primequotes 2025 Review: Everything You Need to Know

2.1 Abstract

The primequotes review shows a fair look at a South Africa-based forex broker. The broker is regulated by the Financial Sector Conduct Authority with license number 53226, which provides some oversight for traders. primequotes offers good features like up to 1:400 leverage and access to multiple trading platforms including MT4, MT5, and cTrader. However, users have given mixed feedback about the company. Several users worry about weak regulation and misleading marketing practices. This hurts its overall rating even though it has a 4/5 score on Trustpilot. The broker works best for experienced traders who want high leverage and many different assets to trade. primequotes offers over 150 tradable assets including forex, commodities, indices, stocks, and cryptocurrencies. While primequotes gives traders many tools and options, new clients should know about its local regulatory limits and mixed customer service reviews. This primequotes review uses public information and user feedback to show both good and bad points for smart decision-making.

2.2 Disclaimer and Important Notes

primequotes is regulated by the FSCA in South Africa only. This may not meet regulatory standards in other countries around the world. While some parts of its business are clear, users should know that regulatory protection changes based on where they live. This review comes from public information, user reviews, and third-party insights. The experiences shown here may not match every trader's experience with the company. The review method uses verified user feedback and documented broker information that anyone can access. Several important details like deposit methods and account opening steps are not fully explained in available sources. Readers should research these areas more before putting money into accounts. The information here reflects current market observations and aims to give a balanced view of primequotes' strengths and weaknesses.

2.3 Rating Framework

2.4 Broker Overview

Primequotes is a fintech company based in Cape Town, South Africa. The company gives traders access to a flexible trading environment with many options. The exact year when primequotes started is not known from available sources, but the broker has built a reputation for offering multiple trading platforms and many different assets to trade. The company's background focuses on new financial technology to help experienced market traders. Its business model centers on competitive leverage options and a wide range of assets, making it appealing to traders who want diversity in their portfolios. According to available information, primequotes tries to combine advanced technology features with easy trading conditions, though some users have noted transparency issues.

The trading setup at primequotes includes an impressive group of platforms like MetaTrader 4 , MetaTrader 5 , and cTrader. This multi-platform approach works for both technical and strategic traders who need strong and customizable environments. Clients can trade more than 150 assets including forex pairs, commodities, indices, stocks, and cryptocurrencies. The broker is regulated by the FSCA with license number 53226, which gives some oversight, though it has caused mixed reactions among users. By offering high leverage up to 1:400, primequotes aims to help experienced traders increase their market exposure, even though the lack of detailed information about other account conditions raises questions about operational transparency.

Primequotes works under the rules of the Financial Sector Conduct Authority in South Africa with license number 53226. This means it follows certain regulatory standards enforced by the FSCA, but users must understand its regional limits and the regulatory differences that come with it. Compared to global standards, the effectiveness of FSCA oversight might be different for users located outside of South Africa.

