Kaifin 2025 In-Depth Review: Opportunity or Trap?

Executive Summary

Kaifin stands as an unregulated offshore broker known for enticing features like low minimum deposits and high leverage options. It attracts a specific target audience, primarily experienced traders seeking low-cost entry points and acknowledging the high risks associated with such trading environments. However, this broker poses significant dangers for those less familiar with the complexities of forex and commodities trading, particularly new traders who may lack experience or adequate risk management skills. The trade-offs presented by Kaifin include potential high rewards against substantial risks stemming from its lack of regulatory oversight, poor user feedback, and alarming withdrawal issues. Possessing a low trustworthiness rating and a troubling operational history, Kaifins allure may quickly dissolve upon closer examination of the risks involved.

⚠️ Important Risk Advisory & Verification Steps

WARNING: Trading with Kaifin carries significant risks due to its unregulated status. Potential harms include:

- Lack of oversight may jeopardize fund safety.

- Numerous complaints regarding withdrawal difficulties pose liquidity concerns.

- High leverage ratios (up to 1:1000) can exaggerate risks and lead to rapid losses.

Before engaging with an offshore broker like Kaifin, consider taking the following self-verification steps:

- Research Regulatory Oversight:

- Visit regulatory websites to verify Kaifin's license status (e.g., NFA‘s BASIC database).

- Use resources like the local Financial Services Authority (FSA) of St. Vincent & the Grenadines to confirm the broker's registration.

- Review User Feedback:

- Look for independent reviews and testimonials from current or former Kaifin users on platforms like Trustpilot or Reddit.

- Analyze feedback focusing on withdrawal success rates and customer support interactions.

- Check Website Functionality:

- Attempt to navigate Kaifin’s website to identify any links that might be non-functional.

- Evaluate the availability of trading platforms advertised by Kaifin, such as MT5 and cTrader, to ensure they are operational.

- Understand Risk Management Features:

- Inquire whether Kaifin offers negative balance protection to safeguard against excessive losses.

- Contact Customer Support:

- Reach out to Kaifins customer service for inquiries; assess response times and the quality of service provided.

Remember, the absence of regulation and considerable user concerns suggests that investments with Kaifin could be highly risky.

Broker Overview

Company Background and Positioning

Established in 2022, Kaifin operates under the auspices of Kaifin LLC, claiming its headquarters to be in Saint Vincent & the Grenadines, a notorious offshore zone known for lax regulatory standards. This lack of formal oversight is a red flag and contributes to a landscape where investor safety cannot be guaranteed, leading many analysts to categorize it as a scam. Furthermore, the company lacks a valid license from any credible regulatory authority, casting further doubt on its legitimacy.

