WNS Trade Limit 2025 Review: Everything You Need to Know

Executive Summary

WNS Trade Limit is a new player in the forex and CFD trading world. The company focuses on excellent customer service and detailed market analysis, setting itself apart from other brokers in the industry. This wns trade limit review looks at a broker that started its work in Mauritius. The company targets traders who want access to foreign exchange and contract for difference trading opportunities.

The broker stands out through several important features. Most notably, it offers leverage of up to 1:500 and keeps customer support services running 24 hours a day. These features make WNS Trade Limit an attractive choice for traders who value easy access and stronger trading power through leverage.

WNS Trade Limit works under the watch of the Mauritius Financial Services Commission. This gives the company a solid foundation of regulatory compliance for its operations. The broker's target customers include many types of traders interested in forex and CFD trading. This ranges from beginners who need lots of support to experienced traders looking for competitive trading conditions.

User feedback shows a very high satisfaction rate. Customer service gets a perfect 5/5 rating from available reviews. This means the broker has successfully made client relationships and support quality a top priority. These factors often serve as crucial differences in the competitive online trading industry.

However, WNS Trade Limit is a newer broker that started in 2023. The company is still building its track record and market presence, which potential clients should think about when choosing their broker options.

Important Disclaimer

WNS Trade Limit is registered in Mauritius, so traders should know that rules and protections may be very different across various countries. The Mauritius Financial Services Commission works under different regulatory standards compared to major financial centers like the UK's FCA or Cyprus's CySEC. Potential clients must carefully review their local legal requirements. They also need to understand how these may affect their trading relationship with the broker.

This review uses publicly available information from various sources and user feedback available when this was written. The assessment aims to give an objective analysis while knowing that information about newer brokers may be limited. Traders should strongly consider doing their own research and verify all broker claims on their own before putting money in accounts.

The regulatory world for financial services keeps changing. Traders should make sure they understand what it means to trade with a Mauritius-regulated company based on where they live and their local laws.

Rating Framework

Based on available information and industry standards, WNS Trade Limit receives the following comprehensive ratings:

Overall Rating: 7.0/10

Broker Overview

WNS Trade Limit started operations in 2023. The company set up its headquarters in Mauritius with a focus on providing forex and contract for difference trading services to international clients. The company has placed itself in the competitive online trading market by focusing on two main areas: exceptional customer service delivery and comprehensive market analysis capabilities. This strategic focus shows an understanding that modern traders need both reliable support systems and quality market intelligence to make smart trading decisions.

The broker's business model centers on giving access to various financial instruments through CFD trading. This allows clients to guess on price movements without owning the actual assets. WNS Trade Limit has structured its services to meet diverse trading preferences. The company offers what appears to be a tiered account system designed to accommodate traders with different experience levels and capital requirements. The company's focus on transparency and market analysis suggests an approach aimed at building long-term client relationships rather than focusing only on transaction volume.

WNS Trade Limit operates under the supervision of the Mauritius Financial Services Commission (FSC) from a regulatory perspective. This provides the legal framework for its operations. The broker offers trading access to multiple asset classes including foreign exchange pairs, stock CFDs, index CFDs, commodities such as oil, and precious metals including gold. This diverse asset offering lets traders build varied portfolios and take advantage of opportunities across different market sectors.

The company's recent establishment means it is still building its market presence and reputation within the industry. However, early user feedback suggests that WNS Trade Limit has successfully put quality service standards in place, particularly in customer support areas. These often serve as critical differences for newer brokers seeking to establish credibility in competitive markets.

WNS Trade Limit operates under the regulatory oversight of the Mauritius Financial Services Commission (FSC). The specific license number and detailed regulatory information were not clearly specified in available sources. Potential clients should verify this directly with the broker before opening accounts.

