bull sphere 2025 Review: Everything You Need to Know

Abstract

In this bull sphere review, we examine Bull Sphere, a forex broker operating under the oversight of the Vanuatu Financial Services Commission . Overall assessments lean positive. However, some debates persist concerning its regulatory legitimacy in certain regions. Bull Sphere offers a variety of account types—including Micro, Standard, ECN, and Classic accounts—designed to address the diverse needs of both novice and seasoned traders. The broker supports multiple popular trading platforms such as MetaTrader 4, MetaTrader 5, and cTrader. This further enhances its appeal among both individual and institutional investors. By providing access to an array of tradable assets like foreign exchange paired with energy markets and precious metals, Bull Sphere aims to cater to a broad spectrum of market participants. Despite these strengths, potential users are advised to remain cautious. Gaps exist in detailed information regarding fees, minimum deposit requirements, and other account-specific particulars. This review is based solely on publicly available information and user feedback. It ensures that readers receive a comprehensive perspective before making any commitment.

Important Notices

Bull Sphere operates in a cross-border regulatory environment. This has led to some controversy regarding its legal status in certain jurisdictions. Prospective clients should conduct thorough research and verify the regulatory standards applicable in their regions before opening an account. The information presented in this review is compiled from public data sources and aggregated user experiences. It is intended to offer a broad view of the broker's capabilities and limitations. Users are encouraged to contact the broker directly for the most up-to-date details on trading conditions, fees, and service offerings. As with any financial service, understanding the implications of local regulations and the broker's specific compliance measures is essential before proceeding.

Scoring Framework

Broker Overview

Bull Sphere is an online trading service provider that caters to both individual retail clients and institutional investors. As a broker operating under VFSC oversight, Bull Sphere has positioned itself within the competitive forex and CFD market by offering a range of trading accounts tailored to different investor profiles. The firm showcases a commitment to diversity in trading options through its multiple account types, such as Micro, Standard, ECN, and Classic. While the exact establishment year and comprehensive company background details are not explicitly disclosed, the broker is known for its efforts in facilitating a robust trading environment. This bull sphere review highlights that the firm's overall reputation remains positive. However, the lack of detailed information on certain fee structures and procedural guidelines remains a concern.

In addition to its array of account options, Bull Sphere provides access to leading trading platforms including MetaTrader 4, MetaTrader 5, and cTrader. This multi-platform support allows traders to choose software that best suits their trading style and operational needs. The available asset classes include foreign exchange pairs, key energy commodities such as crude oil and Brent oil, and precious metals, thereby broadening the scope for diverse investment strategies. The broker's adherence to VFSC regulatory standards is a notable point, as it helps instill confidence among clients regarding overall safety. However, controversies still exist in some markets. This comprehensive bull sphere review indicates that while the platform offers attractive features and a wide range of services, key information gaps merit further investigation before committing to the broker.

Bull Sphere is regulated by the Vanuatu Financial Services Commission . This provides a level of oversight and contributes to the broker's overall reputation. The VFSC regulatory framework is designed to ensure that brokers under its jurisdiction adhere to certain operational standards, offering traders a degree of safety regarding fund security and fair dealing.