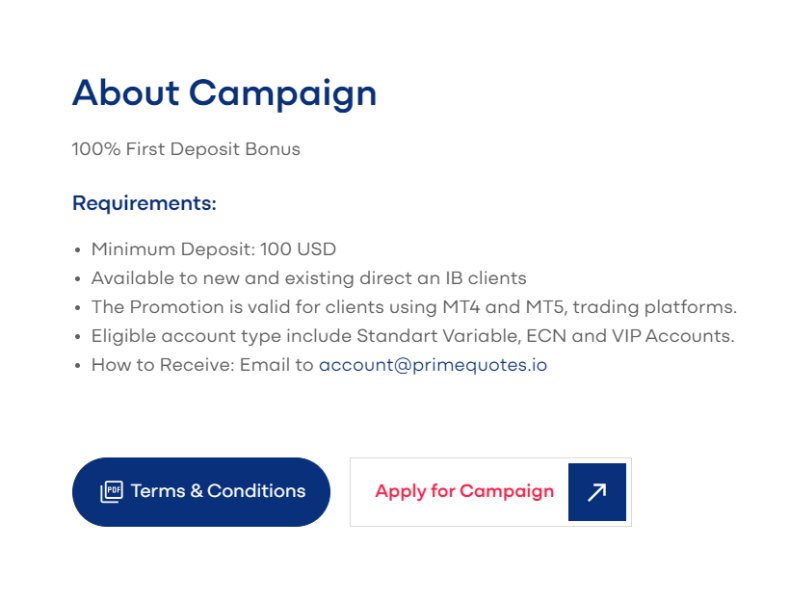

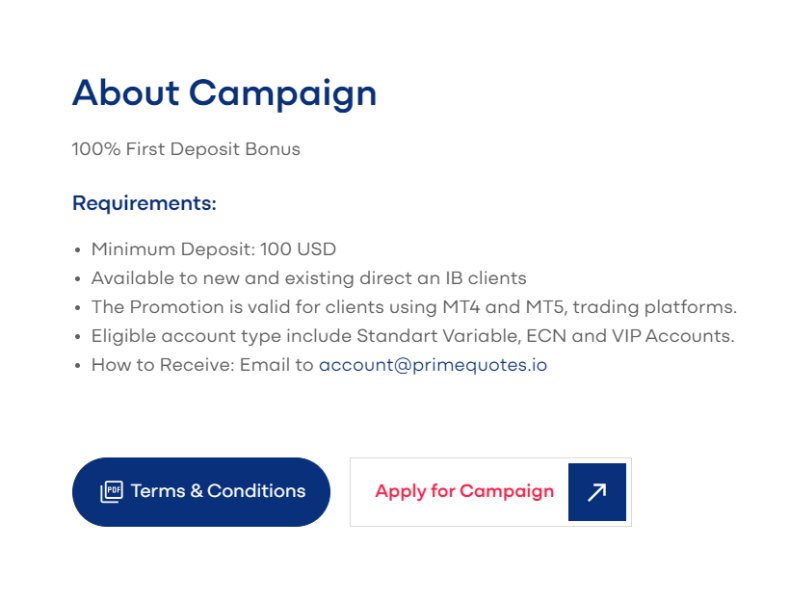

For deposit and withdrawal methods, specific details like accepted payment options and processing times are not clearly mentioned in available sources. Information about minimum deposit requirements is also not provided, leaving potential traders unsure about the money needed to start trading with primequotes. Promotional features like bonuses or special offers are not clearly detailed in the available information either.

The asset selection at primequotes is diverse with over 150 tradable instruments including major and minor forex pairs, commodities, indices, stocks, and cryptocurrencies. This extensive variety allows for a well-rounded trading experience and helps traders diversify their investment strategies. However, when it comes to cost structure, there is limited public information on spreads, commissions, or other transaction-related charges, making it wise for traders to ask the broker directly for clarity. For leverage, primequotes offers an aggressive maximum of up to 1:400, which can significantly boost trading positions but also increases risk exposure. The platform selection is strong with support for MT4, MT5, and cTrader, ensuring traders have access to advanced technical analysis and diverse features. Details on regional restrictions and available customer service language options remain unclear in the accessible data.

This detailed overview combines key points from available sources and shows both the offerings and information gaps surrounding primequotes.

2.6 Detailed Rating Analysis

2.6.1 Account Conditions Analysis

When looking at account conditions, primequotes shows several unclear areas that need caution. There is no clear information about specific account types or special features like Islamic accounts. Most importantly, minimum deposit requirements are not clearly disclosed, which creates uncertainty for potential traders and makes it hard to compare with other brokers. The account opening process is not explained in available information, leaving key questions about verification, timeframes, and documentation requirements unanswered. Based on user feedback, there is clear dissatisfaction about the lack of transparent information on these operating details. Users have reported that while the broker's online presence gives some general information, there is a lack of detailed operational guidance that one would typically expect from a well-established platform. Compared to other brokers that offer clear breakdowns of deposit thresholds and account benefits, primequotes falls short in establishing a complete profile for potential clients. This lack of clarity in account conditions is a significant problem that affects the overall user experience and trustworthiness, as it creates potential challenges in managing expectations once the account is set up. Overall, the data summarized here relies on publicly available information where many specifics are either briefly mentioned or completely left out, leaving room for further questions.

The range of trading tools and resources available at primequotes is one of the broker's biggest advantages. The provision of multiple trading platforms including MT4, MT5, and cTrader gives traders advanced technical analysis capabilities, extensive charting options, and automated trading systems. Each of these platforms is praised for its technical indicators and customizable layouts, working for both manual and algorithmic trading strategies. Though the broker does not explain additional research or educational resources, the built-in quality of these platforms provides a strong toolkit for experienced traders. Users have commented positively on the stability and reliability of the trading interfaces, which suggests a solid underlying infrastructure. However, despite these strengths, there is limited confirmation of extra resources like market analysis reports, webinars, or trading seminars, which could further support traders in making informed decisions. In summary, while primequotes excels in offering multi-platform support and an extensive array of over 150 tradable instruments, the absence of clear details on research support leaves a gap. Nevertheless, the diverse selection of tools offered is a key reason behind the broker's appeal to experienced traders seeking flexibility in executing their trading strategies.

