Is Multi Stock Trading safe?

Software Index

License

Is Multi Stock Trading Safe or Scam?

Introduction

Multi Stock Trading is an online brokerage that positions itself in the forex market, promising a diverse range of trading instruments including forex, commodities, stocks, and cryptocurrencies. However, as the trading landscape continues to evolve, traders must exercise caution when selecting a broker. The potential for scams and unregulated activities is significant, making it crucial for investors to assess the legitimacy and safety of their trading platforms. This article investigates whether Multi Stock Trading is safe or a scam by examining its regulatory status, company background, trading conditions, client feedback, and overall risk profile.

Regulation and Legitimacy

The regulatory landscape is a critical factor in determining the safety of any trading platform. Multi Stock Trading operates as an offshore broker, which raises immediate red flags regarding its legitimacy. The lack of regulation from recognized authorities such as the Financial Conduct Authority (FCA) or the Cyprus Securities and Exchange Commission (CySEC) is concerning. An unregulated broker can pose significant risks to traders, as they often lack the necessary oversight to protect clients' funds.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | St. Vincent and the Grenadines | Unverified |

The absence of regulatory oversight means that traders have limited recourse in the event of disputes or financial losses. Furthermore, the operational claims of Multi Stock Trading regarding its regulatory status have been found to be misleading. This lack of transparency in regulatory compliance is a significant indicator that Multi Stock Trading may not be a safe option for traders.

Company Background Investigation

Multi Stock Trading LLC claims to offer a robust trading environment, yet its company history and ownership structure remain opaque. Established in 2021, the company operates from multiple locations, including St. Vincent and the Grenadines and the UK. However, the legitimacy of these claims is questionable, as the regulatory framework in St. Vincent is minimal, allowing for easy establishment of brokerage firms without stringent checks.

The management team behind Multi Stock Trading is another area of concern. There is limited information available regarding their professional backgrounds and qualifications, which raises questions about their capability to manage a trading platform effectively. Transparency regarding the company's ownership and operational history is crucial for building trust, and the lack thereof suggests that Multi Stock Trading may not prioritize client security and service.

Trading Conditions Analysis

Examining the trading conditions offered by Multi Stock Trading reveals a mixed bag. The broker advertises competitive spreads and high leverage options, which can be appealing to traders looking for quick profits. However, the overall fee structure is unclear, and there are indications of potential hidden fees that could impact traders negatively.

| Fee Type | Multi Stock Trading | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 0.5 pips | 0.2 - 0.5 pips |

| Commission Model | N/A | $5 - $10 per lot |

| Overnight Interest Range | N/A | Varies |

The absence of a clear commission structure and information on overnight fees raises concerns about the transparency of Multi Stock Trading's pricing policies. Traders may find themselves facing unexpected costs, making it difficult to gauge the true cost of trading. Such practices are often associated with unregulated brokers, further questioning the safety of engaging with Multi Stock Trading.

Client Fund Safety

The safety of client funds is paramount when evaluating a broker's reliability. Multi Stock Trading does not provide adequate information regarding its fund security measures. There are no indications that client funds are kept in segregated accounts, which is a common practice among regulated brokers to ensure the safety of client assets.

Additionally, the absence of investor protection schemes leaves traders vulnerable to potential losses. In the event of financial issues or insolvency, clients may find it challenging to recover their funds. The lack of negative balance protection further exacerbates the risk, as traders could potentially lose more than their initial investment. These factors contribute to the growing concern about whether Multi Stock Trading is indeed safe for traders.

Customer Experience and Complaints

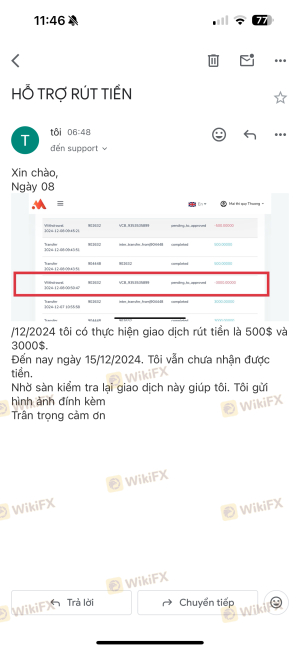

Customer feedback is an essential aspect of assessing a broker's reliability. Many reviews of Multi Stock Trading indicate a range of negative experiences, with common complaints centered around withdrawal difficulties and unresponsive customer support. Traders have reported facing hurdles when attempting to withdraw their funds, which is a significant red flag for any broker.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Unresponsive Customer Support | Medium | Poor |

| Misleading Information | High | Poor |

Typical cases include traders claiming that their withdrawal requests were either delayed or outright denied, leading to frustrations and financial losses. The lack of a robust customer service framework to address these issues further indicates that Multi Stock Trading may not prioritize trader satisfaction or safety.

Platform and Trade Execution

The trading platform offered by Multi Stock Trading is the widely used MetaTrader 5 (MT5), which is known for its advanced features and user-friendly interface. However, the platform's performance has raised concerns among users regarding execution quality and potential manipulation. Reports of slippage and rejected orders have surfaced, suggesting that the broker may not provide a fair trading environment.

Traders may encounter discrepancies between quoted prices and executed prices, leading to unexpected losses. Such issues can severely impact trading outcomes and raise questions about the integrity of the trading platform. The possibility of platform manipulation is a serious concern and contributes to doubts about whether Multi Stock Trading is safe.

Risk Assessment

Engaging with Multi Stock Trading presents several risks that traders should consider. The unregulated status, unclear fee structures, and negative customer feedback collectively indicate a high-risk environment.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Lack of oversight from recognized authorities. |

| Financial Risk | High | Potential for loss of funds without protection. |

| Operational Risk | Medium | Issues with withdrawal and customer support. |

| Platform Risk | High | Concerns regarding execution quality and manipulation. |

To mitigate these risks, traders should conduct thorough research before engaging with Multi Stock Trading. Seeking out regulated brokers with transparent practices and robust customer support is advisable.

Conclusion and Recommendations

In conclusion, the evidence suggests that Multi Stock Trading is not a safe option for traders. The lack of regulation, combined with negative customer feedback and unclear trading conditions, raises significant concerns about the broker's legitimacy. While the platform may offer appealing features, the associated risks far outweigh the potential benefits.

Traders are advised to exercise extreme caution and consider alternative options that are regulated and have a proven track record of client satisfaction. Reputable brokers with strong regulatory oversight provide a safer trading environment, ensuring that clients' funds are protected and that they receive the support they need. Overall, it is clear that Multi Stock Trading may not be a reliable choice for those looking to engage in forex trading safely.

Is Multi Stock Trading a scam, or is it legit?

The latest exposure and evaluation content of Multi Stock Trading brokers.

Multi Stock Trading Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Multi Stock Trading latest industry rating score is 2.03, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.03 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.