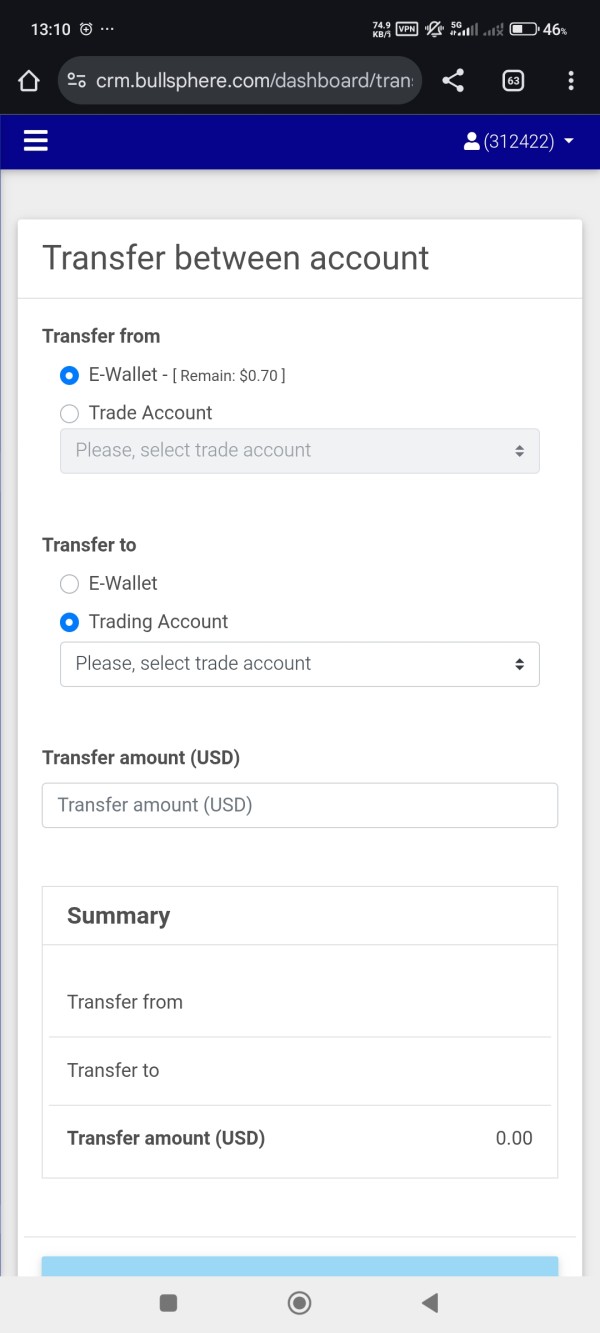

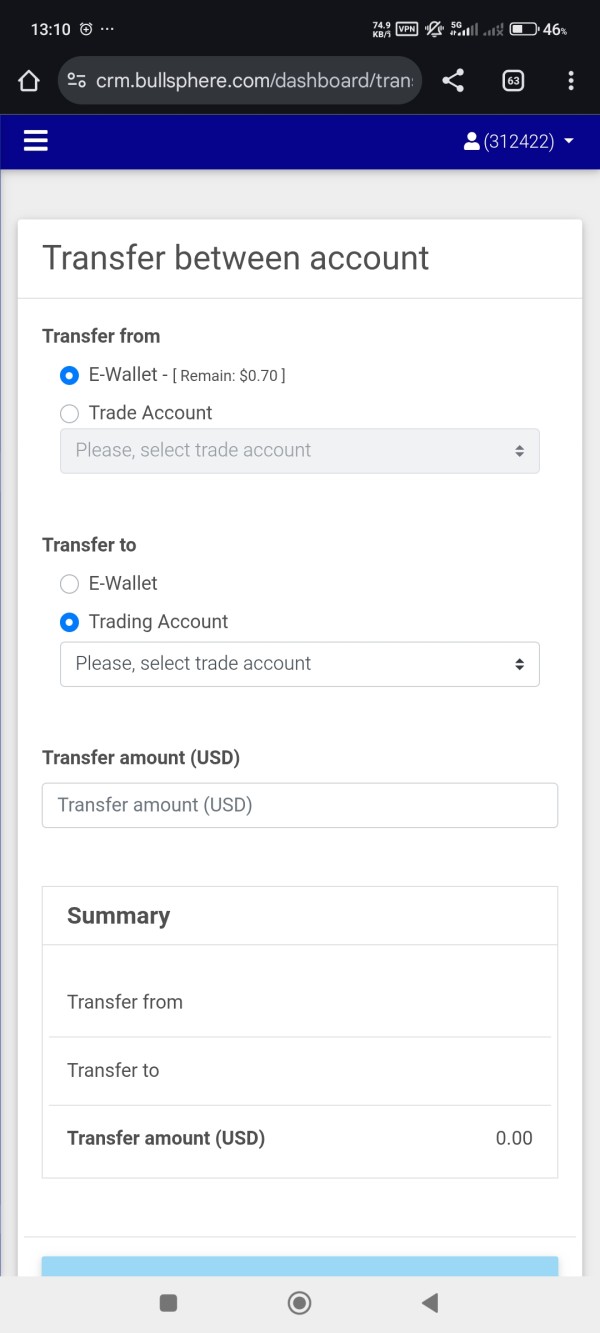

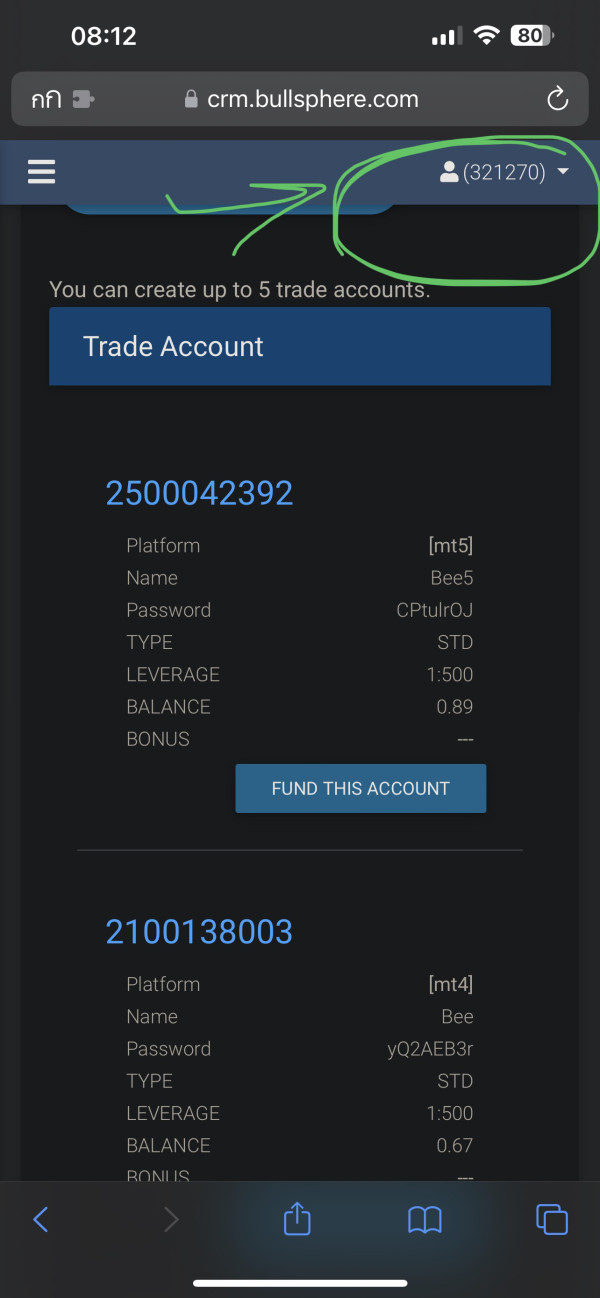

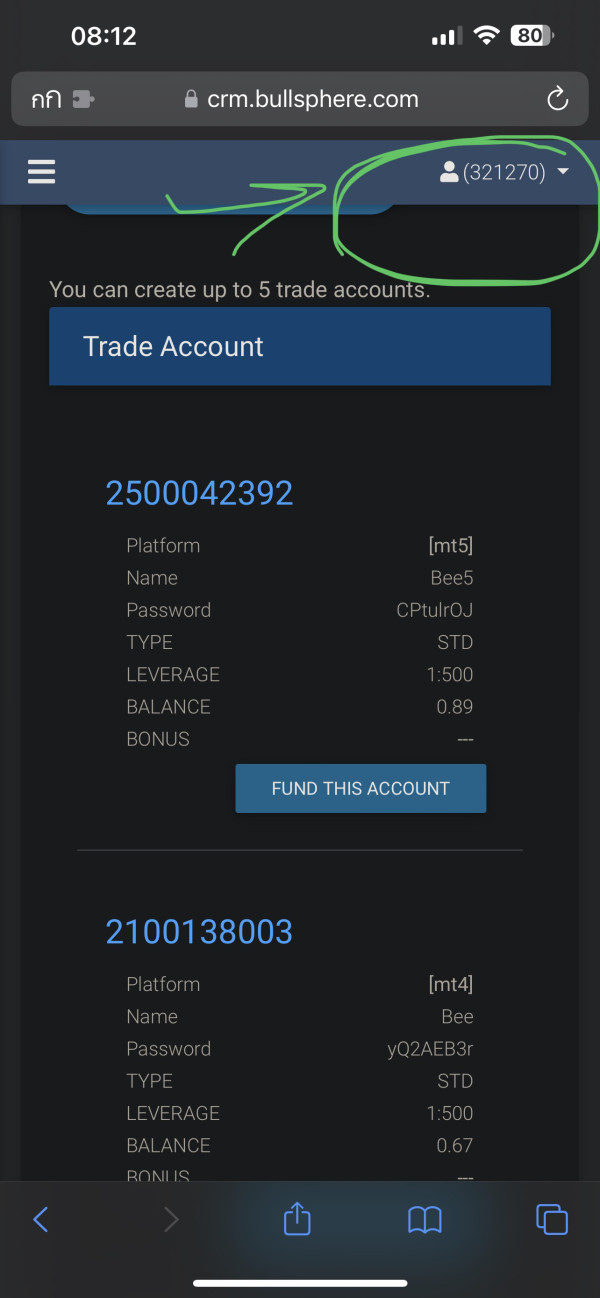

Regarding deposit and withdrawal methods, specific details were not provided in the available information. The broker's website and related public data do not clearly specify which deposit options are available. This leaves potential users to seek direct clarification from Bull Sphere. Similarly, information on minimum deposit requirements remains undisclosed, making it difficult for prospective clients to assess the initial investment needed.

Bonus promotions and incentive schemes are mentioned in many broker reviews. However, for Bull Sphere, related details remain sparse and require further investigation. When it comes to tradable assets, Bull Sphere provides access to major asset classes including forex pairs, leading energy commodities—such as crude oil and Brent oil—and precious metals. This aligns with the needs of diverse traders.

The cost structure, including details on spreads, commissions, and potential hidden fees, has not been explicitly outlined. Such key data is crucial for traders attempting to evaluate overall trading costs. Also absent is specific commentary on leverage ratios—the leverage available to clients remains an information gap that potential traders should investigate independently.