2.6.3 Customer Service and Support Analysis

Customer service and support are critical factors in evaluating the overall quality of any broker. For primequotes, there appears to be significant room for improvement in this area. Although the broker is regulated by FSCA, user feedback shows concerns about responsiveness and inefficiencies in the service department. Reports indicate that customers have experienced delays in response times, and in some cases, misleading marketing information has contributed to negative views. Multiple users have indicated that while there are several channels available for customer support, the quality and consistency of the responses vary widely. Moreover, there is no complete data available about multi-language support or extended operating hours, which are often deciding factors for traders operating in different time zones. The lack of detailed disclosure about these aspects only increases the uncertainty among potential customers. When compared with industry standards where customer support is both timely and helpful, primequotes appears to lag behind, potentially affecting customer satisfaction and long-term loyalty. The mixed reviews suggest that while the technical platform offerings are strong, the brokerage's service infrastructure may need significant upgrades to align with best practices seen in the competitive forex market.

2.6.4 Trading Experience Analysis

The overall trading experience at primequotes has both notable strengths and areas that need further clarification. Users have generally reported that the trading platforms operate with good stability and execution speed, ensuring that trades are processed reliably. The availability of MT4, MT5, and cTrader gives traders a suite of advanced tools and technical indicators, creating an environment that supports detailed chart analysis and strategic order management. Despite these positives, specific details on order execution quality such as the consistency of spreads, commission structures, and liquidity conditions are not adequately detailed in the available information, leaving some uncertainty for serious traders. Furthermore, aspects like mobile trading experiences remain unaddressed, which might impact traders who rely on trading while mobile. It is also important to consider that while the trading platforms themselves are strong, the overall execution experience may be influenced by other factors including network conditions and broker-specific policies. This primequotes review shows that although the core trading experience is generally favorable, potential users should seek further verification on transaction costs and mobile accessibility to gain a complete picture. These gaps highlight the need for additional transparency to fully assess the broker's commercial reliability and performance for active traders.

