Multi Stock Trading 2025 Review: Everything You Need to Know

In the world of online trading, Multi Stock Trading has emerged as a platform that raises significant concerns among users and experts alike. This review synthesizes various sources to provide an in-depth analysis of the broker's offerings, risks, and overall reputation. Users should be cautious, as this broker operates without adequate regulatory oversight, raising red flags regarding the safety of funds and the legitimacy of its operations.

Note: It is essential to recognize that Multi Stock Trading operates under different entities across various regions, which may affect the level of regulatory protection available to clients. This review aims to present a fair and accurate assessment based on multiple sources.

Ratings Overview

We evaluate brokers based on user feedback, expert analysis, and factual data regarding their operations.

Broker Overview

Founded in an undisclosed year, Multi Stock Trading is an offshore brokerage that claims to provide a range of trading services. It offers the popular MetaTrader 5 (MT5) platform, which is known for its advanced trading capabilities. The broker claims to provide access to various asset classes, including forex, commodities, indices, stocks, and cryptocurrencies. However, it lacks a credible regulatory framework, operating primarily out of St. Vincent and the Grenadines, a location notorious for its lax financial regulations.

Detailed Breakdown

Regulatory Landscape

Multi Stock Trading claims to operate from multiple jurisdictions, including the UK and St. Vincent and the Grenadines. However, it does not hold a license from any reputable regulatory authority, such as the Financial Conduct Authority (FCA) in the UK or the Cyprus Securities and Exchange Commission (CySEC). This absence of regulation is a significant concern, as it exposes traders to potential scams and untrustworthy practices.

Deposit and Withdrawal Options

The broker claims to accept several deposit and withdrawal methods, including credit cards, Skrill, Neteller, and Bitcoin. The minimum deposit requirement is set at a low $50, which is attractive for new traders. However, due to the broker's unregulated status, users should be wary of the risks associated with these payment methods, particularly with cryptocurrencies, which can be difficult to trace and recover.

Asset Classes

Multi Stock Trading offers a diverse range of trading instruments, including over 50 forex pairs, various commodities, indices, stocks, and cryptocurrencies. Despite this variety, the lack of regulatory oversight raises questions about the safety and reliability of these offerings.

Costs and Fees

The broker advertises spreads starting from 0.5 pips and offers leverage of up to 1:1000. While these conditions may seem attractive, they come with substantial risks, especially for inexperienced traders. High leverage can lead to significant losses, and the lack of transparency regarding fees and commissions further complicates the trading experience.

