Is CMV CAPITALS safe?

Software Index

License

Is CMV Capitals A Scam?

Introduction

CMV Capitals, an online forex broker, has emerged as a player in the highly competitive foreign exchange market. However, the lack of substantial regulatory oversight and numerous user complaints have raised significant concerns about its legitimacy. In an environment where financial markets are often fraught with risks, it is imperative for traders to conduct thorough evaluations of any broker they consider engaging with. This article aims to dissect the credibility of CMV Capitals by examining its regulatory status, company background, trading conditions, customer fund safety, and user experience. The analysis is based on a review of multiple online sources, user testimonials, and industry reports.

Regulation and Legitimacy

The regulatory environment is a critical factor in determining the safety and reliability of a forex broker. CMV Capitals claims to operate under the jurisdiction of Saint Vincent and the Grenadines (SVG), a region known for its lax regulatory framework concerning forex trading. This raises red flags, as the local Financial Services Authority (FSA) explicitly states that it does not license forex brokers and does not supervise international business companies involved in such activities.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Financial Services Authority (SVG) | N/A | Saint Vincent and the Grenadines | Not Verified |

The absence of a valid license means that CMV Capitals lacks the legal protections typically afforded to clients of regulated brokers. In contrast, brokers operating in established financial centers, such as the UK, the EU, or Australia, are subject to stringent regulations that mandate the segregation of client funds, negative balance protection, and participation in compensation schemes. These regulations are designed to provide a safety net for traders, ensuring that their investments are secure even in the event of a broker's insolvency. Without such oversight, the risk of fraud and mismanagement is significantly heightened.

Company Background Investigation

CMV Capitals Ltd. was established in 2021, and its ownership structure remains opaque, with little information available about its management team or operational history. This lack of transparency is concerning, as reputable brokers typically provide detailed information about their executives and corporate governance. The absence of such disclosures can indicate a lack of accountability and raises questions about the broker's operational integrity.

Moreover, the website of CMV Capitals does not provide a physical address or clear contact information, which is a common tactic employed by fraudulent brokers to avoid accountability. The anonymity associated with CMV Capitals makes it difficult for clients to seek recourse in case of disputes or issues related to fund withdrawals. Reliable brokers, on the other hand, are usually transparent about their business operations and maintain open lines of communication with clients.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions is paramount. CMV Capitals offers a variety of account types, including micro, standard, pro, and premium accounts, with a minimum deposit requirement of $100. While these conditions may seem attractive, the lack of regulatory oversight raises questions about the actual execution of trades and the overall fairness of the trading environment.

| Fee Type | CMV Capitals | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | N/A | 1.0 - 1.5 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The trading fees and commissions associated with CMV Capitals are not explicitly stated on its website, which is a significant concern. Legitimate brokers typically provide clear and transparent fee structures, allowing clients to understand the costs involved in trading. The lack of clarity regarding fees can lead to unexpected charges and diminish overall trading profitability.

Customer Fund Safety

The safety of client funds is a critical consideration when choosing a forex broker. CMV Capitals does not offer segregated accounts, which means that client funds are not kept separate from the broker's operational funds. This increases the risk that client money could be misappropriated or lost in the event of financial difficulties faced by the broker. Furthermore, CMV Capitals does not provide any negative balance protection, leaving clients vulnerable to losing more than their initial investment.

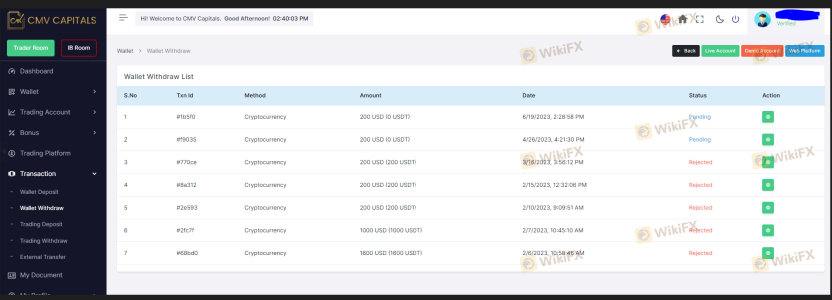

Historically, unregulated brokers have faced numerous allegations related to fund mismanagement and withdrawal issues. Reports indicate that clients of CMV Capitals have experienced difficulties when attempting to withdraw their funds, often facing delays or outright denials. Such practices are common in scams, where brokers employ tactics to keep clients' money locked within their trading accounts.

Customer Experience and Complaints

User feedback is a vital component in assessing the reliability of a broker. Reviews of CMV Capitals reveal a pattern of dissatisfaction among clients, with many expressing concerns about withdrawal difficulties and poor customer support. Common complaints include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Lack of Transparency | Medium | Poor |

| Unresponsive Customer Support | High | Poor |

For example, several users have reported that after making initial deposits, they were unable to access their funds or faced excessive delays when requesting withdrawals. Additionally, the company's customer support has been criticized for being unresponsive and unhelpful, further exacerbating users' frustrations.

Platform and Trade Execution

The trading platform offered by CMV Capitals is reportedly based on the popular MetaTrader 5 (MT5) software. However, users have raised concerns regarding the platform's performance, including issues with stability, order execution quality, and instances of slippage. These factors can significantly impact a trader's ability to execute trades effectively and could indicate potential manipulation by the broker.

Furthermore, the presence of user complaints regarding rejected orders and execution delays raises questions about the broker's operational integrity. A reliable broker should provide a seamless trading experience, with minimal slippage and high execution quality.

Risk Assessment

Engaging with CMV Capitals poses several risks that potential clients should be aware of. The following risk assessment summarizes the key risk areas:

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Operates without valid regulatory oversight |

| Fund Security Risk | High | No segregation of client funds |

| Withdrawal Risk | High | Historical complaints about withdrawal issues |

| Transparency Risk | Medium | Lack of information about company operations |

Given these risks, it is crucial for potential clients to proceed with extreme caution. Traders should consider utilizing risk management strategies and be prepared for the possibility of losing their entire investment.

Conclusion and Recommendations

In light of the evidence presented, it is clear that CMV Capitals exhibits several concerning characteristics that warrant caution. The lack of regulatory oversight, transparency issues, and numerous client complaints strongly suggest that this broker may not be trustworthy. While the trading conditions may appear appealing at first glance, the associated risks and the potential for fund mismanagement are significant red flags.

For traders seeking a reliable forex broker, it is advisable to consider alternatives that are regulated by reputable authorities, such as the FCA in the UK or ASIC in Australia. These brokers typically offer better protections for client funds and a more transparent trading environment. Some recommended alternatives include well-established brokers like IG, OANDA, and Forex.com, which provide a higher level of security and customer support.

Ultimately, conducting thorough research and due diligence is essential in the forex market to safeguard investments and ensure a positive trading experience.

Is CMV CAPITALS a scam, or is it legit?

The latest exposure and evaluation content of CMV CAPITALS brokers.

CMV CAPITALS Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

CMV CAPITALS latest industry rating score is 2.02, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.02 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.