Platform options are one of Bull Sphere's strengths. The broker supports three of the most popular trading platforms: MetaTrader 4, MetaTrader 5, and cTrader. This choice enables traders to select a platform that best fits their preferred trading style and technical requirements. Additionally, there is no detailed information available regarding regional restrictions or the languages in which customer service is offered. These are critical aspects for a global client base. As such, investors are encouraged to inquire further to ensure the broker meets their specific needs.

Detailed Scoring Analysis

2.6.1 Account Conditions Analysis

Bull Sphere provides four distinct account types—Micro, Standard, ECN, and Classic—in an effort to accommodate a wide range of trader profiles. Each account category is designed to meet the needs of varying trading volumes and strategies. It potentially offers essential features such as tailored spreads and execution models. However, the specific account details, including spread data, commission structures, and minimum deposit requirements, are not presented in the publicly available information. This lack of detail makes it challenging to determine the full cost implications for traders. Additionally, the account signup process remains unclear. Any unique features like Islamic accounts are not mentioned. In this bull sphere review, the absence of detailed information on account conditions means that while the range of account types is promising, prospective users must perform additional due diligence to meet their trading needs adequately. Comparisons with other brokers are difficult without knowing the exact fee structure or detailed terms of service. The available data merely confirms the existence of multiple account offerings without delving into the specifics that many traders consider crucial when evaluating a broker.

Bull Sphere's array of trading platforms—MetaTrader 4, MetaTrader 5, and cTrader—demonstrates a commitment to providing a versatile trading environment. These platforms are recognized globally for their reliability, robust charting tools, and algorithmic trading capabilities. Additionally, the ability to access multiple asset classes through these platforms suggests that Bull Sphere is focused on meeting the needs of a diverse client base. However, while the platforms themselves are industry standards, there is little information regarding supplementary resources such as research tools, market analysis, or educational materials. The absence of these details in public documentation means traders may need to seek additional third-party resources to inform their trading decisions. In this bull sphere review, the tools and resources offered are solid but could benefit from enhanced support through integrated research and educational initiatives. The firm's choice to offer three major platforms is commendable. Yet without clarity on added research capabilities, the full potential of these tools remains partially untapped. Therefore, while the fundamental trading tools are excellent, there's room for improvement to match the comprehensive service packages offered by other competitors.