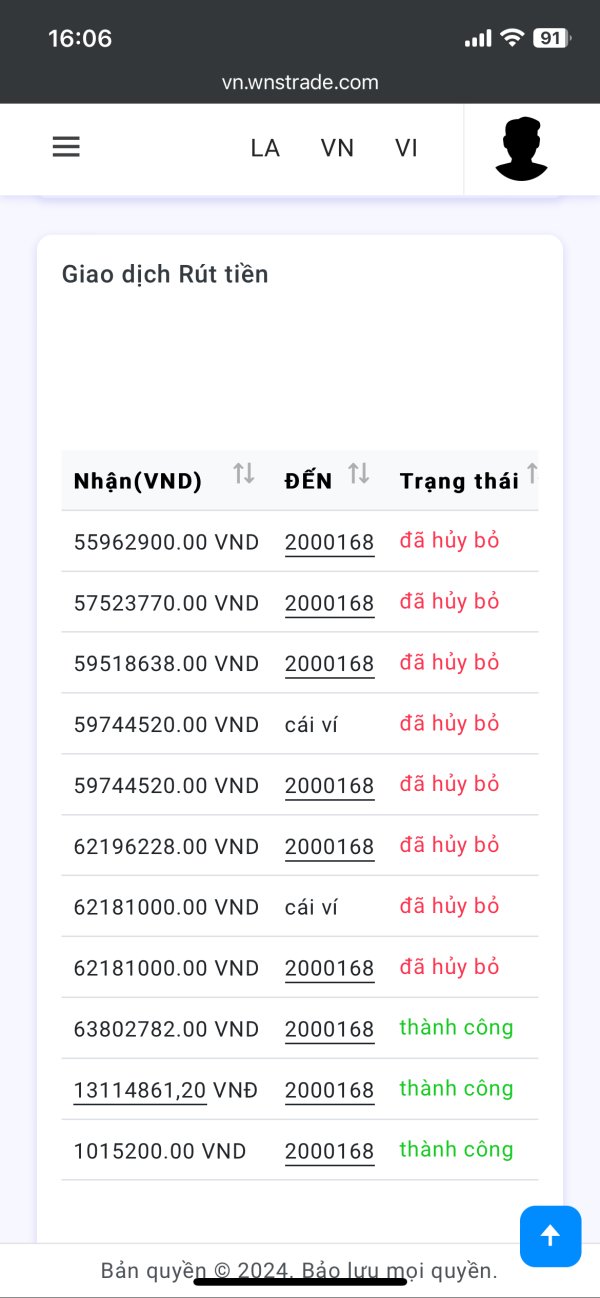

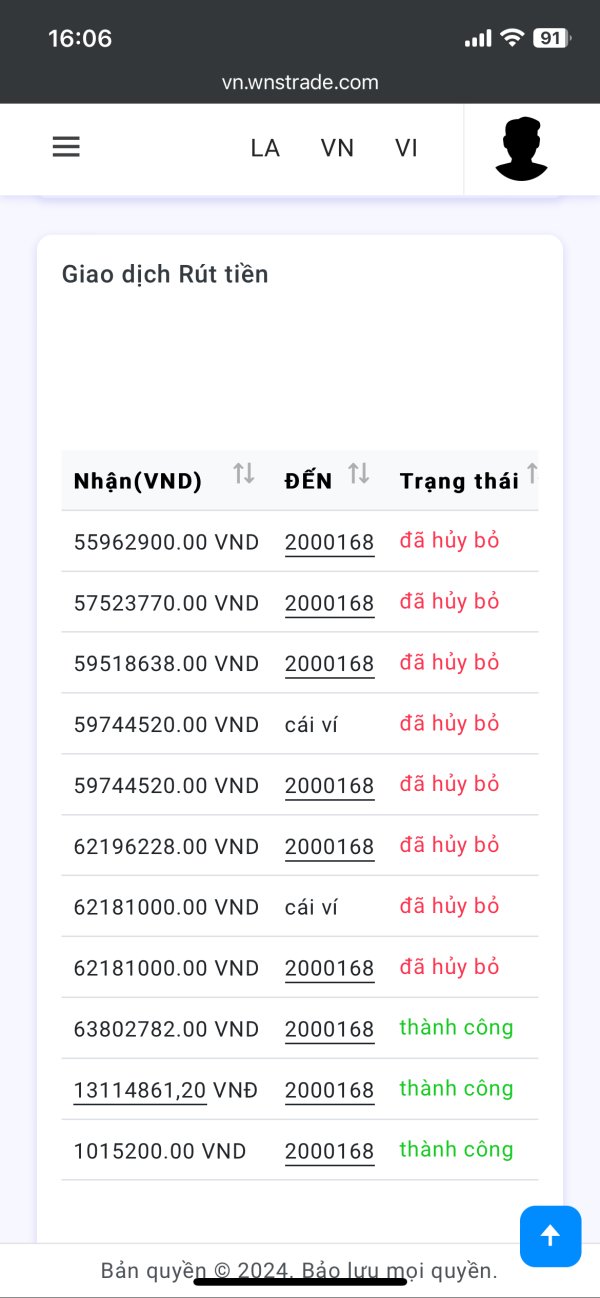

Deposit and Withdrawal Methods

Information about specific deposit and withdrawal methods was not detailed in available sources. Prospective clients should contact WNS Trade Limit directly to understand available funding options, processing times, and any fees for financial transactions.

