VTindex 2025 Review: Everything You Need to Know

Summary

VTindex is a forex broker that started in 2020. It has gotten a lot of attention in the trading community, but most of this attention comes from worries about whether it's real and how it operates. This vtindex review shows a platform that works without rules from known financial authorities. This creates big red flags for traders who might want to use it.

The broker says it offers trading across many types of assets like forex, indices, precious metals, cryptocurrencies, and commodities. VTindex promotes itself as giving access to various financial tools, but it lacks regulatory oversight and uses questionable marketing practices. This has led to widespread doubt within the trading community.

User feedback shows that VTindex has received mixed reviews with an overall rating of 7 out of 10 points. You should view this score carefully because there are limited verified user testimonials. The platform supposedly supports MetaTrader 4, though clear evidence of this connection remains unclear.

The main users seem to be traders with some market experience. However, the risks that come with unregulated brokers make this platform unsuitable for most retail traders, especially beginners.

Important Notice

Traders should be very careful when thinking about VTindex because it lacks regulation from recognized financial authorities. The absence of proper regulatory oversight means that client funds may not be protected by standard investor compensation schemes. There may also be limited options if disputes or operational issues arise.

This review is based on publicly available information and user feedback collected from various sources. We have not conducted direct trading tests with VTindex. All assessments come from external reports and user testimonials.

Given the concerns raised about this broker's legitimacy, we strongly recommend thorough research before engaging with this platform. You should always check multiple sources before making any trading decisions.

Rating Framework

Broker Overview

VTindex entered the forex market in 2020. It positions itself as a global trading platform with claimed operations across multiple jurisdictions.

The company is reportedly based in Anguilla, though its actual corporate structure and operational base remain unclear. According to available information from scambrokersreviews.com, VTindex presents itself as a globally regulated broker with worldwide offices. However, no concrete evidence supports these claims.

The broker's business model centers around providing access to various financial derivatives including forex pairs, stock indices, precious metals, cryptocurrencies, and commodity markets. The lack of transparency regarding its operational framework and the absence of verifiable regulatory credentials have raised significant concerns among industry observers and potential clients.

This vtindex review reveals that while the platform claims to serve traders across different experience levels, the questionable nature of its regulatory status makes it particularly risky for retail investors. The company's marketing materials suggest comprehensive trading services. However, the disconnect between promotional claims and verifiable facts has led to widespread scrutiny from the trading community and regulatory watch organizations.

Regulatory Status: VTindex operates without oversight from recognized financial regulatory authorities. Despite claims of global regulation, no verifiable licenses from established regulators such as the FCA, CySEC, or ASIC have been confirmed.

