Finco 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive finco review examines a financial services provider that has generated significant attention in 2025. The attention has not always been positive. Based on available user feedback, FINCO currently holds a concerning user rating of 1.5 out of 5 stars, indicating substantial challenges in customer satisfaction and service delivery.

Despite this low rating, the company has demonstrated financial activity, notably distributing $57 million in dividends over a 12-month period. This suggests underlying business operations remain active. FINCO appears to operate primarily in the insurance brokerage and consulting services sector, positioning itself to serve clients requiring specialized financial advisory services.

However, the significant gap between the company's financial activities and user satisfaction raises important questions about service quality and customer experience. The company's recent dividend payouts came after central bank restrictions were loosened, allowing commercial bank licensees to reduce surplus liquidity stockpiles. While this demonstrates the company's participation in regulated financial markets, potential clients should carefully consider the substantial negative user feedback when evaluating FINCO as a service provider.

Important Notice

Regional Entity Differences: Due to limited regulatory information available in public sources, investors and potential clients should exercise heightened caution when considering FINCO's services. Different regional entities may operate under varying regulatory frameworks, and specific licensing information was not detailed in available materials.

Review Methodology: This evaluation is based on user feedback data, publicly available company information, and financial news reports. This review has not involved direct testing of services or comprehensive regulatory verification. Potential clients are strongly advised to conduct independent due diligence and verify current regulatory status before engaging with any financial services provider.