Minimum Deposit Requirements

The minimum deposit requirement for opening an account with WNS Trade Limit was not specified in available information sources. This represents a significant information gap that potential traders should clarify before proceeding with account opening procedures.

No specific information about bonuses, promotions, or incentive programs was found in available sources. Traders interested in promotional offerings should ask the broker directly about current or planned promotional activities.

Tradeable Assets

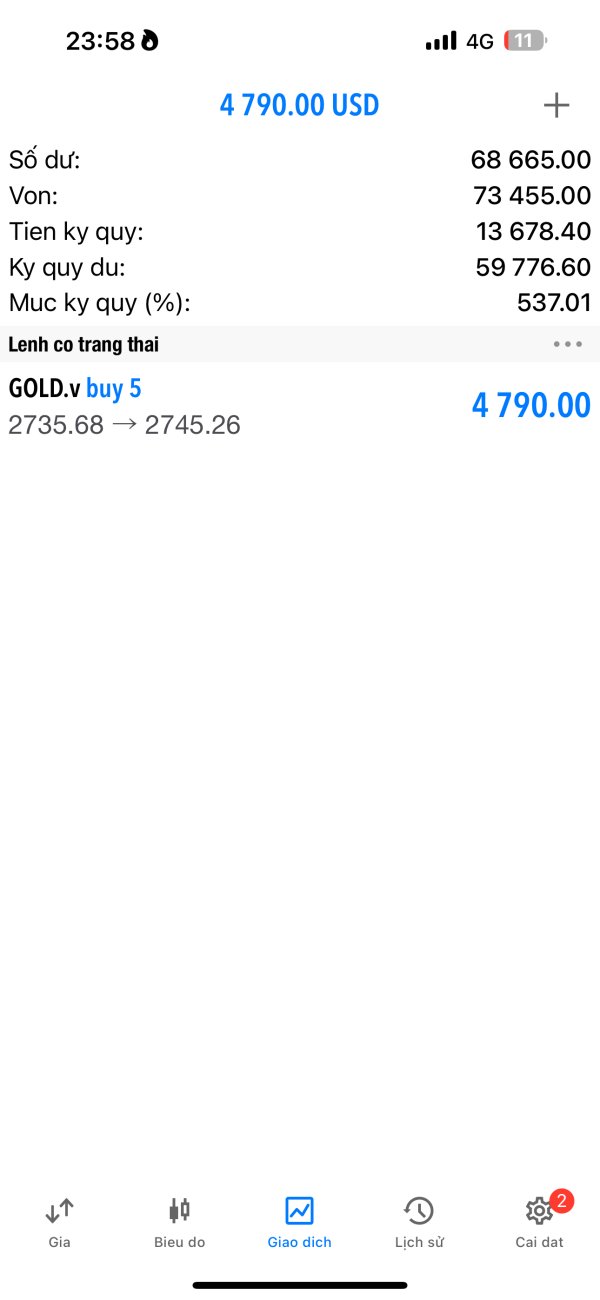

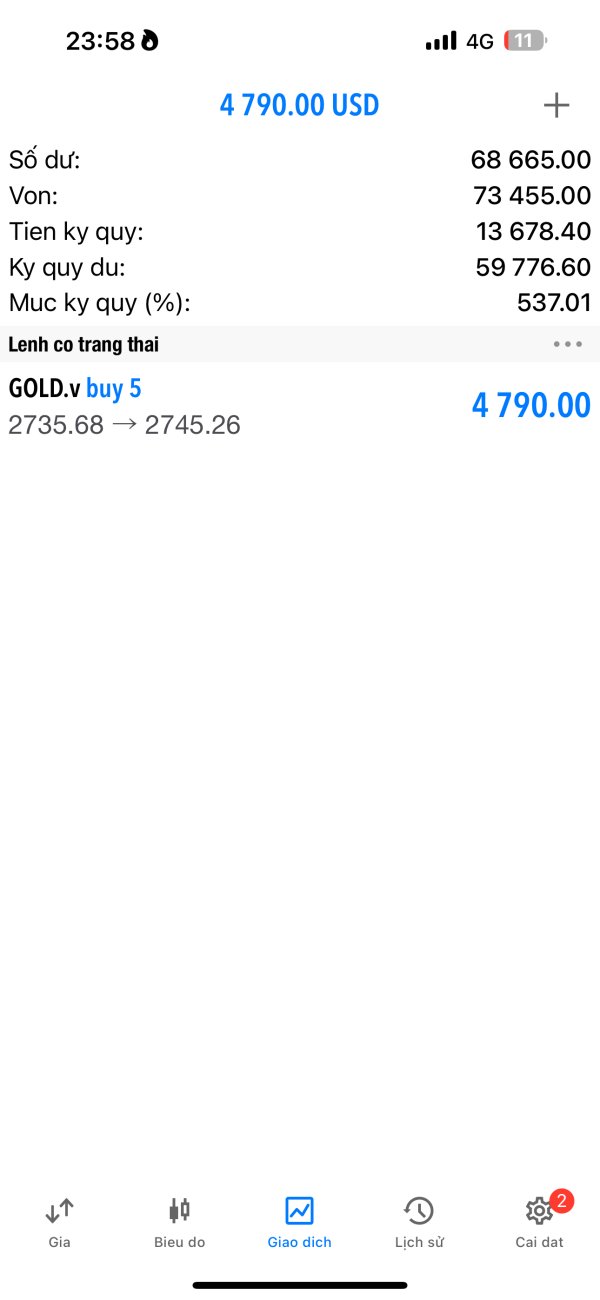

WNS Trade Limit provides access to a diverse range of trading instruments through CFD products. The asset portfolio includes major and minor foreign exchange currency pairs, enabling forex trading across global markets. Additionally, the platform offers stock CFDs, allowing traders to speculate on individual company share prices, and index CFDs for broader market exposure. Commodity trading opportunities include energy products such as oil and precious metals including gold. This provides portfolio diversification options across different asset classes.

Cost Structure

Specific information about spreads, commissions, overnight financing charges, and other trading costs was not detailed in available sources. This wns trade limit review identifies this as a crucial information gap that traders must address before committing to the platform.

Leverage Ratios

WNS Trade Limit offers maximum leverage of up to 1:500. This represents a competitive offering in the retail trading market. This leverage level allows traders to control larger positions with smaller capital requirements, though it also increases both profit potential and risk exposure significantly.

Specific details about trading platform choices, whether proprietary or third-party solutions like MetaTrader, were not provided in available information sources.

Geographic Restrictions