Core Business Overview

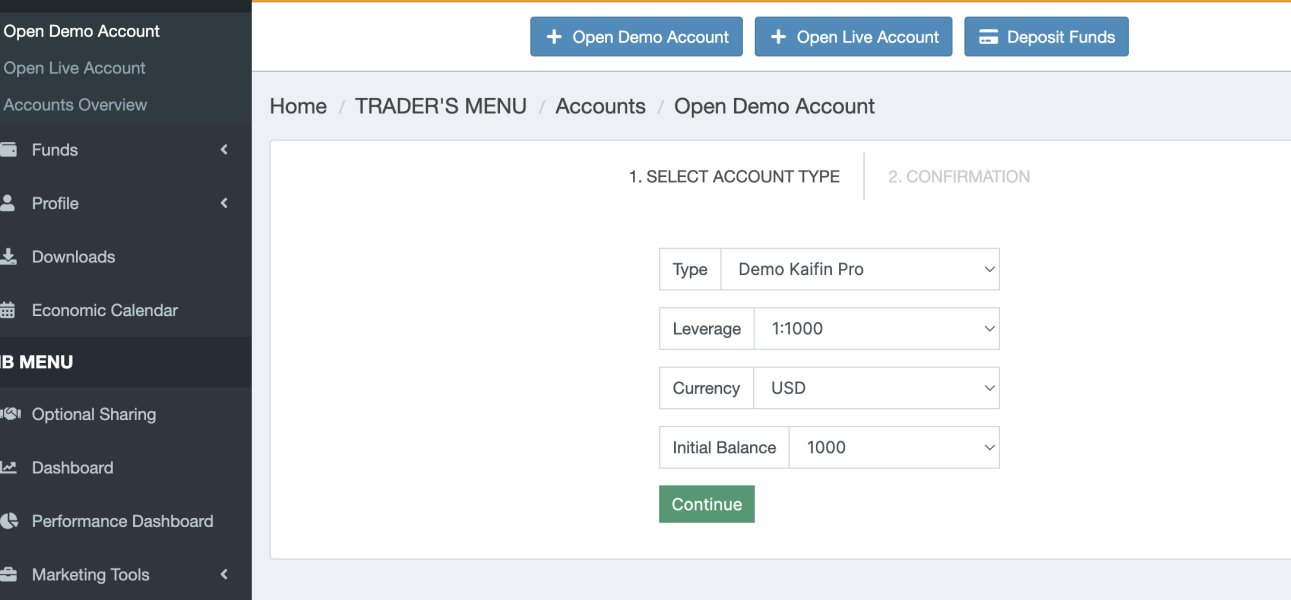

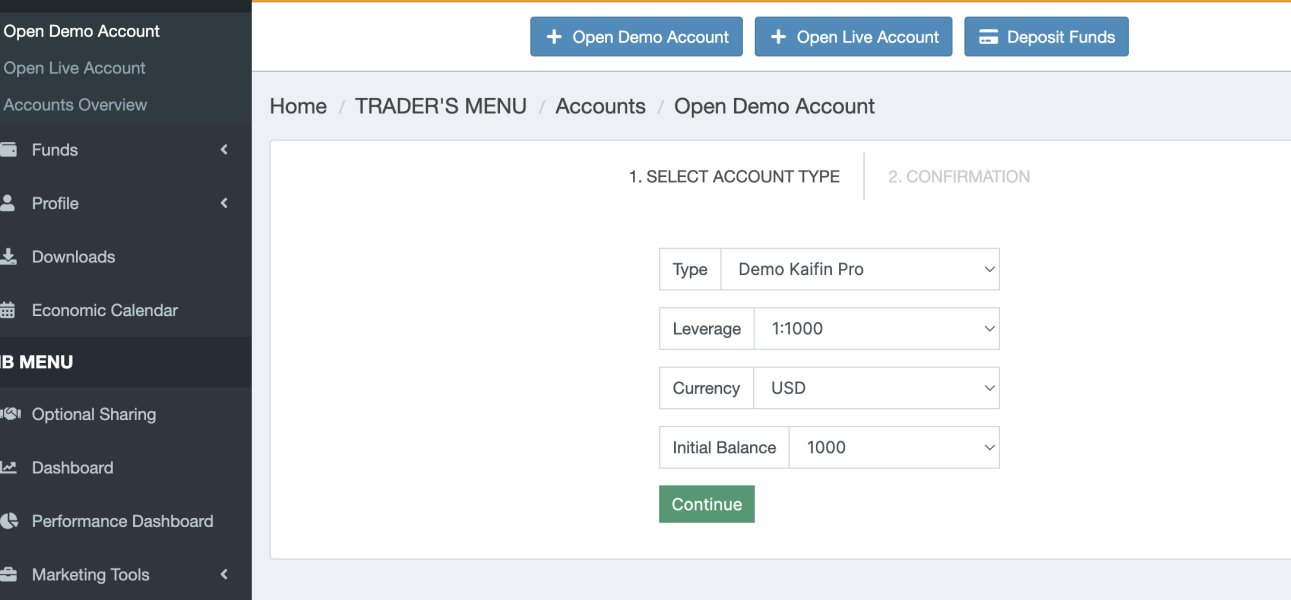

Kaifin purports to offer a variety of trading instruments, including forex, crypto, commodities, and indices. Their platform allows trading with features touted as competitive, such as a minimal deposit of just $10 and leverage up to 1:1000. Despite these attractive characteristics, the functionality of its trading platforms remains unverified, further complicating Kaifin's standing in the market. Company claims regarding regulatory licensing and the safety of funds are undermined by the lack of transparency and a host of negative user experiences documented in reviews.