Rating Framework

Broker Overview

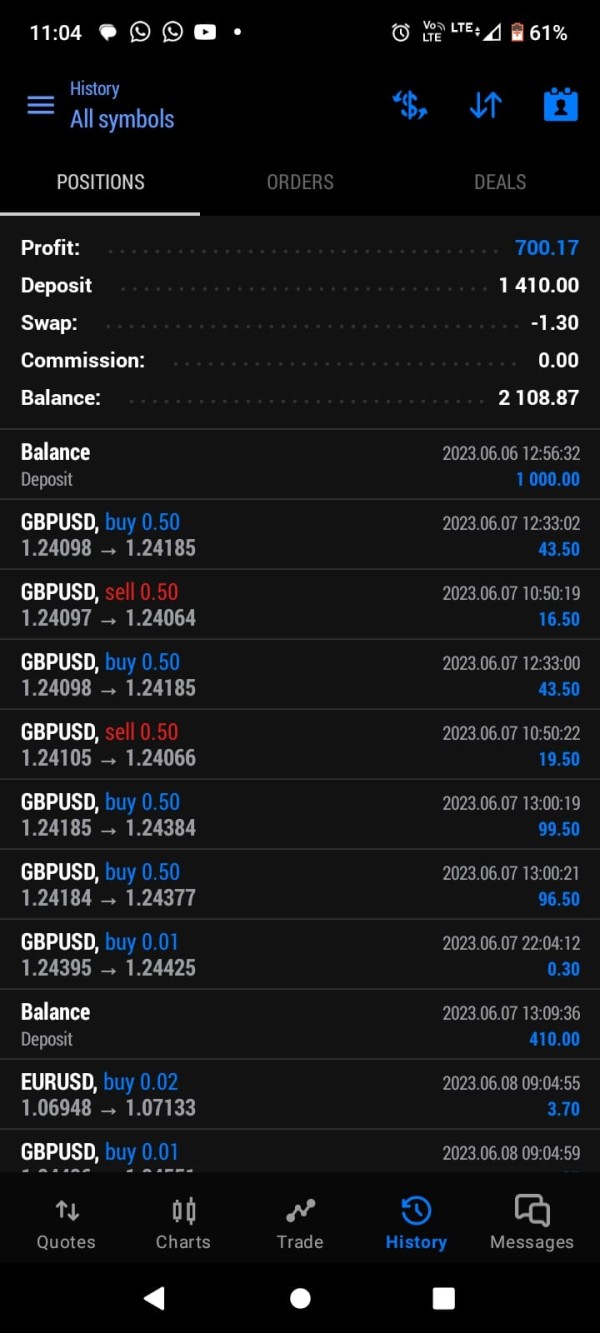

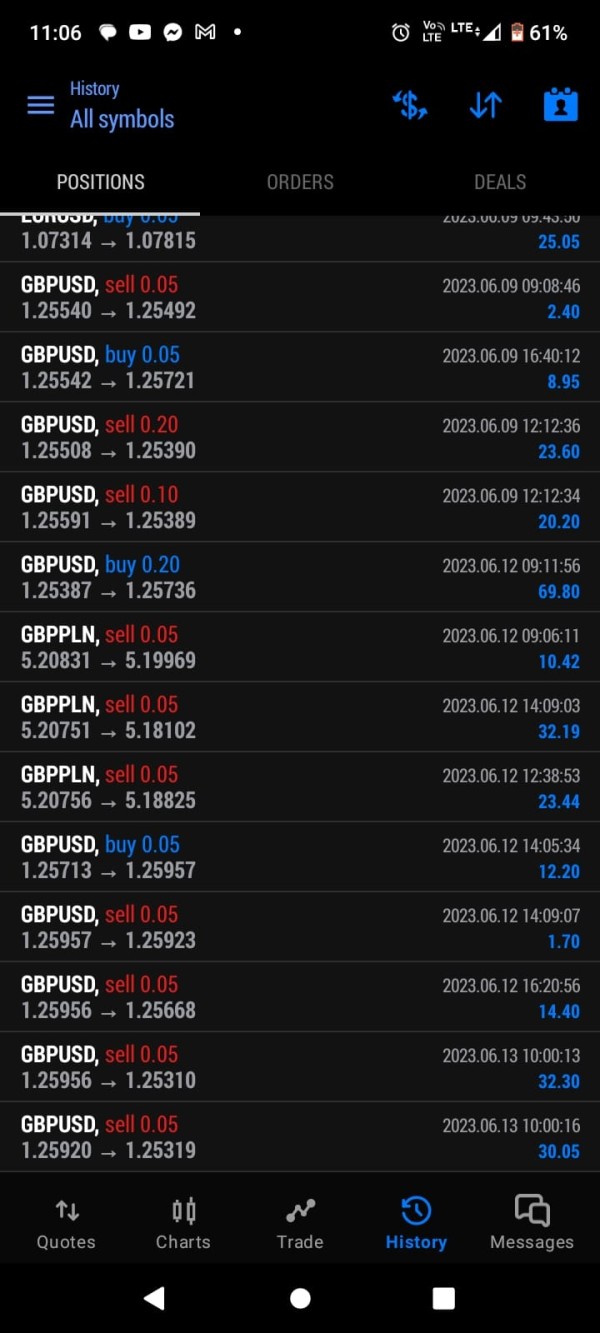

FINCO operates as a financial services entity with documented activity in insurance brokerage and consulting services. The company has demonstrated significant financial activity, with reports indicating dividend distributions totaling $57 million over a 12-month period.

This substantial payout occurred following regulatory changes where central banking authorities loosened restrictions on dividend declarations by commercial bank licensees. The goal was to reduce the industry's surplus liquidity stockpile exceeding $3 billion. The company's business model appears centered on insurance brokerage and consulting services, though specific details about trading platforms, asset offerings, or client service structures were not detailed in available public information.

Recent financial reports suggest the company experienced growth primarily driven by releases of provision for credit losses. This was partially offset by lower revenue and higher operating costs. However, this finco review must emphasize the concerning disconnect between the company's apparent financial activity and user satisfaction levels.

The 1.5-star user rating suggests significant challenges in service delivery, customer relations, or platform functionality that potential clients should carefully consider.

Regulatory Status: Specific regulatory oversight information was not detailed in available source materials. The company's dividend activities suggest operation under commercial banking regulatory frameworks.

Deposit and Withdrawal Methods: Payment processing and fund transfer options were not specified in available documentation.

Minimum Deposit Requirements: Entry-level investment or account opening requirements were not detailed in source materials.

Bonus and Promotions: Current promotional offerings or incentive programs were not mentioned in available information.

Tradeable Assets: Specific asset classes, instruments, or investment options were not detailed in accessible materials.

Cost Structure: Fee schedules, commission rates, or pricing models were not specified in available sources. This represents a significant information gap for this finco review.

Leverage Ratios: Trading leverage options or margin requirements were not detailed in source materials.

Platform Options: Trading platform types, software options, or technology infrastructure details were not available in source documentation.

Geographic Restrictions: Service availability by region or country-specific limitations were not specified.

Customer Service Languages: Multilingual support options were not detailed in available materials.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of FINCO's account conditions faces significant limitations due to the absence of detailed account structure information in available sources. This represents a critical transparency gap that potential clients should note.

Traditional financial services providers typically offer multiple account tiers with varying minimum deposits, features, and service levels. Specific details about FINCO's account offerings were not accessible through public sources. The lack of publicly available account condition information, combined with the low user rating of 1.5 stars, suggests potential clients may encounter difficulties in understanding service terms before engagement.

Industry best practices typically include clear disclosure of account types, minimum balance requirements, maintenance fees, and special features. Without specific account opening process details, verification procedures, or account management features, this finco review cannot provide definitive guidance on account conditions. The absence of this fundamental information may itself be indicative of transparency issues that contribute to poor user satisfaction ratings.

Potential clients should directly contact FINCO for comprehensive account condition details and carefully review all terms before proceeding with any account opening procedures.

Assessment of FINCO's trading tools and analytical resources encounters substantial limitations due to insufficient publicly available information about platform capabilities and client resources. Modern financial services providers typically offer comprehensive tool suites including technical analysis software, market research, economic calendars, and automated trading capabilities.

Specific details about FINCO's offerings were not detailed in accessible sources. The absence of clear information about research and analysis resources raises concerns about the company's commitment to client support and market education.

Professional trading environments typically provide real-time market data, charting tools, risk management features, and educational materials to support client decision-making. Without documented evidence of platform capabilities, mobile applications, or third-party tool integrations, potential clients cannot adequately assess whether FINCO's technology infrastructure meets modern trading standards.

