Regarding the legitimacy of PrimeQuotes forex brokers, it provides FSCA and WikiBit, (also has a graphic survey regarding security).

Is PrimeQuotes safe?

Software Index

License

Is PrimeQuotes markets regulated?

The regulatory license is the strongest proof.

FSCA Derivatives Trading License (EP)

Financial Sector Conduct Authority

Financial Sector Conduct Authority

Current Status:

UnverifiedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

TITAN FINANCIAL GROUP (PTY) LTD

Effective Date: Change Record

2023-12-18Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

6 WAHID STREETPENLYN ESTATECAPE TOWN7780Phone Number of Licensed Institution:

0836473347Licensed Institution Certified Documents:

Is PrimeQuotes A Scam?

Introduction

PrimeQuotes is a relatively new player in the forex trading market, having been established in 2023. It positions itself as a multi-asset broker offering a variety of trading instruments, including forex, commodities, indices, stocks, and cryptocurrencies. As with any trading platform, it is crucial for traders to exercise caution and conduct thorough research before committing their funds. The foreign exchange market is rife with scams and unregulated entities, making it imperative for traders to evaluate the legitimacy of brokers like PrimeQuotes. This article aims to provide a comprehensive analysis of PrimeQuotes, focusing on its regulatory status, company background, trading conditions, customer experiences, and overall risks associated with trading on this platform.

Regulation and Legitimacy

One of the most critical factors in assessing the safety of any forex broker is its regulatory status. PrimeQuotes claims to hold a financial service corporate license from the Financial Sector Conduct Authority (FSCA) in South Africa. However, it's important to note that its forex trading services fall outside the authorized scope of this license. This effectively means that PrimeQuotes operates in an unregulated environment, which raises significant concerns regarding investor protection and fund security.

| Regulatory Authority | License Number | Regulatory Area | Verification Status |

|---|---|---|---|

| FSCA | 53226 | South Africa | Exceeded Business Scope |

The lack of robust regulatory oversight can lead to increased risks for traders, as there are no stringent requirements for transparency, accountability, or operational integrity. Historical compliance issues further exacerbate these concerns, as unregulated brokers often have a higher propensity for fraudulent practices. Therefore, the absence of credible regulation is a significant red flag for potential investors considering PrimeQuotes.

Company Background Investigation

Understanding the background of a trading firm is essential for evaluating its credibility. PrimeQuotes was founded in 2023 and is reportedly based in China, although it also claims to operate out of Cape Town, South Africa. The ownership structure and management team of PrimeQuotes remain ambiguous, which can be a cause for concern. A lack of transparency regarding the individuals behind the company may indicate potential risks.

The management teams background is crucial for assessing the broker's reliability. Unfortunately, there is limited information available about the qualifications and experience of the team members. This lack of transparency can lead to skepticism among potential clients, as a strong management team with relevant experience is often indicative of a trustworthy broker.

Moreover, the companys information disclosure level is inadequate. Potential clients should be able to access detailed information about the firm's operations, management, and financial health. The absence of such information can lead to questions about the legitimacy of the broker and its intentions.

Trading Conditions Analysis

PrimeQuotes offers a variety of trading conditions, including competitive spreads and high leverage options. However, the overall fee structure raises some concerns. The broker provides various account types—Standard, ECN, and VIP—with differing spreads and commission structures.

| Fee Type | PrimeQuotes | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 1.3 pips | From 1.0 pips |

| Commission Model | No commission (Standard) | Varies widely |

| Overnight Interest Range | Varies | Varies |

While the low minimum deposit requirement might attract novice traders, the potential hidden fees and commission structures could lead to unexpected costs. The high leverage of up to 1:400 is another double-edged sword; while it can amplify profits, it also significantly increases the risk of substantial losses. Traders need to be aware of these conditions and ensure they fully understand the implications before trading with PrimeQuotes.