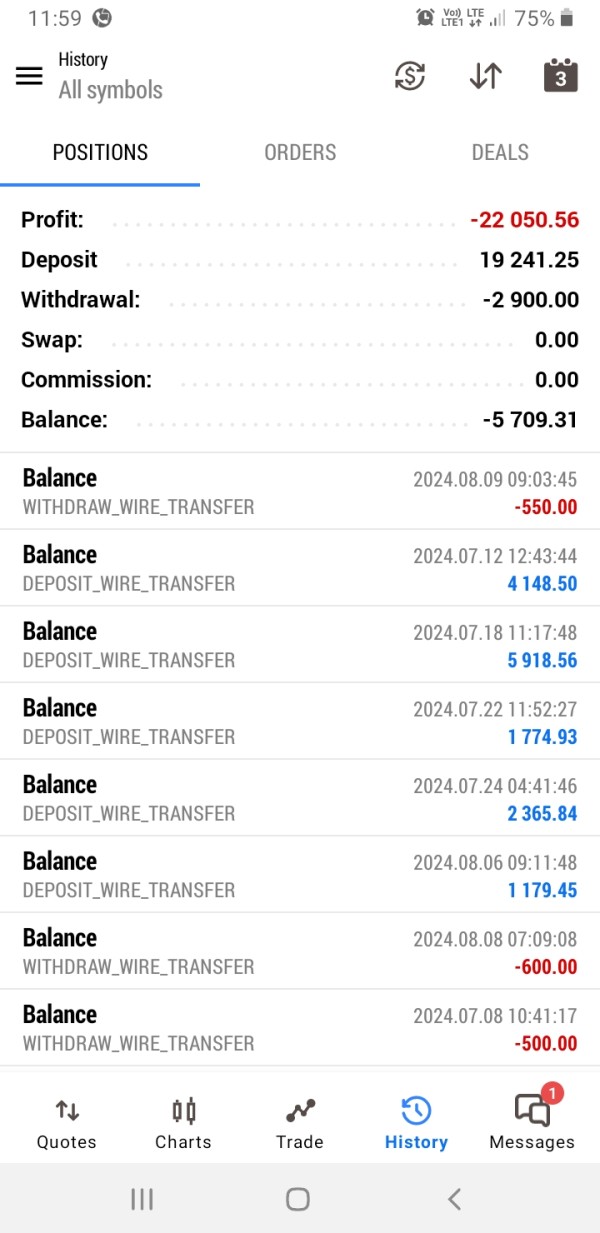

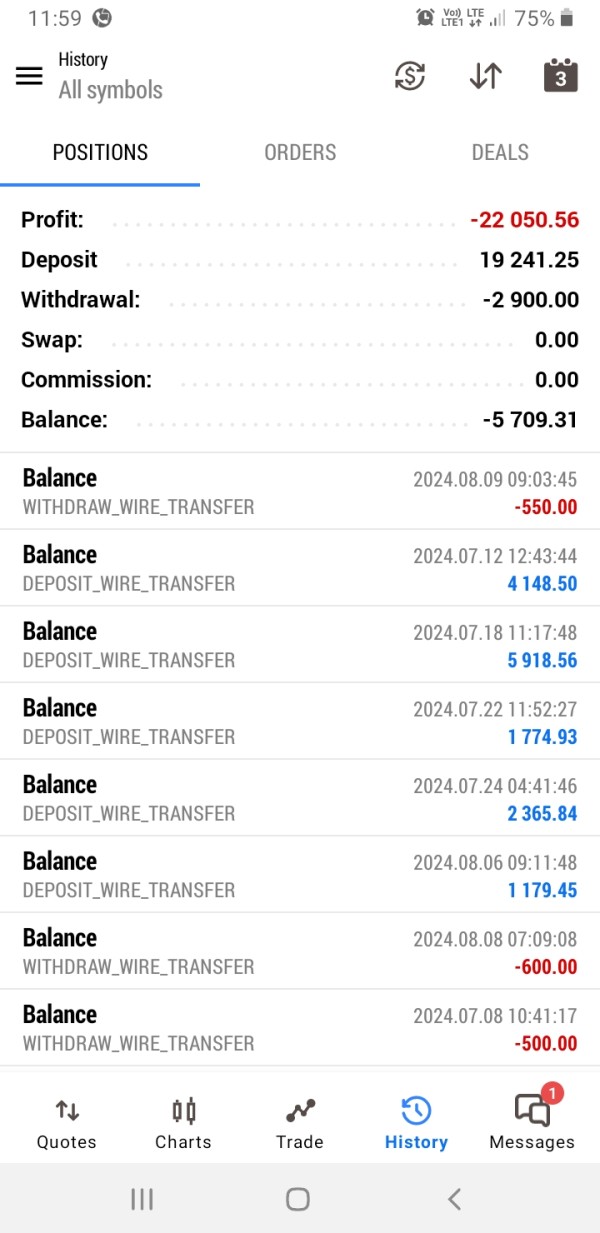

Deposit and Withdrawal Methods: Specific information regarding accepted payment methods and processing procedures is not clearly disclosed in available materials. This lack of transparency makes it difficult for traders to understand their options.

Minimum Deposit Requirements: The platform's minimum deposit thresholds are not specified in accessible documentation. Traders cannot determine what initial investment is required.

Bonuses and Promotions: Current promotional offerings and bonus structures are not detailed in available sources. This makes it impossible to evaluate potential incentives.

Tradeable Assets: The broker claims to offer trading in forex, indices, precious metals, cryptocurrencies, and commodities. However, the exact number of instruments and their specifications remain unclear.

Cost Structure: Detailed information about spreads, commissions, and other trading costs is not transparently provided in available materials. Traders cannot accurately calculate their potential trading expenses.

