Is Bull Sphere safe?

Pros

Cons

Is Bull Sphere A Scam?

Introduction

Bull Sphere is an online forex broker that has emerged in the trading landscape, offering various trading services primarily focused on forex and energy markets. As with any broker, it is crucial for traders to conduct thorough evaluations to ensure that they are making informed decisions regarding where to invest their money. The forex market is known for its volatility and risks, making it imperative for traders to choose brokers that are not only reliable but also regulated. This article aims to provide a comprehensive assessment of Bull Sphere, analyzing its regulatory status, company background, trading conditions, customer experiences, and overall safety. The evaluation is based on extensive research from various online sources, including reviews, regulatory filings, and user feedback.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors that traders should consider. Regulation serves as a safeguard for traders, ensuring that brokers adhere to specific standards that protect client funds and promote fair trading practices. Bull Sphere claims to operate under the National Futures Association (NFA) in the United States; however, it is important to note that its license is deemed unauthorized. This raises significant concerns about the legitimacy of its operations.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| NFA | 0548533 | USA | Unauthorized |

The lack of legitimate regulation means that Bull Sphere is not subject to the same oversight and protections that regulated brokers must comply with. This absence of oversight can lead to potential risks for traders, including the possibility of fund mismanagement and fraudulent activities. Historically, unregulated brokers have been associated with various issues, including withdrawal problems and lack of transparency. Therefore, it is crucial for traders to approach Bull Sphere with caution, as trading with an unregulated broker can expose them to significant financial risks.

Company Background Investigation

Bull Sphere was established in 2020 and is based in Bangkok, Thailand. The company operates under the name Bull Sphere Global Limited, but information regarding its ownership structure and management team is sparse. The lack of transparency raises questions about its credibility and operational practices. A thorough background check reveals that the company does not provide substantial details about its history or the qualifications of its management team, which is a red flag for potential investors.

The absence of clear information about the company's founders and their professional experience further complicates the assessment of Bull Sphere's reliability. A reputable broker typically offers detailed insights into its management team's background, showcasing their expertise and experience in the financial sector. The lack of such information may suggest that the company is not fully committed to transparency, which is essential for building trust with clients.

Trading Conditions Analysis

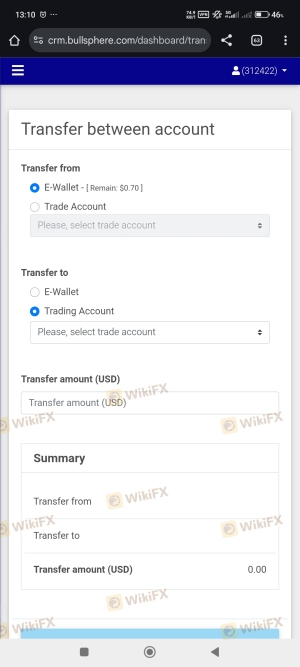

Bull Sphere offers a variety of trading accounts, including micro, standard, ECN, and classic accounts, with a low minimum deposit requirement of just $10. While this low entry barrier may attract new traders, it is essential to scrutinize the overall cost structure and trading conditions provided by the broker.

| Cost Type | Bull Sphere | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.2 pips | 1.0 pips |

| Commission Model | Unspecified | Varies |

| Overnight Interest Range | Varies | Varies |

The spreads offered by Bull Sphere appear competitive, particularly for the standard accounts. However, the absence of clear information regarding commission structures and overnight interest rates creates uncertainty for traders. Unusual fees or hidden charges can significantly affect overall trading costs, and the lack of transparency in this area is concerning.

Additionally, the broker's terms of service should clearly outline all applicable fees, including withdrawal fees or inactivity fees, which can often catch traders off guard. Traders are advised to read the fine print and ensure they understand all potential costs involved in trading with Bull Sphere.

Customer Funds Security

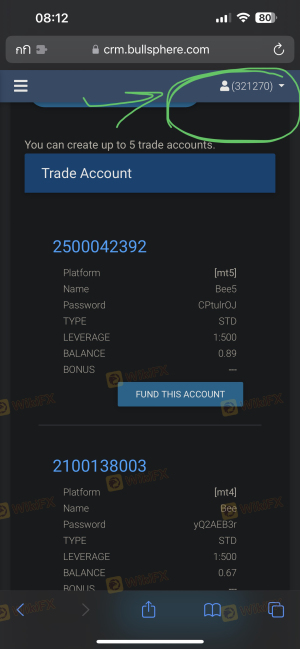

The safety of customer funds is a paramount concern for any trader. Bull Sphere's lack of regulation raises significant questions regarding its security measures. The broker does not appear to offer segregated accounts, which are essential for protecting client funds in the event of financial difficulties faced by the broker. Furthermore, the absence of investor protection schemes, such as those provided by regulated brokers, leaves traders vulnerable to potential losses.