2.6.5 Trustworthiness Analysis

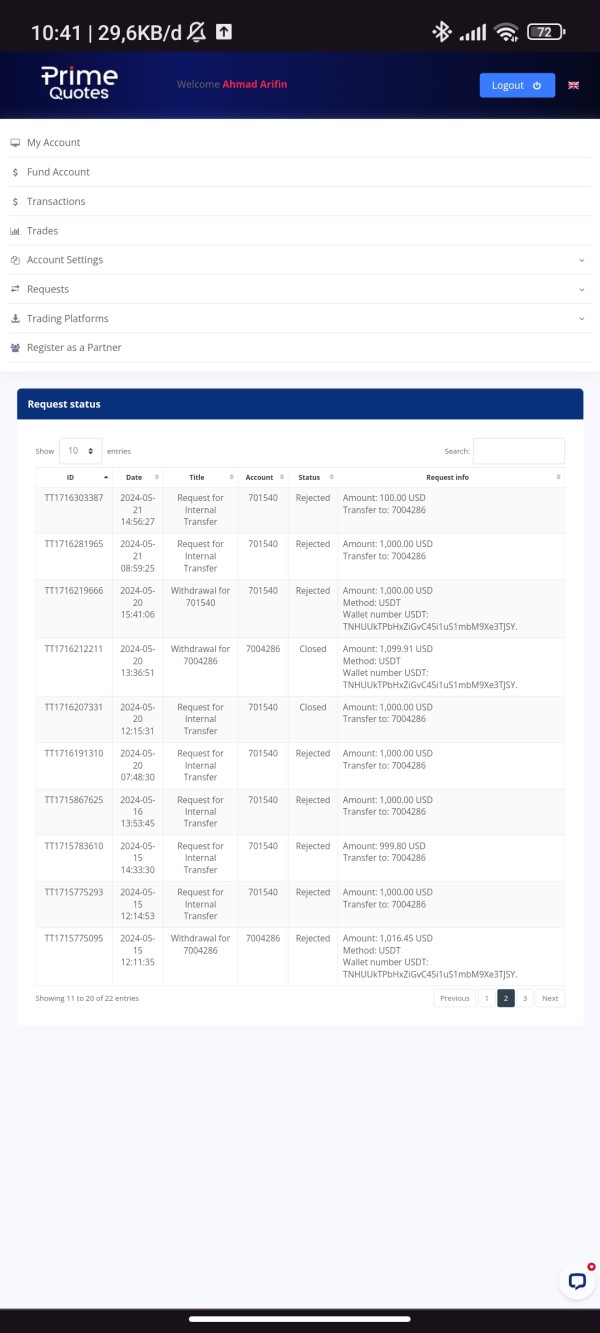

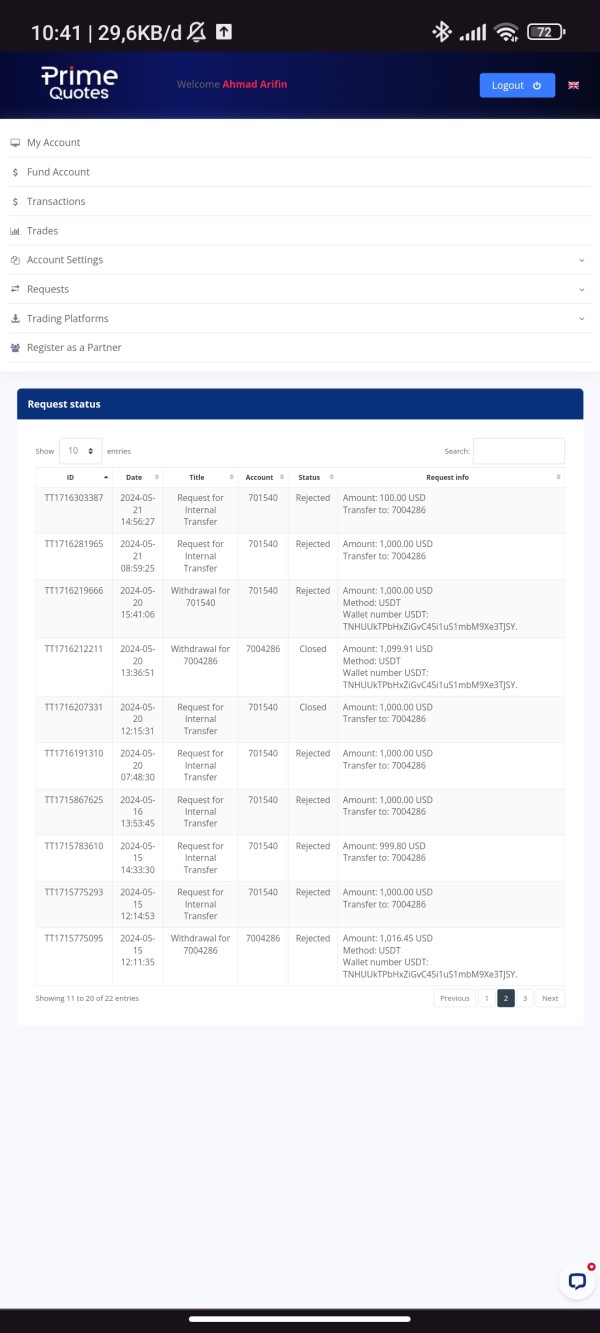

Trust and transparency are at the heart of any broker's reputation. In this regard, primequotes presents mixed signals that potential clients should carefully consider. On one hand, the broker operates under the regulatory oversight of the FSCA with license number 53226, which should in theory offer a level of investor protection. However, multiple user alerts and scam warnings have emerged, questioning the broker's overall trustworthiness and raising red flags for potential investors. There is an apparent gap between the regulatory affiliation and the recurring complaints about deceptive marketing practices and the unclear nature of certain business operations. Specific details about the safety of client funds, segregation of accounts, and security measures are not clearly provided, adding to concerns about the broker's credibility. Industry comparisons reveal that while many regulated brokers provide complete disclosures about their risk management practices and client protection policies, primequotes falls short in this regard. The lack of clear information on financial security and the publicized negative feedback from certain users contribute to an overall trust rating of 4/10. Consequently, despite FSCA oversight, the doubts cast by customers and the absence of detailed operational transparency suggest that potential investors should exercise caution when considering primequotes as their primary trading platform.

2.6.6 User Experience Analysis

The user experience provided by primequotes combines positive aspects with areas requiring significant improvement. The overall satisfaction score, as reflected by a 4/5 rating from various platforms, indicates that many users appreciate the broker's diverse trading options and the availability of multiple advanced platforms. The layout and navigation of the trading interfaces are often mentioned as strengths, enabling experienced traders to access necessary tools with relative ease. However, issues have been raised about the transparency of the registration and verification processes, with several users reporting delays or difficult procedures during account setup. Furthermore, the convenience of deposit and withdrawal operations appears to be less than ideal for some, as reflected in feedback about delays and a lack of clear communication. These operational inefficiencies, combined with previously mentioned customer service concerns, suggest that primequotes' overall user experience is inconsistent across different aspects of the service. The combined feedback points towards a broker that works well for experienced traders but may leave newcomers struggling with procedural uncertainties and less-than-ideal service responsiveness. Overall, while the platform's technical aspects are solid, improvements in customer service, clearer operational guidelines, and enhanced support for transaction processes could significantly boost user satisfaction.

2.7 Conclusion

In summary, primequotes offers a compelling package for experienced traders through its high leverage of up to 1:400, extensive asset selection, and multi-platform support through MT4, MT5, and cTrader. However, this primequotes review also reveals significant areas of concern that potential users should carefully consider. The lack of transparency in account conditions, combined with mixed customer service experiences and trust issues, means that potential users should exercise caution before committing funds. While the trading tools and overall stability are good, the broker's regulatory and operational gaps suggest that only those with advanced trading experience and a tolerance for uncertainty should consider engaging with primequotes. Prospective clients are advised to carry out further research before committing to ensure that their trading needs are fully met and that they understand all associated risks.