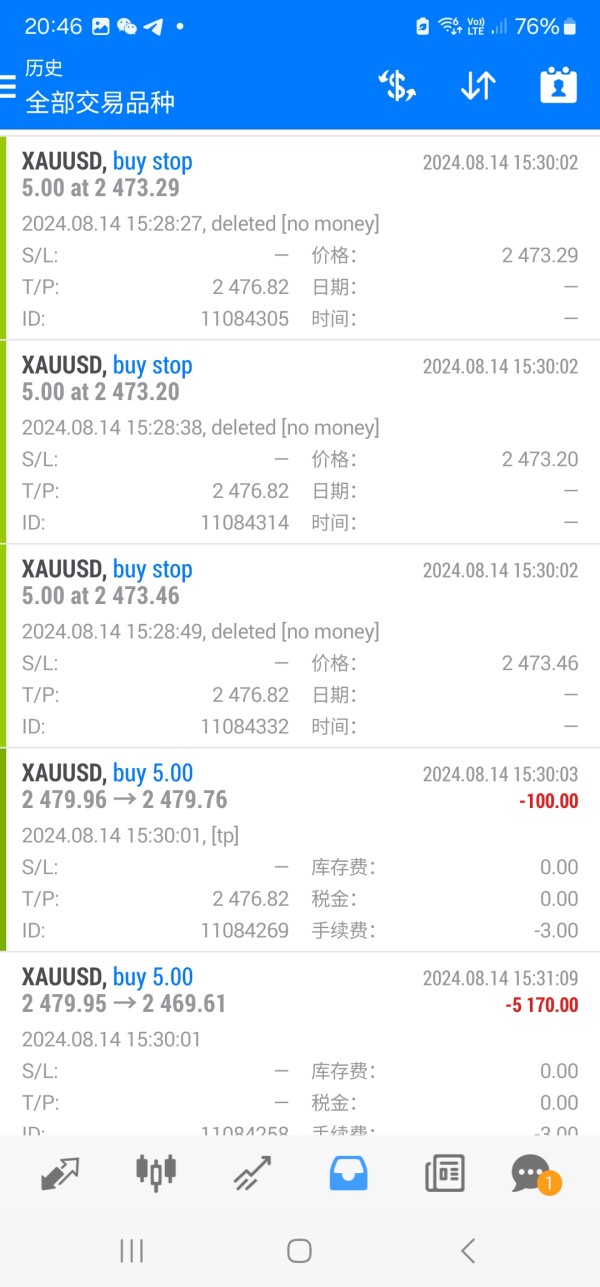

Account Management Features

Management of trading accounts on Titan FX is straightforward, yet issues related to fund withdrawals add complexity to the user experience. Traders have highlighted the difficulty of securely and quickly getting their funds back after trading, a significant point of concern.

Learning Resources Available

While Titan FX does provide some educational materials, the depth and range of these resources are below industry standards. This is crucial for novice traders who may require more comprehensive support and educational content to navigate the forex trading landscape successfully.

Customer Support Analysis

Overview of Customer Support Services

Titan FX offers customer support through various channels, including live chat, email, and phone. However, users often report slow response times during peak hours, indicating that customer support remains a challenge that could impact trader satisfaction.

Availability of Help Options

While 24/5 support is available, the absence of weekend customer service can pose a disadvantage for traders who might wish to operate outside standard business hours. As one user remarked, “The service team is great, but the wait times can be frustrating.”

Response Quality Assessment

Overall, while Titan FX attempts to provide adequate support, the inconsistency in response times and quality detracts from the trading experience. Improvements in this area are necessary to enhance user confidence and retention rates.

Account Conditions Analysis

Account Types Offered

Titan FX provides several account types, including standard, blade, and micro, each catering to different trading strategies. However, the varying leverage options (up to 1:1000 for the micro account) can increase the risk levels significantly, particularly for inexperienced traders.

Minimum Deposit Insight

Requiring a minimal deposit of $200 to open an account can be an attractive entry point for new investors. However, the potential risk associated with high leverage means that this opportunity must be approached with caution by new traders and should prompt adequate market research.

Withdrawal and Inactivity Fees

Users have indicated that withdrawal processes can be cumbersome, with delays and fees that were not clearly communicated during account setup. Adapting clarity around fees would greatly enhance user experience.

Conclusion

In summary, Titan FX presents an enticing option for experienced traders due to its competitive trading landscape and range of instruments. However, the significant downside risk stemming from its offshore regulation and notable user complaints on fund withdrawal and customer service raises critical concerns that potential traders must consider.

Prospective traders should approach Titan FX with caution, ensuring they are well-informed about the risks involved and prepared to manage them effectively. Balancing cost benefits against potential hazards remains key to navigating their trading experience with Titan FX successfully. As with any financial decision, thorough research and self-verification should guide traders before committing any capital.