There have been reports from clients indicating difficulties in withdrawing their funds, which is a common issue associated with unregulated brokers. Such incidents highlight the importance of ensuring that a broker has robust security measures and a transparent withdrawal process in place. Traders considering Bull Sphere should be aware of these risks and carefully evaluate their willingness to engage with a broker that lacks adequate fund protection measures.

Customer Experience and Complaints

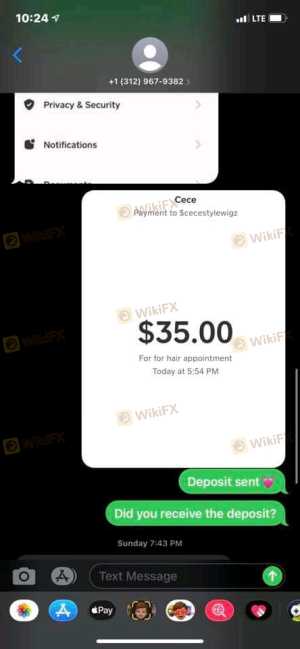

Customer feedback is an invaluable resource for assessing the reliability of a broker. Reviews of Bull Sphere reveal a concerning trend of complaints, particularly regarding withdrawal issues and poor customer service. Many users have expressed frustration over their inability to withdraw funds, with some reporting that their accounts were blocked after making deposits.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service | Medium | Slow |

Typical complaints include delayed withdrawals, lack of communication from customer support, and issues with account access. These complaints suggest a pattern of operational inefficiency and a lack of responsiveness, which can severely impact a trader's experience. Notably, some users have reported that their requests for withdrawals were ignored or met with unreasonable delays, raising serious concerns about the broker's reliability.

Platform and Trade Execution

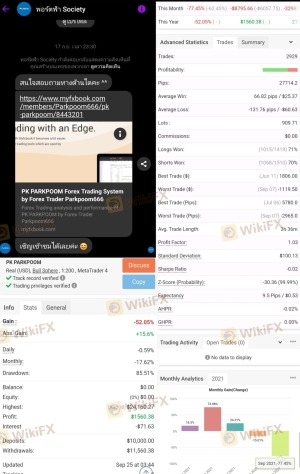

Bull Sphere provides access to popular trading platforms such as MetaTrader 4, MetaTrader 5, and cTrader. These platforms are well-regarded for their advanced trading capabilities and user-friendly interfaces. However, the performance of these platforms, particularly in terms of order execution and slippage, remains a critical factor for traders.

While the platforms themselves may be reliable, reports of execution issues and slippage have surfaced among users. Traders have noted instances where orders were not executed at the expected prices, leading to potential losses. This raises concerns about the overall integrity of the trading environment provided by Bull Sphere.

Risk Assessment

Engaging with Bull Sphere carries inherent risks, primarily due to its unregulated status and the numerous complaints reported by users. Traders should be aware of the following risk factors:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of regulation increases vulnerability. |

| Withdrawal Risk | High | Reports of difficulties in fund withdrawals. |

| Transparency Risk | Medium | Limited information about fees and company background. |

To mitigate these risks, traders should consider only investing funds they can afford to lose and explore alternative brokers with robust regulatory oversight and positive user reviews. Additionally, conducting thorough research and seeking out reputable trading platforms can help minimize exposure to potential scams.

Conclusion and Recommendations

In conclusion, the evidence gathered suggests that Bull Sphere poses significant risks to potential investors. The lack of regulation, coupled with numerous complaints regarding withdrawal issues and poor customer service, raises serious concerns about the broker's legitimacy. While the low minimum deposit and access to popular trading platforms may be appealing, the overall safety and reliability of Bull Sphere are questionable.

Traders are advised to exercise extreme caution when considering Bull Sphere as their broker. It may be prudent to explore alternative options that offer better regulatory protection and a more transparent trading environment. Brokers such as HotForex and FXPro, which are well-regulated and have established reputations, may provide safer trading experiences. Ultimately, thorough research and careful consideration of risk factors are essential for ensuring a secure trading journey.

Is Bull Sphere a scam, or is it legit?

The latest exposure and evaluation content of Bull Sphere brokers.

Bull Sphere Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Bull Sphere latest industry rating score is 2.07, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.07 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.