In-depth Analysis of Each Dimension

Trustworthiness Analysis

The inherent risks surrounding Kaifin are compounded by conflicting regulatory information. As it stands, the company claims incorporation in an offshore territory known for its absence of stringent regulations. This leads to critical concerns about the safety of client funds and the possibility of recovery in case of malpractice.

Analysis of Regulatory Information Conflicts: The claims made by Kaifin regarding regulatory licensing are both ambiguous and misleading. Despite assertions of legitimacy, regulatory watchdogs have made it clear that they do not supervise such entities operating within the SVG jurisdiction. The FSA explicitly warns traders against engaging with brokers based there.

User Self-Verification Guide:

Visit the National Futures Association (NFA) and use the BASIC database.

Check the local FSA to confirm whether Kaifin is listed as a registered entity.

Look for press releases or warnings related to Kaifin.

Explore user communities on platforms like Reddit for personal experiences.

Industry Reputation and Summary: User feedback indicates a prevalent concern regarding fund safety with Kaifin, particularly surrounding withdrawals. One user remarked,

"It took weeks to withdraw my funds, and I was left in the dark with their customer service."

Traders are thus cautioned to thoroughly verify the broker's regulatory claims.

Trading Costs Analysis

Kaifin presents itself as a cost-effective option with a low initial deposit. However, the costs attached to trading reveal a more complicated picture.

Advantages in Commissions: Traders are enticed by its low cost structure, including the minimum deposit of $10 and claims of tight spreads.

The "Traps" of Non-Trading Fees:

- User complaints highlight hidden fees associated with withdrawal requests, such as $30 fees that were not clearly communicated before trading began. It must be noted,

"I lost money to withdrawal fees I never expected."

- Cost Structure Summary: Thus, while Kaifin may seem appealing initially, the potential for unexpected non-trading fees renders it less attractive, especially for those engaging in low-scale trading.

Kaifin claims to provide access to sophisticated trading platforms, which could be an attractive feature for many traders.

Platform Diversity: The broker advertises the availability of MetaTrader 5 and cTrader, known for their analytical depth and user-friendliness.

Quality of Tools and Resources: However, access to these platforms remains unverified due to numerous functionalities failing upon execution.

Platform Experience Summary: User reviews remain skeptical about the value of the claimed platforms. A common complaint is that,

"Links to software downloads and registrations were constantly down, preventing new users from signing up."

User Experience Analysis

The user experience with Kaifin falls short of expectations.

Website Navigation and Accessibility: Many users report difficulty navigating the site, with broken links preventing access to essential information.

Quality of Experience and Technical Issues: Documented complaints suggest that sections of the website fail to load entirely or provide incorrect information. It has prompted analysts to label the platform as “shady,” leading many to question engagement.

User Feedback Summary: Users assert that the platform, meant to offer basic trading functionalities, is poorly executed and unreliable.

Customer Support Analysis

Customer support can make or break a trading experience, and in the case of Kaifin, it appears deeply lacking.

Available Support Options: Limited options for support exist, with only email communication being consistently mentioned on the site.

Quality of Support Provided: Users consistently report dissatisfaction with response times and the quality of service received, reflecting poorly on the companys dedication to client care.

Customer Satisfaction Summary: Reviews confirm significant discontent, with one user stating that,

"If you have queries or issues, expect to wait forever for a response."

Account Conditions Analysis

Kaifin's account conditions, while inviting at first glance, harbor underlying risks.

Minimum Deposit: At just $10 for a trading account, it markets itself as an accessible platform for new traders.

Leverage Options: Traders are tempted by the high leverage of up to 1:1000, presenting significant risks without sufficient safety nets.

Account Conditions Summary: Overall, while conditions might appear favorable, the lack of regulatory oversight raises substantial concerns about overall transaction safety.

Conclusion

While Kaifin represents an accessible entry point into trading for low-cost seekers, its unregulated status poses considerable risks. Numerous user reviews have flagged withdrawal issues and service quality, underscoring the necessity of due diligence. Potential traders are encouraged to prioritize safety and caution when considering options such as Kaifin. Ultimately, the question remains: Is the potential for high rewards worth the array of dangers lurking within this offshore brokerage?