Leverage Ratios: Specific leverage offerings for different account types and asset classes are not clearly documented. This information is crucial for risk management decisions.

Platform Options: VTindex allegedly supports MetaTrader 4, though concrete evidence of this integration is lacking according to industry reports. The actual trading platform capabilities remain uncertain.

Geographic Restrictions: Information about regional trading restrictions and compliance requirements is not readily available. Traders from certain countries may face unexpected limitations.

Customer Support Languages: The range of supported languages for customer service is not specified in accessible documentation. International traders may encounter communication barriers.

This vtindex review highlights the concerning lack of transparency in many fundamental areas that traders typically require for informed decision-making.

Detailed Rating Analysis

Account Conditions Analysis

The account conditions offered by VTindex remain largely unclear, contributing to the low rating in this category. Unlike established brokers that provide clear tiered account structures with specific features and requirements, VTindex fails to deliver transparent information about its account offerings.

This vtindex review finds that potential clients cannot access detailed specifications about minimum deposit requirements, account types, or the specific benefits associated with different tiers. The lack of clarity extends to essential account features such as Islamic account availability for Muslim traders, demo account access for practice trading, and any special account categories for professional or institutional clients.

Industry-standard practices typically include comprehensive account comparison charts and clear eligibility criteria. VTindex's documentation falls short of these expectations.

User feedback suggests confusion about account opening procedures and requirements, with several reports indicating unclear communication during the registration process. The absence of detailed account condition information makes it difficult for traders to understand what they're committing to. This represents a significant disadvantage compared to regulated competitors who must provide clear terms and conditions.

Furthermore, the lack of regulatory oversight means that standard account protections, such as negative balance protection or segregated client funds, may not be guaranteed. This adds additional risk to the account conditions assessment.

VTindex's offering of trading tools and resources receives a moderate rating, primarily based on the claimed availability of multiple asset classes rather than verified tool quality. The broker advertises access to forex, indices, precious metals, cryptocurrencies, and commodities.

This suggests a diverse trading environment. However, the actual quality and depth of these offerings remain questionable due to limited verifiable information.

The platform allegedly supports MetaTrader 4, which would provide access to standard MT4 features including technical analysis tools, expert advisors, and custom indicators. However, as noted by scambrokersreviews.com, concrete evidence of this MT4 integration appears to be lacking. This raises questions about the actual availability of these promised tools.

Research and analysis resources, which are crucial for informed trading decisions, are not clearly documented in available materials. Established brokers typically provide market analysis, economic calendars, trading signals, and educational content.

VTindex's offerings in these areas remain unclear. User feedback does not provide substantial insight into the quality or availability of analytical tools.

Educational resources, another critical component for trader development, appear to be limited or non-existent based on available information. The absence of comprehensive educational materials particularly impacts newer traders who rely on broker-provided learning resources. These traders need help to develop their skills and understanding of market dynamics.

Customer Service and Support Analysis

Customer service quality at VTindex receives a mediocre rating based on limited user feedback and the absence of clear support infrastructure information. The user trust levels regarding customer service appear to be below industry standards.

Specific details about response times, support channels, and service quality are not comprehensively documented. The lack of transparency about available support channels represents a significant concern for potential clients.

Established brokers typically offer multiple contact methods including live chat, telephone support, email assistance, and comprehensive FAQ sections. VTindex's support infrastructure details are not readily available.

This makes it difficult for traders to understand how they can access help when needed. Response time expectations and service level commitments are not clearly communicated.

This contrasts with industry best practices where brokers provide specific response time guarantees and escalation procedures. The absence of this information suggests either inadequate support infrastructure or poor communication of available services.

Multi-language support capabilities, essential for serving international clients, are not specified in available documentation. This limitation could significantly impact non-English speaking traders who require assistance in their native languages.

The lack of clear information about support hours and availability across different time zones further compounds these concerns. Traders in different regions may struggle to get timely assistance.

Trading Experience Analysis

The trading experience at VTindex receives a moderate rating, though this assessment is complicated by the lack of verified user testimonials and concrete platform performance data. The alleged support for MetaTrader 4 could potentially provide a familiar and robust trading environment.