Information about specific geographic restrictions or country limitations was not detailed in available sources.

Customer Support Languages

The range of languages supported by customer service was not specified in available information. However, the broker does provide 24-hour customer support services.

Detailed Rating Analysis

Account Conditions Analysis (Score: 7/10)

WNS Trade Limit appears to offer a structured approach to account management through what is described as a tiered account system. This system is designed to accommodate different trading needs and experience levels. This segmented approach typically allows brokers to provide customized services and features based on client profiles, which can enhance the overall trading experience for users with varying requirements.

However, this wns trade limit review identifies significant information gaps about specific account types and their respective features. The absence of clearly defined minimum deposit requirements represents a notable limitation in evaluating account accessibility for different trader segments. Without this fundamental information, potential clients cannot adequately assess whether the broker's account options align with their available capital and trading objectives.

The account opening process details were not sufficiently covered in available sources. This makes it difficult to evaluate the efficiency and user-friendliness of the onboarding experience. Additionally, information about special account features such as Islamic accounts for clients requiring Sharia-compliant trading conditions was not mentioned.

User feedback suggests that the account structure successfully accommodates diverse trading needs. This indicates that the broker has implemented a thoughtful approach to account segmentation. However, the lack of transparency about specific account conditions and requirements may pose challenges for potential clients seeking to make informed decisions about account selection.