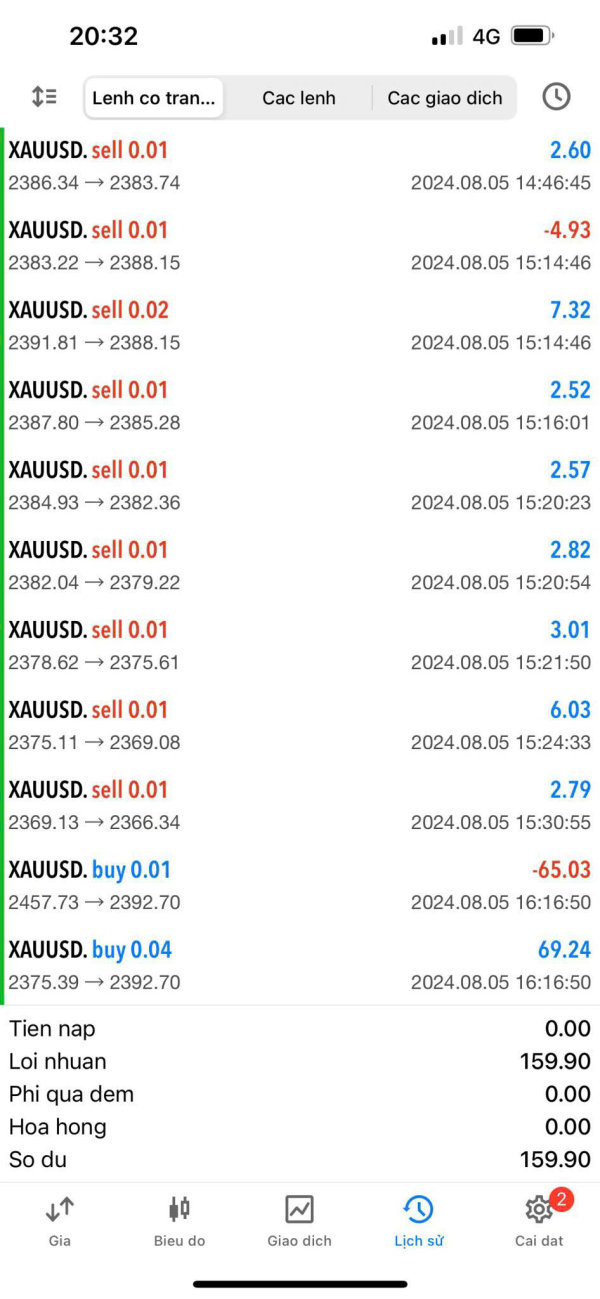

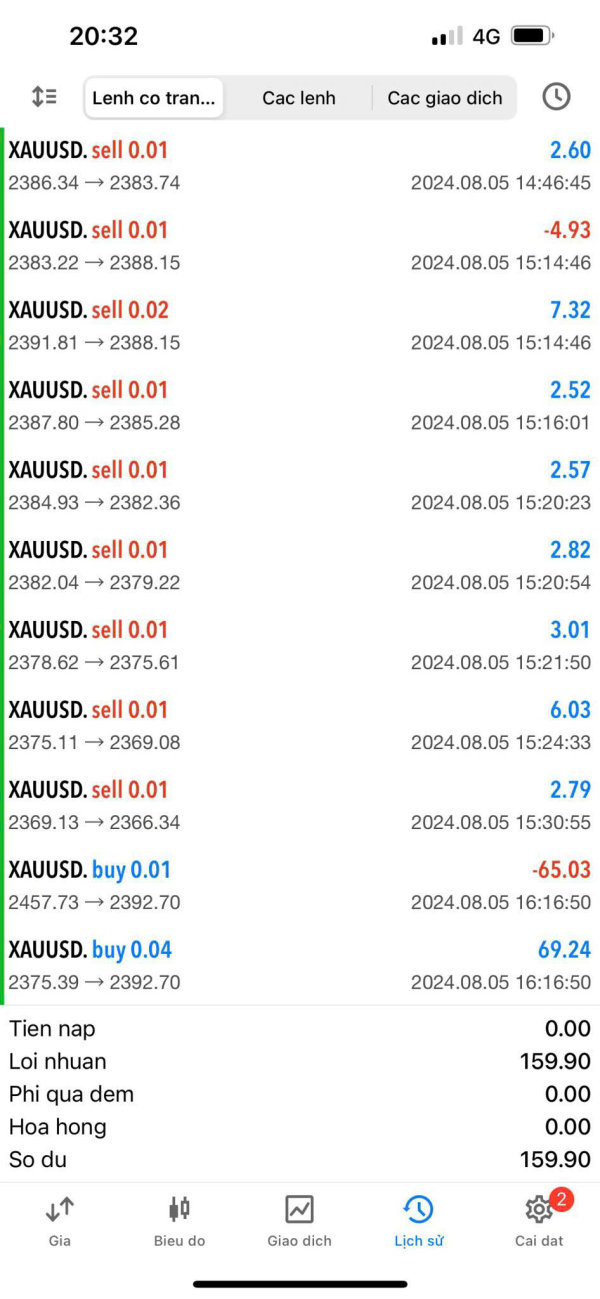

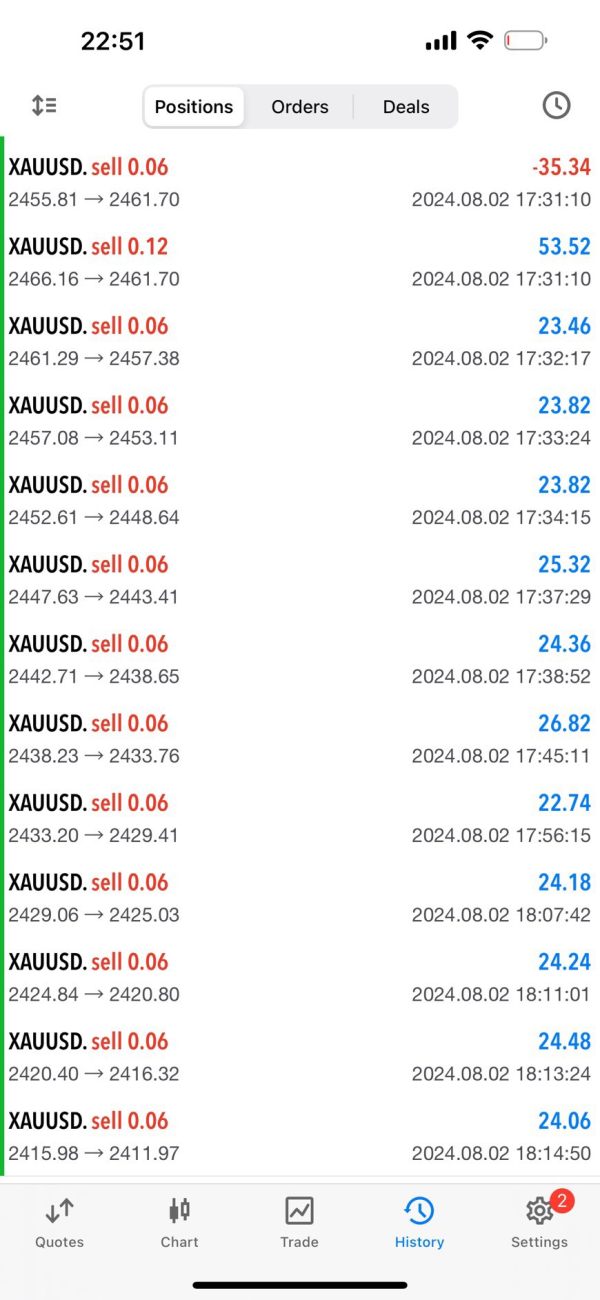

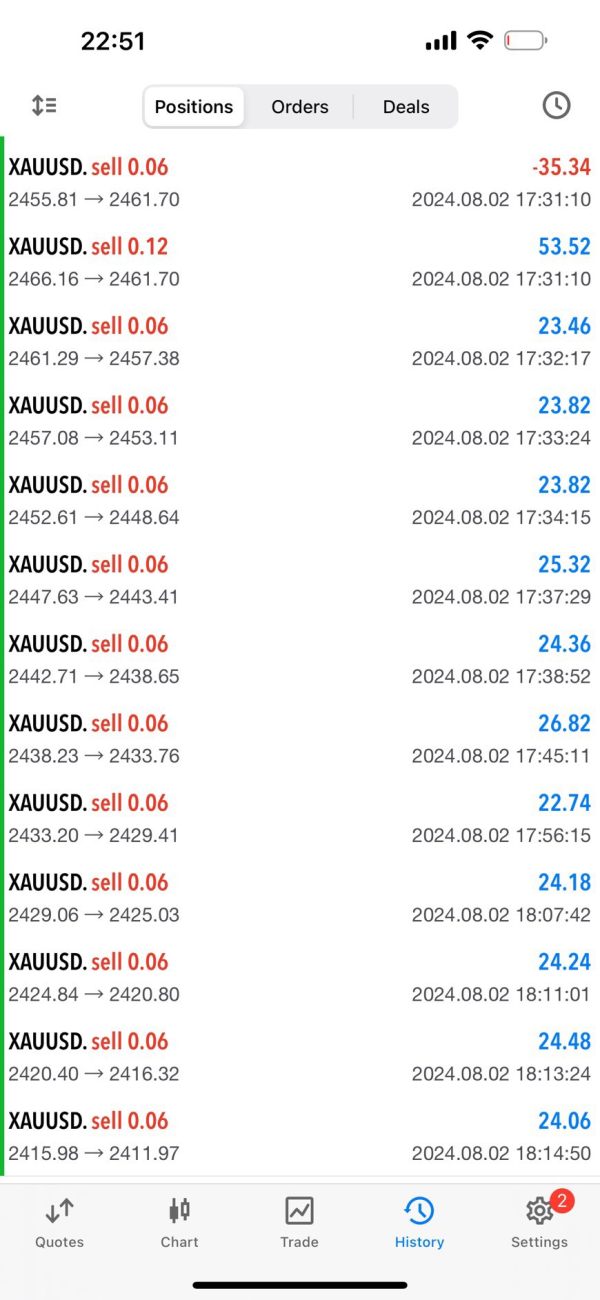

Multi Stock Trading provides access to the MT5 platform, which is widely regarded for its user-friendly interface and comprehensive trading tools. However, the platform's reliability cannot be guaranteed given the broker's questionable practices. Users should be cautious, as even reputable platforms can be manipulated by unregulated brokers.

Restricted Regions

The broker does not specify any restricted regions on its website, but the absence of regulation suggests that it may not be a suitable option for traders in countries with strict financial regulations.