Client Fund Safety

The safety of client funds is paramount for any trading platform. PrimeQuotes claims to implement various security measures, but the effectiveness of these measures remains unverified. The absence of clear information on fund segregation, investor protection, and negative balance protection policies raises concerns about the safety of client funds.

Historically, unregulated brokers have been associated with numerous issues, including fund mismanagement and withdrawal problems. If PrimeQuotes lacks adequate protection mechanisms, clients may find themselves vulnerable to potential financial losses. Therefore, potential investors should carefully consider these factors before trading.

Customer Experience and Complaints

Customer feedback plays a vital role in assessing a broker's reliability. Reviews of PrimeQuotes are mixed, with many users reporting significant issues, particularly concerning withdrawal difficulties and unresponsive customer service. Common complaints include:

| Complaint Type | Severity | Company Response |

|---|---|---|

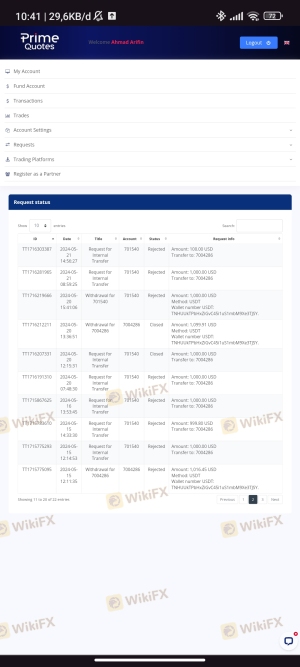

| Withdrawal Issues | High | Unresponsive |

| Customer Service Quality | High | Poor |

Several users have reported being unable to withdraw their funds, which is a major red flag for any trading platform. Additionally, the lack of a responsive customer service team exacerbates these issues, leaving clients feeling unsupported and frustrated. A few typical case studies highlight these concerns, with users expressing dissatisfaction with the broker's handling of their accounts and requests for assistance.

Platform and Execution

The performance of the trading platform is another critical aspect to consider. PrimeQuotes offers popular trading platforms such as MetaTrader 4, MetaTrader 5, and cTrader. However, user experiences regarding platform stability and order execution quality have been inconsistent. Reports of slippage and high rejection rates on orders are concerning and may indicate potential manipulation or operational inefficiencies.

Traders expect a seamless trading experience, and any issues related to execution can significantly impact their profitability. Therefore, it is essential to evaluate the platform's performance before committing to trading on PrimeQuotes.

Risk Assessment

Using PrimeQuotes presents several risks that traders should be aware of. The lack of regulation, poor customer service, and reports of withdrawal difficulties all contribute to a high-risk environment for potential investors.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated operations increase the risk of fraud. |

| Customer Service Risk | High | Poor response to customer inquiries can lead to unresolved issues. |

| Withdrawal Risk | High | Reports of difficulty withdrawing funds are prevalent. |

To mitigate these risks, traders should conduct thorough research, only invest what they can afford to lose, and consider using a demo account to test the platform before committing real funds.

Conclusion and Recommendations

In conclusion, while PrimeQuotes offers a range of trading opportunities, numerous red flags suggest that it may not be a safe or reliable broker. The lack of adequate regulatory oversight, poor customer service, and historical issues with fund withdrawals raise significant concerns about the platform's legitimacy.

For traders seeking a reliable forex broker, it is advisable to consider alternatives that are well-regulated and have a solid reputation in the trading community. Brokers with robust regulatory frameworks, transparent fee structures, and positive customer feedback should be prioritized to ensure a safer trading experience.

Ultimately, potential investors should proceed with caution when considering PrimeQuotes and ensure they are fully informed of the risks involved before making any financial commitments.

Is PrimeQuotes a scam, or is it legit?

The latest exposure and evaluation content of PrimeQuotes brokers.

PrimeQuotes Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

PrimeQuotes latest industry rating score is 2.04, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.04 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.