2.6.3 Customer Service and Support Analysis

When evaluating customer service and support, Bull Sphere leaves several unanswered questions. The available resources do not detail the communication channels, such as live chat, telephone support, or email assistance that traders might expect. The responsiveness and operational hours of the support team are also not disclosed. No information is provided regarding multilingual support or tailored assistance for international clients. In the context of a broker operating in multiple jurisdictions, the availability of robust customer service is vital. In this bull sphere review, the lack of explicit details on support services is a significant gap. Effective customer service can be a crucial determinant in enhancing trust and ensuring timely resolution of issues, especially during volatile trading conditions. Without clear specifications on support quality, potential clients must rely on direct inquiries or third-party reviews to gather insights. The current state of information leaves many aspects of customer service and support unclear. This could be a drawback for traders who prioritize direct and dependable communication with their broker.

2.6.4 Trading Experience Analysis

A smooth trading experience is essential to the performance of any broker. Yet for Bull Sphere, critical factors such as platform stability, order execution speed, and mobile trading functionality are not elaborated upon in available sources. Although the broker offers multiple popular trading platforms, the specifics regarding trading execution, including potential slippage or the quality of order fulfillment under high market volatility, remain undisclosed. In this bull sphere review, there is a noticeable lack of data concerning the technical performance of these platforms. This makes it challenging for prospective clients to gauge what they might expect during live trading conditions. The absence of user testimonials and third-party performance evaluations on these critical metrics further compounds the difficulty in assessing the true trading experience. Without clear evidence of high-speed execution and stable platform operation, traders may feel hesitant, particularly during periods of market turbulence where execution quality can significantly impact outcomes. This informational gap requires further clarification from the broker or through independent testing.