The 1.5-star user rating may partially reflect inadequate tool provision or platform functionality issues. Educational resource availability, including webinars, tutorials, market analysis, and trading guides, could not be verified through available sources. This information gap represents a significant limitation for clients seeking comprehensive market support and learning opportunities.

Customer Service and Support Analysis

Customer service quality emerges as a critical concern in this finco review. The 1.5-star user rating strongly indicates significant deficiencies in support quality and responsiveness.

This exceptionally low rating suggests widespread customer dissatisfaction with service interactions, problem resolution, or communication effectiveness. While specific customer service channels, availability hours, or response time metrics were not detailed in available sources, the poor user rating implies that clients have experienced substantial difficulties when seeking assistance.

Professional financial services typically maintain multiple contact channels including phone, email, live chat, and dedicated account management. FINCO's actual service structure remains unclear. The low user satisfaction score may reflect issues such as inadequate response times, insufficient problem resolution capabilities, language barriers, or limited service availability.

These service quality concerns represent significant risks for potential clients who may require timely support for account issues, technical problems, or trading-related questions. Multilingual support capabilities, specialized technical assistance, and escalation procedures could not be verified through available documentation. Given the poor user ratings, potential clients should carefully evaluate customer service quality through direct interaction before committing to services.

Trading Experience Analysis

Evaluation of FINCO's trading experience faces substantial limitations due to the absence of detailed platform performance data, user interface descriptions, or execution quality metrics in available sources. The 1.5-star user rating suggests potential significant issues with trading platform functionality, order execution, or overall trading environment quality.

Modern trading platforms typically provide stable, fast execution with minimal slippage, comprehensive charting capabilities, and reliable mobile access. However, specific information about FINCO's platform stability, execution speeds, or technical performance was not available through public sources.

This limits this finco review's ability to provide definitive trading experience assessment. The poor user rating may indicate problems with platform reliability, order execution quality, price feeds, or mobile application functionality.

These technical concerns could significantly impact trading effectiveness and client satisfaction, particularly for active traders requiring consistent platform performance. Without documented information about trading conditions, platform features, or execution quality, potential clients cannot adequately assess whether FINCO's trading environment meets professional standards or personal trading requirements.

Trust and Reliability Analysis

Trust and reliability assessment reveals concerning gaps in transparency and regulatory clarity that potential clients should carefully consider. While FINCO has demonstrated financial activity through substantial dividend distributions totaling $57 million, the absence of clear regulatory information and the extremely low user rating of 1.5 stars raise significant reliability concerns.

The company's participation in regulated dividend distribution activities suggests operation within established financial frameworks. This is particularly evident given the involvement of central banking authorities in loosening dividend restrictions.

However, specific regulatory licenses, oversight bodies, or compliance certifications were not detailed in available sources. Fund safety measures, client asset protection protocols, and regulatory compliance procedures could not be verified through accessible documentation.

These transparency gaps, combined with poor user feedback, suggest potential clients should exercise heightened caution and conduct thorough independent verification before engaging services. The substantial disconnect between apparent financial activity and user satisfaction indicates possible issues with service delivery, transparency, or client relations that impact overall trustworthiness and reliability perceptions.

User Experience Analysis

User experience analysis reveals the most concerning aspect of FINCO's service provision. The 1.5-star rating indicates widespread user dissatisfaction across multiple service dimensions.

This exceptionally low satisfaction score suggests fundamental issues with service delivery, platform usability, customer relations, or overall client experience quality. The poor user rating likely reflects multiple experience factors including platform functionality, customer service interactions, account management processes, or problem resolution effectiveness.

Such low satisfaction scores typically indicate systemic issues rather than isolated incidents, suggesting potential clients may encounter similar negative experiences. Interface design quality, registration processes, verification procedures, and fund management experiences could not be evaluated through available sources, but the user rating implies significant deficiencies in these areas.

Modern financial services require intuitive, efficient user interfaces and streamlined processes that apparently may be lacking. Based on available user feedback, FINCO appears better suited for clients specifically seeking insurance brokerage and consulting services, though even these clients should carefully evaluate service quality. The consistently poor user ratings suggest potential clients should explore alternative providers unless specific circumstances require FINCO's particular service offerings.

Conclusion

This comprehensive finco review reveals a financial services provider with significant challenges in user satisfaction and service transparency. While FINCO has demonstrated financial activity through substantial dividend distributions and operates within regulated frameworks, the 1.5-star user rating indicates serious deficiencies in customer experience and service delivery.

The company may be suitable for clients specifically requiring insurance brokerage and consulting services. However, potential users should exercise extreme caution and conduct thorough independent verification before engagement.

The substantial gaps in publicly available information about platform capabilities, regulatory status, and service terms compound concerns raised by poor user feedback.

Key Advantages: Documented financial activity, insurance brokerage background, participation in regulated financial markets.

Major Disadvantages: Extremely poor user satisfaction ratings, limited service transparency, insufficient publicly available information about platform capabilities and regulatory compliance.