The flexibility indicated in user responses suggests that WNS Trade Limit has designed its account offerings with adaptability in mind. More detailed information would strengthen the evaluation of this aspect of their service offering.

The analysis of trading tools and resources available through WNS Trade Limit reveals a mixed picture with both strengths and notable information gaps. While the broker emphasizes its commitment to providing comprehensive market analysis, specific details about the trading tools and technical analysis resources available to clients were not clearly outlined in available sources.

WNS Trade Limit's stated focus on market analysis suggests the presence of research capabilities and analytical resources designed to support trader decision-making. The company's emphasis on providing "fair and comprehensive" market analysis reports indicates an investment in research infrastructure. However, the specific scope, frequency, and quality of these reports require further investigation by potential clients.

The absence of detailed information about trading platform features, charting capabilities, technical indicators, and automated trading support represents a significant limitation in evaluating the broker's technological offerings. Modern traders typically require access to sophisticated analytical tools, real-time market data, and customizable trading interfaces to execute their strategies effectively.

Educational resources, which serve as crucial support tools for developing traders, were not specifically mentioned in available information. Many successful brokers provide comprehensive educational programs including webinars, tutorials, market commentary, and trading guides to help clients improve their skills and understanding of financial markets.

The lack of specific information about mobile trading capabilities, API access for algorithmic trading, and integration with third-party analytical tools further limits the assessment of WNS Trade Limit's technological ecosystem. These features have become increasingly important for traders who require flexibility and advanced functionality in their trading operations.

Customer Service and Support Analysis (Score: 9/10)

Customer service represents a clear strength for WNS Trade Limit. User feedback indicates exceptional satisfaction levels and a perfect 5/5 rating for service quality. This outstanding performance in customer support suggests that the broker has successfully prioritized client relationship management and invested appropriately in support infrastructure and staff training.

The availability of 24-hour customer service demonstrates WNS Trade Limit's commitment to serving an international client base across different time zones. This round-the-clock availability is particularly important for forex traders who operate in markets that function continuously throughout the business week, often requiring support outside traditional business hours.

User feedback consistently highlights positive experiences with the customer service team. This suggests that the broker has implemented effective training programs and service protocols. The high satisfaction ratings indicate that support staff are knowledgeable, responsive, and capable of addressing client inquiries and concerns effectively.

Response time appears to be a strength based on user feedback, with clients reporting timely assistance when needed. This responsiveness is crucial in the trading environment where technical issues or account concerns may require immediate attention to prevent potential losses or missed opportunities.

However, this wns trade limit review notes that specific information about supported languages for customer service was not detailed in available sources. For an international broker, multilingual support capabilities can significantly impact the quality of service for non-English speaking clients. Additionally, the range of communication channels available (phone, email, live chat, etc.) was not comprehensively outlined.

The absence of detailed case studies or specific examples of problem resolution limits the depth of analysis possible for customer service effectiveness. However, the consistently positive user feedback provides strong evidence of service quality.

Trading Experience Analysis (Score: 6/10)

The evaluation of trading experience with WNS Trade Limit faces significant limitations due to insufficient detailed information about platform performance, execution quality, and user interface design. While the broker offers competitive leverage of up to 1:500, which can enhance trading opportunities for experienced traders, the lack of comprehensive platform details makes it difficult to assess the overall trading environment quality.

Platform stability and execution speed represent critical factors for trading success, particularly for strategies that depend on precise timing or rapid market movements. However, specific performance metrics, uptime statistics, or user feedback regarding platform reliability were not available in the sources reviewed for this analysis.

Order execution quality, including factors such as slippage rates, rejection frequencies, and fill rates, could not be adequately assessed due to limited available data. These technical performance aspects significantly impact trading profitability and user satisfaction, making their absence a notable limitation in evaluating the broker's trading environment.

The mobile trading experience, which has become increasingly important as traders seek flexibility and mobility, was not detailed in available information. Modern traders often require seamless transitions between desktop and mobile platforms, with full functionality maintained across different devices and operating systems.

Information about trading environment features such as one-click trading, advanced order types, risk management tools, and customizable interfaces was not sufficiently covered. These features can significantly impact trading efficiency and user satisfaction, particularly for active traders who execute multiple transactions daily.

The absence of specific user feedback regarding trading experience quality, platform functionality, and execution satisfaction represents a significant gap in assessing this crucial aspect of the broker's service offering.