Without confirmation of this integration, the actual trading experience remains uncertain. Platform stability and execution speed, critical factors for successful trading, have not been thoroughly documented through user feedback or independent testing.

This vtindex review finds limited information about slippage rates, requote frequency, or order execution quality. This makes it difficult to assess the technical performance of the trading infrastructure.

The claimed availability of multiple asset classes could provide trading diversity. However, without specific information about spreads, liquidity providers, or market depth, traders cannot adequately evaluate the quality of the trading environment.

Professional traders particularly require detailed information about execution models, whether the broker operates as a market maker or provides ECN access. This information is not clearly available.

Mobile trading capabilities, increasingly important for modern traders, are not specifically addressed in available materials. The absence of information about mobile platform features, app availability, or mobile-optimized web platforms represents a gap in understanding the complete trading experience offered by VTindex.

Trust and Reliability Analysis

Trust and reliability represent the most significant concerns in this vtindex review, earning the lowest score among all evaluated categories. The fundamental issue stems from VTindex's lack of regulation from recognized financial authorities.

This immediately raises red flags about client fund safety and operational transparency. The absence of regulatory oversight means that standard investor protections, such as compensation schemes and mandatory fund segregation, may not be in place.

Established regulatory frameworks provide crucial safeguards including regular audits, capital adequacy requirements, and dispute resolution mechanisms. None of these can be verified for VTindex.

Industry reputation analysis reveals widespread skepticism and concern from trading community observers and regulatory watch organizations. Reports from scambrokersreviews.com specifically highlight concerns about the broker's claims and practices.

These reports note discrepancies between marketed services and verifiable facts. The lack of corporate transparency further undermines trust, with limited verifiable information about company ownership, financial statements, or operational history.

Legitimate brokers typically provide comprehensive corporate information, regulatory filings, and third-party audits. VTindex falls short in these transparency measures.

Client fund security measures, including segregated accounts and insurance coverage, are not clearly documented. This leaves traders uncertain about the safety of their deposits and the broker's commitment to protecting client interests.

User Experience Analysis

User experience at VTindex receives a moderate rating based on limited but mixed feedback from the trading community. According to available information, the platform has received an overall user rating of 7 out of 10 points.

You should interpret this score cautiously given the limited sample size and potential reliability concerns. The reported user feedback includes both positive and neutral reviews, with 3 positive reviews and several neutral responses noted in available sources.

However, the limited volume of verified user testimonials makes it difficult to draw comprehensive conclusions about overall user satisfaction and experience quality. Interface design and usability information is not readily available in accessible materials.

This makes it challenging to assess the platform's user-friendliness and navigation efficiency. Modern traders expect intuitive interfaces, customizable dashboards, and efficient order management systems.

VTindex's capabilities in these areas remain unclear. The registration and account verification processes have not been thoroughly documented through user experiences.

Some reports suggest potential confusion during account opening procedures. Clear and efficient onboarding processes are essential for positive user experiences.

The available information does not provide sufficient detail to evaluate VTindex's performance in this area. Fund management experience, including deposit and withdrawal processes, convenience, and processing times, lacks detailed user feedback.

The absence of comprehensive information about payment processing efficiency represents a significant gap in understanding the overall user experience provided by the platform.

Conclusion

This comprehensive vtindex review reveals a forex broker that presents significant risks and concerns for potential traders. While VTindex claims to offer diverse trading opportunities across multiple asset classes, the fundamental lack of regulatory oversight and widespread industry skepticism make it an unsuitable choice for most retail investors.

The broker's strengths appear limited to the claimed variety of tradeable instruments, though even these offerings lack proper verification and transparency. The substantial weaknesses, including absence of regulatory protection, unclear operational practices, and limited verifiable user feedback, far outweigh any potential advantages.

For traders seeking reliable and secure trading environments, established regulated brokers with transparent operations and verified track records represent significantly safer alternatives. VTindex may only be considered by highly experienced traders who fully understand and accept the substantial risks associated with unregulated platforms.

Even for this demographic, the risks likely outweigh any potential benefits. We strongly recommend choosing regulated brokers that offer proper investor protections and transparent operations.