Customer Support

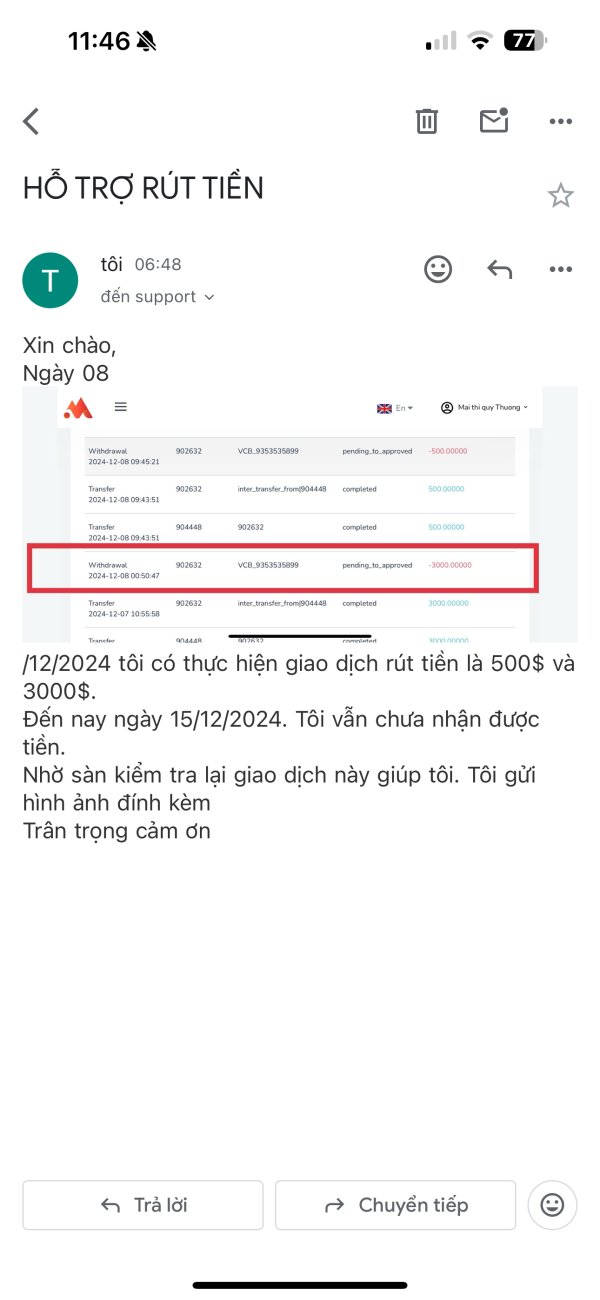

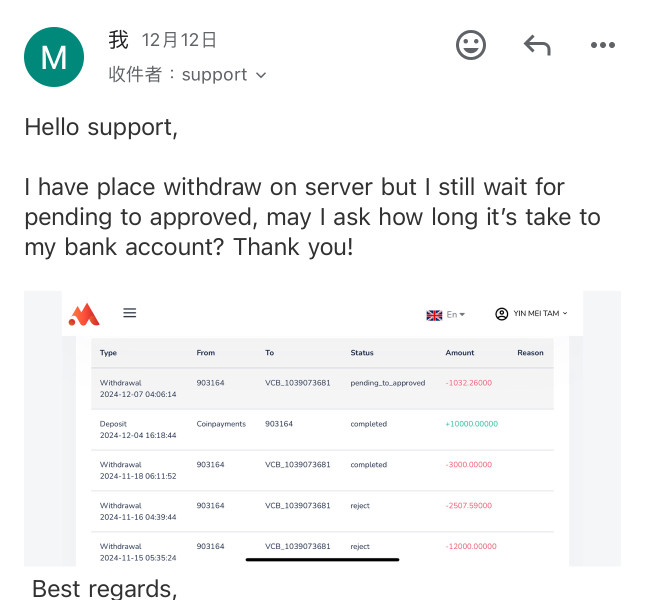

Customer support options are limited, with users reporting difficulties in reaching the broker's representatives. The lack of timely support can be detrimental, especially when traders face issues with withdrawals or account management.

Final Ratings

Detailed Analysis

-

Account Conditions: Multi Stock Trading offers a low minimum deposit of $50, appealing to new traders. However, the lack of regulatory oversight and the potential for hidden fees significantly diminish the attractiveness of these account conditions.

Tools and Resources: The availability of the MT5 platform is a plus, as it provides advanced trading tools. However, the broker's overall lack of transparency and potential for manipulation raises concerns about the reliability of these tools.

Customer Service and Support: Users have reported poor customer service experiences, with difficulties in reaching support for urgent issues. This lack of responsiveness is a significant drawback for traders who may need immediate assistance.

Trading Experience: While the trading conditions appear competitive, the risks associated with high leverage and unregulated operations overshadow these advantages, making trading with Multi Stock Trading a potentially hazardous endeavor.

Trustworthiness: Given its unregulated status and numerous reports of scams associated with offshore brokers, Multi Stock Trading scores low on trustworthiness. Traders are advised to seek licensed brokers to ensure the safety of their funds.

User Experience: The user experience is marred by reports of withdrawal difficulties and lack of support, leading to a frustrating trading environment.

In conclusion, while Multi Stock Trading presents itself as a viable trading option, the overwhelming evidence suggests that it is a risky platform fraught with potential scams and inadequate regulatory oversight. Users are strongly advised to conduct thorough research and consider more reputable, regulated brokers before investing their funds.