Trust and Reliability Analysis (Score: 7/10)

WNS Trade Limit's regulatory status under the Mauritius Financial Services Commission provides a foundation for operational legitimacy. However, the relatively recent establishment of this regulatory relationship requires careful consideration. The Mauritius FSC operates as a recognized financial regulator, though its international standing and enforcement capabilities may differ from major regulatory authorities in established financial centers.

The broker's recent establishment in 2023 means that its track record and industry reputation are still developing. While this doesn't necessarily indicate negative aspects, it does mean that potential clients have limited historical data to evaluate the broker's performance during different market conditions or stress periods.

Fund security measures and client asset protection protocols were not detailed in available sources. This represents a significant information gap for assessing trust and reliability. Modern regulatory frameworks typically require segregation of client funds, though the specific implementation and oversight of these protections at WNS Trade Limit require verification.

Company transparency regarding ownership structure, financial backing, and operational details was not comprehensively covered in available information. Transparency in these areas often serves as an indicator of broker reliability and commitment to ethical business practices.

The absence of information about negative incidents, regulatory actions, or client complaints limits the ability to assess potential risk factors. While no negative information was found, the limited operational history means that the broker's response to challenges or market stress remains untested.

Third-party evaluations and independent assessments were not identified in available sources. These could provide additional perspectives on the broker's reliability and operational quality.

User Experience Analysis (Score: 7/10)

User experience evaluation for WNS Trade Limit shows positive indicators based on available feedback. However, the assessment is limited by the scope of information available about specific user interface elements and operational processes. The positive user feedback suggests that clients generally find their interaction with the broker satisfactory, though detailed breakdowns of different experience aspects were not available.

Overall user satisfaction appears positive based on the available feedback, with particular strength noted in customer service interactions. However, comprehensive user satisfaction surveys or detailed rating breakdowns across different service areas were not found in available sources. This limits the depth of analysis possible.

Interface design and platform usability information was not detailed in available sources. This makes it difficult to assess how effectively the broker has implemented user-centered design principles. Modern trading platforms require intuitive interfaces that allow efficient navigation and quick access to essential trading functions.

The registration and account verification process details were not comprehensively covered. However, these processes significantly impact initial user experience and can influence client retention rates. Streamlined onboarding procedures while maintaining appropriate compliance standards represent an important balance for international brokers.

Fund management experience, including deposit and withdrawal processes, processing times, and associated user interfaces, could not be adequately evaluated due to limited available information. These operational aspects significantly impact overall user satisfaction and convenience.

Common user concerns or frequent complaint areas were not identified in available sources. This could provide valuable insights into potential improvement areas. The absence of balanced feedback including both positive and negative user experiences limits the comprehensiveness of this user experience assessment.

User demographic analysis and feedback from different trader types (beginners vs. experienced, different geographic regions, various trading styles) was not available. Such information could provide valuable insights into how well the broker serves diverse client needs.

Conclusion

This wns trade limit review reveals a broker that demonstrates strong potential in customer service delivery while facing information transparency challenges that may concern potential clients. WNS Trade Limit's establishment in 2023 positions it as a new entrant in the competitive forex and CFD trading market. Early indicators suggest a focus on quality client relationships and service excellence.

The broker's primary strengths lie in customer support quality, with exceptional user ratings of 5/5 and 24-hour availability demonstrating a clear commitment to client service. The competitive leverage offering of up to 1:500 provides traders with enhanced market exposure opportunities. Regulatory oversight by the Mauritius Financial Services Commission offers operational legitimacy.

However, significant information gaps regarding trading costs, platform specifications, account details, and operational procedures represent notable limitations for potential clients seeking comprehensive broker evaluation. The absence of detailed information about spreads, commissions, minimum deposits, and trading platform features makes it challenging for traders to make fully informed decisions.

WNS Trade Limit appears most suitable for traders who prioritize excellent customer service and are comfortable with a newer broker still establishing its market presence. The positive user feedback suggests successful implementation of client-focused policies. However, the limited operational history means the broker's performance during various market conditions remains to be proven.

Prospective clients should conduct thorough due diligence, directly verify all trading conditions, and carefully consider the implications of working with a Mauritius-regulated broker based on their individual circumstances and regulatory requirements.