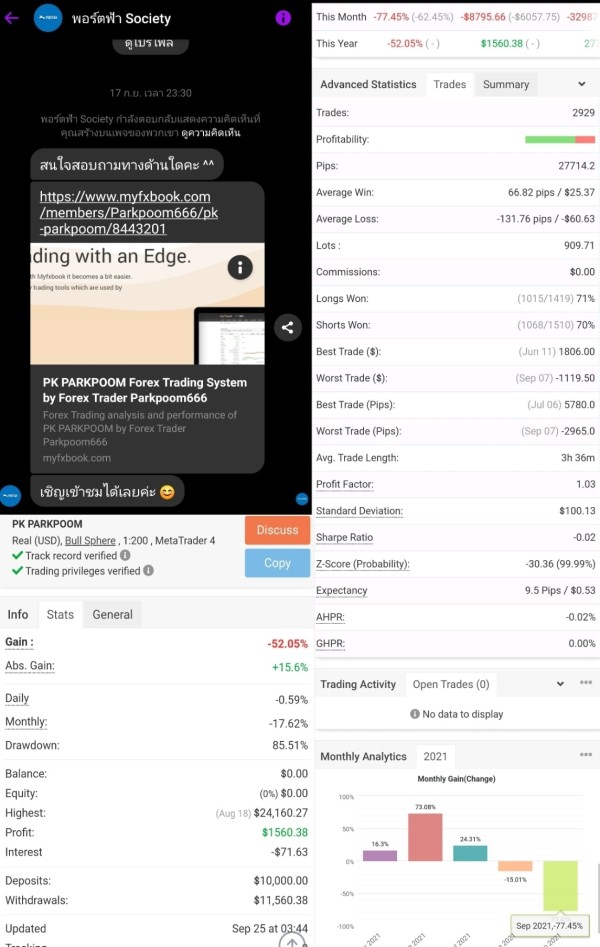

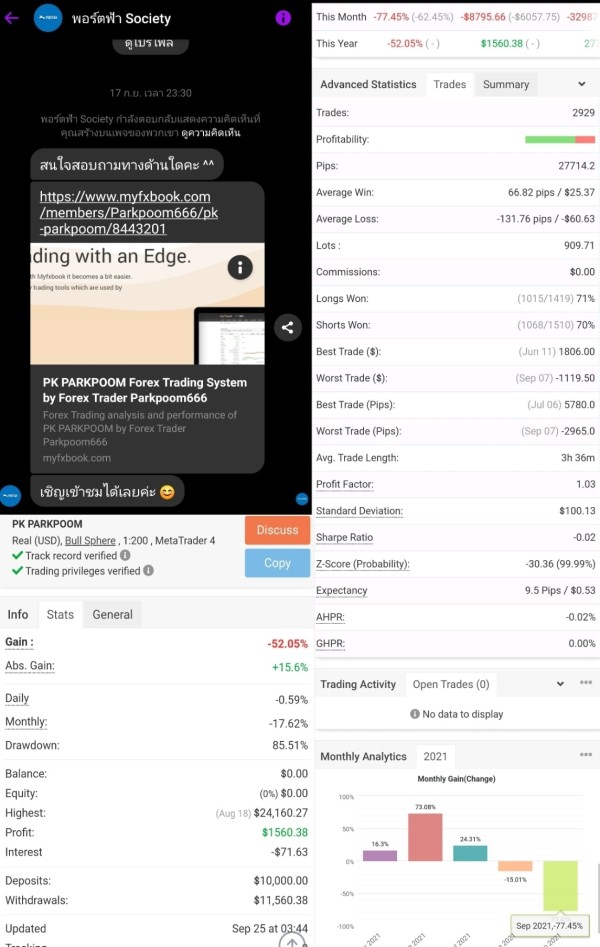

2.6.5 Trust Analysis

Trust remains a foundational element in evaluating any brokerage. In the case of Bull Sphere, its regulatory oversight by the VFSC provides an important mark of credibility. The VFSC is known for enforcing regulatory standards aimed at protecting investor interests, which helps reduce some risks inherent to forex trading. However, despite this regulatory backing, the available public information does not provide in-depth details regarding internal fund security measures, transparency of operations, or protocols for handling customer complaints. Moreover, instances of regulatory controversy have been noted in certain regions. This may affect the broker's reputation among a segment of international traders. This bull sphere review indicates that while the VFSC regulation enhances the broker's trustworthiness, the overall picture is somewhat marred by incomplete disclosures on financial safeguards and company practices. Potential clients are advised to weigh the VFSC credentials against the need for more explicit detailed assurances about fund security and risk management protocols verified by independent sources. Such transparent communication would bolster overall trust further.

2.6.6 User Experience Analysis

User experience is often one of the most subjective yet critical aspects of a broker's offering. For Bull Sphere, many key details remain unclear. There is limited information regarding the design and ease of navigation of its trading platforms or the registration and verification processes for new clients. Additionally, the procedures for performing deposits, withdrawals, and managing funds have not been clearly communicated. This leaves room for uncertainty regarding operational simplicity and efficiency. In this bull sphere review, the lack of detailed user feedback makes it difficult to form a comprehensive picture of the overall client satisfaction. While the broker appears to be tailored to both individual and institutional investors, the absence of metrics on platform usability, customer support interaction, and continuity across mobile and desktop experiences means that prospective users must exercise caution. Reports of legal and regulatory uncertainties further complicate the user experience. Potential headaches related to account verification and service consistency cannot be entirely ruled out without additional direct user testimonials. As such, while initial impressions might be positive, the broker's real-world usability requires further confirmation.

Conclusion

In summary, the total evaluation of Bull Sphere is generally positive. The broker offers a diverse range of account options and multiple well-regarded trading platforms such as MT4, MT5, and cTrader. This bull sphere review indicates that the regulatory oversight by VFSC lends a measure of trust, making it appealing to both individual and institutional investors seeking to trade forex alongside other assets like energy commodities and precious metals. However, notable information gaps—particularly concerning deposit methods, minimum deposits, bonus promotions, cost structures, and customer service—should be carefully considered before engagement. Prospective users are encouraged to perform additional research to ensure the broker fully meets their trading requirements.